Global AI Governance Market Size, Share, Growth Analysis By Component (Solution, Services), By Deployment (On-Premises, Cloud), By Organization Size (Large Enterprise, SMEs), By Vertical (BFSI, Government and Defense, Healthcare and life sciences, Media and Entertainment,Retail, IT and Telecommunication, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162088

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- AI Industry Adoption

- Analysts’ Viewpoint

- Emerging trends

- US Market Size

- Investment and Business Benefits

- By Component

- By Deployment

- By Organization Size

- By Vertical

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

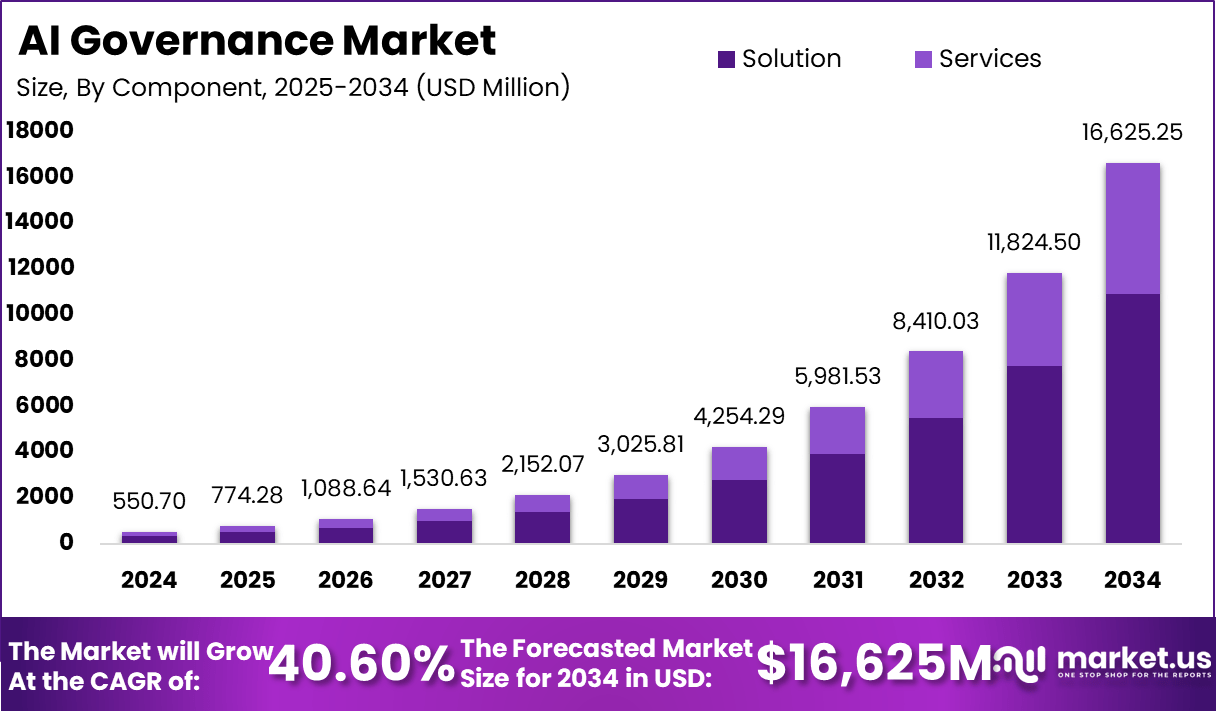

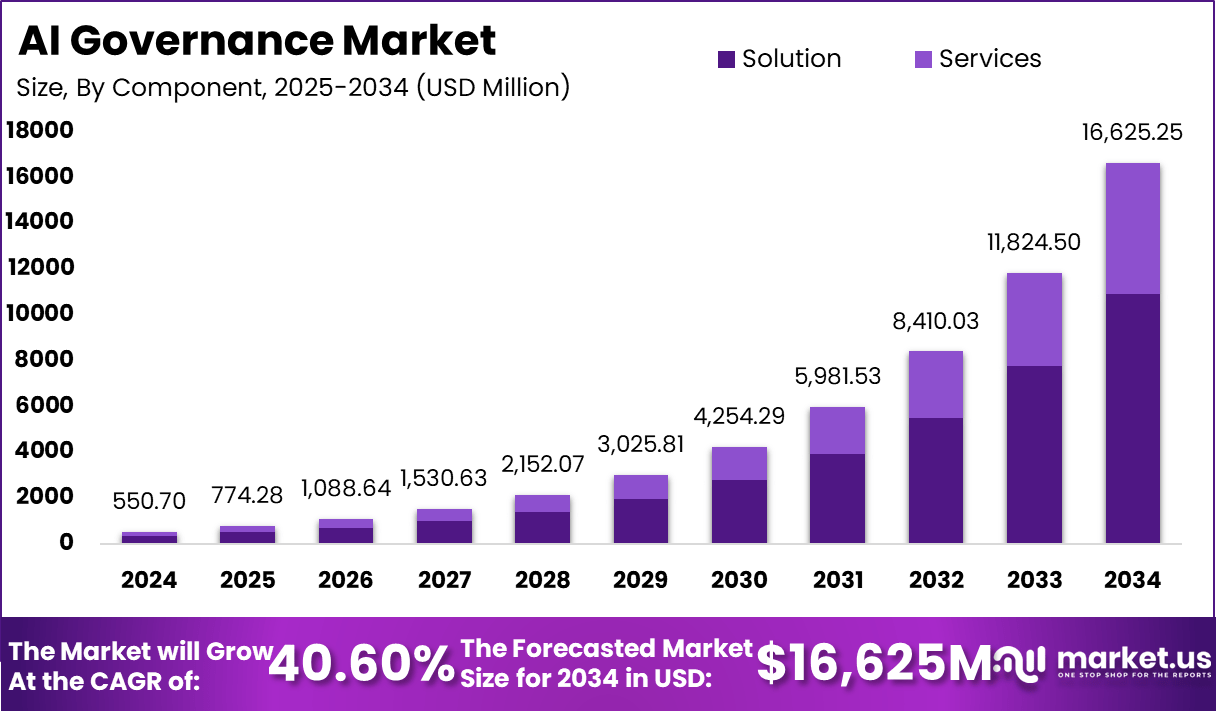

The Global AI Governance Market was valued at USD 550.7 million in 2024 and is projected to surge to approximately USD 16,625.2 million by 2034, expanding at a notable CAGR of 40.6% during the forecast period. This rapid growth reflects the increasing global emphasis on responsible AI deployment, transparency, and compliance with emerging regulatory frameworks. Organizations across sectors are investing heavily in AI governance solutions to ensure ethical decision-making, reduce algorithmic bias, and maintain data privacy.

