Global AI Gaming Monitor Market Size, Share, Industry Analysis Report By Panel Type (IPS Panel, TN Panel, VA Panel), By Screen Size (Less Than 27 Inch, 27-32 Inch, More Than 32 Inch), By Technology (Natural Language Processing (NLP), Machine Learning, Computer Vision, Others), By Sales Channel (Online Stores, Offline Stores), By End User (Commercial, Consumers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163397

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Panel Type Analysis

- Screen Size Analysis

- Technology Analysis

- Sales Channel Analysis

- End User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

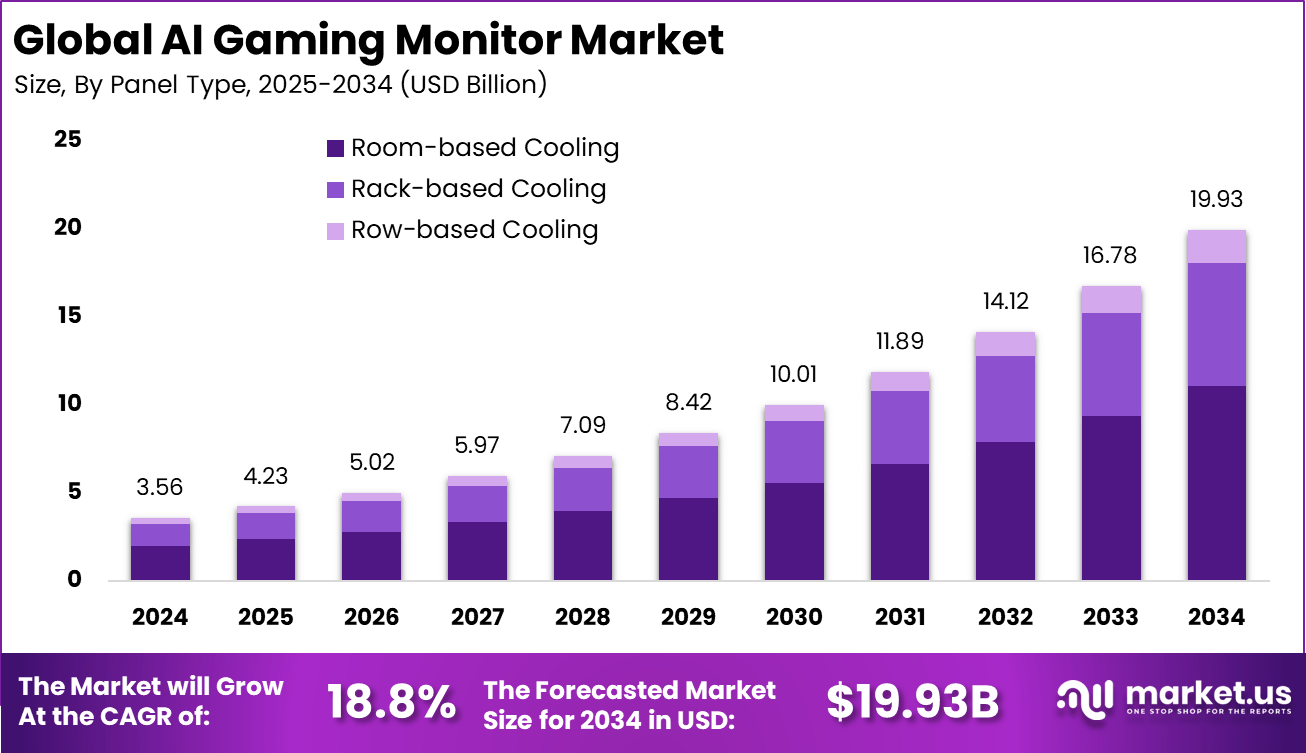

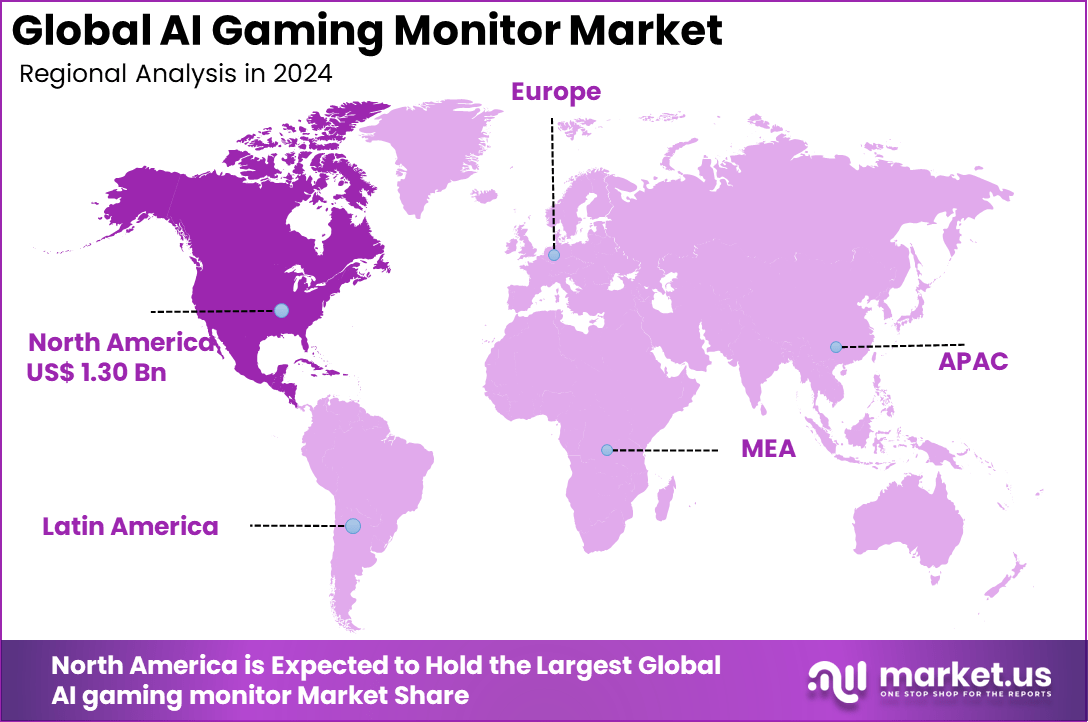

The Global AI gaming monitor Market size is expected to be worth around USD 19.93 billion by 2034, from USD 3.56 billion in 2024, growing at a CAGR of 18.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.6% share, holding USD 1.30 billion in revenue.

The AI gaming monitor market comprises gaming displays that incorporate artificial intelligence (AI) features such as adaptive refresh-rate tuning, motion-prediction algorithms, ambient ambient sensing for optimisation, and user-behaviour learning for dynamic visual adjustments. These devices combine high refresh rates, low latency panels, advanced display technology (OLED, Mini-LED) and AI-enabled functionality to enhance the gaming experience.

Gamers, content creators, and esports professionals are the primary consumers pushing growth. The rise in cloud gaming and next-gen consoles also fuels demand for AI-enhanced monitors that can dynamically optimize visuals and reduce eye strain during extended