Global Advanced Analytics Market By Type (Big Data Analytics, Risk Analytics, Customer Analytics, Business Analytics, and Others Types), By Deployment Mode (Cloud and On-premise), By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By End-Use (BFSI, IT & Telecom, Healthcare, Military & Defense, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 26730

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

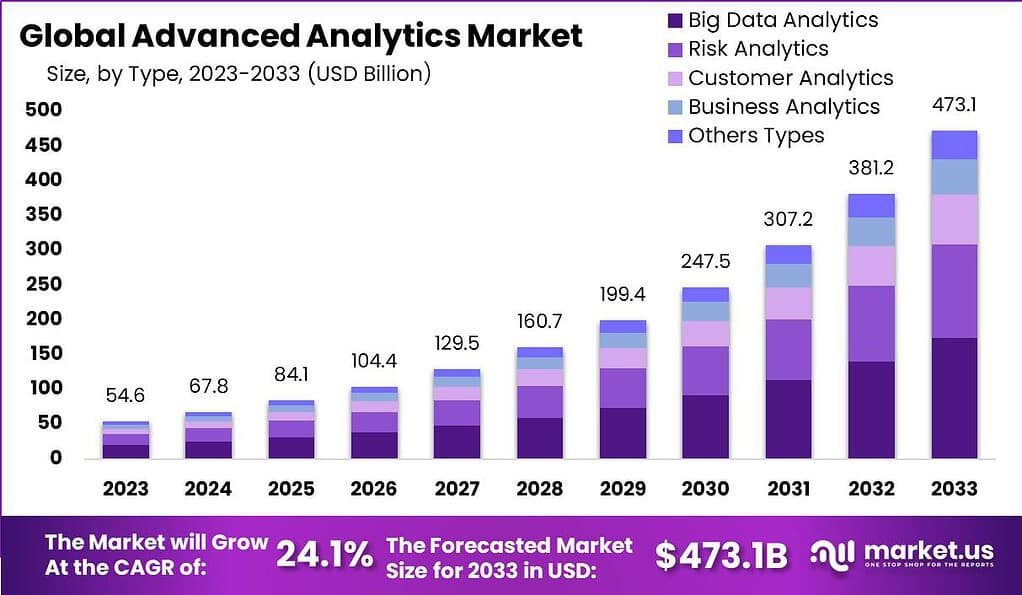

The Global Advanced analytics Market is anticipated to be USD 473.1 billion by 2033. It is estimated to record a steady CAGR of 24.1% in the Forecast period 2024 to 2033. It is likely to total USD 67.8 billion in 2023.

Advanced analytics refers to sophisticated data analysis techniques that go beyond traditional business intelligence to uncover deeper insights, make predictions, and recommend actions based on data. It includes statistical modeling, machine learning, artificial intelligence, deep learning, and other cutting-edge techniques to extract value from data.

The advanced analytics market refers to the business sector associated with the development, sale, and implementation of advanced analytics solutions and services. This market has seen significant growth due to the increasing recognition of the value of data-driven decision-making in various industries.

Note: Actual Numbers Might Vary In Final Report

The goal of advanced analytics is to gain deeper and more meaningful insights from data, which allows companies to take data-driven decisions to optimize processes, find opportunities, manage risks and enhance overall business performance. It is the process of exploring models, analysis, and interpretation of data in order to uncover important insights previously obscure or difficult to discern.

The advanced analytics market includes the products, services and solutions provided by various service and technology companies to help organizations harness sophisticated analytics features. This market encompasses a broad array of platforms, tools and services, including data visualization tools as well as predictive modeling software machines learning systems, as well as consulting services.

The market for advanced analytics has experienced significant growth in the last few years because of the growing access to large data, the advancements in computing capacity, and the rising necessity for businesses to achieve an advantage over competitors by using data-driven insights. Industries like healthcare, finance, retail manufacturing, telecommunications and telecommunications are among the major industries that are driving the adoption of advanced analytics.

Key Takeaways

- Market Projection: The market is anticipated to grow significantly, reaching USD 473.1 billion by 2033, with a steady CAGR of 24.1% during the forecast period from 2024 to 2033, up from USD 67.8 billion in 2023.

