Global Agriculture Analytics Market Size, Share, Industry Analysis Report By Offering (Solution, Service), By Application (Precision Farming, Livestock Farming, Aquaculture Farming, Other), By Field Size (Small, Medium, Large), By Technology (Remote Sensing and Satellite Imagery, Geographic Information System, Robotics and Automation, Big Data and Cloud Computing, Visualization and Reporting, Others), By End-User (Farmers, Agronomists, Agribusinesses, Agricultural Researchers, Government Agencies, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162856

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Impact on Production and Efficiency

- Resource Use and Sustainability

- Adoption Rates and Technology Use

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Offering Segment Analysis

- Application Analysis

- Field Size Analysis

- Technology Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

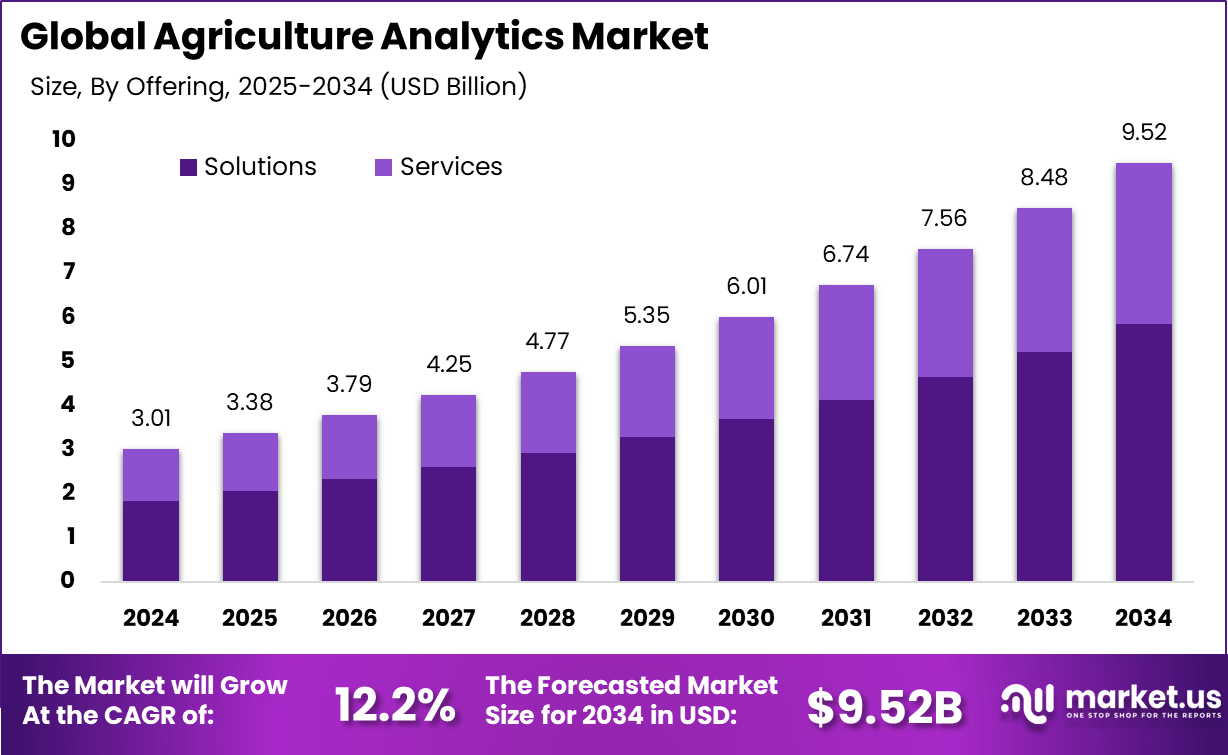

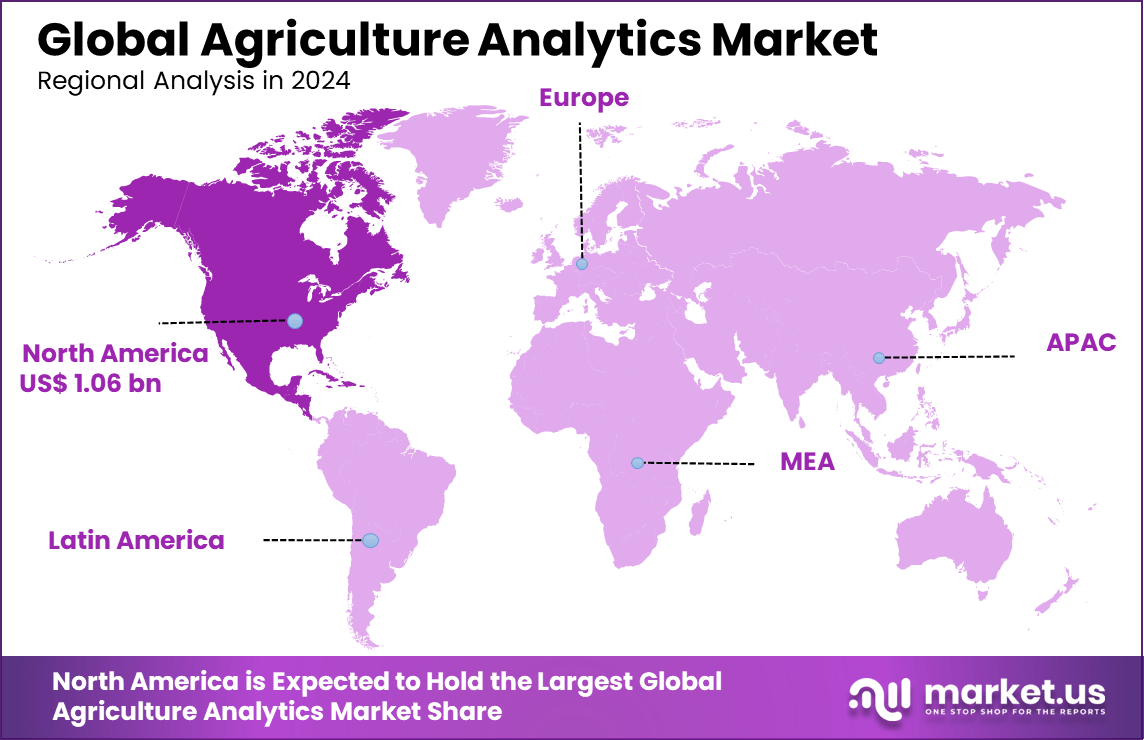

The Global Agriculture Analytics Market size is expected to be worth around USD 9.52 billion by 2034, from USD 3.01 billion in 2024, growing at a CAGR of 12.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.3% share, holding USD 1.06 billion in revenue.

The Agriculture Analytics Market is transforming how farming is managed with data-driven insights that improve crop yield, resource use, and overall productivity. This market encompasses tools and technologies that collect and analyze data from soil, weather, crop health, and equipment to help farmers make informed decisions. These analytics tools help farmers optimize irrigation, fertilization, and pest control for each area, improving efficiency and sustainability.

