Global Account Switching Services Market Size, Share Report By Type (Manual Switching, Automated Switching), By Application (Banking, Financial Services, Insurance, Telecom, Utilities, Others), By Deployment Mode (On-Premises, Cloud-Based), By End-User (Retail Customers, Business Customers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169034

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Type Analysis

- Application Analysis

- Deployment Mode Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

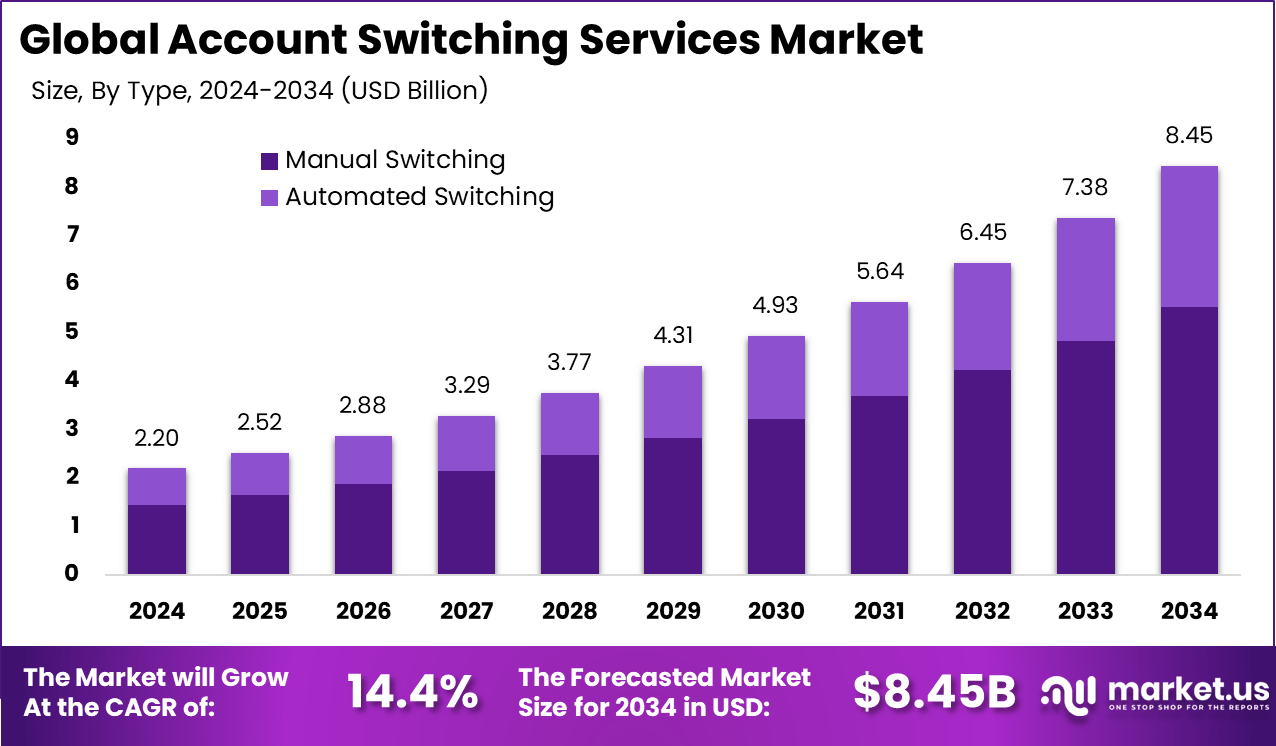

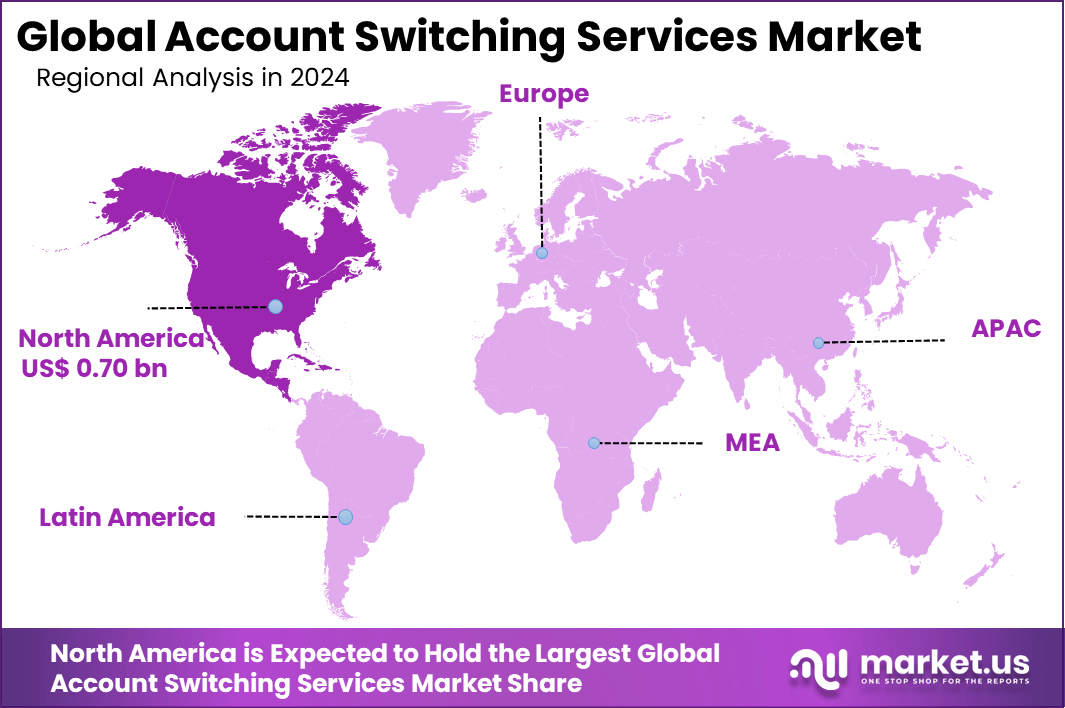

The Global Account Switching Services Market size is expected to be worth around USD 8.45 billion by 2034, from USD 2.20 billion in 2024, growing at a CAGR of 14.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 32.1% share, holding USD 0.70 billion in revenue.

The account switching services market has expanded as consumers and businesses seek faster, safer and more transparent ways to move their financial accounts from one provider to another. Growth reflects rising competition among financial institutions, increasing digital banking adoption and stronger expectations for seamless onboarding. Account switching platforms now coordinate balance transfers, direct deposits, bill payments and recurring transactions within a single automated workflow.

The growth of the market can be attributed to increasing customer mobility, rising dissatisfaction with complex manual switching processes and regulatory focus on improving financial competition. Many users switch accounts to access better digital services, improved fees or enhanced customer experience. Financial institutions rely on automated switching to reduce friction during onboarding and strengthen customer acquisition.