- Big Data Analytics: Emerged as a leading segment in 2023 with a 36.9% share, driven by increasing data volumes and its crucial role in informed decision-making.

- Cloud-Based Solutions: Gained prominence with a 57.4% share in 2023, favored for their scalability, accessibility, and cost-efficiency.

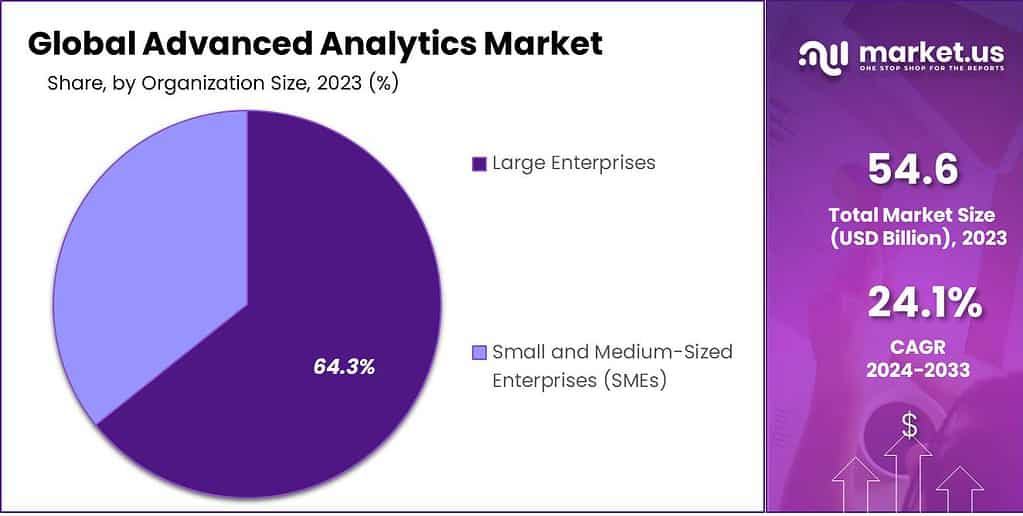

- Organizational Impact: Large Enterprises Commanded a significant market share of over 64.3% in 2023, leveraging their substantial resources for advanced analytics.

- Industry Applications: BFSI: Led the industry usage with a 28.2% share in 2023, employing advanced analytics for risk assessment, fraud detection, and regulatory compliance.

- Growth Drivers: Technology Integration: Adoption of AI, ML, and big data technologies is propelling personalized experiences and operational efficiencies.

- Challenges and Opportunities: Data Security and Integration: Highlighted as primary challenges alongside the cost implications of implementing advanced solutions.

