Global Acetic Acid Market By Application (Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Ester Solvents, Acetic Anhydride, and Others), By End-User (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 31240

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

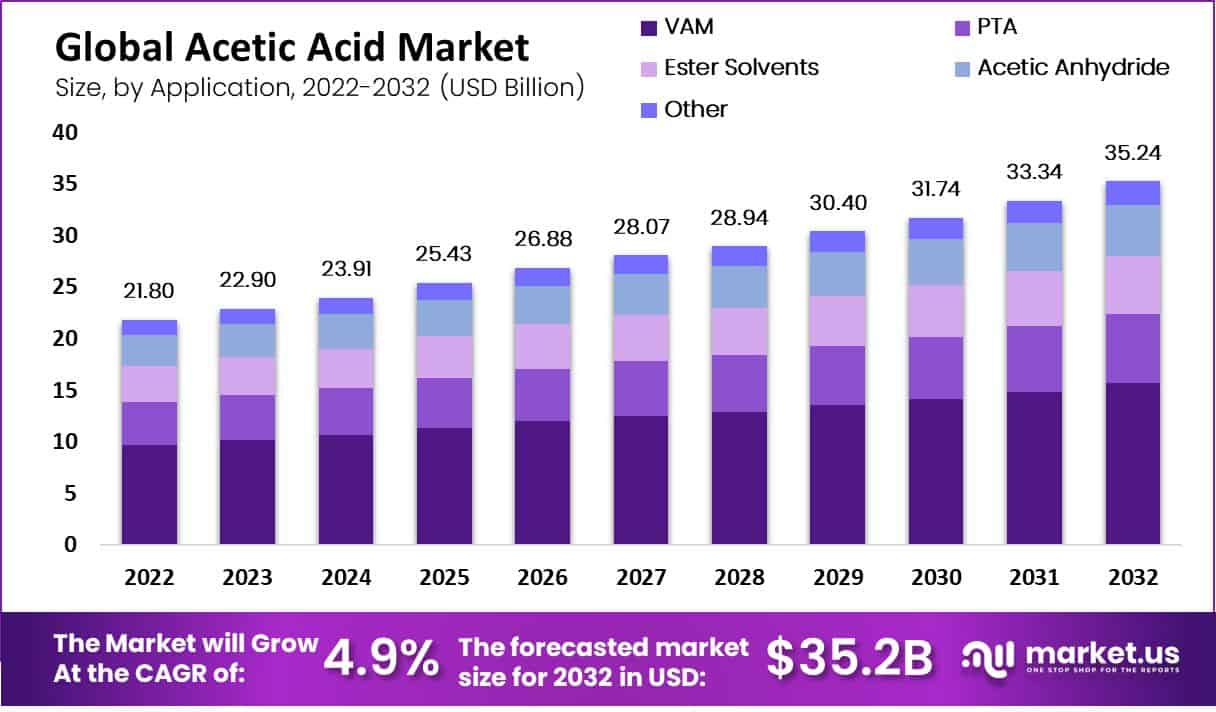

The Global Acetic Acid Market size is expected to be worth around USD 35.2 billion by 2032 from USD 21.8 billion in 2022, growing at a CAGR of 4.90% during the forecast period from 2022 to 2032.

This high-purity Acetic Acid Market growth is due to its importance as a building block for the manufacture of multiple chemicals and utilities in various industries such as plastics, rubber, inks, and textiles.

Global growth in end-use industries such as plastics, textiles, and chemicals is expected to boost demand for the products in the forecast year. Moreover, the replacement of PET bottles with glass bottles for alcoholic beverages is expected to boost the demand for terephthalic acid, which will have a positive impact on the product industry in the forecast year.

Moreover, the presence of multinational players and their constant expansion initiatives and joint ventures related to the products will likely boost the market growth in the forecast year. This product is considered safe for food use and is “food grade” when used according to good manufacturing practices.

It is considered “safe for food” if it meets the requirements of the Food Chemical Code. Significant growth in products is expected in the forecast year due to increasing demand for food and its safety.

