Global Active Yaw Control System Market Size, Share, Growth Analysis By Component (Sensors, Actuators, Electronic Control Units, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), By Application (Stability Control, Traction Control, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175079

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

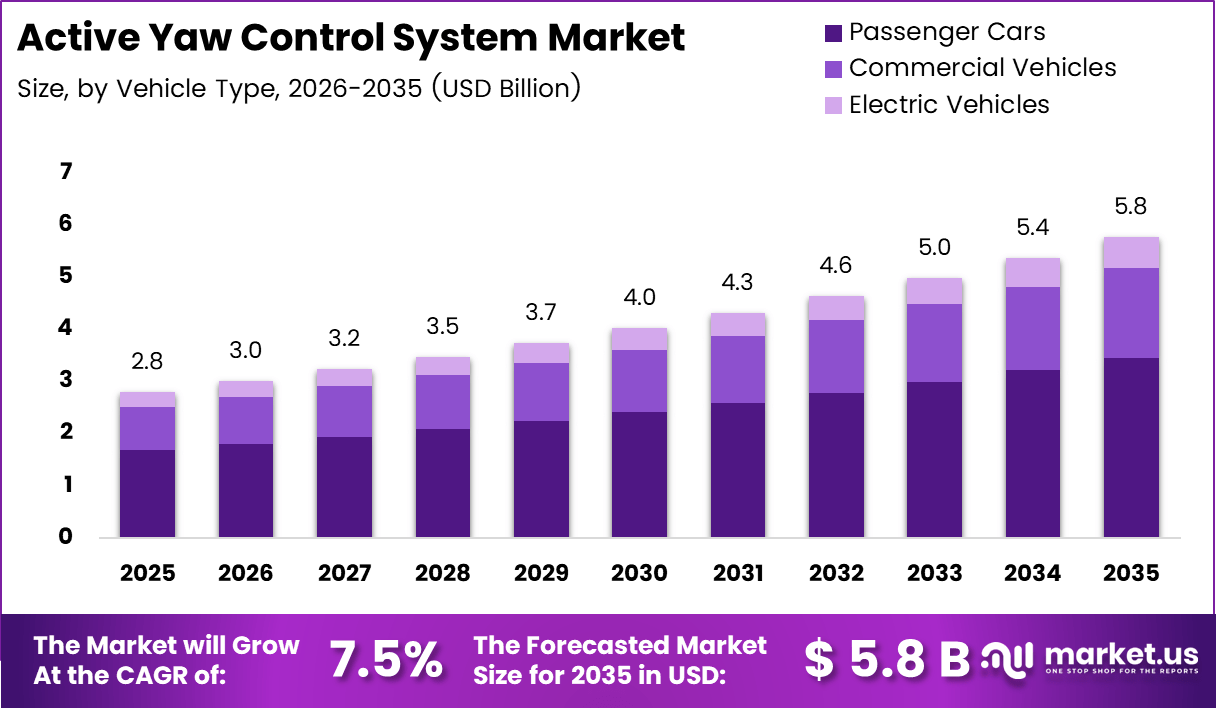

The Global Active Yaw Control System Market size is expected to be worth around USD 5.8 billion by 2035, from USD 2.8 billion in 2025, growing at a CAGR of 7.5% during the forecast period from 2026 to 2035.

The Active Yaw Control System Market represents a specialized segment within advanced vehicle dynamics and Automotive chassis control technologies. It focuses on systems that actively manage torque distribution between wheels to improve vehicle stability. As driving conditions become more complex, this market is increasingly aligned with safety, efficiency, and performance oriented mobility strategies.

From a technology perspective, an active yaw control system uses sensors, control units, and actuators to correct yaw moments during cornering or sudden maneuvers. Consequently, automakers integrate these systems to enhance handling precision. Moreover, the shift toward software driven vehicle architectures supports broader adoption across compact, mid size, and premium vehicle platforms.

