Global Aerospace Electronics Market Size, Share and Trends Report By Component(Avionics Systems, Communication Systems, Radar and Navigation Systems, In-flight Entertainment Systems, Other Components), By End-Use(Commercial, Military), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 127456

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

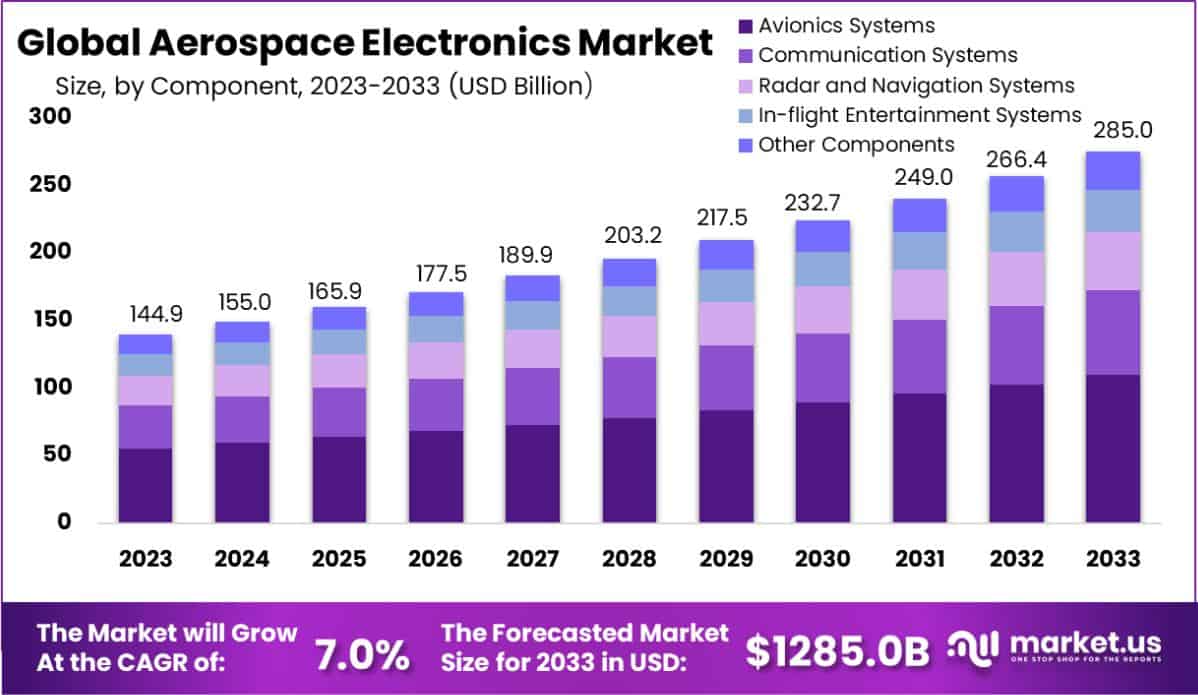

The Global Aerospace Electronics Market size is expected to be worth around USD 285.0 Billion By 2033, from USD 144.9 Billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2024 to 2033. In 2023, North America emerges as the dominant region, accounting for 37.4% of the market share, with a valuation of USD 54.19 billion.

Aerospace electronics, also known as avionics, encompasses the electronic systems used in aircraft, satellites, and spacecraft. These systems are crucial for communication, navigation, flight control, and monitoring functions within aerospace vehicles. Aerospace electronics also include radar systems, sensors, and onboard computing systems that ensure the safe and efficient operation of aircraft in various environments.

The technology continues to evolve with advancements in artificial intelligence, automation, and real-time data processing, enhancing the capabilities of aerospace systems and contributing to the safety and reliability of aviation. The aerospace electronics market is witnessing significant growth due to the increasing demand for modernized aircraft, both in commercial and military sectors. The market is driven by the need for advanced avionics systems to support enhanced communication, navigation, and surveillance capabilities.

Key factors fueling the market include the expansion of air travel, advancements in unmanned aerial vehicles (UAVs), and the modernization of defense equipment. The market also benefits from investments in satellite technology and space exploration, with a growing focus on sustainability and efficiency in aerospace systems.