play. Additionally, AI-powered features like predictive maintenance extend product lifespans, offering better value to users. These factors together drive strong market growth, particularly in regions with high gaming adoption such as North America and Asia-Pacific.

Adoption of AI technologies in gaming monitors includes AI-driven display calibration, human presence detection, and scene-based performance adjustments. Smart systems automatically fine-tune settings like color accuracy, refresh rate, and power consumption without manual input, improving convenience and reducing fatigue. Gamers adopt these due to enhanced image clarity, better eye protection, and the ability to customize gaming environments seamlessly.

For instance, in January 2025, LG launched the UltraGear GX9 series with WOLED tech, curved displays, and AI-powered gaming monitors featuring the world’s first 5K2K OLED gaming display, focusing on immersive visuals combined with AI personalization.

Key Takeaway

- The IPS Panel segment led the market with 55.7%, driven by high color accuracy, wide viewing angles, and superior image quality preferred by professional and casual gamers alike.

- The 27–32-inch display segment accounted for 44.6%, reflecting strong consumer demand for larger screens that enhance gaming immersion and AI-assisted visual performance.

- Natural Language Processing (NLP) technology held 40.8%, highlighting the integration of voice-command features that allow users to adjust settings and controls hands-free.

- The Offline Stores segment dominated with 58.6%, as customers continue to prefer in-person product demonstrations and direct purchase experiences for premium monitors.

