Global Activated Charcoal Supplement Market By Product Type(Capsules, Tablets), By End User(Antidiarrheal, Detoxification, Eliminate Swelling), By Distribution Channels(Pharmacies and Drug Stores, Supermarket/Hypermarket, Online Retailers, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 14470

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

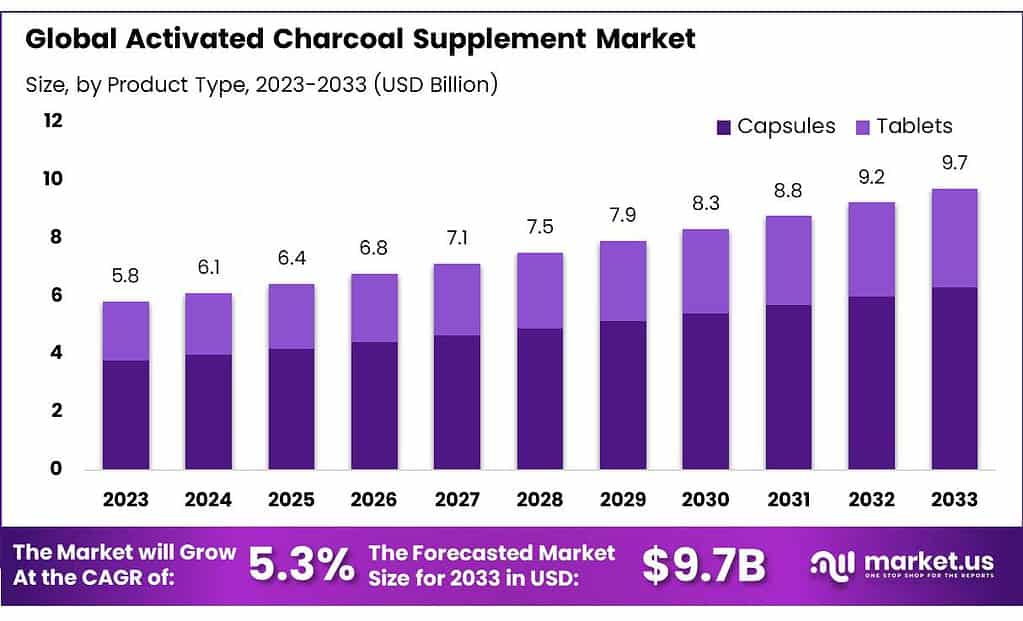

The Activated Charcoal Supplement Market size is expected to be worth around USD 9.7 billion by 2033, from USD 5.8 Bn in 2023, growing at a CAGR of 5.3% during the forecast period from 2023 to 2033.

The Activated Charcoal Supplement Market encompasses the segment of the healthcare and wellness industry that deals with the production, distribution, and sale of activated charcoal as a dietary supplement. Activated charcoal is a fine, odorless, black powder made from carbon-rich materials, such as wood, coconut shells, or peat, that have been processed at high temperatures to create a vast surface area.

This processing enhances its ability to adsorb (bind to) chemicals, gases, and toxins, making it a popular choice for detoxification purposes, alleviating gas and bloating, and promoting kidney health by filtering out undigested toxins and drugs.

Supplements containing activated charcoal are available in various forms, including capsules, tablets, and powders, catering to consumers seeking natural remedies for detoxification and digestive health.

The market’s growth is driven by increasing consumer awareness of health and wellness, the rising popularity of natural and organic supplements, and the diverse applications of activated charcoal in medical and emergency treatments for poisonings and overdoses. This market segment operates within the broader nutraceutical industry and is subject to regulatory oversight to ensure the safety and efficacy of activated charcoal products for consumer use.

Key Takeaways

- Market Growth: Projected to expand from USD 5.8 billion in 2023 to USD 9.7 billion by 2033, growing at a CAGR of 5.3%.

- Dominant Product Type: Tablets lead the market with a 62.46% share in 2023, favored for their convenience and ease of use.

- Leading Application: Over 62.9% of the market in 2023 was dominated by antidiarrheal applications, highlighting the supplement’s efficacy in digestive health.

- Top Distribution Channel: Pharmacies & Drug Stores were the primary channels, holding over 45.6% of the market, trusted for immediate access and professional advice.

