Global AI-Based Driving Systems (L2 to L5) Market Size, Share, Industry Analysis Report By Automation Level (Level 2 - Partial Automation, Level 3 - Conditional Automation, Level 4 - High Automation, Level 5 - Full Automation), By Component (AI Hardware - Chips, GPUs, ASICs, FPGAs, Software - Perception, Planning, Control Algorithms, Sensors - LiDAR, Radar, Cameras, Ultrasonic Sensors, Connectivity Modules - V2X, 5G, Edge Devices), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Robo-Taxis / Autonomous Shuttles), By Propulsion Type (Internal Combustion Engine - ICE, Electric Vehicles - EVs, Battery Electric Vehicles - BEVs, Plug-in Hybrid Electric Vehicles - PHEVs), By End User (OEMs, Tech Providers / AI Startups, Fleet Operators, Mobility-as-a-Service - MaaS Companies, Logistics & Delivery Companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157122

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

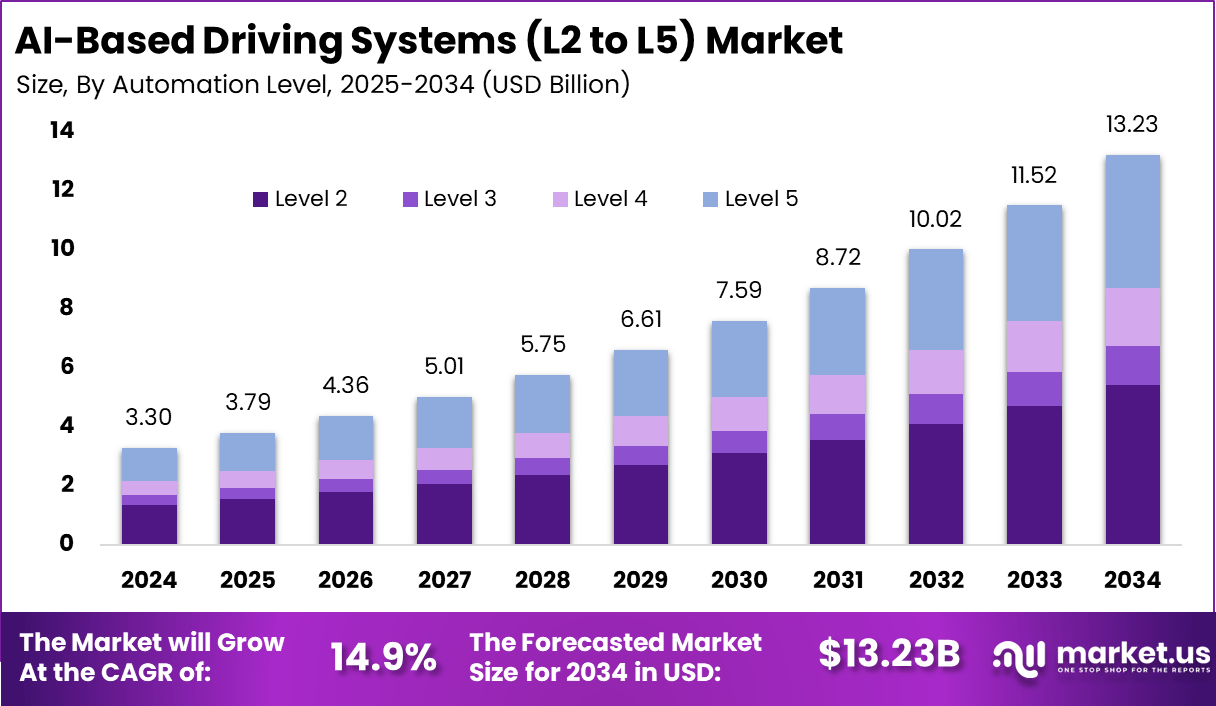

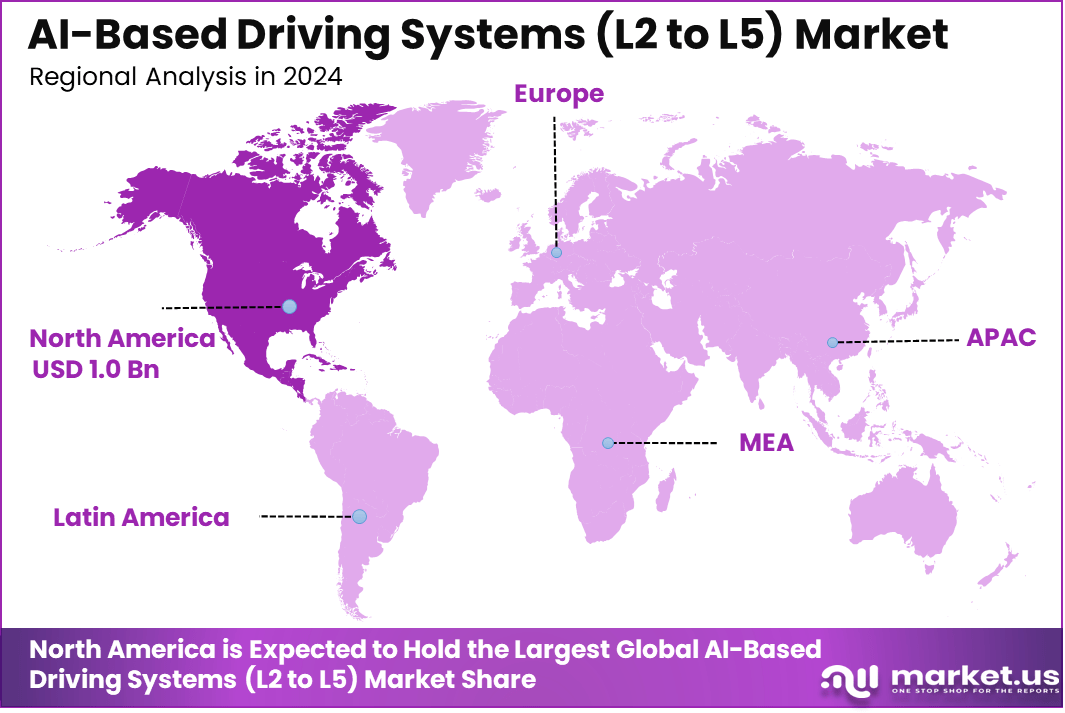

The Global AI-Based Driving Systems (L2 to L5) Market size is expected to be worth around USD 13.23 Billion By 2034, from USD 3.3 billion in 2024, growing at a CAGR of 14.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 32% share, holding USD 1.0 Billion revenue.

AI-Based Driving Systems covering Levels 2 to 5 represent the growing integration of artificial intelligence in vehicles to enable various stages of automation, from partial driving assistance (Level 2) to full autonomy without human intervention (Level 5). These systems use AI algorithms combined with cameras, radar, LiDAR, and sensors to perceive the environment, make decisions, and control the vehicle.

The market focuses on improving safety, efficiency, and convenience by enabling features such as adaptive cruise control, lane-keeping, and fully driverless capabilities. Advances in AI software and sensor technologies are essential to these developments, with adoption progressing first in semi-autonomous systems and moving towards full autonomy.

Top driving factors for this market include the pressing need to reduce traffic accidents caused by human errors, which account for a large majority of crashes. AI systems improve road safety by offering real-time hazard detection and autonomous response functions, which help prevent collisions. Increased demand for improved mobility solutions in congested urban areas and rising environmental concerns also support these systems, as AI optimizes fuel efficiency and traffic flow.

Key Insight Summary

- By automation level, Level 2 (Partial Automation) led the market with 40.9% share.

