Global Agricultural Antibacterials Market By Product Type (Copper-Based,Dithiocarbamates,Amides,Nano Copper and Hybrid Cu/Zn,Antibiotics,Biologicals,Others), By Formulation Form (Liquid Suspensions, Liquid-Dispersible Granules (WDG), Wettable Powders, Nano-dispersions and Encapsulates), By Application Method (Foliar Spray, Seed/Transplant Treatment, Soil Injection, Water-System and Drip-Irrigation Injection), By Crop (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Commercial Crops, Turf and Ornamentals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157300

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

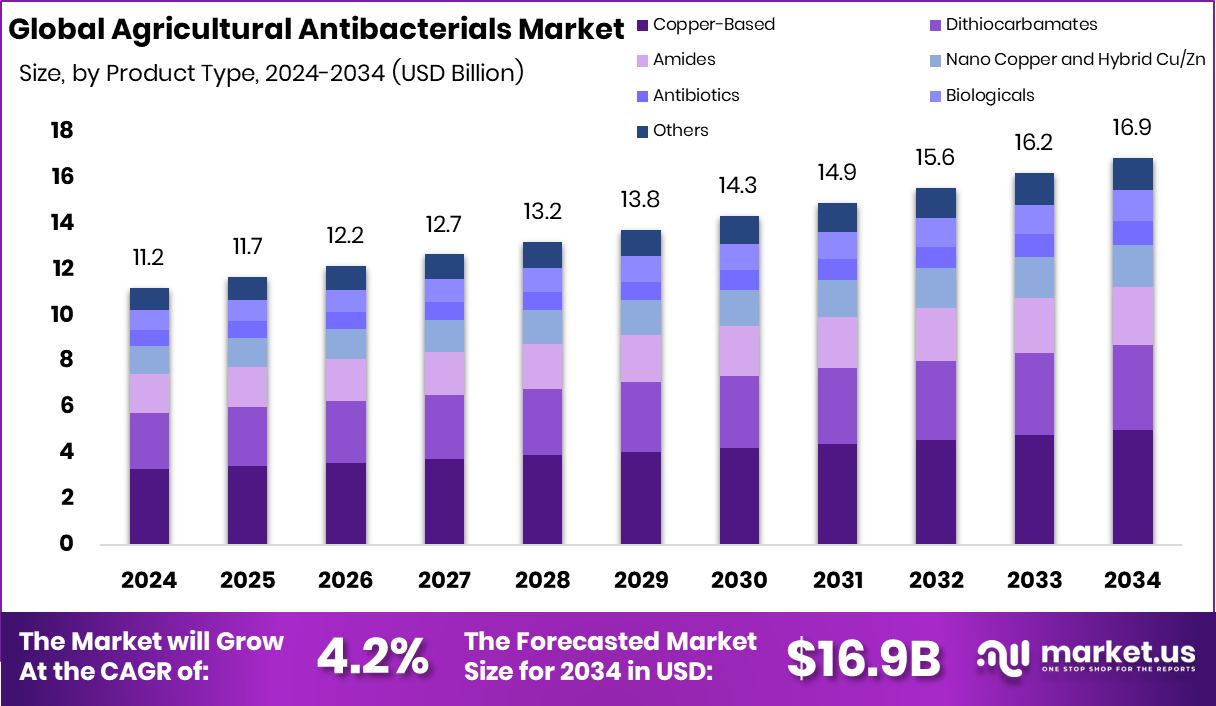

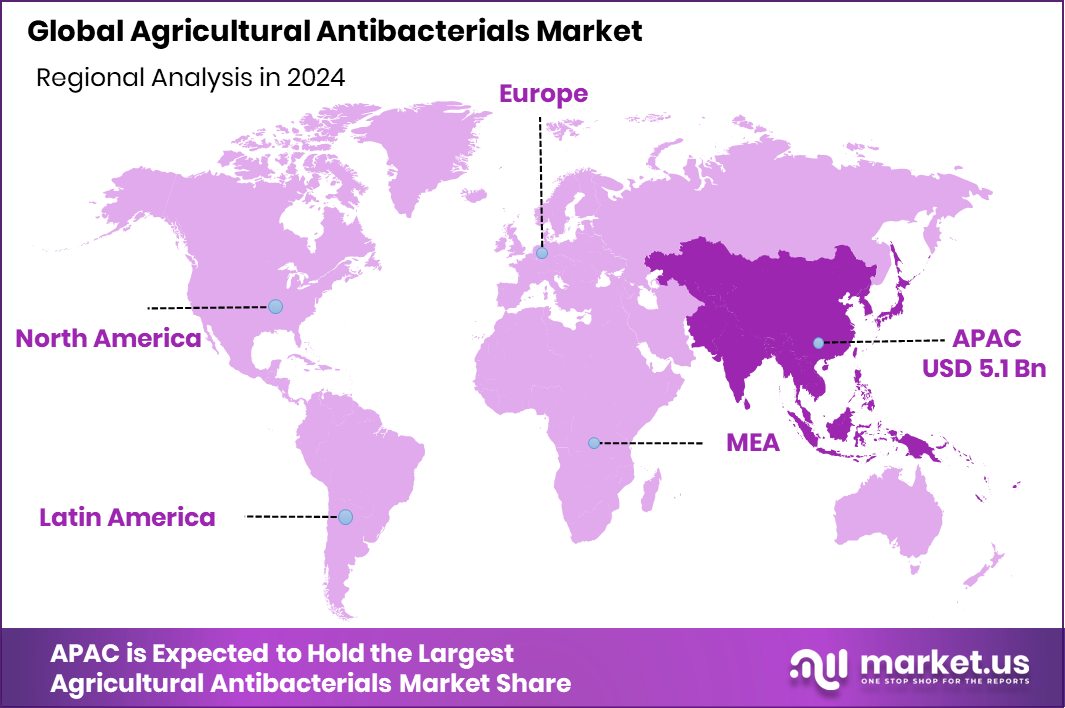

The Global Agricultural Antibacterials Market is expected to be worth around USD 16.9 billion by 2034, up from USD 11.2 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034. Asia Pacific, holding 45.90% and USD 5.1 Bn, remains the key driver of market growth.

Agricultural antibacterials are substances used to prevent or control bacterial infections in crops and livestock. They work by suppressing or eliminating harmful bacteria that can damage plant health, reduce crop yields, or affect the well-being of animals. These products can be applied directly to plants, soil, or animals, ensuring a healthier agricultural environment and reducing the risk of foodborne diseases.

