Global Agricultural Planting And Fertilizing Machinery Market Size, Share, And Industry Analysis Report By Type (Planting Machinery, Seed Drills, Planters and Transplanters, Fertilizing Machinery, Fertilizer Spreaders), By Operation (Automatic, Manual), By Power Source (Internal Combustion Engine, Electric, Hybrid), By Capacity (Mid Capacity, Low Capacity, High Capacity), By Application (Seed Planting, Fertilizer Application, Soil Preparation, Crop Care), By End Use (Large-Scale Commercial Farms, Family-Owned Farms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178414

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

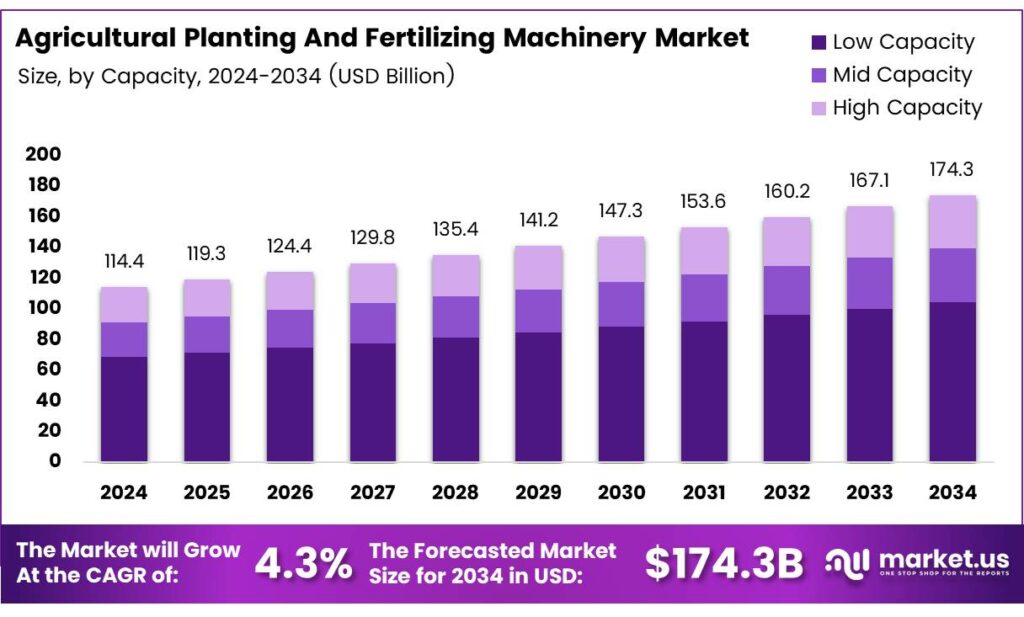

The Global Agricultural Planting and Fertilizing Machinery Market size is expected to be worth around USD 174.3 billion by 2034 from USD 114.4 billion in 2024, growing at a CAGR of 4.3% during the forecast period 2025 to 2034.

Agricultural planting and fertilizing machinery covers equipment used to sow seeds, apply nutrients, and prepare soil at scale. Farmers rely on seed drills, planters, fertilizer spreaders, and combined seed-cum-fertilizer drills. These machines help producers reduce labor costs, improve planting accuracy, and manage inputs more efficiently across large field operations.

Rising global food demand pushes farms to increase productivity without expanding land use. Consequently, machinery makers respond with smarter, faster, and more fuel-efficient equipment. Modern planting systems now integrate GPS guidance, variable-rate technology, and digital sensors that allow operators to adjust seed and nutrient placement in real time across diverse soil conditions.

- The United States recorded total farm tractor retail sales of 195,857 units for the full year January through December 2025, reflecting steady underlying demand for mechanized agriculture. This volume signals that North American farmers continue to invest in modern field equipment despite cyclical headwinds in commodity prices.

- Canada posted total farm tractor retail sales of 23,246 units for the full year 2025, while self-propelled combine sales reached 1,806 units over the same period. These figures confirm that North American markets remain foundational to global agricultural machinery demand, supporting broader market growth projections through the forecast period.

