Global AI in Contract Packaging Market Size, Share, Industry Analysis Report By Material Type (Plastic, Glass, Paper & Paperboard, Others), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Predictive Analysis, Others), By Packaging Type (Primary Packaging, Secondary Packaging, Tertiary Packaging), By Application (Inventory Management and Supply Chain Optimization, Customization and Personalization, Quality Control and Material Inspection, Advanced Robotics, Date Labelling, Others), By End-use Industry (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Electronics, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155831

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- By Material Type Analysis

- By Technology Analysis

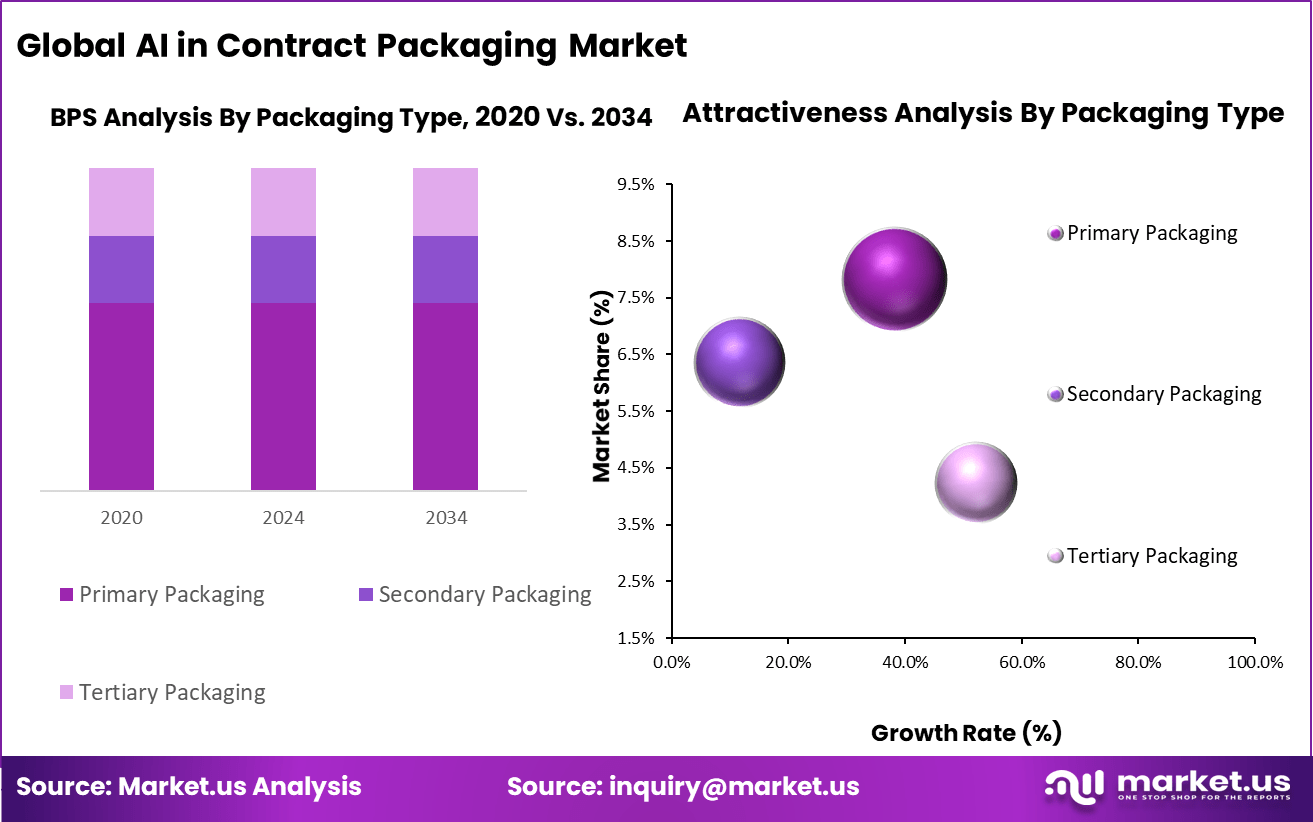

- By Packaging Type Analysis

- By Application Analysis

- By End-use Industry

