Global AI Calendar Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Type (Surveillance Cameras, Smartphone Cameras, Digital Cameras, Industrial Cameras, Others), By Technology (Image/Face Recognition, Voice/Speech Recognition, Computer Vision, Context Awareness, Others), By Industry (Consumer Electronics, Manufacturing, Sports, Agriculture, Retail, Healthcare, Transportation, Government & Law Enforcement, Automotive, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161740

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analyst Viewpoint

- Role of Generative AI

- Notable AI Calendar

- U.S. AI Calendar Market Size

- Component Analysis

- Type Analysis

- Technology Analysis

- Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

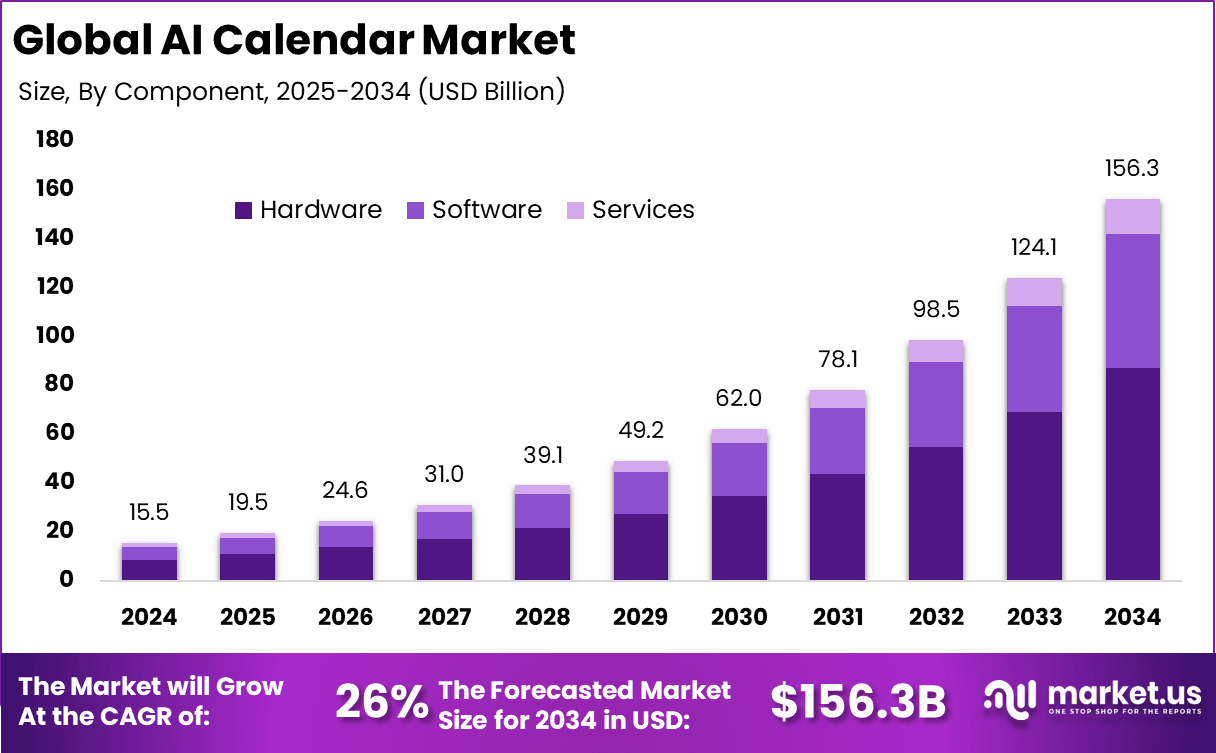

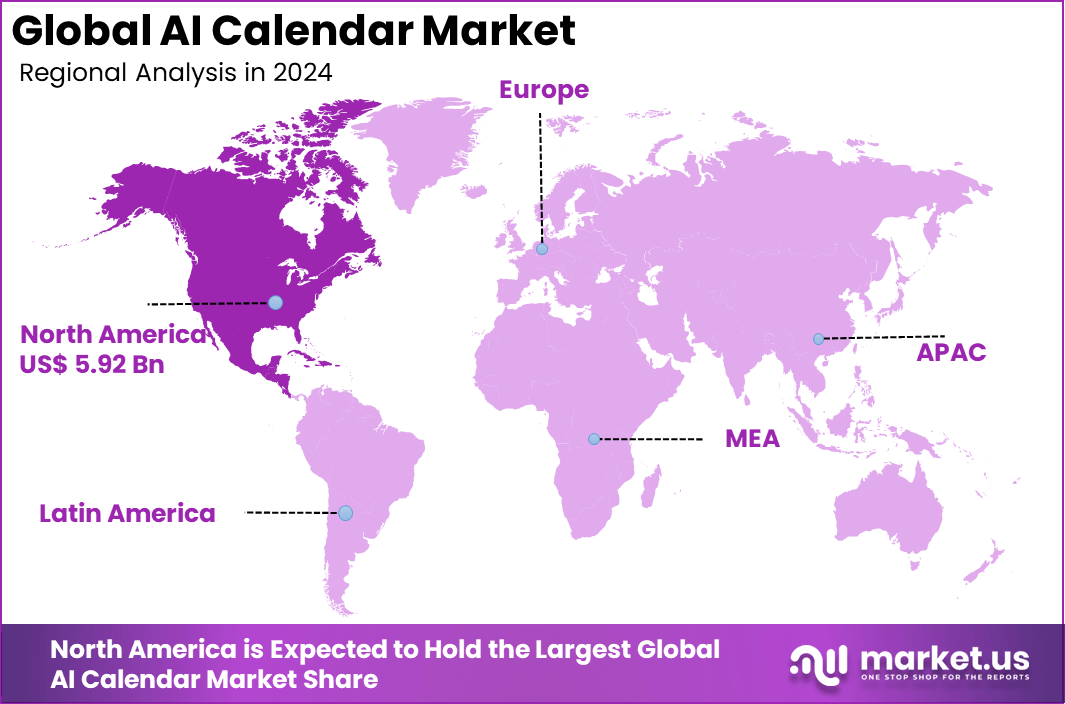

The Global AI Calendar Market size is expected to be worth around USD 156.3 billion by 2034, from USD 15.5 billion in 2024, growing at a CAGR of 26.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.2% share, holding USD 5.92 billion in revenue.

The AI calendar market includes intelligent scheduling tools and digital assistants that use artificial intelligence to organize meetings, manage availability, send reminders, and coordinate events across individuals and teams. These platforms integrate with email, messaging apps, conferencing tools, and workplace software. They automate scheduling tasks by understanding user preferences, work patterns, time zones, and calendar conflicts.

