Global Agentic AI Insurance Market Size, Share, Industry Analysis Report By Application (Underwriting Automation, Claims Management, Customer Engagement, Product Personalization, Compliance & Governance, Others), By Insurance Type (Life Insurance, Health Insurance, Property & Casualty (P&C) Insurance, Commercial Insurance, Travel & Microinsurance, Others), By Technology Stack (Cognitive Agents, Autonomous Decision Engines, Multi-agent Systems, LLM Integration (with Guardrails), Explainable AI (XAI), Others), By Deployment Mode (On-Premise, Cloud-Based (SaaS), By End-User (Insurance Carriers, InsurTech Companies, Third-party Administrators (TPAs), Brokers & Agencies, Reinsurers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164897

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- AI Agent Statistics

- Performance Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Application Analysis

- Insurance Type Analysis

- Technology Stack Analysis

- Deployment Mode Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

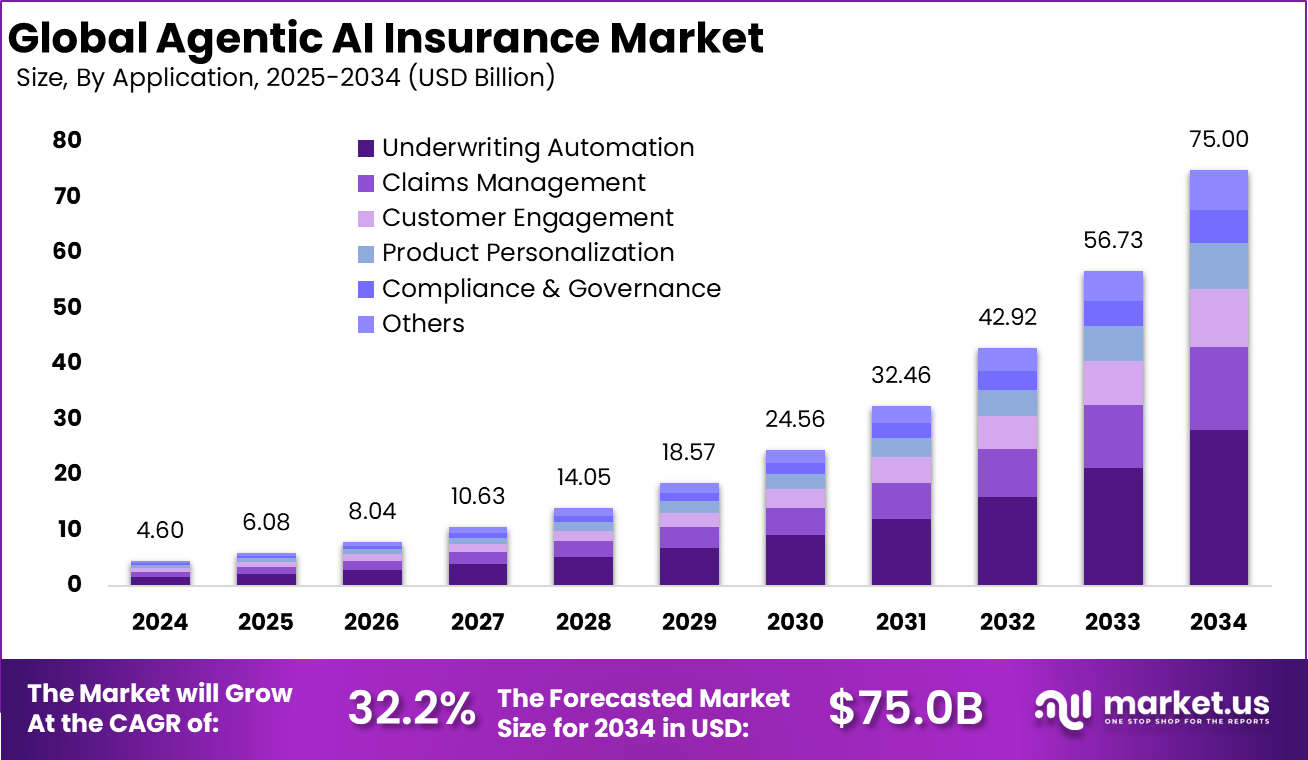

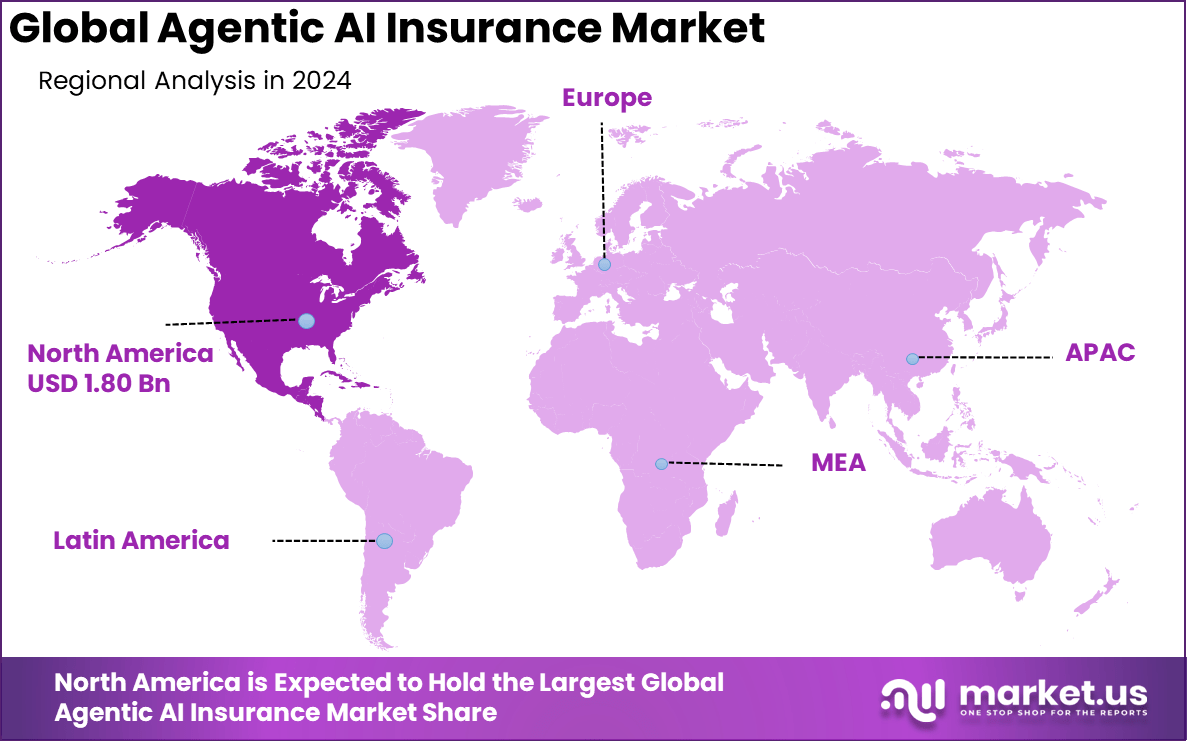

The Global Agentic AI Insurance Market size is expected to be worth around USD 75.00 billion by 2034, from USD 4.60 billion in 2024, growing at a CAGR of 32.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.3% share, holding USD 1.80 billion in revenue.

Agentic AI in insurance involves intelligent systems that autonomously handle complex processes such as underwriting, claims management, and fraud detection. These systems make independent decisions within set parameters, moving insurance operations from manual task automation to continuous and adaptive management. This approach improves decision accuracy and accelerates service delivery.