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

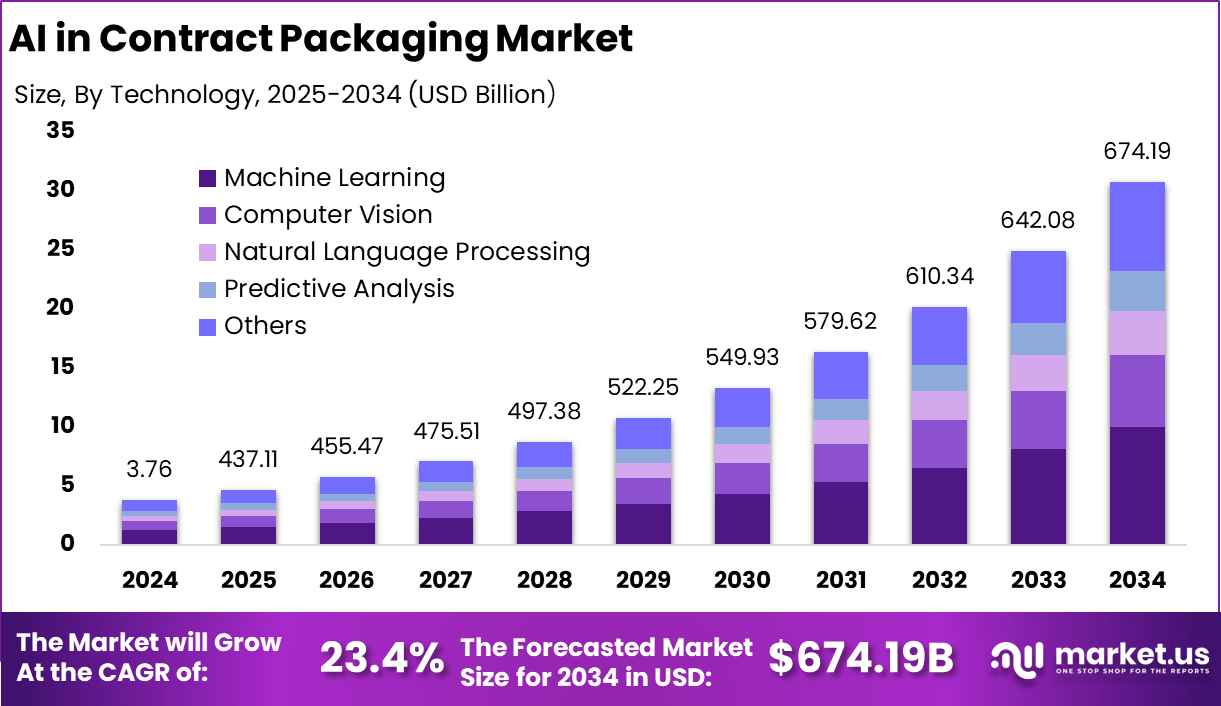

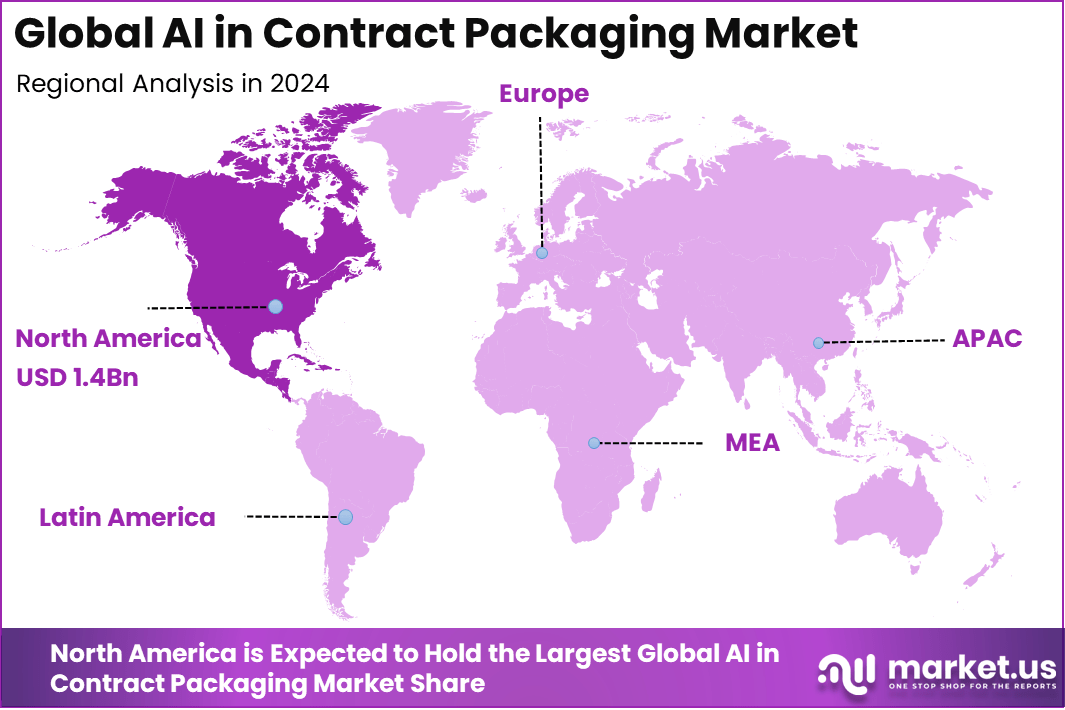

The Global AI in Contract Packaging Market size is expected to be worth around USD 674.19 Billion By 2034, from USD 3.76 billion in 2024, growing at a CAGR of 23.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 1.4 Billion revenue.

Artificial intelligence in contract packaging refers to the use of data-driven models to plan, run, and verify packaging operations that are performed by external co-packers. It is applied to machine vision for defect detection, predictive maintenance of fillers, cappers, and labelers, digital twins for line balancing, and intelligent planning for changeovers and material flow.

The approach allows contract packers to raise throughput, stabilize quality, and maintain traceability while serving multiple brands with frequent SKU changeovers. These applications are already visible in packaging plants, where machine vision, predictive maintenance, and simulation are among the most active use cases.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 3.76 Bn Forecast Revenue (2034) USD 674.1 Bn CAGR(2025-2034) 23.4% Leading Segment By Packaging Type: Primary Packaging- 45.7% Leading Region Share North America [38.5% Market Share] Largest Country U.S. [USD 1.2 Bn Market Revenue], CAGR: 20.5% Key Insight Summary

- Plastic dominated the material type segment with 38.7% share.

- Machine Learning led the technology segment with 32.4% share.

- Primary Packaging was the largest packaging type, accounting for 45.7% share.

- Inventory Management and Supply Chain Optimization was the top application, with 30.6% share.

