Global Energy Efficient Glass Market Size, Share, And Industry Analysis Report By Coating (Soft Coat, Hard Coat), By Glazing (Single Glazing, Double Glazing, Triple Glazing), By End Use (Building and Construction, Automotive, Solar Panel, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174960

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

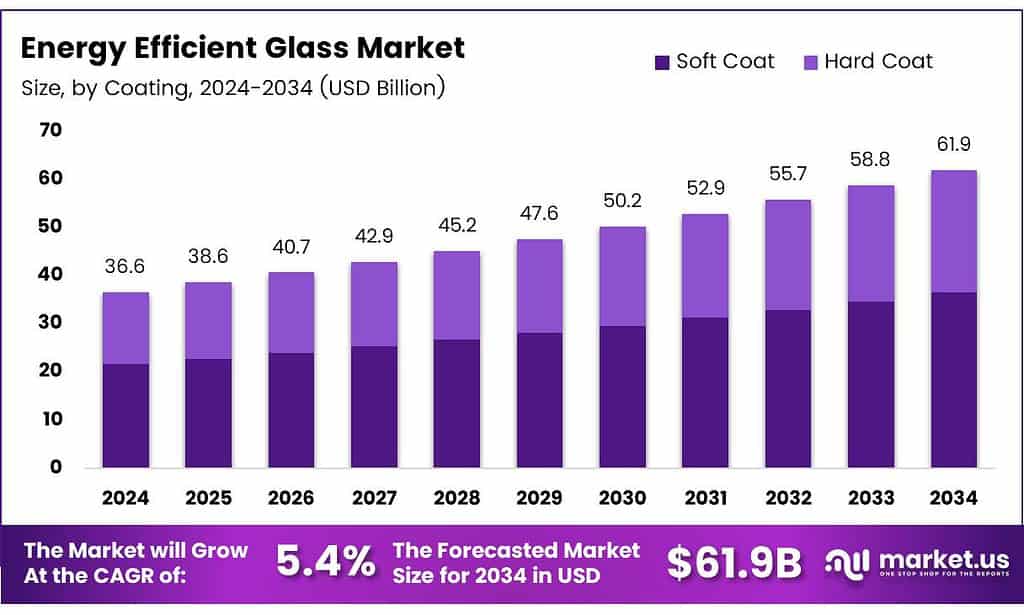

The Global Energy Efficient Glass Market size is expected to be worth around USD 61.9 billion by 2034, from USD 36.6 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Energy Efficient Glass concept refers to advanced glazing designed to reduce heat loss, limit solar gain, and improve indoor comfort. In practice, it combines low-emissivity coatings, insulated units, and smart layers. As a result, buildings consume less energy, lower operating costs, and meet tightening sustainability expectations across commercial and residential construction.

The Energy Efficient Glass Market represents the organized supply, demand, and deployment of these products across buildings, infrastructure, and selective industrial uses. Consequently, demand rises alongside green building codes and retrofit activity. Buyers increasingly evaluate glass not only by price, but also by lifetime energy savings, compliance value, and carbon-reduction performance.

- In the EU, container glass dominates production, accounting for 50–60% of the market, with bottles representing 75% and food jars 20%, while flat glass contributes about 20%. Because glass melting consumes nearly 75–85% of total production energy, efficiency gains—especially in flat glass play a direct role in building-sector decarbonization, supporting climate goals while improving long-term industry competitiveness.

Manufacturing efficiency remains a central priority for the glass industry. Even when purchased electricity and heat are excluded, onsite emissions from fuel combustion and production processes still account for around 20% of total emissions. This has pushed both producers and buyers to favor technologies that lower downstream energy demand and reduce the overall carbon footprint of glass products.

Key Takeaways

- The Global Energy Efficient Glass Market is projected to grow from USD 36.6 billion in 2024 to USD 61.9 billion by 2034 at a 5.4% CAGR.

- Soft Coat glass leads the coating segment with a dominant 59.1% share due to superior insulation performance.

- Single-glazing holds the highest glazing share at 49.6%, supported by affordability and presence in older buildings.