One of the main drivers fueling the adoption of agentic AI in insurance is the pressure from customers for faster, more personalized service alongside rising operational costs. Insurers also face stringent regulatory demands that require precise compliance and risk management. Agentic AI delivers by automating complex and multi-step workflows, from policy issuance to fraud prevention, thus improving both accuracy and speed of service delivery.

The market for Agentic AI insurance is driven by its ability to significantly enhance operational efficiency. Agentic AI automates complex insurance workflows such as claims processing, underwriting, and fraud detection, reducing manual errors and accelerating turnaround times. This automation allows insurers to handle more work with fewer resources, leading to cost savings and faster service delivery.

According to Market.us, The Global Agentic AI Market is projected to reach USD 196.6 billion by 2034, rising sharply from USD 5.2 billion in 2024, with a strong CAGR of 43.8% during 2025–2034. North America dominated the market in 2024, accounting for over 38% of global revenue, valued at approximately USD 1.97 billion. Within the region, the United States led the market with an estimated value of USD 1.58 billion and a steady CAGR of 43.6%.

For instance, in September 2025, Rishabh Software highlighted its multi-agent AI ecosystem designed for insurance claims processing, fraud detection, and customer support. Their AI agents automate resource-intensive claims workflows, detect fraud using machine learning, and enhance customer service with 24/7 AI-powered assistants.

Based on data from Hexaware, by 2024, around 87% of insurance companies are expected to adopt AI, increasing from 65% in 2021. Automated claims processing through AI is projected to reduce processing times by 50-70%, saving insurers billions of dollars each year. AI-powered chatbots and virtual assistants are expected to handle 30% of customer service interactions by 2025, improving response speed and satisfaction levels.