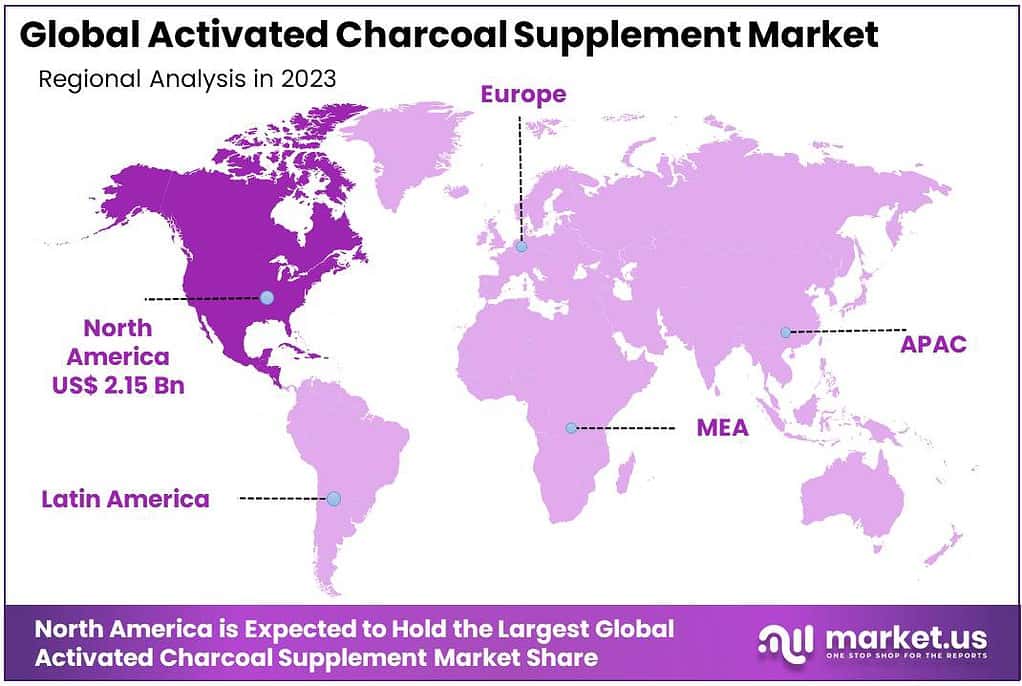

- Regional Insights: North America leads with over 33.4% revenue share, driven by the demand for natural treatments for diarrheal diseases among children.

- Asia Pacific Potential: Expected to grow at a robust CAGR of 14.4%, with rising gastrointestinal disorders in countries like India and Japan boosting demand.

Product Type Analysis

In 2023, tablets held an overwhelming market share of activated charcoal supplements- 62.46% to be exact – which was driven by consumer preference due to their convenient and straightforward usage. Their solid form provided ease of consumption without the hassle of preparation or measuring, appealing to individuals seeking a simple and portable option for incorporating activated charcoal into their routines.

Following tablets, capsules held significance in the activated charcoal supplement market. Offering an alternative to tablets, capsules provided consumers with another convenient method of intake. Encapsulated forms appealed to those who preferred this mode of consumption, appreciating the ease of swallowing and controlled dosage.

Additionally, powdered activated charcoal supplements carved their own niche in the market. Powders offered versatility, allowing users to tailor their dosage by easily incorporating the supplement into various liquids or foods. This adaptability appealed to consumers seeking customizable intake options suited to their preferences.

In contrast, liquid forms of activated charcoal supplements existed, albeit with a smaller market share. These liquid solutions served specific purposes, such as medical or healthcare settings, where liquid intake was preferred or when blending the supplement into beverages was more practical. Beyond these dominant types, a spectrum of other formulations and presentations existed within the activated charcoal supplement market.

These variations, including gummies, chewable tablets, or specialized formulations, targeted specific consumer preferences or industry needs. The diversity in supplement types reflected the market’s effort to cater to varying preferences and applications, emphasizing factors like ease of use, versatility, and specific consumption needs.