Market growth is supported by rising demand for vehicle safety systems and stricter regulatory focus on accident reduction. Governments across major automotive regions emphasize stability control mandates and emission efficiency programs. As a result, active yaw control aligns with public investments in intelligent transportation systems and safer road mobility frameworks.

In commercial terms, the market benefits from electrification trends and modular vehicle platforms. Electric and hybrid drivetrains simplify torque vectoring implementation, improving system responsiveness. Therefore, manufacturers view active yaw control as a value adding feature that enhances driving confidence while supporting compliance with evolving efficiency and safety regulations.

Opportunities continue to emerge through lightweight vehicle design and energy optimization initiatives. According to research, at a speed of 120 km/h, around 18% of total power is lost due to air drag and 6% due to rolling resistance. These inefficiencies encourage system level optimization across powertrain and chassis functions.

Further analysis from the same engineering sources indicates that nearly 76% of power losses originate from exhaust gas at about 30%, engine cooling at about 27%, air charge near 5%, engine friction around 8%, auxiliary drives at 2%, and drivetrain losses near 2%. Such data highlights the need for intelligent torque management.

In hybrid and electric vehicles, studies note that a compact electric motor with roughly 2 kW output can generate wheel differential torque close to 1000 Nm for many applications. Therefore, active yaw control systems become more feasible, cost effective, and scalable, strengthening their role within modern vehicle efficiency and stability strategies.

Key Takeaways

- The Global Active Yaw Control System Market is projected to reach USD 5.8 billion by 2035, growing from USD 2.8 billion in 2025 at a CAGR of 7.5%.

- Sensors led the component segment with a dominant market share of 38.9% in 2025, supported by real-time vehicle dynamics monitoring demand.

- Passenger Cars dominated the vehicle type segment, accounting for a 59.8% market share in 2025 due to higher safety and driving comfort adoption.

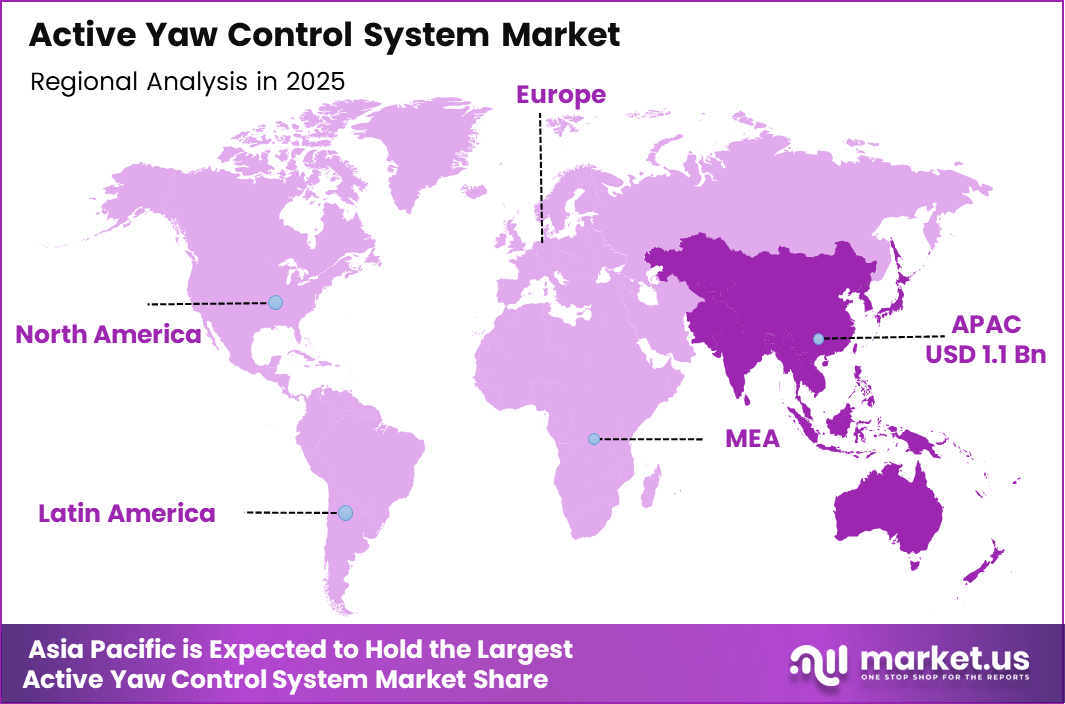

- Asia Pacific held the leading regional position with a 39.5% market share, valued at USD 1.1 billion in 2025.