For instance, in April 2024, the U.S. Department of Agriculture reported a 25% rise in the adoption of precision farming techniques among U.S. farmers over the past three years. The report emphasized that precision farming has greatly enhanced productivity, optimized resource use, and contributed to more sustainable agricultural practices.

Top driving factors for this market include the growing need for sustainable farming to address food security and resource scarcity. Large-scale farms, particularly in regions with extensive agricultural lands, are adopting analytics to manage operations efficiently. Demand is fueled by farmers’ increasing reliance on technologies such as IoT sensors, drones, and satellite imagery to obtain real-time insights, which help reduce waste and improve crop quality.

The market for Agriculture Analytics is driven by the growing adoption of advanced technologies such as AI, machine learning, and IoT in farming. These innovations enable farmers to collect detailed data on soil, weather, and crop health, allowing more precise decision-making. This leads to higher crop yields, reduced costs, and sustainable farming practices.

For instance, in February 2025, IBM advanced its Watson Decision Platform for Agriculture with expanded crop models and predictive analytics. The platform offers irrigation management, disease risk analysis, and yield prediction across multiple regions globally. IBM’s Soil and Water Assessment Tool was also augmented with AI capabilities, enhancing decision-making for sustainability.

Key Takeaway

- The Solutions segment led with 61.4%, driven by the increasing adoption of analytics platforms for crop monitoring, yield optimization, and farm management.

