Global Active Pharmaceutical Ingredient Market By Synthesis (Biologic and Synthetic) By Application (Cardiovascular Diseases, Oncology, CNS and Neurology, Orthopedic, Endocrinology, Pulmonology, Gastroenterology, Nephrology, Ophthalmology and Other Applications) By Type (Generic and Innovative) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023–2033

- Published date: Nov 2023

- Report ID: 22857

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

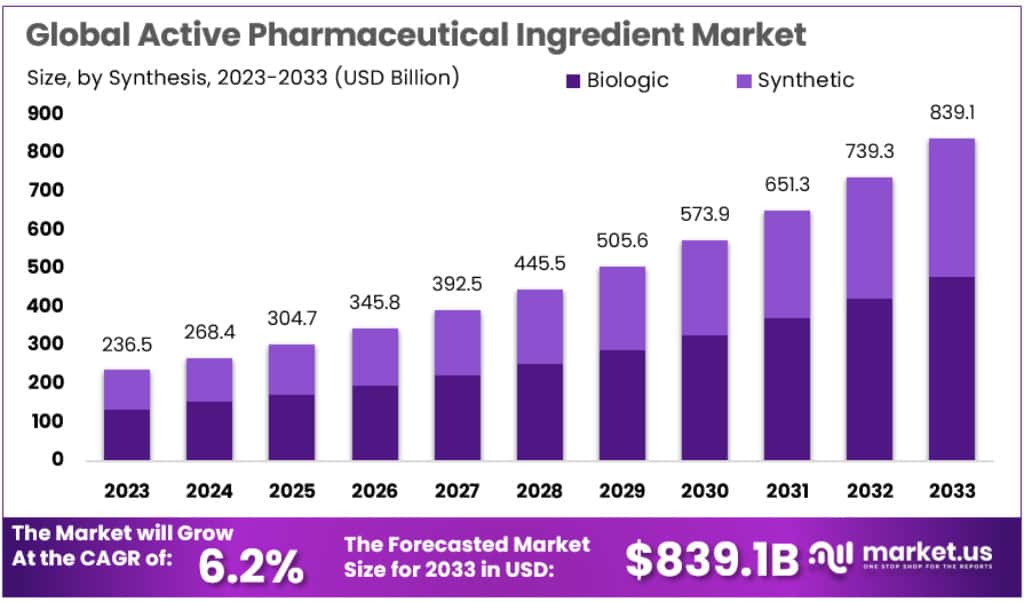

The Global Active Pharmaceutical Ingredient Market size is expected to be worth around USD 839.1 Billion by 2033, from USD 236.5 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

This growth rate is due to advancements in active pharmaceutical ingredients (API) manufacturing as well as the increasing prevalence of chronic infectious.

An Active Pharmaceutical Ingredient (API) is any ingredient that provides biologically active or other direct effect in the diagnosis, cure, mitigation, treatment, or prevention of disease or to affect the structure or any function of the body of humans or animals. The API is the central ingredient in a pharmaceutical drug that produces the intended effects.

APIs are produced from raw materials with a specified strength and chemical concentration. They are the active components in a pharmaceutical drug that produce the required effect on the body to treat a condition. APIs have pharmacological activity mainly used with combination of other ingredients to diagnose, cure, mitigate, and treat the disease.

Key Takeaways

- The API Market size will grow from USD 236.5 Billion in 2023 to about USD 839.1 Billion by 2033.

- The market is expected to grow at a CAGR of 6.2% from 2023 to 2033.

- Synthetic APIs dominate the market with a 68.9% share in 2023.

- Biologic APIs, though smaller in market share, are showing strong growth.

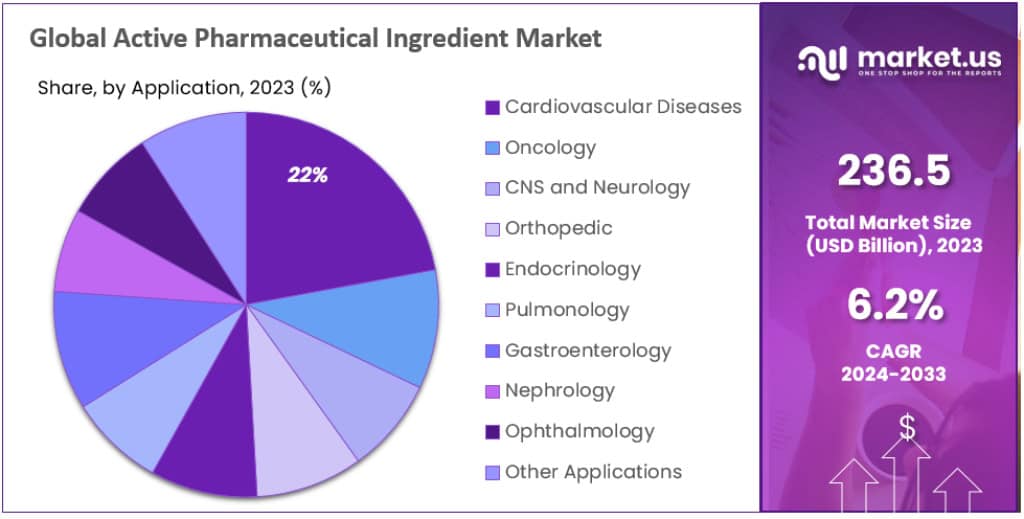

- The cardiovascular diseases segment leads API applications with a 22.1% market share in 2023.