By Component Analysis

Sensors dominates with 38.9% due to its critical role in real time vehicle dynamics monitoring.

In 2025, Sensors held a dominant market position in the By Component Analysis segment of Active Yaw Control System Market, with a 38.9% share. Sensors continuously measure yaw rate, wheel speed, and steering input. Therefore, they form the foundation of accurate torque correction and stability enhancement across driving conditions.

Actuators play a functional role by executing control commands generated by the system. Consequently, they enable precise torque distribution between wheels during cornering or sudden maneuvers. Their integration supports smoother handling responses, particularly in performance focused and safety driven vehicle architectures.

Electronic Control Units act as the decision making core of active yaw control systems. Moreover, ECUs process sensor data and coordinate actuator responses in milliseconds. This capability supports adaptive control strategies, improving system reliability and alignment with advanced driver assistance frameworks.

Others include wiring, connectors, and supporting hardware essential for system integration. Although smaller in contribution, these components ensure durability and signal integrity. As vehicle platforms evolve, these elements increasingly support modular design and easier system scalability.

By Vehicle Type Analysis

Passenger Cars dominates with 59.8% driven by rising safety expectations and comfort focused driving experience.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Active Yaw Control System Market, with a 59.8% share. Consumers increasingly expect enhanced stability and handling. Therefore, automakers integrate active yaw control to differentiate offerings and meet safety oriented purchasing behavior.

Commercial Vehicles adopt active yaw control to improve load stability and driver confidence. Consequently, fleet operators value reduced accident risks and improved vehicle control under varying cargo conditions. Adoption remains selective but continues to grow with safety regulation awareness.

Electric Vehicles increasingly support active yaw control integration due to flexible drivetrain layouts. Moreover, electric powertrains enable faster torque modulation. This compatibility enhances system efficiency and aligns with broader electrification driven vehicle control strategies.