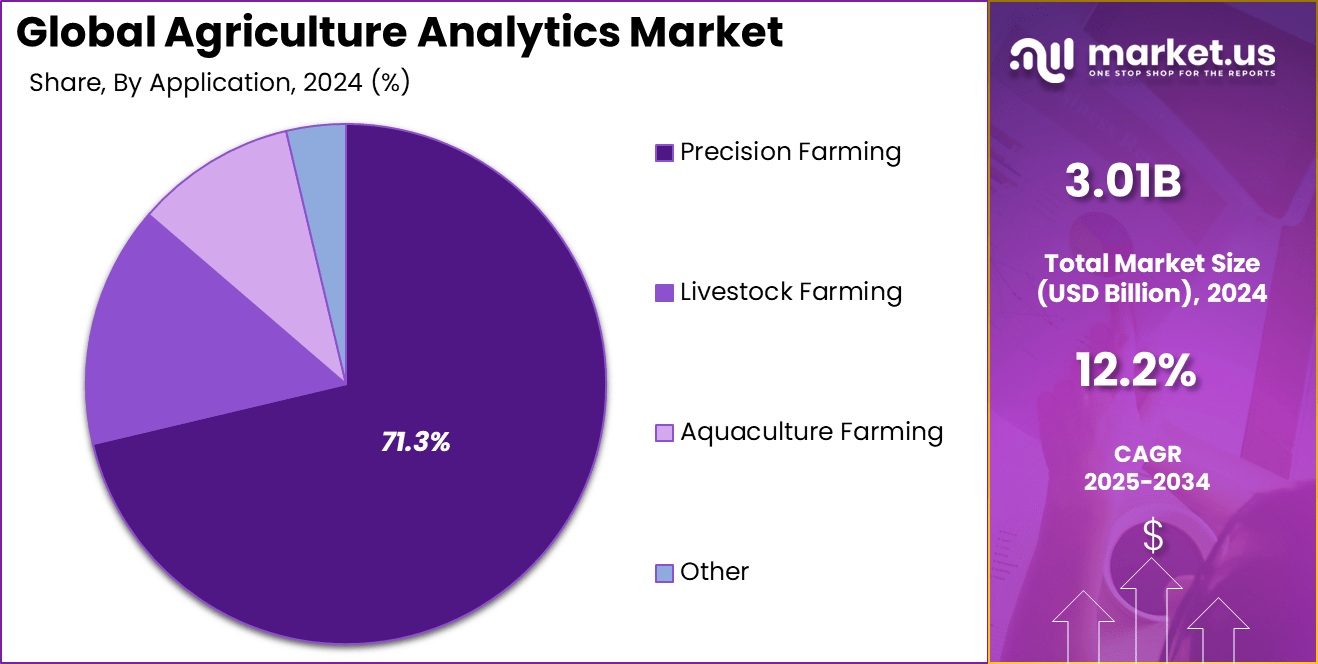

- Precision Farming dominated with 71.3%, reflecting widespread use of data-driven insights and IoT-based systems to improve productivity and resource efficiency.

- The Large Farms segment accounted for 52.8%, supported by higher investment capacity and advanced digital infrastructure for agricultural data utilization.

- Big Data and Cloud Computing captured 23.3%, emphasizing their importance in managing vast agricultural datasets and enabling real-time decision-making.

- Agribusinesses held 35.5%, highlighting their growing reliance on analytics for supply chain optimization and sustainability tracking.

