Global Adult Incontinence Products Market Size, Share, Growth Analysis By Product Type (Adult Diapers, Protective Underwear, Pads & liners, Others), By Consumer Group (Female, Male, Unisex), By Age Group (Seniors (65 & above), Young Adults (20-39), Middle-aged Adults (40-64)), By Category (Disposable, Reusable), By Size (Medium, Small, Large, Extra large), By Distribution Channel (Pharmacies, Supermarkets & Hypermarkets, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168130

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Consumer Group Analysis

- Age Group Analysis

- Category Analysis

- Size Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Adult Incontinence Products Company Insights

- Recent Developments

- Report Scope

Report Overview

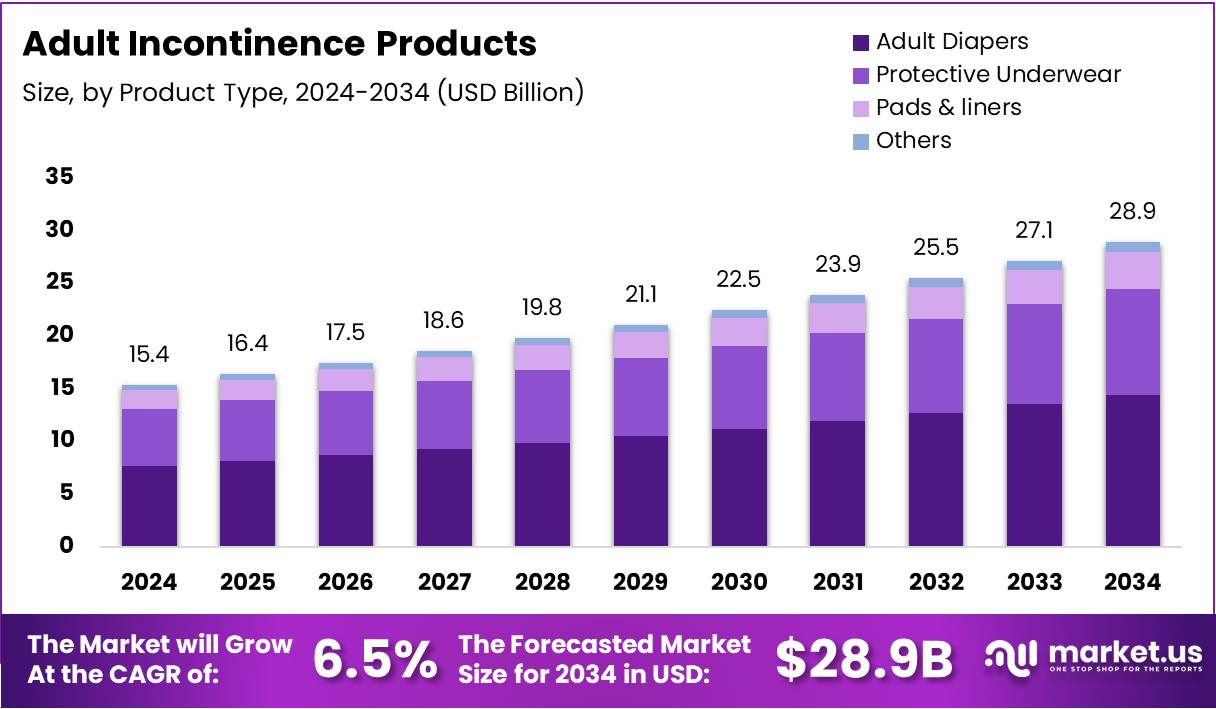

The Global Adult Incontinence Products Market size is expected to be worth around USD 28.9 Billion by 2034, from USD 15.4 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The Adult Incontinence Products Market represents a fast-expanding hygiene category that supports individuals managing bladder or bowel control challenges. It includes pads, briefs, protective underwear, and skin-friendly essentials designed to improve comfort and mobility. Moreover, rising awareness and better product availability are encouraging consumers to choose discreet, easy-to-use incontinence care solutions.

The Adult Incontinence Products sector continues gaining traction as ageing populations expand across major economies. Growing life expectancy and shifting lifestyle patterns are prompting consumers to prefer high-absorbency materials, breathable fabrics, and odor-control technologies. As a result, demand for innovative incontinence pads, pull-ups, and underpads is strengthening across home-care and institutional settings.