A major driver is the increase in remote and hybrid work, which has raised the need for automated coordination across teams and clients. Professionals handle more meetings across different platforms, making manual scheduling inefficient. Rising use of virtual collaboration and distributed workforce models has encouraged adoption of smart scheduling systems. Personal productivity needs and time optimization also play a strong role.

Recent adoption statistics show that about 75% of firms have incorporated AI into their scheduling systems by 2025, up from 55% in 2024, demonstrating rapid acceptance across industries such as healthcare, finance, and IT. Demand analysis points out that businesses are increasingly adopting AI scheduling as a necessity to manage hybrid work environments and optimize team workflows.

For instance, in October 2025, Google introduced a new Gemini-powered feature that significantly enhances meeting scheduling within Gmail. The “Help me schedule” tool uses Gemini AI to analyze email content and suggest optimal meeting times based on the availability in Google Calendar. This feature allows users to coordinate meetings quickly by selecting from suggested slots, reducing lengthy email exchanges.

Technologies such as natural language processing, machine learning, IoT integration, and predictive analytics play critical roles in advancing the functionality of these tools. The AI calendar not only schedules but also understands context, meeting type, and participant profiles to tailor scheduling recommendations, which enhances user satisfaction and meeting effectiveness

Key Takeaway

- Hardware makes up about 55.8%, showing strong reliance on physical AI-enabled devices to support calendar automation and scheduling functions.

- Surveillance cameras account for nearly 40.6%, reflecting growing integration of AI scheduling with monitoring and security systems.