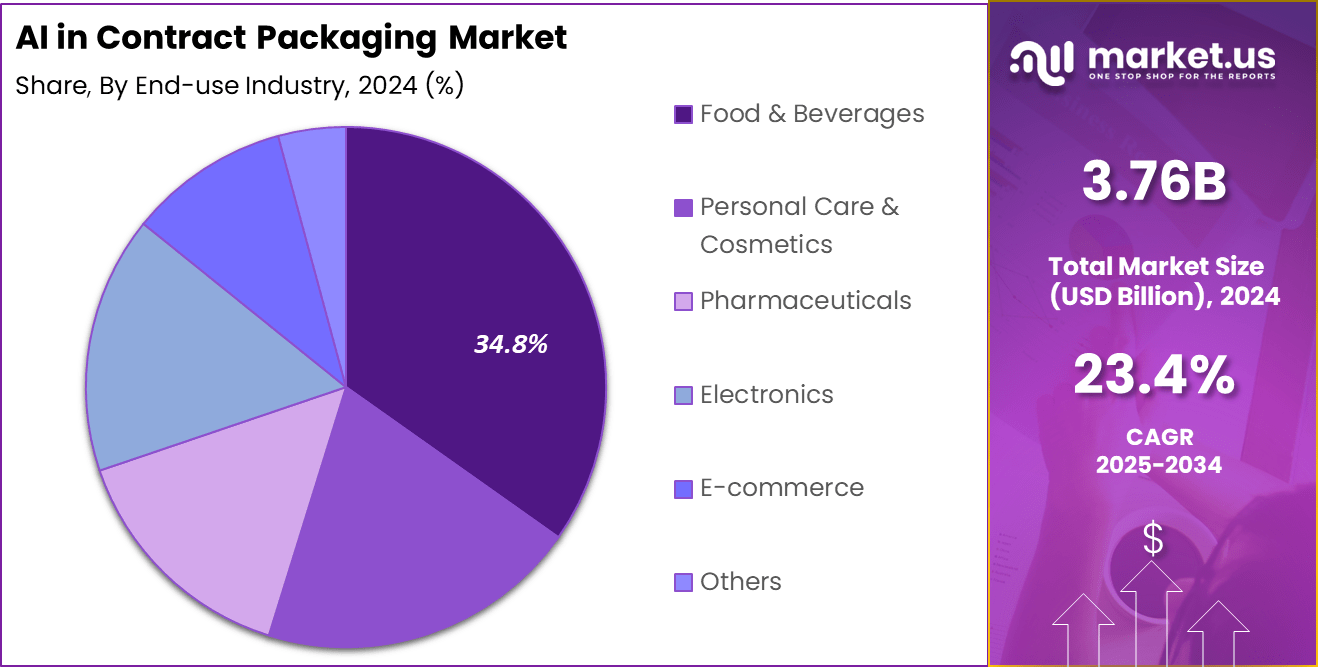

- Food & Beverages emerged as the leading end-use industry with 34.8% share.

- North America captured 38.5% share of the global market.