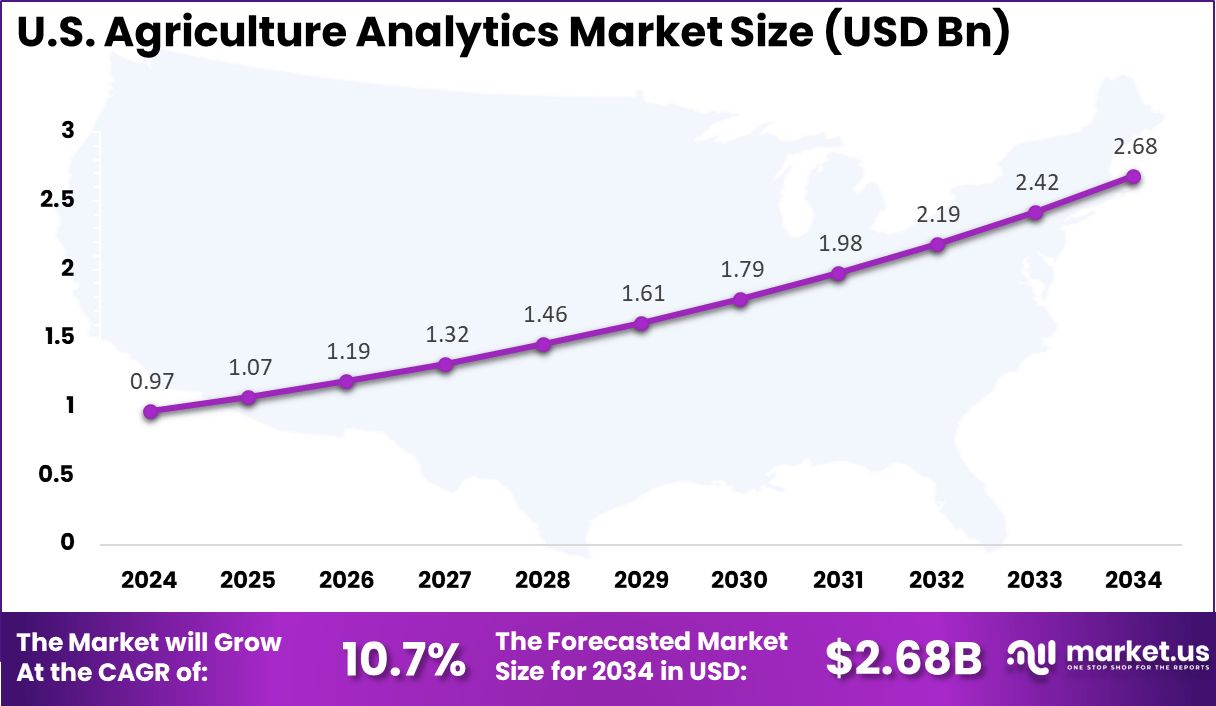

- The US market reached USD 0.97 Billion in 2024, registering a strong 10.7% CAGR, fueled by rising adoption of AI, satellite imaging, and predictive analytics in farming operations.

- North America maintained dominance with a 35.3% global share, supported by advanced digital agriculture practices and a well-established technological ecosystem.

Impact on Production and Efficiency

- Increased yields: Artificial intelligence (AI) is proving transformative in precision farming. Optimized irrigation and fertilization powered by AI tools have been shown to increase crop yields by 10–15%, enabling farmers to maximize production from existing land.

- Improved forecasting accuracy: Predictive analytics has significantly enhanced crop forecasting, with advanced methods reducing deviations from actual yields to within 10% when local historical data is applied. This accuracy helps farmers make better decisions and minimize losses.

- Enhanced productivity: A 2021 study revealed that precision farming technologies boosted farmers’ overall production by 4%, underscoring steady gains from digital adoption.

- Livestock productivity: Analytics also benefit livestock management. In Brazil, insights into feeding and breeding strategies contributed to a 4.5% increase in the value of livestock products in 2023, compared with the previous year.

Resource Use and Sustainability

- Reduced water usage: Agriculture accounts for 70% of global freshwater withdrawals, yet precision irrigation systems have cut water use by up to 50%, conserving resources while maintaining productivity.

- Optimized chemical use: Targeted application of inputs reduces environmental impact. A 2021 study found fertilizer usage declined by 7% and herbicide applications by 9% through precision technologies.

- Decreased fossil fuel consumption: Fuel efficiency gains are also evident, with reports showing a 6% reduction in fossil fuel use from precision farming systems.

- Climate-smart practices: In the United States, over 60,000 farms spanning more than 25 million acres had adopted climate-smart practices by 2024, supported by analytics-driven insights.

- Reduced food waste: Analytics can help curb global food waste by identifying inefficiencies across the supply chain. By 2030, such measures could prevent losses worth $155-405 billion annually.

Adoption Rates and Technology Use

- Satellite imagery: Remote sensing plays a central role in data-driven farming. In 2024, satellite and aerial imagery accounted for 38.7% of the global agriculture analytics data market, reflecting high reliance on these sources.

- High adoption on large farms: Precision technologies are widely integrated on larger operations. In the United States in 2023, around 70% of large crop-producing farms used autosteering guidance systems, a key component of modern precision agriculture.

- IoT deployment: IoT-enabled farm management systems are increasingly deployed to collect real-time data on soil, weather, and crop conditions, improving operational efficiency and enabling responsive decision-making.

Role of Generative AI

The role of Generative AI in Agriculture Analytics has become a game-changer by enabling smarter decisions for farmers. It helps predict crop yields, assess weather impacts, and plan inputs more precisely. Recent data shows that generative AI usage in agriculture is growing rapidly, with machine learning leading the way, holding around 42.5% of related technology applications.

This technology improves forecasting accuracy and also supports smallholder farmers in adapting to climate challenges through localized and multilingual advisory tools, boosting precision farming efforts by over 15%. Such advancements make farming more efficient and sustainable. Generative AI also fosters scenario planning and AI-driven yield predictions, helping farmers optimize resource use while facing unpredictable weather patterns.