End User Analysis

In 2023, activated charcoal supplements dominated the antidiarrheal market share with over 62.9 % market share in terms of market share. Both consumers and healthcare practitioners relied on activated charcoal supplements for managing diarrhea as an intestinal condition. Their ability to absorb toxins and gases in the digestive tract further emphasizes their efficacy for supporting overall digestive health.

Beyond their primary use in antidiarrheal applications, activated charcoal supplements have found numerous applications across different sectors. One significant area was in detoxification programs, where their adsorbent properties were leveraged to eliminate toxins and impurities from the body. This usage in cleansing and detox regimes underscored their role in wellness and purification.

Additionally, skincare and beauty industries quickly recognized activated charcoal supplements’ value for skin health. Their absorbency makes them perfect for use in facial masks, cleansers, and beauty products that draw out impurities from cells for healthier-looking results. Its ability to draw out impurities made activated charcoal an attractive ingredient for creating clearer complexions.

Activated charcoal supplements also play an integral role in purification systems for water and air, harnessing their adsorption abilities to power filters and purification mechanisms to ensure cleaner water and air quality in different settings. Their reach goes far beyond consumer uses into environmental and industrial areas where quality standards have increased as a result of this application of activated charcoal supplements.

In various other sectors, such as wound care, environmental cleanup, and veterinary medicine, activated charcoal supplements showcased their versatility. Their wide-ranging potential across diverse industries highlighted their adaptability and reliability, reinforcing their significance beyond their dominant role in addressing gastrointestinal issues.

By Distribution Channels

In 2023, Pharmacies & Drug Stores held a dominant market position in the Activated Charcoal Supplement Market, capturing more than a 45.6% share. This segment’s success is attributed to consumer trust in professional healthcare advice available at these outlets and the immediate availability of supplements for urgent needs.

Supermarkets and Hypermarkets also played a significant role, contributing substantially to market distribution with their wide reach and the convenience of one-stop shopping for consumers. This channel benefits from high foot traffic and the ability to offer a diverse range of health-related products alongside daily necessities.

Online Retailers have seen remarkable growth, offering easy access to a vast selection of activated charcoal supplements. The convenience of home delivery, competitive pricing, and the abundance of product information and reviews online support this segment’s expansion. Consumers appreciate the ability to compare products and prices, contributing to the growing preference for online purchases.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Capsules

- Tablets

By End User

- Antidiarrheal

- Detoxification

- Eliminate Swelling

By Distribution Channels

- Pharmacies & Drug Stores

- Supermarket/Hypermarket

- Online Retailers

- Other

Drivers

In 2023, the activated charcoal supplement market experienced significant expansion due to several key drivers. Perhaps most notable among them is increased consumer awareness regarding digestive health and wellness; with many turning towards natural remedies like activated charcoal for treating symptoms like bloating, gas, and diarrhea with excellent results. This trend increased demand for digestive comfort supplements that contributed significantly to market expansion.

Another influential factor was the increasing trend of detoxification and cleansing programs, with activated charcoal supplements becoming an essential element of many detox regimes due to their ability to absorb toxins effectively – this coincided with wellness circles’ current obsession with detoxing; driving an increase in demand for these supplements further driving market expansion.

Activated charcoal has greatly contributed to the beauty and skincare industries’ upward trajectory. Widely recognized for its adsorbent properties, activated charcoal quickly became a sought-after ingredient in skincare products such as facial masks and cleansers; its reputation of purifying skin by drawing out impurities resonated strongly with consumers looking for clearer and healthier complexions, further amplifying its popularity within the beauty sector.

The mounting concerns about environmental issues played a pivotal role as well. Activated charcoal supplements found extensive usage in water and air purification systems due to their effective adsorption of contaminants. This application expanded the supplement’s market reach beyond consumer-centric uses, addressing environmental concerns and emphasizing its role in ensuring cleaner water and air quality.

The adaptability and versatility of activated charcoal supplements across various industries and applications propelled market growth. Their multifaceted uses, spanning from antidiarrheal solutions to detoxification, skin care, and purification systems, appealed to a broad spectrum of consumers and industries. This versatility underscored the supplement’s relevance and contributed significantly to its market expansion across diverse sectors.