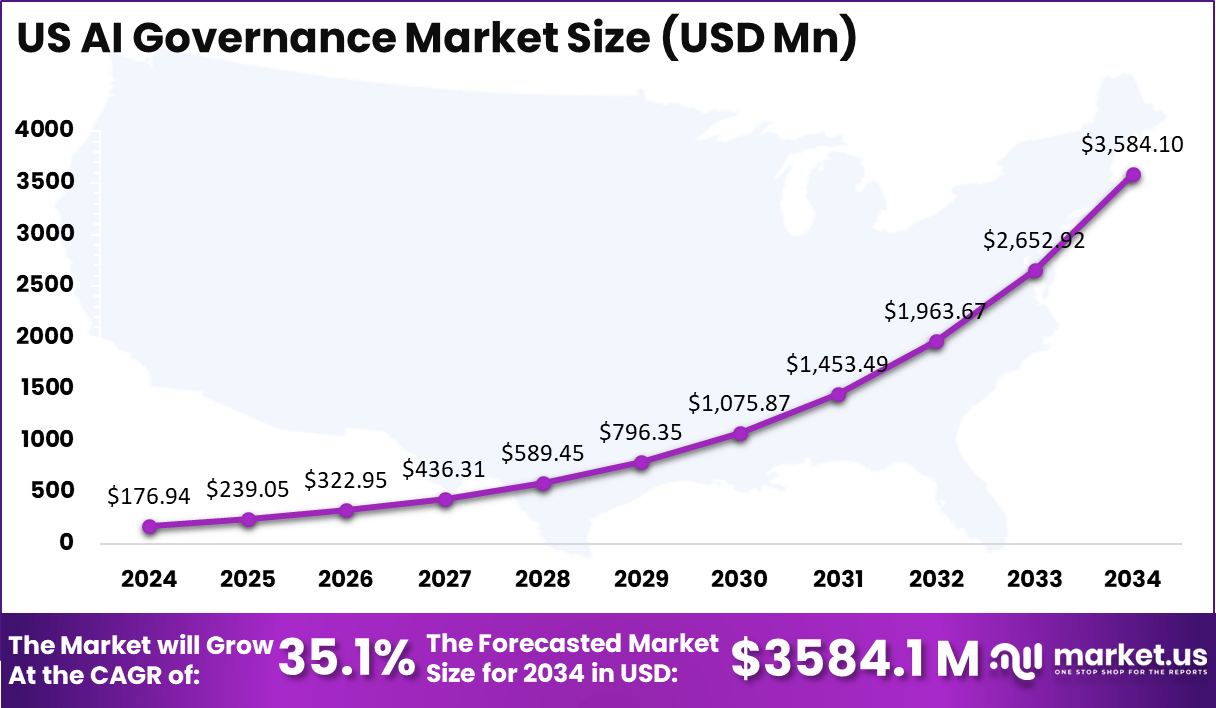

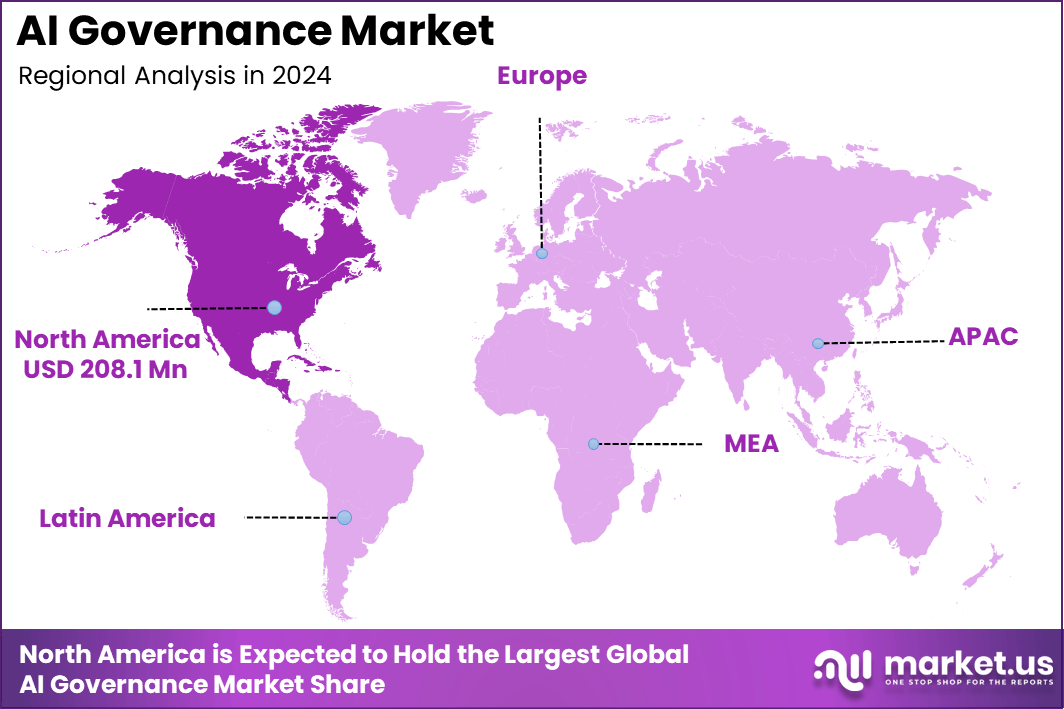

North America remains the dominant region, accounting for 37.8% of the global share with a market value of USD 208.1 million in 2024. The US, contributing USD 176.94 million, is expected to reach USD 3,584.1 million by 2034, registering a strong CAGR of 35.1%, driven by regulatory initiatives, corporate accountability measures, and accelerated AI integration in critical industries such as finance, healthcare, and government.

AI governance refers to the framework of policies, processes, and technologies designed to ensure that artificial intelligence systems are developed, deployed, and managed responsibly, ethically, and transparently. It encompasses principles such as fairness, accountability, explainability, and data privacy, aiming to prevent unintended consequences like algorithmic bias, discrimination, or misuse of AI outputs. As AI becomes integral to decision-making in sectors such as finance, healthcare, defense, and public administration, the need for structured governance frameworks has intensified globally.

Governments and organizations are increasingly adopting AI governance strategies to comply with regulations such as the EU AI Act, the U.S. Blueprint for an AI Bill of Rights, and similar initiatives across Asia and the Middle East. Companies are implementing internal governance models that define AI risk management, human oversight, and ethical auditing mechanisms to align innovation with public trust. Moreover, the integration of explainable AI (XAI) tools and bias detection software is gaining momentum, allowing businesses to validate AI decisions and enhance transparency.

With global investments accelerating in AI oversight platforms and regulatory compliance solutions, AI governance is expected to evolve into a core component of corporate digital strategy, bridging the gap between technological advancement and ethical responsibility. Investment activity in AI governance has been robust this year. In 2025, AI-focused startups captured about 51% of global venture capital funding – a record high for the sector, with the U.S. representing roughly 85% of these transactions.

In just the week of October 5–11, 2025, AI startups raised over USD 2.4 billion in new funding, including USD 2 billion for Reflection AI (open frontier models), USD 180 million for n8n (AI workflow orchestration), and USD 150 million for EvenUp (legal automation). In India, public sector programs like MeitY’s GENESIS are providing grants up to INR 10 lakh for early AI ventures, while iCreate offers up to INR 50 lakh for market-ready AI solutions.

Mergers and acquisitions have also accelerated. In 2025’s first quarter alone, there were 381 AI-related transactions – up 21% year-over-year, following nearly 1,277 AI-driven deals in 2024, almost triple the number seen in 2020. Companies across semiconductors, life sciences, and fintech are actively acquiring AI governance capabilities to strengthen compliance and decision-making processes. These deals are increasingly shaped by regulatory issues such as data rights, cross-border confidentiality, and evaluation of ethical AI maturity.

Key Takeaways

- The global AI governance market was valued at USD 550.7 million in 2024 and is projected to reach USD 16,625.2 million by 2034, growing at a strong CAGR of 40.6%, driven by the rising emphasis on ethical and transparent AI adoption.

- North America led the market with a 37.8% share in 2024, amounting to USD 208.1 million, supported by robust regulatory frameworks and early enterprise-level implementation.

- The United States emerged as the key contributor, valued at USD 176.94 million in 2024, and is expected to reach USD 3,584.1 million by 2034 at a CAGR of 35.1%, driven by policy support and extensive AI integration across industries.