Furthermore, this market benefits from increasing government attention on elderly wellbeing and long-term care. Public health agencies are investing in community programmes that promote hygiene support and accessible healthcare. Consequently, reimbursement frameworks and improved care guidelines are helping more adults access essential incontinence solutions. These measures are also encouraging suppliers to enhance product safety, comfort, and sustainability.

Simultaneously, several growth opportunities are emerging as healthcare facilities upgrade patient-care standards. Rising adoption of eco-friendly materials, biodegradable pads, and dermatologically tested solutions is shaping new demand patterns. Besides, hospitals and nursing homes are prioritizing leakage-protection products that reduce infection risks and support better hygiene outcomes, creating room for premium-quality offerings.

Moreover, regulatory bodies are pushing for higher product performance, skin-compatibility benchmarks, and more transparent labeling. These evolving rules are guiding manufacturers to improve absorbency levels, airflow design, and anti-bacterial features. Thus, companies are focusing on consumer comfort, nighttime protection, and gender-specific product fit to strengthen long-term market penetration.

Toward the end, rising prevalence levels are also influencing market expansion. According to report, 14 million people in the UK are living with some degree of urinary incontinence, highlighting strong product need. Similarly, research shows 10%–30% of women below 64 face urinary incontinence, while 15%–30% of individuals above 65 experience it.

Finally, institutional demand remains significant as studies estimate that 50% or more of nursing-home residents experience fecal incontinence. These indicators reinforce the sustained requirement for absorbent products, hygiene pads, and protective underwear, supporting continuous growth across the Adult Incontinence Products Market.

Key Takeaways

- The global Adult Incontinence Products Market is expected to reach USD 28.9 Billion by 2034, growing from USD 15.4 Billion in 2024 at a CAGR of 6.5%.

- Adult Diapers dominate the market with a 49.8% share among product types.

- Female consumers lead with a 59.6% market share by consumer group.

- Seniors (65 & above) represent 69.9% of the market by age group.

- Disposable products hold 91.2% of the market within the category segment.

- Medium size products capture 41.3% market share by size.

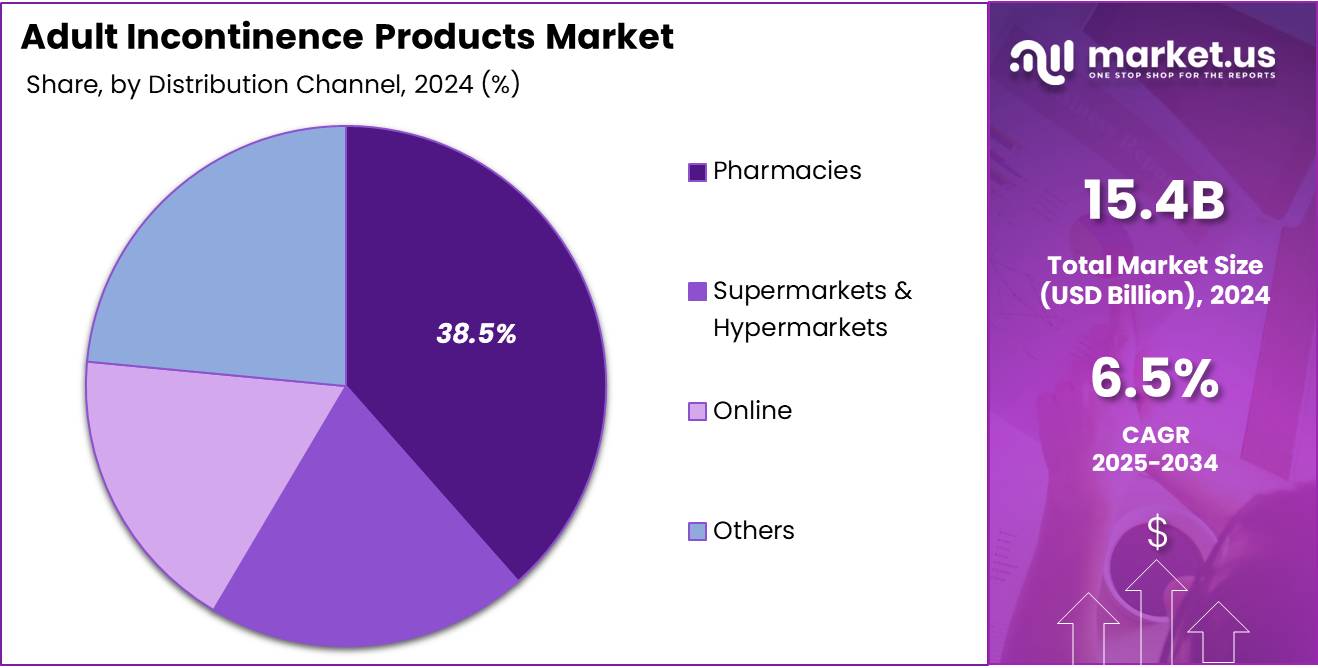

- Pharmacies account for 38.5% of the market in distribution channels.

