Global Acrylic Foam Tape Market, By Type (Double Sided Tape, Single Sided Tape and Self-Stick Tape), By Technology (Solvent-Based, Water-Based, Hot Melt-Based), By Thickness (Less than 1 mm, 1.1 - 2 mm, 2.1 - 3 mm, Above 3 mm), By End Use (Automotive, Building And Construction, Electrical And Electronics, Paper And Printing, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 18924

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

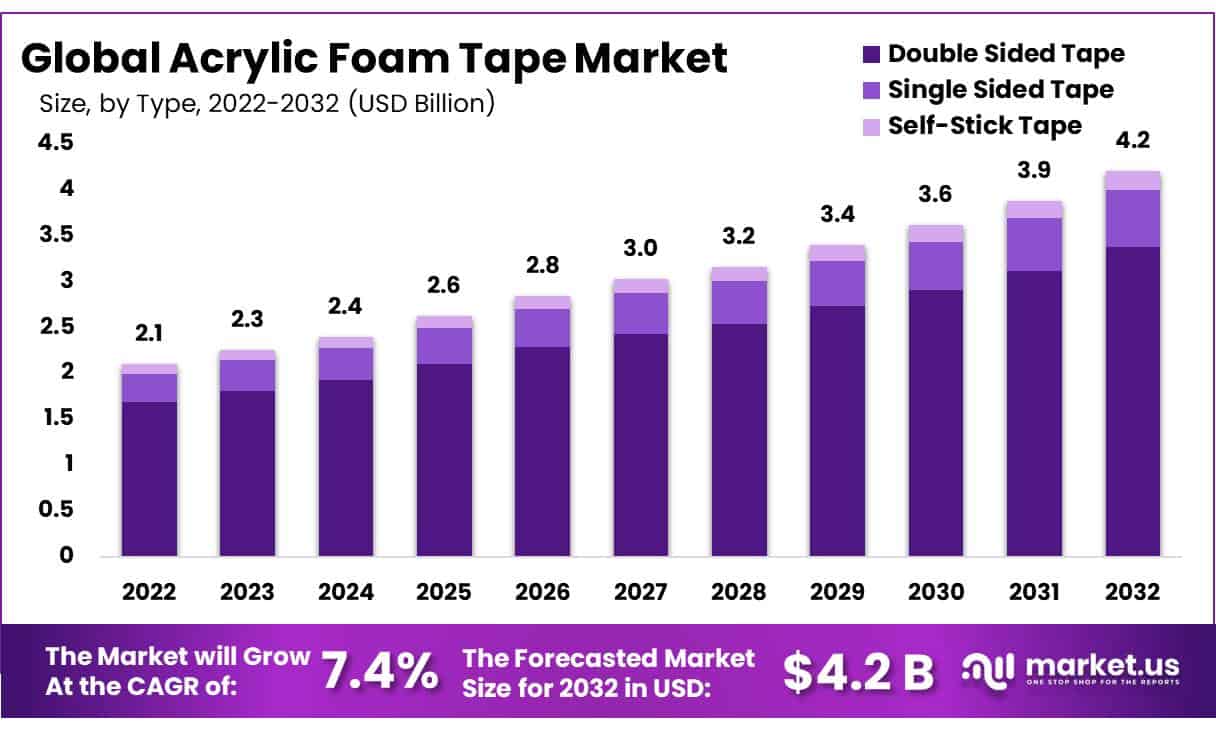

In 2022, the Global Acrylic Foam Tape Market was valued at USD 2.1 Billion, is projected to reach USD 6.95 billion in 2032 and from 2023 to 2032, this market is estimated to register a CAGR of 7.4%.

Acrylic foam tapes are high-performance synthetic tapes that provide solutions for extensive industrial applications and are used for replacing spot welds, liquid adhesives, mechanical fasteners, and other permanent fasteners.

These tapes are ideally used for bonding numerous painted metals, unpainted metals, better surface electricity plastics, and wherein thicker conformable products are required. In addition, creating everlasting and dependable bonds among numerous substrates, which include glass, painted surfaces, wood, metals, composite materials, and plastics, is a key characteristic of acrylic foam tape supplied to the end users.