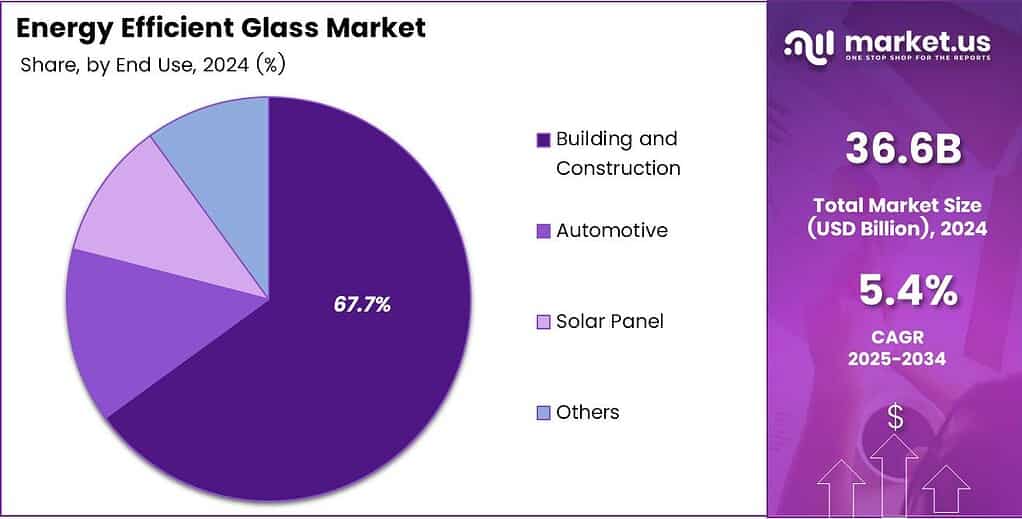

- Building and Construction remains the top end-use segment, capturing 67.7% of the total market.

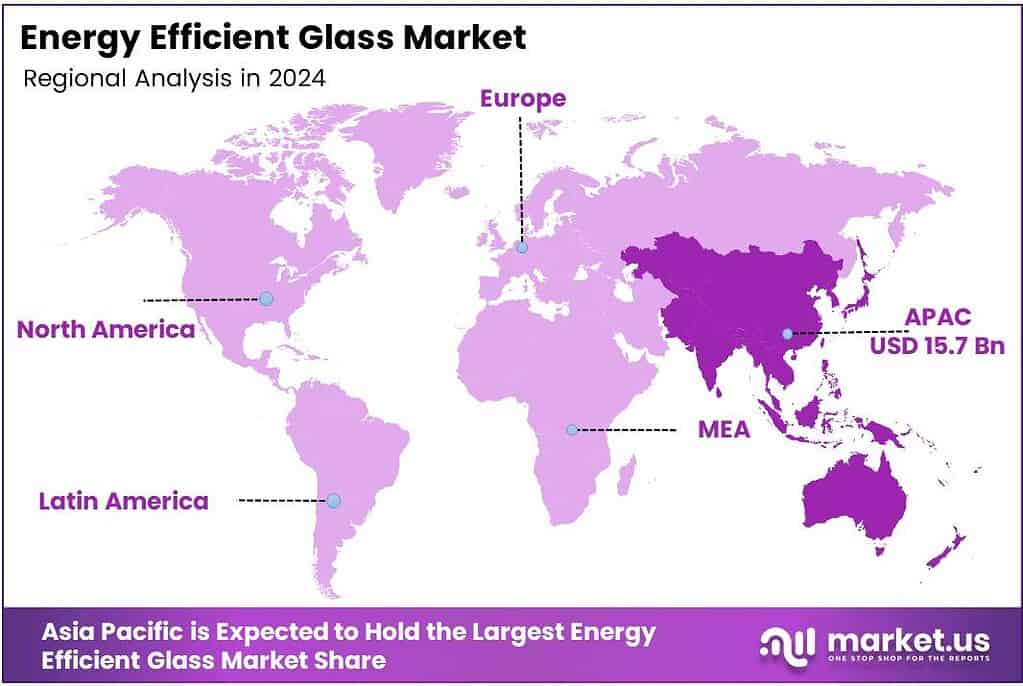

- Asia Pacific dominates the regional landscape with a 42.9% share, valued at USD 15.7 billion.

By Coating Analysis

Soft Coat dominates with 59.1% due to its superior thermal insulation performance and energy-saving capability.

In 2025, Soft Coat held a dominant market position in the By Coating Analysis segment of the Energy Efficient Glass Market, with a 59.1% share. This leadership is driven by its ability to reflect heat while allowing natural light. As a result, buildings achieve better indoor comfort and lower energy consumption.

Moreover, soft coat glass is widely used in modern commercial and residential buildings because it supports green building standards. It performs well in both hot and cold climates. Consequently, architects and developers increasingly prefer it for projects focused on long-term energy efficiency.

Hard-coated glass, although holding a smaller share, continues to play a supportive role in the market. It is valued for its durability and ease of handling. Therefore, it is often selected for projects where cost control and mechanical strength are key considerations.

By Glazing Analysis

Single Glazing dominates with 49.6% owing to its affordability and widespread use in existing buildings.