The global acetic acid market size is highly competitive due to the presence of multiple multinational companies involved in extensive research and development activities and can take on expansion, collaboration, and joint venture initiatives to gain a competitive advantage increase. Therefore, the impact of competitors in the acetic acid market size is expected to remain high during the forecast period.

Key Takeaways

- Market Growth: In 2022, the global acetic acid market reached USD 21.8 billion and is projected to experience significant expansion by 2032 – reaching an approximate value of USD 35.20 billion due to an impressive Compound Annual Growth Rate (CAGR) of 4.90% between 2023-2032.

- Application Analysis: As of 2022, monomers composed of vinyl held a 44.5% market share due to the increasing popularity of printed items such as coatings, paints, and papers coated with vinyl coatings.

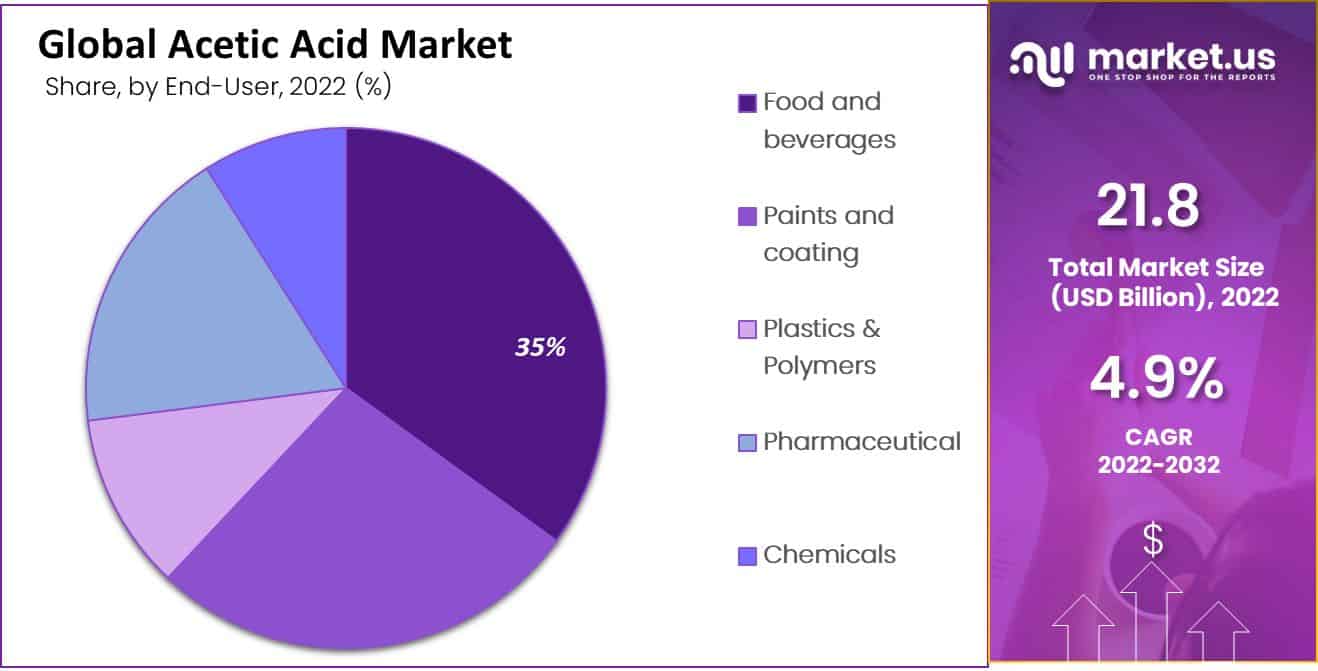

- End User Analysis: According to an analysis conducted of end-uses for this product, food, and beverage sales remain one of the top revenue generators. Acetic acid later used for producing plastic containers used to hold beverages or foods is another key area.

- Drivers: Acetic acid’s growth market can be seen through its widespread applications across industries – particularly chemical manufacturing, textile production, and food processing. Acetic acid’s unique solvent and reactant qualities make it invaluable.