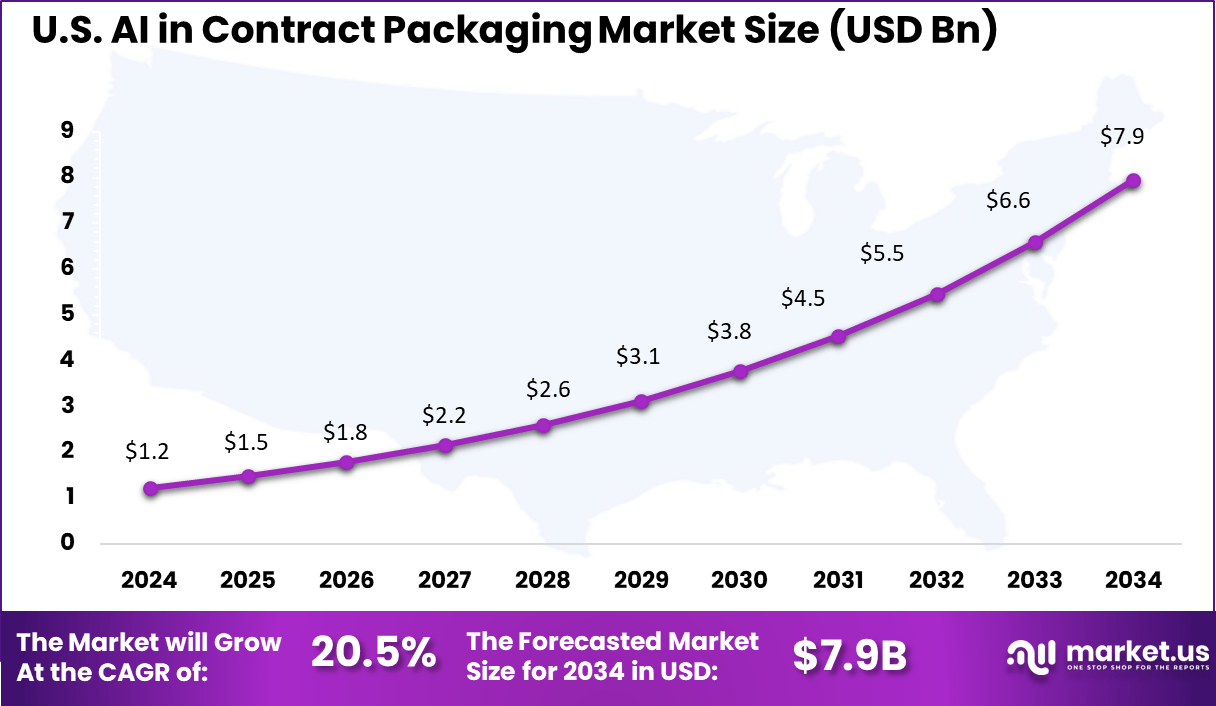

- The U.S. market was valued at USD 1.23 billion in 2024, grow at a strong CAGR of 20.5%.

One of the strongest driving forces in this market is the need for greater cost efficiency and process automation. Businesses pressure contract packagers for shorter lead times, flexible run sizes, and lower costs. AI can automate repetitive tasks, forecast demand, and execute predictive maintenance, which all reduce labor and minimize downtime.

Increased interest in sustainability further accelerates the adoption of AI, as companies use intelligent tools to minimize packaging waste, track regulatory compliance, and design more sustainable solutions. AI technology in contract packaging finds major use in inventory management, quality assurance, predictive maintenance, and robotics.

US Market Size

The U.S. AI in Contract Packaging Market was valued at USD 1.2 Billion in 2024 and is anticipated to reach approximately USD 7.9 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 20.5% during the forecast period from 2025 to 2034.

In 2024, North America held a dominan Market position, capturing more than a 38.5% share, holding USD 1.4 Billion revenue. The region’s lead can be attributed to a deep base of consumer goods and healthcare co-packers, strict food and product traceability rules, and fast digitalization of warehousing and fulfillment.

The U.S. Food and Drug Administration’s FSMA 204 traceability rule has driven serialization and recordkeeping upgrades across packaging lines, even as compliance timelines are being phased and extended, which sustains technology spending in contract packaging.

By Material Type Analysis

In 2024, Plastic materials make up 38.7% of the AI in contract packaging market, indicating their central role in modern packaging solutions. Plastics are widely favored in packaging due to their durability, lightweight nature, and versatility, which align well with AI-enabled automated systems.

Contract packagers rely on AI-driven technologies with plastics to streamline operations, monitor material usage, and reduce waste, contributing to both economic and environmental goals. AI systems are often trained to recognize defects, optimize sealing processes, and adapt to different plastic formats, making production lines more efficient and responsive.

By Technology Analysis

In 2024, Machine learning holds a 32.4% share in powering AI technologies within the contract packaging industry. Machine learning algorithms enable systems to “learn” from historical data, spot trends and anomalies, and suggest efficiency improvements without human intervention. This capability drives improvements in quality control, predictive maintenance, and order accuracy.

Deploying machine learning models allows contract packagers to automate decision-making processes, such as sorting products, managing real-time inventory, and forecasting demand. As a result, companies can minimize downtime, optimize staffing, and better allocate resources – giving them a competitive advantage in an industry where responsiveness and cost-efficiency are increasingly critical.

By Packaging Type Analysis

In 2024, Primary packaging – responsible for the direct enclosure of products – accounts for 45.7% of the AI in contract packaging market. This segment benefits immensely from AI, as automated systems must consistently ensure product protection, quality, and compliance with stringent safety standards. AI-driven inspection and handling systems are particularly valuable for products like food, beverages, and pharmaceuticals, where contamination or mispackaging can have serious consequences.

Contract packagers employing AI in primary packaging can detect defective items early, maintain product integrity, and comply with regulatory requirements more reliably than with traditional methods. The ability for AI-powered machines to adapt quickly to new product lines also supports greater production flexibility and quicker time-to-market for clients.