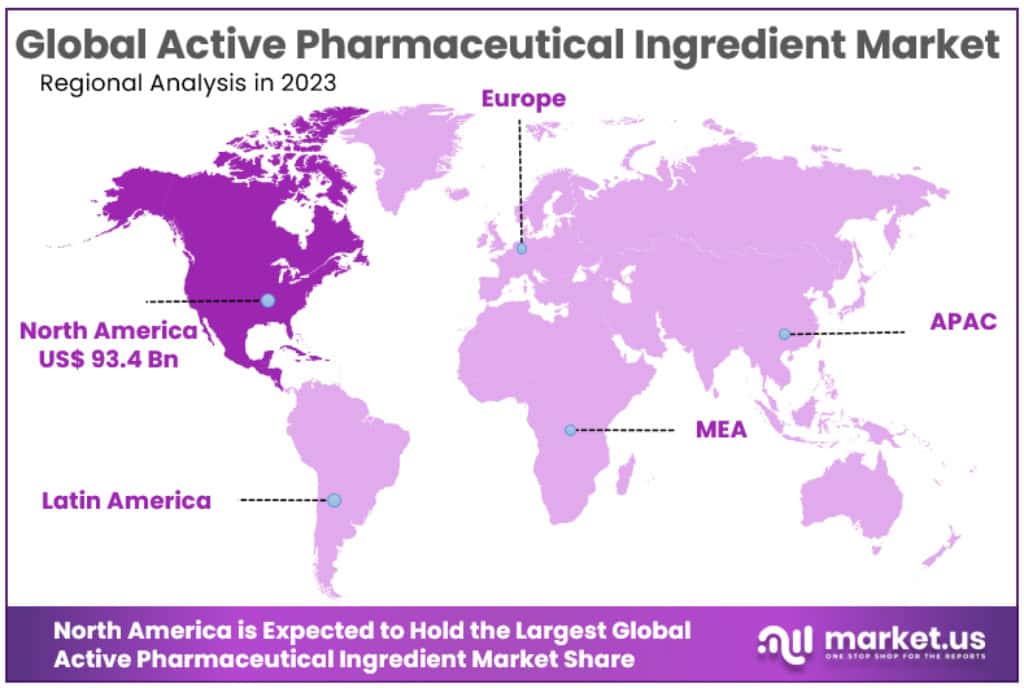

- North America has the largest market revenue share of 39.5% in 2023.

- Asia Pacific is projected to have the fastest growth rate, with a CAGR of 8.4%.

- Europe is also expected to see considerable growth in the API market.

- Innovative APIs hold more than a 54% share of the market in 2023.

- Generic APIs maintain a significant market share due to demand for cost-effective treatment options.

- The US, Canada, and Mexico are significant contributors to the North American market.

- India and China are key players in the Asia Pacific due to their capability to produce APIs at lower costs.

Synthesis Analysis

In 2023, the Synthetic API segment held a dominant market position, capturing more than a 68.9% share. The predominance of synthetic APIs can be attributed to the extensive portfolio of generics and the advanced state of chemical synthesis technology. The production of synthetic APIs benefits from streamlined regulatory pathways and cost-effective manufacturing processes, facilitating their strong market presence.

Conversely, the Biologic API segment, while smaller, is demonstrating robust growth. Advances in biotechnology are driving the expansion of this sector, with biologic APIs gaining traction due to their specificity and efficacy in treating various chronic diseases. The development of biosimilars is further expected to stimulate market growth in this segment, given the expiration of patents for several blockbuster biologics.

Both segments are influenced by the increasing incidence of chronic diseases globally, rising demand for pharmaceuticals, and heightened investment in research and development. As regulatory bodies continue to streamline approval processes, especially for biologics, the market is poised for dynamic evolution. The cautious optimism for the market is further buoyed by the ongoing shift towards personalized medicine, which promises novel opportunities for both synthetic and biologic APIs.

Application Analysis

In 2023, the cardiovascular segment held a dominant market position in the Active Pharmaceutical Ingredient (API) sector, capturing more than a 22.1% share. The segment’s leadership stems from the high global incidence of cardiovascular diseases, coupled with the ongoing introduction of innovative cardiac therapies. The production and development of APIs for cardiovascular conditions remain pivotal due to the persistent need for effective treatment options.

