Global Aesthetic Implants Market By Implant Type (Breast Implants, Dental Implants, Facial Implants, and Other Implant Types), By Material Type (Metals, Ceramic, Polymer and Biological Materials), By Gender Type (Female, Male, By End-User, Hospital, and Specialty Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 95333

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

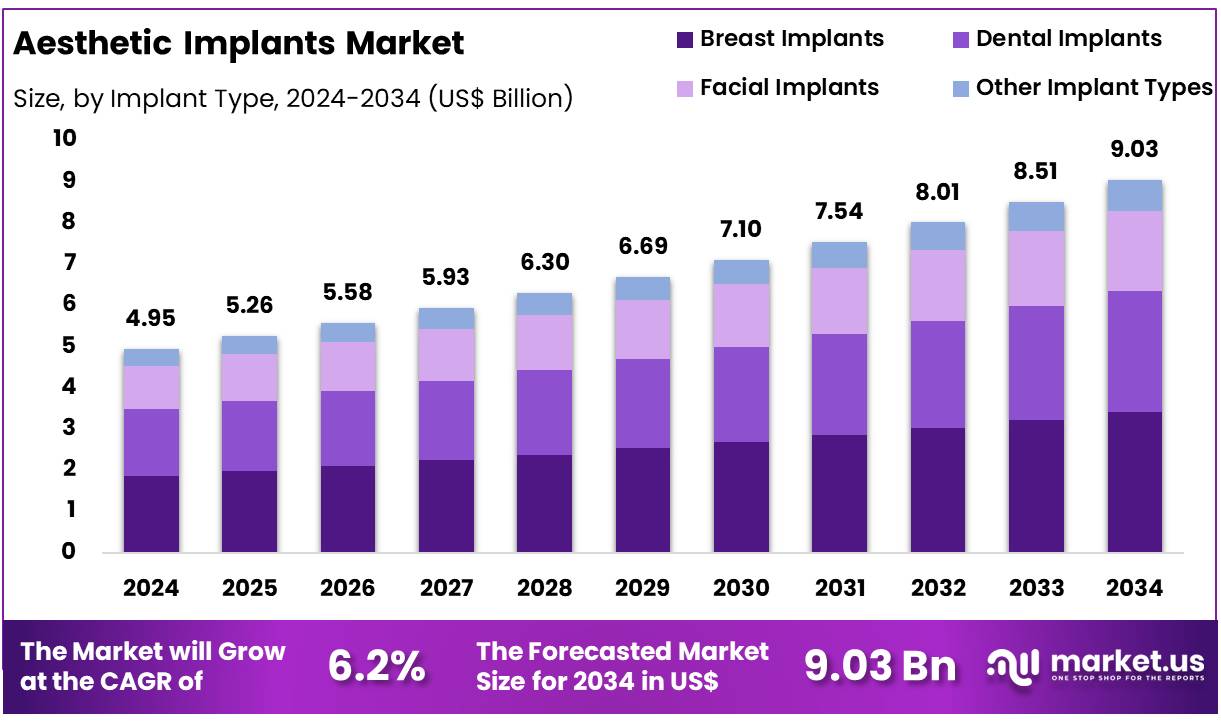

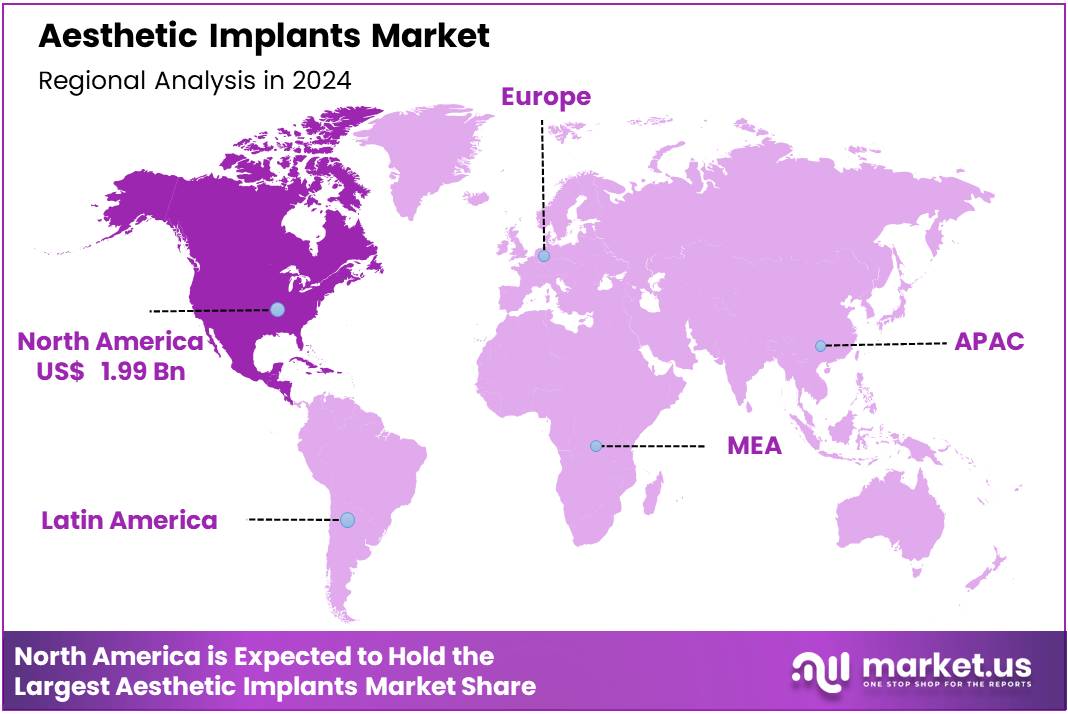

Global Aesthetic Implants Market size is expected to be worth around US$ 9.03 Billion by 2034 from US$ 4.95 Billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. In 2024, North America led the market with a revenue of US$ 1.99 Billion.

Owing to expenses on aesthetic procedures, this target market’s growth is upsurging. The increasing prevalence of breast cancer, the growing count of reconstructive surgeries, as well as the increasing number of cosmetic surgeries are witnessing positive market revenue expansion. The growing requirement for an attractive physical appearance increased the count of product launches associated with aesthetic implants.

However, ethical concerns around privacy, data security, and genetic discrimination remain challenges. Despite this, the increasing adoption of genetic testing across healthcare, research, and wellness sectors presents strong growth opportunities, with the market expected to continue expanding in the coming years.

Aesthetic implant therapy plays a crucial role in advancing oral implantology, making it an essential part of modern implant dentistry. Recent progress includes innovations in regenerating implant recipient sites by stimulating both soft and hard tissues, as well as replicating healthy peri-implant tissue architecture that withstands masticatory trauma and mechanical stress. Contemporary aesthetic approaches now prioritize patient preferences, making it essential to address their unique concerns in a spontaneous and personalized manner within restorative dental practices.

Key Takeaways

- Market Size: Global Aesthetic Implants Market size is expected to be worth around US$ 9.03 Billion by 2034 from US$ 4.95 Billion in 2024.

- Market Growth: The Market growing at a CAGR of 6.2% during the forecast period 2025 to 2034.

- Product Analysis: In 2024, North America led the market with a revenue of US$ 1.99 Billion.

- Implant Type Analysis: Breast Implants are pre-owned to regain shape or enlarge the volume of female breasts which held major market share in 2024 of 37.8%.