Restraints

In 2023, the activated charcoal supplement market encountered several limitations that influenced its growth trajectory. Regulatory complexities presented a significant challenge, with varying regulations across regions complicating classification, labeling, and permissible uses. This ambiguity posed hurdles for manufacturers and marketers, potentially impeding market expansion due to compliance concerns and uncertainties in navigating diverse regulatory landscapes.

Safety considerations and the necessity for precise dosage administration emerged as restraining factors. Activated charcoal’s adsorptive properties raised concerns about potential interactions with medications and nutrients, demanding careful dosage instructions. Consumer apprehension regarding potential side effects or adverse interactions might have hindered widespread acceptance, limiting market reach.

Perception and misinformation surrounding activated charcoal supplements also posed challenges. Conflicting information regarding their effectiveness and potential health risks created ambiguity, impacting consumer confidence and potentially dissuading some individuals from embracing these supplements for their perceived benefits.

The limited availability of conclusive clinical evidence contributed to market restraints. While activated charcoal supplements showed promise in certain applications, the lack of extensive scientific data or conclusive clinical trials demonstrating their efficacy across diverse uses hindered efforts to substantiate their widespread benefits.

The competitive landscape, coupled with the presence of alternative remedies and supplements, also affected market dynamics. Other natural or pharmaceutical alternatives offering comparable benefits, alongside a plethora of wellness products, intensified competition, challenging the positioning of activated charcoal supplements as a preferred choice among consumers.

Addressing these limitations necessitated efforts to streamline regulations, enhance safety profiles and dosage precision, educate consumers to dispel misconceptions, and invest in comprehensive research to establish the efficacy and benefits of activated charcoal supplements across various applications. Overcoming these hurdles was crucial to fostering broader acceptance and market growth for these supplements.

Opportunities

In 2023, the activated charcoal supplement market presented various promising opportunities poised to fuel its expansion and diversification. One notable avenue was the potential for extensive research and clinical studies to validate the broad spectrum of benefits associated with these supplements.

Investment in comprehensive scientific exploration could ensure the effectiveness of various applications ranging from digestive health to skincare, expanding market appeal and potential consumer base. Activated charcoal supplements saw great opportunity in today’s health and wellness trends, which aligned perfectly with consumer preferences for natural remedies and holistic well-being.

By catering to such trends, activated charcoal supplements could become sought-after solutions for detoxification, digestive wellness and skincare – tapping into consumer trends that were likely to increase market demand and acceptance.

Educational campaigns were an essential way for the market to dispel misconceptions and provide accurate information about activated charcoal supplements, dispelling myths and creating accurate knowledge among customers about its benefits, safe use practices and multiple applications – increasing consumer confidence while expanding market reach into previously under-served segments.

Opportunities for innovation in product formulations and presentation formats existed. Developing novel formulations and enhanced delivery methods could attract new consumer segments and drive market growth by offering unique and appealing options that catered to evolving preferences.

Beyond consumer use, the supplements’ adsorptive properties created opportunities for environmental applications. From soil purification to air and water filtration, activated charcoal supplements had the potential to contribute significantly to environmental sustainability efforts, capitalizing on our collective focus on eco-friendly solutions.

Strategic partnerships and collaborations were also seen as promising avenues. Aligning with healthcare professionals, wellness experts, and industry leaders could increase credibility, garner endorsements, expand distribution networks, and open new channels for market penetration and customer outreach.

Realizing these opportunities required a combination of research, education, innovation, and strategic partnerships. By accepting emerging trends and applications while expanding collaborations between different industries and markets, activated charcoal supplement markets could take full advantage of the opportunities presented.

Challenges

In 2023, the activated charcoal supplement market encountered several hurdles that influenced its growth and acceptance. Regulatory complexities stood out as a significant challenge, with varying regulations across regions posing hurdles in classification, labeling, and permissible uses. Adhering to these diverse regulations demanded meticulous attention and resources, potentially hindering market expansion due to compliance uncertainties.

Safety concerns and the necessity for precise dosage administration emerged as another pressing challenge. Activated charcoal’s adsorptive properties raised apprehensions about potential interactions with medications and nutrients. Ensuring accurate and safe usage instructions remained a challenge, impacting consumer confidence and market adoption due to concerns about potential adverse effects.

