Global Aerospace And Defense Core Materials Market Size, Share, And Industry Analysis Report By Type, Foam (Balsa, Honeycomb), By Application (Airframe Manufacturers, Aerostructures Manufacturers, Research And Development, Maintenance, Repair And Overhaul (MRO), Original Equipment Manufacturers (OEMs)) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171817

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

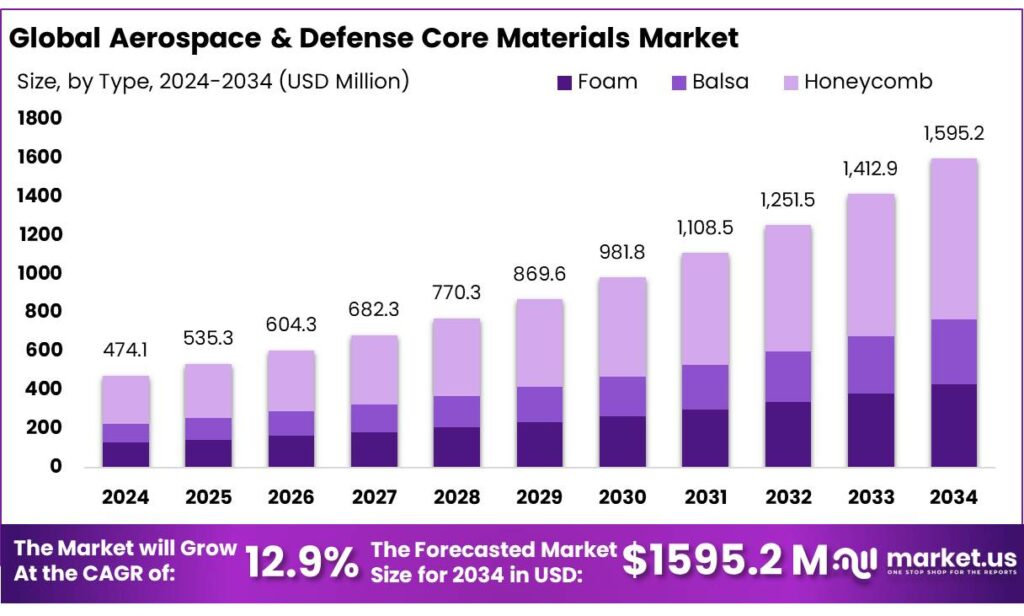

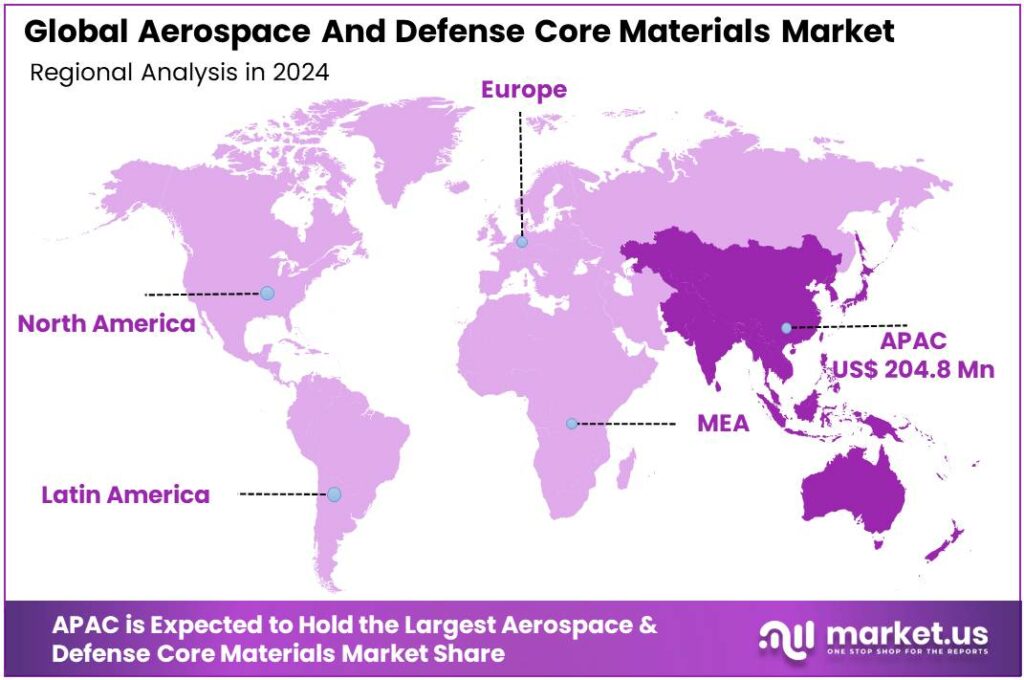

The Global Aerospace And Defense Core Materials Market size is expected to be worth around USD 1595.2 Million by 2034, from USD 474.1 Million in 2024, growing at a CAGR of 12.9% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.2% share, holding USD 204.8 Million in revenue.

Aerospace & defense (A&D) core materials—mainly honeycomb and structural foams used inside sandwich panels—sit at the heart of lightweight structures such as nacelles, control surfaces, fairings, rotor blades, radomes, floors, and increasingly, space and unmanned platforms. The value proposition is simple: by replacing “solid laminate” thickness with a low-density core, OEMs and tier suppliers achieve higher stiffness-to-weight, better buckling resistance, and improved vibration/acoustic behavior—without paying the full mass penalty of thicker skins. This lightweighting logic has become more important as modern airframes lean heavily into advanced materials; for example, Airbus notes the A350 is built with 70% advanced materials, including 53% composites and 14% titanium.

Industrial demand for these cores closely follows the build-rate and retrofit cycles of commercial aviation, plus defense modernization and readiness spending. On the commercial side, OEM output is still supply-chain-constrained, but the installed base and backlog keep the materials pipeline busy: Airbus delivered 766 commercial aircraft in 2024 and reported a year-end backlog of 8,658 aircraft, a strong forward indicator for multi-year aerostructure demand. Boeing reported 348 total commercial airplane deliveries in full-year 2024.

