Global Agriculture Cro Services Market Size, Share, Growth Analysis By Service Type (Field Services, Laboratory Services, Regulatory Services, Other), By Sector (Crop Protection Chemicals, Fertilizers, Seeds, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158257

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

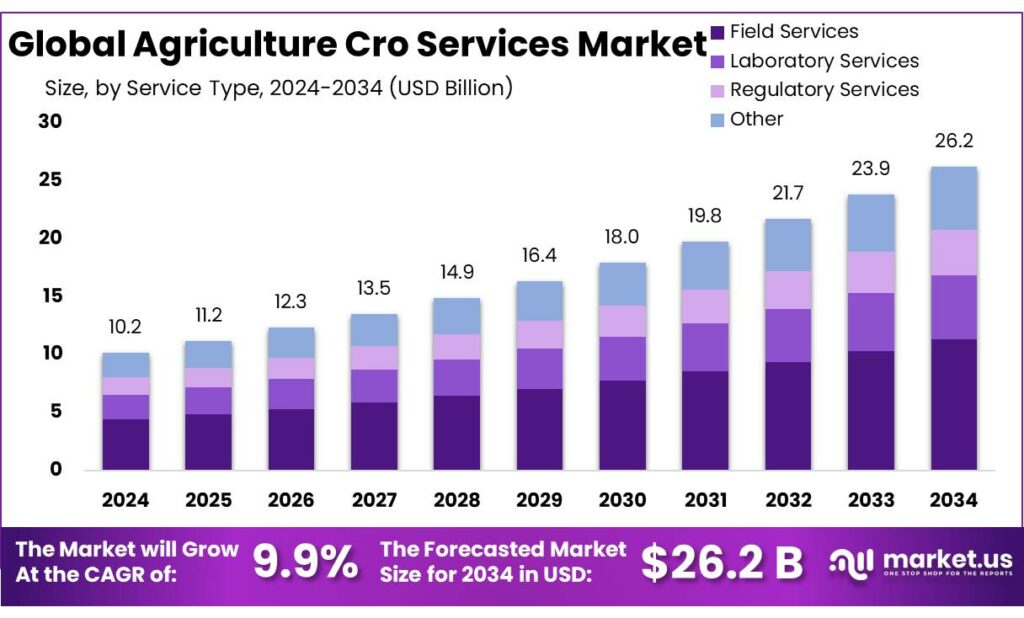

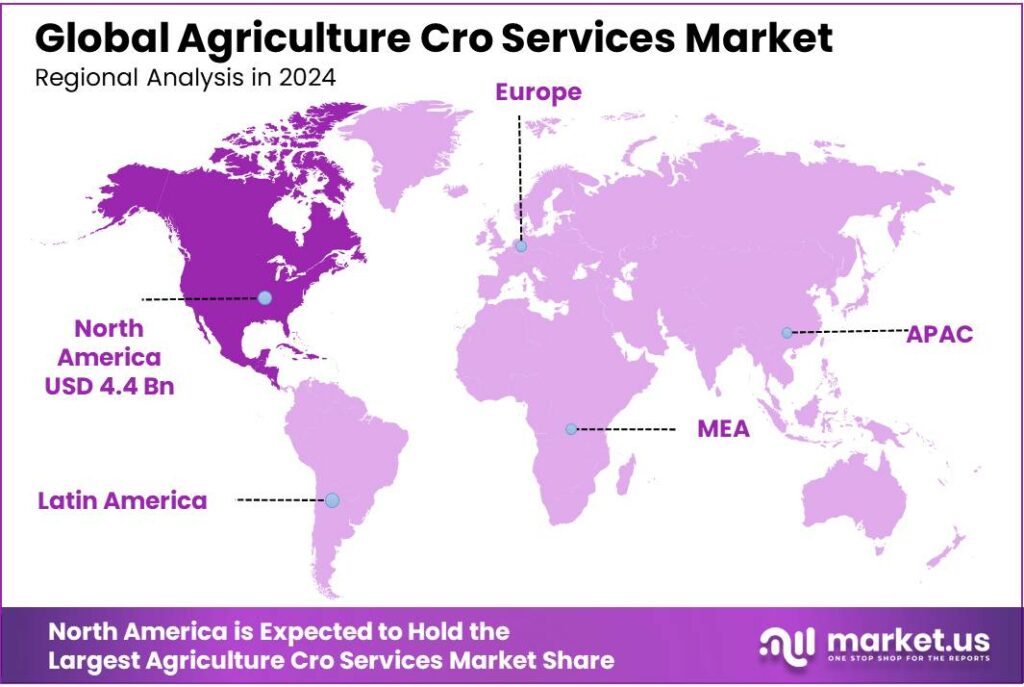

The Global Agriculture Cro Services Market size is expected to be worth around USD 26.2 Billion by 2034, from USD 10.2 Billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.9% share, holding USD 4.4 Billion in revenue.