The demand for aerospace electronics is significantly shaped by the ongoing modernization of existing aircraft fleets and the continuous advancements in aerospace technologies. The market is poised to expand further with the rising adoption of UAVs and autonomous systems, and as global air traffic continues to recover and expand post-pandemic. Additionally, the introduction of more stringent regulations regarding aviation safety and emissions is prompting aerospace manufacturers to increasingly turn to high-performance electronics solutions.

Opportunities within the aerospace electronics market are abundant, particularly in the development and integration of IoT and AI technologies, which can lead to further innovations in aircraft diagnostics, maintenance, and flight operation systems. Emerging markets also present significant opportunities for expansion as they continue to build and modernize their aerospace capabilities.

Furthermore, collaborations between technology providers and aerospace manufacturers are likely to open new avenues for growth, particularly in customized and advanced electronics solutions tailored to specific aerospace needs. The Aerospace Electronics sector is poised for significant expansion, underpinned by strategic governmental investments and policy initiatives aimed at bolstering domestic manufacturing capabilities and fostering innovation.

For instance, In July 2024, RTX Corporation disclosed a strategic partnership aimed at the enhancement of avionic systems through the integration of artificial intelligence. This collaborative endeavor focuses on refining navigation solutions, thereby propelling the modernization of aircraft operations. The initiative is designed to elevate safety standards within the aerospace electronics sector, aligning with ongoing industry efforts to integrate more sophisticated and reliable technological advancements in avionic systems.

A substantial commitment has been made by the government, as evidenced by a ₹15,000 crore (approximately $1.8 billion) investment plan targeted at infrastructure development in aerospace parks and manufacturing facilities by 2024. This financial infusion is projected to substantially enhance the production capacities within the aerospace electronics domain, driving forward the sector’s growth trajectory.

Furthermore, a pivot towards self-reliance is evident in the Ministry of Defense’s recent budget allocations, with 60% of its procurement budget in 2023 dedicated to indigenous products, including aerospace electronics. This strategic allocation not only aims to reduce the dependency on imported electronics but also stimulates local industries, potentially leading to increased market competitiveness and technological advancements.

In addition to financial investments, the government’s commitment to research and development (R&D) in aerospace electronics is manifesting through an allocated ₹5,000 crore (around $600 million) in 2023, with aspirations to elevate this investment to ₹7,500 crore (approximately $900 million) by 2024. This focus on advanced technologies and innovation is expected to yield cutting-edge developments in the sector, further enhancing its global standing and operational excellence.

Key Takeaways

- The Global Aerospace Electronics Market size is expected to be worth around USD 285.0 Billion By 2033, from USD 144.9 Billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2024 to 2033.

- In 2023, Avionics Systems held a dominant market position in the Component segment of the Aerospace Electronics Market, capturing more than a 38.5% share.

- In 2023, Commercial held a dominant market position in the End-Use segment of the Aerospace Electronics Market, capturing more than a 59.1% share.

- North America dominated a 37.4% market share in 2023 and held USD 54.19 Billion revenue of the Aerospace Electronics Market.

North America Aerospace Electronics Market

In 2023, North America held a dominant market position in the Aerospace Electronics Market, capturing more than a 37.4% share with revenues reaching USD 54.19 billion. This leading stance is largely fueled by the presence of major aerospace corporations and extensive R&D investments in the region, particularly in the United States, which is home to some of the world’s largest aircraft manufacturers and aerospace technology firms.

The region’s leadership in the market can also be attributed to significant government spending on defense and aerospace, which propels demand for advanced electronics in military and space applications. The U.S. government’s focus on modernizing its aircraft fleets and enhancing national defense capabilities has led to increased investments in cutting-edge aerospace technologies, thus bolstering the market growth.

Furthermore, North America is at the forefront of technological advancements in aerospace electronics. The integration of AI, IoT, and robotics into aerospace systems is more pronounced in this region, driven by a robust technological ecosystem and collaborations between leading tech companies and aerospace firms. These technological integrations are enhancing efficiencies in aircraft operations, maintenance, and safety, setting a high standard for innovation globally.

AI in Aerospace Electronics

Artificial Intelligence (AI) plays a pivotal role in transforming the aerospace electronics sector, driving innovations that significantly enhance operational efficiency, safety, and system functionality. AI’s integration into aerospace is multifaceted, impacting various aspects from design and manufacturing to in-flight operations and maintenance.