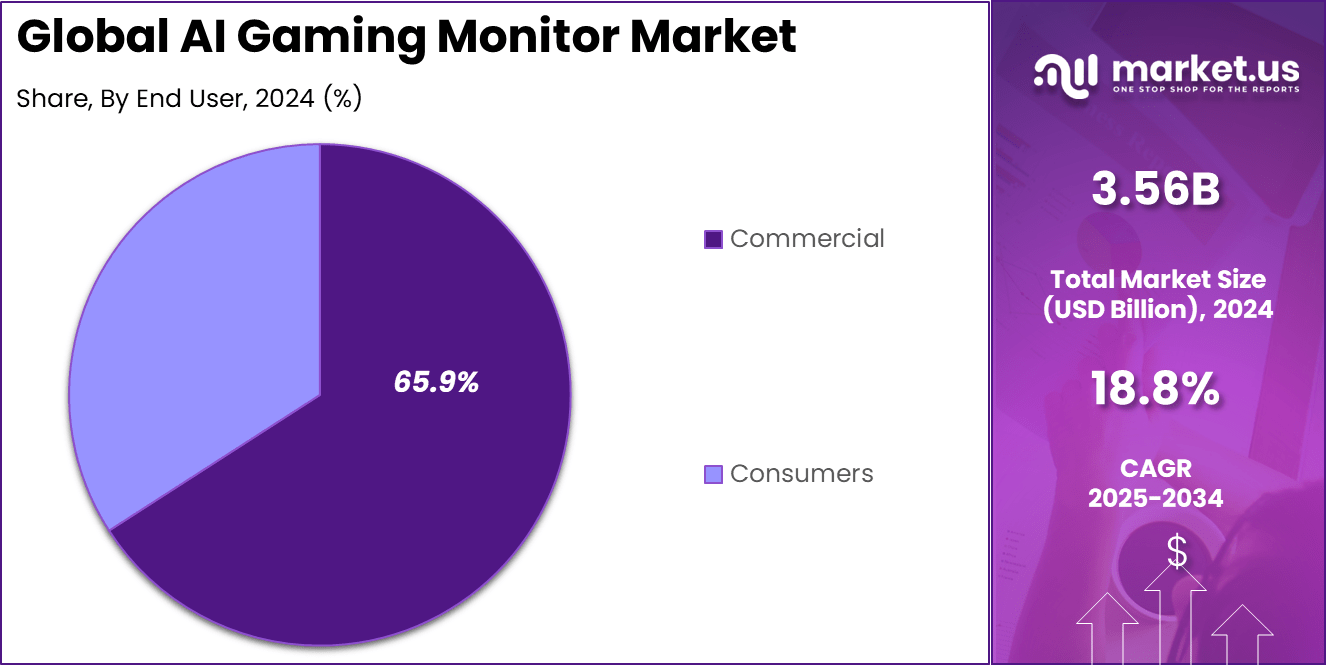

- The Commercial segment captured 65.9%, driven by the increasing use of AI-powered displays in gaming arenas, esports venues, and entertainment centers.