Precision agriculture technologies deliver measurable input savings, making them attractive to cost-conscious farm operators. Variable-rate systems allow producers to apply the right amount of fertilizer only where soil maps indicate a need. Therefore, farms reduce waste, lower input bills, and improve overall yield outcomes while also meeting sustainability commitments tied to carbon reporting and government program eligibility.

Key Takeaways

- The Global Agricultural Planting and Fertilizing Machinery Market was valued at USD 114.4 billion in 2024, to reach USD 174.3 billion by 2034, growing at a CAGR of 4.3%.

- Planting Machinery holds the dominant share at 58.2% in 2025.

- Automatic machinery leads with a 83.5% market share.

- Internal Combustion Engine dominates with a 67.1% share.

- Mid-capacity machinery accounts for 56.4% of the market.

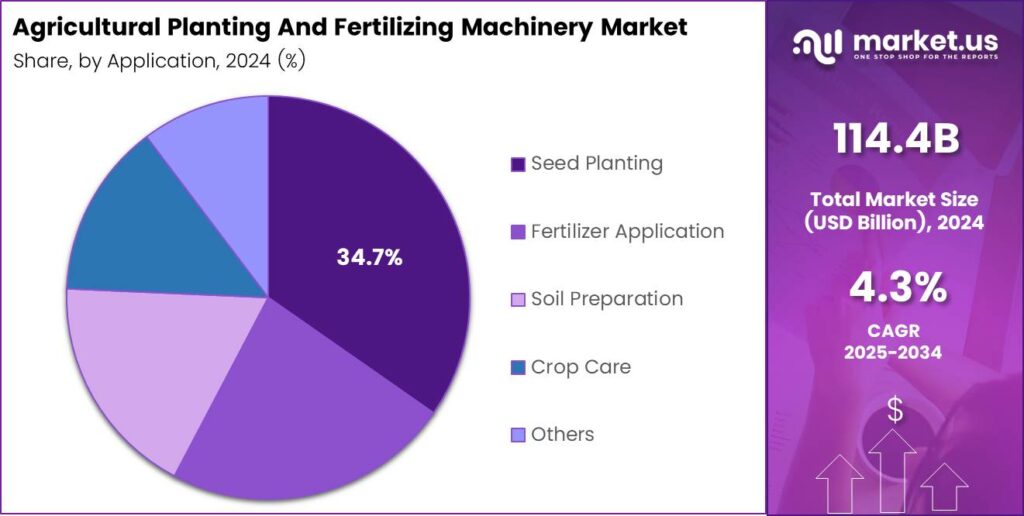

- Seed Planting is the leading application segment at 34.7%.

- Large-Scale Commercial Farms hold a dominant share of 62.9%.