Key driving factors are performance economics, survivability requirements, and certification expectations. Weight reduction remains a direct lever for fuel burn and payload/range, which makes high stiffness-to-weight sandwich panels attractive across commercial and military airframes. In parallel, defense demand is structurally supported by rising national budgets and accelerated procurement. SIPRI reports world military expenditure reached $2,718 billion in 2024, expanding the addressable base for military aviation, drones, and protected mobility structures that use lightweight cores. In the U.S., the FY2025 request includes about $850 billion in discretionary spending for DoD military programs, underpinning continued acquisition and sustainment activity.

Government initiatives and trusted public programs also shape the opportunity set—especially where decarbonization and new propulsion concepts drive material redesign. For example, the U.S. FAA opened funding windows totaling $245 million for Sustainable Aviation Fuel (SAF) infrastructure projects and $47 million for low-emission aviation technology projects, which helps accelerate fleet transition and aircraft technology upgrades that often require new lightweight structures and thermal/acoustic solutions—areas where core materials are routinely specified.

On the defense side, U.S. national defense budgeting remains extremely large in absolute terms; CRS notes $895.2 billion requested for discretionary activities within the FY2025 national defense budget function, with ~$883.7 billion falling within the scope of FY2025 NDAA proposals/versions—supporting ongoing procurement, sustainment, and modernization demand signals.

Key Takeaways

- Aerospace And Defense Core Materials Market size is expected to be worth around USD 1595.2 Million by 2034, from USD 474.1 Million in 2024, growing at a CAGR of 12.9%.

- Honeycomb held a dominant market position, capturing more than a 52.3% share.