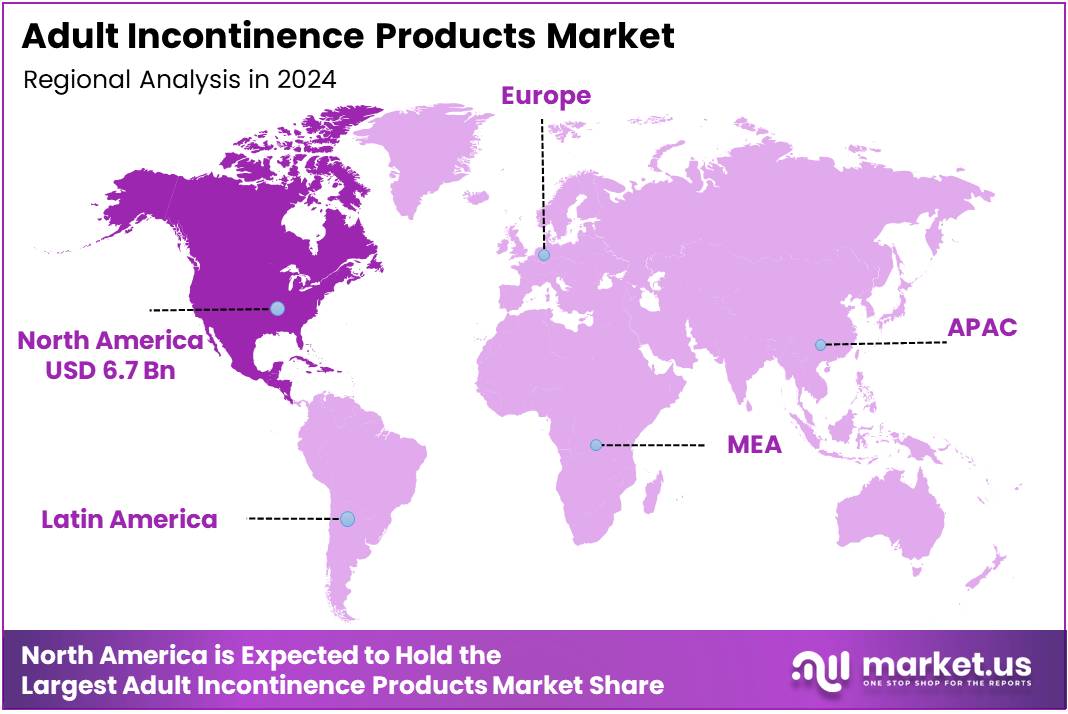

- North America dominates the market with 43.6% share, valued at USD 6.7 Billion.

Product Type Analysis

Adult Diapers dominates with 49.8% due to superior absorbency and full coverage protection.

Adult Diapers command the largest market share at 49.8%, establishing themselves as the preferred choice for managing severe incontinence. These products offer maximum absorbency capacity and comprehensive leak protection, making them ideal for individuals with complete loss of bladder control. Their tab-style design ensures secure fitting and easy caregiving, particularly benefiting bedridden patients and those requiring extended wear. The segment’s dominance reflects growing awareness about maintaining dignity and comfort among users with moderate to heavy incontinence needs.

Protective Underwear represents a significant segment, appealing to active adults seeking discreet solutions. These pull-up style products resemble regular underwear, providing psychological comfort alongside functional protection. They enable users to maintain independence and confidence during daily activities while managing light to moderate incontinence effectively.

Pads & Liners cater to consumers experiencing mild incontinence or occasional leakage. Their slim profile and compatibility with regular underwear make them popular among working professionals and socially active individuals. These products offer cost-effective protection without compromising mobility or discretion.

Others include specialized products like underpads, bedding protection, and skin care items that complement primary incontinence solutions, addressing diverse consumer requirements across various care settings.