- By component, solutions dominated with a 65.7% share, reflecting the growing adoption of AI bias detection, transparency tools, and model validation software.

- On-premises deployment accounted for 70.4% of the market, indicating a preference for secure and compliant environments, especially within data-sensitive sectors.

- Large enterprises represented 75.2% of total adoption, showcasing their proactive investment in structured AI governance frameworks for risk and compliance management.

- The BFSI sector led the market by vertical with a 38.9% share, emphasizing the need for fair, explainable, and regulatory-compliant AI in financial decision-making systems.

Role of AI

Artificial Intelligence (AI) plays a crucial role in transforming industries, governance, and decision-making processes by enabling automation, data-driven insights, and intelligent problem-solving. In the context of governance, AI enhances efficiency, transparency, and accountability through predictive analytics, real-time monitoring, and automated reporting. It assists policymakers and organizations in analyzing large datasets, identifying risks, and making evidence-based decisions. AI systems also help detect fraud, monitor regulatory compliance, and ensure ethical use of technology in both public and private sectors.

In corporate environments, AI supports governance frameworks by auditing algorithms, identifying bias, and maintaining data integrity. Businesses leverage AI tools for model explainability, performance tracking, and compliance verification, ensuring that automated systems operate within legal and ethical boundaries. Moreover, AI enhances cybersecurity governance by detecting anomalies, preventing data breaches, and safeguarding critical assets.

On a broader scale, AI facilitates responsible innovation by aligning technology development with societal values and human oversight. Through its ability to streamline processes and generate actionable intelligence, AI strengthens governance structures, promotes accountability, and enables organizations to balance innovation with regulation—making it an indispensable enabler of modern governance systems in a rapidly digitalizing world.

