Global Agriculture Drone Market By Type (Fixed Wing, Rotary Wing), By Component (Hardware, Software, Services), By Farming Environment (Indoor Farming, Outdoor Farming), By Application (Crop Management, Field Management, Crop Spraying, Livestock Monitoring, Variable Rate Application, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 24694

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

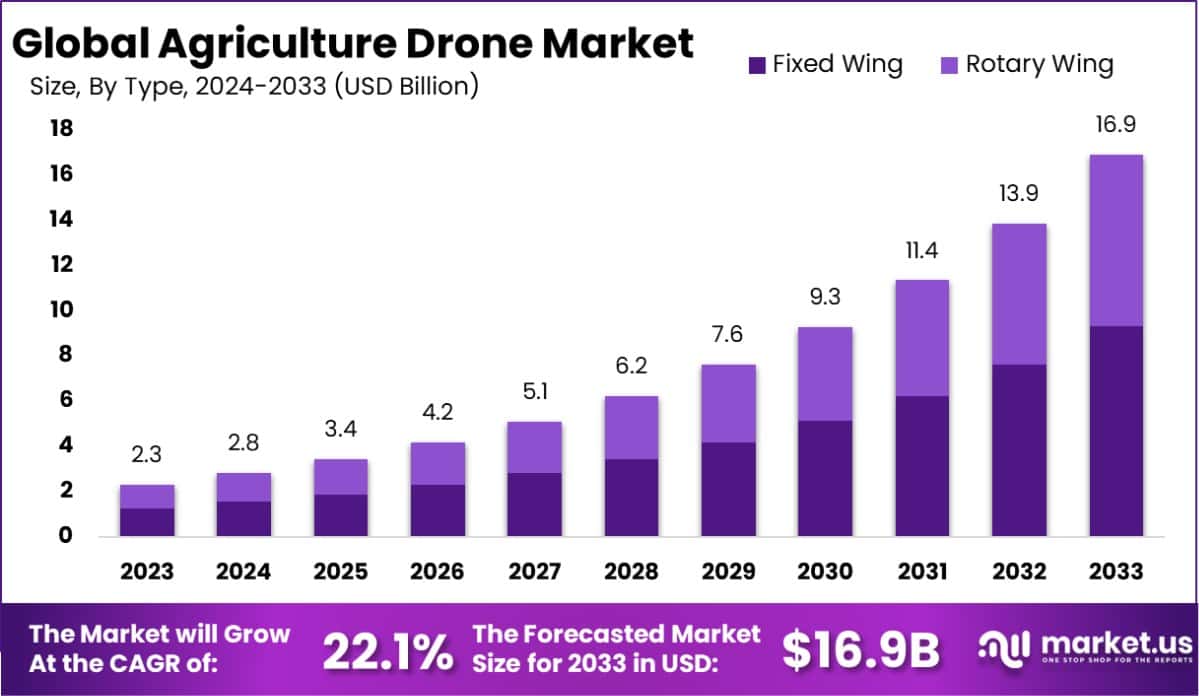

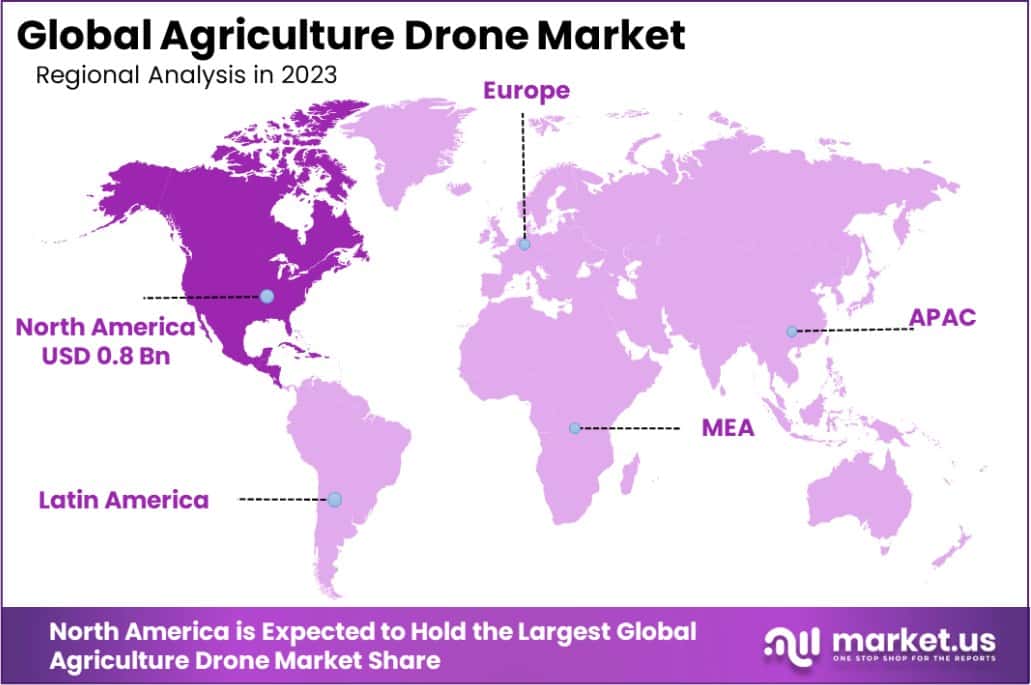

The Global Agriculture Drone Market size is expected to be worth around USD 16.9 Billion by 2033, from USD 2.3 Billion in 2023, growing at a CAGR of 22.1% during the forecast period from 2024 to 2033. North America dominated a 35.3% market share in 2023 and held USD 0.8 Billion in revenue from the Agriculture Drone Market.

An agriculture drone, also known as an unmanned aerial vehicle (UAV), is specifically designed for farming operations to enhance crop production and monitor crop growth. These drones carry out various precision agricultural tasks, including aerial planting, crop spraying, field and soil analysis, and monitoring crop health and irrigation systems.

The agriculture drone market encompasses the sale and development of UAVs for agricultural purposes. This market has been expanding due to the increasing adoption of precision farming techniques, efficient crop monitoring, and the growing demand for drone-acquired data to optimize farming practices.

The growth of the agriculture drone market can be attributed to the technological advancements in drone and sensor technologies, which have made UAVs more accessible and effective for real-time crop surveillance and data collection.

Demand in the agriculture drone market is driven by the global shift towards precision agriculture practices that require detailed monitoring and management of crops, aimed at enhancing yield and efficiency.