Consumer Group Analysis

Female consumers dominates with 59.6% due to physiological factors and higher incontinence prevalence.

Female consumers represent 59.6% of the market, reflecting the higher prevalence of incontinence among women across age groups. Biological factors including pregnancy, childbirth, menopause, and pelvic floor weakening contribute significantly to this dominance. Women demonstrate greater willingness to seek solutions and discuss incontinence issues, driving product innovation tailored to female anatomy. The segment benefits from targeted marketing campaigns and product designs that prioritize discretion, comfort, and feminine aesthetics.

Male consumers constitute a substantial portion, primarily driven by prostate-related conditions and age-related bladder control issues. The segment witnesses growing acceptance as stigma around male incontinence diminishes. Manufacturers increasingly develop anatomically appropriate products featuring masculine designs and enhanced absorbency in frontal areas, encouraging more men to adopt these solutions confidently.

Unisex products serve diverse needs across gender identities and preferences. These versatile options provide practical solutions for caregiving facilities, hospitals, and consumers seeking flexible alternatives. The segment emphasizes functionality over gender-specific design, offering economical choices for institutional buyers and individuals prioritizing performance over personalized aesthetics in their incontinence management approach.

Age Group Analysis

Seniors (65 & above) dominates with 69.9% due to age-related physiological changes and chronic conditions.

Seniors (65 & above) account for an overwhelming 69.9% market share, reflecting the natural correlation between aging and incontinence prevalence. Age-related muscle weakening, neurological changes, and chronic conditions like diabetes and dementia significantly increase incontinence likelihood among elderly populations. This demographic requires high-absorbency products with extended wear capabilities, driving demand for premium adult diapers and protective underwear. The segment’s dominance also reflects growing geriatric populations globally and increased life expectancy rates.

Young Adults (20-39) represent an emerging consumer base experiencing incontinence due to postpartum complications, sports injuries, neurological disorders, or developmental disabilities. This segment prioritizes discreet, lifestyle-compatible products that don’t interfere with professional and social activities. Manufacturers target these consumers with slim-fit designs and modern branding that reduces embarrassment and encourages early intervention.

Middle-aged Adults (40-64) face incontinence challenges stemming from hormonal changes, surgical procedures, obesity, and stress-related factors. This demographic values product reliability and discretion while maintaining active lifestyles. They demonstrate strong purchasing power and preference for quality products that balance performance with comfort, driving innovation in premium protective underwear categories.

Category Analysis

Disposable products dominates with 91.2% due to convenience and hygiene advantages.

Disposable incontinence products command an impressive 91.2% market share, driven by unmatched convenience and superior hygiene standards. These single-use products eliminate laundering requirements, reduce infection risks, and offer consistent absorbency performance. Their popularity spans institutional settings including hospitals, nursing homes, and home healthcare where sanitation protocols demand disposable solutions. Consumers appreciate the hassle-free disposal and time savings, particularly caregivers managing multiple patients or family members with demanding schedules. Technological advancements in super-absorbent polymers and odor-control systems further strengthen this segment’s market position.

Reusable incontinence products serve environmentally conscious consumers and budget-focused households managing long-term incontinence. These washable alternatives reduce ongoing costs and environmental waste, appealing to sustainability-minded users. Modern reusable products feature improved absorbent fabrics, waterproof barriers, and aesthetic designs that rival disposable options. Despite representing a smaller market share, this segment experiences steady growth among consumers seeking eco-friendly solutions. Healthcare facilities also utilize reusable underpads and protective bedding to balance cost management with environmental responsibility while maintaining adequate patient care standards.

Size Analysis

Medium size dominates with 41.3% due to its suitability for average body types.

Medium size products capture 41.3% market share, aligning with standard body dimensions across diverse populations. This sizing category accommodates typical waist measurements ranging from 34 to 44 inches, fitting the majority of adult consumers requiring incontinence solutions. Manufacturers prioritize medium-size production, ensuring widespread availability across distribution channels and competitive pricing through economies of scale. The segment’s dominance simplifies inventory management for retailers while meeting mainstream consumer needs effectively.

Small size products cater to petite individuals and those with slighter builds, particularly among elderly populations experiencing age-related weight loss. This segment ensures proper fit and leak prevention for consumers whom larger sizes would inadequately serve. Proper sizing prevents gaps and ensures absorbent materials contact skin appropriately for maximum effectiveness.