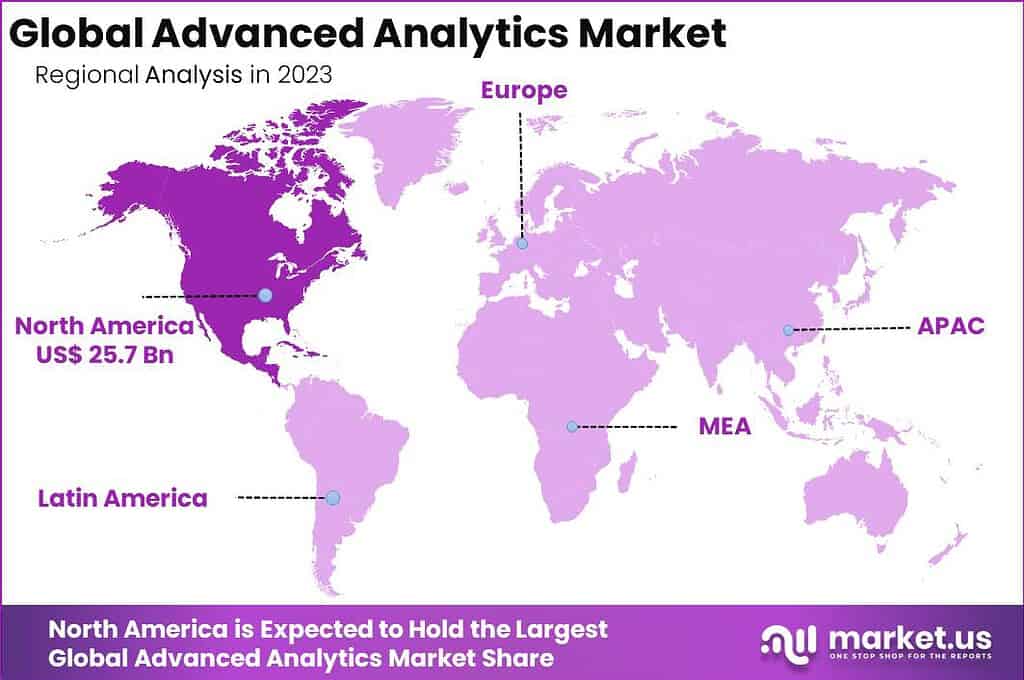

- Regional Dynamics: North America: Held a dominant position with over 46.0% share in 2021, thanks to its advanced infrastructure and technological adoption.

Type Analysis

In 2023, the Big Data Analytics segment asserted its dominance in the market for advanced analytics and secured a market share of 36.9%. This impressive growth is due to the increasing amount of data produced across different industries, and the increasing acceptance of its function in guiding data-driven decision-making processes. Additionally, the incorporation of advanced technologies, like machine learning and artificial intelligence in Big Data Analytics solutions further made it more appealing to businesses who seek to get actionable information from huge data sets.

Moving towards, Risk Analytics segment, it has seen a notable growth in 2023, which reflects its vital function in managing risk across all industries. With a keen eye in examining, diagnosing and reducing the risk of potential threats This segment has racked up significant market share, aided by the increasing complexity of the business world. Modern techniques and models that predict the future have increased the effectiveness of Risk Analytics which allows companies to identify risks and strengthen their strategies for managing risk.

Customer Analytics is a different segment that was also able to show a substantial market share in 2023. getting the attention of businesses who are keen to understand customer behavior and preferences. This segment’s prominence, with a substantial share in the market, can be attributed to the increasing emphasis on delivering personalized experiences. Leveraging customer data, businesses harnessed Customer Analytics to optimize marketing campaigns, improve product offerings, and enhance overall customer satisfaction.

In the realm of Business Analytics, 2023 witnessed this segment maintaining a pivotal role in facilitating data-driven decision-making within organizations. With a notable market share, Business Analytics continued to empower enterprises by providing them with comprehensive insights into their operations, financial performance, and strategic planning. This segment’s growth was propelled by the constant need for businesses to adapt to changing market dynamics and make informed choices.

Lastly, exploring the broader category of “Other Types” within advanced analytics, we find a diverse range of specialized analytics solutions catering to specific industry needs. While the market share of this segment is distributed among various niche analytics categories, its cumulative impact on the advanced analytics landscape is considerable. Organizations sought these specialized analytics to address unique challenges, ensuring that their analytical needs were met effectively.

Deployment Mode

By 2023 the Cloud-Based sector has dominated the market for advanced analytics and secured a significant market share of 57.4%. This remarkable growth is attributable to the inherent advantages that cloud-based deployments offer, including scalability and access as well as cost-efficiency. Businesses are increasingly turning towards cloud-based solutions to benefit from the capabilities of advanced analytics, without the need for the infrastructure on premises.

This shift was driven by the necessity for speed in the field of data processing and analytics. This allows businesses to swiftly adapt to the changing dynamics of markets and gain actionable insights from massive data sets. Additionally the ease of integration to other services that are cloud-based, as well as the capability to utilize the latest technologies such as machine learning and artificial intelligence further strengthened the cloud-based segment’s status as the most preferred option for advanced analytics by 2023.

However the On-premise market retained a substantial market share. however, with a lower portion of the market than the cloud-based counterpart. Its value lies in its capacity to serve businesses that had strict security and compliance needs. In industries where control and privacy of data were crucial, on-premise deployment was a reliable option. In addition, some companies prefer the on-premise option to ensure total control over their infrastructure for data. While the cloud-based segment jumped over the other market segments in terms of share however, the on-premise segment was still playing a crucial function, especially in the industries which data sovereignty and security were important.