Opportunities within the agriculture drone market include the integration of AI and machine learning algorithms, which can improve the analysis of data collected by drones, enabling more precise and predictive farming. Additionally, expanding drone services in emerging economies presents a significant growth avenue.

The agriculture drone market is poised for significant expansion, driven by substantial governmental support and technological advancements. The Indian government’s strategic investment of Rs. 129.19 crores (approximately $15.5 million) to promote Kisan Drones underlines a strong commitment to integrating advanced technologies in agriculture.

This initiative includes comprehensive financial assistance schemes, providing up to 100% funding for drone acquisitions by agricultural institutions and up to 75% cost coverage for farmer demonstrations. This considerable reduction in financial barriers is likely to accelerate the adoption of UAV technology across India’s vast agricultural sectors.

Moreover, the capability of drones to perform surveys and collect data at a rate ten times faster than traditional methods marks a transformative shift towards high-efficiency agricultural practices.

The rapid data collection facilitated by drones not only enhances crop monitoring and management but also supports quick decision-making, essential for optimizing yield and reducing waste. Consequently, this strategic focus is expected to catalyze market growth, presenting lucrative opportunities for both local and international drone manufacturers.

Key Takeaways

- The Global Agriculture Drone Market size is expected to be worth around USD 16.9 Billion by 2033, from USD 2.3 Billion in 2023, growing at a CAGR of 22.1% during the forecast period from 2024 to 2033.

- In 2023, Fixed Wing held a dominant market position in the By Type segment of the Agriculture Drone Market, with a 55% share.

- In 2023, Hardware held a dominant market position in the By Component segment of Agriculture Drone Market, with a 52.4% share.