The global share of generative AI in agriculture is expected to expand significantly, with North America alone capturing more than 37.5% of the market due to early technology adoption. This trend indicates a shift toward farm management tools that combine AI with satellite imagery and IoT, making precision agriculture more accessible and impactful in real time.

Investment and Business Benefits

Investors see sizable opportunities in developing specialized analytics platforms and smart devices that cater to diverse farm sizes and regional needs. Improvements in digital infrastructure and government subsidies for precision agriculture technologies also drive new investments. Enhanced connectivity and the integration of AI and machine learning models amplify the capacity of analytics solutions to deliver actionable forecasts and recommendations.

Business benefits of agriculture analytics include optimized resource allocation, higher crop uniformity, risk mitigation through disease and pest predictions, and improved supply chain resilience. Analytics aid in predictive maintenance of expensive farm equipment, reducing downtime costs estimated at billions annually.

U.S. Market Size

The market for Agriculture Analytics within the U.S. is growing tremendously and is currently valued at USD 0.97 billion, the market has a projected CAGR of 10.7%. This market is growing due to the increasing adoption of precision farming techniques and advanced data analytics tools that help farmers optimize yields and manage resources effectively.

Rising demand for sustainable agriculture and government support through initiatives promoting smart farming practices further drive market expansion. The use of AI, IoT, drones, and satellite imagery enables real-time insights into soil, crop health, and weather conditions. Regions like California and Iowa lead due to their large, technologically advanced farms.

For instance, in September 2025, CropX Technologies (San Francisco, California, USA) acquired crop supply intelligence company Acclym to expand sustainability and supply chain analytics capabilities. CropX continues to enhance its soil sensor tech and agronomic management platform aimed at maximizing yield and resource efficiency.

In 2024, North America held a dominant market position in the Global Agriculture Analytics Market, capturing more than a 35.3% share, holding USD 1.06 billion in revenue. This leadership stems from the region’s large-scale farming operations and early adoption of advanced technologies like precision agriculture and IoT.

Government initiatives supporting sustainable farming and investments in digital infrastructure further accelerate technology integration. Strong presence of agri-tech companies, widespread broadband access, and innovation hubs in the U.S. and Canada drive continuous growth in agriculture analytics applications and solutions.

For instance, in October 2025, Deere & Company (Moline, Illinois, USA) strengthened its tech-enabled agriculture lead through advanced AI-powered solutions such as autonomous tractors and See & Spray systems. Their integrated farm ecosystem and data platform, John Deere Operations Center, continues to improve productivity and farmer lock-in, backed by positive analyst outlooks.

Offering Segment Analysis

In 2024, The Solutions segment held a dominant market position, capturing a 61.4% share of the Global Agriculture Analytics Market. Solutions include software platforms and tools designed to help farmers and agribusinesses collect, interpret, and act upon agricultural data. These tools provide insights into weather, soil conditions, and crop status, enabling better decisions for enhanced productivity.

The demand for solutions reflects growers’ need for easy-to-use, integrated technologies that improve farming outcomes through data-driven strategies. This preference for solutions also signals a shift from traditional farming practices to more modern, technology-led approaches. As farms adopt more digital tools, there is a growing reliance on software that can handle complex datasets and present actionable recommendations.

For Instance, in October 2025, Trimble Inc. announced enhancements to its Trimble Unity software suite with new capabilities focusing on asset lifecycle management, which supports farm data integration and operational planning. These solutions help farmers and agribusinesses manage their assets more efficiently through connected data platforms.

Application Analysis

In 2024, the Precision Farming segment held a dominant market position, capturing a 71.3% share of the Global Agriculture Analytics Market. This dominance is due to its role as a transformative application of agriculture analytics. This method uses data from drones, GPS, IoT devices, and sensors to optimize resource use and crop management at the field level.

It helps farmers apply water, fertilizers, and pesticides precisely where needed, improving yields and reducing waste significantly. The high share reflects the growing adoption of site-specific crop management techniques in the agricultural sector.

The rising focus on sustainable farming practices and resource conservation has accelerated precision farming’s importance in agriculture. With detailed, real-time field data, farmers can respond dynamically to changing conditions, boosting profitability and environmental stewardship simultaneously.

For instance, in March 2025, John Deere Operations Center integrated its farm machinery data with EOSDA Crop Monitoring, allowing automatic synchronization of field data and improved precision farming mapping. This development simplifies the use of real-time data from equipment to optimize field-level decision-making.