The agricultural antibacterials market refers to the global trade and demand for antibacterial products specifically designed for farming and food production. It includes solutions for crop protection, livestock care, and food safety management. The market is influenced by rising agricultural challenges such as bacterial outbreaks, climate change impacts, and the need for sustainable farming practices. According to an industry report, Peptobiotics, a startup focused on replacing antibiotics in aquaculture with antimicrobial peptide technology, secured $6.2 million in its Series A funding round.

The growing pressure to feed a rising global population has significantly boosted the need for effective antibacterial solutions in agriculture. According to the FAO, food production must increase by nearly 60% by 2050 to meet demand. This rising necessity pushes farmers to adopt antibacterial measures that help protect crops and livestock from bacterial losses, supporting stable yields.

Consumer demand for safe, high-quality food is a major factor driving the use of agricultural antibacterials. With stricter food safety regulations and increased awareness about contamination risks, farmers and producers are adopting advanced antibacterial practices to ensure products are safe from farm to table. According to an industry report, Sound Agriculture has completed a $75 million Series D funding round to drive crop breeding and climate-smart agriculture solutions.

Sustainability and innovation are opening new opportunities in this market. The push for eco-friendly farming practices and reduced chemical usage encourages the development of natural and bio-based antibacterial products. This shift provides scope for new solutions that balance effectiveness with environmental safety, offering long-term growth for the agricultural antibacterials sector.