Predictive analytics supported by AI have enhanced fraud detection by over 20%, minimizing financial losses. The use of machine learning in underwriting has increased accuracy by 50%, allowing more precise risk assessments. As of 2023, about 34% of insurers had already implemented AI-based tools for real-time pricing models, improving pricing accuracy and profitability.

Key Takeaway

- The Underwriting Automation segment led the market with 37.5%, driven by the increasing adoption of AI-powered systems that streamline risk assessment and accelerate policy issuance.

- The Life Insurance segment captured 34.6%, reflecting the growing use of intelligent agents to personalize offerings and optimize claim management for long-term policies.

- Cognitive Agents held 32.2%, highlighting their role in automating decision-making, customer support, and claims processing through adaptive learning models.

- The On-Premise deployment segment accounted for 58.9%, underscoring insurers’ preference for maintaining control over sensitive customer data and regulatory compliance.

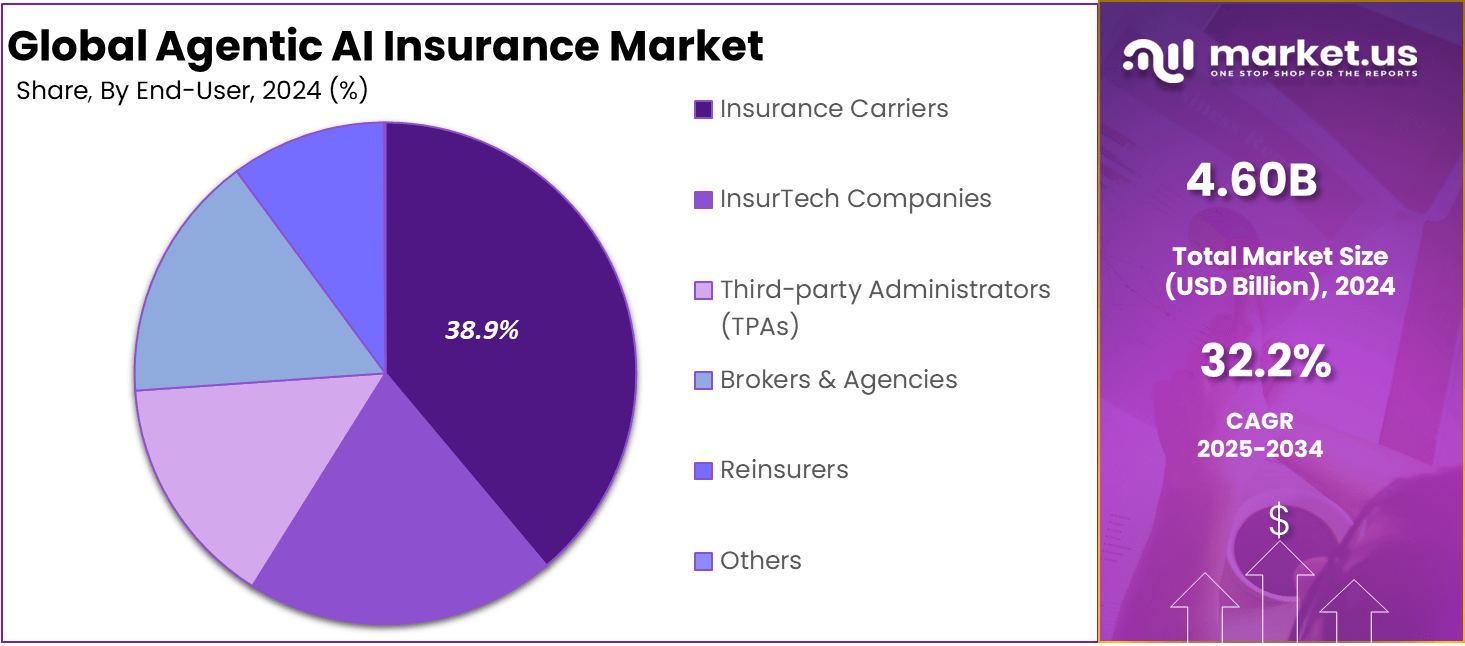

- The Insurance Carriers segment represented 38.9%, supported by increasing integration of agentic AI to enhance customer engagement and operational efficiency.