Field Size Analysis

In 2024, The Large segment held a dominant market position, capturing a 52.8% share of the Global Agriculture Analytics Market. These farms cover extensive land areas and generate vast data volumes, which require advanced analytics for effective management. Large-scale operations have the financial and infrastructural means to invest in analytics technologies for monitoring and optimizing multiple farm functions.

The focus on large farms demonstrates how big agricultural businesses use data-driven tools to handle complexities at scale. Investing in analytics helps them maximize outputs, reduce costs, and improve resource management across their wide geographic footprint.

For Instance, in February 2025 saw Farmers Edge Inc. launched services targeting large-scale agribusinesses with a focus on improving farm productivity and insurance risk management through detailed, tech-powered data insights. Their solutions help manage complex operations typical of large field sizes more effectively.

Technology Analysis

In 2024, The Big Data and Cloud Computing segment held a dominant market position, capturing a 23.3% share of the Global Agriculture Analytics Market. Their strength lies in processing vast amounts of information from sensors, satellite imagery, and equipment to generate meaningful insights. Cloud computing offers scalability and remote access to analytics tools, allowing farmers and businesses to make timely decisions irrespective of location.

Together, these technologies enable faster data analysis, storage efficiency, and seamless integration of diverse datasets. Their adoption is crucial as farms tackle increasing volumes of data and seek real-time actionable insights to enhance farm management practices.

For Instance, in February 2025, IBM advanced its Watson Decision Platform for Agriculture by integrating AI and big data analytics to provide predictive models for crops and irrigation. This platform allows processing massive datasets from farms to deliver actionable insights to users spanning the US and other regions.

End-User Analysis

In 2024, The Agribusinesses segment held a dominant market position, capturing a 35.5% share of the Global Agriculture Analytics Market. These companies use data analytics not only for growing crops but also for supply chain management, logistics, and strategic planning. Their adoption highlights the importance of data-driven solutions throughout the entire agricultural value chain, beyond just the farm.

The notable share of agribusinesses shows their reliance on analytics to increase operational efficiency and competitiveness. By integrating advanced analytics, these businesses can optimize production, better forecast demands, and manage risks more effectively.

For Instance, in November 2024, Farmers Edge further expanded its portfolio to support large agribusiness clients through managed services that reduce technology costs and help scale digital operations efficiently, addressing the specific needs of this end-user segment.

Emerging Trends

Emerging trends in agriculture analytics reveal a strong focus on precision agriculture enabled by real-time data and IoT integration. By 2025, more than 80% of large farms are expected to adopt advanced data analytics to manage crops more effectively.

Technologies such as satellite imagery, drones, and sensor networks are now common tools that help farmers monitor soil moisture, nutrient levels, and pest infestations promptly, leading to higher productivity and better resource use. This movement toward data-driven farming is crucial for addressing global food security and sustainability challenges.

Another notable trend is the increasing availability of localized, multilingual AI tools designed for farmers in underrepresented regions. These tools leverage generative AI to provide climate-smart advice that enhances crop resilience in diverse agricultural settings.

Governments and private sector players are collaborating to make such technologies accessible and affordable. Moreover, the integration of cloud computing and machine learning accelerates the analysis of large agricultural data sets and supports remote decision-making, further driving the adoption of digital farming.

Growth Factors

The growth factors fueling agriculture analytics include the rising demand for sustainable and efficient farming practices worldwide. Precision farming methods enabled by AI and IoT reduce input waste while optimizing yields, which is critical as the global population grows.

Statistics indicate that precision agriculture techniques contributed to a 25% increase in farm productivity in key regions over recent years. Additionally, the enhanced ability to predict weather and disease outbreaks reduces risks and improves resilience in farming operations. Another key growth driver is the push by farmers and agribusinesses to meet consumer demand for sustainable and traceable food products.

Analytics tools improve transparency throughout the supply chain, helping farms comply with environmental standards and product quality requirements. This shift creates competitive advantages and supports long-term market success. Furthermore, advances in cloud infrastructure and improved IoT networks enable smaller farms to access sophisticated analytics, broadening market reach and adoption.