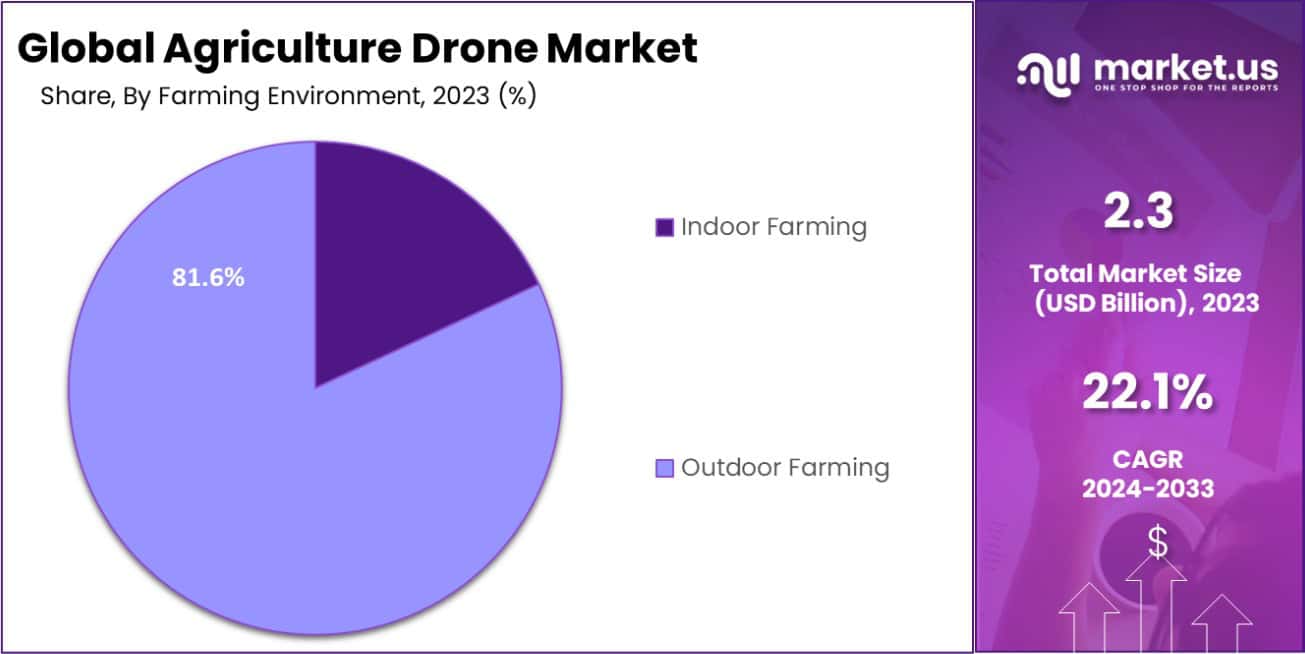

- In 2023, Outdoor Farming held a dominant market position in the By Farming Environment segment of the Agriculture Drone Market, with an 81.6% share.

- In 2023, Crop Spraying held a dominant market position in the application segment of the Agriculture Drone Market.

- North America dominated a 35.3% market share in 2023 and held USD 0.8 Billion in revenue from the Agriculture Drone Market.

By Type Analysis

In 2023, the Agriculture Drone Market was significantly led by the Fixed Wing type, commanding a dominant market share of 55%. This segment’s substantial share is primarily attributed to its extended range and endurance capabilities, which are essential for comprehensive agricultural monitoring and data collection over large areas.

Fixed-wing drones are preferred for their efficiency in capturing consistent imagery, making them invaluable for precision farming practices that require regular monitoring of crop health, soil conditions, and irrigation systems.

Conversely, the Rotary Wing type, while flexible and capable of hovering, held a smaller portion of the market. These drones are particularly effective for targeted applications such as spraying pesticides and fertilizers and performing spot checks on specific areas of interest within a field.

Their ability to take off and land vertically makes them ideal for use in agricultural environments with limited space. Despite their versatility, the preference for Fixed-wing drones in applications requiring extensive and frequent monitoring contributes to the continued prominence of this segment in the Agriculture Drone Market.

By Component Analysis

In 2023, Hardware secured a dominant market position in the By Component segment of the Agriculture Drone Market, holding a substantial 52.4% share. This segment encompasses a variety of critical components that are integral to drone functionality, including Frames, Flight Control Systems, Navigation Systems, Propulsion Systems, Cameras, Sensors, and other related hardware.