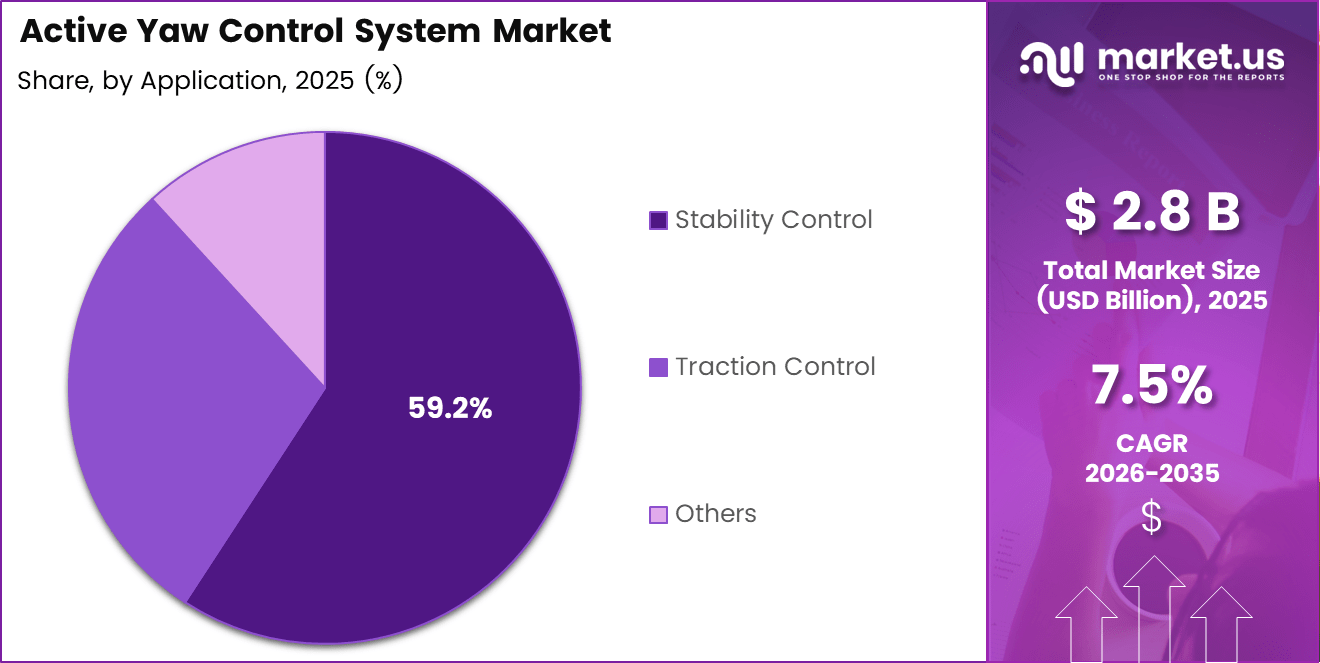

By Application Analysis

Stability Control dominates with 59.2% due to its direct impact on vehicle safety and handling performance.

In 2025, Stability Control held a dominant market position in the By Application Analysis segment of Active Yaw Control System Market, with a 59.2% share. Stability focused applications actively correct yaw deviations. Therefore, they reduce skidding risks and improve driver control during emergency maneuvers.

Traction Control applications complement yaw control by managing wheel slip during acceleration. Consequently, they enhance grip on low friction surfaces. This integration supports consistent vehicle behavior across diverse road and weather conditions.

Others include performance tuning and advanced handling optimization applications. These uses focus on driving dynamics rather than safety alone. As driving assistance technologies mature, such applications gain relevance in premium and performance oriented segments.

By Sales Channel Analysis

OEM dominates with 88.4% supported by factory level integration and regulatory compliance needs.

In 2025, OEM held a dominant market position in the By Sales Channel Analysis segment of Active Yaw Control System Market, with a 88.4% share. Vehicle manufacturers integrate systems during production. Therefore, they ensure calibration accuracy, reliability, and alignment with safety standards.

The Aftermarket segment serves replacement and upgrade needs for existing vehicles. However, adoption remains limited due to installation complexity. Still, demand exists among performance focused users seeking enhanced handling and stability characteristics.

Key Market Segments

By Component

- Sensors

- Actuators

- Electronic Control Units

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

By Application

- Stability Control

- Traction Control

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Integration of Advanced Vehicle Dynamics Control Systems Drives Market Growth

The active yaw control system market is driven by the rising use of advanced vehicle dynamics control systems, especially in premium and performance vehicles. Automakers increasingly integrate these systems to improve vehicle handling, balance, and responsiveness during cornering and sudden maneuvers. As driving expectations rise, manufacturers focus on delivering smoother and safer performance at higher speeds.

Regulatory emphasis on electronic stability control and rollover prevention also supports market growth. Safety authorities across major automotive markets encourage or mandate technologies that reduce loss of control during sharp turns or emergency situations. Active yaw control directly supports these goals by maintaining directional stability and reducing oversteer or understeer risks.

Consumer demand for confident driving experiences further accelerates adoption. Drivers increasingly value stability, precision, and control, particularly on highways and winding roads. Active yaw control enhances these qualities, making vehicles feel more predictable and secure under dynamic driving conditions.

OEMs also view intelligent chassis systems as a way to differentiate their vehicle platforms. By offering advanced yaw control, manufacturers position their models as technologically superior, supporting brand value and customer loyalty in competitive segments.