For instance, in October 2025, Barclays rolled out a switch bonus of up to £900 for customers moving to its Bank or Premier accounts via the Current Account Switch Service. Newcomers get £200-£400 cash just for shifting direct debits and deposits, plus ISA perks. While UK-focused, it mirrors North American trends where firms like Fiserv enable such incentives through rock-solid platforms.

The growth of the market can be attributed to increasing customer mobility, rising dissatisfaction with complex manual switching processes and regulatory focus on improving financial competition. Many users switch accounts to access better digital services, improved fees or enhanced customer experience. Financial institutions rely on automated switching to reduce friction during onboarding and strengthen customer acquisition.

The UK recorded more than 1.2 million current account switches in 2024, reflecting strong consumer movement toward better banking services. A record week in April saw 57,874 switches, showing rising confidence in streamlined digital switching processes. In the first quarter of 2025, 99.7% of all switches were completed within seven working days, indicating high operational efficiency across participating banks.

Customer satisfaction remained strong, as 89% of individuals who used the switching service in the past three years reported being satisfied with the experience. This steady satisfaction level suggests that reliability, speed, and reduced administrative burden continue to support adoption of the UK’s account switching ecosystem.

Key Takeaway

- Manual switching accounted for 65.5% in 2024, showing that many users still prefer direct and assisted processes when moving accounts between institutions.

- The banking segment held 36.7%, indicating that traditional banks remain the main providers of account switching support across customer groups.

- On-premises deployment represented 58.6%, reflecting continued preference for in-house control over customer data and migration workflows.