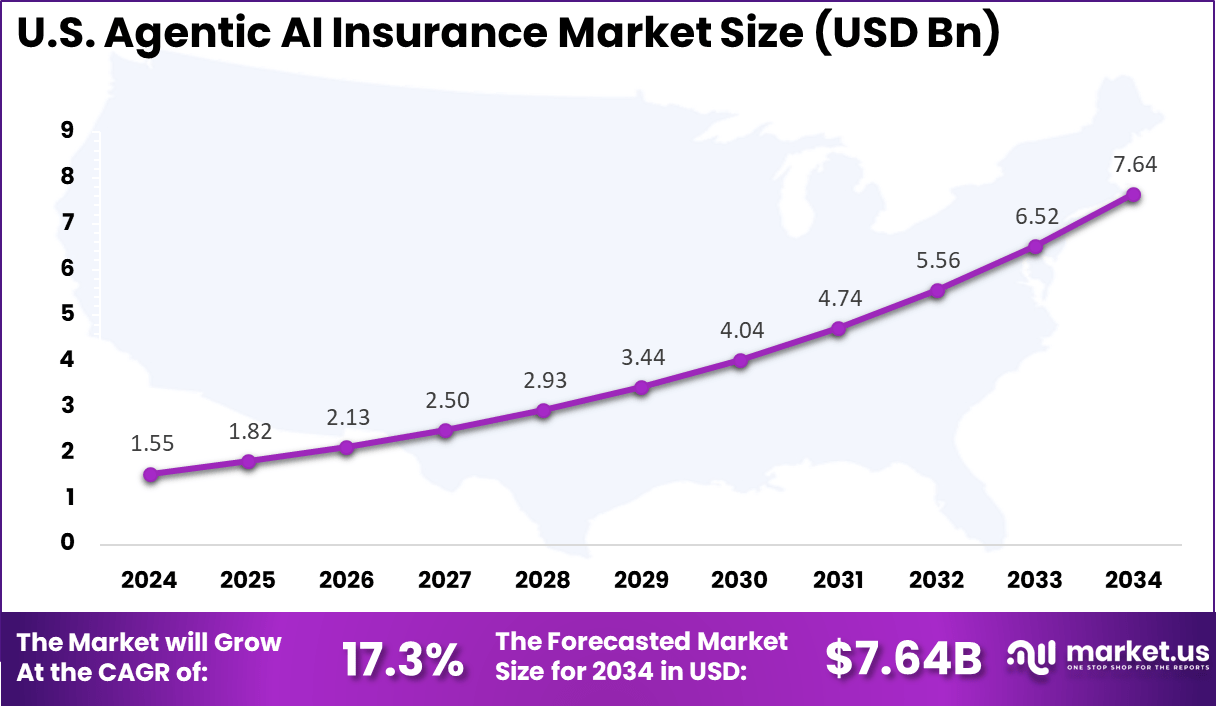

- The U.S. market reached USD 1.55 Billion in 2024, expanding at a robust 17.3% CAGR, driven by advanced AI deployment across underwriting, risk modeling, and policy servicing.

- North America dominated with a 39.3% share of the global market, supported by early adoption of AI in financial services, regulatory adaptability, and strong digital transformation initiatives among insurers.

AI Agent Statistics

- According to datagrid, As of mid-2024, 76% of U.S. insurance companies had implemented generative AI in at least one business function, signaling a rapid acceleration in adoption. However, only 10% achieved scaled deployment, revealing a significant execution gap between pilot initiatives and enterprise-wide transformation.

- Full AI adoption among insurers surged from 8% in 2024 to 34% in 2025, a 26% point year-over-year increase, indicating accelerated integration of AI agents across the insurance value chain.

- Claims processing has seen the most transformative impact, with resolution times reduced by 75%, from 30 days to 7.5 days. Routine claims now process within 24-48 hours, down from 7-10 days, while policy coverage verification has achieved near-99% time reduction, falling from 15–20 minutes to just seconds.

- About 64% of insurers prioritize processing unstructured data and documents using AI, positioning claims management as the most advanced and widely adopted application area.

- Overall, AI-driven claims automation has cut processing times by 55-75%, while routine claim workflows show a 75-85% time reduction, underscoring claims processing as the most proven high-ROI use case for immediate operational improvement.

Performance Statistics

- Cost reduction: Companies that implement agentic AI are achieving notable savings. Insurers adopting intelligent automation report 25-35% reductions in operational costs within the first year. Across the broader industry, AI integration is projected to save up to USD 1.2 trillion annually through improved efficiency and process automation.

- Claims processing: Claims management has seen major transformation. Processing times have been cut by up to 75%, while automation enables near-instant settlements. Lemonade’s AI claims bot, AI Jim, processed a claim in just two seconds, and around 40% of claims are now handled instantly by AI systems.

- Underwriting and risk assessment: AI-driven underwriting systems have improved accuracy by as much as 50% and shortened time-to-quote by 40%. Agentic AI streamlines data collection and analysis, reducing decision cycles from several weeks to only a few hours.

- Fraud detection: AI-based fraud detection models have enhanced detection rates by over 20%, with some insurers reporting improvements of up to 40%. These advances have significantly reduced financial losses caused by fraudulent claims.