Oncology, as an application segment, is also significant, driven by the rising prevalence of cancer and substantial investments in cancer research. APIs for oncology are experiencing a surge in demand, reflective of the urgency in addressing the diverse and complex nature of cancer diseases.

The CNS and neurology segment is notable for its focus on APIs aimed at addressing disorders such as Alzheimer’s, Parkinson’s, and depression, which are becoming more prevalent with an aging global population. Here, the market is seeing incremental growth as research delves deeper into brain health and neurodegenerative diseases.

Other application segments, including orthopedic, endocrinology, pulmonology, gastroenterology, nephrology, and ophthalmology, though smaller in market share, are essential to the overall API market landscape. Each area is responding to distinct therapeutic needs, propelling the development of specialized APIs.

Segments like orthopedic and endocrinology are gaining momentum as they cater to the rising cases of diabetes and musculoskeletal disorders. Meanwhile, pulmonology APIs are critical in the management of respiratory conditions, which have come under the spotlight due to environmental factors and the recent respiratory disease pandemics.

The gastroenterology, nephrology, and ophthalmology segments are projected to grow consistently, driven by the increasing burden of related diseases and the aging population. With each segment responding to specific health concerns, the API market is showcasing a diversified and targeted approach to drug development.

Across all segments, a common thread is the push towards more targeted and effective treatments, aligning with global health trends and patient-specific needs. As the market advances, each application area is expected to evolve, influenced by technological advancements, regulatory changes, and a deeper understanding of diseases at the molecular level.

Type Analysis

In 2023, Innovative APIs held a dominant market position, capturing more than a 54% share. This segment benefits from strong patent protections and high investment in new drug development, reflecting the pharmaceutical industry’s focus on novel treatments. The demand for innovative APIs is propelled by the need for advanced therapeutics in managing complex diseases.

Meanwhile, the Generic APIs segment commands a significant portion of the market, driven by the expiration of patents and a global push for cost-effective treatment options. The affordability of generic medications makes them a cornerstone in the effort to enhance healthcare accessibility worldwide. Generic APIs are crucial in serving large volumes, particularly in emerging markets where cost constraints are more pronounced.

The market dynamics for both innovative and generic APIs are shaped by factors such as the rising prevalence of chronic diseases, increased healthcare spending, and technological advancements in drug development and manufacturing. While innovative APIs are associated with cutting-edge research and potentially higher profit margins, generics are linked to competitive pricing and widespread use.

Going forward, both segments are poised to experience growth. Innovative APIs will likely see sustained investment in research and development, while generics will expand due to the increasing number of drugs going off-patent and the ongoing demand for accessible medication globally. The balance between innovation and affordability remains a central theme in the API market landscape.

Кеу Маrkеt Ѕеgmеntѕ:

By Synthesis

- Biologic

- Synthetic

BY Application

- Cardiovascular Diseases

- Oncology

- CNS and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Other Applications

By Type

- Generic

- Innovative

Drivers

Growing Need for Medicines Boosts API Market

The world is seeing more people with chronic illnesses, which means there’s a bigger call for medicine. More diseases are showing up, and they need treatments. This demand is pushing the growth of the API market.

More ANDA Approvals Propel Demand

When a generic drug gets an ANDA (Abbreviated New Drug Application) green light, it means it’s almost the same as the brand-name drug and ready for the market. More approvals like this mean more need for APIs.

Opportunities

Synthetic APIs Gain Popularity

Synthetic APIs, which are key steps in making drugs, are getting a lot of attention. There’s a big focus on making safe medicines for kids and on “small molecule” drugs. These have been getting a thumbs up from regulators a lot, and it looks like this trend will keep going.

High Demand for Powerful APIs

Pharma companies are looking for strong APIs that work well at small doses. These not only work better but also hit the right spots in the body. They’re in high demand, giving API makers a chance to stand out.

Restraints

Slow Approvals Slow Down Growth

Drug makers often have to wait for a drug’s patent to end before they can make it. This wait can slow down the market’s growth.

Hard-to-Find Treatments in Some Places

Making APIs needs a lot of money and strict rules, which not all countries can manage. This means there’s a bigger need for cheaper alternatives, especially in less wealthy countries.

Regional Analysis

In 2023, North America held the largest share of the Active Pharmaceutical Ingredient market revenue, at 39.5%, and is anticipated to maintain its leading position through the forecast period, with a market value of 93.4 billion USD. This is due to rising exchange rates of cancer and other lifestyle-induced illnesses, which stimulates Pharmaceutical R&D Investment and thereby boosts the market.