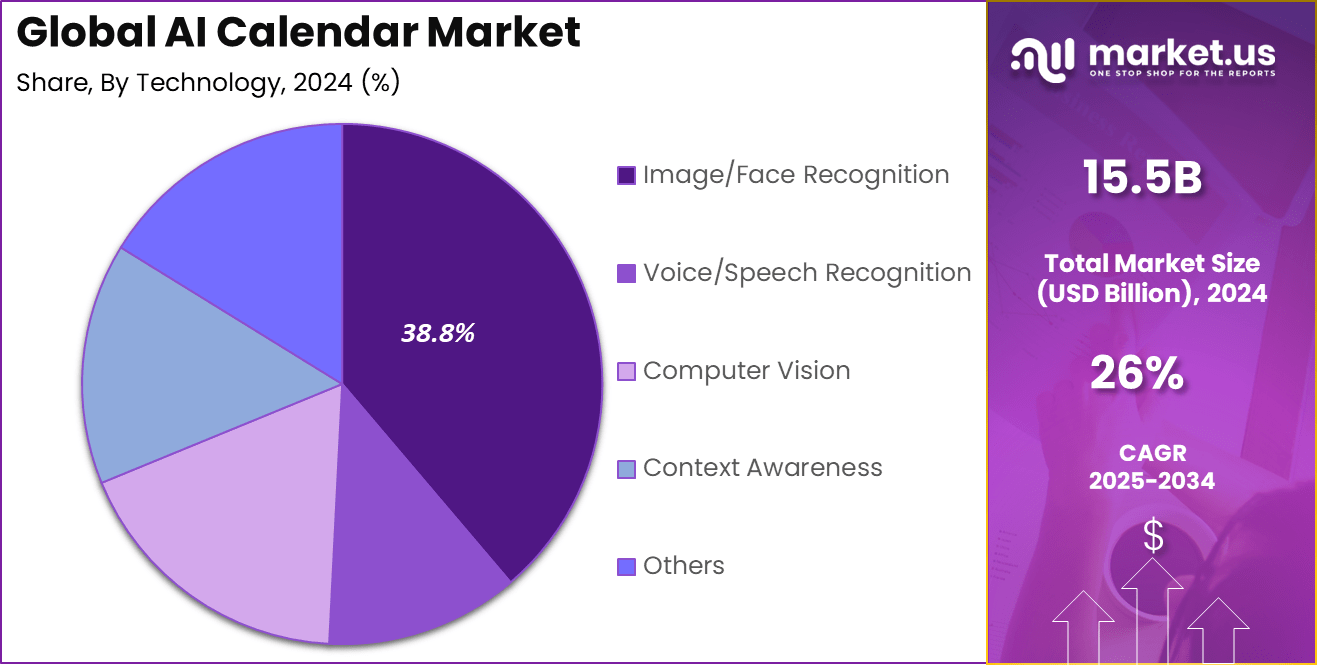

- Image and face recognition hold around 38.8%, driven by authentication, access control, and automated event coordination.

- Consumer electronics contribute close to 30.7%, highlighting everyday use through smart devices and connected platforms.

- North America represents over 38.2%, supported by high adoption in enterprises, smart homes, and public infrastructure.