AI Industry Adoption

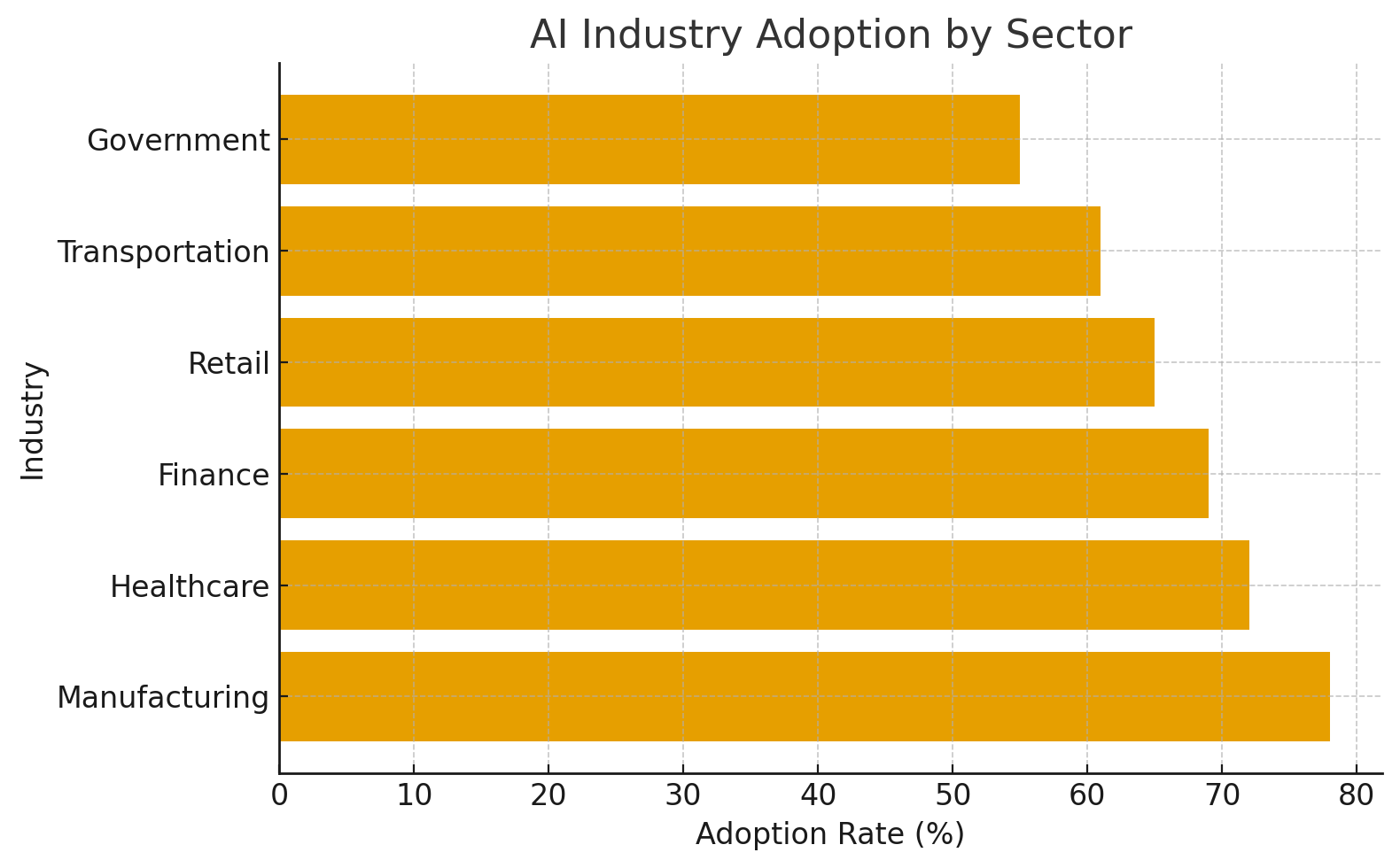

AI industry adoption is accelerating across sectors as organizations recognize its potential to drive innovation, efficiency, and competitive advantage. In manufacturing, AI is transforming production lines through predictive maintenance, quality control, and supply chain optimization. The healthcare sector increasingly leverages AI for diagnostics, personalized treatment, and drug discovery, improving patient outcomes while reducing operational costs. Financial institutions adopt AI for fraud detection, credit scoring, and algorithmic trading, ensuring faster and more secure transactions.

Retail and e-commerce industries use AI to enhance customer experiences through recommendation engines, demand forecasting, and inventory optimization. Meanwhile, in the transportation and logistics sectors, AI supports autonomous systems, route optimization, and fleet management to improve safety and efficiency. Governments and public sector agencies are also integrating AI for citizen services, predictive policing, and administrative automation, boosting transparency and service delivery.

Despite rapid adoption, challenges such as ethical concerns, data privacy, and regulatory compliance remain critical. However, as global standards and governance frameworks mature, AI is expected to become an integral part of every industry’s digital transformation strategy. The growing adoption reflects a shift from experimentation to enterprise-wide deployment, marking AI as a foundational pillar for future-ready, intelligent industries.

Analysts’ Viewpoint

Industry analysts highlight that while organizations are rapidly deploying AI across diverse sectors, the maturity of governance frameworks is still lagging. According to David Menninger at ISG Research, even though 71% of enterprises now have data governance policies—up from 38% just a decade ago—only a fraction have equivalent maturity in AI governance. His review found that among 25 major software providers evaluated, very few offered end-to-end governance capabilities such as bias detection, reproducibility, and model catalogs.

Other analyst firms emphasize regulation as a key growth driver. For example, studies from Roots Analysis suggest that the increasing rollout of strict AI regulations (such as the EU AI Act) and mandates for transparency and accountability are compelling enterprises to invest in governance frameworks. Analysts caution, however, that many firms remain underprepared: governance initiatives are often reactive, fragmented, and still embedded within traditional data-governance functions rather than tailored for AI’s unique risks and dynamics.

In summary, the consensus among analysts is that the growth of the AI governance market is not merely a function of technology adoption—but hinges critically on the ability of organizations to embed governance into the lifecycle of AI models: from design and validation through monitoring and retirement. The market’s projected strong growth underscores both the urgency of closing the governance gap and the opportunity for vendors offering end-to-end solutions.