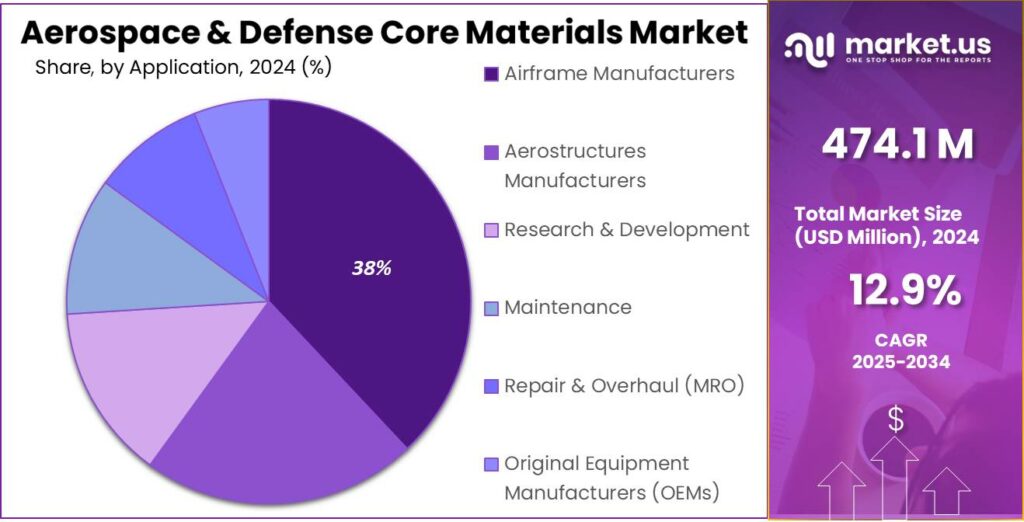

- Airframe Manufacturers held a dominant market position, capturing more than a 38.7% share.

- Asia Pacific (APAC) region emerged as a key geographical leader in the aerospace & defense core materials market, capturing a commanding 43.20% share with an estimated USD 204.8 million.

By Type Analysis

Honeycomb core materials lead with a strong 52.3% share, supported by their lightweight strength

In 2024, Honeycomb held a dominant market position, capturing more than a 52.3% share in the aerospace and defense core materials market, mainly due to its high strength-to-weight ratio and reliable structural performance. Honeycomb cores were widely used in aircraft panels, flooring, control surfaces, radomes, and interior structures, where weight reduction and stiffness are critical. During 2024, steady commercial aircraft production and ongoing defense fleet upgrades supported consistent demand for honeycomb materials, as manufacturers focused on improving fuel efficiency and payload capacity.

In 2025, adoption remained strong as new aircraft programs and next-generation military platforms continued to rely on honeycomb structures for improved durability and fatigue resistance. The material’s ability to absorb energy, resist compression, and integrate easily with composite skins further reinforced its leadership. Honeycomb cores also benefited from proven performance under strict aerospace certification standards, making them a preferred choice for long-term structural applications across both commercial and defense segments.

By Application Analysis

Airframe manufacturers lead demand with a solid 38.7% share, driven by structural integration needs

In 2024, Airframe Manufacturers held a dominant market position, capturing more than a 38.7% share in the aerospace and defense core materials market, supported by their direct involvement in primary aircraft structures. Core materials were extensively used in fuselage sections, wings, tail structures, and floor panels, where strength, stiffness, and weight efficiency are critical. During 2024, rising aircraft build rates and ongoing replacement of aging fleets increased material consumption at the airframe level, as manufacturers focused on improving fuel efficiency and structural durability.

In 2025, continued production of next-generation commercial aircraft and military platforms sustained demand, with airframe manufacturers increasingly selecting advanced core materials to meet strict safety and performance standards. The need for reliable, certified materials that integrate seamlessly with composite skins remained a key factor reinforcing this segment’s leadership.

Key Market Segments

By Type

- Foam

- Balsa

- Honeycomb

By Application

- Airframe Manufacturers

- Aerostructures Manufacturers

- Research & Development

- Maintenance

- Repair & Overhaul (MRO)

- Original Equipment Manufacturers (OEMs)

Emerging Trends

Tighter Quality Controls and Traceability Are Becoming the New Standard

A clear latest trend in aerospace and defense core materials is the industry’s shift from “lightweight at any cost” to lightweight with deeper proof of quality—meaning tighter inspection, better traceability, and more process control across every layer of a sandwich structure. Core materials work best when thickness, bonding quality, and material uniformity are consistent. As production rates rise and fleets stay in service longer, OEMs and regulators are pushing suppliers to show stronger evidence that panels are built exactly as designed, every time.