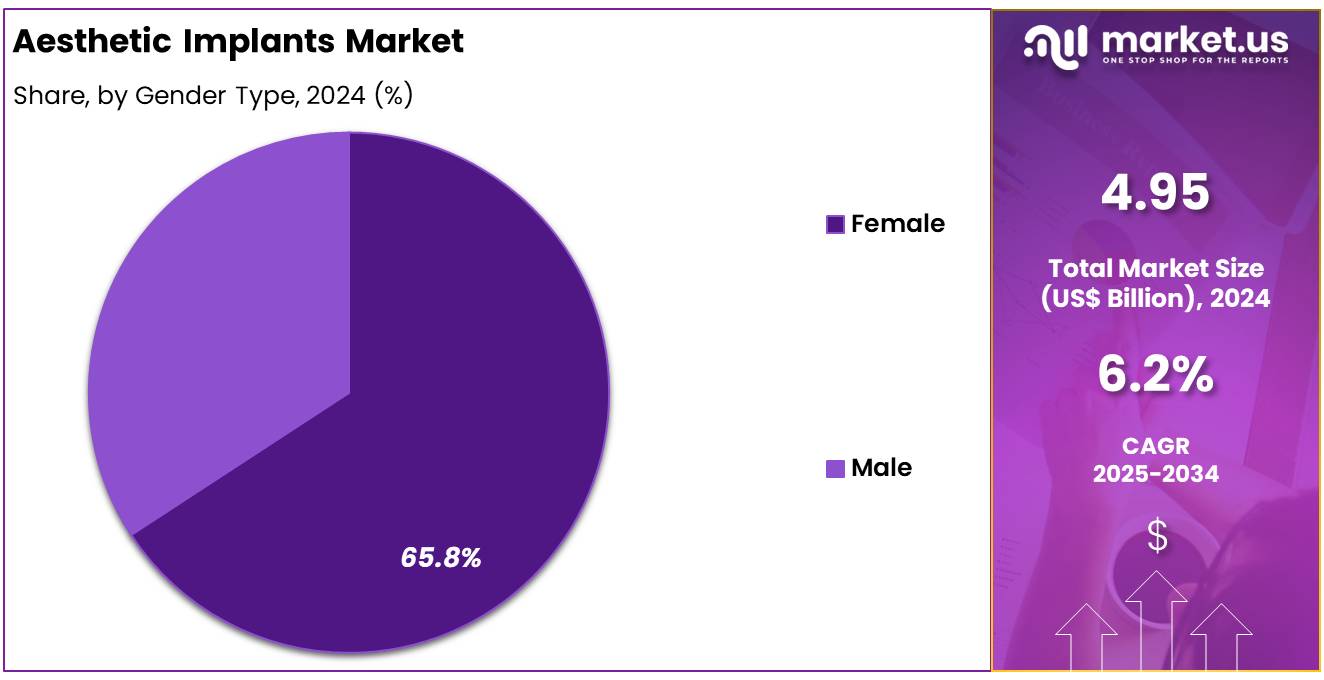

- Gender Type Analysis: The global aesthetic implants market is largely driven by the female segment, which accounts for 65.8% of the market share.

- End-Use Analysis: Hospital segments uphold the largest share of 56.5% in the global aesthetic implants market in 2024.

- Regional Analysis: In 2024, North America led the market with a revenue of US$ 1.99 Billion.

- Diverse Range of Implants: The aesthetic implants market encompasses an expansive variety of implants designed to enhance body parts such as breast, facial, buttock and calf implants – each tailored specifically towards improving aesthetic appearances. These cosmetic enhancements aim to restore their former glory through cosmetic surgery procedures such as breast augmentation.

- Cosmetic and Reconstructive Applications: Aesthetic implants serve both aesthetic and reconstructive uses. Cosmetic applications aim at increasing aesthetics while reconstructive ones restore normal body parts following injury or surgery.

- Breast Augmentation: Silicone and saline implants, among the most well-known aesthetic implants, have long been utilized for breast augmentation to increase size and shape of a woman’s bust line.

- Facial Implants: Facial implants such as chin implants, cheek implants and jaw implants are used to improve facial contour, symmetry and overall aesthetics – often for cosmetic reasons.

