Global Acrylate Oligomer Market Size, Share, And Enhanced Productivity By Type (Aliphatic, Aromatic, Hybrid, Water-Soluble, UV-Curable), By Formulation (Solvent-Based, Water-Based, Powder-Based, Paste-Based, Liquid-Based), By Functionality (Crosslinking Agents, Reactive Diluents, Thickeners, Stabilizers, Additives), By Application (Coatings, Adhesives, Inks, Composites, Sealants, Others), By End Use (Automotive, Construction, Electronics, Aerospace, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177264

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

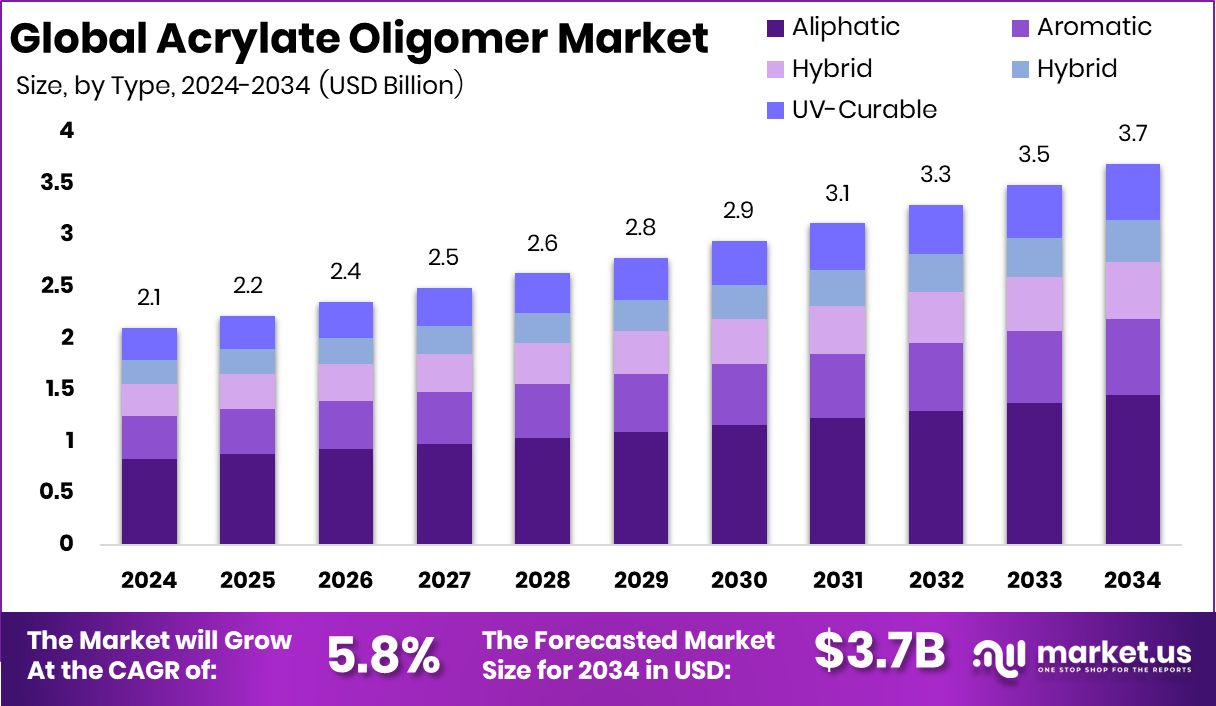

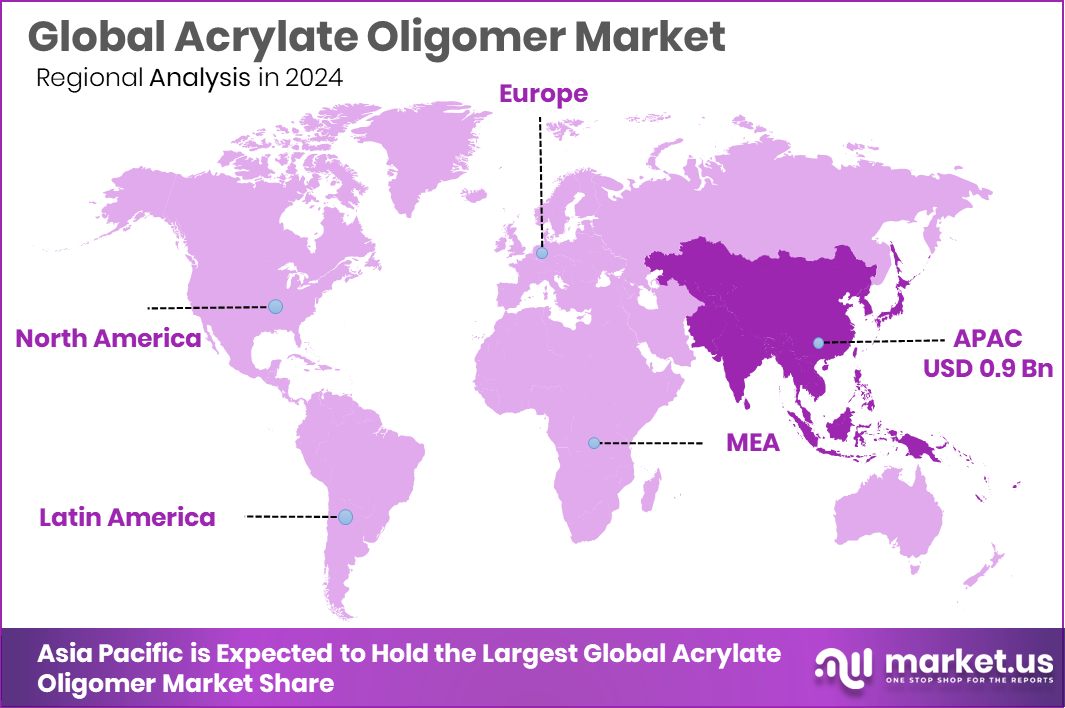

The Global Acrylate Oligomer Market is expected to be worth around USD 3.7 billion by 2034, up from USD 2.1 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. In the Asia Pacific, the Acrylate Oligomer Market achieved a 43.8% share and USD 0.9 Bn.

The Acrylate Oligomer Market covers a broad taxonomy that includes types such as aliphatic, aromatic, hybrid, water-soluble, and UV-curable systems, along with multiple formulations like solvent-based, water-based, powder, paste, and liquid forms. These materials serve functional roles as crosslinkers, reactive diluents, thickeners, stabilizers, and various additives. Their versatility allows wide use across coatings, adhesives, inks, composites, and sealants, supplying key end-use sectors including automotive, construction, electronics, aerospace, and healthcare.

