Global Aerospace Plastics Market By Application (Aerostructure, Satellites, Components, Equipment, Systems & Support, and Other Applications), By End-Use (General Aviation, Commercial & Freighter Aircraft, Rotary Aircraft, Military Aircraft, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: August 2023

- Report ID: 14776

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

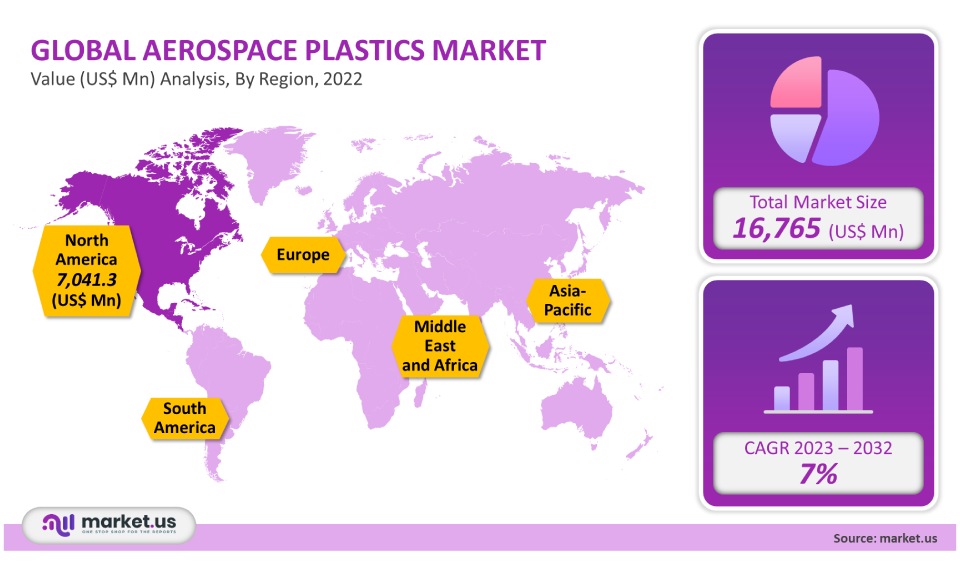

The market for Aerospace Plastics was valued at US$ 16,765 million in 2021 and is forecast to grow at a 7% CAGR between 2023-2032.

In the coming years, developments in fuel-efficient aircraft manufacturing will drive demand for aerospace materials. The market is also expected to be positively impacted by the increased use of efficient and environmentally-friendly products. Market growth will continue to be driven by aerospace plastics’ increasing popularity over aluminum and other common materials, due to their strength, lightness, durability, and chemical resistance.

Global Aerospace Plastics Market Analysis

Application Analysis

The largest aerospace market segment in 2021 was Aerostructure. It accounted for 40% of the total revenue. Maintenance is reduced by the frequent use of composites and other plastics in the high-tension environment of the fuselage. Plastics can also be used in the fuselage to minimize part count through fasteners or integral clips. Over the forecast period, the demand for aerospace plastics will rise due to increased production of aircraft components, including airframes, fuselage, and empennage.

Thermoplastics are used extensively in the manufacture of bearings. The components join the aircraft’s structures and attach the panels and sheets of plastic to the interiors or exteriors. Plastics are in high demand as components for aerospace.

Due to growing concern over global warming, bio-based plastics are expected to be more important in aerospace manufacturing. Over the forecast period, the following factors will likely drive the demand for aerospace plastics.

End-Use Analysis

was commercial and freighter segment held significant revenue share in 2021. The aerospace industry has a lot of use for plastics, with large passenger aircraft and freight being two of its main applications. Plastics used in aircraft can help reduce operating costs and keep maintenance costs under control.

This has inspired aerospace manufacturers to possibly increase the amount of plastic content in commercial and freighter planes. Due to the growing demand for fuel-efficient parts and lower maintenance costs, commercial aviation has moved away from aluminum to more plastics.

Aerospace plastics are used to assemble night vision systems, heads-up displays, firearms, and other military and aerospace applications. Aerospace plastics are used more frequently in manufacturing integrated circuits for military planes, as they can operate at high temperatures. This will increase the demand for aerospace materials over the forecast period.

Key Market Segments

By Application

- Aerostructure

- Satellites

- Components

- Equipment, Systems & Support

- Other Applications

By End-Use

- General Aviation

- Commercial & Freighter Aircraft

- Rotary Aircraft

- Military Aircraft

- Other End-Uses

Market Dynamics

North America is forecast to experience an above-average increase in both volume and revenue during the forecast period. This can be mainly attributed to the U.S.’s large number of aerospace parts manufacturing plants.