Key Market Segments

By Offering

- Solution

- Service

- Professional Services

- Managed Services

By Application

- Precision Farming

- Yield Monitoring

- Field Mapping

- Crop Scouting

- Weather Tracking & Forecasting

- Irrigation Management

- Inventory Management

- Farm Labor Management

- Livestock Farming

- Milk Harvesting

- Breeding Management

- Feeding Management

- Animal Comfort Management

- Farm Labor Management

- Aquaculture Farming

- Other

By Field Size

- Small

- Medium

- Large

By Technology

- Remote Sensing and Satellite Imagery

- Geographic Information System

- Robotics and Automation

- Big Data and Cloud Computing

- Visualization and Reporting

- Others

By End-User

- Farmers

- Agronomists

- Agribusinesses

- Agricultural Researchers

- Government Agencies

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Adoption of Advanced Technologies

The agriculture analytics market is being driven by the rapid adoption of advanced technologies like artificial intelligence, machine learning, and IoT in farming. These technologies enable farmers to gather precise data on soil, weather, and crop health, allowing them to make smarter decisions. By applying analytics, farmers can optimize irrigation, fertilizer use, and pest control, which leads to increased crop yields and reduced costs.

Furthermore, the demand to feed a growing global population sustainably motivates the adoption of these technologies. Agriculture analytics helps balance the need to increase food production while minimizing environmental impact by reducing resource waste. The integration of cloud computing and AI enhances the efficiency and accessibility of farming insights, making these tools fundamental to modern farming success.

For instance, in May 2025, Trimble Inc. shared a development involving technology-enabled workflow improvements in data center construction, highlighting efforts toward sustainability and efficiency. Their work on a large-scale, sustainable data center campus in Illinois underlines the push for integrating advanced cooling technologies like immersion cooling for enhanced operational efficiency.

Restraint

Limited Digital Literacy Among Small Farmers

One major restraint on the growth of agriculture analytics is the limited digital literacy among small to medium-sized farmers, especially in developing regions. Many farmers are unfamiliar with the technology or find it too complex to implement without training. This lack of knowledge inhibits widespread adoption of sophisticated analytics platforms, which often require an understanding of data tools and interpretation skills.

This digital divide means that while large agribusinesses can leverage analytics effectively, many small farmers remain underserved. Bridging this gap requires investments in education, user-friendly interfaces, and support services, but until these are widespread, technology adoption will remain concentrated in areas with better access and training. This limits the market’s reach and slows overall growth in some regions.

Opportunities

Expansion of Cloud-Based and AI-Enabled Platforms

Cloud-based analytics platforms and AI-driven tools present a significant opportunity in agriculture analytics. These platforms allow farmers to access real-time data and predictive insights remotely, making sophisticated analytics more user-friendly and scalable. By integrating data from multiple sources such as sensors, drones, and satellites, these platforms provide actionable intelligence on crop conditions, weather patterns, and pest threats.

This opportunity is particularly promising in regions with increasing internet connectivity and mobile device usage. Cloud solutions reduce upfront costs and enable new service models like subscription or Farming-as-a-Service, opening access to smaller farms. As AI technology advances, predictive models improve resource efficiency and yield forecasts, encouraging broader adoption and creating a new frontier for agricultural innovation.

For instance, in October 2025, Farmers Edge Inc. announced enhancements to its digital infrastructure to improve data unification and operational efficiency across farms. These advances rely heavily on robust data center performance, where immersion cooling solutions can offer critical benefits by supporting increased computational capacity and energy efficiency for handling large agricultural datasets.

Challenges

Data Privacy and Security Concerns

A significant challenge facing agriculture analytics is ensuring data privacy and security for the massive amounts of sensitive farm data collected. The farmers’ operational details, such as land use patterns and crop data, represent valuable information that must be protected from breaches and misuse. However, with multiple data sources and cloud storage, maintaining robust security becomes complex.

This challenge affects trust in analytics platforms, potentially deterring farmers from full participation. Without clear data ownership rules and strong security practices, confidentiality concerns can slow adoption. Providers in agriculture analytics must prioritize transparent data governance and invest in cybersecurity to build trust and support wider use of analytics solutions in farming.

For instance, in October 2025, Granular, Inc. (Corteva) highlighted its focus on data privacy in farm management solutions, reflecting the broader challenge of securing sensitive agriculture data in digital infrastructure. Implementing immersion cooling requires integrating with complex data architectures, which heightens concerns over data protection and regulatory compliance.

Key Players Analysis

The Agriculture Analytics Market is dominated by leading agritech and data solution providers such as Trimble Inc., Deere & Company (John Deere Operations Center), Climate LLC (Bayer AG), and IBM Corporation. These companies leverage AI, IoT, and satellite-based analytics to optimize crop management, soil health, and precision farming operations.