- Customer service: AI chatbots are expected to manage about 30% of all customer service interactions by 2025. In one example, an insurer’s 24/7 AI-powered chatbot led to an 11% increase in the number of prospective customers purchasing policies.

Role of Generative AI

Agentic AI in insurance is reshaping decision-making by using generative AI to produce real-time insights and personalized solutions. Generative AI supports agentic AI by creating vast amounts of structured and unstructured data outputs, such as customer profiles, risk analytics, and policy documents. This blend has led to a 35% increase in underwriting accuracy and a 28% boost in automated claims processing efficiency.

These improvements allow insurers to speed up operations and tailor products more closely to individual needs, drastically reducing manual errors while enhancing customer satisfaction. More than 22% of insurers plan to have agentic AI solutions fully operational by the end of 2026, indicating strong traction.

Agentic AI cores take generative AI’s content generation further by autonomously executing complex workflows like fraud detection, policy adjustments, and dynamic risk assessment. The ability of agentic AI to constantly learn and adapt means it can improve decision quality over time, giving insurers a competitive edge in a rapidly evolving market landscape.

Investment and Business Benefits

Investment in Agentic AI technology holds attractive prospects, particularly in claims automation, risk assessment tools, and fraud analytics. Insurers investing strategically can capitalize on cost savings from reduced manual interventions and lower fraud-related losses. There is also growing interest in AI-driven customer engagement platforms that personalize policy recommendations and provide round-the-clock service, which can drive retention and lifetime customer value growth.

The business benefits of Agentic AI extend beyond cost savings to include enhanced productivity, scalability without major system overhauls, and the ability to innovate while maintaining everyday operations smoothly. Companies report operational cost reductions of 30% or more after implementing Agentic AI solutions. The technology also supports compliance by continuously monitoring policy adherence and regulatory changes, maintaining audit trails, and reducing the risks of human error.

U.S. Market Size

The market for Agentic AI Insurance within the U.S. is growing tremendously and is currently valued at USD 1.55 billion, the market has a projected CAGR of 17.3%. This growth is driven by the increasing adoption of AI technologies by insurers to enhance operational efficiency, especially in underwriting, claims processing, and fraud detection. Agentic AI’s autonomous decision-making capabilities reduce manual tasks and accelerate process times, leading to improved customer satisfaction and lower operational costs.

Insurers are also using agentic AI to personalize policies and improve risk assessment accuracy. Further growth in the market is supported by the industry’s push towards data-driven automation that meets regulatory and compliance requirements while maintaining data security. Agentic AI helps insurers overcome legacy system limitations by integrating complex data and enabling real-time analytics.

For instance, in October 2025, Salesforce announced the launch of Agentforce 360 at Dreamforce 2025 in San Francisco. This platform connects humans and AI agents on one trusted system to elevate employee productivity and customer engagement in insurance and other sectors. CEO Marc Benioff emphasized an era where AI assistants handle routine tasks so people can focus on strategic work, reinforcing Salesforce’s lead in AI-driven insurance solutions in the U.S. market.

In 2024, North America held a dominant market position in the Global Agentic AI Insurance Market, capturing more than a 39.3% share, holding USD 1.80 billion in revenue. This dominance is largely due to the region’s advanced technology ecosystem, strong investments in AI research and development, and early adoption of AI-driven automation by insurers. The presence of leading AI and tech companies fuels innovation, while favorable regulations support secure, compliant AI deployments across insurance processes.

Additionally, North America’s high digital maturity and widespread cloud infrastructure enable insurers to efficiently deploy agentic AI for underwriting, claims, and customer service. This environment accelerates AI integration and helps insurers improve operational efficiency and risk management, sustaining the region’s leading market position.

For instance, in October 2025, Virtusa showcased its generative AI-powered Helio platform at ITC Vegas 2025, focused on transforming underwriting, claims, and automation for insurance carriers. Virtusa’s ongoing innovation positions it as a leading AI services provider for insurance companies in North America.

Application Analysis

In 2024, the Underwriting Automation segment held a dominant market position, capturing a 37.5% share of the Global Agentic AI Insurance Market. These AI systems autonomously gather data from multiple sources and intelligently sequence evidence requests, greatly reducing the manual back-and-forth and shortening decision cycles from weeks to hours. This means insurers can handle more applications accurately and faster, improving overall efficiency.

Besides accelerating workflows, agentic AI enhances risk profiling by dynamically analyzing data in real time, detecting anomalies, and reducing human bias. It also frees human underwriters from repetitive tasks, allowing them to focus on complex cases where human judgment is essential. This combination improves service quality and boosts compliance with regulatory requirements.