- Gluteal and Calf Implants: Implants designed specifically to enhance buttock and calves provide a sculpted, balanced appearance to these areas of the body.

- Individualized Customization: Patients often select aesthetic implants based on personal preferences and desired results; with customisation they can realize their aesthetic goals more successfully.

Implant Type Analysis

Based on Implant type, the market for global aesthetic implants is characterized by breast implants, dental implants, face implants, and other implant types. Breast Implants are pre-owned to regain shape or enlarge the volume of female breasts which held major market share in 2024 of 37.8%. In December 2024, Mentor Worldwide LLC, the leading global brand in breast aesthetics and a part of Johnson & Johnson MedTech, has announced that the U.S. Food and Drug Administration (FDA) has approved the MENTOR MemoryGel Enhance Breast Implants for use in primary and revision breast reconstruction surgery for women post-mastectomy.

Facial Implants are known to provide shape to the different parts of the human face (jaw, forehead, chick bones, lips, chin, temples, and nasal dorsal)

Additionally, the demand for dental implants is being boosted by the rise in dental abnormalities due to lifestyle choices and rising accidents around the world. Additionally, when the senior population increases, so does their proportion in dental procedures. Due to the rising cases of breast cancer, the need for breast implant Segment is increasing. Thus it makes the breast implant a dominant segment and primarily contributes to the market growth.

Moreover, the growing choices of women to improve their attractiveness (physically) are upraising breast implant demand. On the other hand, the dental implant segment is anticipated to rise in the projection period due to the increasing need for tooth replacements, high awareness among individuals suffering from dental disorders, and rising insights into prosthetics. Other implants include abdominal implants and pectoral implants.

Gender Type Analysis

The global aesthetic implants market is largely driven by the female segment, which accounts for 65.8% of the market share. This dominance is attributed to the high prevalence of treatments aimed at facial enhancement and breast enlargement, which continue to be preferred choices among women. The rising demand for such procedures has significantly supported the expansion of the female demographic within the market.

At the same time, the male segment is witnessing steady growth due to increasing acceptance of aesthetic procedures. Surgeries such as abdominal and pectoral implants are gaining popularity, supported by rising awareness and societal acceptance of male cosmetic enhancement. Furthermore, the adoption of testicular implants has also contributed to demand. This growing acceptance among men is gradually shaping the dynamics of the aesthetic implants market, creating new opportunities for expansion while maintaining the female segment as the dominant consumer base.

End-User Analysis

Hospital segments uphold the largest share of 56.5% in the global aesthetic implants market in 2024. They are projected to increase their shareholding during the forecast period of 2023 to 2032 due to the rising number of hospitals per year.

In Addition, there is a rise in acceptance of aesthetic procedures using advanced technologies, and the availability of highly qualified and experienced surgeons is likely to fuel this market growth during the forecast period. Hence hospital remains to be the leading segment

The expansion of the hospital segment is mainly accredited owing to the rising number of populations undergoing cosmetic surgeries. Same on the other path, the specialty clinics segment is projected to highlight extensive growth in the forecast period due to the rising number of cosmetic surgeons and increasing density of specialty clinics, which ultimately expand the sales of implants.

In December 2024, MedTalks News features The Esthetic Clinics as a leading destination in India’s thriving Cosmetic Surgery medical tourism industry. Over 15% of its patients are from international locations, making the clinic chain a trusted choice for advanced cosmetic surgery procedures at competitive prices.

Key Market Segments

By Implant Type

- Breast Implants

- Dental Implants

- Facial Implants

- Other Implant Types

By Material Type

- Metals

- Ceramic

- Polymer

- Biological Materials

By Gender Type

- Female

- Male

By End-User

- Hospital

- Specialty Clinics

Drivers

Rising Cosmetic Surgeries

The growing demand for cosmetic procedures is a major driver for the aesthetic implants market. With an increasing number of people seeking to enhance their appearance, aesthetic implants, particularly breast implants and facial implants, have seen a surge in popularity. In 2020, the American Society of Plastic Surgeons (ASPS) reported over 300,000 breast augmentations in the U.S., making it one of the most common cosmetic procedures. This trend is not limited to developed countries; the demand for aesthetic implants is expanding globally, fueled by increasing disposable incomes, greater social acceptance of cosmetic enhancements, and improved access to healthcare services.

