Global Aerospace NDT Market By Component (Equipment, Software, Services, Consumables), By Technique (Traditional/Conventional, AI-enabled), By Testing Method (Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Visual Inspection Testing, Eddy-Current Testing, Acoustic Emission Testing, Thermography/Infrared Testing, Computed Tomography Testing), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167702

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

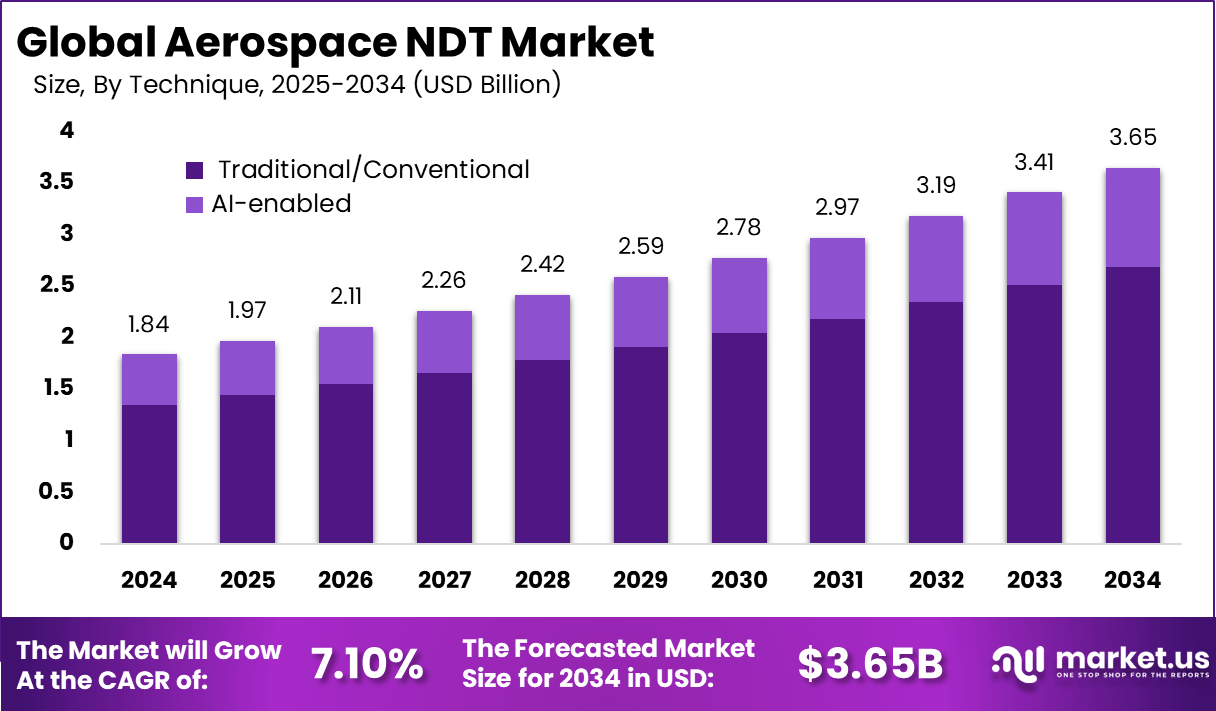

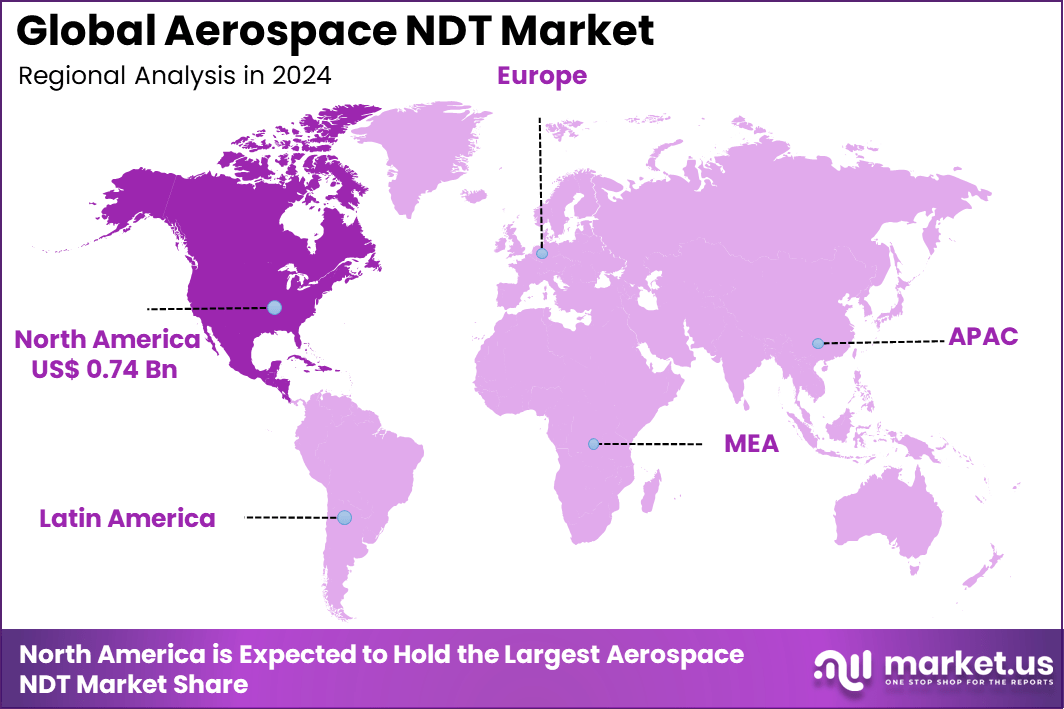

The Global Aerospace NDT Market generated USD 1.84 billion in 2024 and is predicted to register growth from USD 1.97 billion in 2025 to about USD 3.65 billion by 2034, recording a CAGR of 7.10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 40.3% share, holding USD 0.74 billion revenue.

The aerospace NDT market has expanded as aircraft manufacturers, maintenance providers and defence organisations adopt advanced inspection technologies to ensure structural integrity and flight safety. Growth reflects rising aircraft utilisation, stricter safety standards and the increasing complexity of aerospace materials. NDT methods are now essential throughout the aircraft lifecycle, supporting production quality, routine maintenance and life extension programs.

The growth of the market can be attributed to increasing global air travel, ageing aircraft fleets and the broader requirement for reliable inspection systems. The rise of composite materials in modern aircraft increases the need for precise defect detection. Expanding defence aviation activity and stronger regulatory oversight also encourage continuous investment in NDT capabilities.

Demand is rising across commercial aviation, military aircraft programs, business jets and space systems. Airlines rely on NDT to maintain airworthiness and manage high utilisation rates. Defence operators use advanced inspection tools for mission ready aircraft and critical components. Space launch providers apply NDT to engines, tanks and structural parts where even small flaws can cause mission failure.