Restraints

High System Cost Limits Wider Market Adoption

One key restraint in the active yaw control system market is the high system cost. These systems rely on advanced sensors, actuators, and real-time control software, all of which increase vehicle production expenses. As a result, adoption remains concentrated in higher-end vehicle segments rather than mass-market models.

The cost challenge becomes more visible for price-sensitive regions and entry-level vehicles. Automakers must balance added safety and performance benefits against overall vehicle affordability. This often delays large-scale deployment despite growing interest in advanced handling technologies.

System complexity also acts as a restraint. Active yaw control requires precise calibration to match each vehicle’s weight, suspension layout, and drivetrain characteristics. Integrating the system across different vehicle architectures increases development time and engineering effort.

For OEMs with diverse model portfolios, managing multiple calibrations and ensuring consistent performance can be challenging. This complexity slows adoption, especially for manufacturers aiming to streamline platforms and reduce engineering costs.

Growth Factors

Expanding Adoption in Electric Vehicles Creates New Growth Opportunities

The growing adoption of electric and hybrid vehicles presents strong growth opportunities for active yaw control systems. Electric powertrains allow faster and more precise torque adjustments, making yaw control more effective and easier to implement. This aligns well with the performance and safety goals of modern electric vehicles.

The rise of autonomous and semi-autonomous driving systems also supports market expansion. Active yaw control enhances vehicle stability during automated lane changes, obstacle avoidance, and emergency braking. As automation levels increase, stable vehicle motion becomes a critical requirement.

Motorsports-inspired performance road vehicles further drive demand. Automakers increasingly transfer racing technologies into consumer vehicles to enhance brand appeal and driving excitement. Active yaw control fits well into this strategy.

Technological progress is also enabling software-defined and modular yaw control solutions. These designs simplify upgrades and integration, encouraging wider adoption across multiple vehicle platforms.

Emerging Trends

Integration with Intelligent Chassis Systems Shapes Market Trends

One major trend in the active yaw control system market is the shift toward brake-based yaw control combined with torque vectoring. This approach improves handling while reducing reliance on complex mechanical components, supporting efficiency and cost optimization.

Integration with AI-driven vehicle motion management software is another key trend. Advanced algorithms analyze driving conditions in real time and adjust yaw control strategies instantly. This improves responsiveness and supports adaptive driving modes.

Sensor technology is also evolving. The use of high-precision MEMS and AMR sensors enables more accurate yaw detection and faster system response. Improved sensing directly enhances control accuracy and driving safety.

Collaboration between chassis system suppliers and automotive OEMs is increasing. Joint development efforts help align hardware and software innovations, accelerating commercialization and ensuring system reliability across diverse vehicle models.

Regional Analysis

Asia Pacific Dominates the Active Yaw Control System Market with a Market Share of 39.5%, Valued at USD 1.1 Billion

Asia Pacific held a dominant position in the active yaw control system market, accounting for 39.5% share and reaching a valuation of USD 1.1 Billion. Growth in this region is driven by expanding automotive production, rising adoption of advanced vehicle stability technologies, and increasing regulatory emphasis on safety and efficiency. Rapid electrification of vehicles and integration of electronic control systems further support demand across passenger and commercial segments. The presence of large manufacturing bases and cost-efficient supply chains continues to strengthen regional leadership.

North America Active Yaw Control System Market Trends

North America represents a technologically mature market for active yaw control systems, supported by strong demand for premium vehicles and advanced driver assistance features. Adoption is influenced by stringent safety standards and high consumer awareness of vehicle handling and stability. Continuous innovation in electric and autonomous vehicles is reinforcing system integration across new platforms. The region maintains steady growth through upgrades in existing vehicle architectures.

Europe Active Yaw Control System Market Trends

Europe demonstrates consistent demand for active yaw control systems due to strict emission and safety regulations across major economies. Automakers in the region emphasize vehicle dynamics, driving comfort, and performance optimization, supporting system penetration. The transition toward electric mobility and software-driven vehicle platforms is accelerating adoption. Strong regulatory alignment continues to shape long-term market expansion.