Asia Pacific will experience the fastest CAGR at 8.4% over the forecast period. The Asia Pacific is fortunate to have economies like India and China that can produce APIs at lower costs. The Active Pharmaceutical Ingredient market size is expected to grow due to rising healthcare spending in the product segment by region.

Europe is forecast to experience significant growth over the forecast period. The Active Pharmaceutical Ingredient market size will be driven by an increase in research funding and the local presence of key players and market participants in the commercial segment by region. Due to increased investments, the number of European companies in the pharmaceutical fortune business rapid expansions is increasing.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

High complexity is the market for highly potent active pharmaceutical ingredients. The Active Pharmaceutical Ingredient market for active Teva pharmaceutical ingredients is complex. There will be a blockbuster drug patent expiration and increased outsourcing activities due to high manufacturing costs. Stringent regulations regarding the production of APIs will also help to keep the level of competition high during the forecast period.

To maintain their market size position, many key advantage players are focused on the launch of new product segment features. Teva pharmaceutical companies and MEDinCell were approved by the U.S FDA in 2021 for a new medication to treat schizophrenia. Legal issues also slow down the establishment of new sources of API facilities.

In 2020, for example, Dr. Reddy’s Laboratories as well as Eli Lilly and Company had to deal with problems with the U.S. FDA regarding their API plants. Because of the capital requirements, it is hard to enter the Active Pharmaceutical Ingredient market without being a major player. The following are some of the most prominent key advantages players in the global highly potent active pharmaceutical ingredient

Маrkеt Кеу Рlауеrѕ

- Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Teva Pharmaceutical Industries Ltd.

- Albemarle Corporation

- Viatris Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- And Others

Recent Development

- December 2022: Pfizer and Acuitas Therapeutics sign an agreement to develop a lipid nanoparticle delivery system for mRNA vaccines, aiming to broaden the distribution of Pfizer’s mRNA vaccines globally.

- January 2023: Sanofi and IGM Biosciences enter a strategic collaboration to enhance the development and commercialization of IgM antibody agonists, potentially advancing treatments in oncology, immunology, and inflammation.

- February 2023: Merck announces Phase 1 clinical trial outcomes for MK-3201 in patients with advanced solid tumors, indicating good tolerance and promising efficacy of the novel cancer therapy.

- March 2023: Novartis releases positive Phase 3 results for Canakinumab in preventing angioedema attacks in individuals with Hereditary Angioedema, highlighting its effectiveness and safety.

- April 2023: Eli Lilly reports Phase 3 trial data for Verzenio in advanced HER2-Positive breast cancer patients, demonstrating its potential as an effective and well-tolerated option.

Report Scope

Report Features Description Market Value (2023) USD 236.5 Billion Forecast Revenue (2033) USD 839.1 Billion CAGR (2023-2032) 6.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Synthesis (Biologic and Synthetic) By Application (Cardiovascular Diseases, Oncology, CNS and Neurology, Orthopedic, Endocrinology, Pulmonology, Gastroenterology, Nephrology, Ophthalmology and Other Applications) By Type (Generic and Innovative) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Cipla, Inc., Teva Pharmaceutical Industries Ltd., Albemarle Corporation, Viatris Inc., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd. and Dr. Reddy’s Laboratories Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Active pharmaceutical ingredients market is expected to grow at?The Active pharmaceutical ingredients market is expected to grow at a CAGR of 7.2% (2023-2032).

List the segments encompassed in this report on the Active pharmaceutical ingredients market?Market.US has segmented the Active pharmaceutical ingredients market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type of Synthesis, the market has been segmented into Synthetic and Biotech. By Type of Manufacturer, the market has been further divided into Captive APIs and Merchant APIs. By Type, the market has been further divided into Innovative APIs and Generic APIs. By application, the market has been further divided into Cardiovascular Diseases, Ophthalmology, CNS and Neurology, Oncology, and Other Applications.

List the key industry players of the Active pharmaceutical ingredients market?Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Cipla, Inc., Teva Pharmaceutical Industries Ltd., Albemarle Corporation, Viatris Inc., and Other Key Players engaged in the Active Pharmaceutical Ingredients Market.

Which region is more appealing for vendors employed in the Active pharmaceutical ingredients market?North America is expected to account for the highest revenue share of 40.6%. Therefore, the Active pharmaceutical ingredients industry in North America is expected to garner significant business opportunities over the forecast period.

Which segment accounts for the greatest market share in the active pharmaceutical ingredients industry?With respect to the Active pharmaceutical ingredients industry, vendors can expect to leverage greater prospective business opportunities through the innovative APIs segment, as this area of interest accounts for the largest market share.

Active Pharmaceutical Ingredient MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Active Pharmaceutical Ingredient MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Teva Pharmaceutical Industries Ltd.

- Albemarle Corporation

- Viatris Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- And Others