Top Market Takeaways

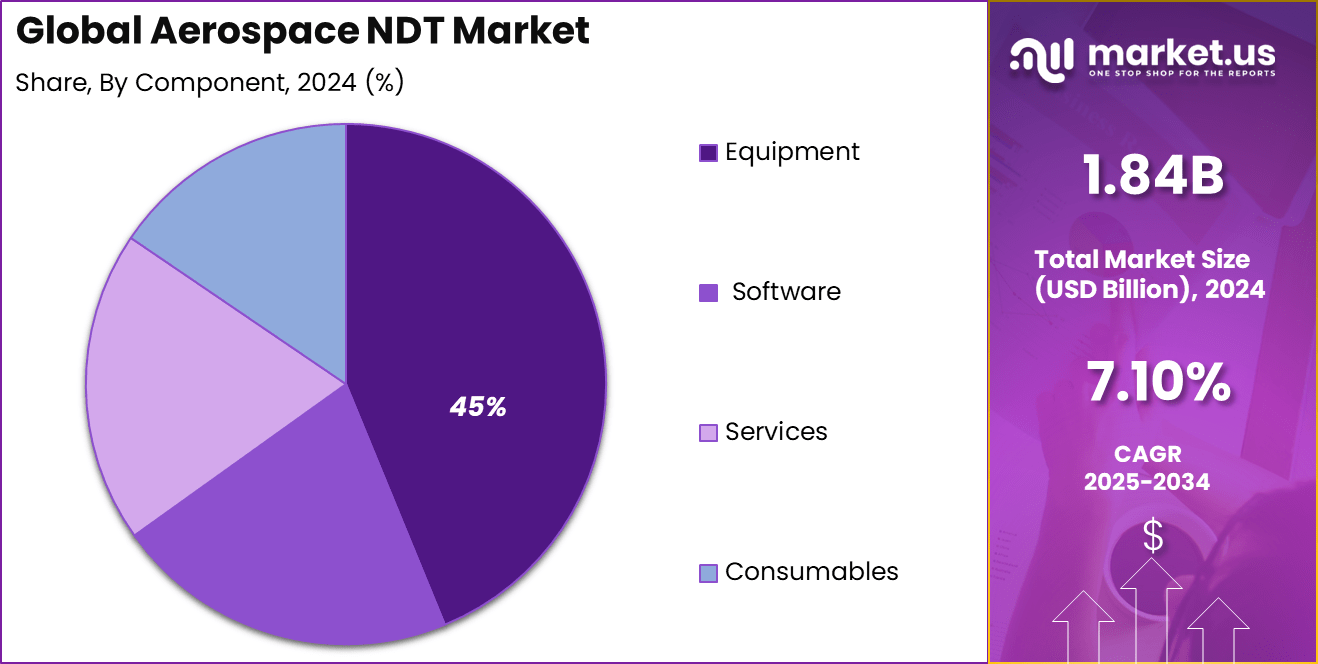

- By component, equipment accounts for approximately 45.2% of the market, with significant investments in advanced NDT devices such as precision scanners, phased-array probes, and high-energy computed tomography (CT) machines that are pivotal in aerospace manufacturing and maintenance.

- By technique, traditional/conventional NDT methods dominate with 73.6% share, underscoring their proven reliability and certification acceptance in safety-critical aerospace applications despite emerging AI-enabled and automated technologies gaining traction.

- By testing method, ultrasonic testing (UT) represents about 20.8% of the market. UT remains crucial for detecting internal defects in metallic and composite aerospace components, supported by innovations like phased-array and AI-enhanced probes for faster and more accurate inspection.

- North America holds roughly 40.3% market share, led by the U.S. aerospace industry’s established manufacturing hubs, stringent safety regulations from the FAA, and a strong maintenance, repair, and overhaul (MRO) ecosystem demanding advanced NDT.