Prominent players such as Granular, Inc. (Corteva), Proagrica Ltd (RELX), Raven Industries (CNH Industrial), CropX Technologies, and Farmers Edge Inc. provide integrated data analytics platforms that combine farm management software with real-time monitoring and decision support tools. Their solutions help farmers reduce input costs, improve sustainability, and increase productivity through data-driven insights and smart automation.

Additional contributors including Agrostar (Stellapps), Agrivi Ltd., AgEagle Aerial Systems Inc., PrecisionHawk, Inc., SAS Institute Inc., CropIn Technology Solutions, Taranis, Planet Labs PBC, Descartes Labs, GeoPard Agriculture, Agworld Pty Ltd., and Farmbeat (Microsoft Corporation), along with other participants, focus on satellite imaging, drone-based analytics, and AI-powered farm intelligence.

Top Key Players in the Market

- Trimble Inc.

- Deere & Company (John Deere Operations Center)

- Climate LLC (Bayer AG)

- IBM Corporation

- Granular, Inc. (Corteva)

- Proagrica Ltd (RELX)

- CropX Technologies

- Farmers Edge Inc.

- Agrostar (Stellapps)

- Raven Industries (CNH Industrial)

- Iteris Inc.

- AgEagle Aerial Systems Inc.

- Agrivi Ltd.

- Conservis Corporation

- PrecisionHawk, Inc.

- SAS Institute Inc.

- DataFarm Inc.

- CropIn Technology Solutions

- Taranis

- Planet Labs PBC

- Descartes Labs

- OneSoil AG

- xarvio Digital Farming Solutions (BASF)

- GeoPard Agriculture

- Agworld Pty Ltd.

- Farmbeat (Microsoft Corporation)

- Others

Recent Developments

- In October 2025, Trimble Inc. launched new GPS-based solutions and smart tractors aimed at optimizing planting and irrigation, particularly in South America and the Asia-Pacific regions. They also enhanced their Farmer Pro software with Crop Health Imagery and Work Orders features, improving farm management capabilities.

- In September 2025, Climate LLC, a Bayer AG subsidiary, introduced a next-generation Climate FieldView analytics module combining machine learning-driven yield prediction with pest and disease risk modeling, enabling better in-season decisions for farmers.

Report Scope

Report Features Description Market Value (2024) USD 3.01 Bn Forecast Revenue (2034) USD 9.52 Bn CAGR(2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solution, Service), By Application (Precision Farming, Livestock Farming, Aquaculture Farming, Other), By Field Size (Small, Medium, Large), By Technology (Remote Sensing and Satellite Imagery, Geographic Information System, Robotics and Automation, Big Data and Cloud Computing, Visualization and Reporting, Others), By End-User (Farmers, Agronomists, Agribusinesses, Agricultural Researchers, Government Agencies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trimble Inc., Deere & Company (John Deere Operations Center), Climate LLC (Bayer AG), IBM Corporation, Granular, Inc. (Corteva), Proagrica Ltd (RELX), CropX Technologies, Farmers Edge Inc., Agrostar (Stellapps), Raven Industries (CNH Industrial), Iteris Inc., AgEagle Aerial Systems Inc., Agrivi Ltd., Conservis Corporation, PrecisionHawk, Inc., SAS Institute Inc., DataFarm Inc., CropIn Technology Solutions, Taranis, Planet Labs PBC, Descartes Labs, OneSoil AG, xarvio Digital Farming Solutions (BASF), GeoPard Agriculture, Agworld Pty Ltd., Farmbeat (Microsoft Corporation), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agriculture Analytics MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Agriculture Analytics MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Trimble Inc.

- Deere & Company (John Deere Operations Center)

- Climate LLC (Bayer AG)

- IBM Corporation

- Granular, Inc. (Corteva)

- Proagrica Ltd (RELX)

- CropX Technologies

- Farmers Edge Inc.

- Agrostar (Stellapps)

- Raven Industries (CNH Industrial)

- Iteris Inc.

- AgEagle Aerial Systems Inc.

- Agrivi Ltd.

- Conservis Corporation

- PrecisionHawk, Inc.

- SAS Institute Inc.

- DataFarm Inc.

- CropIn Technology Solutions

- Taranis

- Planet Labs PBC

- Descartes Labs

- OneSoil AG

- xarvio Digital Farming Solutions (BASF)

- GeoPard Agriculture

- Agworld Pty Ltd.

- Farmbeat (Microsoft Corporation)

- Others