Large size options address growing obesity rates and consumers with fuller figures. These products feature enhanced absorbency zones and reinforced leg elastics to accommodate larger waist circumferences while maintaining comfort and security during movement.

Extra Large sizes serve bariatric patients and individuals requiring specialized fitting solutions. This segment reflects manufacturers’ commitment to inclusive product ranges, ensuring dignity and protection for all body types within the incontinence care market.

Distribution Channel Analysis

Pharmacies dominates with 38.5% due to professional guidance and immediate product availability.

Pharmacies lead distribution channels with 38.5% market share, offering consumers professional consultation alongside product purchases. Pharmacists provide valuable guidance on product selection, sizing, and usage, building trust among first-time buyers and those managing complex incontinence conditions. These establishments ensure immediate product availability for urgent needs while maintaining discrete purchasing environments. Insurance reimbursement processing and prescription medication pickups create convenient one-stop shopping experiences, encouraging consumers to purchase incontinence supplies during routine pharmacy visits.

Supermarkets & Hypermarkets provide accessible purchasing options integrated into regular grocery shopping routines. These large-format retailers offer competitive pricing, bulk purchase options, and diverse brand selections under one roof. Consumers appreciate the convenience of adding incontinence products to weekly shopping baskets without separate store visits, reducing purchasing stigma through normalized retail environments.

Online channels experience rapid growth, offering unparalleled discretion and home delivery convenience. E-commerce platforms provide detailed product comparisons, customer reviews, and subscription services ensuring never running out of supplies. This channel particularly appeals to younger consumers and caregivers seeking convenient reordering solutions.

Others include specialized medical supply stores, direct-to-consumer programs, and institutional suppliers serving healthcare facilities with bulk procurement needs and specialized product requirements.

Key Market Segments

By Product Type

- Adult Diapers

- Protective Underwear

- Pads & liners

- Others

By Consumer Group

- Female

- Male

- Unisex

By Age Group

- Seniors (65 & above)

- Young Adults (20-39)

- Middle-aged Adults (40-64)

By Category

- Disposable

- Reusable

By Size

- Medium

- Small

- Large

- Extra large

By Distribution Channel

- Pharmacies

- Supermarkets & Hypermarkets

- Online

- Others

Drivers

Aging Global Population Increasing Demand for Incontinence Care

The Adult Incontinence Products Market is growing steadily as the global population continues to age. More adults are living longer, and this shift is increasing the demand for reliable incontinence solutions. As a result, manufacturers are focusing on products that offer comfort, convenience, and dignity to elderly users. This trend is becoming a key market driver.

Moreover, the rising number of chronic diseases is contributing to higher incidences of urinary incontinence. Conditions such as diabetes, mobility disorders, and neurological issues often lead to bladder control challenges. This is pushing healthcare providers to recommend advanced incontinence products for long-term use, strengthening market adoption across both home care and clinical settings.

Additionally, ongoing technological advancements are transforming the quality of adult incontinence products. Companies are developing solutions with improved absorbency, better odor control, and enhanced skin protection. Features like breathable fabrics, slim designs, and smart moisture indicators are making products more comfortable and discreet. These innovations are helping consumers shift from traditional solutions to more efficient and skin-friendly products.

Restraints

Rising Environmental Concerns Over Disposable Adult Incontinence Products

Growing environmental worries are becoming a major restraint for the adult incontinence products market. Many products are made using non-biodegradable materials, which add to landfill waste. As sustainability becomes a key priority for consumers and regulators, brands face pressure to shift toward eco-friendly designs. This transition can slow market growth because developing greener products often requires higher costs and longer innovation cycles. As a result, manufacturers must balance performance, affordability, and environmental responsibility to remain competitive.

At the same time, social stigma around incontinence continues to limit wider product adoption. Many adults hesitate to seek help or openly discuss their needs due to embarrassment. This lack of awareness leads to delayed treatment and lower usage of appropriate products. In several regions, education about incontinence management remains limited, reducing market penetration. Overcoming these barriers requires stronger awareness campaigns and better community-level guidance. Healthcare professionals play a key role in normalizing conversations and supporting product use.

Growth Factors

Development of Eco-Friendly and Biodegradable Incontinence Products Drives Market Growth

The adult incontinence products market is witnessing strong opportunities as consumers show growing interest in eco-friendly solutions. Many users now prefer products made from biodegradable materials, creating room for innovation in sustainable pads, briefs, and liners. This shift encourages manufacturers to develop products that reduce waste while maintaining comfort and protection.