Acrylic foam tapes are also used for marine creation, steel fabrication, and window fabrication, which are attributable to their conformability, flexibility, and compressibility. Thus, these tapes are also ideal for outside and indoor usage, attributable to their excessive durability and more desirable thermal resistance properties.

These tapes have numerous applications in the Automotive enterprise because of their bonding and attachment solutions for exterior and interior automotive components such as skirts, door visors, side molding, cladding, spoons, and side-sill.

Key Factors

- Double-sided tape accounted for the largest share, 3%, of the global acrylic foam tape market because of its precise adhesive properties.

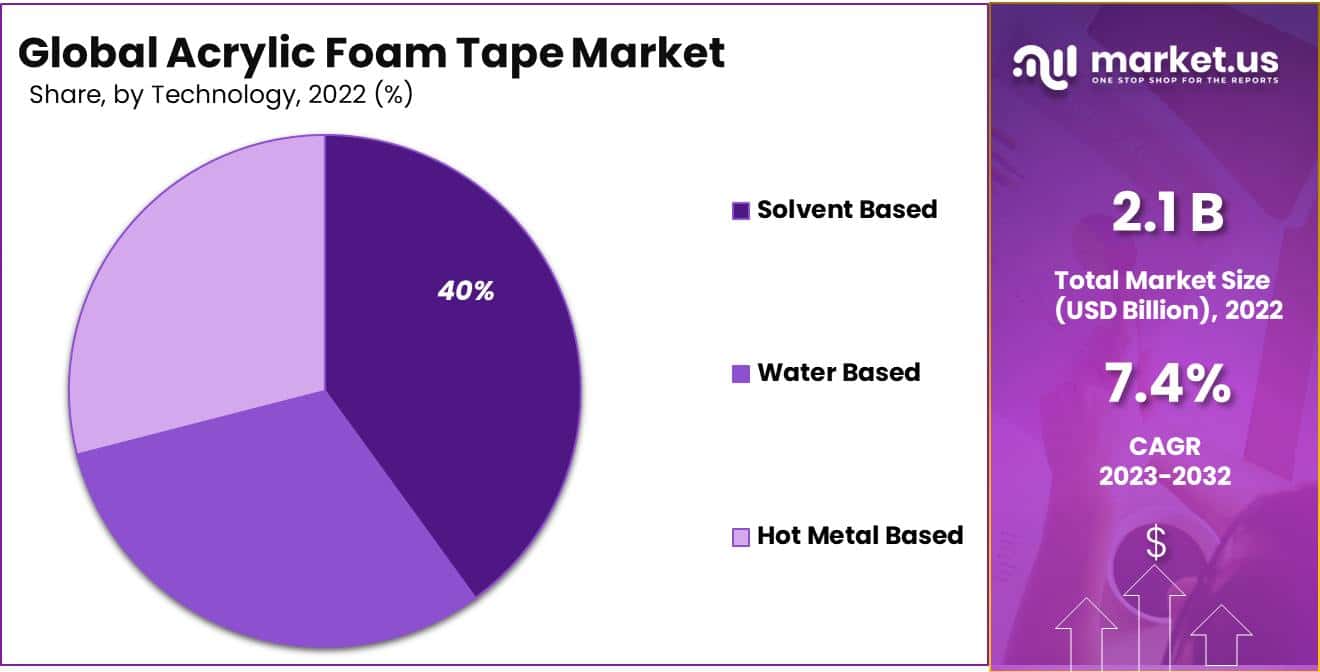

- Solvent-based Technology will hold the highest share of 40% due to its chemical resistance properties.

- The 1 – 2 mm segment dominated the market owing to its increasing demand.

- The Automotive segment held the largest share of 31% because of the rising demand for foam tape in diverse applications of the automotive section.

- A wide range of applications of foam tape will help the acrylic foam tape market grow.

- Increasing demand for product longevity bolstered the growth of the acrylic foam tape market.

- Higher prices of raw materials and end products may hinder the growth of the acrylic foam market.