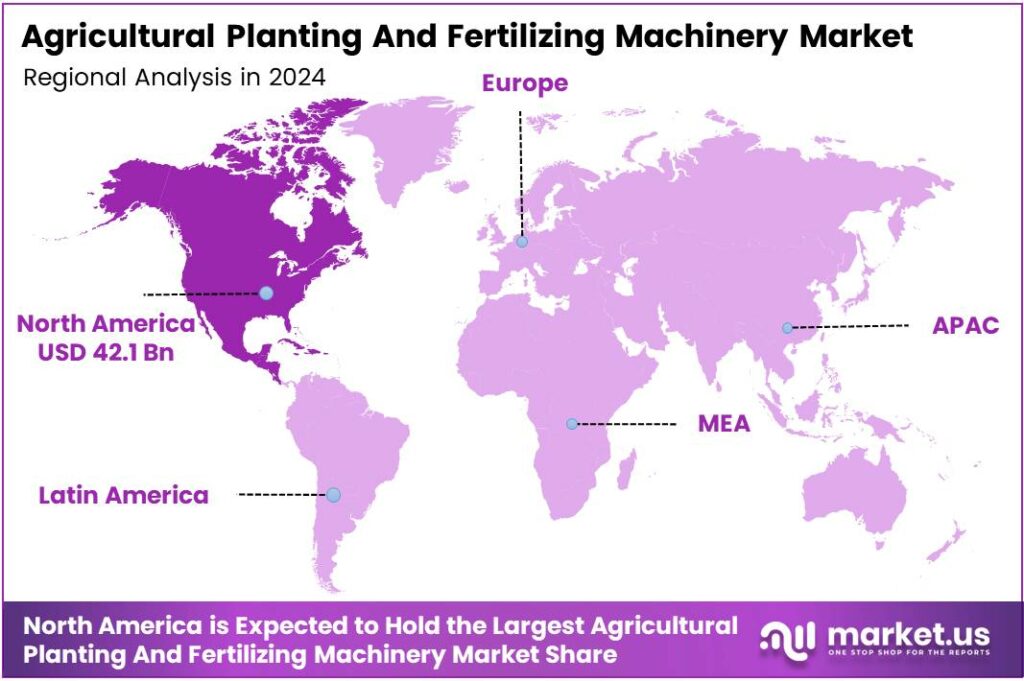

- North America leads all regions with a market share of 36.8%, valued at USD 42.1 billion.

Type Analysis

Planting Machinery dominates with 58.2% due to high adoption across large-scale commercial farming operations globally.

In 2025, Planting Machinery held a dominant market position in the By Type segment of the Agricultural Planting and Fertilizing Machinery Market, with a 58.2% share. Farmers increasingly adopt automated planting systems to improve seed placement accuracy and reduce labor dependency. Moreover, planting machinery integrates easily with GPS and variable-rate technologies, making it the preferred equipment choice across large commercial fields worldwide.

Seed Drills represent a critical sub-category within planting equipment. These machines deliver precise seed-to-soil contact at controlled depths, improving germination rates. Additionally, modern seed drills support single-pass field operations by combining soil preparation and seeding, which reduces total field passes and cuts fuel consumption across both smallholder and commercial farming systems.

Planters and Transplanters serve specialized crop applications, including row crops, vegetables, and transplanted seedlings. Consequently, demand for this sub-segment grows as diversified farming operations expand globally. High-precision planters equipped with individual row control systems allow operators to skip already-planted areas, significantly reducing seed waste and improving population uniformity across variable soil zones.

Fertilizing Machinery captures growing market attention due to rising precision nutrient management requirements. Prescription-map-compatible spreaders and applicators help farmers apply fertilizer only where soil tests indicate need. Therefore, this sub-segment delivers measurable input cost savings while supporting compliance with environmental mandates, including the EU Nitrates Directive requirements affecting farm operations across European markets.

Seed-cum-Fertilizer Drills gain traction, especially in dryland and rain-fed farming zones. These combined machines allow simultaneous seeding and fertilizer placement in a single field pass, reducing fuel and labor costs. Moreover, they support nutrient placement close to the seed zone, improving early plant uptake efficiency and overall crop establishment in low-rainfall agricultural regions.

Operation Analysis

Automatic machinery dominates with 83.5% due to efficiency gains and labor-saving advantages in commercial farm operations.

In 2025, Automatic machinery held a dominant market position in the By Operation segment of the Agricultural Planting and Fertilizing Machinery Market, with an 83.5% share. Automatic systems reduce operator skill requirements while improving field consistency. Consequently, large-scale commercial farms prioritize automatic planting and fertilizing equipment to manage thousands of hectares efficiently with smaller workforces and tighter operating margins.

Manual machinery retains relevance primarily among smallholder and family-owned farms in developing markets. However, policy-backed mechanization programs across the Asia-Pacific are gradually shifting these operations toward semi-automated and fully automated alternatives. Manual equipment continues to serve terrain-constrained plots and specialty crop systems where machine-guided automation remains impractical or economically unjustifiable, given field scale and crop value.

Power Source Analysis

Internal Combustion Engine dominates with 67.1% due to established infrastructure and high power output for heavy field operations.