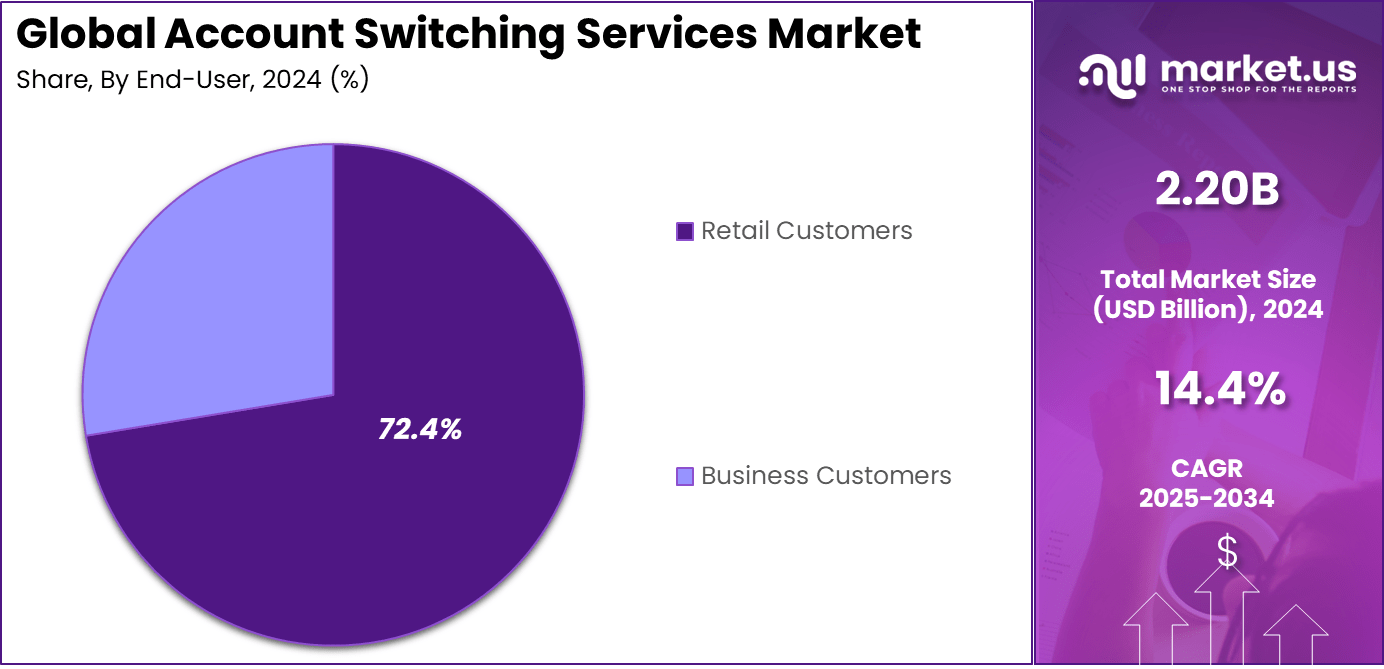

- Retail customers captured 72.4%, confirming that individual consumers drive most account transfer activity in the market.