Middle East and Africa Active Yaw Control System Market Trends

The Middle East and Africa market is at a developing stage, with gradual adoption of advanced vehicle control technologies. Demand is supported by rising imports of high-end vehicles and increasing focus on road safety initiatives. Infrastructure development and modernization of transport fleets contribute to market potential. Growth remains moderate but is expected to strengthen with improving automotive ecosystems.

Latin America Active Yaw Control System Market Trends

Latin America shows emerging opportunities for active yaw control systems, driven by improving automotive manufacturing capabilities and rising safety awareness. Adoption is primarily concentrated in higher-end vehicle segments and urban markets. Economic recovery and regulatory progress are supporting gradual system integration. The region is expected to experience steady, long-term growth as vehicle technologies advance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Active Yaw Control System Company Insights

The global Active Yaw Control System market in 2025 is seeing strategic innovation and competitive positioning from leading automotive technology suppliers.

Continental AG continues to leverage its deep expertise in vehicle dynamics and sensor integration to enhance active yaw control capabilities, focusing on improving safety and handling. Continental’s emphasis on modular, scalable systems positions it well with both OEMs and aftermarket partners, driving adoption across vehicle segments.

Robert Bosch GmbH remains a cornerstone in advanced chassis control technologies, bringing a systems-level approach that integrates yaw control with stability control and ADAS functionalities. Bosch’s strong R&D investments and global footprint enable rapid iteration and deployment, helping it secure long-term contracts with major global automakers. Their ability to tailor solutions to regional regulatory requirements further strengthens their market position.

ZF Friedrichshafen AG is advancing its active yaw control offerings through a blend of mechanical expertise and electronic control innovations. ZF’s portfolio emphasizes enhanced vehicle dynamics and efficiency, appealing to premium and performance-oriented vehicle manufacturers. The company’s strategic collaborations with EV and hybrid platform developers are expanding its relevance in emerging vehicle architectures, underpinning future growth.

Aisin Seiki Co., Ltd. leverages its comprehensive powertrain and chassis systems know-how to deliver reliable active yaw control modules that integrate seamlessly with braking and steering systems. Aisin’s strong relationships with Japanese and Asian automakers support sustained uptake of its technology, while ongoing optimization efforts focus on cost efficiency and adaptability to diverse vehicle platforms.

Top Key Players in the Market

- Continental AG

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Aisin Seiki Co., Ltd.

- Magna International Inc.

- Hitachi Automotive Systems, Ltd.

- Hyundai Mobis Co., Ltd.

- Nissan Motor Corporation

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- BMW AG

- Volkswagen AG

Recent Developments

- In Oct 2025: announced plans to expand its North American portfolio with a second new model, adding an off-road-focused vehicle alongside the previously revealed new BEV model, strengthening its regional SUV and electrification strategy.

- In May 2024: The company unveiled its North American business roadmap, Momentum 2030, to dealer partners, outlining long-term growth priorities, product diversification, and a renewed focus on electrification and performance-led utility vehicles. Progress under the Momentum 2030 plan began with the launch of the 2025 Outlander SUV, marking a key step in refreshing Mitsubishi’s lineup and reinforcing its commitment to competitive, technology-driven models in the region.

Report Scope

Report Features Description Market Value (2025) USD 2.8 billion Forecast Revenue (2035) USD 5.8 billion CAGR (2026-2035) 7.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Sensors, Actuators, Electronic Control Units, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), By Application (Stability Control, Traction Control, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Magna International Inc., Hitachi Automotive Systems, Ltd., Hyundai Mobis Co., Ltd., Nissan Motor Corporation, Toyota Motor Corporation, Honda Motor Co., Ltd., BMW AG, Volkswagen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Active Yaw Control System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Active Yaw Control System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Continental AG

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Aisin Seiki Co., Ltd.

- Magna International Inc.

- Hitachi Automotive Systems, Ltd.

- Hyundai Mobis Co., Ltd.

- Nissan Motor Corporation

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- BMW AG

- Volkswagen AG