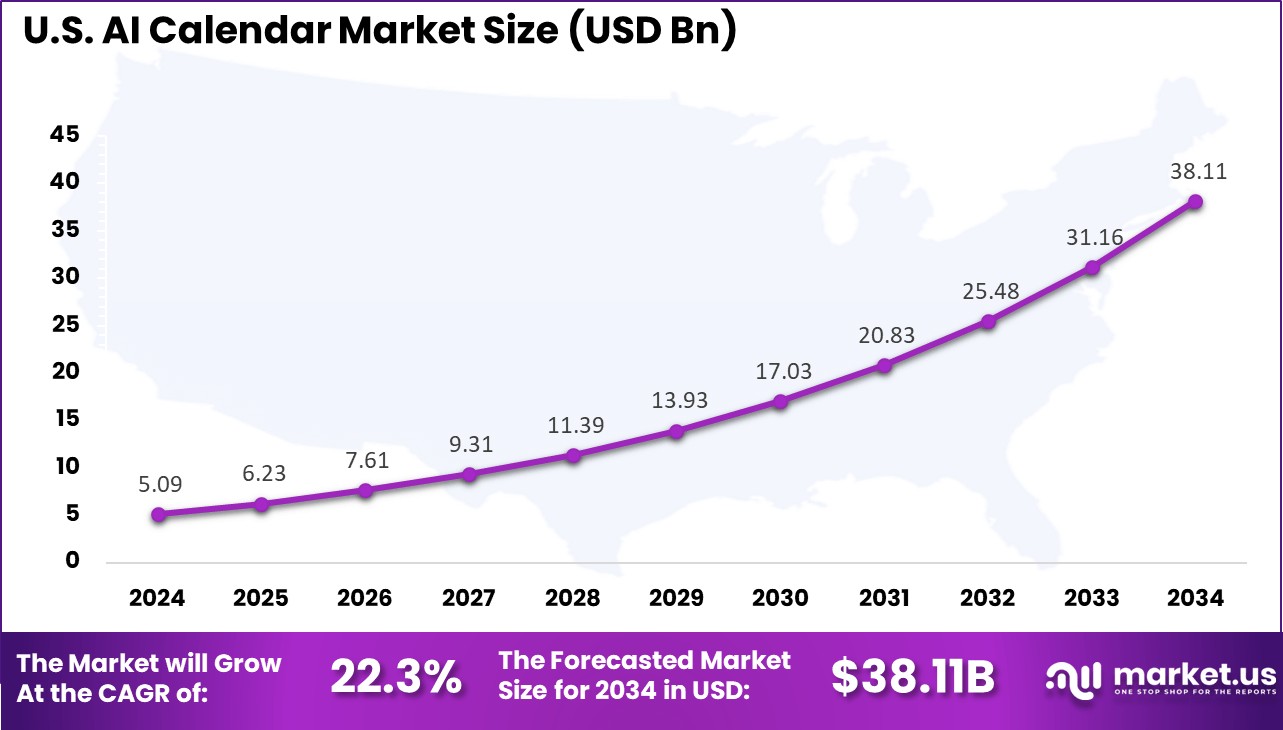

- The U.S. leads regional share with expanding use of AI-enabled scheduling in personal, commercial, and security ecosystems.

- A growth rate of about 22.3% CAGR shows strong momentum as AI calendars become embedded in smart devices and integrated work environments.

Analyst Viewpoint

Investment opportunities in this market are substantial, particularly as AI calendars integrate more deeply with broader business ecosystems like CRM, project management, and communication platforms. Emerging markets and AI-driven innovations are attracting strategic investments, with companies allocating about 20% of their tech budgets to AI scheduling tools as of 2025.

Cross-sector expansion and geographical growth in emerging regions present avenues for new ventures and technological disruption. The business benefits of adopting AI calendar solutions are clear and measurable. Enhanced efficiency, reduced manual labor, better customer engagement, and improved internal collaboration are recurring outcomes.

For example, companies utilizing AI-driven calendars have seen customer acquisition increases of 26%, translating into higher revenue potential. Additionally, AI calendars support work-life balance by intelligently proposing breaks and managing personal appointments, reducing employee burnout and improving job satisfaction.

Role of Generative AI

AI Calendar technology is transforming scheduling by saving users up to 40% of their time organizing meetings and appointments, allowing more focus on important work. These smart tools reduce administrative burdens and offer personalized suggestions based on habits and preferences, making daily planning smoother and less stressful.

Generative AI enhances calendar capabilities by creating meeting summaries, drafting agendas, and suggesting follow-up actions. This results in a 30% improvement in meeting efficiency, helping users prepare better and reduce repetitive tasks, turning calendars into proactive assistants.

Emerging trends include deeper syncing across communication platforms, expected by 65% of users, and growing voice control adoption, preferred by over 50% for scheduling and adjustments. These trends boost convenience, especially for multitaskers and remote workers.

Notable AI Calendar

Tool Description Motion Combines task management with scheduling. Uses AI to prioritize tasks and auto-schedule deadlines. Reclaim.ai Focuses on work-life balance. Intelligently schedules habits, breaks, and focus blocks around meetings. Clockwise Optimizes team collaboration. Creates focus time and reschedules low-priority meetings to reduce conflicts. BeforeSunset AI Builds personalized schedules. Introduces AI-generated “Oasis” environments to maintain focus. Calendly Simplifies booking. Provides automated scheduling, templates, and integrations for teams and individuals. Microsoft Outlook/Scheduler with AI Embedded in Microsoft 365. Delivers AI-driven meeting suggestions and productivity insights. Google Calendar with AI Suggests optimal meeting times. Integrates seamlessly with Google Workspace for efficient scheduling. U.S. AI Calendar Market Size

The market for AI Calendar within the U.S. is growing tremendously and is currently valued at USD 5.09 billion, the market has a projected CAGR of 22.3%. The market is growing tremendously due to the widespread adoption of remote and hybrid work models that demand intelligent scheduling solutions.