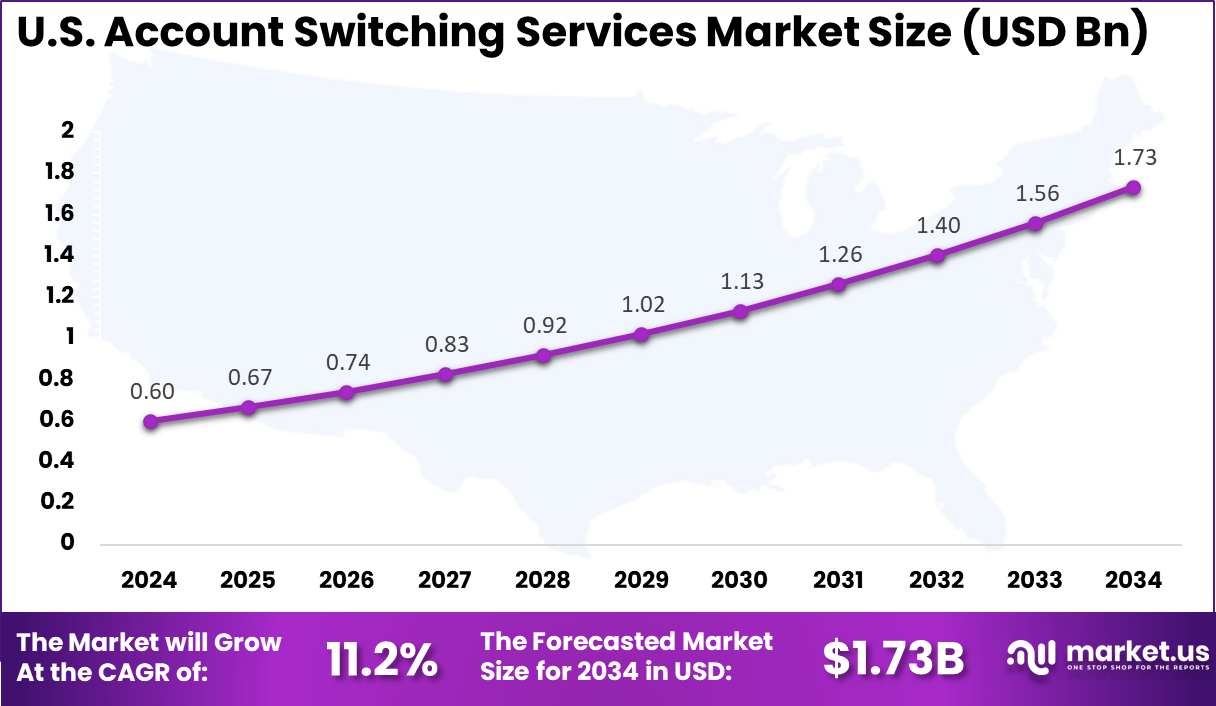

- The U.S. market reached USD 0.60 billion in 2024 and maintained an 11.2% CAGR, showing steady uptake as digital migration becomes more common.

- North America held 32.1%, supported by widespread banking modernization and rising emphasis on smoother account mobility.

Key Statistics

- Total switches crossed 1.2 million in 2024, and activity peaked with 57,874 switches recorded in a single week in April.

- In Q1 2025, 99.7% of all switches were completed within seven days, confirming that the service continues to meet its speed commitments.

- Customer satisfaction reached 89%, showing strong confidence among users who switched within the past three years.

- The main reasons for choosing a new account included better online or mobile app banking at 41%, improved interest earnings at 33%, and stronger service benefits at 28%.

- Switching decisions were driven by demand for better rewards and competitive rates, while negative experiences and low service quality acted as key push factors.

- SME participation remained much lower, with usage of CASS occurring four times less frequently compared to personal customers.

- Awareness of the service stood at 78% in Q1 2024, indicating strong public reach across the UK.

- Confidence in the ease, speed, and security of switching remained high at 78%, reflecting steady trust in the system.

- Awareness levels differed by demographics, with men at 80% compared to women at 75%, and the highest awareness at 91% among users aged 65 and older versus 44% among those under 25.

Role of Generative AI

Generative AI helps account switching services by creating clear guides and chat support that answer customer questions fast. Banks use it to handle common tasks like checking balances or making payments, which cuts wait times during switches. 73% of bank workers’ time could see changes from this tech, with much going to better customer service.

It also spots problems early by looking at past switches and predicts what people need next. This makes the whole process smoother for folks changing banks without hassle. 75% of early gains from such AI come from stronger customer talks and quick fixes.

Investment and Business Benefits

Banks can pour funds into digital switch platforms to cut manual work and lift conversion rates from leads. Upgrading to API-driven systems opens doors to partner with fintechs for faster global transfers in over 150 countries. Self-service kiosks and AI analytics promise quick returns by slashing support calls and speeding onboarding.

Firms gain from lower back-office costs as automation drops staff time on routine tasks from 4 hours to 10 minutes. New accounts activate fully, sparking cross-sells and steady transaction income without disruptions. Better service keeps customers longer, with over half already using multiple linked products post-switch.

U.S. Market Size

The market for Account Switching Services within the U.S. is growing tremendously and is currently valued at USD 0.60 billion, the market has a projected CAGR of 11.2%. This growth is driven by increasing consumer demand for flexible banking, rising adoption of digital platforms, and greater competition among financial institutions.