- The Asia-Pacific region accounted for a significant share of the global acrylic foam tape market.

Actual Numbers Might Vary in the final report

Market Scope

Type Analysis

The Double-Sided Tape Holds The Largest Share Of The Global Acrylic Foam Tape Market Because Of Its Precise Adhesive Properties.

Based on type, The global acrylic foam tape market is segmented into double-sided tape, single-sided tape, and self-stick tape. Among both, double-sided tape accounted for an 80.3% share of the global acrylic foam tape market in 2022.

This dominance is attributed to the fact that it reveals incredible dampening properties, precise adhesive properties, high energy, high strength, and several other characteristics. Double-sided foam tapes may be used for hole filling, packing, acoustic dampening, thermal insulation, and temporary or everlasting fixing.

These tapes are available in various thicknesses and are constructed from both open/closed-cell foams and covered with various pressure-sensitive adhesives (PSAs).

Technology Analysis

Solvent-based technology will hold the highest share due to its chemical resistance properties.

Based on technology, the global acrylic foam tape market is segmented into solvent-based, water-based, and hot-melt-based. Among these, the solvent-based segment accounted for the largest share, with 40% in 2022.

Solvent-based technology is employed when high tensile strength, peel and shear strength, and longevity are required for foam tapes. Moreover, solvent-based foam tapes are also durable and temperature-resistant, making them appropriate for several applications.

Solvent-based acrylic adhesives can be formulated to provide remarkable chemical resistance, making them adequately suitable for use in environments where such exposure is a possibility. This makes them perfect for use in the acrylic foam tape market.

While solvent-based technology has its benefits and advantages, there is a growing demand for alternative, environmentally friendly solutions. The ongoing transition towards these alternatives may additionally impact the future sales volume of solvent-based technology.

Thickness Analysis

The 1 – 2 mm segment dominates the market because of its versatile balance between bonding strength and flexibility.

Based on thickness, the global acrylic foam tape market is segmented into less than 1 mm, 1.1 – 2 mm, 2.1 – 3 mm, and above 3 mm. Among these, the 1–2 mm segment dominates the market because of its increasing demand in various manufacturing industries. This range offers a versatile balance between bonding strength and flexibility.

This makes them suitable for a wide array of applications across different industries. They can effectively bond various substrates, including metals, plastics, glass, and composite materials.

Each thickness of the acrylic foam strip has its performance characteristics, and the 1-2 mm thickness provides a noble balance of strength and flexibility; it gives high bonding energy, excellent stress distribution, and correct conformability to irregular surfaces.

Acrylic foam tape is broadly utilized in diverse applications, including automobiles, production, electronics, and others. The 1-2mm thickness is suitable for a variety of applications and offers reliable bonding to overall performance.

End-Use Analysis

The automotive segment held the largest share because of the rising demand for foam tape in diverse applications of the automotive section.

Based on end users, the global acrylic foam market is segmented into automotive, building and construction, electrical and electronics, paper and printing, and others. Among these, the automotive segment holds the largest share of 37.3% because of the rising demand for foam tape in diverse automotive section applications, including the manufacturing of wheel flares, side mirrors, roof molding, and several others.

The growing demand for lightweight and durable glazing materials within the automotive industry will drive the growth of the acrylic foam tape market in the coming years. Overall, the use of acrylic foam tape in the automotive industry is driven by the need for robust, durable, and excessive-overall performance bonding solutions that could resist harsh environmental situations and offer aesthetic enchantment.

Key Market Segments

By Type

- Double Sided Tape

- Single Sided Tape

- Self-Stick Tape

By Technology

- Solvent Based

- Water Based

- Hot Melt Based

By Thickness

- Less than 1 mm

- 1 – 2 mm

- 1 – 3 mm

- Above 3 mm

By End Use

- Automotive

- Building & Construction

- Electrical & Electronics

- Paper & Printing

- Others

Drivers

Wide Range Of Applications Of Foam Tapes Increasing its Demand.

Foam tape applications are rising within the construction and automotive industries. The increasing utilization of electronic gadgets, devices, and lightweight automobiles drives the foam tape market.