This trend is being reinforced by real regulatory actions. In December 2025, European aviation regulators ordered inspections on certain Airbus A320 aircraft after a fuselage panel thickness issue linked to a supplier. The guidance required airlines to check thickness of affected forward fuselage panels within six months, and it applied to 177 in-service aircraft and an additional 451 aircraft still in production. Even though this case is about fuselage panels, the message travels across the materials chain: thickness control, manufacturing records, and repair history are no longer “nice to have.” They are becoming mandatory proof points.

At the same time, aircraft output expectations remain high, so the market is looking for quality systems that do not slow production. Airbus delivered 766 commercial aircraft in 2024 and ended the year with a backlog of 8,658 aircraft. A backlog of that size pushes Tier-1 and Tier-2 suppliers to scale, but scaling without stronger quality control creates risk. That is why manufacturers are investing in more in-process checks—digital work instructions, batch traceability, and non-destructive inspection approaches that can catch thickness or bonding issues early, before assembly and service.

Government and industry climate programs are also quietly accelerating this quality-and-traceability trend. New aircraft concepts are being developed under initiatives that aim for step-change efficiency, and that typically means more composite and sandwich structures. For example, the Clean Aviation partnership states an ambition to decrease aircraft greenhouse gas emissions by no less than 30% compared with 2020 state-of-the-art technology. Separately, ICAO’s 41st Assembly adopted a long-term goal of net-zero carbon emissions by 2050 for international aviation.

Drivers

Lightweighting Pressure From Fuel Costs and Net-Zero Targets Drives Core Materials Use

This demand is not theoretical—it is being pulled by a long, visible production pipeline. Airbus delivered 766 commercial aircraft in 2024 and reported a year-end backlog of 8,658 aircraft, which implies multi-year build activity across thousands of structures where lightweight panels are standard practice. This demand is not theoretical—it is being pulled by a long, visible production pipeline. Airbus delivered 766 commercial aircraft in 2024 and reported a year-end backlog of 8,658 aircraft, which implies multi-year build activity across thousands of structures where lightweight panels are standard practice.

Climate commitments are also turning lightweighting into a board-level priority. IATA member airlines passed a resolution committing to net-zero carbon by 2050, which keeps continuous pressure on the whole value chain—airframes, materials, operations, and fuels—to find real reductions, not just small tweaks. ICAO reinforced the same direction when its 41st Assembly adopted a long-term goal of net-zero carbon emissions by 2050 for international aviation. These commitments matter for core materials because lighter aircraft need less energy to move, and sandwich structures are one of the cleanest “physics wins” engineers can still capture at scale.

Government initiatives are adding another layer of momentum by funding technology pathways that require structural change, not only fuel blending. In the United States, the U.S. Sustainable Aviation Fuel (SAF) Grand Challenge sets targets of 3 billion gallons per year by 2030 and 35 billion gallons by 2050 (while aiming for at least a 50% life-cycle emissions reduction versus conventional fuel). Even when SAF is the headline, the practical effect is broader: airlines and OEMs pursue multiple levers at once—SAF plus aerodynamic and structural efficiency—because no single lever is enough on its own.

Europe is pushing both regulation and R&D in parallel. The European Commission notes that ReFuelEU Aviation is designed to deliver a CO₂ emissions reduction of more than 60% by 2050 (compared with 1990 levels), reinforcing long-term efficiency and technology change across aircraft and operations. On the innovation side, Clean Aviation (an EU public-private partnership) is explicitly aimed at disruptive aircraft technologies and sets a technology ambition to deliver net GHG reductions of no less than 30% versus 2020 state-of-the-art, with readiness targeted for entry-into-service by 2035.