Customers now expect seamless transitions when changing banks, supported by user-friendly, secure digital tools. Regulatory support for data portability and the rise of fintech innovators are also fueling this trend, encouraging banks to invest in smarter, more efficient switching solutions.

For instance, in September 2025, FIS acquired Amount, an AI-powered platform for unified digital account origination, enabling financial institutions to streamline account opening, reduce friction, and accelerate customer switching to new banking relationships. The acquisition bolsters FIS’s dominance in modernizing account transitions and deposit growth for U.S. banks.

In 2024, North America held a dominant market position in the Global Account Switching Services Market, capturing more than a 32.1% share, holding USD 0.70 billion in revenue. This dominance is largely due to the region’s advanced digital banking infrastructure, strong regulatory frameworks supporting customer data rights, and high consumer willingness to switch financial providers.

U.S. and Canadian banks have embraced digital transformation, enabling smoother account switching experiences. The presence of key fintech players and early adoption of open banking initiatives have further strengthened the region’s position in driving market innovation and growth.

For instance, in March 2025, First State Bank completed a major account processing switch to Fiserv’s Premier platform, marking a significant technology transformation that enhances digital banking capabilities and customer onboarding efficiency. This deployment underscores Fiserv’s leadership in seamless account switching services across North America.

Type Analysis

In 2024, Manual switching accounted for around 65.5% of the market, showing its continued use despite advancements in digital automation. Many banks and financial institutions still depend on manual processes due to legacy systems and security concerns. This approach allows greater control and oversight when transferring sensitive financial data between accounts.

The preference for manual switching is stronger in regions where automation systems are still being developed or where regulatory requirements limit automatic transfers. However, the higher operational costs and time delays associated with manual procedures are encouraging providers to gradually move toward hybrid and automated models

For Instance, in October 2025, Fiserv moved its stock listing to Nasdaq from the NYSE. This shift helps streamline operations for clients handling manual account processes. Banks using their tools gain better access to updates during switches. It supports smoother manual oversight in core processing.

Application Analysis

In 2024, The banking sector held about 36.7% of the market share, reflecting the strong adoption of account switching services by financial institutions. These services support improved customer experience by enabling quick and secure account transfers between banks. Growing competition in retail and commercial banking has pushed adoption among institutions trying to retain clients.

Banks also use these services to simplify account closure, fund transfers, and switching to digital channels. The steady growth in open banking frameworks has promoted transparency, allowing smoother integration of switching platforms within regulated financial systems.

For instance, in November 2025, Santander offers £200 to customers switching current accounts via the service. Banking users get quick transfers of debits and payments in days. This draws folks seeking better daily banking perks. Incentives fuel active banking segment growth.

Deployment Mode Analysis

In 2024, On-premises deployment represented nearly 58.6% of the total market. Many financial organizations prefer this model because it offers higher control over data security and integration with existing IT systems. It also supports compliance with local data storage and privacy regulations, which remain a top concern in financial operations.

Though cloud solutions are gaining attention, on-premises options remain dominant among large institutions with complex infrastructures. The flexibility to customize systems and ensure continuous operation without external dependency continues to favor this deployment mode.

For Instance, in April 2025, Fiserv powered Vanquis Bank’s shift to its on-premises Vision Next platform. Banks keep data in-house for secure manual deployments during switches. This setup fits custom needs without cloud risks. It strengthens control in processing.

End-User Analysis

In 2024, Retail customers contributed to around 72.4% of the market, driven by growing awareness of easier account transfer options. Individual users increasingly switch accounts to access better interest rates, digital services, and reduced fees. The simplicity of these switching platforms has encouraged adoption among younger and digitally active customers.

Financial institutions are aligning their offerings to attract and retain such customers through seamless transfer services. As digital banking continues to expand, the retail segment is expected to maintain strong growth, supported by user-friendly platforms and wider access to multi-bank integrations.

For Instance, in October 2025, Lloyds uses the switch service to move retail payments in seven days. Customers close old accounts while redirecting salaries and bills. Retail users value the free, hands-off process. It closes accounts automatically post-switch.