Additionally, the integration of smart technology presents another major opportunity. Digital monitoring tools, such as wearable sensors, are helping caregivers track moisture levels and product usage more accurately. These solutions improve hygiene, reduce skin issues, and support better care management. As digital health adoption continues to rise, tech-enabled incontinence products are expected to attract both healthcare providers and home-care users.

The market is also benefiting from rising demand for gender-specific and age-specific products. Consumers increasingly look for solutions that fit their body type, lifestyle, and comfort preferences. Products tailored for men, women, and different age groups provide improved fit, better absorbency, and greater confidence for users. This trend supports broader product diversification and helps brands target specific consumer segments more effectively.

Emerging Trends

Growing Popularity of Ultra-Thin and Discreet Solutions Drives Market Trends

The adult incontinence products market is witnessing strong momentum as consumers increasingly prefer ultra-thin and discreet diaper designs. This shift is driven by the need for comfort, flexibility, and confidence in social settings. Brands are focusing on slim profiles and advanced absorbent materials that offer better performance without bulkiness, making these products more appealing for daily use.

Additionally, e-commerce platforms are transforming how consumers purchase incontinence solutions. The rise of direct-to-consumer channels is creating easier access and wider product choices. Online retailers offer doorstep delivery, subscription models, and discreet packaging, encouraging more people to buy regularly. This trend is reshaping buying behavior, especially among tech-friendly and convenience-focused shoppers.

There is also a growing focus on fragrance-free and sensitive-skin formulations as consumers become more aware of skin health. People are demanding products made with gentle materials, free from dyes and irritants. Manufacturers are responding by launching dermatologically tested variants that reduce the risk of rashes and allergies. This shift toward skin-friendly options is strengthening customer trust and supporting long-term usage.

Regional Analysis

North America Dominates the Adult Incontinence Products Market with a Market Share of 43.6%, Valued at USD 6.7 Billion

North America maintains a commanding position in the global adult incontinence products market, holding a market share of 43.6% with a valuation of USD 6.7 billion. The region’s dominance is primarily attributed to the rapidly aging population, with the baby boomer generation entering their senior years, coupled with increasing awareness about incontinence management and personal hygiene. The United States leads the regional market, driven by well-established healthcare infrastructure, high healthcare expenditure, favorable reimbursement policies for incontinence products, and the presence of major retail distribution channels. Additionally, reduced social stigma surrounding incontinence issues and growing acceptance of these products as essential healthcare items have significantly boosted market penetration across diverse age groups and demographics.

Europe Adult Incontinence Products Market Trends

Europe represents a significant market for adult incontinence products, characterized by one of the world’s oldest populations and advanced healthcare systems. The region benefits from comprehensive social welfare programs and government initiatives that provide subsidies or reimbursements for incontinence products, making them more accessible to consumers. Countries such as Germany, France, and the United Kingdom are key contributors to market growth, supported by increasing healthcare awareness, rising disposable incomes, and a strong emphasis on quality of life for elderly citizens. The European market is also witnessing innovation in product design, with manufacturers focusing on discreet, comfortable, and environmentally sustainable options to cater to the evolving preferences of health-conscious consumers.

Asia Pacific Adult Incontinence Products Market Trends

The Asia Pacific region is emerging as the fastest-growing market for adult incontinence products, driven by rapidly aging populations in countries like Japan, China, and South Korea, combined with improving healthcare infrastructure and rising disposable incomes. Japan stands out as a mature market with high product adoption rates due to its super-aged society, while China and India present enormous growth potential with their large elderly populations and increasing awareness about incontinence care. The region is experiencing a gradual shift in cultural attitudes toward discussing and addressing incontinence issues, supported by government healthcare initiatives, expansion of modern retail channels, and growing penetration of international brands offering innovative and affordable product solutions.

Middle East and Africa Adult Incontinence Products Market Trends

The Middle East and Africa region represents an emerging market for adult incontinence products, with growth driven by improving healthcare infrastructure, increasing awareness about personal hygiene, and gradual economic development across key nations. The Gulf Cooperation Council countries, particularly Saudi Arabia and the UAE, are witnessing higher adoption rates due to better healthcare facilities, rising expatriate populations, and increasing healthcare spending. However, the market faces challenges including cultural sensitivities surrounding incontinence discussions, limited distribution networks in remote areas, and affordability concerns in several African nations. Despite these barriers, urbanization, growing medical tourism, and government initiatives to enhance healthcare accessibility are creating opportunities for market expansion in the region.