- Restraints: Among the numerous challenges presented to acetic acid producers are fluctuating feedstock costs and environmental concerns associated with production, while regulatory constraints could impede market dynamics.

- Opportunities in the Acetic Acid Market: The acetic acid market offers great potential for expansion due to technological innovations, an increased emphasis on sustainable production methods, and expanding applications within various industries.

- Trends: Key trends in the acetic acid market include the adoption of bio-based acetic acid driven by environmental considerations. Furthermore, innovative applications and increasing demand in emerging economies are notable developments within this space.

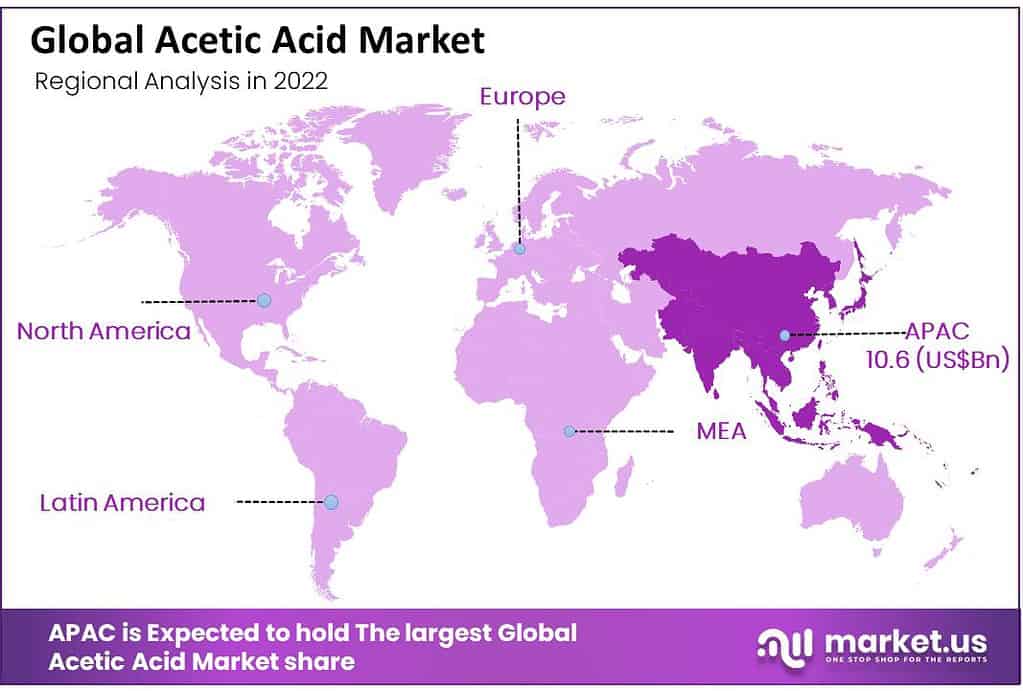

- Regional Dominance: By 2022 it was estimated that Asia-Pacific held 48.8% of revenues worldwide; this growth can primarily be attributed to Acetic acid’s widespread application across various industries such as pharmaceutical, construction automobile textile, and construction as its popularity is evident across a spectrum of applications like pharmaceutical production facilities, automobile production plants textile production as well as textile mills – hence expanding further with demand within these fields.

- Key Players in the Acetic Acid Market: Eastman Chemical Company, Celanese Corporation, LyondellBasell Industries Holding B.V., and SABIC are among the foremost players in the global acetic acid market and play an instrumental role in driving growth, innovation, and global presence of this market.

Driving Factors

Increasing Demand for Vinyl Acetate Monomer to Aid Growth

In the production of resins and polymers for coatings, adhesives, films, paints, textiles, and other end products, vinyl acetate monomer (VAM) is used as an intermediate. PET bottles use VAM as a barrier resin. A variety of substrates can be adhered to it, such as wood, paper, metal, and plastic films. The growth of the acetic acid market mentioned above will lead to increased demand for vinyl acetate monomers.