Key Takeaways

- The Global Agricultural Antibacterials Market is expected to be worth around USD 16.9 billion by 2034, up from USD 11.2 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- Copper-based products hold a 29.5% share, showing strong adoption in the agricultural antibacterials market.

- Liquid suspensions dominate with 57.8%, highlighting farmers’ preference for easy-to-apply antibacterial formulations.

- Foliar sprays account for 59.1%, making them the most effective application method in this market.

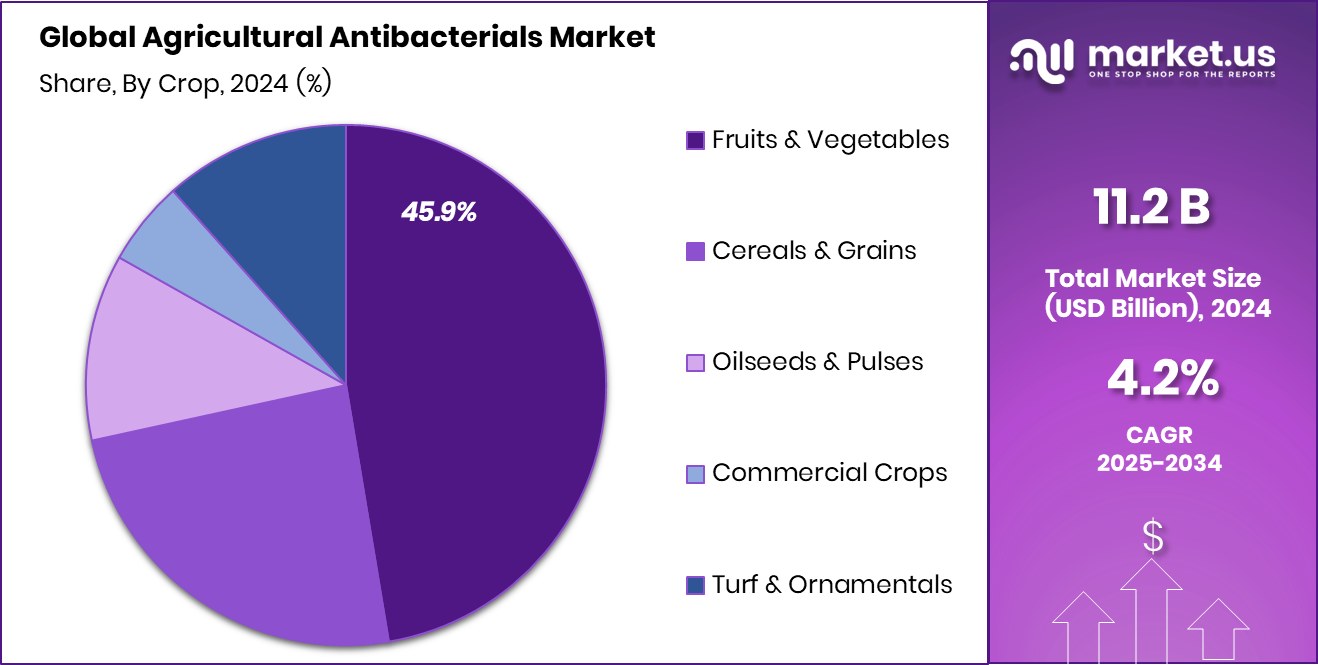

- Fruits and vegetables lead usage at 45.9%, reflecting antibacterial solutions’ importance in protecting perishable crops.

- Strong agricultural activity and rising food safety needs boosted Asia Pacific’s 45.90% share, USD 5.1 Bn.

By Product Type Analysis

Agricultural Antibacterials Market shows copper-based products holding 29.5% global share.

In 2024, Copper-Based held a dominant market position in the By Product Type segment of the Agricultural Antibacterials Market, with a 29.5% share. Copper compounds have been widely recognized for their broad-spectrum antibacterial activity and long-standing effectiveness in agriculture.