In 2025, Internal Combustion Engine (ICE) machinery held a dominant market position in the By Power Source segment of the Agricultural Planting and Fertilizing Machinery Market, with a 67.1% share. ICE-powered equipment delivers the torque and range required for large-field planting and fertilizing tasks. Moreover, established fuel supply chains and dealer service networks make diesel-powered machinery the most practical option across global agricultural markets today.

Electric power source machinery gains momentum as battery technology improves and carbon-credit incentives grow. Manufacturers now develop electric planters and spreaders suited for precision operations on smaller or controlled-environment farms. Additionally, lower operating costs and zero direct emissions make electric agricultural machinery attractive in regions with strong renewable energy access and government clean-technology subsidy programs.

Hybrid power systems combine internal combustion and electric drives to balance power output with fuel efficiency. These systems suit mid-to-large operations seeking transition pathways toward lower-emission machinery without sacrificing field performance. Therefore, hybrid agricultural equipment appeals to farm operators who want measurable fuel savings and emission reductions while maintaining the operational reliability that diesel systems currently provide.

Capacity Analysis

Mid-capacity machinery dominates with 56.4% due to versatility across both medium commercial farms and transitioning smallholder operations.

In 2025, Mid Capacity machinery held a dominant market position in the By Capacity segment of the Agricultural Planting and Fertilizing Machinery Market, with a 56.4% share. Mid-capacity equipment balances field productivity with capital cost, making it the preferred choice for a wide range of farm sizes. Moreover, it suits farms transitioning from manual operations to mechanized systems across the Asia-Pacific and Latin American growth markets.

Low-capacity machinery serves smallholder and family-owned farms operating on constrained land holdings. These compact machines offer affordable entry points into mechanization for emerging-market farmers. However, government subsidy programs increasingly support upgrades from low to mid-capacity systems, accelerating the movement of smallholder farms toward greater productivity and commercial viability in developing agricultural economies.

High-capacity machinery drives productivity on large commercial farms in North America, Europe, and Australia. Wide-boom spreaders and multi-row planters cover thousands of hectares per season, reducing per-hectare operating costs significantly. Additionally, high-capacity systems integrate advanced automation and precision controls, enabling large operations to achieve field efficiency levels that justify the premium capital investment required for this equipment tier.

Application Analysis

Seed Planting dominates with 34.7% due to broad demand across all crop types and farm scales globally.

In 2025, Seed Planting held a dominant market position in the By Application segment of the Agricultural Planting and Fertilizing Machinery Market, with a 34.7% share. Seed planting applications span row crops, cereals, oilseeds, and vegetables, making this segment the broadest in terms of equipment deployment. Consequently, manufacturers invest heavily in planting technology innovation to serve diverse agronomic requirements across global cropping systems.

Fertilizer Application represents the fastest-growing application category, driven by precision nutrient management adoption. Farmers increasingly use prescription-based application systems tied to soil sampling data and yield maps. Moreover, regulatory pressure in Europe and North America to reduce nutrient runoff accelerates demand for variable-rate fertilizer application technology that improves efficiency and demonstrates environmental compliance to government regulators.

Soil Preparation machinery applications include tillage and seedbed conditioning equipment that readies fields for planting. Reduced tillage and no-till farming practices shift demand toward lighter, more targeted soil preparation tools. Additionally, combined soil preparation and planting systems are gaining popularity as farms seek to reduce field passes, lower fuel consumption, and minimize soil compaction in high-intensity cropping programs.

Crop Care applications cover in-season nutrient top-dressing and micronutrient delivery using specialized spreaders and applicators. These systems allow farmers to correct nutrient deficiencies identified through satellite imagery or drone scouting. Therefore, crop care machinery integrates closely with digital farm management platforms, creating growing demand for connected, data-driven field application equipment across precision-oriented commercial farming operations.

End Use Analysis

Large-Scale Commercial Farms dominate with 62.9% due to high equipment investment capacity and productivity-driven mechanization demand.