In the production of ethylene vinyl alcohol (EVOH), barrier resins for food packaging, gas tanks, and other engineering polymers are the fastest-growing applications. Several other derivatives of VAM, such as B. The vinyl chloride-vinyl acetate copolymer is used in adhesives and sealants.

Technological breakthroughs aimed at developing polymers and other products using VAM as a raw material have effectively increased product demand for vinyl acetate monomer acetic acid, actively supporting market growth.

Restraining Factors

Harmful Effects of Acetic Acid on Market Growth

It can be a dangerous chemical if not used safely and properly. It is highly corrosive to human skin and eyes and should be handled with care. It also damages internal organs if ingested or inhaled.

In addition, increasing consumer awareness of the harmful effects of chemicals may hinder the adoption of chemicals and impede market growth. VAM is also a mature market, gradually increasing or decreasing, and an important application for acetic acid. Declining VAM consumption may hinder acetic acid market growth and act as a disincentive.

Application Analysis

In 2022, the vinyl acetate monomer application segment held a 44.5% market share. Vinyl acetate monomer’s high market share can be attributed to the rising demand for printed goods, paints and coatings, and paper coatings. Acetic acid is one of the main raw materials used to make vinyl acetate monomer, which is then used to make polyvinyl acetate. Paints and coatings are further manufactured using polyvinyl acetate.

Demand for paints and coatings is being driven by improvements in consumer lifestyles as well as an increase in the number of home renovations and redecorations. This has a direct impact on the demand for vinyl acetate monomer. In 2022, Acetic Anhydride had the second largest market share globally with 19% of the market value.

Its widespread use in photographic films and other coated materials is the main reason for the market growth. Additionally, it is also utilized in the production of cigarette filters. It is regarded as an essential raw material for the creation of headache-relieving medications like aspirin. Wood preservation makes extensive use of acetic acid.

End-User Analysis

Based on end-users, the food and beverage segment dominates the market and continues to grow favorably in terms of revenue. Acetic acid is later used to manufacture plastic bottles containing food and beverages. In food processing companies, acetic acid is often used as a cleaning agent and disinfectant. Acetic acid is the main ingredient in vinegar, a common cooking ingredient used in sauces and pickling vegetables.

The acetic acid market size is growing as a result of advancements in the food and beverage industry. The paints and coatings segment is the fastest-growing global acetic acid market share. When VAM is polymerized to produce polyvinyl acetate or other important components of the paint industry, paint and coating compositions require significant amounts of vinyl acetate monomer produced.

Key Market Segments

Based on Application

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid (PTA)

- Ester Solvents

- Acetic Anhydride

- Others

Based on End-User

- Food and beverages

- Paints and coating

- Plastics & Polymers

- Pharmaceutical

- Chemicals

- Others

Growth Opportunity

Emerging nations are anticipated to experience rapid growth in the acetic acid market. Chemical, textile, and coating manufacturing facilities have exploded in these nations’ rapidly expanding economies. The rise in these projects will eventually increase the demand for the Acetic Acid Market.

Latest Trends

Ester solvents are used in the coatings industry for their superior properties, such as evaporation rate, leveling properties, color fastness, solvent activity, coating resin solubility, and good solvent release. These properties are used for products in coating formulations. Coatings continue to be used in automotive, infrastructure, and industrial applications.

The coating implemented by the present invention has the advantages of environmental protection, high-temperature resistance, strong chemical resistance, long life of the coated film, high mechanical strength, elastic strength, and abrasion resistance. Rising consumption of coatings continues to drive acetic acid market growth.

Regional Analysis

In 2022, the Asia-Pacific region had a 48.8% share of the market’s revenue. The rising demand for acetic acid in a variety of sectors, including the construction, pharmaceutical, automotive, and textiles sectors, is to blame for this expansion. The expansion of the region’s pharmaceuticals industry is to blame for the product’s rising demand. Acetic acid is primarily utilized in drug development. The region’s overall demand for the product is likely to be driven by consumers’ growing reliance on medicinal tablets.