Businesses are looking to increase productivity by automating meeting coordination and reducing conflicts. Additionally, strong technology infrastructure and a high level of AI innovation in the U.S. foster faster AI calendar integration into everyday tools. Growing awareness of AI’s benefits in time management and digital workflows is driving more organizations and individuals to adopt these smart calendar systems.

In 2024, North America held a dominant market position in the Global AI Calendar Market, capturing more than a 38.2% share, holding USD 5.92 billion in revenue. This dominance is due to its advanced technology ecosystem and high digital adoption rates. The region’s strong infrastructure supports seamless implementation of AI-powered scheduling tools across industries.

Additionally, the presence of major tech companies and startups driving innovation accelerated market growth. North America’s early embrace of remote and hybrid work models further increased demand, making efficient AI calendar solutions essential for managing complex, geographically dispersed teams and enhancing overall productivity.

For instance, in January 2025, SK Telecom launched its AI assistant named Aster, integrating seamlessly with Google Calendar and Yelp. This launch highlights North America’s dominance in the AI calendar market by leveraging cutting-edge partnerships and advanced AI capabilities to enhance scheduling and real-world activity planning.

Component Analysis

In 2024, the hardware segment accounted for 55.8% of the Global AI Calendar Market. It forms the core infrastructure that allows AI calendars to run smoothly by supplying the processing strength and data-handling ability needed for real-time functions. Components such as AI-focused chips, sensors, and connected peripherals make it possible for these platforms to integrate with other smart devices.

Advancements in hardware are improving the responsiveness and accuracy of AI calendars. Strong processing capability supports functions like biometric login, voice inputs, and instant scheduling updates. As these features become more refined, users experience faster interpretation of their actions and more reliable performance.

Investment in hardware is also expanding the reach of AI calendars across devices. From smartphones to enterprise communication systems, robust setups ensure smooth synchronization and interoperability. This wide compatibility is increasing adoption in both personal and workplace environments.

For Instance, in September 2025, Nartick introduced the world’s first AI-powered E-Ink smart calendar device, designed to transform traditional scheduling into a personal assistant role. The hardware innovation focuses on long battery life, voice command capabilities, and intelligent task management to meet the needs of increasingly fragmented daily schedules.

Type Analysis

In 2024, surveillance cameras accounted for 40.6% of the Global AI Calendar Market. Their integration with AI calendars supports automated scheduling by detecting occupancy, monitoring movement, and triggering alerts or events without manual input. This connection improves how organizations manage security operations and facility usage in real time.

Urban development and the expansion of smart city projects continue to drive demand for AI-enabled surveillance systems. Cameras linked with calendars help schedule security patrols, manage access, and coordinate maintenance activities based on real-world activity. Their ability to capture and relay information directly into planning systems increases efficiency.

This segment’s prominence highlights a shift toward merging monitoring tools with automated scheduling platforms. By connecting surveillance infrastructure with AI calendars, industries gain smarter resource allocation and faster response mechanisms, making these systems critical for both safety and operational planning.

For instance, in March 2025, IPTECHView launched its AI Orchestrator platform at ISC West, aiming to transform video surveillance with real-time AI insights. This innovative platform enhances surveillance cameras by integrating AI-driven analytics and real-time event detection, which can be linked to AI calendar systems for smarter scheduling and automated response management.

Technology Analysis

In 2024, the Image and Face Recognition segment captured 38.8% of the Global AI Calendar Market. Its rise reflects the growing reliance on visual data to automate calendar functions. Features such as automatic check-ins, attendance tracking, and personalized reminders reduce manual input and improve security.

Faster and more accurate recognition systems make these tools practical in offices, events, and enterprise settings. Users gain convenience, while organizations reduce administrative tasks and improve compliance. The technology transforms calendars into adaptive assistants that respond to real-time user presence.

Regulation is also shaping this segment. In September 2025, digital rights groups pressed the European Commission to enforce the AI Act on schedule to govern facial recognition and related calendar applications. The act seeks to protect personal rights by limiting unauthorized biometric surveillance, which directly affects how AI calendars use such data.