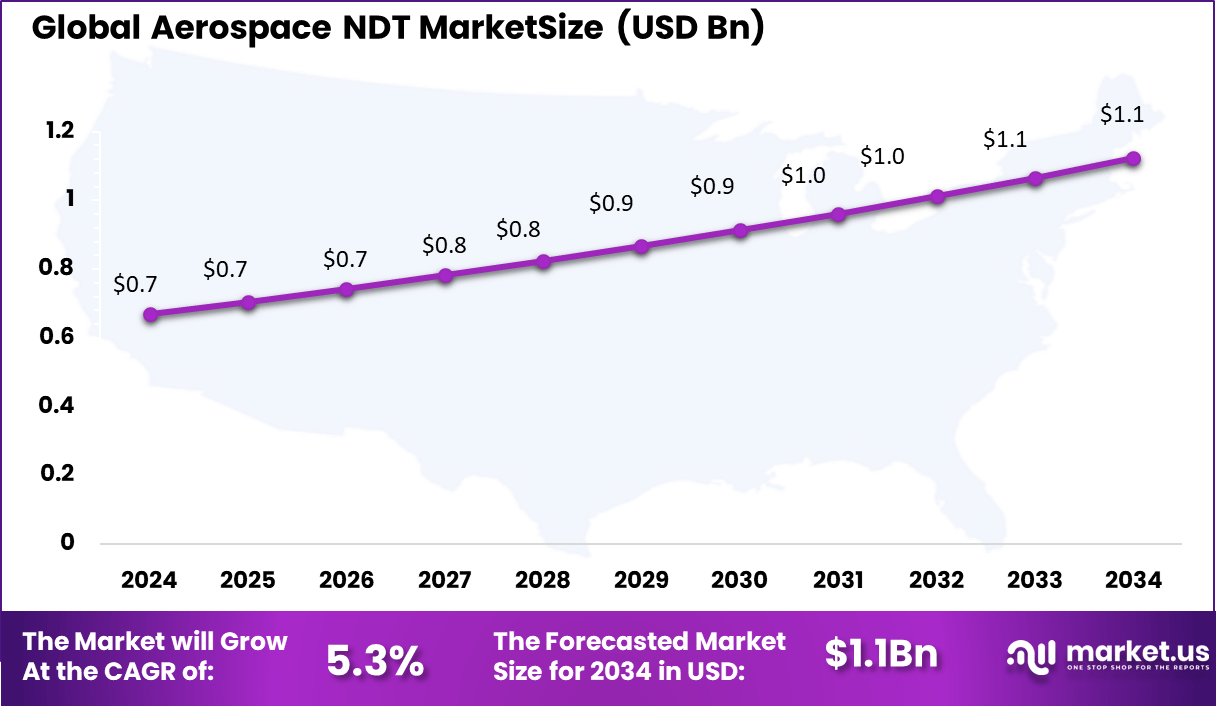

- The U.S. market size is estimated at around USD 0.67 billion in 2025.

- The market is growing at a CAGR of approximately 5.3%, propelled by increasing production of commercial and military aircraft, integration of composite materials requiring advanced NDT, and investment in new NDT methods including digital and automated systems.

By Component

The equipment segment has a substantial 45% share in the aerospace non-destructive testing (NDT) market. This dominance is due to the critical role played by advanced instruments like ultrasonic probes, radiographic devices, and phased-array systems in ensuring aircraft safety and structural integrity.

High-cost, high-precision equipment drives rigorous testing protocols essential for compliance with stringent aviation regulations. These versatile tools enable comprehensive inspections through multiple NDT methods, supporting both production quality control and maintenance inspections.

Investment in cutting-edge equipment continues to grow as aerospace manufacturers and MRO providers push for faster, more accurate diagnostics to improve fleet reliability and safety. The trend towards automation and AI integration in NDT equipment is further enhancing inspection efficiency, allowing for predictive maintenance and reducing downtime, which are key in cost-sensitive airline operations.

By Technique

Traditional or conventional NDT techniques dominate the market with a commanding 73.6% share. Proven methods such as visual inspection, magnetic particle testing, penetrant testing, and radiography retain strong usage due to well-established standards and certification requirements in aerospace safety. Their reliability and familiarity among technicians and regulators sustain their prominence, especially for inspection of critical components exposed to extreme stress and fatigue.

Despite the rise of advanced methods like computed tomography and acoustic emission testing, conventional techniques offer cost-effectiveness and broad applicability. The aerospace sector continues to rely on these methods to complement newer technologies, balancing innovation with proven safety protocols.

By Testing Method

Ultrasonic testing accounts for a significant 20.8% of the aerospace NDT market, reflecting its versatility and precision in detecting internal flaws, cracks, and corrosion. UT uses high-frequency sound waves to evaluate material integrity without causing damage, making it suitable for inspecting engine components, fuselage structures, and composite materials.

Advancements such as phased-array UT and automated scanning increase inspection speed and accuracy, enabling more thorough analysis within tight maintenance windows. Growing adoption of automated ultrasonic systems integrated with AI enhances flaw detection and classification, decreasing human error and improving predictive maintenance practices.