The efficiency and performance of an airplane are directly affected by its overall weight. In the case of commercial aircraft, a one-kilogram weight reduction will reduce operating costs and fuel costs. The growing aviation industry will also boost demand for aerospace materials in the future.

The market’s most crucial application segment was Aerostructure as of 2021. Other critical applications for aerospace plastics include systems & support and cabin interiors. The demand for aircraft is directly related to air travel. This, in turn, is linked with rising per-capita income and a positive economic outlook. India and China are two examples of developing countries that have seen an increase in air travel in recent decades. This is a sign of solid optimism about the industry’s future. Globalization and international trade are also factors in the industry’s growth. The use of composite materials in general aviation and military aircraft design has increased rapidly. This includes electronic systems, flight-control surfaces, cabin equipment, and others.

Aerospace plastics have many advantages that aircraft manufacturers choose over other materials. Accordingly, the market for aerospace plastics will see an increase in product demand throughout the aviation industry during the forecast period. As a result of rising fuel prices, aviation suffered losses. In turn, the industry saw a decrease in air passengers. But, the market has recovered thanks to the stabilization of crude oil prices, which has created new growth opportunities.

The growing demand for aerospace plastics can also be attributed to the increased need for lightweight materials within the expanding aviation industry. Aerospace plastics are popular due to their outstanding corrosion resistance. Composite components from carbon fibers or fiber-reinforced plastics are flexible and resist damage. This extends the aircraft’s shelf-life.

Global aerospace plastics market vendors are expected to reap benefits from increased utilization of composites for new-generation aircraft and ongoing research activities related to green energy sources such as natural gas.

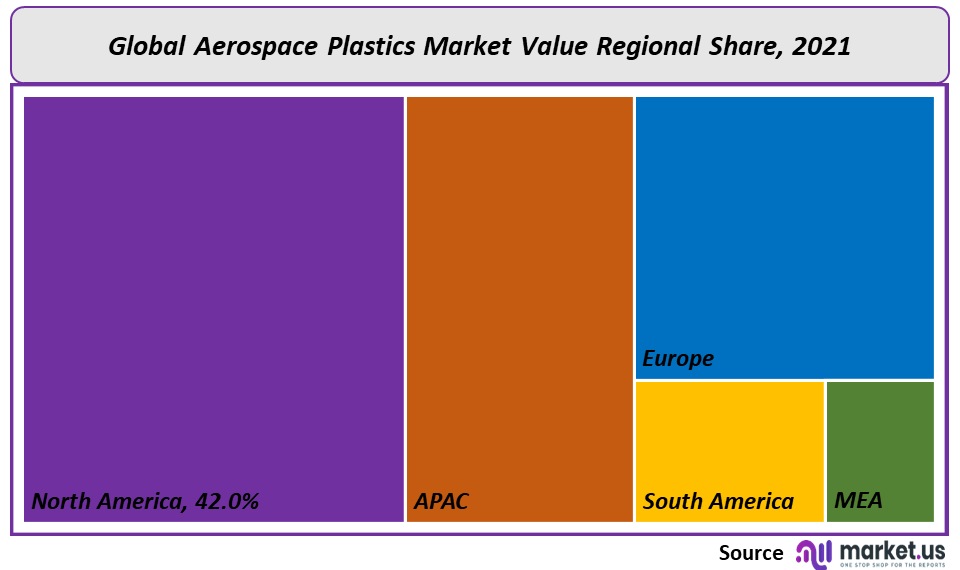

Regional Analysis

North America Dominated the Aerospace Plastics market accounting for 42% in 2021. In the last few years, the aviation industry has seen significant changes due to the changing economic environment in the Asia Pacific. However, the rise of the aviation manufacturing industry is driving the growth of aerospace plastics markets in the Asia Pacific, such as China, India, and Japan.

Japanese companies, such as Mitsubishi Heavy Industries and Kawasaki Heavy Industries, are proving reliable and gaining popularity worldwide. Aerospace plastics are in high demand due to expanding military budgets and the licensed production of defense aircraft.