Agriculture CRO Services refer to outsourced R&D, testing, regulatory, field trial, laboratory analysis, safety & toxicology, residue & environmental studies, seed/trait validation, and other specialized services provided to agrochemical companies, seed developers, biotechnology firms, regulatory bodies, and sometimes government agencies. Rather than doing all research in‐house, agrochemical firms contract out parts of discovery, development, compliance, or monitoring to specialist CROs to reduce costs, manage regulatory complexity, speed up time to market, or access particular expertise.

Government initiatives play a pivotal role in fostering the growth of Agriculture CRO services. The Indian government has allocated over INR 1.75 trillion to the agriculture sector for the fiscal year 2025-2026, marking a significant increase in funding to support rural incomes and control inflation. Additionally, the Maharashtra government has approved a new initiative, the ‘MahaAgri-AI Policy 2025-2029,’ with an allocation of INR 500 crore over five years to integrate artificial intelligence and modern technologies into agriculture.

The Agriculture CRO services market presents several growth opportunities. The implementation of AI-powered weather forecasting tools, as demonstrated by the Indian government’s initiative to provide accurate and localized weather predictions to 38 million farmers, is expected to enhance decision-making and resource management.

Government initiatives have been instrumental in fostering the growth of the Agriculture CRO services sector. The Indian government has allocated ₹1,61,965 crore (US$ 18.7 billion) to the Ministry of Chemicals and Fertilizers in the Union Budget 2025-26, emphasizing the importance of the chemical sector, including agrochemicals, in the nation’s economic development. Additionally, schemes like the Pradhan Mantri Krishi Sinchai Yojana, with a budget of ₹50,000 crore, aim to improve farm productivity and ensure better utilization of resources, indirectly benefiting the Agriculture CRO services sector.

Key Takeaways

- Agriculture Cro Services Market size is expected to be worth around USD 26.2 Billion by 2034, from USD 10.2 Billion in 2024, growing at a CAGR of 9.9%.

- Field Services held a dominant market position, capturing more than a 43.2% share of the Agriculture CRO Services market.

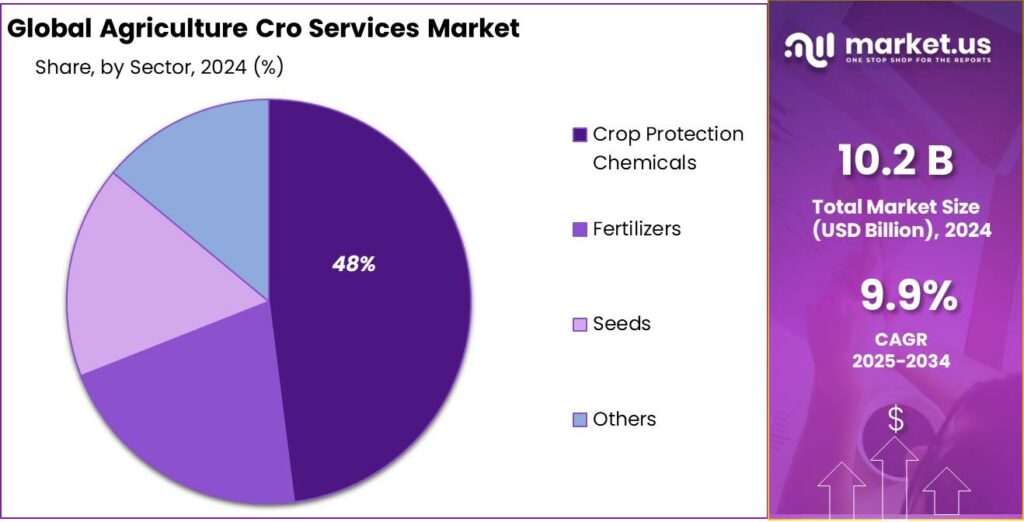

- Crop Protection Chemicals held a dominant market position, capturing more than a 48.7% share of the Agriculture CRO Services market.

- North America emerged as the dominant region in the Agriculture Contract Research Organization (CRO) Services market, capturing a substantial 43.90% share, equating to approximately USD 4.4 billion.

By Service Type Analysis

Field Services Dominates with 43.2% Share in 2024, Driven by Demand for On-Ground Research

In 2024, Field Services held a dominant market position, capturing more than a 43.2% share of the Agriculture CRO Services market. This dominance reflects the critical role field services play in providing essential on-ground research and data collection for agrochemical companies, seed developers, and regulatory bodies.