Additionally, an increase in media and celebrity influence has contributed to the normalization of aesthetic enhancements. The demand for body contouring procedures such as breast implants, buttock implants, and facial implants is particularly strong in regions like North America, Europe, and Asia-Pacific.

Furthermore, the rising awareness of aesthetic procedures in emerging markets such as India and Brazil is contributing to the market’s growth. This expansion is also supported by innovative marketing strategies and the increasing number of trained professionals offering aesthetic implant procedures, making them more accessible to a broader demographic.

Restraints

Higher Cost of Implants

The Higher price of implants makes it difficult for the average population to spend on cosmetic procedures and undergoing implantation surgeries just to look physically attractive and beautiful. Surgical risks such as infection, scarring, implant rupture, and capsular contracture can discourage patients from opting for implants. For instance, a report from the U.S. Food and Drug Administration (FDA) suggests that the risk of implant rupture ranges from 5% to 10% over a 10-year period. Capsular contracture, a condition where the tissue around the implant hardens, is another common complication, occurring in about 5% to 10% of patients.

Some less developed countries are not having the advanced technologies as well as facilities to perform such operations. A highly qualified number of well-experienced surgeons, advanced hospitals, and key market players are recommended in a country to give rise to such procedures. Thus less developed countries are not involved in these procedures.

The cost for a single dental implant in the United States ranges from $2,000 to $5,000. Premium brands such as Straumann and Nobel Biocare are typically at the higher end of that scale. Comprehensive procedures like All-on-4 implants, which restore a full arch, cost between $12,000 and $28,000 in the US, while All-on-6 can go from $24,000 to $31,000.

Zygomatic implants, used for patients with severe bone loss in the upper jaw, can range from $21,500 to as high as $40,000 for full-mouth cases. Moreover, aesthetic breast augmentation with implants averages around $4,875 per procedure in the United States, but can be much more at high-end clinics or in major cities.

Opportunities

The growth of the global aesthetics market is being strongly influenced by expanding reconstructive surgeries and the rising social acceptance of cosmetic enhancements. Reconstructive procedures remain a key driver, with reports indicating that approximately 15.5 million plastic surgeries are performed annually in the United States alone. These surgeries are not only aimed at enhancing appearance but also at addressing deformities resulting from congenital disorders, trauma, or accidents.

Aesthetic implants, developed from a variety of materials including metals, ceramics, and biological substances, play a central role in restoring functionality and improving overall appearance. Their adoption is gaining significant momentum worldwide as individuals increasingly seek corrective and enhancement procedures. The dominance of social media platforms has further amplified this trend by shaping perceptions of beauty and creating heightened awareness about personal aesthetics. Consequently, materialistic advancement and the growing societal emphasis on appearance continue to drive demand for aesthetic implants globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the genetic testing market, impacting both supply and demand. On the macroeconomic front, economic conditions like inflation, recessions, and income levels can affect consumer spending on genetic testing services, particularly in the Direct-to-Consumer (DTC) segment.

Economic downturns may lead to reduced discretionary spending, limiting the adoption of genetic testing for non-essential purposes, such as ancestry or wellness testing. Conversely, in wealthier economies, the increasing demand for personalized healthcare and precision medicine boosts the market for genetic diagnostics, especially for early disease detection and cancer treatment.

Geopolitical factors, such as international trade policies, can disrupt the supply chains for genetic testing consumables and equipment. Trade restrictions, tariffs, or sanctions may increase the cost of key reagents, sequencers, and diagnostic kits, affecting market pricing and availability. Moreover, political instability in certain regions can limit access to cutting-edge genetic testing technologies, hindering the market’s growth in those areas.