Acrylate oligomers are short-chain acrylic polymers known for fast curing, strong adhesion, and durable surface performance. Their ability to form tough, chemically resistant networks makes them ideal for UV-curable and high-performance materials. The Acrylate Oligomer Market represents the industries and technologies that rely on these formulations to improve durability and efficiency in modern manufacturing.

Growth in this market is supported by steady industrial expansion and the rising shift toward energy-efficient curing systems. Funding activities like Anaphite securing £1.4m, Ecoat raising €21M, and GIT Coatings adding $10M highlight increasing confidence in advanced coating technologies.

Demand continues to rise as industries push for tougher, low-emission, and high-performance materials. Innovations such as Nature Coatings’ $2.45m, Brightplus’ EUR 2m, and Rolith’s $5m funding signal new material possibilities benefiting acrylate systems.

Opportunities emerge from sustainability-driven manufacturing, where breakthroughs like Sparxell’s €4.2m and Vexlum’s $12M support cleaner coatings, improved processing, and next-generation surface technologies—all creating a favorable environment for acrylate oligomer advancement.

Key Takeaways

- The Global Acrylate Oligomer Market is expected to be worth around USD 3.7 billion by 2034, up from USD 2.1 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- The Acrylate Oligomer Market grows strongly as aliphatic types achieve a notable 39.4% share.