The automobile industry is a leading end-user of acrylic foam tapes, where these tapes are used in a variety of applications, including sound dampening, insulating, gasketing, cushioning/filling, and sealing.

Therefore, the economic growth of the automotive industry is expected to boost the demand for acrylic foam tape over the next few years. In addition, the construction and electrical electronic industries are slated to provide good growth potential for the acrylic foam tape industry.

Furthermore, the revenue growth of the global acrylic foam tape market is driven by a surge in the demand for high-strength and flexible adhesive products in the manufacturing industry. The various types available, in terms of density and thickness, make it valuable for multiple end-user industries.

Increasing Demand For Product Longevity

Compared to vehicle tapes, welded metal-to-metal bonding necessitates extensively greater certifications, training, and inspection, which increases labor charges. The application of acrylic foam tape is easy, produces work of extra quality at a lesser cost, and requires little training.

Because it increases sales, decreasing the cost of the finished product is positive for both the customers and the manufacturers. Acrylic foam tape forces along the complete bond line, in contrast to fasteners, which only do so where they are attached. Compared to screws, foam tapes have a stronger bond and hold objects together substantially extra securely.

These elements are expected to be present in the growth of the global acrylic foam tape market. Moreover, acrylic foam tape can withstand high temperatures and has excellent aging and weather resistance.

Due to the increasing demand for these tapes for various end-use industry applications, such as in furniture manufacturing, the global acrylic foam tape market is expected to record significant revenue gains over the forecast period to achieve superior aesthetic appeal.

Restraints

Higher Prices of Raw Materials and End Products May Hinder the Growth of Acrylic Foam Market

Acrylic foam tapes are manufactured using several types of raw materials, such as polyester, polyether urethane, vinyl nitrile, and polyvinyl chloride. However, currently, the prices of these materials vary on account of the onset of the ongoing global pandemic.

These prices are volatile and are constantly changing, thereby impacting various end-use industries such as the construction, automotive, electronics industry, etc., in turn hindering this target market over the forecast timeline.

The low tack or initial adhesive strength of acrylic adhesives and their poor adhesion to polyolefin are expected to hinder the revenue growth of the global acrylic foam tape market over the forecast period.

In addition, high costs related to these products are also another major factor that is expected to hinder market growth opportunities for the global acrylic foam tape industry over the forecast period.

Opportunity

Advancement in Manufacturing Technologies and end product

The demand for biodegradable and green foam has increased in the past few years because of stringent environmental policies and consumer preferences. The innovation of hot melt-based totally and UV hot melt-based totally technologies enables acrylic foam tape manufacturers or converters to coat the tapes on PE, PU, and acrylic foam types without any release of solvents or water.

The shift towards hot melt-based and UV-based technologies is increasing, mainly in APAC. Innovations along with curable foam tape are intended for more Specialty tapes. All these elements provide opportunities for the market players to provide innovative products for various applications.

The customizing of acrylic foam tape according to the needs of end users is likely to create a key growth opportunity for the global acrylic foam tape market. Printing the manufacturer’s name on the tape’s core and the tape itself is a significant trend in the global acrylic foam tape market.

Trends

Rising adoption of acrylic resin-based foam tape

Acrylic resin-based totally foam tapes are gaining popularity due to their higher tack and peel adhesion in comparison to silicone-primarily based tapes. These tapes offer top-notch bonding performance and are appropriate for a wide variety of programs, contributing to the growth of the acrylic foam tape market.

It also has suitable cohesiveness and humidity resistance, making it applicable for utilization in loads of environments. Acrylic resin-based totally foam tapes also are much less costly than other types. Its high adhesive talents make it popular in the medical and automotive industries.

2023 Recession Analysis

Increased Competition – During the recession, companies faced increased competition, which could make it more difficult for them to maintain their market share and sales of acrylic foam tape Market.

High Production And Processing Costs – One of the reasons why the market may slow down during a recession is due to the high cost of manufacturing and processing foam tapes. Acrylic foam tape prices can fluctuate depending on the cost of materials and how they’re made, which could affect how much people are willing to buy it. Even though the market is growing, it could be held back by the high prices of raw materials and production methods.