- Enhanced Flight Operations and Safety: AI significantly improves flight operations through advanced algorithms that optimize flight paths, manage air traffic, and enhance the overall efficiency of air transportation systems. The adoption of AI in autopilot systems has evolved from basic functions to more complex autonomous controls that improve safety and operational efficiency. This transformative technology enables more precise navigation, improves decision-making, and reduces the pilot’s workload, thereby enhancing overall flight safety.

- Maintenance Optimization: In aircraft maintenance, AI leverages predictive analytics to forecast potential system failures and schedule timely maintenance, thereby reducing downtime and operational disruptions. The integration of AI extends beyond predictive maintenance; it also optimizes repair processes, analyzes airspace restrictions, and improves resource management. This not only ensures higher operational reliability but also contributes to cost efficiency by minimizing unplanned repairs and extending aircraft lifespan.

- Autonomous and Unmanned Operations: AI is critical in the development and operation of unmanned aerial vehicles (UAVs), including drones and autonomous aircraft. These systems rely on AI for navigation, surveillance, and complex mission execution without human intervention. AI enhances the capabilities of these vehicles to operate in diverse and challenging environments, offering solutions for military, commercial, and research applications.

- Data Management and Security: The role of AI extends to enhancing cybersecurity measures within aerospace systems. AI algorithms are employed to monitor, detect, and respond to cyber threats in real-time, safeguarding sensitive data and communications essential to aerospace operations. This proactive security management is crucial given the increasing connectivity and digitalization of aerospace systems.

- Future Prospects and Sustainability: Looking ahead, AI is set to play a more transformative role in the aerospace sector, particularly in advancing sustainable practices. AI’s ability to optimize flight operations and reduce fuel consumption aligns with the industry’s goals to minimize environmental impact and enhance energy efficiency. The continuous evolution of AI technologies promises further advancements in aerospace applications, driving towards a more sustainable and efficient future.

Component Analysis

In 2023, the Avionics Systems segment held a dominant position in the Aerospace Electronics Market, capturing more than a 38.5% share. This segment’s leadership can be attributed to its critical role in both cockpit and cabin electronics, which are essential for the operation, safety, and efficiency of aircraft.

Avionics systems encompass flight control systems, navigation systems, and communication systems, which are integral to modern aviation. The increasing demand for advanced avionic systems is driven by the growing emphasis on flight safety and the need for efficient flight operations.

Enhanced avionic technologies such as real-time system monitoring, flight management systems, and autopilot systems contribute to this segment’s expansion by optimizing fuel consumption and improving navigation accuracy.

Furthermore, regulatory mandates for upgraded avionic systems in commercial and military fleets have bolstered the market growth. These regulations often require aircraft to be equipped with the latest avionics to meet stringent safety and environmental standards.

Moreover, the integration of new technologies such as IoT and AI in avionics is transforming cockpit operations and maintenance processes, leading to higher adoption rates. The development of connected avionics systems, which facilitate better data exchange and communication on board, is also a significant factor propelling the market growth. These advancements enhance the operational efficiency of airlines and military operations, which in turn, supports the dominant market share of the Avionics Systems segment.

In conclusion, the Avionics Systems segment continues to lead in the Aerospace Electronics Market due to its vital role in enhancing flight operations, safety, and regulatory compliance. The incorporation of advanced technologies and adherence to global safety norms are set to drive further growth in this segment.

End-Use Analysis

In 2023, the Commercial segment held a dominant market position within the Aerospace Electronics Market, capturing more than a 59.1% share. This substantial market share is primarily attributed to the significant expansion in global commercial aviation, driven by rising air travel demand and the introduction of new airline routes, especially in emerging economies.

The surge in both passenger and cargo traffic necessitates advanced aerospace electronics to ensure efficient, safe, and economical operations. Technological advancements in aircraft electronics, such as enhanced in-flight entertainment systems and more sophisticated communication and navigation systems, have further fueled this segment’s growth.

Airlines are increasingly investing in these technologies to improve passenger experience, operational efficiency, and to meet the stringent safety regulations set forth by aviation authorities worldwide. Moreover, the modernization of older aircraft fleets with new electronic systems to extend their operational lifespan also contributes significantly to the dominance of the commercial segment.