Organization Size

In 2023, the Large Enterprises segment firmly established its position as the dominant player in the market for advanced analytics and commanded a significant market share of more than 64.3%. The dominance of this segment is due to the solid capacity and financial resources large corporations have, allowing them to spend a significant amount of money on advanced analytics software. They recognized the crucial significance of data-driven decisions in getting an edge in competitiveness and maintaining expansion in a constantly changing business environment. This is why they adopted advanced analytics to boost efficiency in operations, improve the allocation of resources, and spur innovation.

The ability to tap into vast data sets, develop advanced analytics models, and utilize cutting-edge technologies like artificial intelligence has given them an advantage when it came to using data to make strategic decisions.

However, Small and Medium-Sized Enterprises (SMEs) also enjoyed a significant presence in the market for advanced analytics in 2023, though having a lesser market share than those with larger budgets. SMEs are increasingly recognizing the value of advanced analytics for improving their efficiency, understanding customer behavior and opportunities for growth.

Despite the constraints on resources numerous SMEs implemented scaled-down analytics solutions that are tailored to their specific needs usually through cloud-based solutions or outsourcing analytics service providers. Their ability and flexibility to adjust to market conditions enabled them to take advantage of advanced analytics in order to be competitive against larger companies.

Note: Actual Numbers Might Vary In Final Report

End-Use Industry

In 2023, The BFSI (Banking, Financial, Services and Insurance) segment has firmly established its position as the dominant player in the market for advanced analytics with a market share of 28.2%. This dominant position is due to the crucial role played by data-driven insights within the BFSI sector, where precision and timeliness are paramount. Banks and financial institutions embraced advanced analytics to improve the risk assessment process as well as fraud detection and the customer experience.

As compliance requirements for regulatory compliance become increasingly complicated, these companies relied on advanced analytics to manage the regulatory landscape efficiently. Furthermore, the continuous flow of data generated by digital transactions and banking online led to the rise of advanced analytics within the BFSI industry, enabling institutions to make better informed decisions to optimize investment decisions and manage risks with greater precision.

Lastly, the “Other End-Uses” category represented a diverse range of industries where advanced analytics played a role, albeit with varying market shares. These end-uses spanned across manufacturing, retail, energy, and more, showcasing the versatility of advanced analytics in addressing specific industry challenges. The adoption of advanced analytics in these sectors was often driven by the pursuit of operational excellence, cost optimization, and market competitiveness.

Key Market Segments

Type

- Big Data Analytics

- Risk Analytics

- Customer Analytics

- Business Analytics

- Others Types

Deployment Mode

- Cloud-Based

- On-Premise

Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

End-Use Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Manufacturing

- Government

- Military & Defense

- Other End-Use Industries

Driving Factors

- Rising adoption of big data and related technologies: The Advanced Analytics Market is fueled by the rising use of big data and related technologies. Organizations are harnessing huge amounts of data to get important insights, which is driving the need for advanced analytics solutions which can analyze and process the data efficiently.

- Advent of ML and AI to offer personalized customer experiences: The advent of Machine Learning (ML) and Artificial Intelligence (AI) has transformed customer experience. Companies are taking advantage of these technologies to deliver customized offerings, recommendations and services, increasing the level of customer loyalty and satisfaction.

- Growing need to preclude fraudulent activities during the pandemic: The pandemic heightened the need to prevent fraud, especially for online transactions and healthcare. Advanced analytics plays a crucial role in detecting and preventing fraud by analyzing patterns and anomalies in data.

- Increasing demand for advanced analytics in HR, finance & accounting, operations and supply chain, sales & marketing, and other business functions: Advanced analytics is in high demand across various business functions, including operations, HR, finance and supply chain, as well as sales and marketing. It helps organizations take data-driven decisions, enhance processes and gain an competitive edge.

Restraining Factors

- Lack of skilled workforce and technological expertise in underdeveloped and developing economies: The economies of the developing and underdeveloped typically face a shortage of qualified professionals and technical expertise in advanced analytics. This is a barrier to the widespread use of these technologies.

- Lack of awareness in the backward regions: In certain areas there is a lack of knowledge about the benefits that advanced analytics can bring. The lack of awareness could discourage companies to invest in using advanced analytics tools efficiently.

- Lack of a strong IT infrastructure in underdeveloped economies: Underdeveloped economies may not have a strong IT infrastructure that is vital for the implementation and maintenance of modern analytics strategies. Lack of a solid infrastructure could cause significant issues.