Farmers continue to rely on copper-based formulations because they provide strong protection against a variety of bacterial diseases affecting both crops and soil health. Their ability to act as a preventive and curative measure makes them a preferred choice, particularly in regions where bacterial outbreaks pose significant risks to yield and quality.

The dominance of copper-based antibacterials is also supported by regulatory acceptance and proven performance in integrated pest management practices. They are especially valuable in fruit and vegetable production, where bacterial diseases can cause heavy economic losses if left unchecked.

Moreover, the relatively lower cost of copper formulations compared to some modern alternatives has ensured their continued adoption across small and large farming operations. With rising global food demand and heightened focus on food safety, copper-based antibacterials are expected to maintain their strong market presence.

By Formulation Form Analysis

Liquid suspensions dominate the Agricultural Antibacterials Market, accounting for 57.8% product usage.

In 2024, Liquid Suspensions held a dominant market position in the By Formulation Form segment of the Agricultural Antibacterials Market, with a 57.8% share. This dominance is largely attributed to their ease of application, higher effectiveness in field conditions, and better absorption rates when compared with other forms.

Liquid suspensions provide uniform coverage on crops and soil, which ensures a more consistent antibacterial effect and reduces the chances of untreated patches that could foster bacterial growth. Their versatility in being applied through spraying, irrigation, or mixing with other agricultural inputs further strengthens their acceptance among farmers.

The prominence of liquid suspensions is also driven by their stability and efficiency in addressing bacterial diseases across a wide range of crops. They are particularly suited for large-scale commercial farming where speed, precision, and convenience play crucial roles in disease management.

Additionally, the growing trend of adopting advanced spraying technologies has increased the compatibility of liquid suspension products, making them the preferred choice for modern agricultural practices. With global food demand rising and the need to minimize bacterial crop losses becoming more critical, liquid suspensions are expected to remain the leading formulation, sustaining their 57.8% share and driving further adoption in the coming years.

By Application Method Analysis

Foliar spray application leads the Agricultural Antibacterials Market with 59.1% adoption globally.

In 2024, Foliar Spray held a dominant market position in the By Application Method segment of the Agricultural Antibacterials Market, with a 59.1% share. This leading position is supported by the method’s efficiency in delivering active antibacterial agents directly to the plant leaves, where infections commonly begin.

Foliar spraying ensures quick absorption and fast action against bacterial pathogens, helping farmers protect crop health at critical growth stages. Its effectiveness in providing uniform coverage across large fields has made it the most preferred method for both small-scale growers and large commercial farms.

The strong adoption of foliar sprays also comes from their flexibility in use, as they can be applied with conventional sprayers and advanced mechanized systems. This ease of application reduces labor efforts and makes it a practical choice in intensive farming practices. Furthermore, foliar sprays minimize wastage of antibacterial agents by targeting the plant surface directly, which improves efficiency and cost-effectiveness for farmers.

The rising need for high-quality yields and the demand to reduce crop losses due to bacterial infections have reinforced the reliance on this method. With these advantages, foliar sprays continue to dominate the application method segment, firmly holding their 59.1% market share in 2024.

By Crop Analysis

Fruits and vegetables drive Agricultural Antibacterials Market, capturing 45.9 of % overall demand.

In 2024, Fruits and Vegetables held a dominant market position in the By Crop segment of the Agricultural Antibacterials Market, with a 45.9% share. This leadership is driven by the high vulnerability of fruits and vegetables to bacterial infections, which can quickly reduce both yield and quality.

These crops are more perishable compared to grains or oilseeds, making them especially sensitive to bacterial diseases that can spread rapidly in humid and warm conditions. The economic value of fruits and vegetables is also higher on a per-acre basis, prompting farmers to invest more in antibacterial protection to safeguard returns.

The dominance of this segment is further reinforced by growing global demand for fresh produce, supported by dietary shifts toward healthier and plant-based foods. With consumers expecting blemish-free, safe, and long-lasting produce, farmers are under increasing pressure to adopt effective antibacterial treatments.