Industry Analysis

In 2024, the consumer electronics segment accounted for 30.7% of the Global AI Calendar Market. Devices such as smartphones, smartwatches, and home assistants now embed AI calendars that adapt to user habits. These systems deliver personalized reminders, automated scheduling, and seamless coordination across connected gadgets.

Growth in this segment is tied to the wider adoption of IoT and intelligent personal technology. Users increasingly rely on synchronized, context-aware assistants that operate in the background and streamline daily routines. This expectation pushes manufacturers to design AI calendars that enhance productivity and improve time management.

In July 2025, Samsung launched new Galaxy smartphones with advanced AI calendar capabilities. These calendars integrate with native apps and onboard sensors to automate event creation, adjust schedules, and provide tailored reminders based on user behavior and preferences.

Emerging Trends

One significant trend in AI calendars is context-aware scheduling, which enables the system to understand meeting goals, suggest optimal time slots, and recommend relevant participants. By 2025, it is expected that 75% of firms will have integrated AI features into their scheduling processes.

Another rising trend is hyper-personalization driven by AI analyzing user preferences and past behaviors to tailor scheduling experiences uniquely for each individual. With automated reminders and preparation material suggestions now becoming standard, users experience fewer missed meetings and better-prepared sessions. These evolving capabilities are shaping the calendar market’s future and improving productivity significantly.

Growth Factors

The growth in AI calendar adoption is fueled by increased demand for efficient time management across industries like healthcare, finance, and IT. The shift to hybrid work models requires robust tools that support real-time collaboration and seamless integration with various platforms.

Cloud-based solutions offering scalability and accessibility also contribute to adoption rates, facilitating smooth updates and cross-device compatibility. AI-powered enhancements, such as intelligent scheduling and automated follow-ups, are further driving uptake by reducing manual effort and boosting user satisfaction. Combined, these factors are propelling steady market expansion.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Type

- Surveillance Cameras

- Smartphone Cameras

- Digital Cameras

- Industrial Cameras

- Others

By Technology

- Image/Face Recognition

- Voice/Speech Recognition

- Computer Vision

- Context Awareness

- Others

By Industry

- Consumer Electronics

- Manufacturing

- Sports

- Agriculture

- Retail

- Healthcare

- Transportation

- Government & Law Enforcement

- Automotive

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Need for Efficient Scheduling

The demand for efficient scheduling has become one of the strongest drivers of the AI calendar market. As workplaces deal with remote teams, multiple time zones, and complex meeting patterns, traditional calendar tools are no longer sufficient. AI calendars automate tasks such as meeting bookings, conflict resolution, and reminders, which cuts down the time spent on manual coordination and improves overall productivity.

The shift toward hybrid work has accelerated adoption. Employees and managers now expect calendars that synchronize effortlessly across devices and locations. AI-driven suggestions based on past activity make these tools more adaptable and intelligent compared to standard digital calendars. This growing reliance on automated scheduling is expected to keep pushing the market forward as organizations prioritize efficiency and collaboration.

In March 2025, Google expanded its AI calendar capabilities by integrating Gemini AI into Google Calendar for Workspace users. The update enables users to manage schedules through natural language commands and is being tested through Google Workspace Labs. This move underscores Google’s broader plan to embed AI into productivity ecosystems to meet rising expectations for smarter scheduling tools.

Restraint

Concerns Over Privacy and Data Security

Data privacy concerns form a substantial restraint on AI calendar adoption. These systems require access to sensitive information such as emails, contacts, and meeting schedules, which raises questions about confidentiality and data misuse. Many users hesitate to grant AI tools deep access to their personal or professional calendars due to the perceived risk of breaches or unauthorized use of information.

Regulatory requirements further complicate deployment. Global laws like GDPR require strict compliance, demanding secure data infrastructure and transparent policies. Meeting these expectations increases operational costs and slows adoption, particularly in sectors such as finance and healthcare where confidentiality standards are high.

In October 2025, researchers identified a security threat known as “CometJacking”, which targeted AI-native platforms such as Perplexity’s Comet AI browser. The attack used malicious prompt injections through crafted links to hijack access to sensitive data – including calendar content – without stealing credentials. The incident underscored the growing vulnerabilities associated with AI-integrated scheduling systems.