- Technical misspecifications: Technical misspecifications, such as mistakes in data collection or model design, could cause incorrect results, which can hinder the efficiency of advanced analytics software.

Growth Opportunities

- Rising internet proliferation and growing usage of connected and smart devices: The proliferation of the internet and the widespread use of connected and smart devices create opportunities for advanced analytics. These technologies generate vast amounts of data that can be analyzed to extract valuable insights.

- Increasing demand for predictive analytics: Predictive analytics is in high demand across industries. Businesses are looking to anticipate future trends, customer behaviors, and market changes, creating a significant growth opportunity for advanced analytics providers.

- Growing adoption of cloud-based advanced analytics solutions: The adoption of cloud-based advanced analytics solutions is on the rise. This trend offers scalability, flexibility, and cost-effectiveness, making it an attractive option for businesses seeking advanced analytics capabilities.

- Increasing demand for advanced analytics in the healthcare sector: The healthcare sector is increasingly turning to advanced analytics to improve patient outcomes, optimize resource allocation, and enhance operational efficiency, presenting substantial growth opportunities.

Challenges

- Ensuring data privacy and security: Ensuring the privacy and security of data used in advanced analytics is a paramount challenge. Data breaches and privacy violations can have severe consequences, necessitating robust security measures.

- Difficulty in integrating advanced analytics solutions with legacy systems: Integrating advanced analytics solutions with legacy systems can be complex and challenging. Compatibility issues can arise, hindering seamless data flow and analysis.

- High implementation costs: The initial investment required for implementing advanced analytics solutions, including software, hardware, and skilled personnel, can be prohibitively high for some organizations.

- Lack of standardization in advanced analytics solutions: The lack of standardization in advanced analytics solutions can lead to interoperability issues and difficulties in comparing and selecting the most suitable tools and methodologies.

Key Market Trends

- Increasing adoption of AI and ML in advanced analytics solutions: The integration of Artificial Intelligence (AI) and Machine Learning (ML) into advanced analytics solutions is a prominent trend. These technologies enhance the capabilities of analytics tools, enabling more accurate predictions and insights.

- Growing demand for real-time analytics: Real-time analytics is gaining popularity as organizations seek to make immediate decisions based on the latest data. This trend is particularly relevant in dynamic industries such as finance and e-commerce.

- Increasing use of predictive analytics in various industries: Predictive analytics is being embraced across diverse industries, from finance to healthcare. Its ability to forecast future events and trends is driving its adoption for strategic decision-making.

- Growing popularity of cloud-based advanced analytics solutions: Cloud-based advanced analytics solutions are becoming increasingly popular due to their flexibility, scalability, and accessibility, aligning with the evolving needs of modern businesses.

Regional Analysis

North America accounted for over 46.0% of global advanced analytics in 2021. This can be attributed both to the existence of supporting infrastructure for cutting-edge analytics, and the increased adoption of advanced technologies like AI and machine learning.

Microsoft Corporation announced, for example, a partnership with Consumer Value Store Health (CVS Health), which is a healthcare solution provider, in December 2021 to develop innovative solutions that help consumers improve their overall health. CVS Health would use Azure cognitive services like Computer Vision or Text Analytics for Health for automating tasks. Azure services would help CVS Health accelerate its digital transformation. They will allow the company to expand its multi-cloud presence by adding over 1,500 new business applications to its cloud.

Asia Pacific is expected to grow at a significant CAGR of 23.5% over the forecast period. The adoption of big data analytics tools in the region has driven the growth of this market. Numerous enterprises in the region are investing in customer analytics in order to improve their productivity and business efficiency.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A handful of large players dominate this market. The market has seen a shift in recent years due to the rise of niche players providing industry-specific solutions. In order to improve their products, companies often engage in mergers, purchases, and partnerships. To acquire new customers, companies are constantly improving their products.

Top Kеу Рlауеrѕ:

- Medtronic Plc.

- Koninklijke Philips N.V.

- GE Healthcare

- Stanley Healthcare

- Siemens AG

- Athenahealth

- Allscripts Healthcare Solutions Inc.

- Microsoft Corporation

- SAP SE

- Samsung Healthcare

- Honeywell International Inc.