Moreover, fruits and vegetables are a major export category, and strict international food safety standards push growers to use reliable antibacterial solutions to meet quality requirements. This has created strong momentum for antibacterial adoption in horticulture.

Key Market Segments

By Product Type

- Copper-Based

- Dithiocarbamates

- Amides

- Nano Copper and Hybrid Cu/Zn

- Antibiotics

- Biologicals

- Others

By Formulation Form

- Liquid Suspensions

- Liquid-Dispersible Granules (WDG)

- Wettable Powders

- Nano-dispersions and Encapsulates

By Application Method

- Foliar Spray

- Seed/Transplant Treatment

- Soil Injection

- Water-System and Drip-Irrigation Injection

By Crop

- Fruits and Vegetables

- Cereals and Grains

- Oilseeds and Pulses

- Commercial Crops

- Turf and Ornamentals

Driving Factors

Rising Food Safety Concerns Boost Antibacterials Demand

One of the biggest driving factors for the Agricultural Antibacterials Market is the growing concern for food safety. Consumers today are more aware of the risks linked with bacterial contamination in food, especially in fruits, vegetables, and fresh produce. Governments across the world have also introduced stricter safety rules to ensure that crops and livestock products are free from harmful bacteria.

This has increased the use of antibacterial solutions on farms, as farmers want to protect both yields and product quality. As global food supply chains expand, the demand for safe and disease-free produce is becoming even stronger. This focus on food safety is creating steady growth for the agricultural antibacterials market.

Restraining Factors

Environmental Concerns Limit Overuse of Antibacterial Products

A key restraining factor for the Agricultural Antibacterials Market is the rising concern over environmental impact. Continuous or excessive use of antibacterial products, especially chemical-based ones, can lead to soil degradation, water contamination, and harm to beneficial microorganisms. This not only affects the long-term fertility of farmland but also raises ecological risks.

Regulators are increasingly strict about how much and what kind of antibacterial agents farmers can apply, which puts pressure on their adoption. Farmers are also becoming cautious, as overuse may reduce the natural resistance of crops and livestock. These environmental and regulatory challenges slow down market expansion, pushing the industry to look for safer and more sustainable antibacterial alternatives.

Growth Opportunity

Eco-Friendly Antibacterials Create Strong Market Opportunity

A key growth opportunity in the Agricultural Antibacterials Market lies in the rising demand for eco-friendly and sustainable solutions. Farmers and policymakers are becoming increasingly cautious about the long-term effects of chemical-based antibacterials on soil, water, and the environment. This shift is encouraging the development of bio-based and natural antibacterial products that can protect crops without causing ecological harm.

With consumers leaning toward sustainably grown food and regulators supporting greener practices, companies focusing on eco-friendly antibacterial solutions stand to benefit the most. This opportunity is particularly strong in regions where organic farming and sustainable agriculture are expanding quickly.

Latest Trends

Shift Toward Bio-Based and Sustainable Antibacterial Solutions

A major trend shaping the Agricultural Antibacterials Market is the growing shift toward bio-based and sustainable solutions. Farmers and policymakers are increasingly favoring products made from natural ingredients, such as plant extracts, beneficial microbes, and organic compounds, as alternatives to synthetic chemicals.

These bio-based antibacterials are considered safer for the environment and healthier for soil and crops, while still providing effective protection against bacterial infections. The push for sustainability is also supported by stricter regulations on chemical residues in food and exports.

As consumer demand for clean and eco-friendly produce rises, companies and researchers are investing more in developing innovative, natural antibacterial products. This trend is expected to create strong growth opportunities in the coming years.

Regional Analysis

In 2024, Asia Pacific dominated the Agricultural Antibacterials Market with 45.90%, worth USD 5.1 Bn.

The Agricultural Antibacterials Market shows varied growth patterns across key regions, driven by regional farming practices, regulatory frameworks, and crop protection needs. Asia Pacific emerged as the leading region in 2024, holding a dominant 45.90% share valued at USD 5.1 billion.

This leadership is underpinned by the region’s extensive agricultural base, particularly in countries like China, India, and Southeast Asia, where farming plays a central role in both domestic consumption and exports.