The prominence of Hardware in the market can be largely attributed to the essential nature of these components in building robust and efficient agricultural drones.

Frames and Propulsion Systems form the physical and operational backbone of these drones, enabling the stability and maneuverability required for agricultural applications. Meanwhile, advanced Flight Control and Navigation Systems are crucial for the precision of flying patterns necessary for tasks like field mapping and targeted spraying.

Cameras and Sensors play a pivotal role in gathering vital data for precision agriculture, helping farmers enhance productivity and crop health through detailed, real-time insights. The demand for sophisticated, high-performance drones in agriculture drives the substantial market share of the Hardware segment, underpinning the sector’s reliance on technologically advanced components to meet evolving agricultural needs.

By Farming Environment Analysis

In 2023, Outdoor Farming dominated the By Farming Environment segment of the Agriculture Drone Market, capturing a commanding 81.6% market share. This predominance is reflective of the extensive application of drones in outdoor agricultural settings, where they are utilized for a variety of tasks including crop monitoring, field mapping, pesticide spraying, and irrigation management.

The scalability of drones to cover large tracts of land efficiently makes them particularly suitable for outdoor environments, where the spatial expansiveness and variability of conditions demand robust, wide-ranging surveillance and intervention capabilities.

Drones in outdoor farming enhance precision agriculture techniques by enabling real-time data collection and analysis, which aids in making informed decisions regarding planting, fertilizing, and harvesting. Their ability to quickly assess and respond to crop health issues, pest infestations, and nutrient deficiencies significantly contributes to increased yield and reduced waste.

The lower adoption rate in Indoor Farming—accounting for the remaining market share—is due to the smaller scale of operations and different technological requirements, emphasizing the tailored applications of drones in varied agricultural environments.

By Application Analysis

In 2023, Crop Spraying secured a dominant market position in the By Application segment of the Agriculture Drone Market. This application has become increasingly vital as it allows for precise and efficient distribution of pesticides, herbicides, and fertilizers, optimizing crop health and yield.

The strategic deployment of drones for spraying tasks not only enhances the uniformity of application but also reduces the amount of chemicals used, thereby minimizing environmental impact and exposure to hazardous substances for farm workers.

Drones equipped for Crop Spraying offer significant advantages over traditional methods, including the ability to access difficult terrain and perform applications under varying weather conditions, thus ensuring timely interventions that are critical for crop success.

This technological advancement supports sustainable farming practices by targeting specific areas that need treatment, which conserves resources and increases cost-effectiveness.

The high adoption rate of this application reflects its pivotal role in integrating precision agriculture practices that are designed to maximize efficiency and productivity in the farming sector.

While Crop Spraying leads this segment, other applications such as Crop Management, Field Management, Livestock Monitoring, and Variable Rate Application (VRA) also contribute to the comprehensive utilization of drones in agriculture, each addressing different aspects of farm management and operational needs.

Key Market Segments

By Type

- Fixed Wing

- Rotary Wing

By Component

- Hardware

- Frames

- Flight Control Systems

- Navigation Systems

- Propulsion Systems

- Cameras

- Sensors

- Others

- Software

- Services

- Professional Services

- Managed Services

By Farming Environment

- Indoor Farming

- Outdoor Farming

By Application

- Crop Management

- Field Management

- Crop Spraying

- Livestock Monitoring

- Variable Rate Application (VRA)

- Others

Drivers

Key Drivers in the Agriculture Drone Market

The Agriculture Drone Market is witnessing significant growth, driven by the increasing demand for efficient farming techniques and the need for high crop yields. Drones are becoming essential in modern agriculture due to their ability to perform tasks such as precise spraying, crop and field monitoring, and mapping with remarkable accuracy and speed.

This efficiency not only reduces labor costs but also minimizes the use of water and chemicals, promoting sustainable farming practices. Additionally, technological advancements in drone and smart sensor technologies have made these devices more accessible and cost-effective for farmers.