These services include site management, crop protection, testing, and pest management, all of which are key to ensuring the efficacy and safety of agricultural products. Field services are particularly in demand due to the growing emphasis on localized trials and tailored studies, which require direct interaction with field conditions. As the need for precise and region-specific agricultural data increases, field services continue to be integral in helping companies navigate complex regulatory landscapes while providing accurate real-world insights.

By Sector Analysis

Crop Protection Chemicals Leads with 48.7% Market Share in 2024, Reflecting High Demand for Agricultural Safety

In 2024, Crop Protection Chemicals held a dominant market position, capturing more than a 48.7% share of the Agriculture CRO Services market. This segment continues to lead due to the increasing demand for effective pest control solutions in agriculture. With the global push for higher crop yields and protection against pests, diseases, and weeds, crop protection chemicals have become a crucial part of modern farming practices.

The market’s growth is driven by the need for safer, more efficient chemicals that minimize environmental impact while enhancing crop productivity. As agricultural practices evolve, there is a growing focus on integrating innovative solutions and precision technologies to improve the effectiveness of crop protection chemicals, further solidifying their dominant market position in 2024.

Key Market Segments

By Service Type

- Field Services

- Laboratory Services

- Regulatory Services

- Other

By Sector

- Crop Protection Chemicals

- Fertilizers

- Seeds

- Others

Emerging Trends

A Technological Leap for Indian Farmers

In 2025, precision agriculture is emerging as a transformative trend in India’s farming landscape. This approach integrates advanced technologies like artificial intelligence (AI), drones, and satellite imagery to optimize farming practices, enhance productivity, and ensure sustainability.

One notable application of precision agriculture is the use of AI-powered weather forecasting tools. In 2025, the Indian government delivered accurate and localized weather predictions to 38 million farmers using AI models like Google’s NeuralGCM. These tools allowed farmers to make informed agricultural decisions, helping them adapt to the unpredictable climate.

Additionally, the adoption of drone technology for pesticide spraying is gaining momentum. In Uttar Pradesh, a pilot project using drones to spray nano urea and pesticides across six districts aims to boost productivity and streamline crop care through precise and timely application.

The Indian government has been proactive in promoting precision agriculture through initiatives such as the Digital Agriculture Mission. With an investment of ₹2,817 crore, this mission aims to create a robust digital framework for Indian agriculture, supporting farmers and addressing challenges with innovative solutions.

Drivers

Government Support and Investment in Agriculture

A significant driving force behind the growth of agricultural crop services in India is the robust support and investment from the government. Recognizing agriculture as the backbone of the economy, the Indian government has consistently allocated substantial resources to enhance productivity, ensure food security, and improve the livelihoods of farmers.

In the fiscal year 2025-26, the Indian government announced an increase of over 15% in the agriculture budget, bringing the total allocation to approximately ₹1.75 trillion (about $20 billion). This marks the most significant rise in six years and underscores the government’s commitment to the sector. The funds are earmarked for various initiatives, including the promotion of high-yield seed varieties, enhancement of storage and supply infrastructure, and boosting the production of pulses, oilseeds, vegetables, and dairy products

One of the flagship programs under this initiative is the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), which provides direct income support to farmers. Under this scheme, eligible farmers receive ₹6,000 annually in three equal installments, directly credited to their bank accounts. As of 2025, over 14 crore (140 million) farmers have benefited from this program, ensuring a steady income stream and reducing financial stress.

Additionally, the government has been promoting the formation of Farmer Producer Organizations (FPOs) to empower farmers collectively. These FPOs facilitate better access to markets, credit, and technology, thereby enhancing the bargaining power of farmers. The government aims to form and promote 10,000 FPOs by 2027-28, with a budget outlay of ₹6,860 crore

Restraints

Unpredictable Weather Patterns and Their Impact on Crop Services

One of the most pressing challenges facing agricultural crop services in India is the increasing unpredictability of weather patterns. Erratic rainfall, prolonged droughts, and unexpected floods have become more frequent, disrupting planting schedules, damaging crops, and threatening food security. These climatic anomalies not only affect crop yields but also strain the resources of farmers and agricultural service providers.

For instance, during the 2025 kharif season, several states experienced excessive rainfall. Telangana and Punjab reported rainfall levels 58% and 109% above average, respectively. Nationwide, rainfall was 8% above the norm between August and early September. This surplus rain led to waterlogging, crop diseases, and delayed harvesting, particularly affecting rice, pulses, and coarse cereals.

In Punjab, the situation was more severe. The state faced devastating floods that destroyed kharif crops and created uncertainty for the rabi season. The state government announced compensation of ₹20,000 per acre, but this amount fell short of the actual losses. According to the Commission for Agricultural Costs and Prices (CACP), per-acre losses were estimated at ₹27,830 for paddy, ₹30,219 for cotton, and ₹24,455 for maize.