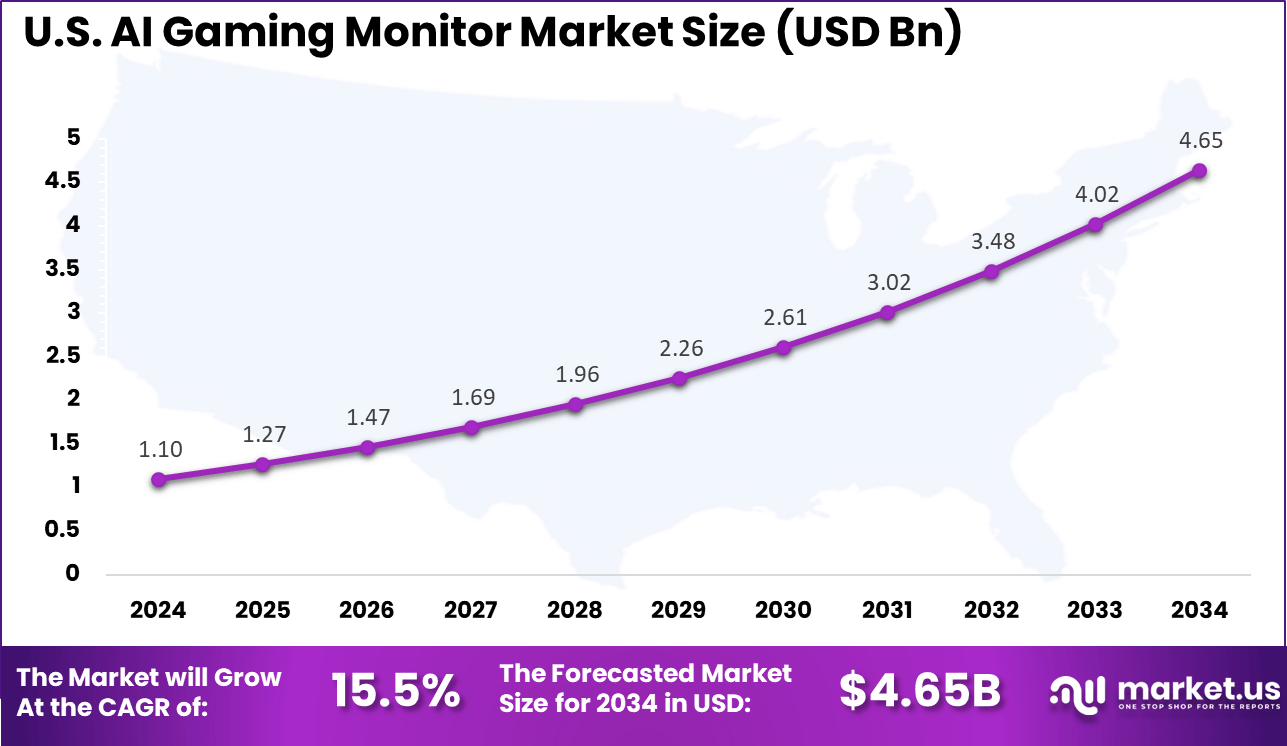

- The US market was valued at USD 1.10 Billion in 2024, growing at a robust 15.5% CAGR, fueled by technological advancements and rising interest in immersive AI-enhanced gaming displays.

- North America held a leading 36.6% share of the global market, supported by strong gaming infrastructure, high disposable income, and early adoption of AI-integrated display technologies.

Role of Generative AI

Generative AI is increasingly becoming essential in gaming monitors by enhancing the overall gaming experience through real-time adaptations and personalized content creation. Nearly 35% of game developers incorporate generative AI to produce dynamic game environments and more engaging storylines.

This technology allows gaming monitors to automatically adjust display settings based on the type of game being played, optimizing visuals and reducing lag for smoother gameplay. Additionally, generative AI supports faster game testing by simulating multiple scenarios and spotting bugs early, speeding up development and improving product quality.

Besides content creation and testing, generative AI also personalizes gameplay by analyzing user behavior to adjust difficulty and game challenges, making play sessions more enjoyable and less frustrating. This leads to higher player retention as games respond uniquely to each individual.

AI-powered monitors adapt in real time to changing game conditions by fine-tuning colors, brightness, and refresh rates, amplifying immersion. These factors are key drivers behind the growing presence of AI in gaming monitors, showing how intelligent technology is changing the way players interact with their games.

Investment and Business Benefits

Investment opportunities exist in AI-driven display technologies, advanced panel development like QD-OLED, and smart gaming accessories that complement AI monitors. Growth prospects are promising in cloud-enabled gaming and wireless connectivity solutions requiring intelligent display management. Beyond hardware, AI tools to monitor and enhance gaming business operations also present attractive opportunities.

These solutions allow gaming companies to identify revenue and engagement opportunities more efficiently, fueling interest from investors in combined AI and gaming tech ventures. Business benefits of AI gaming monitors extend beyond enhanced user experience to operational advantages such as real-time adaptive settings that reduce the need for manual calibrations, improving product usability and customer satisfaction.

AI features that reduce eye strain and improve visual clarity can increase gaming session duration, thus driving higher engagement and loyalty. For manufacturers and retailers, offering AI-enabled monitors differentiates products in a crowded market and builds brand reputation for innovation and customer-centric design.

U.S. Market Size

The market for AI gaming monitors within the U.S. is growing tremendously and is currently valued at USD 1.10 billion, the market has a projected CAGR of 15.5%. This growth is driven by the increasing popularity of esports and competitive gaming, which fuels demand for high-performance monitors with higher resolutions and faster refresh rates.

Advances in AI technologies, such as adaptive brightness and smart calibration, enhance user experience by optimizing visuals in real time. Furthermore, growing consumer interest in immersive gaming experiences and expanding commercial use in esports arenas and gaming cafes contribute to sustained market expansion.