Supply Chain Disruptions – the recession has led to supply chain issues, which have affected the availability and price of the raw materials and parts required for the production of acrylic foam tape. The coronavirus pandemic has had a significant impact on the global supply chain for the high-density acrylic foam tape market, resulting in a cessation of production and a decrease in manufacturing activities.

Regional Analysis

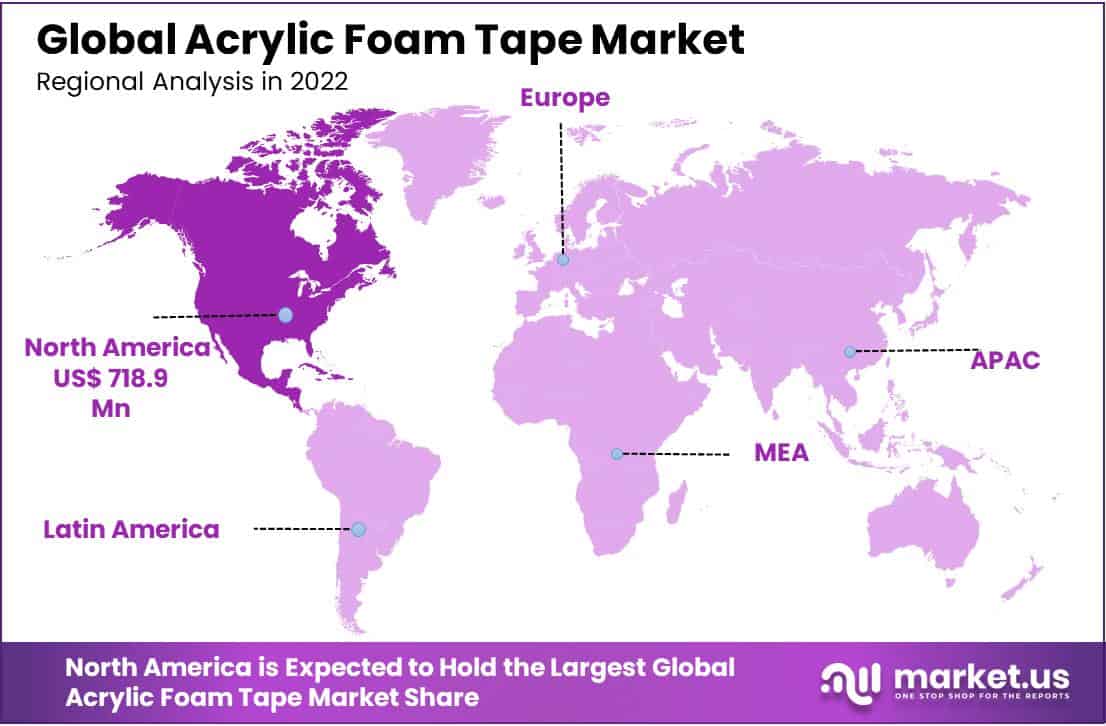

North America Holds Region Accounted Significant Share of the Global Acrylic Foam Tape Market

The acrylic foam tape market in North America is estimated to account for a revenue share of 33.2% in 2022 and is expected to register a CAGR of 7.5% over the forecast period. The first five-year cumulative revenue (2023–2027) for the North American market is estimated to be US$ 4,107.1 Mn, as compared to moderately higher cumulative revenue of US$ 5,944.2 Mn for the latter five years of the forecast period (2028–2032).

Owing to the high penetration of the healthcare and automotive industry, North America is estimated to be the major market in the global acrylic foam tapes market during the forecast period.

The Asia Pacific market is expected to grow at a high CAGR and second largest market. Owing to the rapid industrialization of emerging economies such as India and China, the increasing demand for acrylic foam tape material from the building and construction industry, and the growing activity of several leading automotive manufacturers.