Emerging Trends

One emerging trend is the shift toward personalized banking journeys driven by AI and data. Financial institutions increasingly use AI to move from product‑centred services toward customer‑centred experiences. For account switching services, this could mean customized onboarding flows, tailored notifications to old and new account holders, and adaptive communication based on customer profile and history.

Another trend involves the deeper integration of switching services with broader digital banking ecosystems. As banks modernize legacy back‑end systems and adopt newer architectures, switching services are becoming a core part of digital banking platforms. This integration allows not just the transfer of balances but automatic migration of recurring payments, direct debits, and linked services, minimizing disruption for customers.

Growth Factors

A key growth factor is rising customer expectations for convenience and flexibility. As more people use digital banking, they prefer services that reduce manual effort and time involved in shifting accounts. The fewer hassles involved, the more willing consumers become to switch, making switching services more relevant and in demand.

Another growth factor stems from regulatory and compliance demands, where banks must ensure security, transparency, and data accuracy. As institutions adopt technologies like Generative AI that can reduce manual errors and speed up compliance tasks, they become more willing to offer switching services broadly. That technical readiness, combined with customer demand, helps drive growth in switching services.

Key Market Segments

By Type

- Manual Switching

- Automated Switching

By Application

- Banking

- Financial Services

- Insurance

- Telecom

- Utilities

- Others

By Deployment Mode

- On-Premises

- Cloud-Based

By End-User

- Retail Customers

- Business Customers

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Consumer Preference for Digital Flexibility

Modern banking customers now expect seamless and flexible control over their finances. Many compare financial products online before committing and will readily switch providers offering better digital tools, user-friendly apps, or lower costs. Studies show that around 55% of customers would change banks if their current platform lacks modern digital features or smooth mobile experiences.

This growing focus on convenience strengthens the need for faster and simpler account switching services. Users want assurance that direct debits and incoming payments remain intact during the transition. Service providers that deliver secure, intuitive, and transparent switching processes are better positioned to gain user trust and increase adoption.

For instance, in October 2024, Finastra deployed its Kondor treasury solution at LPBank in Vietnam, modernizing operations to handle higher trading volumes and faster transactions through digital risk analytics and position management. The quick rollout enhances user control over financial tools, aligning with consumer shifts toward providers offering superior digital convenience and lower switching barriers.

Restraint

Data Security Concerns

Concerns around data security continue to slow switching adoption, especially among cautious users. Banks must follow strict privacy and verification regulations, which increase both the time and operational costs of the switching process. While around 99.6% of account switches complete successfully and on schedule, the fear of data breaches or payment issues still makes many customers reluctant to change.

Legacy banking systems in certain regions also create obstacles for secure data transfers. Some users worry that direct debits could fail or that payments might be misrouted during the switch. These security and reliability fears limit adoption in markets where technology upgrades or digital infrastructure remain uneven.

For instance, in September 2025, Serrala enabled Intuitive Surgical to implement SAP Advanced Payment Management, providing real-time global cash visibility while addressing FX risks and intercompany payment security during transitions. This setup ensures compliance and reduces breach concerns in legacy systems, though integration challenges highlight ongoing hurdles in secure data transfers for account moves.

Opportunities

Open Banking Growth

The expansion of open banking regulations is creating new possibilities for account switching services worldwide. Easier data sharing and standardized APIs now allow banks to streamline transfers, helping more people move their accounts safely. Fast-growing markets like the Asia Pacific, which show annual expansion above 17%, provide strong potential for customer growth through more automated and transparent switching.

For small and medium enterprises, around 21,500 of which shifted accounts last year, integrated digital tools are especially attractive. Fintech partnerships that offer real-time alerts and integrated payment features can add long-term value, improving retention and reducing reliance on one-time switching incentives.

For instance, in September 2024, Finastra advanced open finance for treasury and capital markets, integrating best-in-class technologies via APIs to enable data sharing and innovation in payments and liquidity management. This supports growth in high-potential regions by partnering with fintechs for real-time tools, reducing reliance on basic incentives for SMEs and corporates.