For instance, in January 2025, Dell (Alienware) launched the Alienware 27-inch 4K QD-OLED gaming monitor, boasting a 240Hz refresh rate and Dolby Vision HDR. The monitor features AI-enhanced burn-in protection technology, delivering immersive visuals with reduced latency aimed at high-end gamers worldwide.

In 2024, North America held a dominant market position in the Global AI gaming monitor Market, capturing more than a 36.6% share, holding USD 1.30 billion in revenue. This dominance is due to its strong and established gaming culture. The region benefits from widespread adoption of advanced gaming technologies, supported by high consumer spending power and a large base of dedicated gamers.

Additionally, North America hosts numerous esports events, competitive gaming tournaments, and commercial gaming setups, which fuel demand for high-performance monitors. Cutting-edge innovations and significant investments in gaming infrastructure further sustain this leadership position in the market.

For instance, in January 2025, Acer made a strong push in the AI gaming monitor market in North America with the launch of its Predator XB323QX gaming monitor. This model features a large 31.5-inch 5K IPS display with a 144Hz refresh rate, 0.5ms response time, and NVIDIA G-SYNC Pulsar technology for superior visual clarity and smooth gaming performance.

Panel Type Analysis

In 2024, The IPS Panel segment held a dominant market position, capturing a 55.7% share of the Global AI gaming monitor Market. This dominance comes from its excellent color accuracy and wide viewing angles, which gamers appreciate as it makes visuals more vibrant and immersive. Gamers favor IPS panels since they provide consistent, sharp images whether viewed straight-on or from an angle. These qualities make IPS panels a popular pick among those who want the best visual experience.

Additionally, the growth in high-resolution and visually demanding games helps increase the appeal of IPS technology. As gamers seek richer graphics and more lifelike images, the demand for IPS monitors continues to rise steadily.

For Instance, in June 2025, ASUS launched its TUF Gaming Series Five monitors featuring advanced Fast IPS panel technology. These models offer a 1ms gray-to-gray response time, minimal motion blur, and vibrant colors, catering to gamers seeking high-performance IPS displays. ASUS emphasizes ultrasmooth gameplay with refresh rates up to 300Hz, designed to satisfy competitive gaming demands.

Screen Size Analysis

In 2024, the 27-32-inch segment held a dominant market position, capturing a 44.6% share of the Global AI gaming monitor Market. It offers enough screen space for detailed visuals while remaining manageable for typical gaming setups. It strikes a good balance between immersion and practicality, avoiding the drawbacks of smaller or overly large sizes.

Users in this category benefit from clear, expansive viewing without excessive head or eye movement. The comfort and ease of focus on this screen size make it favorable for longer gaming sessions, appealing to a broad spectrum of users from hobbyists to esports professionals.

For instance, in May 2024, Acer unveiled a range of OLED and fast IPS monitors in the 27-32 inch size band, including the Nitro series. The 27-inch GA271U P features a 2560×1440 resolution and a 180Hz refresh rate with IPS technology, designed for gamers who want a balance between size and performance.

Technology Analysis

In 2024, The Natural Language Processing (NLP) segment held a dominant market position, capturing a 40.8% share of the Global AI gaming monitor Market. NLP enhances the interactivity of gaming monitors by enabling smarter voice command features and more natural communication between the user and the device. This leads to an enriched gaming experience where players can control and interact with games using voice input seamlessly.

As game environments become more complex, NLP integration helps make gameplay more intuitive and accessible. This technology also supports adaptive features that respond to player behavior, further improving user engagement and satisfaction in AI-powered gaming monitors.

For Instance, in August 2025, Samsung introduced the Smart Monitor M9 with AI-powered features, including smart picture adaptation using NLP-based algorithms. It enhances entertainment and productivity by analyzing content types and automatically optimizing display settings, including gaming.

Sales Channel Analysis

In 2024, The Offline Stores segment held a dominant market position, capturing a 58.6% share of the Global AI gaming monitor Market. Many consumers prefer buying gaming monitors in physical stores because they want to see and test the product firsthand before making a purchase. The ability to compare models and receive expert advice in-store plays a significant role in driving offline sales.

Despite the rise of online shopping, the tactile and personalized experience of offline retail remains critical in this sector. Offline stores give customers confidence through hands-on interaction and direct customer service, which is especially important for higher-investment consumer electronics like gaming monitors.