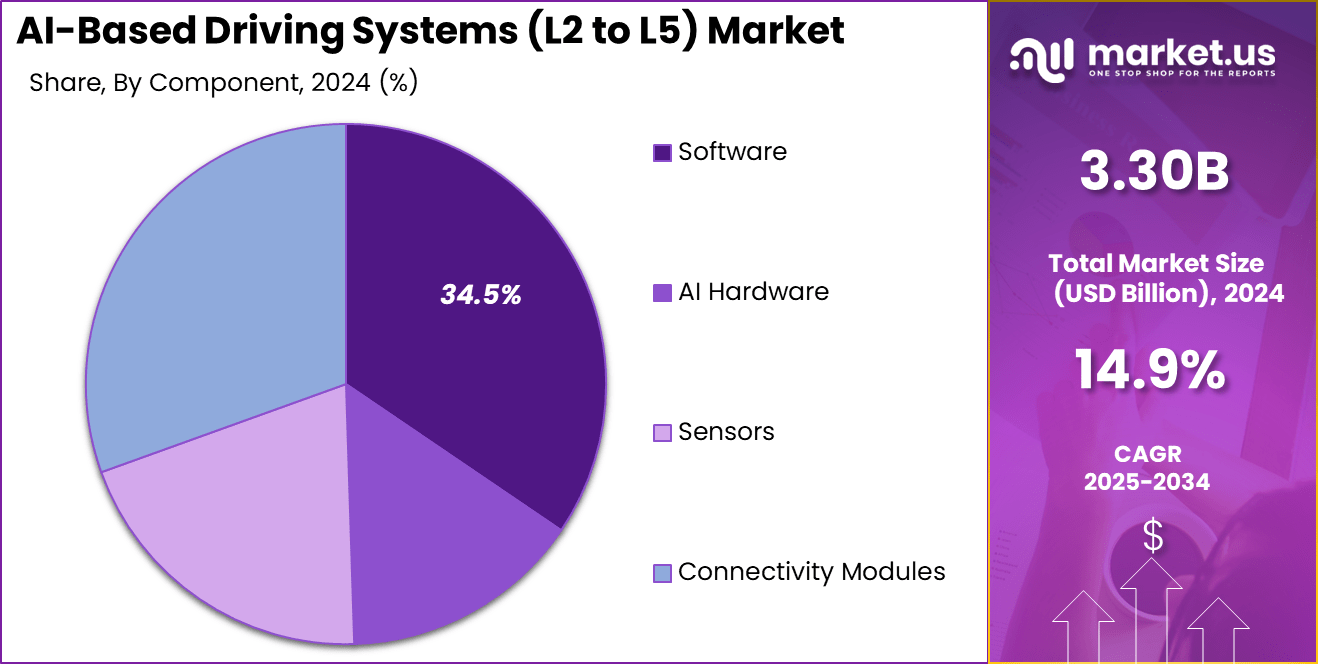

- By component, Software (perception, planning, control algorithms) dominated, holding 34.5% share.

- Passenger Vehicles were the leading vehicle type, capturing 46.9% share.

- By propulsion, Battery Electric Vehicles (BEVs) accounted for 38.3% share.

- Among end users, OEMs secured the largest portion with 36.2% share.

- Regionally, North America held a significant position with 32% share of the market.

Emerging Trends

Key Trend Description Dominance of L2 Systems L2 solutions like adaptive cruise control and lane-keeping assistance hold over 65% market share currently. Growing L3 Adoption in Premium Vehicles Conditional automation for highway driving and traffic management is expanding in premium vehicle segments. L4 & L5 Growth Post-2030 Urban shuttles, robo-taxis, and delivery vehicles adopting higher-level autonomy after infrastructure and policy development. Multi-Sensor Fusion Integration of cameras, radar, lidar, and AI for improved decision-making and environmental perception. Vehicle-Cloud Collaboration Onboard AI supported by cloud computing and real-time data updates via 5G/V2X networks enhancing driving precision. Top Use cases

Use Case Description Adaptive Cruise Control & Lane Keeping Level 2 driving automation easing driver workload and improving safety through speed, steering, and braking control. Highway Autonomy & Traffic Jam Assist Level 3 systems manage complex highway driving and stop-and-go traffic, with conditional driver takeover capabilities. Robo-taxis & Urban Shuttles Level 4/5 fully autonomous vehicles for shared urban mobility and logistics, reducing costs and emissions. Automated Delivery Vehicles Commercial applications of L4 autonomy enable efficient, safe last-mile logistics. Regional Insights

In 2024, North America held a dominant market position, capturing more than 32% share and generating USD 1.0 billion in revenue in the AI-based driving systems market covering Levels 2 to 5. The leadership of this region is driven by early adoption of advanced driver-assistance technologies, strong investments in autonomous vehicle research, and the presence of leading automotive innovators.