By Application Analysis

In 2024, Inventory management and supply chain optimization represent 30.6% of the AI-driven contract packaging applications. Companies leverage AI to predict demand, optimize stock levels, and streamline logistics operations, reducing costs and improving customer satisfaction. Advanced AI analytics also help identify supply chain disruptions and deviations, allowing for quick corrective actions.

In contract packaging, integrating AI with inventory and supply chain systems means packaging lines always have the right materials at the right time, minimizing hold-ups and overstock. The data-driven approach further enhances forecasting accuracy, benefiting both service providers and their customers through more efficient, transparent, and resilient supply chains.

By End-use Industry

In 2024, the food and beverage sector dominates with a 34.8% share of the AI in contract packaging market. Safety, speed, and compliance are absolutely crucial in this industry, and AI-powered systems help ensure products are packed to the highest standards. AI is used to automate inspection, check labeling accuracy, and track packaging conditions in real time, which reduces the risk of errors and recalls.

Food and beverage manufacturers favour AI-enabled contract packaging providers to consistently deliver safe, tamper-proof, and traceable packaging. This enhances consumer trust and enables brands to comply with evolving food safety regulations. As the industry continues to demand higher efficiency and quality, the role of AI will only deepen, solidifying its position in food and beverage contract packaging.

Key Market Segments

By Material Type

- Plastic

- Glass

- Paper & Paperboard

- Others

By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing

- Predictive Analysis

- Others

By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Application

- Inventory Management and Supply Chain Optimization

- Customization and Personalization

- Quality Control and Material Inspection

- Advanced Robotics

- Date Labelling

- Others

By End-use Industry

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Electronics

- E-commerce

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- SpAI in Contract Packagingn

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- ThAI in Contract Packagingland

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Demand for Sustainability and Efficiency

A core driver for the adoption of AI in contract packaging is the pressing demand for both sustainability and operational efficiency. Consumers, retailers, and regulatory bodies are exerting pressure on manufacturers to minimize environmental impact through biodegradable materials, reduced packaging waste, and responsible sourcing.

AI addresses these demands by providing real-time analytics and predictive insights, helping companies select sustainable materials, streamline supply chains, and meet compliance requirements at scale. Simultaneously, AI-powered quality inspection and automation lead to fewer production errors, reduced downtime, and significant waste minimization – aligning economic benefits with climate goals.

This dual focus on sustainability and efficiency compels packaging firms to rethink traditional processes. By harnessing AI’s abilities for advanced data analytics and automation, they gain a competitive edge, responding swiftly to market demands while achieving measurable cost savings and environmental targets.

Restraint Analysis

Implementation Costs and Workforce Adaptation

The ambitious implementation of AI in contract packaging does not come without restraints. A major restraint stems from the high initial investment required for integrating AI systems, including upgrading machinery, establishing compatible digital infrastructure, and ongoing maintenance.

Smaller contract packaging companies, in particular, may find these costs prohibitive, causing a slower pace of adoption within certain market segments. Furthermore, the successful deployment of AI relies heavily on a workforce capable of operating, interpreting, and adapting to new digital technologies, necessitating substantial investment in employee training and change management.

The need to keep up with advancements puts pressure on organizations to continually update systems and skills, creating ongoing operational and financial burdens. Some contract packaging companies remain hesitant to fully embrace AI, preferring incremental adoption or hybrid approaches until a more favorable cost-to-benefit ratio or proven case studies in similar operations emerge.

Opportunity Analysis

AI-Enabled Material and Process Innovation

A significant future opportunity for contract packaging lies in leveraging AI to drive material and process innovation. AI’s ability to model and simulate new packaging materials enables companies to design novel, eco-friendly solutions that minimize waste without sacrificing durability or consumer appeal.

Advanced algorithms help identify optimal packaging configurations, predict material performance under various conditions, and forecast lifecycle environmental impacts long before deployment. This leads to safer, more sustainable products and greater transparency across the supply chain.