Restraints

High Costs and Supply Chain Limits Slow Adoption of Core Materials

One of the biggest restraining factors for aerospace and defense core materials is high cost driven by raw materials, processing complexity, and constrained supply chains. Engineers and procurement teams often love the performance advantages of lightweight cores—such as honeycomb or high-grade structural foams—but real budgets and production bottlenecks frequently force them to pause. Unlike commodity metals and basic alloys, advanced cores require specialized manufacturing, stringent quality checks, and long certification cycles that all add time and money. This means that even when designers want to adopt next-generation materials, finance teams often push back, especially in slower markets or defense programs with tight annual budgets.

To put this into perspective, consider how wider industrial trends underscore the cost sensitivity in aerospace. Energy and input costs have a direct ripple effect on raw material pricing. For example, the Food and Agriculture Organization of the United Nations (FAO) reports that the FAO Food Price Index averaged 118.2 points in 2024, showing that even basic industrial inputs tied to energy and logistics remain volatile and relatively high compared with previous years. These rising indices reflect pressures on freight, manufacturing energy, and supply reliability across sectors—not just food—emphasizing that cost pressures are broad and often unpredictable.

In aerospace, these pressures are more acute because every kilogram matters in the aircraft weight-fuel equation: lighter structures save fuel over the life of a plane, but the upfront cost premium for advanced cores is non-trivial. For some programs, core materials can cost 2–5 times more per kilogram than traditional aluminum honeycomb, depending on the type and certification level. That adds millions to an airframe program before the first revenue flight. Even defense budgets, which are often stable, are affected: in the United States 2025 defense budget, about $850 billion was requested for the Department of Defense’s discretionary activities, but a large share goes to weapons systems and personnel costs before materials procurement.

Government initiatives aimed at supporting domestic industries also sometimes unintentionally restrict access to affordable materials. For instance, the U.S. and European Union both promote domestic sourcing and strategic autonomy for critical aerospace components, but this can reduce global competition and keep prices high. Programs such as Buy America/Buy European clauses condition defense awards on local suppliers, reducing the global supply pool for certain core material technologies and keeping costs elevated when local supply cannot meet demand quickly.

Opportunity

Autonomous Drones and High-Rate Aircraft Builds Create a Big Opportunity

Defense is opening a second, very different lane: large numbers of low-cost drones and uncrewed platforms. The U.S. Department of Defense’s Replicator initiative is one example of this shift toward scale. Public reporting indicates the Pentagon secured roughly $500 million for Replicator in FY2024, and the same amount was included in the FY2025 budget request. Even where the exact platform mix changes, the direction is clear: higher volumes of air vehicles create demand for lightweight, repeatable structures.

This opportunity grows even stronger because defense spending is rising globally. SIPRI reports world military expenditure reached $2,718 billion in 2024, up 9.4% in real terms from 2023, and the fastest year-on-year rise since at least 1988. Larger budgets do not automatically guarantee more advanced materials, but they do increase the number of funded programs—UAVs, rotorcraft upgrades, maritime drones, and deployable structures—where lightweight sandwich panels are a practical advantage.

A third opportunity sits in next-generation aircraft technology programs, especially in Europe, where policy is pushing for step-change efficiency. The Clean Aviation partnership states an ambition to reduce greenhouse gas emissions by about 30% compared with 2020 technology, encouraging disruptive airframe and propulsion solutions. To reach those targets, OEMs and Tier-1s often need structural concepts that cut mass while maintaining stiffness—exactly the engineering “job” core materials do well. That creates space for newer core types that can be qualified for tougher environments and higher production rates.

Regional Insights

APAC leads with a 43.20% share, generating USD 204.8 Million in aerospace & defense core materials due to strong regional industrial growth

In 2024, the Asia Pacific (APAC) region emerged as a key geographical leader in the aerospace & defense core materials market, capturing a commanding 43.20% share with an estimated USD 204.8 million in revenue. This leadership was supported by rapid expansion of commercial and defense aircraft production in countries such as China, India, Japan, and South Korea, where governments and manufacturers have increased investments in aviation infrastructure and modernized defense fleets. APAC’s rising aircraft deliveries and unmanned systems programs drove demand for advanced lightweight materials that improve fuel efficiency, structural performance, and operational durability.