Opportunities

Integration with Voice and IoT

The AI calendar market has significant opportunities through integration with emerging technologies such as voice assistants, natural language processing, and Internet of Things (IoT) devices. Voice-activated scheduling is gaining popularity, with more users preferring to create or modify calendar events hands-free. AI calendars that incorporate voice control offer convenience and accessibility, especially for multitasking professionals or those with disabilities.

Similarly, IoT integration enables smart environments where calendars communicate with connected devices, such as adjusting office lighting or room bookings based on scheduled meetings. This connectivity opens up innovative user experiences and operational optimizations. Predictive analytics further help anticipate scheduling conflicts and resource needs, delivering a smarter, more adaptive calendar solution.

For instance, in April 2025, Perplexity AI launched its advanced voice-activated AI assistant on iPhones, marking a significant step in integrating voice technology with scheduling and IoT functionalities. The Perplexity Assistant allows users to manage their calendars, set up meetings, and handle emails using simple voice commands, all deeply integrated with Apple’s native apps like Apple Calendar and Mail.

Challenges

Adoption Barriers and Technical Complexities

One significant challenge facing the AI calendar market is the complexity of integrating AI tools with existing systems and business workflows. Organizations often use multiple productivity platforms and legacy software, making seamless AI calendar integration difficult.

Incompatibility issues or poor synchronization can lead to double bookings or missed updates, frustrating users and reducing trust in AI scheduling tools. Technical complexity also extends to optimizing AI algorithms, which require continual data input and refinement to provide accurate scheduling recommendations.

Smaller firms often lack the resources to maintain these systems, hindering adoption. Vendors must focus on creating interoperable, easy-to-use solutions and offer robust customer support to overcome these obstacles and drive market expansion.

Key Players Analysis

The AI Calendar Market benefits indirectly from technology leaders such as Samsung Electronics Co., Ltd., LG Electronics, Huawei Technologies Co., Ltd., and Panasonic Holdings Corporation. These companies integrate AI-powered scheduling and time-management assistants into smart displays, mobile devices, and IoT ecosystems.

Security and automation companies including Axis Communications AB, Bosch Security Systems GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., and Johnson Controls contribute by deploying AI-driven scheduling functions into surveillance, facility management, and workforce coordination systems.

Imaging and sensor-focused firms such as Canon Inc., Nikon Corporation, Sony Corporation, Teledyne FLIR LLC, and AV Costar, along with other market participants, offer AI capabilities that integrate with digital assistants, enterprise dashboards, and operational planning software. Their technologies support automated scheduling tied to visual analytics, predictive insights, and event-based coordination across industries such as logistics, manufacturing, and smart buildings.

Top Key Players in the Market

- AV Costar

- Axis Communications AB

- Bosch Security Systems GmbH

- Canon Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Johnson Controls

- LG Electronics

- Nikon Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Teledyne FLIR LLC

- Others

Recent Developments

- In September 2025, at IFA 2025, Bosch unveiled advanced smart home security products, including new motion detectors and AI-enhanced alarm systems that integrate with scheduling and automation platforms. Bosch emphasizes user-friendly solutions that improve home security while simplifying user management through connected devices.

- In September 2025, at the Global Security Exchange 2025, Axis Communications introduced cutting-edge AI-powered bullet cameras and multisensory radars with advanced analytics capabilities. These products support real-time data processing and improve situational awareness in complex environments, tying closely to AI calendar functionalities by enabling intelligent event-triggered automation.

Report Scope

Report Features Description Market Value (2024) USD 15.5 Bn Forecast Revenue (2034) USD 156.3 Bn CAGR(2025-2034) 26% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Type (Surveillance Cameras, Smartphone Cameras, Digital Cameras, Industrial Cameras, Others), By Technology (Image/Face Recognition, Voice/Speech Recognition, Computer Vision, Context Awareness, Others), By Industry (Consumer Electronics, Manufacturing, Sports, Agriculture, Retail, Healthcare, Transportation, Government & Law Enforcement, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AV Costar, Axis Communications AB, Bosch Security Systems GmbH

Canon Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., Johnson Controls, LG Electronics, Nikon Corporation, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Teledyne FLIR LLC, OthersCustomization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AV Costar

- Axis Communications AB

- Bosch Security Systems GmbH

- Canon Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Johnson Controls

- LG Electronics

- Nikon Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Teledyne FLIR LLC

- Others