Latin America Adult Incontinence Products Market Trends

Latin America is experiencing steady growth in the adult incontinence products market, propelled by an aging demographic profile, increasing urbanization, and improving healthcare awareness across the region. Brazil and Mexico are the primary markets, benefiting from expanding middle-class populations, growing retail infrastructure, and rising consumer spending on healthcare and personal care products. The region is witnessing increased product availability through pharmacies, supermarkets, and e-commerce platforms, making incontinence products more accessible to consumers. However, economic volatility, price sensitivity among consumers, and limited insurance coverage for incontinence products in some countries continue to present challenges, though ongoing public health campaigns and educational initiatives are gradually reducing stigma and encouraging product adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Adult Incontinence Products Company Insights

In 2024, the global Adult Incontinence Products Market continued to evolve as manufacturers focused on comfort, skin-friendly materials, and discreet product formats. Leading companies strengthened their portfolios by improving absorbency technologies and expanding distribution networks across mature and emerging regions.

Abena maintained a strong market presence by focusing on high-quality, eco-conscious incontinence solutions. The company expanded its product line with breathable materials and skin-safe designs, helping it appeal to healthcare institutions seeking reliable and sustainable supplies.

Attends Healthcare strengthened its position by offering a broad range of adult diapers, protective underwear, and pads designed for different mobility levels. Its emphasis on comfort and discreet use supported adoption in both homecare and professional care environments.

B. Braun Melsungen leveraged its healthcare expertise to integrate incontinence care products with wider clinical solutions. Its focus on patient comfort, hygiene, and long-term skin protection helped the brand remain relevant in hospitals and specialty care channels.

Cardinal Health continued to scale its incontinence product offerings through strong distribution capabilities and a diverse medical portfolio. The company benefited from demand in long-term care settings by offering dependable, cost-effective absorbent products with consistent performance.

Top Key Players in the Market

- Abena

- Attends Healthcare

- B. Braun Melsungen

- Cardinal Health

- ConvaTec

- Essity

- First Quality Enterprises

- Hayat Kimya

- Hollister

- Kimberly Clark

Recent Developments

- In May 2025, NorthShore expanded its U.S. manufacturing capacity for premium incontinence products, strengthening its domestic supply capabilities. This move supports faster delivery and wider availability of high-absorbency solutions across key retail and online channels.

- In September 2025, Tulips entered the adult hygiene category with the launch of TULIPS Adult Diaper Pants, marking its strategic diversification into elderly care. The brand aims to capture rising demand for comfortable and discreet incontinence wear in India and nearby markets.

- In February 2025, First Quality Enterprises, LLC signed a definitive agreement to acquire Henkel’s Retailer Brands business in North America, expanding its private-label incontinence and personal care offering. The company also announced plans to establish First Quality Home Care Products, a new division focused on long-term care and home-use hygiene solutions.

- In January 2024, Boston Scientific acquired Axonics, Inc., enhancing its portfolio with advanced technologies for urinary and bowel dysfunction treatment. This acquisition strengthens Boston Scientific’s leadership in urology by integrating Axonics’ minimally invasive and next-gen continence therapy systems.

Report Scope

Report Features Description Market Value (2024) USD 15.4 Billion Forecast Revenue (2034) USD 28.9 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Adult Diapers, Protective Underwear, Pads & liners, Others), By Consumer Group (Female, Male, Unisex), By Age Group (Seniors (65 & above), Young Adults (20-39), Middle-aged Adults (40-64)), By Category (Disposable, Reusable), By Size (Medium, Small, Large, Extra large), By Distribution Channel (Pharmacies, Supermarkets & Hypermarkets, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Abena, Attends Healthcare, B. Braun Melsungen, Cardinal Health, ConvaTec, Essity, First Quality Enterprises, Hayat Kimya, Hollister, Kimberly Clark Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Adult Incontinence Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Adult Incontinence Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abena

- Attends Healthcare

- B. Braun Melsungen

- Cardinal Health

- ConvaTec

- Essity

- First Quality Enterprises

- Hayat Kimya

- Hollister

- Kimberly Clark