In 2025, Large-Scale Commercial Farms held a dominant market position in the By End Use segment of the Agricultural Planting and Fertilizing Machinery Market, with a 62.9% share. Commercial farm operators prioritize high-throughput planting and fertilizing equipment to maximize seasonal productivity. Moreover, these farms generate sufficient revenue to justify capital investment in precision-enabled machinery that delivers measurable returns through input savings and yield improvement.

Family-Owned Farms represent a large and growing end-user segment supported by government mechanization programs. Subsidized equipment financing and cooperative purchasing models help family farms access mid-capacity and automatic machinery. Additionally, digital platforms offering machinery-as-a-service models allow smaller farms to benefit from precision agriculture technology without bearing full capital ownership costs, broadening market access across this segment.

Key Market Segments

By Type

- Planting Machinery

- Seed Drills

- Planters and Transplanters

- Fertilizing Machinery

- Seed-cum-Fertilizer Drills

- Fertilizer Spreaders

By Operation

- Automatic

- Manual

By Power Source

- Internal Combustion Engine

- Electric

- Hybrid

By Capacity

- Mid Capacity

- Low Capacity

- High Capacity

By Application

- Seed Planting

- Fertilizer Application

- Soil Preparation

- Crop Care

- Others

By End Use

- Large-Scale Commercial Farms

- Family-Owned Farms

Emerging Trends

Precision Fertilizing and Autonomous Spreading Technologies Reshape the Agricultural Machinery Landscape

Farmers increasingly demand spreaders that receive real-time soil data and adjust application rates automatically. Moreover, ISOBUS-controlled dynamic-weighting systems enable operators to manage multiple field zones from a single cab interface, reducing errors and improving nutrient placement accuracy across diverse crop programs.

Autonomous and semi-autonomous spreader platforms gain mainstream adoption across large commercial operations. Equipment makers integrate machine vision, GPS-RTK guidance, and section control into standard spreader configurations. Consequently, farms reduce headland overlap losses and boundary over-application while meeting stricter EU Farm-to-Fork and Nitrates Directive mandates that require documented evidence of reduced fertilizer use across enrolled agricultural land areas.

High-capacity automatic machinery dominates new equipment purchases on large-scale commercial farms globally. Operators favor wide-boom planters and high-output spreaders that complete field operations within narrow weather windows. Additionally, the shift to single-pass seed-cum-fertilizer drills in dryland zones reduces fuel consumption significantly, aligning with both operational cost goals and the growing carbon-footprint reporting requirements tied to sustainability-linked farm financing programs.

Drivers

Labor Shortages, Policy Support, and Precision Input Savings Drive Strong Agricultural Machinery Market Growth

Persistent farm labor shortages accelerate the adoption of automated seeders and spreaders across all major production regions. Farm operators cannot source sufficient seasonal workers at viable wage levels, making mechanization economically necessary rather than optional. Consequently, manufacturers report strong order pipelines for automatic planting equipment that replaces manual field operations with consistent, GPS-guided mechanical processes requiring minimal skilled labor involvement.

- Policy-backed mechanization programs across the Asia-Pacific convert subsistence farms into commercial production units at a measurable pace. Governments in India, China, and Southeast Asia offer direct equipment subsidies and low-interest credit lines that lower purchase barriers for family and mid-scale farms. Domestic tractor sales in India reached 42,273 units in November 2025 alone, registering 33% growth, which reflects the strength of policy-driven mechanization demand in emerging agricultural markets.

Widespread variable-rate precision technologies deliver double-digit input savings that justify premium equipment investments. Farmers using prescription-map-driven planters and spreaders reduce seed and fertilizer usage by optimizing rates to actual field requirements. Moreover, government subsidy programs in North America and Europe specifically fund precision agriculture equipment purchases, further accelerating adoption among farm operators who seek to improve margins while meeting environmental performance standards.