In 2025, Single Glazing held a dominant market position in the By Glazing Analysis segment of the Energy Efficient Glass Market, with a 49.6% share. This dominance reflects its strong presence in older buildings and cost-focused projects. As a result, it remains widely installed across many regions.

Double Glazing is gaining attention due to its improved insulation and noise reduction benefits. It is increasingly adopted in new residential and commercial developments. Consequently, it supports better indoor comfort while helping reduce heating and cooling requirements.

Triple Glazing represents a premium solution focused on maximum energy efficiency. It is mainly used in high-performance buildings. Although adoption is selective, it aligns strongly with sustainability goals, making it important for future-focused construction strategies.

By End Use Analysis

Building and Construction dominates with 67.7%, driven by rising demand for energy-efficient structures.

In 2025, Building and Construction held a dominant market position in the By End Use Analysis segment of the Energy Efficient Glass Market, with a 67.7% share. This dominance is supported by strict building codes and sustainability goals. Consequently, energy-efficient glass has become a standard material choice.

Within this segment, energy-efficient glass is widely used in residential and commercial buildings to reduce energy loss. It helps maintain indoor temperatures. As a result, developers benefit from lower operating costs and improved environmental performance.

Automotive applications focus on improving passenger comfort and reducing vehicle energy use. Energy-efficient glass helps manage heat inside vehicles. Therefore, it supports better fuel efficiency and enhances the overall driving experience. Solar Panel and Other segments contribute through specialized applications. In solar panels, glass improves energy capture efficiency.

Key Market Segments

By Coating

- Soft Coat

- Hard Coat

By Glazing

- Single Glazing

- Double Glazing

- Triple Glazing

By End Use

- Building and Construction

- Automotive

- Solar Panel

- Others

Emerging Trends

Growing Adoption of Smart and Solar-Control Glass Shapes Market Trends

One of the strongest trends in the Energy Efficient Glass Market is the rising popularity of smart glass technologies. Electrochromic and switchable glass products allow users to control light and heat, offering flexibility and better energy management in homes and commercial spaces.

- The U.S. Department of Energy notes that tightly installed cellular shades can cut heat loss through windows by 40% or more during heating seasons, which can translate to about 10% heating energy savings. Sustainability trends are influencing material choices as well.

Solar-control glass is also becoming a major trend. It prevents excessive heat from entering buildings while allowing natural light, which improves indoor comfort. This trend is especially strong in hot regions where cooling demands are high. Manufacturers are introducing thinner, lighter, and more durable versions of energy-efficient glass.

Drivers

Rising Focus on Reducing Energy Consumption Boosts Market Growth

The Energy Efficient Glass Market is growing because buildings today require smarter ways to reduce electricity use. Governments are promoting green construction, and this pushes architects and developers to choose glass that keeps interiors cooler in summer and warmer in winter. This helps reduce energy bills and supports sustainability.

- Another strong driver is the rising cost of electricity. As consumers look for long-term savings, they prefer glass that improves insulation and reduces the need for air conditioners and heating systems. The same DOE guidance highlights that cellular shades can reduce unwanted solar heat through windows by up to 60%, and with a tight fit can reduce total solar gain to 20%.

The rapid expansion of smart cities is also increasing the demand for advanced glazing materials. Modern buildings use insulated, low-emissivity, and solar-control glass to meet energy regulations. These standards make energy-efficient glass essential rather than optional.

Restraints

High Manufacturing and Installation Costs Limit Market Adoption

The major restraint for the Energy Efficient Glass Market is the high cost of producing and installing these advanced glass products. Specialized coatings, insulation layers, and quality control add to the overall manufacturing expenses, making the final product more expensive than regular glass.

- Many small builders and homeowners find it difficult to invest in these materials due to budget constraints. Windows in the United States account for 30% of building heating and cooling energy, with an annual impact of 4.1 quadrillion BTU (quads) of primary energy.

The lack of awareness in some regions. Many consumers do not fully understand the long-term benefits of energy-efficient glass. As a result, they choose cheaper alternatives without considering the rise in future energy bills or comfort levels. The market also faces limitations because retrofitting old structures with energy-efficient glass is complicated.

Growth Factors

Increasing Green Building Certifications Create Strong Market Opportunities

A major growth opportunity for the Energy Efficient Glass Market comes from the rise in green building certifications such as LEED, BREEAM, and IGBC. These certifications encourage the use of sustainable materials, giving energy-efficient glass a stronger role in modern construction.

Rapid urbanization in emerging economies also presents a large opportunity. As more offices, malls, airports, and residential complexes are built, developers prefer solutions that reduce future energy costs. This trend expands the demand for high-performance glazing materials.

Technological innovation is another opportunity area. Advancements such as smart glass, electrochromic glass, and vacuum-insulated glass allow manufacturers to offer more intelligent products. These innovations attract buyers looking for automation, comfort, and improved energy management.