- Other Key Players

Market News

Acquisitions

- IBM acquires Instana: In October 2023, IBM acquired Instana, a leading application performance monitoring (APM) company, for an estimated $3.6 billion. This move strengthens IBM’s AIOps capabilities and allows it to offer comprehensive monitoring and analytics solutions for hybrid and multi-cloud environments.

- SAP acquires Qualtrics: In January 2023, SAP acquired Qualtrics for $8 billion, marking one of the largest acquisitions in the analytics space. This deal gives SAP a powerful platform for experience management (XM) and helps it compete with the likes of Salesforce and Microsoft in the CRM market.

- Snowflake acquires Iguazio: In September 2023, Snowflake acquired Iguazio, a data science platform provider, for $535 million. This acquisition expands Snowflake’s data cloud offering and its capabilities in areas like data governance and machine learning.

New Trends

- Rise of edge computing: As more data is generated at the edge of the network, edge analytics solutions are becoming increasingly important. These solutions can process data locally before sending it to the cloud for further analysis, providing faster insights and reducing latency.

- Focus on explainability and interpretability: With advanced analytics models becoming more complex, there is a growing demand for solutions that can explain how these models arrive at their conclusions. This is particularly important in areas like healthcare and finance, where decisions based on analytics can have significant consequences.

- Democratization of data and analytics: There is a growing trend towards making data and analytics tools more accessible to non-technical users. This is driven by the need for businesses to empower all employees to make data-driven decisions.

Company News

- Microsoft launches Azure Synapse Analytics: Microsoft announced the general availability of Azure Synapse Analytics, a unified data platform that integrates data warehousing, big data analytics, and machine learning capabilities. This move positions Microsoft as a strong contender in the cloud analytics market.

- Google Cloud unveils Vertex AI: Google Cloud introduced Vertex AI, a unified platform for machine learning (ML) development and deployment. This platform offers a comprehensive set of tools and services for building, training, and deploying ML models.

- Palantir expands into commercial markets: Palantir, known for its work with government agencies, has been making inroads into the commercial market. The company has secured deals with major airlines and financial institutions, highlighting the growing demand for its advanced analytics solutions.

Report Scope

Report Features Description Market Value (2023) US$ 54.6 Bn Forecast Revenue (2032) US$ 473.1 Bn CAGR (2023-2032) 24.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Big Data Analytics, Risk Analytics, Customer Analytics, Business Analytics, and Others Types), By Deployment Mode (Cloud and On-premise), By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By End-Use (BFSI, IT & Telecom, Healthcare, Military & Defense, and Other End-Uses) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Medtronic Plc., Koninklijke Philips N.V., GE Healthcare, Stanley Healthcare, Siemens AG, Athenahealth, Allscripts Healthcare Solutions Inc., Microsoft Corporation, SAP SE, Samsung Healthcare, Honeywell International Inc., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Advanced Analytics Market?The Advanced Analytics Market refers to the industry that provides sophisticated data analysis tools and solutions to extract valuable insights, patterns, and trends from complex datasets, enabling organizations to make informed decisions.

What is the use of advanced analytics?Advanced analytics is used to analyze large and complex datasets to uncover patterns, trends, and insights that traditional analytics may not capture. Its applications span various industries, including marketing, finance, healthcare, and more, helping organizations make data-driven decisions, predict future outcomes, optimize processes, and enhance overall business performance.

What drives the growth of the Advanced Analytics Market?The market's growth is propelled by factors such as the increasing adoption of big data and related technologies, the emergence of Machine Learning (ML) and Artificial Intelligence (AI), the need to prevent fraudulent activities, and the rising demand for data-driven decision-making across various business functions.

How do Machine Learning and Artificial Intelligence impact the Advanced Analytics Market?Machine Learning (ML) and Artificial Intelligence (AI) play a transformative role by revolutionizing customer experiences, providing personalized offerings, recommendations, and services. These technologies contribute to the market's evolution by enhancing data analysis capabilities.

-

-

- Medtronic Plc.

- Koninklijke Philips N.V.

- GE Healthcare

- Stanley Healthcare

- Siemens AG

- Athenahealth

- Allscripts Healthcare Solutions Inc.

- Microsoft Corporation

- SAP SE

- Samsung Healthcare

- Honeywell International Inc.

- Other Key Players