Additionally, the shift towards more fuel-efficient and environmentally friendly aircraft has led to the development of new aircraft models equipped with state-of-the-art electronic systems. These developments are designed to reduce carbon footprints and operating costs, appealing to commercial airlines aiming to meet both regulatory standards and corporate sustainability goals.

Key Market Segments

Component

- Avionics Systems

- Communication Systems

- Radar and Navigation Systems

- In-flight Entertainment Systems

- Other Components

End-Use

- Commercial

- Military

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Advanced Aerospace Technologies

The global aerospace electronics market is substantially driven by the increasing demand for air travel and business aviation, which necessitates new and updated aircraft equipped with advanced electronics. Technological advancements in avionics systems, communication technologies, and satellite systems are crucial, enhancing the safety and functionality of aircraft.

Moreover, the integration of cutting-edge technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) in aircraft electronics boosts their efficiency and utility, thereby supporting market growth

Restraint

High Development and Production Costs

A major restraint in the aerospace electronics market is the significant cost associated with the development and production of advanced aerospace electronics. These high costs, encompassing extensive research and development efforts, pose a substantial barrier, particularly for smaller firms, potentially slowing the overall market growth.

Furthermore, the stringent regulatory requirements for safety, reliability, and certification in the aerospace sector add another layer of complexity and expense, impeding the entry of new competitors and the development of new technologies

Opportunities

Government and Defense Investments

Significant opportunities exist in the aerospace electronics market due to robust government and defense spending on aerospace projects. For instance, substantial financial commitments to research and development in aerospace electronics by governments are poised to foster innovative developments within this sector. These investments not only enhance the technological capabilities of national defense systems but also promote the advancement of civil aerospace technologies, thereby expanding the market.

Challenges

Technological Obsolescence and Integration Issues

The aerospace electronics market faces challenges related to the rapid pace of technological obsolescence, requiring continual updates and adaptations to maintain relevance and functionality. Additionally, integrating new electronic systems with existing aerospace frameworks is technically complex and expensive, which can deter the adoption of new technologies. Security concerns related to potential electronic warfare and cyber threats also pose significant challenges, necessitating robust protective measures for aerospace electronics.

Growth Factors

Growth Catalysts in Aerospace Electronics

The aerospace electronics market is experiencing robust growth, fueled by several key factors. The increasing complexity of aircraft systems and a greater focus on safety and efficiency are driving demand for advanced electronic components.

Additionally, modernization initiatives in both civilian and military aviation sectors necessitate upgrades to existing electronics infrastructure to meet new regulatory standards and operational requirements. The expansion of global aircraft fleets to accommodate rising passenger numbers, particularly in emerging markets, further boosts market growth.

Technological advancements in areas such as connectivity and autonomous flying are also significant, as they enable the development of more sophisticated and integrated systems. These growth drivers, combined with ongoing investments in research and development, position the aerospace electronics market for sustained expansion in the coming years.

Emerging Trends

Trends Shaping Aerospace Electronics

Emerging trends in the aerospace electronics market are revolutionizing the industry, primarily driven by advancements in digitalization and connectivity. Increasing adoption of the Internet of Things (IoT) and artificial intelligence (AI) is enhancing aircraft performance, maintenance, and safety by enabling real-time data monitoring and decision-making.

Furthermore, the shift towards more electric aircraft (MEA) is prompting significant demand for advanced electronic systems that reduce weight and improve energy efficiency. Another notable trend is the development of autonomous flight technologies, which rely heavily on sophisticated electronics for navigation and control systems.

These trends not only promise to improve operational efficiencies and passenger experiences but also open new avenues for market growth as aerospace companies invest heavily in next-generation electronic solutions to meet evolving industry standards and consumer expectations.

Key Players Analysis

In the global aerospace electronics market in 2023, significant players such as Honeywell International Inc., Thales Group, and BAE Systems plc are pivotal in shaping industry dynamics. Each entity brings unique strengths and strategic initiatives that cater to the evolving demands of aerospace technology.

Honeywell International Inc. continues to solidify its market position through innovative solutions in avionics and flight management systems. The company’s focus on integrating artificial intelligence and machine learning technologies into its products is enhancing operational efficiencies and safety protocols, addressing key market needs. Honeywell’s robust global supply chain and commitment to R&D investments further reinforce its competitive edge.