The China market revenue accounts for a significant share of the total Asia Pacific market. Furthermore, the European market is also growing because of awareness among customers for better quality and more reliable products rather than going for inexpensive ones.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Some of the major players in this industry, such as 3M Company, Nitto Denko Corporation, Intertape Polymer Group, Inc., Avery Dennison Corporation, Fuji Chemical Industries Co. Ltd., Saint-Gobain Performance Plastics, have taken a leadership position while trying to establish their market through innovative marketing strategies.

Major companies are now focusing on adopting multiple policies to expand their respective businesses globally. Policies such as strategic mergers and acquisitions, joint ventures, partnerships with other companies, etc., are generally carried out to develop new products, expand existing product portfolios, and maintain or improve their respective market positions.

This is another major factor that is expected to complement the financial trajectory of this industry in the foreseeable future.

Top Key players

- 3M Company

- Nitto Denko Corporation

- Scapa Group Plc

- Intertape Polymer Group, Inc.

- Lintec Corporation

- Avery Dennison Corporation

- HALCO

- Saint-Gobain Performance Plastics

- Tape-Rite Co. Inc.

- Fuji Chemical Industries Co. Ltd.

- American Biltrite

- ECHOtape

- AFT Company

- Seal King Ind Co. Ltd.

- Avery Dennison

- Other Key Players

Recent Development

In August 2022, 3M and Nordson unveiled a revolutionary automated bonding system, offering a quicker, easier, and more eco-friendly approach to production processes. This comprehensive bonding solution combines the benefits of 3M VHB Tapes and the adaptability of a liquid adhesive into one integrated system, making it suitable for applications of any size.

In June 2019: RPM’s Tremco business acquired Schul International Co. LLC, a manufacturer of joint sealants for commercial construction, and Willseal LLC, a company that markets and sells Schul’s products. Both companies are headquartered in Hudson, New Hampshire, with combined annual net sales of about USD 15 million. Schul’s product line consists primarily of pre-compressed, self-expanding foam tapes used to seal joints in applications including window seals, prefabricated concrete, modular construction, and concrete facade restorations.

Report Scope

Report Features Description Market Value (2022) US$ 2.1 Bn Forecast Revenue (2032) US$ 4.2 Bn CAGR (2023-2032) 7.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Double-sided Tape, Single Sided Tape and Self-Stick Tape), By Technology (Solvent-based, Water-based, Hot-melt-based) By Thickness (Less than 1 mm, 1.1 – 2 mm, 2.1 – 3 mm, Above 3 mm) By Application (Automotive, Building & Construction, Electrical & Electronics, Paper & Printing Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape 3M Company, Nitto Denko Corporation, Scapa Group Plc, Intertape Polymer Group, Inc., Lintec Corporation, Avery Dennison Corporation, HALCO, Saint-Gobain Performance Plastics, Tape-Rite Co. Inc., Fuji Chemical Industries Co. Ltd., American Biltrite, ECHOtape, AFT Company, Seal King Ind Co. Ltd., Avery Dennison Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size for Acrylic Foam Tape Market?In 2022, the Global Acrylic Foam Tape Market was valued at USD 2.1 Billion, is projected to reach USD 6.95 billion in 2032 and from 2023 to 2032

What CAGR is projected for the Acrylic Foam Tape market?The Acrylic Foam Tape market is expected to grow at 7.4% CAGR (2023-2032).Name the major industry players in the Mushroom Market.3M Company, Nitto Denko Corporation, Scapa Group Plc, Intertape Polymer Group, Inc., Lintec Corporation, Avery Dennison Corporation, HALCO, Saint-Gobain Performance Plastics, Tape-Rite Co. Inc., Fuji Chemical Industries Co. Ltd., American Biltrite, ECHOtape, AFT Company, Seal King Ind Co. Ltd., Avery Dennison, Other Key Players.

-

-

- 3M Company

- Nitto Denko Corporation

- Scapa Group Plc

- Intertape Polymer Group, Inc.

- Lintec Corporation

- Avery Dennison Corporation

- HALCO

- Saint-Gobain Performance Plastics

- Tape-Rite Co. Inc.

- Fuji Chemical Industries Co. Ltd.

- American Biltrite

- ECHOtape

- AFT Company

- Seal King Ind Co. Ltd.

- Avery Dennison

- Other Key Players