For Instance, in August 2023, MSI continues to emphasize offline retail presence 2023, with flagship monitors available through specialized gaming stores globally. The MSI MAG 272F X24, for example, is a 27-inch rapid IPS monitor widely stocked in retail outlets because customers prefer hands-on experience given the technical nature of gaming hardware.

End User Analysis

In 2024, The Commercial segment held a dominant market position, capturing a 65.9% share of the Global AI gaming monitor Market. This segment includes gaming cafes, esports venues, and professional gaming setups where high-quality monitors are essential. These environments demand durable, high-performance monitors that can handle long hours of use and provide top-tier visual and technical features.

The commercial demand incentivizes manufacturers to continually enhance product features and reliability. This user base fuels innovation and sales growth as businesses invest in technology that offers competitive advantages and superior gaming experiences for their customers and players.

For Instance, in January 2025, Dell’s Alienware gaming monitors, designed with professional gamers and esports venues in mind, emphasized high refresh rates and color accuracy for commercial usage. These monitors meet the demands of commercial environments such as gaming centers and streaming setups.

Emerging Trends

Emerging trends in the AI gaming monitor sector focus heavily on hardware innovations and smart features that improve visual quality and performance. OLED screens, known for superior color accuracy and faster response times, are becoming more common, providing gamers with sharper and more fluid images.

Around 27% of new gaming monitors now come with AI-powered upscaling technology, enhancing lower-resolution content to near 4K quality, meaning better graphics without needing more powerful hardware. The industry is also seeing rising demand for ultra-high refresh rates, with monitors reaching up to 500Hz, catering to competitive gamers who need smooth and responsive displays.

Smart adjustments based on the gaming environment are also a growing feature. About 30% of new monitors introduced in 2025 include AI systems that automatically recalibrate brightness and contrast depending on ambient lighting and game styles. These adaptive features help reduce eye strain and maintain visual clarity, which gamers appreciate during extended play.

Growth Factors

Growth in the AI gaming monitor market is due to the rising demand for equipment that enhances competitive gaming and streaming experiences. Around 62% of high-end gaming monitors now feature AI-enhanced technologies like real-time image adjustments and adaptive refresh rates. These technologies result in faster response times and better visual output, which are crucial for esports and live streaming, where every millisecond matters.

Consumers value monitors that can upscale graphics dynamically instead of relying solely on powerful GPUs, making advanced graphics accessible without extra cost. This demand encourages manufacturers to incorporate AI features that balance performance and affordability. As a result, the expansion of AI capabilities adds value by improving the quality and enjoyment of games, stimulating steady growth in the segment.

Key Market Segments

By Panel Type

- IPS Panel

- TN Panel

- VA Panel

By Screen Size

- Less Than 27 Inch

- 27-32 Inch

- More Than 32 Inch

By Technology

- Natural Language Processing (NLP)

- Machine Learning

- Computer Vision

- Others

By Sales Channel

- Online Stores

- Offline Stores

By End User

- Commercial

- Consumers

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Enhanced Gaming Experience

The increasing demand for advanced gaming visuals is a key driver for the AI gaming monitor market. Gamers seek high-performance monitors that adapt in real time to gameplay by adjusting brightness, contrast, and refresh rates, offering smoother, immersive experiences. This technology helps reduce eye strain and enhances visual quality during competitive and casual gaming sessions.

Moreover, AI capabilities like motion prediction and frame interpolation further improve performance by reducing blurs and enabling fluid graphics. As esports and online streaming grow, both professional and casual gamers prioritize monitors with AI features to achieve the best visual fidelity and responsiveness, pushing the market forward.

For instance, in October 2025, ASUS launched a new AI-powered gaming monitor that uses real-time adaptive brightness and motion prediction to enhance gameplay clarity. The company highlighted how this product caters to gamers seeking immersive experiences, addressing the rising demand driver in the market.

Restraint

High Cost of AI-Enabled Gaming Monitors

The expensive price point of AI-powered gaming monitors serves as a significant restraint to market expansion. Integrating AI requires advanced hardware components and software, which drives prices higher than conventional gaming monitors. This premium cost deters many budget-conscious users from upgrading their systems despite the potential performance benefits.

Additionally, the cost barrier impacts adoption in regions with limited disposable incomes or economic uncertainties. Consumers may also face added expenses for system compatibility upgrades, amplifying the overall investment required and slowing market growth.

For instance, in September 2025, Acer announced a premium AI gaming monitor priced higher than its traditional models, reflecting cost challenges in adopting AI technology. This pricing strategy has limited some consumer segments from switching to the new AI-enabled displays, demonstrating the market restraint.