The United States has been at the forefront of testing and deploying semi-autonomous and fully autonomous systems, supported by extensive pilot programs and collaborations between automakers, technology companies, and mobility service providers. The dominance of North America is also supported by a favorable regulatory environment and proactive government initiatives that encourage innovation in vehicle automation.

Several states in the U.S. have established clear legal frameworks for testing autonomous cars on public roads, which has accelerated the integration of AI-based driving technologies. Furthermore, the region’s advanced infrastructure, including connected road networks and widespread 5G rollout, has enhanced the operational efficiency and safety of AI-powered vehicles.

By Automation Level

The Level 2 autonomous driving segment, representing partial automation, held the largest share of 40.9% in 2024. This level includes ADAS that can control steering, acceleration, and braking but require human attention and intervention. Level 2 systems are widely adopted as they provide a balance between automation benefits and human oversight, making them suitable for current regulatory environments and consumer readiness.

The dominance of Level 2 reflects industry focus on gradually introducing autonomous features to enhance safety and convenience without fully removing driver control. These systems improve driving comfort on highways and in traffic, reducing driver fatigue while maintaining overall safety through constant human monitoring.

By Component

Software components critical to autonomous driving such as perception systems, planning algorithms, and control units accounted for 34.5% of the market in 2024. These software systems enable real-time interpretation of sensor data, environment mapping, and decision-making for vehicle navigation. Advanced AI and machine learning models are integrated to improve accuracy and adaptability in dynamic driving conditions.

The software segment is a key driver for innovation in autonomous vehicles since it governs how the vehicle senses, reacts, and navigates safely. Continuous improvements in AI algorithms, sensor fusion, and computing power accelerate the development of reliable driving systems from partial to full automation levels.

By Vehicle Type

Passenger vehicles represented the largest market share of 46.9% in 2024, highlighting consumer demand for autonomous features in personal cars. Automakers focus heavily on equipping passenger cars with varying levels of automation to improve safety, convenience, and fuel efficiency. Autonomous passenger vehicles promise to reduce human errors, enhance traffic flow, and offer new mobility solutions like ridesharing and autonomous taxi services.

The growing integration of autonomous technology in passenger vehicles is supported by increased consumer acceptance, regulatory developments, and technological advancements. This segment benefits from significant investments by OEMs and technology companies aiming to commercialize self-driving personal cars in the near future.

By Propulsion Type

Battery Electric Vehicles (BEVs) accounted for 38.3% of the AI-based driving systems market in 2024, driven by the synergy between electric propulsion and autonomous technologies. BEVs’ electronic architectures facilitate seamless integration with autonomous driving software and sensor systems. Moreover, the global push toward decarbonization and EV adoption supports the concurrent growth of autonomous electric vehicles.

The combination of electric propulsion and autonomy aligns with industry trends toward sustainable, efficient, and connected mobility. BEVs equipped with L2-L5 autonomous systems enhance the appeal of clean transportation solutions by adding convenience and safety features, accelerating market adoption.

By End User

Original Equipment Manufacturers (OEMs) represented 36.2% of the market as end users, showcasing their central role in embedding autonomous driving systems into vehicles during production. OEMs collaborate closely with technology firms specializing in AI, sensor hardware, and control software to develop integrated autonomous driving platforms.

Their investments focus on improving system reliability, safety certification, and regulatory compliance to bring autonomous vehicles to market successfully. By controlling the integration of hardware and software, OEMs ensure optimized performance and consumer trust in autonomous vehicles.