Emerging Trends

Key Trends Description Automation and Robotics Integration Use of autonomous drones and robotic systems to enhance inspection speed and accuracy in complex aerospace structures. AI and Data Analytics Application of AI and machine learning for predictive maintenance and deep defect analysis improving reliability. Digital Twin and Simulation Leveraging digital twin technology to simulate inspections and predict potential failure areas preemptively. Portable and Lightweight Equipment Development of compact, portable NDT devices enabling on-site inspections and reducing downtime. Expansion into Emerging Markets Growing aerospace manufacturing and MRO activities in Asia-Pacific and Latin America driving demand. Growth Factors

Key Factors Description Rising Air Travel and Fleet Expansion Increasing commercial aircraft production and aging fleets require more rigorous inspection and maintenance. Stringent Safety and Regulatory Standards Regulatory compliance mandates regular and advanced NDT inspections to ensure passenger safety. Technological Advancements Continuous innovation in ultrasonic, radiographic, and thermographic testing technologies improving defect detection. Growth in Military and Defense Spending Increased defense budgets leading to higher demand for NDT in military aerospace systems. Shift Towards Predictive Maintenance Adoption of condition-based maintenance strategies driving the need for frequent and precise NDT checks. Main Factors Driving Adoption

- Safety assurance: NDT detects hidden flaws and cracks before they lead to catastrophic failures, protecting passengers and crew.

- Regulatory compliance: Aerospace authorities require rigorous inspections throughout the product lifecycle to meet safety and airworthiness standards.

- Quality control: NDT ensures consistent quality during production, preventing defective parts from assembling into final products.

- Reduced downtime: Faster, efficient inspections minimize grounding time for aircraft during maintenance or repair.

- Cost-effectiveness: By identifying issues early, costly repairs, replacements, and accidents can be avoided.

- Extended asset life: Regular NDT assessments allow aircraft components to be safely used for longer periods, optimizing lifecycle costs.

- Support for advanced materials: NDT adapts to inspecting new lightweight composites and complex parts used in modern aerospace engineering.

- Integration with automation and AI: Adoption of automated and AI-driven NDT improves accuracy, speeds analysis, and reduces human errors.

Benefits

- Enhanced safety reputation: Airlines and manufacturers improve trust and brand value by ensuring safe, reliable aircraft.

- Increased operational efficiency: Minimizes aircraft downtime and maintenance costs through rapid, precise inspections.

- Cost savings: Early defect detection prevents expensive failures and unscheduled repairs.

- Higher product reliability: Consistent quality control reduces recalls and warranty claims, stabilizing revenue.

- Regulatory alignment: Complies with stringent aviation safety regulations, avoiding penalties and grounding.

- Sustainability: By extending asset lifespans and reducing scrap, NDT supports eco-friendly practices.

- Competitive edge: Advanced inspection capabilities support innovation and market leadership in aerospace manufacturing and maintenance.

- Improved maintenance planning: Enables predictive maintenance through detailed condition monitoring, optimizing resource use.

Key Market Segments

By Component

- Equipment

- Software

- Services

- Consumables

By Technique

- Traditional/Conventional

- AI-enabled

By Testing Method

- Ultrasonic Testing

- Radiographic Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Visual Inspection Testing

- Eddy-Current Testing

- Acoustic Emission Testing

- Thermography/Infrared Testing

- Computed Tomography Testing

Regional Analysis

North America took the lead in the aerospace non-destructive testing (NDT) market, holding a substantial 40.3% share. The market in this region is valued at approximately USD 0.67 billion, growing steadily at a CAGR of 5.3%. The growth is driven by the extensive aerospace manufacturing and maintenance, repair, and overhaul (MRO) activities concentrated in North America, particularly around major hubs like Seattle and Miami.

Strict regulatory frameworks imposed by the Federal Aviation Administration (FAA) mandate rigorous inspection and safety protocols, boosting demand for advanced NDT technologies such as ultrasonic testing, phased-array probes, and computed tomography. Additionally, increasing use of composite materials in aerospace requires sophisticated inspection techniques, further propelling market expansion.

The U.S., the market is lifted by robust aerospace production and a strong aftermarket services sector. The country benefits from a leading cluster of aerospace manufacturers, including Boeing and Lockheed Martin, which rely heavily on precise NDT methods to ensure structural integrity and safety compliance in both commercial and defense aircraft.