In 2021, Asia-Pacific was a major contributor to the global market for vinyl acetate monomers. In addition, over the course of the forecast period, the expanding building and construction industries, particularly in China and India, are likely to become significant contributors to the market in the region. It is anticipated that the demand for the acetic acid market in the Middle East and Africa will rise as a result of the improved pharmaceutical industry and increased demand for medicines in nations like Saudi Arabia, Qatar, the United Arab Emirates, and Bahrain. A large number of people with diabetes, heart disease, and other conditions are caused by an aging population. Acetic acid is in greater demand in the region’s pharmaceutical industry as a result of rising life expectancy.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- APAC

- China

- Vietnam

- Japan

- Indonesia

- South Korea

- India

- Australia & New Zealand

- Singapore

- Thailand

- Malaysia

- Philippines

- Rest of APAC

- Latin America

- Colombia

- Chile

- Brazil

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- United Arab Emirates

- Saudi Arabia

- Kuwait

- Nigeria

- Israel

- South Africa

- Turkey

- Rest of the Middle East and Africa.

Key Players Analysis

With so many multinational players in the market, competition has become fierce. In order to enhance the quality and range of their products, these businesses are implementing a number of expansion and collaboration initiatives. Some of the major players in the acetic acid market are SABIC, Celanese Corporation, HELM AG, and Indian Oil Corporation.

In order to improve product quality and production efficiency, market players make significant investments in R&D and continuously innovate. Continuous research and development is the key to these businesses’ market dominance.

Market Key Players

- Eastman Chemical Company

- Celanese Corporation

- LyondellBasell Industries Holding B.V.

- SABIC

- HELM AG

- Airedale Chemical Company Limited

- Indian Oil Corporation Ltd

- Gujrat Narmada Valley Fertilizers & Chemicals Limited

- Pentokey Organic

- Ashok Alco Chem Limited

- DAICEL CORPORATION

- The Dow Chemical Product

- DubiChem

- INEOS

- Other Key Players

Recent Developments

- January 2021 – In order to expand its geographic reach and diversify its product offering, INEOS will join BP’s global aromatics and acetyls business, comprising 15 different manufacturing sites and 10 joint ventures around the world.

- In March 2020, South Korean Lotte and British chemical and energy company BP collaborated to expand South Korea’s acetic acid production capacity. The cost of the investment is approximately $175 million, and the capacity will be increased to 100,000 t/y by May 2019. Companies will be able to meet Korea’s growing demand thanks to this venture.

Report Scope

Report Features Description Market Value (2022) US$ 21.8 Bn Forecast Revenue (2032) US$ 35.2 Bn CAGR (2023-2032) 4.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Ester Solvents, Acetic Anhydride, and Others), By End-User (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals, and Others), By Region and Companies Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Eastman Chemical Company, Celanese Corporation, LyondellBasell Industries Holding B.V., SABIC, HELM AG, Airedale Chemical Company Limited, Indian Oil Corporation Ltd, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Pentokey Organy, Ashok Alco Chem Limited, DAICEL CORPORATION, The Dow Chemical Product, DubiChem, INEOS, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

What is the Global Acetic Acid Market size is expected in 2032?The Global Acetic Acid Market size is expected to be worth around USD 35.2 million by 2032.

What is the Acetic Acid Market size during the forecast period 2023-2032?The Global Acetic Acid Market size will grow at USD 35.2 million by 2032 from USD 21.8 Billion in 2022

What is the Cagr of Acetic Acid Market during the forecast period??The Global Acetic Acid Market CAGR of 4.90% during the forecast period from 2022 to 2032.

-

-

- Eastman Chemical Company

- Celanese Corporation

- LyondellBasell Industries Holding B.V.

- SABIC

- HELM AG

- Airedale Chemical Company Limited

- Indian Oil Corporation Ltd

- Gujrat Narmada Valley Fertilizers & Chemicals Limited

- Pentokey Organy

- Ashok Alco Chem Limited

- DAICEL CORPORATION

- The Dow Chemical Product

- DubiChem

- INEOS

- Other Key Players