Opportunities

Expansion through Curved and OLED Displays

Curved and OLED gaming monitors combined with AI features present a major opportunity for market growth. Curved screens enhance immersion with a wider field of view and reduced glare, appealing to gamers who want an engaging experience. AI-driven dynamic calibration in these monitors further elevates image quality and user comfort.

OLED panels offer superior color accuracy and contrast, forming a premium category enriched by AI’s real-time display optimizations. As manufacturers develop AI-enhanced curved and OLED models, the demand from both enthusiasts and professional gamers for these immersive displays continues to rise, opening new revenue streams.

For instance, in August 2025, Samsung expanded its AI gaming monitor lineup with curved OLED displays featuring AI-driven color calibration and dynamic contrast adjustment. This development capitalizes on the opportunity presented by combining AI technology with advanced display types to attract gaming enthusiasts and professionals.

Challenges

Compatibility and Hardware Requirements

Compatibility issues and high hardware requirements restrain the adoption of AI gaming monitors. These monitors need powerful GPUs, updated CPUs, and modern ports like HDMI 2.1 or DisplayPort 1.4 to fully utilize AI functionalities. Many existing gaming setups lack these specifications, reducing the effectiveness of AI features and discouraging upgrades.

Moreover, developing seamless software integration across various systems and game titles is complex, requiring ongoing collaboration between hardware makers and game developers. This technical challenge slows widespread adoption and elevates support costs, making the market less accessible to average users.

For instance, in July 2025, MSI faced compatibility issues with some AI features on older gaming setups, highlighting a challenge in ensuring that AI gaming monitors work seamlessly across diverse hardware and software configurations. The company noted ongoing efforts to improve compatibility and broaden user accessibility.

Key Players Analysis

The AI Gaming Monitor Market is dominated by leading electronics and display manufacturers such as ASUS, Acer, Dell (Alienware), and MSI. These companies integrate artificial intelligence into gaming monitors to enhance image optimization, refresh rate adjustment, and color calibration in real time.

Prominent consumer electronics brands including Samsung, LG Electronics, and HP (OMEN, HyperX) are advancing the market with next-generation OLED, QD-OLED, and mini-LED display technologies. These brands utilize AI algorithms for automatic brightness control, motion prediction, and adaptive contrast adjustment to deliver a more immersive gaming experience.

Additional contributors such as BenQ (Zowie), Gigabyte (AORUS), ViewSonic, and other major players are focusing on integrating AI-based performance tuning and personalized visual enhancement features. Their monitors combine real-time analytics with predictive AI models to optimize frame synchronization and visual quality.

Top Key Players in the Market

- ASUS

- Acer

- Dell (Alienware)

- MSI

- Samsung

- LG Electronics

- BenQ (Zowie)

- Gigabyte (AORUS)

- ViewSonic

- HP (OMEN, HyperX)

- Other Major Players

Recent Developments

- In May 2025, ASUS introduced the ROG Strix Ace XG248QSG esports monitor with a record 610Hz refresh rate and AI-powered gaming features like dynamic shadow boost and dynamic crosshair support, targeting competitive gamers needing ultra-low input lag and fast response times.

- In May 2025, MSI revealed AI-powered QD-OLED gaming monitors with AI Navigator and AI Care Sensor technology that optimizes settings in real-time, extends lifespan, and manages energy usage, raising the bar for intelligent display management in gaming monitors.

Report Scope

Report Features Description Market Value (2024) USD 3.56 Bn Forecast Revenue (2034) USD 19.93 Bn CAGR(2025-2034) 18.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Panel Type (IPS Panel, TN Panel, VA Panel), By Screen Size (Less Than 27 Inch, 27-32 Inch, More Than 32 Inch), By Technology (Natural Language Processing (NLP), Machine Learning, Computer Vision, Others), By Sales Channel (Online Stores, Offline Stores), By End User (Commercial, Consumers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ASUS, Acer, Dell (Alienware), MSI, Samsung, LG Electronics, BenQ (Zowie), Gigabyte (AORUS), ViewSonic, HP (OMEN, HyperX, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ASUS

- Acer

- Dell (Alienware)

- MSI

- Samsung

- LG Electronics

- BenQ (Zowie)

- Gigabyte (AORUS)

- ViewSonic

- HP (OMEN, HyperX)

- Other Major Players