Additionally, government policies, including healthcare reforms and regulations, play a crucial role in shaping the genetic testing market. For example, favorable government reimbursement policies for genetic testing in cancer or prenatal diagnostics can drive adoption, while restrictive regulations may impede market expansion. Overall, these macroeconomic and geopolitical dynamics create both challenges and opportunities for stakeholders in the genetic testing market.

Latest Trends

Rising Infrastructure, Economic Growth, and Spending Ability

The global demand for aesthetic implants is being propelled by rapid economic development and the continuous improvement of medical infrastructure. These advancements have created a favorable environment for the adoption of advanced surgical solutions and cosmetic enhancements worldwide.

In addition, the rising prevalence of tooth deformities and congenital facial disorders has further fueled the need for corrective procedures. A significant driver of market expansion is the growing adoption of minimally invasive reconstruction surgeries, which are increasingly preferred due to their ability to restore both function and appearance with reduced recovery time. Such procedures are being widely utilized in diverse applications, including laceration repair, hand surgery, tumor excision, scar revision, and breast reconstruction.

The combination of these medical and socio-economic factors underscores the growing reliance on aesthetic implants, not only as tools for cosmetic improvement but also as essential solutions for addressing functional deformities and improving overall quality of life.

Regional Analysis

North America is leading the Aesthetic Implants Market

North America was at the top in market revenue in 2022 and is predicted to continue with a major shareholding over the forecast period. The high cost of implants, procedures, rapid acceptance of aesthetic implants, and tactical position of major manufacturers, are considerable factors attributable to the growth of this market.

In recent years RealSelf collaborated with The American Society for Aesthetic Plastic Surgery to fetch studies and develop resources to offer a detailed analysis of the Breast Implants Market, which will drive the market growth of North America.

In Europe, the aesthetic implants market is projected to expand owing to the large number of plastic surgery in the United Kingdom U.K. demand for breast and facial implants, rising social media influence, and new product introduction.

Asia Pacific is anticipated to report considerable growth in this market during the forecast period due to the massive influence of western culture, growing breast surgery, and instant adoption of cosmetic surgeries, especially in China, India, and Japan.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Aesthetic Implants market includes Allergan (AbbVie), Sientra, Inc., Mentor (Johnson & Johnson), GC Aesthetics, Implantech Associates, Inc., Laboratoires Arion, POLYTECH Health & Aesthetics, Koken Co., Ltd., Establishment Labs, Silimed (Medi-Tech), TUV Rheinland, Cosmoflex, and Other key players.

Allergan, a subsidiary of AbbVie, is a leading player in the aesthetic implants market, renowned for its highly popular breast implants. The company’s implants, including Natrelle saline and silicone breast implants, are widely used globally due to their advanced design and safety features.

Sientra, Inc. specializes in breast implants, offering a range of silicone gel implants that focus on patient safety and comfort. Known for its unique production process and high-quality materials, Sientra continues to expand its presence in the U.S. aesthetic implants market.

Mentor, a part of Johnson & Johnson, is a major player in the aesthetic implants market, known for its innovative silicone and saline breast implants. The company emphasizes safety and offers a wide array of implant options, including the MemoryGel and MemoryShape lines.

Top Key Players

- Allergan (AbbVie)

- Sientra, Inc.

- Mentor (Johnson & Johnson)

- GC Aesthetics

- Implantech Associates, Inc.

- Laboratoires Arion

- POLYTECH Health & Aesthetics

- Koken Co., Ltd.