For Instance, in November 2025, Allianz launched its first agentic AI solution specifically targeting claims automation, reducing processing times dramatically from days to hours. This system automates the food spoilage claims process with human oversight, showing Allianz’s commitment to increasing efficiency in underwriting and claims workflows.

Insurance Type Analysis

In 2024, the Life Insurance segment held a dominant market position, capturing a 34.6% share of the Global Agentic AI Insurance Market. Traditional life insurance underwriting is known to be slow with detailed data requirements. Agentic AI speeds this up by auto-verifying applicant details and managing extensive records like medical reports without human delays. This automation reduces backlogs and enhances customer satisfaction by delivering quicker policy approvals.

In addition to speed, agentic AI brings better accuracy and fraud detection, key for life insurers managing sensitive health and financial information. It also supports compliance by enforcing regulatory standards, making the entire underwriting process smoother and less error-prone.

For instance, in July 2025, Hexaware introduced its Tensai®-powered agentic AI suite engineered to transform underwriting in life insurance by automating risk profiling and medical data summarization. Their AI agents mimic roles like junior underwriters to reduce manual workload, allowing human experts to focus on complex cases. This development marks significant progress in operational efficiency within life insurance.

Technology Stack Analysis

In 2024, The Cognitive Agents segment held a dominant market position, capturing a 32.2% share of the Global Agentic AI Insurance Market. These agents act like virtual experts that can plan, learn, and execute tasks independently. They analyze diverse data inputs and adapt decisions dynamically, making them crucial for complex underwriting scenarios where static systems fall short.

Their ability to autonomously navigate through workflows and coordinate multi-departmental tasks leads to better risk profiling and faster policy processing. This intelligence creates a more robust underwriting framework that continuously improves with experience, differentiating agentic AI from traditional automation.

For Instance, in May 2025, LTIMindtree partnered with Boomi to deploy customized agentic AI solutions featuring cognitive agents for complex insurance workflows. Their AI harnesses generative capabilities combined with integration across systems to automate nuanced tasks requiring reasoning and adaptation, thus enhancing underwriting precision and consistency.

Deployment Mode Analysis

In 2024, The On-Premise segment held a dominant market position, capturing a 58.9% share of the Global Agentic AI Insurance Market. This shows how insurers prioritize data security and regulatory compliance by keeping AI systems within their own infrastructure. On-premise solutions reduce dependency on external cloud services, lowering risks related to data sovereignty and latency, which is critical for real-time decision-making during underwriting.

Insurers especially prefer on-premise deployments for regulated products where data privacy is paramount. This mode enables full control over sensitive customer and risk data, supporting seamless integration with existing IT environments and ensuring stringent adherence to industry standards.

For Instance, in June 2025, Hexaware emphasized its on-premise deployment option for agentic AI solutions, catering especially to insurers focused on data security and regulatory compliance. Their AI suite operates within clients’ IT ecosystems, avoiding cloud dependency, which is critical for handling sensitive underwriting data securely.

End-User Analysis

In 2024, The Insurance Carriers segment held a dominant market position, capturing a 38.9% share of the Global Agentic AI Insurance Market. These carriers increasingly deploy agentic AI to automate complex functions like underwriting, claims processing, and customer engagement. By offloading mundane tasks to AI agents, carriers improve operational efficiency and reduce costs.

Agentic AI enables carriers to personalize policies, detect fraud earlier, and ensure faster claim settlements. This strategic use of AI helps carriers maintain competitiveness and respond quickly to market changes while managing regulatory challenges effectively.

For Instance, in September 2025, Cognizant announced a strategic partnership with Venbrook Group to develop an agentic AI-powered third-party administrator (TPA) platform. This collaboration enables insurance carriers to modernize claims processing and policy administration, resulting in cost reductions and operational efficiencies.

Emerging Trends

A prominent emerging trend is the use of autonomous multi-agent systems that continuously learn and adapt, resulting in smarter risk assessment and fraud detection. This shift enables real-time data integration from multiple sources, which enhances underwriting accuracy and policy renewal decisions.

Approximately 43% of companies now allocate more than half of their AI budgets to building agentic AI capabilities, indicating a strong strategic focus on these trends. Another trend is the expansion of AI beyond operational tasks into customer engagement through virtual assistants that offer 24/7 support and personalized communication.

This development leads to higher policyholder retention and loyalty, as AI-driven chatbots and sentiment analysis tools refine customer offerings. More than 80% of organizations exploring agentic AI are focused on expanding autonomous decisions within their insurance operations, signaling rapid adoption of these emerging innovations.