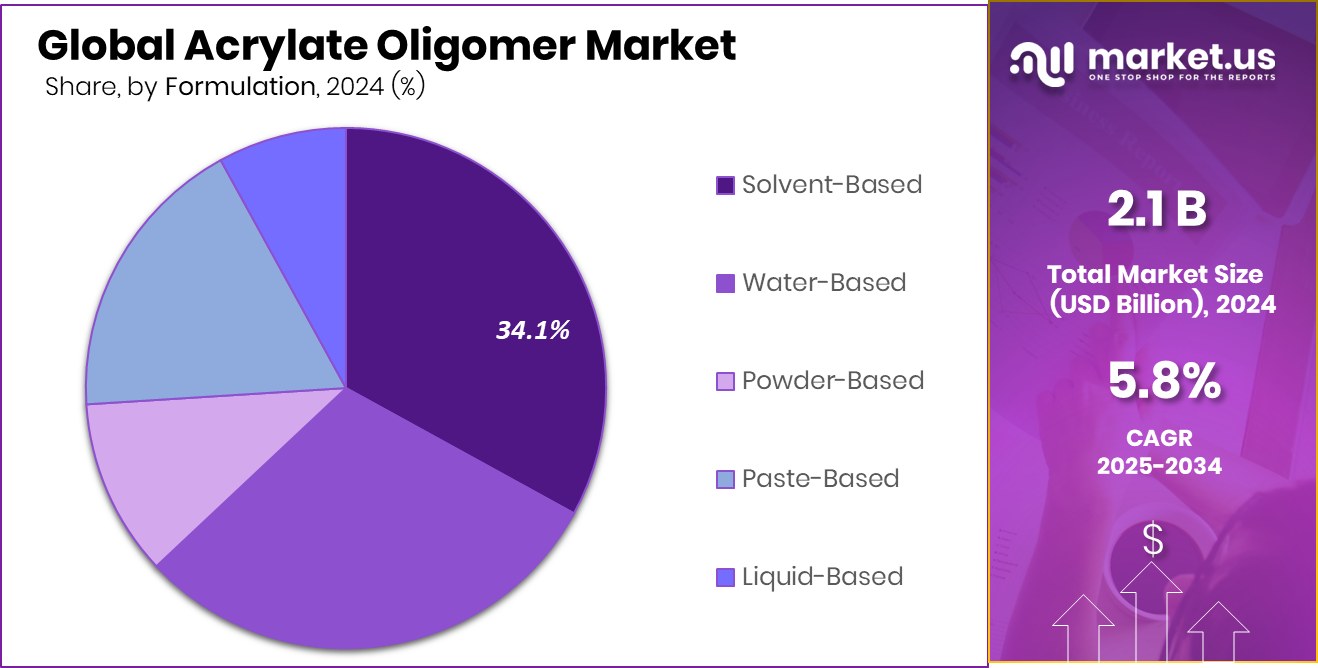

- Water-based formulations dominate the Acrylate Oligomer Market, contributing significantly with a stable 34.1% preference.

- Crosslinking agents remain essential in the Acrylate Oligomer Market, holding an impressive 38.5% functional share.

- Coatings applications drive major expansion in the Acrylate Oligomer Market, accounting for a strong 48.5% contribution.

- Automotive end-use leads growth in the Acrylate Oligomer Market, maintaining a powerful 38.3% industry share.

- The Asia Pacific region maintained 43.8% dominance, valuing the market at USD 0.9 Bn.

By Type Analysis

Acrylate Oligomer Market was dominated by aliphatic types with 39.4% share.

In 2024, the Acrylate Oligomer Market continued to strengthen its position across global manufacturing, with aliphatic acrylate oligomers dominating the Type segment at 39.4%. This dominance reflects their superior resistance to yellowing, high UV stability, and suitability for premium performance coatings.

Industries such as electronics, aerospace, and automotive are increasingly shifting to aliphatic-based formulations to meet stricter environmental and performance requirements. The push toward durable surfaces in outdoor products and energy-efficient buildings has also boosted usage.

Manufacturers increasingly prefer aliphatic systems due to their consistent curing behavior and compatibility with advanced UV/EB curing technologies. As sustainability standards rise, the market is witnessing higher adoption of low-VOC and eco-friendly aliphatic oligomers in multiple applications.

By Formulation Analysis

Water-based formulations dominated the Acrylate Oligomer Market, holding a strong 34.1% share.

In 2024, the Acrylate Oligomer Market saw a clear shift towards greener chemistries, with water-based formulations dominating at 34.1% in the Formulation segment. This growth is largely driven by global regulatory pressure to reduce VOCs and solvent emissions across coatings, inks, and adhesives. Water-based acrylate oligomers offer manufacturers a safer and more compliant alternative without compromising performance. Their ease of application, low odor, and compatibility with UV curing make them popular across packaging, wood coatings, textiles, and industrial finishes.

Additionally, rising environmental awareness among consumers has encouraged brands to adopt water-based systems for product labeling and sustainability commitments. As industries transition to circular manufacturing practices, demand for water-borne acrylate oligomers is expected to continue rising steadily.

By Functionality Analysis

Crosslinking agents dominated the Acrylate Oligomer Market, securing a notable 38.5% share.