Emerging trends

Stronger regulatory frameworks and global standardization: Governments around the world are accelerating efforts to regulate AI. Legislative mentions of AI increased significantly across 75+ countries, while the number of U.S. federal AI regulatory initiatives doubled in 2024.

AI auditing, monitoring, and “explainability by design”: Companies are investing heavily in real-time oversight of AI systems—bias detection, model logging, red-teaming, and transparency mechanisms are becoming integral.

Rise of self- and internal governance mechanisms alongside technical controls: Beyond external regulation, organizations are building internal AI governance programs, blending policy, human oversight, and technical tools (like metadata tracking, monitoring, automated alerts) to manage AI risk.

Human-centric and ethics-first design: Ethical AI, human oversight, and fairness considerations are becoming mainstream. Business teams are embedding ethics and governance into AI workflows rather than treating them as afterthoughts.

Growing demand for governance skills and specialized tools: As AI governance becomes more critical, organizations need talent and tools capable of implementing governance frameworks, performing compliance assessments, and managing AI risks across the lifecycle.

US Market Size

The AI Governance Market in the United States was valued at USD 176.94 million in 2024 and is projected to reach approximately USD 3,584.1 million by 2034, expanding at a strong CAGR of 35.1%. This substantial growth reflects the nation’s leadership in AI innovation, regulatory evolution, and early enterprise adoption of responsible AI frameworks. The US market benefits from a robust technology ecosystem, active participation of leading AI solution providers, and growing investments in compliance-driven AI infrastructure.

Government initiatives such as the National AI Research Resource (NAIRR) and the Blueprint for an AI Bill of Rights are shaping a structured governance landscape, ensuring AI deployment aligns with ethical and transparent principles. The private sector, particularly in finance, healthcare, and defense, is accelerating the adoption of AI governance solutions to ensure accountability, manage algorithmic bias, and protect consumer data.

Rising demand for explainable AI (XAI), model validation, and risk assessment tools is further driving market growth. Enterprises are integrating AI governance platforms to meet regulatory expectations, enhance brand trust, and strengthen decision-making reliability. With continued emphasis on ethical innovation and public-private collaboration, the US is expected to remain at the forefront of global AI governance advancements throughout the forecast period.