Growth Factors

Key growth drivers include the push for operational efficiency combined with heightened regulatory compliance demands. Agentic AI helps insurers automate routine tasks while providing explainability and calibrated human oversight, reducing errors and improving audit readiness. Companies report cost reductions of around 30% and operational speed improvements of up to 80% through implementing agentic AI solutions, fueling interest in further expansion.

Additionally, customer expectations for personalized insurance experiences motivate growth. Hyper-personalized products resulting from AI analysis attract and retain high-value customers. Increased adoption rates are supported by the scalable nature of agentic AI systems, which integrate easily with legacy infrastructure and allow insurers to innovate without extensive overhaul. This flexibility appeals to executives balancing innovation with ongoing operations.

Key Market Segments

By Application

- Underwriting Automation

- Claims Management

- Customer Engagement

- Product Personalization

- Compliance & Governance

- Others

By Insurance Type

- Life Insurance

- Health Insurance

- Property & Casualty (P&C) Insurance

- Commercial Insurance

- Travel & Microinsurance

- Others

By Technology Stack

- Cognitive Agents

- Autonomous Decision Engines

- Multi-agent Systems

- LLM Integration (with Guardrails)

- Explainable AI (XAI)

- Others

By Deployment Mode

- On-Premise

- Cloud-Based (SaaS)

By End-User

- Insurance Carriers

- InsurTech Companies

- Third-party Administrators (TPAs)

- Brokers & Agencies

- Reinsurers

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Automation Boosts Operational Efficiency

Agentic AI in insurance is driving significant improvements in operational efficiency by automating complex tasks such as claims processing, underwriting, and fraud detection. These AI agents work autonomously, reducing human error and speeding up decision-making, which leads to faster claims settlements and cost savings. This efficiency gain helps insurers manage higher volumes with fewer resources, an essential factor as demand and operational complexity grow.

By automating routine and intricate insurance processes, Agentic AI enables insurers to shift their focus towards customer engagement and innovation, strengthening their competitive edge. The rapid execution of tasks supported by real-time data analysis translates to operational speed that was not possible with traditional systems.

For instance, In November 2025, Allianz introduced its first agentic AI solution, named Nemo, designed to automate food spoilage insurance claims. The system significantly reduces claim processing time from several days to only a few hours while maintaining human oversight. This initiative serves as a model for expanding AI-driven automation across various insurance products and regions.

Restraint

Regulatory and Privacy Concerns

A major restraint in adopting Agentic AI in insurance is the complex regulatory environment and stringent data privacy laws. Insurance companies operate in highly regulated markets where transparency, fairness, and data protection are critical. Autonomous AI decision-making raises concerns about explainability and accountability, especially where decisions impact customers’ claims, pricing, or eligibility.

Adapting legacy systems and ensuring compliance with privacy regulations slow down AI deployment. Furthermore, regulators’ cautious approach toward AI governance creates uncertainties. Insurers must invest heavily to meet these standards while balancing automation benefits with ethical and legal safeguards, making large-scale Agentic AI adoption challenging.

For instance, in February 2025, Simplifai introduced tailored agentic AI solutions designed for bodily injury, motor, and travel insurance claims. The company ensures its AI agents meet strict insurance compliance and security requirements. Simplifai develops pre-configured AI tools that accelerate claims handling while prioritizing regulatory adherence, reflecting how the industry faces challenges balancing innovation with privacy and legal policies.

Opportunities

Expansion into Underserved Markets

Agentic AI opens a valuable opportunity to expand insurance coverage to underserved and emerging markets by overcoming traditional barriers of cost and complexity. Legacy insurance models struggle to serve gig workers, microinsurance clients, and other segments due to rigid product designs and distribution inefficiencies. Agentic AI’s ability to autonomously design, distribute, and manage policies at scale offers a zero-marginal-cost approach to reach these populations profitably.

By enabling personalized, on-demand policies and automating risk assessment with data from IoT and other digital sources, insurers can tap new revenue streams and increase insurance penetration globally. This approach transforms AI from a tool into a digital business unit driving inclusion and growth in difficult-to-serve sectors.

For instance, in February 2025, Salesforce collaborated with McGill and Partners, a London specialty insurance broker, to launch an autonomous agentic AI platform for risk assessment and insurance placement. This partnership enables personalized insurance solutions and real-time decision-making at scale. Salesforce’s Agentforce platform illustrates the opportunity to expand insurance offerings with AI-driven agility, reaching new customers with faster, more flexible processes.

Challenges

Technical Integration Complexity

One significant challenge for insurers deploying Agentic AI is integrating these sophisticated AI systems with existing legacy IT infrastructure. Insurance companies often rely on outdated systems that are not designed for real-time data exchange or autonomous AI workflows. Complex integration projects are costly, time-consuming, and carry risks that can disrupt ongoing operations.