The integration of AI and data analytics further enhances the capability of drones to provide actionable insights into crop health and soil conditions, thereby enabling farmers to make informed decisions quickly and improve crop management strategies. These factors collectively drive the adoption of drones in the agriculture sector, offering significant improvements in productivity and operational efficiency.

Restraint

Challenges in Agriculture Drone Adoption

Despite the growing popularity of agriculture drones, several restraints hinder their widespread adoption. Key among these is the high initial cost of drones equipped with advanced technologies, which can be a significant barrier for small to medium-sized farms.

Regulatory challenges also play a critical role, as airspace restrictions and privacy concerns in various regions can limit drone operations in agricultural settings. Additionally, there is a notable skills gap in the rural workforce; the technical expertise required to operate and maintain sophisticated drone systems is not universally available, which complicates their integration into traditional farming practices.

These factors contribute to slower adoption rates and could potentially restrict the full utilization of drone technology in the agriculture sector, impacting overall market growth.

Opportunities

Expanding Horizons in Drone Farming

The Agriculture Drone Market presents substantial opportunities for growth, particularly through the expansion of drone applications in emerging markets. As global demand for food increases, drones offer a promising solution to enhance agricultural productivity and efficiency, especially in regions that are newly adopting modern farming practices.

The continuous advancements in drone technology, such as improved battery life, enhanced imaging systems, and integrated AI analytics, are opening new possibilities for crop management and disease detection. Additionally, as regulations evolve to become more drone-friendly, and as rural areas receive better technological education, the barriers to entry are lowering.

This environment encourages more farmers and agricultural businesses to adopt drone technology, which could significantly boost market expansion and innovation in the coming years, providing both economic and environmental benefits.

Challenges

Navigating Drone Market Barriers

The Agriculture Drone Market faces several challenges that could impede its growth. One of the main hurdles is the complexity of data management. Farmers often find it difficult to interpret the vast amounts of data collected by drones, which can hinder effective decision-making.

Additionally, the integration of drone technology with existing agricultural systems poses significant technical challenges, requiring substantial customization and technical support. Weather variability also impacts drone operations, as adverse conditions can restrict flight times and affect data collection quality.

Furthermore, privacy and security concerns regarding data captured by drones can lead to resistance from communities and regulatory scrutiny. Addressing these challenges requires continuous technological advancements, effective training programs for farmers, and clear regulations that balance innovation with privacy and safety concerns.

Growth Factors

Drivers Elevating Agriculture Drone Usage

The growth of the Agriculture Drone Market is propelled by several key factors. Increased adoption is primarily driven by the pressing need for higher crop yields and more efficient farming methods amidst a growing global population.

Drones offer a high-tech solution for comprehensive field analysis, enabling precise applications of water, fertilizers, and pesticides, which helps maximize output while minimizing waste. Technological advancements in drone capabilities, such as longer flight times, better sensors, and enhanced imaging techniques, further boost their utility in farming.

Additionally, government support and subsidies in many countries encourage the adoption of innovative agricultural tools to enhance food security. The trend towards sustainable farming practices also aligns with the capabilities of drones, promoting their use as a means to achieve environmentally friendly and economically viable agricultural operations. These factors collectively contribute to the robust growth trajectory of the agriculture drone market.

Emerging Trends

Trends Shaping Future Drone Farming

Emerging trends in the Agriculture Drone Market are shaping the future of farming, focusing on increased efficiency and sustainability. One significant trend is the integration of artificial intelligence (AI) with drones, which enhances data processing capabilities, enabling real-time, precision farming decisions.

This trend allows for the optimization of crop yields and health through more targeted interventions. Another growing trend is the use of multi-spectral imaging technology that provides detailed insights into crop health that are invisible to the naked eye, facilitating early detection of diseases and nutrient deficiencies.

Additionally, there is a move towards fully autonomous drones that can operate without human intervention, increasing the scalability of drone operations across larger farmlands. These advancements are making drones an indispensable tool in modern agriculture, driving forward the capabilities and efficiencies of global farming practices.

Regional Analysis

The Agriculture Drone Market exhibits varied growth dynamics across global regions, reflecting diverse agricultural practices and technological adoption rates.