Restraints

High Capital Costs and Technical Skill Gaps Slow Precision Agricultural Machinery Adoption in Key Markets

Prohibitive upfront costs of precision-enabled planters and applicators restrict market access for small and mid-scale farm operations. Advanced equipment with GPS, variable-rate drives, and sensor arrays commands significant price premiums over conventional machinery. Consequently, many family-owned farms in developing markets cannot afford these systems without substantial government subsidy support, limiting the pace of precision agriculture adoption beyond the large commercial farm segment.

- Europe recorded total tractor registrations of just 204,500 units in calendar year 2024, described as a 10-year low for the region. This decline reflects how economic uncertainty, high equipment costs, and shifting farm income conditions can suppress machinery market demand even in technologically advanced agricultural economies, reinforcing that cost and complexity barriers remain real and persistent restraints across developed markets as well.

Technical skill gaps in GPS calibration, prescription mapping, and sensor diagnostics create adoption barriers across emerging agricultural markets. Farm operators and service technicians often lack the training required to operate and maintain advanced precision systems effectively. Moreover, limited rural dealer infrastructure means equipment downtime during critical planting and fertilizing seasons can result in significant yield and revenue losses that discourage further investment in complex technology platforms.

Growth Factors

Carbon Credits, AgTech-as-a-Service Models, and Desert Farming Expansion Unlock New Market Opportunities

Widening carbon-credit revenue streams rewards farms that verify nutrient reduction through precision placement practices. Programs in North America and Europe now pay farmers directly for documented fertilizer input reductions achieved through variable-rate application technology. Consequently, equipment investments in precision planters and spreaders deliver dual financial returns — direct input cost savings plus tradable carbon credits — strengthening the business case for advanced machinery adoption.

- Agriculture-technology-as-a-service models bundle hardware with agronomic analytics, removing upfront capital barriers for smaller farm operations. Service providers offer subscription-based access to precision planting and fertilizing equipment combined with soil data, prescription maps, and yield analysis. CNH Industrial’s 2025 advancements in Active and Passive Implement Guidance ensure over 95% of seeds land within 0–5 cm of the intended path, demonstrating the yield value these bundled technology services deliver to farm operators.

Rising demand for high-specification machinery in controlled-environment and desert farming projects creates premium growth opportunities for equipment manufacturers. Gulf states, Israel, and North African nations invest heavily in mechanized agriculture systems that perform reliably under extreme heat and water-limited conditions. The proliferation of single-pass seed-cum-fertilizer drills in dryland zones reduces fuel consumption while improving nutrient placement, making these machines central to expanding arid-region food production programs globally.

Regional Analysis

North America Dominates the Agricultural Planting and Fertilizing Machinery Market with a Market Share of 36.8%, Valued at USD 42.1 Billion

North America leads the global agricultural planting and fertilizing machinery market, holding a 36.8% share valued at USD 42.1 billion. The United States and Canada operate large-scale, highly mechanized farm sectors that consistently invest in precision planting and fertilizing equipment. Moreover, government support programs and strong commodity crop production volumes sustain robust machinery replacement and upgrade cycles across the region’s extensive grain and oilseed farming areas.

Asia Pacific emerges as the fastest-growing regional market for agricultural machinery, supported by strong government mechanization policies. India, China, and Southeast Asian nations fund equipment subsidies that convert smallholder farms into productive commercial operations. Additionally, Deutz-Fahr Group’s 2025 strategic partnership with Topcon Agriculture to expand precision agriculture solutions signals growing multinational interest in serving the region’s rapidly modernizing farm equipment demand landscape.

Middle East and Africa represent emerging opportunity markets for advanced planting and fertilizing machinery, particularly in desert and arid-zone farming projects. Gulf nations invest in controlled-environment agriculture that requires high-specification mechanized systems. Moreover, African governments increasingly prioritize farm mechanization as a food security strategy, creating new demand for affordable mid-capacity planting and fertilizing equipment suited to diverse smallholder and commercial farm environments across the continent.