In 2024, the Acrylate Oligomer Market experienced strong demand for advanced performance materials, with crosslinking agents dominating the Functionality segment at 38.5%. Crosslinkers play a pivotal role in determining coating hardness, chemical resistance, adhesion, and long-term durability, making them essential for high-performance surfaces. Industries such as automotive, electronics, fiber optics, and industrial machinery rely heavily on crosslinking acrylate oligomers to meet strict mechanical and environmental requirements.

The rise in UV-curable technologies also supports their growth, as crosslinkers enhance cure efficiency and surface toughness. As manufacturers seek coatings that withstand abrasion, chemicals, and weathering while remaining environmentally compliant, the share of crosslinking acrylate oligomers continues to expand across global production lines.

By Application Analysis

Coatings applications dominated the Acrylate Oligomer Market, capturing the highest 48.5% share.

In 2024, the Acrylate Oligomer Market continued to be led by the Coatings segment, dominating with a 48.5% share. Coatings remain the largest consumer of acrylate oligomers due to their fast curing, exceptional gloss, scratch resistance, and compatibility with UV/EB technologies. Industrial, automotive, packaging, and wood coatings all use oligomer-based formulations to achieve high efficiency and reduced operational downtime.

The shift toward environmentally friendly and low-energy curing systems also favors acrylate oligomers, which enable rapid processing with lower emissions. As manufacturers prioritize productivity, energy savings, and long-lasting finishes, coatings applications are becoming even more central to market expansion. The continuous rise of UV-curable industrial coatings further reinforces this dominant position.

By End Use Analysis

Automotive end use dominated the Acrylate Oligomer Market, achieving a 38.3% share.

In 2024, the Acrylate Oligomer Market saw significant momentum from the transportation sector, with automotive applications dominating the end-use segment at 38.3%. Automakers increasingly rely on acrylate oligomer-based coatings and adhesives to achieve lightweighting goals, improved fuel efficiency, and long-term durability. These oligomers offer exceptional scratch resistance, faster curing times, and enhanced appearance—qualities essential for both interior and exterior vehicle components.

The growing adoption of electric vehicles has further boosted demand for UV-curable materials used in battery modules, electronics, and protective coatings. Additionally, OEMs are embracing low-VOC and eco-friendly formulations to meet global environmental standards. As automotive production expands, acrylate oligomers remain integral to modern manufacturing.

Key Market Segments

By Type

- Aliphatic

- Aromatic

- Hybrid

- Water-Soluble

- UV-Curable

By Formulation

- Solvent-Based

- Water-Based

- Powder-Based

- Paste-Based

- Liquid-Based

By Functionality

- Crosslinking Agents

- Reactive Diluents

- Thickeners

- Stabilizers

- Additives

By Application

By End Use

- Automotive

- Construction

- Electronics

- Aerospace

- Healthcare

- Others

Driving Factors

Rising demand for fast-curing coating materials

The Acrylate Oligomer Market continues to grow as industries place stronger emphasis on fast-curing, energy-efficient coating materials. The shift toward UV-curable and rapid-processing systems is encouraging manufacturers to adopt acrylate oligomers for coatings, adhesives, and inks that require shorter production cycles and high surface durability. This momentum is also supported by innovation funding across the wider materials sector, such as Cohera Medical raising $26.3M in a Series D round, which reflects increasing confidence in advanced polymer technologies that improve performance and workflow efficiency. These developments highlight a broader push toward materials that simplify curing, reduce downtime, and support higher throughput manufacturing, strengthening demand for acrylate oligomers in multiple industrial environments.

Restraining Factors

High production costs limit broader adoption

Despite strong demand, the Acrylate Oligomer Market faces challenges tied to high production costs and the need for specialized raw materials. These costs can limit broader adoption, especially among smaller manufacturers that require more affordable formulations or simpler processing systems. The pressure on raw material supply chains adds to the complexity, making cost planning and production stability a key concern.

Funding activity across related chemical and bio-material sectors, such as Montinutra, raising €2 million led by Metsä Spring, shows growing interest in alternative and more cost-efficient feedstocks. While such efforts may eventually ease cost pressures, the current financial burden of production still acts as a constraint on large-scale expansion.

Growth Opportunity

Strong potential in sustainable UV-curable systems

Opportunities within the Acrylate Oligomer Market are expanding as industries accelerate their shift toward sustainable UV-curable systems. These systems reduce energy use, lower emissions, and offer performance benefits that traditional curing technologies cannot match.