Regional Analysis

Asia Pacific Dominates the Energy Efficient Glass Market with a Market Share of 42.9%, Valued at USD 15.7 Billion

Asia Pacific leads the global Energy Efficient Glass Market, holding a substantial 42.9% share and generating around USD 15.7 billion in revenue. The region’s dominance is driven by rapid urban development, large-scale infrastructure expansion, and stricter energy-saving building codes. Rising construction of commercial buildings and adoption of green architecture across China, India, and Southeast Asia further strengthen its leadership position.

North America continues to expand steadily due to strong enforcement of energy efficiency regulations and higher adoption of sustainable building materials. The region benefits from rising retrofit activities, particularly in the U.S., where government incentives encourage low-emission and insulated glass installations. Increasing consumer awareness of energy conservation also supports long-term market growth.

Europe remains a mature and technologically advanced market driven by strict EU climate policies and building performance directives. Demand is supported by renovation programs aimed at reducing energy loss in older structures. The region also witnesses rising integration of smart glazing systems aligned with its long-term carbon-neutrality goals.

Asia Pacific outside the dominating narrative continues to show strong adoption supported by urban infrastructure upgrades and government-backed sustainability initiatives. Growth is aided by rising housing demand, commercial construction, and increasing awareness of thermal insulation benefits in emerging economies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Saint-Gobain Glass is positioned as a “solutions-first” leader in 2025, pairing high-performance low-E glazing with integrated offerings for façades, interiors, and renovation. Its strength is scale and specification influence, which helps it respond quickly to tighter building-energy codes and growing demand for lower embodied carbon. The focus is likely to stay on coatings, acoustic comfort, and circularity features that help projects meet green-building targets.

AGC Inc. stands out for its deep materials know-how and ability to industrialize advanced coatings for solar control, thermal insulation, and glare management. In 2025, AGC’s advantage is balancing performance with manufacturability—important as developers push for consistent quality across large portfolios. Expect continued emphasis on next-generation coated glass and partnerships across the construction value chain to support performance guarantees.

Guardian Glass benefits from strong architectural relationships and a portfolio that is well aligned with high-volume commercial demand. In 2025, the company’s competitive edge is likely to be in delivering reliable low-E and solar-control products with short lead times, while expanding options for daylighting and occupant comfort. Guardian’s market impact often comes from simplifying specification choices for designers and contractors.

NSG Group remains a key player where performance, durability, and compliance matter most, including demanding climates and complex façade designs. In 2025, NSG’s opportunity is to convert more retrofit and refurbishment projects by offering energy-saving glazing that fits existing frames and construction constraints. A sharper push on environmental product transparency and lifecycle value can further strengthen its bid with sustainability-driven buyers.

Top Key Players in the Market

- Saint Gobain Glass

- AGC Inc.

- Guardian Glass

- NSG Group

- Vitro Architectural Glass

- Xinyi Glass Holdings Ltd.

- CSG Holding

- Fuyao Glass Industry Group

- Flat Glass Group Co., Ltd.

- Taiwan Glass Industry Corporation

Recent Developments

- In 2025, Saint-Gobain Glass will focus on advancing vacuum insulation and sustainable practices in energy-efficient glass. The company launched INSIO, the first tempered vacuum glazing with 0.3–0.5 W/m²K insulation to earn voluntary CE marking, incorporating LuxWall’s technology for enhanced energy efficiency in buildings.

- In 2025, AGC Inc. emphasized sustainability and innovation in energy-efficient and related glass technologies. AGC outlined plans to accelerate the adoption of energy-efficient high-insulation architectural glass, setting shipment volume targets as part of its AGC plus-2026 medium-term plan.

Report Scope

Report Features Description Market Value (2024) USD 36.6 Billion Forecast Revenue (2034) USD 61.9 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coating (Soft Coat, Hard Coat), By Glazing (Single Glazing, Double Glazing, Triple Glazing), By End Use (Building and Construction, Automotive, Solar Panel, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Saint Gobain Glass, AGC Inc., Guardian Glass, NSG Group, Vitro Architectural Glass, Xinyi Glass Holdings Ltd., CSG Holding, Fuyao Glass Industry Group, Flat Glass Group Co., Ltd., Taiwan Glass Industry Corporation Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Energy Efficient Glass MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Energy Efficient Glass MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Saint Gobain Glass

- AGC Inc.

- Guardian Glass

- NSG Group

- Vitro Architectural Glass

- Xinyi Glass Holdings Ltd.

- CSG Holding

- Fuyao Glass Industry Group

- Flat Glass Group Co., Ltd.

- Taiwan Glass Industry Corporation