Moreover, AI-fueled innovation helps contract packagers deliver greater value to their clients by rapidly adapting to changing product specifications, regulatory environments, and market trends. This agility creates new service offerings and revenue streams, positioning contract packagers as indispensable innovation partners for brands seeking to differentiate themselves through both sustainability and performance.

Challenge Analysis

Data Security and System Integration Complexity

Despite its potential, AI adoption introduces challenges around data security and system integration. With packaging operations increasingly relying on real-time data from IoT sensors, quality control devices, and customer engagement platforms, the need for robust cybersecurity measures is paramount.

Contract packagers must navigate the risks associated with sensitive data flows – ranging from consumer information to proprietary production analytics – while ensuring compliance with tightening data protection regulations. Alongside security, integrating AI into existing production and supply chain infrastructure often proves complex.

Legacy machinery may not seamlessly communicate with AI platforms, resulting in fragmented workflows or underutilized capabilities. This creates additional technical and financial obstacles that can hinder smooth, scalable AI implementation. Contract packagers need to balance the promise of AI-driven transformation with strategic planning and prudent technology partnerships to overcome integration and security hurdles in their journey toward digital excellence.

Competitive Analysis

The AI in Contract Packaging Market features a diverse mix of technology leaders, packaging providers, and solution developers. Global technology firms such as Schneider Electric, Hewlett Packard Enterprise Development LP, and International Business Machines Corporation are focused on integrating artificial intelligence into packaging operations.

Specialized packaging providers also hold a strong role in this market. Firms like Tayana Solutions, Custom Pak Illinois, Inc., blp (Northern) Limited, and BUCKEYE CORRUGATED focus on delivering packaging-specific services that integrate AI tools for design, quality control, and supply chain management. Their contribution lies in offering tailored solutions for industries such as food, pharmaceuticals, and consumer goods.

In addition, solution providers such as Infor, Signicent Information Solutions LLP, and logistics specialists like Kenco are shaping the digital side of AI in contract packaging. Their offerings span enterprise resource planning, market intelligence, and supply chain optimization supported by AI-driven insights. These companies are helping manufacturers and packaging firms align with digital transformation strategies, ensuring better coordination across packaging operations

Top Key Players in the Market

- Schneider Electric

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Tayana Solutions

- Custom Pak Illinois, Inc.

- blp (Northern) Limited

- BUCKEYE CORRUGATED

- Infor

- Signicent Information Solutions LLP

- Kenco

- Others

Recent Developments

- In May 2025, Schneider Electric announced its acquisition of Motivair – an innovator in liquid cooling solutions for high-performance computing – for $850 million. This acquisition accelerates Schneider’s vision for sustainable AI-driven data center solutions, with clear implications for AI deployment in packaging and manufacturing environments.

- In 2024, Amazon introduced its AI-powered Package Decision Engine, which optimizes packaging processes by tailoring material use based on the fragility and protection needs of items. This innovation significantly improved operational efficiency and contributed to reducing packaging waste, aligning with sustainability goals in contract packaging.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI in Contract Packaging impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Material Type (Plastic, Glass, Paper & Paperboard, Others), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Predictive Analysis, Others), By Packaging Type (Primary Packaging, Secondary Packaging, Tertiary Packaging), By Application (Inventory Management and Supply Chain Optimization, Customization and Personalization, Quality Control and Material Inspection, Advanced Robotics, Date Labelling, Others), By End-use Industry (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Electronics, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, SpAI in Contract Packagingn, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, ThAI in Contract Packagingland, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schneider Electric, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Tayana Solutions, Custom Pak Illinois, Inc., blp (Northern) Limited, BUCKEYE CORRUGATED, Infor, Signicent Information Solutions LLP, Kenco, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Contract Packaging MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Contract Packaging MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Tayana Solutions

- Custom Pak Illinois, Inc.

- blp (Northern) Limited

- BUCKEYE CORRUGATED

- Infor

- Signicent Information Solutions LLP

- Kenco

- Others