Challenges

Keeping New Users

While cash bonuses and promotional offers continue to draw new switchers, many customers move again once incentives end. High churn rates, seen in record switching volumes exceeding 430,000 in recent quarters, show the struggle to maintain sustainable user retention. Banks that rely mainly on promotional schemes risk losing these new customers to competitors with better digital ecosystems.

Older banking platforms also find it hard to compete against digital-first rivals offering advanced money-management tools. Strong retention depends on building loyalty through better tracking, personalized insights, and ongoing engagement. Without continuous improvement in these areas, customer retention remains a major hurdle to steady market growth.

For instance, in November 2025, Broadridge equipped Merck with Swift’s Instant Cash Reporting via SCORE+, delivering real-time visibility across 400+ accounts to cut complexity in payment tracking. Despite high volumes, the shift from bank-specific APIs reveals retention issues, as legacy silos make it tough to sustain engagement without ongoing digital insights.

Key Players Analysis

Fiserv and FIS lead the account switching services market with platforms that streamline transfers of payments, direct debits, and standing instructions between financial institutions. Their systems focus on secure data exchange, automated verification, and reduced switching friction. These providers support banks aiming to increase customer mobility and regulatory compliance. Growing demand for faster, more transparent switching experiences reinforces their strong position in the sector.

HSBC, Santander, Barclays, Lloyds Banking Group, NatWest, Bank of America, JPMorgan Chase, Wells Fargo, Intesa Sanpaolo, BNP Paribas, Deutsche Bank, ING, UBS, and Citi strengthen the market with integrated switching frameworks that simplify onboarding while protecting existing financial relationships. Their solutions emphasize customer assurance, timely updates, and consistent communication throughout the switching cycle.

TSB Bank, Metro Bank, Monzo, Starling Bank, and other participants expand the landscape through digital-first switching journeys tailored for modern mobile banking users. Their platforms offer easy authentication, instant notifications, and quick setup of recurring payments. These companies focus on transparency, user-friendly workflows, and strong customer support. Increasing consumer preference for flexible banking relationships continues to accelerate adoption of streamlined account switching services worldwide.

Top Key Players in the Market

- Fiserv

- Fis

- HSBC

- Santander

- Barclays

- Lloyds Banking Group

- NatWest Group

- Bank of America

- JPMorgan Chase

- Wells Fargo

- Intesa Sanpaolo

- BNP Paribas

- Deutsche Bank

- ING Group

- UBS

- Citi

- TSB Bank

- Metro Bank

- Monzo Bank

- Starling Bank

- Others

Recent Developments

- In October 2025, Fiserv shifted its stock listing to Nasdaq from NYSE, marking a strategic move that boosts visibility for its core banking platforms handling account switches. Banks using Fiserv’s systems, like First State Bank earlier in the year, keep seeing smoother transitions for customers moving deposits and payments. This reinforces North American tech leadership in making account switching seamless for millions.

- In September 2025, FIS snapped up Amount, a digital account origination specialist, to unify how banks open new accounts and switch old ones with AI smarts built in. The deal targets deposits, loans, and cards for everyday folks and small businesses, cutting the hassle in the switch process. It’s a clear win for U.S. firms pushing faster, fraud-proof banking handoffs.

Report Scope

Report Features Description Market Value (2024) USD 2.20 Bn Forecast Revenue (2034) USD 8.45 Bn CAGR(2025-2034) 14.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Manual Switching, Automated Switching), By Application (Banking, Financial Services, Insurance, Telecom, Utilities, Others), By Deployment Mode (On-Premises, Cloud-Based), By End-User (Retail Customers, Business Customers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fiserv, Fis, HSBC, Santander, Barclays, Lloyds Banking Group, NatWest Group, Bank of America, JPMorgan Chase, Wells Fargo, Intesa Sanpaolo, BNP Paribas, Deutsche Bank, ING Group, UBS, Citi, TSB Bank, Metro Bank, Monzo Bank, Starling Bank, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Account Switching Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Account Switching Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fiserv

- Fis

- HSBC

- Santander

- Barclays

- Lloyds Banking Group

- NatWest Group

- Bank of America

- JPMorgan Chase

- Wells Fargo

- Intesa Sanpaolo

- BNP Paribas

- Deutsche Bank

- ING Group

- UBS

- Citi

- TSB Bank

- Metro Bank

- Monzo Bank

- Starling Bank

- Others