North America emerges as the leading region, holding a dominant market share of 35.3%, valued at USD 0.8 billion. This dominance is driven by advanced technological infrastructure, substantial investments in R&D, and supportive regulatory frameworks that facilitate the widespread use of drones in agriculture.

In Europe, the market is growing steadily, supported by strong government initiatives promoting precision agriculture. The integration of drones with other smart farming technologies is accelerating market expansion. Asia Pacific is witnessing rapid growth due to increasing technological adoption in large agricultural countries like China and India, where drones significantly enhance productivity and crop monitoring on large-scale farms.

Meanwhile, the Middle East & Africa, and Latin America are developing markets with significant potential. These regions are gradually adopting agricultural drones to overcome challenges related to water scarcity and inefficient traditional farming practices, presenting opportunities for substantial market penetration and growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global agriculture drone market, key players such as Drone Deploy, DJI, and GoPro are driving significant advancements and adoption of drone technology within the sector.

DroneDeploy has emerged as a leading figure in the agriculture drone market by offering versatile drone software solutions that allow for comprehensive mapping and data analysis. The company’s platform supports efficient crop monitoring and management, enabling farmers to make informed decisions that enhance yield and reduce costs. The growth of DroneDeploy can be attributed to its continuous innovation in user-friendly software that integrates seamlessly with existing agricultural practices.

DJI holds a dominant position, primarily due to its robust hardware offerings. As the largest manufacturer of commercial drones, DJI’s technology is renowned for its reliability, high-quality imagery, and precision in flight control.

The company’s drones are extensively utilized in agriculture for a range of applications, from crop monitoring to spraying, making it a pivotal contributor to the market’s expansion. DJI’s ongoing commitment to technological enhancement ensures its stronghold in the market, appealing to both large-scale and smallholder farmers.

GoPro, traditionally known for action cameras, has ventured into the drone space with offerings that appeal to a niche segment of the agriculture market. While not a primary player, GoPro’s high-resolution cameras when mounted on drones provide valuable aerial footage for agricultural analysis, although its impact on the market is comparatively limited next to giants like DJI and DroneDeploy.

Collectively, these companies are essential to the agriculture drone market’s dynamics, with each contributing to the technological evolution and increasing accessibility of drone usage in farming operations. The integration of their advanced systems into agricultural practices is pivotal for the market’s growth trajectory into 2024 and beyond.

Top Key Players in the Market

- Drone Deploy

- DJI

- GoPro

- Precision Hawk

- AeroVironment Inc.

- Trimble Inc.

- 3D Robotics

- Ageagle Aerial Systems, Inc.

- Parrot Drone

- Sintera LLC.

- Delair Tech SAS

- Other Key Players

Recent Developments

- In September 2023, Precision Hawk enhanced their drone software in September 2023, streamlining data collection for agricultural insights, and improving farm monitoring efficiency.

- In August 2023, AeroVironment Inc. launched a new drone model designed specifically for crop analysis, offering higher-resolution imaging and increased battery life.

- In July 2023, Trimble Inc. introduced an update to their agriculture drones in July 2023, featuring advanced navigation systems to assist in precise field mapping and data accuracy.

Report Scope

Report Features Description Market Value (2023) USD 2.3 Billion Forecast Revenue (2033) USD 16.9 Billion CAGR (2024-2033) 22.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Fixed Wing, Rotary Wing), By Component(Hardware(Frames, Flight Control Systems, Navigation Systems, Propulsion Systems, Cameras, Sensors, Others), Software, Services(Professional Services, Managed Services)), By Farming Environment(Indoor Farming, Outdoor Farming), By Application (Crop Management, Field Management, Crop Spraying, Livestock Monitoring, Variable Rate Application (VRA), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Drone Deploy, DJI, GoPro, Precision Hawk, AeroVironment Inc., Trimble Inc., 3D Robotics, Ageagle Aerial Systems, Inc., Parrot Drone, Sintera LLC., Delair Tech SAS, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agriculture Drone MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Agriculture Drone MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Drone Deploy

- DJI

- GoPro

- Precision Hawk

- AeroVironment Inc.

- Trimble Inc.

- 3D Robotics

- Ageagle Aerial Systems, Inc.

- Parrot Drone

- Sintera LLC.

- Delair Tech SAS

- Other Key Players