- Establishment Labs

- Silimed (Medi-Tech)

- TUV Rheinland

- Cosmoflex

- Other key players

Key Opinion Leaders

Leaders Key Opinion Dr. Sarah Thompson, Plastic Surgeon and KOL in Aesthetic Medicine “Companies like Sientra have truly revolutionized the aesthetic implant industry with their cohesive gel silicone implants. These implants are not only safer but provide a more natural look and feel, which is crucial for patient satisfaction. Sientra’s continued focus on research and development, especially in creating implants that reduce the risk of complications like capsular contracture, has made them a leader in the market. The FDA’s approval of their advanced implants signals strong consumer trust, and I foresee even greater adoption as patients look for safer, more reliable options in breast augmentation.” Dr. Mark Stevenson, Cosmetic Surgeon and Industry Expert “As a surgeon, I can confidently say that Mentor (Johnson & Johnson) is a brand that’s synonymous with quality. Their commitment to innovation, especially with their MemoryGel breast implants, has set the standard in terms of both safety and patient satisfaction. What I appreciate about Mentor is their focus on long-term studies and data, which builds patient confidence. However, it’s their continuous investment in improving the bio-compatibility of their implants that sets them apart. I expect Mentor to maintain a strong market position as patient awareness of product safety continues to rise.” Dr. Elizabeth Carter, Dermatologist and Aesthetic Treatments Advocate “GC Aesthetics has truly addressed a gap in the market by offering implants that are not only high-quality but also designed with an aesthetic approach in mind. Their Natura breast implants, in particular, offer a fantastic natural feel with low rupture rates. What sets them apart is their patient-centric approach. By focusing on both patient safety and visual outcomes, GC Aesthetics has positioned itself well to cater to the growing demand for aesthetically pleasing, yet safe implants. The company’s recent expansion into emerging markets is also a smart move to increase accessibility to advanced aesthetic enhancements.” Recent Developments

- In December 2024, GC Aesthetics (GCA), a privately-owned medical technology company offering aesthetic and reconstructive solutions to healthcare markets worldwide, announced the launch of a major multi-center, prospective clinical study in Europe. The study aims to assess and validate the safety, effectiveness, and patient satisfaction of the innovative PERLE smooth opaque round breast implant.

- In September 2024, Establishment Labs Holdings Inc., a leading global medical technology company focused on advancing women’s health, particularly in breast aesthetics and reconstruction, announced that it has received approval from the U.S. Food and Drug Administration (FDA) for the use of Motiva SmoothSilk Ergonomix and Motiva SmoothSilk Round breast implants in both primary and revision breast augmentation procedures.

- In September 2024, POLYTECH, a leading provider in breast aesthetics, reconstruction, and body contouring, introduced Opticon Plus, an innovative addition to its extensive portfolio. Renowned for offering the widest selection of products in the industry, POLYTECH now includes this new implant, positioned between their anatomical forms Replicon and Opticon. Opticon. Plus provides surgeons with an option that features a base shape bridging the round Replicon base and the standard Opticon short oval base. Available in both the MESMO® microtextured surface and the POLYTECH Microthane micro-polyurethane surface, Opticon Plus meets the increasing demand for natural breast aesthetics.

Report Scope

Report Features Description Market Value (2024) US$ 4.95 Billion Forecast Revenue (2034) US$ 9.03 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Implant Type (Breast Implants, Dental Implants, Facial Implants, and Other Implant Types), By Material Type (Metals, Ceramic, Polymer and Biological Materials), By Gender Type (Female, Male, By End-User, Hospital, and Specialty Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allergan (AbbVie), Sientra, Inc., Mentor (Johnson & Johnson), GC Aesthetics, Implantech Associates, Inc., Laboratoires Arion, POLYTECH Health & Aesthetics, Koken Co., Ltd., Establishment Labs, Silimed (Medi-Tech), TUV Rheinland, Cosmoflex, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allergan (AbbVie)

- Sientra, Inc.

- Mentor (Johnson & Johnson)

- GC Aesthetics

- Implantech Associates, Inc.

- Laboratoires Arion

- POLYTECH Health & Aesthetics

- Koken Co., Ltd.

- Establishment Labs

- Silimed (Medi-Tech)

- TUV Rheinland

- Cosmoflex

- Other key players