Rising population levels and growing demand for fresh fruits and vegetables have further increased the reliance on antibacterial solutions to protect crops from bacterial infections. Additionally, government support for modernizing farming methods and ensuring food safety has fueled adoption across smallholder and large-scale farms.

In North America and Europe, market growth is driven largely by strict food safety regulations and advanced farming technologies, leading to higher use of effective antibacterial products. Meanwhile, Latin America benefits from its strong horticulture and export-focused agriculture, creating opportunities for antibacterial applications.

The Middle East & Africa, though smaller in market size, are gradually expanding with the rise of modern farming practices. Despite these developments, the Asia Pacific clearly dominates the global market landscape, maintaining its strong 45.90% share in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Bayer AG continued to strengthen its presence in the agricultural antibacterials market through its diversified crop protection portfolio. The company’s long-standing expertise in plant health and commitment to research-driven solutions have positioned it as a key player. Bayer’s focus on integrating antibacterials into broader crop protection strategies allows farmers to manage bacterial diseases effectively while aligning with sustainability goals. The company’s investment in innovative formulations highlights its approach to balancing performance with environmental responsibility.

Syngenta AG also played a vital role in shaping the market landscape in 2024. Leveraging its strong global distribution network and farmer-focused solutions, Syngenta has emphasized practical antibacterial applications in fruits, vegetables, and staple crops. The company’s ability to provide targeted solutions that address regional crop challenges gives it a competitive edge. Syngenta’s ongoing development of formulations designed for efficiency and compatibility with modern spraying systems has boosted farmer adoption, particularly in high-value horticultural segments.

Corteva Agriscience demonstrated steady progress by expanding its antibacterial offerings as part of its integrated crop protection strategies. The company has been proactive in responding to the growing demand for safer and more sustainable farming solutions. By combining innovation with farmer outreach programs, Corteva has increased awareness of bacterial crop management practices.

Top Key Players in the Market

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Certis Biologicals

- Koppert

- BioWorks Inc.

- BioSafe Systems, LLC

- Phagelux AgriHealth, Inc

- Parijat Industries (India) Pvt. Ltd.

Recent Developments

- In April 2024, Bayer announced it is developing its first-ever bioinsecticide targeted at arable crops like oilseed rape and cereals. The product is still in development, with a planned launch around 2028, pending further testing and regulatory approval. While not strictly an “antibacterial,” it signals Bayer’s growing interest in biological, eco-friendlier crop protection solutions.

- In March 2025, Syngenta Brazil launched NETURE™, a biological insecticide crafted from Pseudomonas chlororaphis and Pseudomonas fluorescens. Though aimed at insects, its nature-based design and multi-mode action (contact, ingestion, repellency) are part of the same shift toward eco-friendly approaches—aligned with the logic driving biological antibacterials.

Report Scope

Report Features Description Market Value (2024) USD 11.2 Billion Forecast Revenue (2034) USD 16.9 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Copper-Based, Dithiocarbamates, Amides, Nano Copper and Hybrid Cu/Zn, Antibiotics, Biologicals, Others), By Formulation Form (Liquid Suspensions, Liquid-Dispersible Granules (WDG), Wettable Powders, Nano-dispersions and Encapsulates), By Application Method (Foliar Spray, Seed/Transplant Treatment, Soil Injection, Water-System and Drip-Irrigation Injection), By Crop (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Commercial Crops, Turf and Ornamentals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer AG, Syngenta AG, Corteva Agriscience, Sumitomo Chemical Co., Ltd., Albaugh LLC, Certis Biologicals, Koppert,BioWorks Inc. ,BioSafe Systems, LLC, Phagelux AgriHealth, Inc, Parijat Industries (India) Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Antibacterials MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Antibacterials MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Certis Biologicals

- Koppert

- BioWorks Inc.

- BioSafe Systems, LLC

- Phagelux AgriHealth, Inc

- Parijat Industries (India) Pvt. Ltd.