The dominance in 2024 also stemmed from a broader aerospace supply chain evolving to incorporate core materials such as honeycomb and advanced foams in key structural components where weight reduction is critical for performance. In 2025, APAC maintained its leadership position as ongoing production ramp-ups and new aircraft platforms continued to push material consumption higher, supported by growth in aerospace exports and regional collaborations with global OEMs.

The combination of supportive government policies, expanding manufacturing capacity, and competitive cost structures underpinned steady regional adoption of core materials in both commercial and military aerospace applications. APAC’s performance in 2024 and into 2025 highlights its strategic importance to the global aerospace & defense core materials market, with sustained growth expected as regional aircraft production and defense spending continue to strengthen.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Gill Corporation: The Gill Corporation generated ~USD 191.9 million in annual revenue in 2024, supplying advanced honeycomb and sandwich panel materials qualified by major aerospace manufacturers for structural and interior uses. With ~624 employees worldwide, Gill’s portfolio included para‑aramid and fiberglass cores with heat‑resistant phenolic resins, supporting growth in aerospace and defense sectors through 2025 as lightweight composite adoption increased.

Corex Honeycomb: Corex Honeycomb, a UK‑based producer of premium aluminium honeycomb core materials, supported lightweight composite panel applications in aerospace, marine, architecture, and rail markets in 2024, emphasizing high strength‑to‑weight ratios. Corex continued to build market presence in 2025 by supplying structural honeycomb solutions that align with expanding global demand for lightweight cores in transportation sectors.

Euro‑Composites S.A.: Euro‑Composites S.A., headquartered in Luxembourg, delivered a range of honeycomb core materials in 2024—including aluminum, Kevlar®, and Nomex® variants—serving aerospace and defense OEMs with tailored cell sizes and densities. With production expansions underway to meet rising composite demand, Euro‑Composites strengthened its capabilities into 2025.

Top Key Players Outlook

- Hexcel Corporation

- Plascore Incorporated

- Gill Corporation

- Schütz Composites

- Corex Honeycomb

- Euro-Composites

- Gurit Holding Ag

- Acp Composites

- Diab Group

- Armacell International

- General Plastics Manufacturing Co.

- Evonik Industries

- 3A Composites

Recent Industry Developments

Hexcel’s workforce of approximately 5,894 employees in 2024 and global manufacturing footprint enabled efficient production and delivery to major OEMs such as Airbus and Boeing, reinforcing its strategic position in core materials supply.

In 2024, Euro‑Composites S.A. played a distinct role in the aerospace and defense core materials sector by supplying a broad range of high‑performance honeycomb core products used in aircraft interiors, structural panels, and space applications.

Report Scope

Report Features Description Market Value (2024) USD 474.1 Mn Forecast Revenue (2034) USD 1595.2 Mn CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type, Foam (Balsa, Honeycomb), By Application (Airframe Manufacturers, Aerostructures Manufacturers, Research And Development, Maintenance, Repair And Overhaul (MRO), Original Equipment Manufacturers (OEMs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hexcel Corporation, Plascore Incorporated, Gill Corporation, Schütz Composites, Corex Honeycomb, Euro-Composites, Gurit Holding Ag, Acp Composites, Diab Group, Armacell International, General Plastics Manufacturing Co., Evonik Industries, 3A Composites Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aerospace And Defense Core Materials MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Aerospace And Defense Core Materials MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hexcel Corporation

- Plascore Incorporated

- Gill Corporation

- Schütz Composites

- Corex Honeycomb

- Euro-Composites

- Gurit Holding Ag

- Acp Composites

- Diab Group

- Armacell International

- General Plastics Manufacturing Co.

- Evonik Industries

- 3A Composites