Investment and Business Benefits

Investment Rationale

Organizations increasingly view AI governance not just as a cost of compliance but as strategic value-creation: according to research, investments in AI ethics and governance can shift from a reactive “loss-aversion” posture (avoiding fines, reputational damage) to a proactive “value-generation” mindset (enabling innovation, trust, competitive advantage).

From the investor perspective, responsible AI frameworks strengthen risk management, enhance corporate resilience, and appeal to capital markets and ESG-specialized investors as firms demonstrate transparency and ethical use of AI.

As global regulation tightens (data protection, algorithmic fairness, and transparency mandates), investing early in governance positions a company to avoid regulatory penalties, reduce disruption, and unlock markets that may exclude non-compliant providers.

Business Benefits

Risk reduction: Strong governance mitigates risks of bias, data breaches, non-compliance, and reputation loss—enabling smoother AI deployment and reducing the cost of failures.

Enhanced trust and adoption: When stakeholders (customers, partners, regulators) trust that AI systems are properly governed, adoption accelerates, unlocking revenue-generating applications and accelerating time-to-value.

Operational efficiency & innovation: Governance frameworks streamline processes, enable clearer accountability, and encourage scalable AI deployment—letting companies move faster with confidence, integrate AI broadly, and innovate sustainably.

Competitive differentiation: Companies seen as trustworthy and ethical AI users often gain brand advantage, strengthen stakeholder relationships, and may lead in new markets or use cases where governance is a barrier to entry.

By Component

In the AI governance market, the Solution component (software platforms, tools, frameworks) is dominant, accounting for approximately 65.7% of total market value. This strong share comes from the growing enterprise demand for purpose-built tools such as bias-detection engines, model-explainability frameworks (XAI), monitoring & observability platforms, and compliance dashboards.

These solutions act as the foundational “guardrails” for organizations seeking to deploy AI responsibly—providing automation, scalability, and standardized governance across the AI lifecycle. Because regulatory pressures (e.g., the EU AI Act) are intensifying and organizations want proactive compliance, investing in tool-based solutions becomes a must.

On the other hand, the Services component (consulting, system integration, managed services, training) makes up the remaining ~34.3%. These service offerings remain important because many enterprises require help in designing governance frameworks, assessing current AI risk, integrating solutions into existing tech stacks, and developing internal capabilities (e.g., ethics boards, governance committees). While the share for services is smaller than solutions, the role of services is crucial for adoption across industries with complex legacy environments or high regulatory stakes.

By Deployment

In the AI governance segment, the on-premises deployment model holds roughly 70.4% of the market share. This dominance reflects the strategic priorities of organizations operating in highly regulated, data-sensitive sectors (such as banking, healthcare, and government) that demand full control of infrastructure, strict data sovereignty, and reduced exposure to third-party cloud risks. As one analyst article notes: “On-premises AI deployments … provide greater control over data, enhanced security, and lower latency for real-time applications” compared to cloud alternatives.

The preference for on-premises also stems from concerns over compliance, vendor lock-in, and unpredictability of cloud cost structures.

Meanwhile, cloud-based deployment (the remaining ~29.6%) is leveraged chiefly for governance solutions that require rapid scalability, managed services, lighter infrastructure overhead, and agility in deployment. Cloud modules are especially suited for less regulated use cases or initial pilots. But the stronger share of on-premises indicates that for comprehensive AI governance (covering auditability, model monitoring, bias mitigation,n), enterprises still favour infrastructure-in-house or hybrid strategies.

By Organization Size

The large-enterprise segment — those firms with substantial operations, regulatory exposure, and advanced AI deployment — dominates the market with approximately 75.2% share. These organizations are leading adoption because they face complex AI-risk environments: high stakes in sectors like finance, healthcare, telecom, and government, where algorithmic decisions, data governance, compliance, and transparency are mission-critical.

Large enterprises have the internal resources, dedicated budgets, and governance infrastructure to deploy comprehensive AI-governance solutions: platforms, model-audit tools, bias-detection modules, and full-stack governance programs.

In contrast, SMEs (small & medium-sized enterprises) account for the remainder of the market. While their share is smaller now, their growth potential is significant. SMEs typically have fewer resources, simpler governance needs, and may favour cloud-based or simpler governance tools. Many analysts indicate that the SME segment is expected to grow at a relatively higher rate as governance solutions become more accessible and regulatory pressure broadens beyond large players.

In summary, the dominance of large enterprises reflects the scale, complexity, and regulatory demands of high-end AI governance. Meanwhile, SMEs present a rising opportunity for vendors and service providers as adoption spreads and solutions scale down.

By Vertical

The BFSI sector dominates the AI Governance Market, accounting for approximately 38.9% of the total share in 2024. This leadership is primarily driven by the sector’s stringent regulatory environment, extensive data usage, and increasing reliance on AI for critical operations such as credit scoring, fraud detection, and risk management.