Technological innovations integrating AI and predictive analytics into inspection systems are gaining traction, enhancing efficiency and accuracy. Government investments in urban air mobility and military aircraft modernization further stimulate demand for aerospace NDT. These factors position the U.S. as a key driver of growth within the North American aerospace NDT market, setting global standards for quality and safety.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Aerospace Production and Safety Regulations

The aerospace NDT market is driven by the increasing production of commercial and military aircraft, which require intensive non-destructive testing to ensure structural integrity and passenger safety. Stringent government regulations mandate regular inspections and maintenance, pushing aerospace manufacturers and service providers to invest heavily in advanced NDT solutions.

Advancements in composite materials and additive manufacturing in aerospace also necessitate innovative NDT technologies to detect defects effectively. The shift toward predictive maintenance fueled by digital transformation further accelerates demand for sophisticated NDT equipment to avoid costly breakdowns and ensure operational reliability.

Restraint

High Cost of Advanced NDT Equipment

A significant restraint in the aerospace NDT market is the high capital expenditure associated with advanced NDT technologies such as automated ultrasonic testing, phased array ultrasonics, and digital radiography. These systems require substantial investment for procurement, installation, and operator training, which can be prohibitive for smaller enterprises and emerging market players.

The complexity and precision needed in NDT also extend to ongoing maintenance and upgrades, increasing total ownership costs. This financial barrier limits adoption among lower-budget operators and in developing regions, tempering the speed of market growth.

Opportunity

Integration of Automation and AI

There are considerable opportunities in integrating automation, robotics, and artificial intelligence into aerospace NDT. Automated inspection robots and drones improve accuracy and consistency while enabling inspections in hard-to-reach or hazardous environments, reducing human risk and operational downtime.

AI-powered analytics enable real-time data processing, defect detection, and predictive maintenance, enhancing decision-making and asset life management. These innovations support the trend toward Industry 4.0, presenting pathways for next-generation NDT solutions and expanding adoption across aerospace manufacturing and MRO services.

Challenge

Skilled Workforce Shortage and Regulatory Compliance

The aerospace NDT industry faces a critical challenge due to a shortage of highly skilled technicians capable of operating complex NDT equipment and interpreting data accurately. This talent gap slows service delivery and increases training costs, especially as new advanced technologies emerge.

Regulatory compliance is another challenge, with evolving international safety standards requiring continuous adaptation of testing approaches and documentation. Maintaining compliance while embracing innovation demands significant resources and collaboration among aerospace OEMs, regulators, and NDT providers.

Competitive Insights

Baker Hughes, Mistras Group, SGS, Intertek, and Applus lead the aerospace NDT market with strong inspection capabilities across ultrasonic testing, radiography, and eddy current analysis. Their services help aircraft manufacturers and MRO providers ensure structural integrity and regulatory compliance. These companies focus on high-precision imaging and reliable defect detection, reinforcing their position as aviation safety requirements continue to grow globally.

GE Aviation (Waygate Technologies), Olympus, Nikon, Eddyfi Technologies, Teledyne Technologies, Zetec, Sonatest, TWI, and Ashtead Technology strengthen the market with advanced NDT instruments and portable inspection systems. Their technologies support accurate evaluation of engines, composite structures, and critical components.

Vermont Ultrasonics, YXLON International, Hologic, Magnaflux, Fischer Technology, Element Materials Technology, Collins Aerospace, Lufthansa Technik, Airbus AIRTAC, Spirit AeroSystems, Bombardier, and other players expand the landscape with specialized NDT labs and dedicated testing centers. Their capabilities include CT scanning, phased-array ultrasonics, and X-ray inspection.

Top Key Players in the Market

- Baker Hughes Company

- Mistras Group Inc.

- SGS SA

- Intertek Group plc

- Applus Services SA

- General Electric Company (GE Aviation NDT Solutions)

- Olympus Corporation

- Nikon Corporation

- Eddyfi Technologies Inc.