Thales Group stands out with its extensive portfolio in cockpit systems, in-flight entertainment, and advanced radar technologies. Thales’ strategic partnerships and acquisitions are instrumental in expanding its technological capabilities and geographic footprint. The company’s dedication to sustainability and digital innovation aligns with the industry’s shift towards greener and more connected aerospace solutions, potentially driving market expansion and customer engagement.

BAE Systems plc emphasizes its expertise in defense and commercial aerospace sectors, with a significant contribution to electronic warfare and flight control systems. BAE Systems’ approach to integrating cyber resilience in its offerings is critical amidst rising concerns over cybersecurity in aerospace. The firm’s involvement in various international projects underlines its strategic intent to diversify operations and penetrate emerging markets.

Collectively, these key players are not only advancing technological frontiers but are also pivotal in driving the aerospace electronics market toward a more innovative and secure future. Their strategic initiatives and adaptive measures are expected to catalyze growth and redefine industry standards in 2023 and beyond.

Top Key Players in the Market

- Honeywell International Inc.

- Thales Group

- BAE Systems plc

- RTX Corporation

- Northrop Grumman Corporation

- General Electric Company

- L3Harris Technologies, Inc.

- Safran SA

- The Boeing Company

- Airbus SE

- Panasonic Holdings Corporation

- Teledyne Technologies Incorporated

- Other Key Players

Recent Developments

- In July 2024, RTX Corporation announced a partnership to enhance avionic systems, aiming to incorporate AI for better navigation solutions.

- In June 2024, GE launched a new series of energy-efficient power electronics, designed to reduce aircraft carbon emissions by up to 30%.

- In May 2024, Northrop Grumman secured a $200 million contract to develop next-generation radar systems for military aircraft.

Report Scope

Report Features Description Market Value (2023) USD 144.9 Billion Forecast Revenue (2033) USD 285.0 Billion CAGR (2024-2033) 7.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Component(Avionics Systems, Communication Systems, Radar and Navigation Systems, In-flight Entertainment Systems, Other Components), End-Use(Commercial, Military) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell International Inc., Thales Group, BAE Systems plc, RTX Corporation, Northrop Grumman Corporation, General Electric Company, L3Harris Technologies, Inc., Safran SA, The Boeing Company, Airbus SE, Panasonic Holdings Corporation, Teledyne Technologies Incorporated, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Aerospace Electronics?Aerospace electronics encompass the advanced electronic systems used in aircraft, spacecraft, and satellites. These systems are integral for navigation, communication, and operational functionalities. The market for aerospace electronics is propelled by advancements in technology and increasing demand for enhanced safety features in aviation.

How big is Aerospace Electronics Market?The Global Aerospace Electronics Market size is expected to be worth around USD 285.0 Billion By 2033, from USD 144.9 Billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Aerospace Electronics Market?The aerospace electronics market is driven by rising global air traffic, necessitating advanced navigation and communication systems, alongside shifts towards electric and autonomous aircraft, and stringent regulatory and environmental standards.

What are the emerging trends and advancements in the Aerospace Electronics Market?Advancements in IoT and AI are enhancing aerospace electronics, focusing on real-time monitoring and decision-making. Shifts toward electric and autonomous aircraft further drive demand for sophisticated electronic systems, spurring market growth.

What are the major challenges and opportunities in the Aerospace Electronics Market?The aerospace electronics market is buoyed by IoT and AI, enhancing efficiency and supporting sustainability with fuel-efficient technologies. Challenges include industry cyclicality, integration complexities, and the high costs of continuous innovation.

Who are the leading players in the Aerospace Electronics Market?Honeywell International Inc., Thales Group, BAE Systems plc, RTX Corporation, Northrop Grumman Corporation, General Electric Company, L3Harris Technologies, Inc., Safran SA, The Boeing Company, Airbus SE, Panasonic Holdings Corporation, Teledyne Technologies Incorporated, Other Key Players

Aerospace Electronics MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Aerospace Electronics MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- Thales Group

- BAE Systems plc

- RTX Corporation

- Northrop Grumman Corporation

- General Electric Company

- L3Harris Technologies, Inc.

- Safran SA

- The Boeing Company

- Airbus SE

- Panasonic Holdings Corporation

- Teledyne Technologies Incorporated

- Other Key Players