Moreover, agents must ensure smooth coordination between human staff and AI without losing control over processes. The technical complexity also extends to maintaining data quality, model monitoring, and system scalability, which require specialized expertise. These factors can delay AI projects and increase operational risks during transition.

For instance, in May 2025, LTIMindtree partnered with Boomi to develop agentic AI solutions that integrate custom AI agents into insurance workflows. Their collaboration leverages Boomi’s Agent Designer and Control Tower technologies to overcome legacy system limitations. This highlights the technical complexity insurers face when embedding advanced AI agents, requiring significant effort to ensure smooth integration and real-time coordination across systems.

Key Players Analysis

The Agentic AI Insurance Market is shaped by technology and insurance leaders such as Allianz, Simplifai, and Salesforce, Inc. These companies are integrating intelligent agent-driven systems to automate claims management, underwriting, and policy servicing. Their solutions enhance accuracy, accelerate decision-making, and improve customer experience by leveraging AI agents capable of autonomous data interpretation and response.

Prominent contributors including Roots Automation, LTIMindtree Limited, Hexaware Technologies Limited, and Cognizant are deploying agentic AI models to streamline repetitive back-office operations. Their platforms combine generative AI with predictive analytics to assist insurers in risk assessment, fraud detection, and workflow optimization while maintaining strong regulatory compliance and data integrity.

Emerging players such as Virtusa Corp, UiPath, and Newgen Software Technologies Limited, along with other market participants, focus on developing agent-based automation frameworks that integrate with legacy insurance systems. Their emphasis on intelligent orchestration and process transparency positions them as key enablers of the next-generation digital insurance ecosystem.

Top Key Players in the Market

- Allianz

- Simplifai

- Salesforce, Inc.

- Roots Automation

- LTIMindtree Limited

- Hexaware Technologies Limited

- Rishabh Software

- Cognizant

- Virtusa Corp

- UiPath

- Newgen Software Technologies Limited

- Others

Recent Developments

- In November 2025, Allianz launched its first agentic AI solution called Nemo to automate food spoilage claims, cutting processing times from days to hours. This marked a major achievement for Allianz in deploying agentic AI quickly and at scale with a focus on hyper-automation and operational efficiency. They are expanding agentic AI use cases to other types of claims, such as travel delays and simple auto claims, working towards a global ecosystem of AI agents supporting human experts.

- In February 2025, Salesforce launched its Financial Services Cloud (FSC) AI-powered solution specifically for insurance brokerages. It automates policy servicing and commission processes to boost team productivity and improve customer engagement. Salesforce aims to unify data and workflows under one intelligent platform to replace fragmented legacy systems.

- In October 2025, Accenture invested in Lyzr, an AI company that developed a full-stack enterprise agent infrastructure platform. This investment, made through Accenture Ventures, enables Lyzr to collaborate with Accenture in bringing agentic AI to banking, insurance, and financial services companies. Lyzr’s Agent Studio platform supports both professional developers and no-code business users to build secure, reliable AI agents that integrate seamlessly into workflows.

- In October 2025, Happiest Minds Technologies successfully deployed its Agentic AI solution with Intelligent Document Processing (IDP) at MUA Insurance Acceptances Pty Ltd in South Africa. This deployment transformed MUA’s high-volume claims and policy email operations by automating the intake and routing of emails and attachments such as PDFs, scanned forms, and images using GenAI-based classification and smart workflow orchestration.

Report Scope

Report Features Description Market Value (2024) USD 4.60 Bn Forecast Revenue (2034) USD 75 Bn CAGR (2025-2034) 32.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Underwriting Automation, Claims Management, Customer Engagement, Product Personalization, Compliance & Governance, Others), By Insurance Type (Life Insurance, Health Insurance, Property & Casualty (P&C) Insurance, Commercial Insurance, Travel & Microinsurance, Others), By Technology Stack (Cognitive Agents, Autonomous Decision Engines, Multi-agent Systems, LLM Integration (with Guardrails), Explainable AI (XAI), Others), By Deployment Mode (On-Premise, Cloud-Based (SaaS), By End-User (Insurance Carriers, InsurTech Companies, Third-party Administrators (TPAs), Brokers & Agencies, Reinsurers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz, Simplifai, Salesforce, Inc., Roots Automation, LTIMindtree Limited, Hexaware Technologies Limited, Rishabh Software, Cognizant, Virtusa Corp, UiPath, Newgen Software Technologies Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agentic AI Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Agentic AI Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz

- Simplifai

- Salesforce, Inc.

- Roots Automation

- LTIMindtree Limited

- Hexaware Technologies Limited

- Rishabh Software

- Cognizant

- Virtusa Corp

- UiPath

- Newgen Software Technologies Limited

- Others