- Teledyne Technologies Incorporated

- Zetec Inc.

- Sonatest Ltd.

- TWI Ltd.

- Ashtead Technology Ltd.

- Vermont Ultrasonics Inc.

- YXLON International GmbH

- Hologic Inc. (SureScan)

- Waygate Technologies GmbH

- Magnaflux Corporation

- Fischer Technology Inc.

- Element Materials Technology Group Ltd.

- Collins Aerospace (UTAS NDT Lab)

- Lufthansa Technik AG (NDT Services)

- Airbus S.A.S (AIRTAC NDT)

- Spirit AeroSystems Holdings Inc. (NDT Centers)

- Bombardier Inc. (In-house NDT)

- Others

Future Outlook

The Aerospace Non-Destructive Testing (NDT) market is expected to grow steadily due to rising aircraft production, aging fleet maintenance needs, and stringent safety regulations. Advances in AI, automation, and digital twins are transforming inspection processes, enabling faster, more accurate defect detection.

The integration of robotics and advanced sensors will enhance efficiency while reducing human error. Growing aerospace manufacturing in Asia-Pacific and increasing urban air mobility projects also contribute to robust market expansion.

Opportunities lie in

- Adoption of AI-driven and automated inspection systems to improve accuracy and reduce turnaround times.

- Expansion of NDT services in emerging aerospace manufacturing hubs like China and India.

- Increasing demand for advanced inspection of composite materials and additive manufacturing components in new aircraft.

Recent Developments

- October, 2025, Baker Hughes advanced its Waygate Technologies division with AI-driven non-destructive testing (NDT) solutions focusing on predictive maintenance in aerospace.

- August, 2025, Mistras Group Inc. posted strong Q2 and H1 results backed by aerospace and defense demand, investing in advanced ultrasonic and phased-array technologies

Report Scope

Report Features Description Market Value (2024) USD 1.84 Bn Forecast Revenue (2034) USD 7.10 Bn CAGR(2025-2034) 7.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component(Equipment, Software, Services, Consumables), By Technique (Traditional/Conventional, AI-enabled), By Testing Method (Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Visual Inspection Testing, Eddy-Current Testing, Acoustic Emission Testing, Thermography/Infrared Testing, Computed Tomography Testing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Baker Hughes Company, Mistras Group Inc., SGS SA, Intertek Group plc, Applus Services SA, General Electric Company (GE Aviation NDT Solutions), Olympus Corporation, Nikon Corporation, Eddyfi Technologies Inc., Teledyne Technologies Incorporated, Zetec Inc., Sonatest Ltd., TWI Ltd., Ashtead Technology Ltd., Vermont Ultrasonics Inc., YXLON International GmbH, Hologic Inc. (SureScan), Waygate Technologies GmbH, Magnaflux Corporation, Fischer Technology Inc., Element Materials Technology Group Ltd., Collins Aerospace (UTAS NDT Lab), Lufthansa Technik AG (NDT Services), Airbus S.A.S (AIRTAC NDT), Spirit AeroSystems Holdings Inc. (NDT Centers), Bombardier Inc. (In-house NDT), and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Baker Hughes Company

- Mistras Group Inc.

- SGS SA

- Intertek Group plc

- Applus Services SA

- General Electric Company (GE Aviation NDT Solutions)

- Olympus Corporation

- Nikon Corporation

- Eddyfi Technologies Inc.

- Teledyne Technologies Incorporated

- Zetec Inc.

- Sonatest Ltd.

- TWI Ltd.

- Ashtead Technology Ltd.

- Vermont Ultrasonics Inc.

- YXLON International GmbH

- Hologic Inc. (SureScan)

- Waygate Technologies GmbH

- Magnaflux Corporation

- Fischer Technology Inc.

- Element Materials Technology Group Ltd.

- Collins Aerospace (UTAS NDT Lab)

- Lufthansa Technik AG (NDT Services)

- Airbus S.A.S (AIRTAC NDT)

- Spirit AeroSystems Holdings Inc. (NDT Centers)

- Bombardier Inc. (In-house NDT)

- Others