Key Market Segments

By Automation Level

- Level 2 (Partial Automation)

- Level 3 (Conditional Automation)

- Level 4 (High Automation)

- Level 5 (Full Automation)

By Component

- AI Hardware (Chips, GPUs, ASICs, FPGAs)

- Software (Perception, Planning, Control Algorithms)

- Sensors (LiDAR, Radar, Cameras, Ultrasonic Sensors)

- Connectivity Modules (V2X, 5G, Edge Devices)

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Robo-Taxis / Autonomous Shuttles

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicles (EVs)

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

By End User

- OEMs

- Tech Providers / AI Startups

- Fleet Operators

- Mobility-as-a-Service (MaaS) Companies

- Logistics & Delivery Companies

By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- Asia Pacific

- The Middle East and Africa

Driver Analysis

Growing Safety and Efficiency Demand

The AI-based driving systems market is strongly driven by increasing consumer and regulatory demand for safer and more efficient vehicles. These systems, especially L2 and L3 levels, help reduce road accidents caused by human errors, which account for over 90% of traffic incidents.

Features like automated emergency braking, lane-keeping assist, and collision avoidance provide drivers with safety and comfort previously unavailable. Additionally, AI-powered decision-making optimizes acceleration, braking, and route planning, improving fuel efficiency and reducing emissions. This dual benefit of enhanced safety and lower environmental impact is pushing automakers to integrate more AI solutions into their vehicles.

Over time, the adoption momentum grows especially as these systems become standard in mid to premium segments of passenger and commercial vehicles. As infrastructure and connectivity improve, AI-based driving systems also enable vehicle-to-everything communication, linking cars with traffic signals and other vehicles for predictive decision-making. This integration transforms urban mobility by reducing congestion and facilitating shared autonomous fleets.

Restraint Analysis

High Costs and Infrastructure Issues

Despite the market’s promising outlook, the high development and deployment costs of L4 and L5 AI driving systems restrain widespread adoption. Advanced sensors such as LiDAR, high-performance AI processors, and sensor fusion technologies significantly increase vehicle costs. This limits the availability of fully autonomous vehicles mainly to premium or fleet sectors, restricting broader market penetration.

Additionally, many emerging markets face inadequate road infrastructure and connectivity issues that prevent reliable operation of high-level autonomous vehicles. Without sufficient smart roads, clear signage, and communication systems, the AI’s effectiveness diminishes, delaying rollout plans.

Regulatory complexity further compounds this restraint. Different countries and regions maintain inconsistent autonomous vehicle regulations, leading to approval delays and higher compliance costs for manufacturers aiming for multinational launches. Finally, consumer concerns over system reliability and cybersecurity risks also slow adoption, as buyers hesitate to trust AI systems unconditionally.

Opportunity Analysis

Expansion of Autonomous Fleet Services

One of the most promising opportunities lies in the growth of autonomous fleet services such as self-driving taxis, last-mile delivery vehicles, and logistics trucks. AI-powered driverless fleets offer businesses a chance to reduce operating costs by eliminating driver wages and minimizing accident-related expenses. They also improve efficiency through continuous operation without fatigue and optimized routing.

Moreover, autonomous ride-sharing and mobility-as-a-service (MaaS) platforms are expected to become new revenue streams for automotive and tech companies. These services not only create convenience for end users but also open sustainable business models in urban transport.

Governments are increasingly supporting smart city initiatives that favor autonomous fleets, including infrastructure upgrades and regulatory frameworks. For investors and industry players, this shift toward AI-enabled fleet automation represents a substantial market growth avenue beyond private vehicle sales.

Challenge Analysis

Safety Validation and Public Trust

A major challenge for AI-based driving systems is ensuring consistent safety performance and gaining public trust. Autonomous vehicles must safely handle an enormous variety of complex, real-world scenarios, including unusual weather, unexpected obstacles, and erratic human behavior.

Achieving near-perfect perception and decision-making requires extensive training data, advanced AI algorithms, and rigorous testing. However, the lack of standardized safety benchmarks and incidents involving autonomous vehicles have made the public skeptical about these technologies.

Building public confidence calls for transparent validation processes, effective communication from manufacturers, and clear regulatory safety standards. Additionally, ethical concerns about decision-making in emergency situations complicate development. Without widespread trust, consumer hesitation will impede market expansion.

Competitive Analysis

The AI-Based Driving Systems (L2 to L5) market is shaped by a diverse group of global leaders that bring different strengths to the ecosystem. Companies such as Tesla, NVIDIA, and Intel’s Mobileye are strongly positioned due to their deep integration of artificial intelligence with advanced computing platforms. Tesla leverages its extensive fleet data, while NVIDIA delivers high-performance chips tailored for autonomous driving.