Indian Aerospace Plastic Companies include Tata Advanced Materials Limited in India and Hindustan Aeronautics Limited in India. These companies make up a large portion of India’s market. They are also known for producing quality products in Europe, North America, and Europe. Over the forecast period, the demand for aerospace plastics is expected to grow with the help of more suppliers, particularly from emerging countries, and government support programs.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

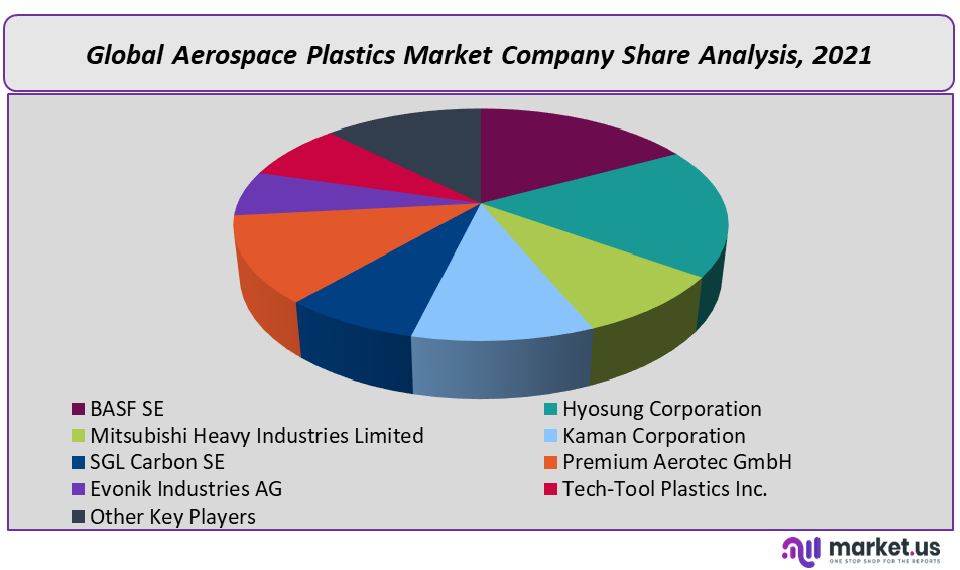

Many of the leading players in the global market space for aerospace plastics have merged their production and distribution operations in order to improve product quality and expand regional reach. The companies gain competitive advantages in terms of cost savings and thus increase their profit margins. Research & Development activities are undertaken by companies to develop new products and meet the changing needs of end-users.

Маrkеt Кеу Рlауеrѕ:

- BASF SE

- Hyosung Corporation

- Mitsubishi Heavy Industries Limited

- Kaman Corporation

- SGL Carbon SE

- Premium Aerotec GmbH

- Evonik Industries AG

- Tech-Tool Plastics Inc.

- Other Key Players

For the Aerospace Plastics Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Aerospace Plastics market in 2021?The Aerospace Plastics market size is US$ 16,765 million in 2021.

Q: What is the projected CAGR at which the Aerospace Plastics market is expected to grow at?The Aerospace Plastics market is expected to grow at a CAGR of 7% (2023-2032).

Q: List the segments encompassed in this report on the Aerospace Plastics market?Market.US has segmented the Aerospace Plastics market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application, the market has been segmented into Aerostructure, Satellites, Components, Equipment, Systems & Support, and Other Applications. By End-Use, the market has been further divided into General Aviation, Commercial & Freighter Aircraft, Rotary Aircraft, Military Aircraft, and Other End-Uses.

Q: List the key industry players of the Aerospace Plastics market?BASF SE, Hyosung Corporation, Mitsubishi Heavy Industries Limited, Kaman Corporation, SGL Carbon SE, Premium Aerotec GmbH, Evonik Industries AG, Tech-Tool Plastics Inc., and Other Key Players are engaged in the Aerospace Plastics market

Q: Which region is more appealing for vendors employed in the Aerospace Plastics market?North America is expected to account for the highest revenue share of 42%. Therefore, the Aerospace Plastics industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Aerospace Plastics?The US, Canada, UK, Japan, Mexico, India, China & Germany are key areas of operation for the Aerospace Plastics Market.

Q: Which segment accounts for the greatest market share in the Aerospace Plastics industry?With respect to the Aerospace Plastics industry, vendors can expect to leverage greater prospective business opportunities through the Aerostructure segment, as this area of interest accounts for the largest market share.

Aerospace Plastics MarketPublished date: August 2023add_shopping_cartBuy Now get_appDownload Sample

Aerospace Plastics MarketPublished date: August 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Hyosung Corporation

- Mitsubishi Heavy Industries Limited

- Kaman Corporation

- SGL Carbon SE

- Premium Aerotec GmbH

- Evonik Industries AG

- Tech-Tool Plastics Inc.

- Other Key Players