Latin America sustains strong agricultural machinery demand led by Brazil and Argentina’s large-scale soy, corn, and sugarcane production sectors. Farmers in these markets invest heavily in high-capacity planters and precision fertilizer application systems. Consequently, Latin America delivers consistent volume opportunities for global machinery manufacturers, supported by export-oriented farm economics that demand productivity-enhancing equipment capable of covering millions of hectares each growing season efficiently.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGCO Corporation operates as one of the world’s largest agricultural equipment manufacturers, delivering planting and fertilizing solutions under its Fendt, Massey Ferguson, and Challenger brands. AGCO invests heavily in precision agriculture integration, including variable-rate planting technology and ISOBUS-compatible spreader systems. The company serves both large commercial and family farm segments across North America, Europe, and high-growth Asia-Pacific markets with a broad product portfolio.

CLAAS reported net sales of €4,997.4 million for its fiscal year ended September 30, 2024, supported by research and development costs of €330.8 million during the same period. This R&D investment reflects CLAAS’s commitment to advancing precision seeding and fertilizing technologies. The company’s EBITDA reached €584.2 million in FY2024, demonstrating strong operational performance that funds continued product innovation across its planting and harvesting machinery lines.

CNH Industrial reported full-year consolidated revenues of $19.84 billion for FY2024, with a full-year net income of $1,259 million. CNH’s Case IH and New Holland brands deliver industry-leading planting and fertilizing equipment for large commercial farms globally. In 2025, CNH advanced planter automation through Active and Passive Implement Guidance systems, achieving over 95% seed placement accuracy within 0–5 cm of the intended path, directly improving farm productivity and input efficiency.

Kubota Corporation recorded consolidated revenue of ¥3,018,891 million for FY2025, with its Farm and Industrial Machinery segment contributing ¥2,628.6 billion in revenue. Overseas revenue reached ¥2,273.8 billion, confirming Kubota’s strong global market presence. The company’s operating profit for FY2025 stood at ¥265,470 million, reflecting efficient operations and growing demand for Kubota’s mid-capacity and precision-enabled planting and fertilizing equipment across North American, European, and Asian markets.

Top Key Players in the Market

- AGCO

- CLAAS

- CNH Industrial

- Deutz-Fahr Group

- Kinze Manufacturing

- Kubota

- Kverneland

- Lemken

- Mahindra & Mahindra

- Maschio Gaspardo

Recent Developments

- In 2025, CNH emphasized Planter Automation advancements: Active Implement Guidance and Passive Implement Guidance. These ensure over 95% of seeds are placed within 0–5 cm of the intended path, optimizing nutrient/fertilizer placement and root development for higher yields and reduced seed/fertilizer costs.

- In 2025, Deutz-Fahr Group entered into a strategic partnership with Topcon Agriculture and PFG America (exclusive Deutz-Fahr distributor in the USA) to expand aftermarket precision ag solutions for Deutz-Fahr tractors, improving compatibility and support for attached planting/fertilizing implements.

Report Scope

Report Features Description Market Value (2024) USD 114.4 Billion Forecast Revenue (2034) USD 174.3 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Planting Machinery, Seed Drills, Planters and Transplanters, Fertilizing Machinery, Seed-cum-Fertilizer Drills, Fertilizer Spreaders), By Operation (Automatic, Manual), By Power Source (Internal Combustion Engine, Electric, Hybrid), By Capacity (Mid Capacity, Low Capacity, High Capacity), By Application (Seed Planting, Fertilizer Application, Soil Preparation, Crop Care, Others), By End Use (Large-Scale Commercial Farms, Family-Owned Farms) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AGCO, CLAAS, CNH Industrial, Deutz-Fahr Group, Kinze Manufacturing, Kubota, Kverneland, Lemken, Mahindra & Mahindra, Maschio Gaspardo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Agricultural Planting and Fertilizing Machinery MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Agricultural Planting and Fertilizing Machinery MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AGCO

- CLAAS

- CNH Industrial

- Deutz-Fahr Group

- Kinze Manufacturing

- Kubota

- Kverneland

- Lemken

- Mahindra & Mahindra

- Maschio Gaspardo