Similarly, Karnataka reported crop losses on over 5.2 lakh hectares due to relentless rainfall since June 2025. Regions like Malnad and north Karnataka suffered significant damage, including submerged tur and black gram fields. Officials estimated that up to 25% of the seasonal crop output might be lost.

Opportunity

Digital Transformation in Agriculture: A Path to Empowerment

One of the most promising growth opportunities for agricultural crop services in India lies in embracing digital transformation. With over 60% of Indian farmers expected to access real-time market data via digital platforms by 2025, the potential for technology to revolutionize agriculture is immense.

The Indian government’s Digital Agriculture Mission (DAM) is at the forefront of this transformation. Launched with an investment of ₹2,817 crore, DAM aims to create a comprehensive farmer-centric digital ecosystem. Key components include the development of AgriStack—a digital public infrastructure comprising a farmers’ registry, geo-referenced village maps, and a crop sown registry—and the Krishi Decision Support System, which leverages AI and satellite data to provide timely advisories to farmers.

Furthermore, the Open Network for Digital Commerce (ONDC) is facilitating market access for Farmer Producer Organizations (FPOs). By 2024, nearly 5,000 FPOs were onboarded onto the ONDC platform, enabling them to sell over 3,100 different types of value-added agricultural products across India. This integration has significantly improved market linkages and income opportunities for farmers.

Regional Insights

North America Leads Agriculture CRO Services Market with 43.90% Share in 2024

In 2024, North America emerged as the dominant region in the Agriculture Contract Research Organization (CRO) Services market, capturing a substantial 43.90% share, equating to approximately USD 4.4 billion in market value. This significant presence underscores the region’s pivotal role in the global agricultural research and development landscape.

The robust market position of North America is attributed to several key factors. The United States, in particular, boasts a highly developed agricultural infrastructure, characterized by advanced research facilities, extensive farmland, and a strong network of academic and private institutions dedicated to agricultural innovation. This infrastructure facilitates comprehensive field trials, regulatory compliance studies, and environmental impact assessments, all of which are integral components of CRO services.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Eurofins Scientific SE is a global laboratory services provider headquartered in Luxembourg, offering comprehensive testing and support services across various sectors, including pharmaceuticals, food, environment, and agriscience. The company operates over 900 laboratories in 62 countries, providing a broad range of analytical methods and services to meet the needs of its diverse clientele.

SGS S.A., based in Geneva, Switzerland, is a leading inspection, verification, testing, and certification company. Established in 1878, SGS operates a network of over 2,600 offices and laboratories worldwide, employing approximately 99,600 people. The company provides a wide range of services to ensure that products meet national and international quality and safety standards, enhancing supply chain efficiency and reducing risks for its clients.

SynTech Research Group is a leading global agricultural contract research organization (CRO) providing comprehensive contract efficacy, environmental, regulatory, and market support services to agrochemical, biostimulant, biocontrol, and seed companies worldwide. With a network spanning over 40 countries, SynTech’s team of over 800 experienced technicians and managers operates from state-of-the-art field stations, laboratories, and regulatory service locations to meet clients’ diverse needs.

Top Key Players Outlook

- Eurofins Scientific SE

- SGS SA

- Charles River Laboratories International, Inc.

- Syntech Research Group, Inc.

- Knoell Germany GmbH

- ERM International Group Limited

- Staphyt Group

- Anadiag Group SAS

- RIFCON GmbH

- Smithers Group Inc.

Recent Industry Developments

In 2024, Eurofins Scientific SE reported revenues of €6.95 billion, marking a 6.7% increase from €6.51 billion in 2023.

In 2024 SynTech Research Group, reported annual revenues exceeding $100 million, capturing approximately 15% of the market share in its sector.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Bn Forecast Revenue (2034) USD 26.2 Bn CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Field Services, Laboratory Services, Regulatory Services, Other), By Sector (Crop Protection Chemicals, Fertilizers, Seeds, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eurofins Scientific SE, SGS SA, Charles River Laboratories International, Inc., Syntech Research Group, Inc., Knoell Germany GmbH, ERM International Group Limited, Staphyt Group, Anadiag Group SAS, RIFCON GmbH, Smithers Group Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agriculture Cro Services MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Agriculture Cro Services MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurofins Scientific SE

- SGS SA

- Charles River Laboratories International, Inc.

- Syntech Research Group, Inc.

- Knoell Germany GmbH

- ERM International Group Limited

- Staphyt Group

- Anadiag Group SAS

- RIFCON GmbH

- Smithers Group Inc.