Financial institutions are prioritizing AI governance frameworks to ensure transparency, prevent algorithmic bias, and comply with regulatory standards like Basel III and GDPR. The integration of explainable AI (XAI) and model validation tools is becoming essential for maintaining accountability in automated decision-making systems.

Beyond BFSI, other verticals such as government and defense, healthcare and life sciences, media and entertainment, retail, IT and telecommunication, automotive, and others are steadily adopting AI governance solutions. Governments are emphasizing responsible AI usage to ensure data privacy and ethical AI deployment in public systems, while healthcare organizations are adopting governance measures to validate clinical AI algorithms and protect patient information.

Similarly, industries like retail and media are using AI governance to regulate customer data analytics and content personalization, whereas automotive and telecom sectors are applying governance frameworks to enhance safety and reliability in autonomous systems and intelligent networks. Collectively, these sectors highlight a broadening focus on ethical, compliant, and accountable AI operations across industries.

Key Market Segments

By Component

- Solution

- Services

By Deployment

- On-Premises

- Cloud

By Organization Size

- Large Enterprise

- SMEs

By Vertical

- BFSI

- Government and Defense

- Healthcare and life sciences

- Media and Entertainment

- Retail

- IT and Telecommunication

- Automotive

- Others

Regional Analysis

The North American region commands a substantial presence in the global AI Governance market, contributing around 37.8% of the regional share with a market size estimated at USD 208.1 million in 2024. This dominance stems from several key structural advantages: robust technology infrastructure, high enterprise AI adoption, and mature regulatory/ethical frameworks that are driving demand for governance solutions. The substantial concentration of leading technology providers, research institutions, and high-AI-maturity enterprises in the U.S. and Canada further reinforces the region’s leadership in governance implementation.

Within North America, the U.S. stands out as the primary market, given its scale, regulatory initiatives, and enterprise budgets for AI oversight. The region’s governance momentum is boosted by rising concerns around algorithmic bias, data privacy, transparency, and model accountability—especially in high-stakes industries such as finance, healthcare, defense, and the public sector. Enterprises in North America are prioritizing governance platforms, model-audit tools, compliance dashboards, and monitoring infrastructures to manage AI-driven risk.

Going forward, North America is poised to remain a core growth engine for the AI Governance market, as regulatory pressures increase, governance becomes embedded in AI lifecycles, and organizations transition from pilot-stage AI to enterprise-wide AI estates. Vendors and service providers targeting this region must align with stringent expectations around security, compliance, and ethical AI deployment to win in this market.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The AI Governance Market is experiencing rapid growth due to the increasing adoption of artificial intelligence across industries such as banking, healthcare, defense, and telecommunications. The need for ethical, explainable, and compliant AI systems has intensified, prompting organizations to establish governance frameworks that ensure transparency and accountability in AI-driven decisions.

Governments and international bodies are also introducing stringent policies—such as the EU AI Act and the U.S. AI Bill of Rights—to regulate AI use and minimize risks related to bias, discrimination, and privacy violations. These factors are creating a robust environment for AI governance adoption globally.

Another key driver is the growing integration of explainable AI (XAI) and bias detection solutions in enterprise systems. Companies are recognizing the business value of trustworthy AI models that can be audited and validated to meet internal and external compliance requirements.

With industries becoming more data-driven, the implementation of AI governance ensures responsible automation, strengthens consumer trust, and enhances corporate reputation. As digital transformation accelerates, organizations are investing in AI governance tools that align innovation with ethical responsibility, positioning it as a strategic necessity rather than a compliance obligation.

Restraint Factors

One of the major restraints affecting the AI Governance Market is the high cost and complexity associated with deploying governance frameworks across large enterprises. Developing and maintaining AI governance systems requires advanced infrastructure, specialized skill sets, and continuous oversight—all of which increase operational expenses.

Additionally, many organizations lack in-house expertise in AI ethics, algorithmic fairness, and risk assessment, creating barriers to effective implementation. These limitations are particularly evident in small and medium-sized enterprises (SMEs), where budget constraints often prevent the adoption of advanced governance solutions.

Furthermore, the absence of global AI governance standards adds another layer of difficulty. Each region or country follows different regulatory protocols, making it challenging for multinational companies to maintain uniform governance practices. The evolving nature of AI technologies also complicates compliance, as regulatory frameworks often lag behind innovation. This mismatch between policy and technology slows down the pace of adoption, forcing organizations to rely on fragmented governance models that may not be sufficient for long-term risk management.

Growth Opportunities

The market presents strong opportunities as enterprises worldwide increasingly recognize the strategic importance of AI governance in mitigating reputational and legal risks. The development of scalable governance platforms that combine automation, bias detection, and real-time monitoring offers significant potential for vendors.

Governments are funding responsible AI initiatives, creating new avenues for solution providers to collaborate with public institutions. Additionally, the rise of cloud-based and hybrid deployment models allows smaller businesses to adopt governance tools more cost-effectively, broadening the overall market base.