A second cluster of players, including Alphabet’s Waymo, Aptiv, Continental, Bosch, ZF Friedrichshafen, and Aurora, are driving innovation through both hardware and software integration. Waymo continues to expand its autonomous ride-hailing services, while Aptiv and Continental focus on system-level integration for global manufacturers. Bosch and ZF provide essential sensor and braking technologies that are critical for reliable automation.

The competitive landscape also includes Cruise, Pony.ai, Nuro, AutoX, Valeo, Hyundai Mobis, XPeng Motors, Baidu Apollo, Huawei, and Qualcomm. Cruise and Pony.ai emphasize urban deployment and ride-sharing applications, while Nuro and AutoX specialize in autonomous delivery. Valeo and Hyundai Mobis focus on supplying scalable sensor and ADAS solutions. XPeng and Baidu Apollo highlight the growing influence of Chinese innovators in large-scale road testing.

Top Key Players in the Market

- Tesla, Inc.

- NVIDIA Corporation

- Intel Corporation (Mobileye)

- Alphabet Inc. (Waymo)

- Aptiv PLC

- Continental AG

- Bosch Mobility Solutions

- ZF Friedrichshafen AG

- Aurora Innovation

- Cruise (GM)

- Pony.ai

- Nuro Inc.

- AutoX

- Valeo

- Hyundai Mobis

- XPeng Motors (XNGP System)

- Baidu Apollo

- Huawei Technologies

- Qualcomm Technologies

Recent Developments

- In June 2025, Plus Automation, an AI-based virtual driver software company specializing in autonomous trucking, merged with Churchill Capital Corp IX to go public under the name PlusAI. This move positions Plus to scale its autonomous trucking software, SuperDrive, with funding up to $300 million to support commercial launch planned for 2027.

- In April 2024, Intel announced the acquisition of Silicon Mobility SAS to enhance AI-powered electric vehicle (EV) energy management. Alongside this, Intel revealed a new family of AI-enhanced software-defined vehicle (SDV) system-on-chips (SoCs) aimed at in-vehicle AI applications like generative AI and camera-based driver monitoring.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Bn Forecast Revenue (2034) USD 13.23 Bn CAGR(2025-2034) 14.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Automation Level (Level 2 – Partial Automation, Level 3 – Conditional Automation, Level 4 – High Automation, Level 5 – Full Automation), By Component (AI Hardware – Chips, GPUs, ASICs, FPGAs, Software – Perception, Planning, Control Algorithms, Sensors – LiDAR, Radar, Cameras, Ultrasonic Sensors, Connectivity Modules – V2X, 5G, Edge Devices), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Robo-Taxis / Autonomous Shuttles), By Propulsion Type (Internal Combustion Engine – ICE, Electric Vehicles – EVs, Battery Electric Vehicles – BEVs, Plug-in Hybrid Electric Vehicles – PHEVs), By End User (OEMs, Tech Providers / AI Startups, Fleet Operators, Mobility-as-a-Service – MaaS Companies, Logistics & Delivery Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tesla, Inc., NVIDIA Corporation, Intel Corporation (Mobileye), Alphabet Inc. (Waymo), Aptiv PLC, Continental AG, Bosch Mobility Solutions, ZF Friedrichshafen AG, Aurora Innovation, Cruise (GM), Pony.ai, Nuro Inc., AutoX, Valeo, Hyundai Mobis, XPeng Motors (XNGP System), Baidu Apollo, Huawei Technologies, Qualcomm Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Based Driving Systems (L2 to L5) MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Based Driving Systems (L2 to L5) MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla, Inc.

- NVIDIA Corporation

- Intel Corporation (Mobileye)

- Alphabet Inc. (Waymo)

- Aptiv PLC

- Continental AG

- Bosch Mobility Solutions

- ZF Friedrichshafen AG

- Aurora Innovation

- Cruise (GM)

- Pony.ai

- Nuro Inc.

- AutoX

- Valeo

- Hyundai Mobis

- XPeng Motors (XNGP System)

- Baidu Apollo

- Huawei Technologies

- Qualcomm Technologies