With manufacturers seeking cleaner and more efficient materials, acrylate oligomers present a strong pathway for developing next-generation coatings and adhesives. This direction aligns well with funding in sustainability-driven materials innovation, such as BindEthics Ltd. securing $5.8M to advance non-toxic bio-adhesives, demonstrating rising confidence in eco-friendly chemistry. As more industries embrace low-impact processes, UV-curable acrylate oligomers gain meaningful room for adoption and product diversification across global markets.

Latest Trends

Shift toward low-emission coating technologies

A clear trend in the Acrylate Oligomer Market is the rapid transition toward low-emission and environmentally responsible coating technologies. Manufacturers are increasingly replacing solvent-heavy systems with formulations that support cleaner processing, faster curing, and compliance with emerging sustainability standards. This shift parallels broader material innovations enabled by new investments, including geCKo Materials securing $2 million in pre-seed funding to advance sustainable adhesive technologies.

Such developments mirror the industry’s movement toward safer, reduced-impact chemistries and provide direction for future acrylate oligomer advancements. As sustainability becomes a central requirement, low-emission oligomer technologies are shaping the next phase of product development and industrial adoption.

Regional Analysis

Asia Pacific led the Acrylate Oligomer Market with 43.8%, reaching USD 0.9 Bn.

The Acrylate Oligomer Market shows distinct performance across major global regions, with Asia-Pacific emerging as the dominant hub. Asia Pacific accounts for 43.8% of the total market, valued at USD 0.9 billion, supported by strong manufacturing activity, expanding coatings consumption, and a mature UV-curing ecosystem.

North America maintains a steady demand driven by advanced industrial applications, while Europe benefits from its established coatings and automotive production base. In the Middle East and Africa, gradual infrastructure expansion and industrial diversification contribute to moderate adoption of acrylate oligomers.

Meanwhile, Latin America reflects stable growth, supported by the rising use of coatings and adhesives in the construction and packaging industries. Across all regions, Asia Pacific clearly leads in both scale and influence, outpacing others through strong industrial output and higher consumption of UV-curable materials, making it the central driver of global market momentum.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mitsubishi Chemical Corporation continues to play a pivotal role with its strong materials portfolio and focus on performance polymers, allowing it to support high-demand applications in coatings, electronics, and industrial processing. The company’s emphasis on quality, consistency, and engineered material development gives it a steady advantage in sectors seeking reliable UV-curable solutions.

Toagosei Co., Ltd. remains another influential contributor, leveraging its longstanding expertise in monomers, adhesives, and specialty resins. Its disciplined manufacturing approach and targeted product enhancements help meet the rising need for efficient curing, surface durability, and low-emission formulations across industrial applications.

Arkema, positioned as a major global materials innovator, strengthens the competitive landscape through its broad portfolio of performance additives and advanced oligomer technologies. Its strategic focus on sustainability, high-functionality coatings, and technology-driven polymers reinforces its relevance in end-use segments requiring fast-curing and durable materials.

Top Key Players in the Market

- Mitsubishi Chemical Corporation

- Toagosei Co., Ltd.

- Arkema

- IGM Resins

- Alberdingk Boley GmbH

- Rahn AG

- Eternal Materials Co., Ltd.

Recent Developments

- In January 2025, Toagosei announced a revision to the price of ARONIX products in its commodity chemicals segment. This change indicates active portfolio management and strategic pricing of its acrylate-related products.

- In February 2024, Mitsubishi Chemical Corporation announced the release of new biodegradable biopolyester resins SA916N and SA916F. Although not specifically acrylate oligomers, this development reflects the company’s accelerated innovation in sustainable polymer materials, which aligns with its acrylic and resin product strategy. These biodegradable materials expand the company’s environmentally focused resin portfolio.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 3.7 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Aliphatic, Aromatic, Hybrid, Water-Soluble, UV-Curable), By Formulation (Solvent-Based, Water-Based, Powder-Based, Paste-Based, Liquid-Based), By Functionality (Crosslinking Agents, Reactive Diluents, Thickeners, Stabilizers, Additives), By Application (Coatings, Adhesives, Inks, Composites, Sealants, Others), By End Use (Automotive, Construction, Electronics, Aerospace, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Chemical Corporation, Toagosei Co., Ltd., Arkema, IGM Resins, Alberdingk Boley GmbH, Rahn AG, Eternal Materials Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Acrylate Oligomer MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Acrylate Oligomer MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Mitsubishi Chemical Corporation

- Toagosei Co., Ltd.

- Arkema

- IGM Resins

- Alberdingk Boley GmbH

- Rahn AG

- Eternal Materials Co., Ltd.