The emergence of advanced technologies such as generative AI, natural language processing, and predictive analytics is opening new frontiers for AI governance. As these technologies become integral to decision-making, the demand for oversight mechanisms will continue to grow. Companies offering explainable AI, regulatory reporting, and algorithm auditing services are expected to benefit most from this shift. Strategic partnerships between AI developers and governance solution providers will further enhance innovation, ensuring compliance and ethical accountability across industries.

Challenging Factors

A significant challenge facing the AI Governance Market is balancing innovation with regulation. As organizations race to implement AI solutions, they often struggle to maintain ethical and regulatory compliance without slowing innovation. Rapid advancements in machine learning models make it difficult for governance frameworks to keep pace, leading to inconsistencies in oversight and accountability. Additionally, the lack of interoperability between governance tools and AI platforms hampers scalability and cross-platform integration, limiting the effectiveness of governance initiatives.

Cybersecurity risks and data privacy concerns pose another major challenge. AI governance systems often rely on vast datasets, making them vulnerable to breaches and misuse if not properly secured. The lack of skilled professionals capable of managing governance tools and ethical frameworks further compounds the problem.

Moreover, inconsistent global regulations and unclear accountability between AI developers, data owners, and end-users create uncertainty in implementation. Addressing these challenges requires a coordinated effort between governments, industry bodies, and technology providers to establish robust, harmonized governance standards that enable both innovation and ethical AI deployment.

Competitive Analysis

The competitive landscape of the AI Governance Market is characterized by a blend of technology leaders, IT service providers, and industrial solution developers focusing on ethical AI, compliance, and risk management. IBM Corporation remains one of the most influential players, offering a comprehensive AI governance framework that integrates transparency, fairness, and accountability across enterprise operations.

Its offerings combine advanced software, consulting services, and automation tools that align with global regulatory standards. Microsoft Corporation follows closely, leveraging its Azure AI platform and Responsible AI initiatives to embed governance features directly into its enterprise cloud ecosystem. Similarly, Oracle Inc. and SAP SE are embedding AI governance layers into their ERP and analytics solutions, helping businesses manage model transparency, explainability, and compliance within existing enterprise workflows.

IT service and consulting giants such as Infosys Ltd, DXC Technology Company, Tata Consultancy Services (TCS) Ltd, and NTT Data play a vital role in implementing governance frameworks, particularly for clients in regulated sectors such as finance, healthcare, and manufacturing. These firms focus on system integration, risk auditing, and policy alignment.

Industrial and automation leaders like ABB Ltd and Siemens SA are expanding AI governance solutions tied to operational safety, predictive maintenance, and ESG-driven automation systems. Meanwhile, TIBCO Software Inc. strengthens its position with explainable AI and data observability tools, supporting AI model transparency and monitoring. Together, these players form a competitive ecosystem balancing infrastructure innovation, governance consulting, and ethical compliance—positioning AI governance as a core pillar of enterprise digital transformation worldwide.

Top Key Players in the Market

- ABB Ltd

- DXC Technology Company

- IBM Corporation

- Infosys Ltd

- Microsoft Corporation

- NTT Data

- Oracle Inc

- SAP SE

- Siemens SA

- Tata Consultancy Services (TCS) Ltd

- TIBCO

- Others

Major Developments

- January 2025: Google Cloud Unveils AI Trust and Safety Suite

Google Cloud launched a new AI Trust and Safety Suite that empowers organizations to manage AI risks and ensure model compliance. The suite includes explainability modules, risk scoring engines, and secure audit logs for AI lifecycle management. It is part of Google’s ongoing efforts to promote responsible AI adoption among enterprise clients.

- February 2025: PwC Introduces Global AI Assurance Services

PwC announced its AI Assurance Services aimed at helping clients evaluate, audit, and certify their AI systems against ethical and regulatory benchmarks. The service framework focuses on algorithmic transparency, data governance, and performance validation, supporting clients in aligning innovation with responsible AI principles.

- March 2025: IBM Launches AI Governance Platform for Enterprise Compliance

IBM introduced a next-generation AI governance platform designed to help enterprises manage compliance, data transparency, and ethical AI use. The platform includes tools for bias detection, model monitoring, explainability, and regulatory reporting, aligning with global standards such as the EU AI Act and ISO/IEC 42001. The solution aims to simplify governance integration across industries, including BFSI, healthcare, and public administration.

Report Scope

Report Features Description Market Value (2024) USD 550.7 Mn Forecast Revenue (2034) USD 16,625.2 Mn CAGR(2025-2034) 40.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solution, Services), By Deployment (On-Premises, Cloud), By Organization Size (Large Enterprise, SMEs), By Vertical (BFSI, Government and Defense, Healthcare and life sciences, Media and Entertainment, Retail, IT and Telecommunication, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd, DXC Technology Company, IBM Corporation, Infosys Ltd, Microsoft Corporation, NTT Data, Oracle Inc, SAP SE, Siemens SA, Tata Consultancy Services (TCS) Ltd, TIBCO, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- ABB Ltd

- DXC Technology Company

- IBM Corporation

- Infosys Ltd

- Microsoft Corporation

- NTT Data

- Oracle Inc

- SAP SE

- Siemens SA

- Tata Consultancy Services (TCS) Ltd

- TIBCO

- Others