Misinformation surrounding activated charcoal supplements created confusion among consumers. Due to conflicting information about their effectiveness and health risks, many were wary about accepting supplements as part of a healthy lifestyle. Clearing up misconceptions and sharing accurate facts became paramount in building trust with consumers and increasing consumer acceptance of such supplements.

The limited availability of conclusive scientific evidence posed a challenge. While showing promise in certain applications, the lack of extensive clinical trials and comprehensive research hindered efforts to validate their efficacy across diverse uses. This limitation impacted the market’s credibility and hindered broader acceptance among consumers and healthcare professionals.

The competitive landscape, with alternative remedies and a multitude of wellness products, presented additional challenges. The presence of various natural or pharmaceutical alternatives alongside a wide array of wellness offerings intensified competition, making it challenging to position activated charcoal supplements as the preferred choice among consumers.

Addressing these challenges necessitated concerted efforts in navigating regulations, enhancing safety profiles, dispelling misconceptions, investing in robust research, and effectively differentiating activated charcoal supplements in a highly competitive market. Achieving a balance between compliance, safety considerations, consumer perceptions, and substantiating their benefits through solid scientific evidence was crucial to overcoming these hurdles and fostering sustained market growth

Regional Analysis

North America held the highest revenue share at over 33.4% in 2023. Activated charcoal is still being sought after in the region. This is due to an increase in diarrheal disease among children aged 1 through 23. These diseases are increasing in severity and people seek natural, healthier options than traditional medicines. Activated charcoal tablets will be in high demand.

North America will likely be one of the largest regional markets during the forecast period due to increasing demand from the U.S. Europe is expected the fastest-growing market, due to the growing disposable income and presence of players like Carbotech.

The Asia Pacific holds a significant share of the market. It is expected to grow at a CAGR of 14.4% during the forecast period. Jacobi Carbons (OSAKA GAS) is a major player in this region. It holds a large portion of Japan’s market. Due to the rise in gastrointestinal disorders, countries like India and Japan will see a high demand for activated carbon supplements.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Diverse manufacturers are working to improve their product offerings and expand their product ranges. They have begun to include activated charcoal in their ice creams, calling it black ice cream. Its goal is to increase the value of its product and attract customers. iHalo Krunch in Toronto has been making headlines for its activated charcoal-infused coconut flavor ice cream. It also comes in a waffle cone.

Manufacturers are also attempting to penetrate the market with activated charcoal products. They are using activated charcoal in many beauty products to reap the skin benefits. Companies like WOW and Healthvit have begun selling activated charcoal-based skin care products that naturally purify the skin. To increase toothpaste’s value, some manufacturers use activated charcoal to make toothpaste. This is due to its teeth-whitening abilities. Cali White Activated Charcoal Toothpaste, for example, is loaded with the best whitening and detoxifying ingredients.

Маrkеt Кеу Рlауеrѕ

- Jacobi Carbons

- Country Life

- FORZA

- Amy Myrers

- Schizandu Organics

- CarboTech AC GmbH

- Nature’s Way

- Holland & Barrett

- Other Key Players

Recent Developments

In March 2023, Health Canada advised against the application of activated charcoal supplements for the prevention or treatment of COVID-19.

In February 2023, The European Food Safety Authority (EFSA) concluded that there is insufficient scientific data to justify the usage of activated charcoal supplements for any medical condition.

Report Scope

Report Features Description Market Value (2023) USD 5.8 Bn Forecast Revenue (2033) USD 9.7 Bn CAGR (2023-2032) 5.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Capsules, Tablets), By End User(Antidiarrheal, Detoxification, Eliminate Swelling), By Distribution Channels(Pharmacies & Drug Stores, Supermarket/Hypermarket, Online Retailers, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Jacobi Carbons, Country Life, FORZA, Amy Myrers, Schizandu Organics, CarboTech AC GmbH, Nature’s Way, Holland & Barrett, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Activated Charcoal Supplement MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Activated Charcoal Supplement MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Jacobi Carbons

- Country Life

- FORZA

- Amy Myrers

- Schizandu Organics

- CarboTech AC GmbH

- Nature's Way

- Holland & Barrett

- Other Key Players