Global 6G Wireless Technology Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Spectrum Band (Sub-THz, THz), By Application (Enhanced Mobile Broadband, Ultra-Reliable Low Latency Communications, Massive Machine Type Communications, Others), By End-Use (Telecommunications, Automotive, Healthcare, Manufacturing, Media and Entertainment, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160527

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaway

- Analysts’ Viewpoint

- Performance & Technical Specifications

- Investment and Business Benefits

- Notable research and development

- China Market Size

- Component Analysis

- Spectrum Band Analysis

- Application Analysis

- End-Use Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

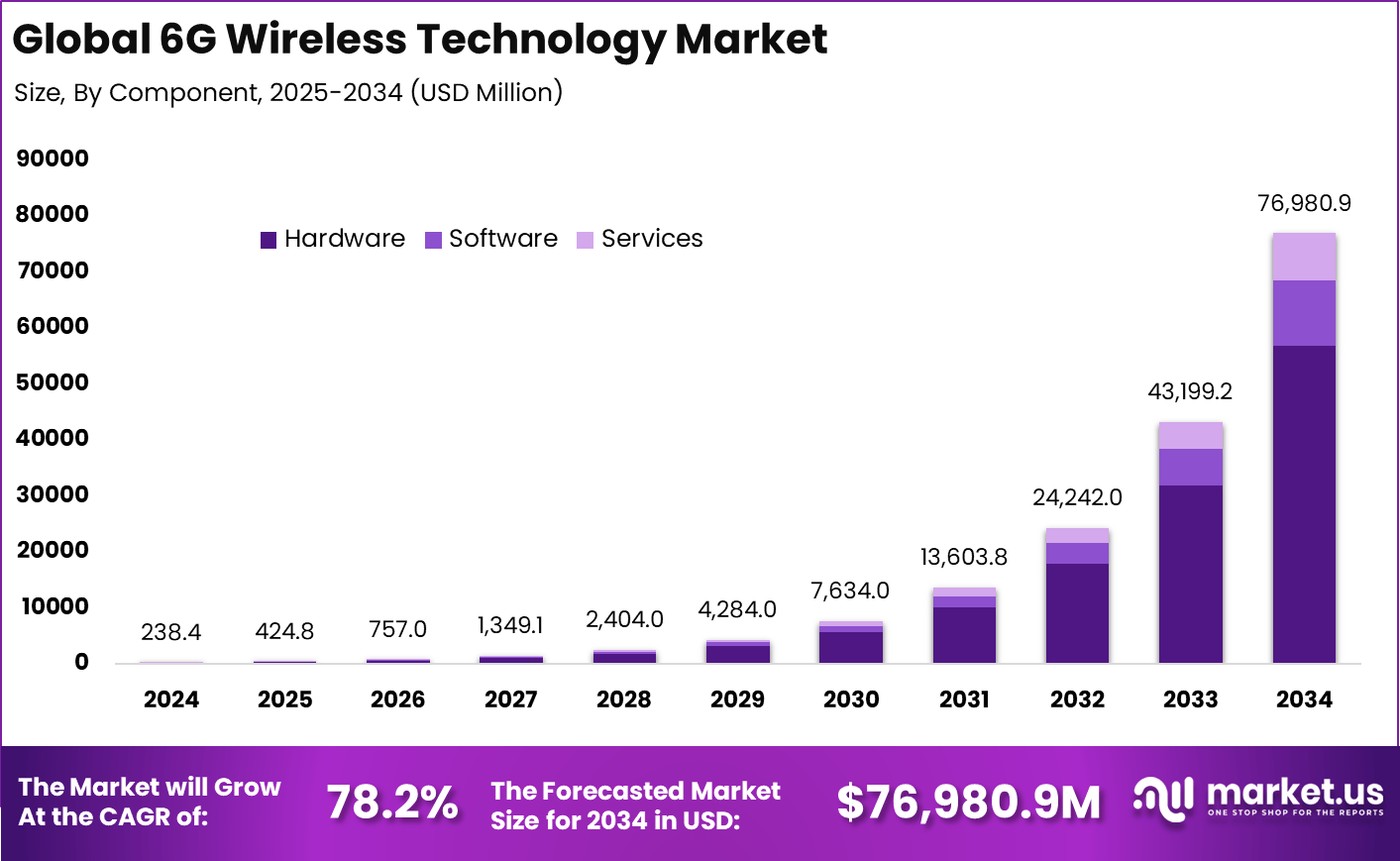

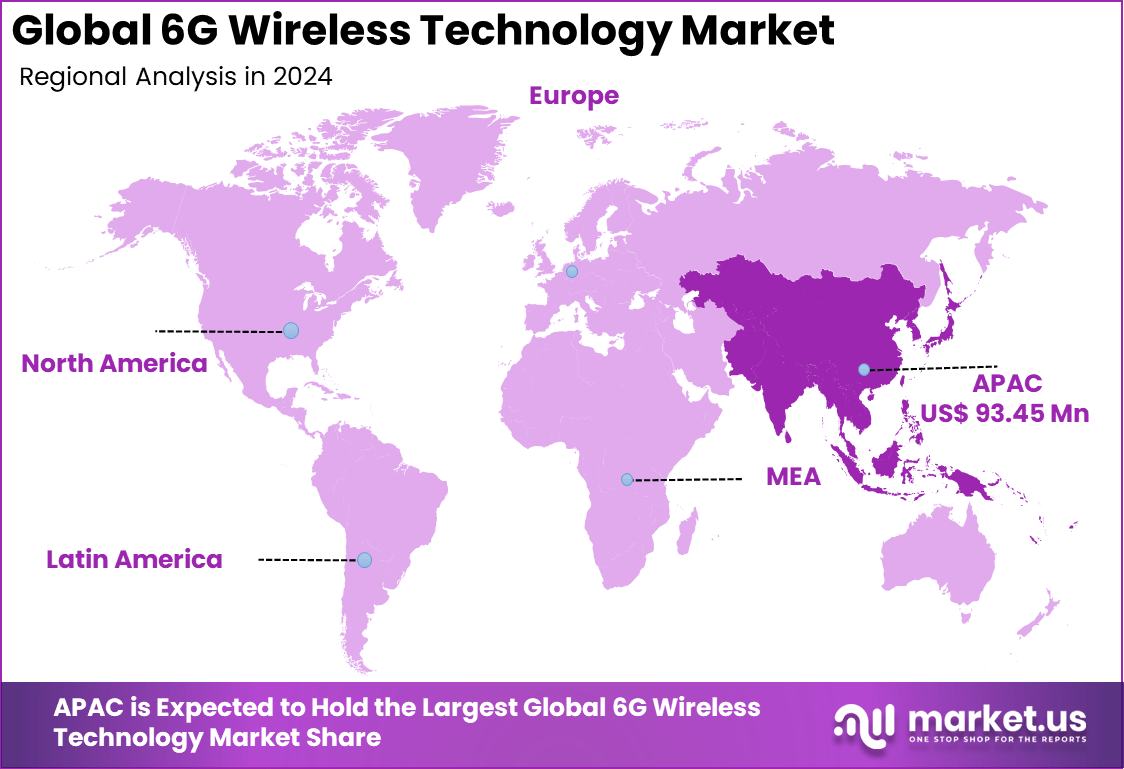

The Global 6G Wireless Technology Market size is expected to be worth around USD 76,980.9 million by 2034, from USD 238.4 million in 2024, growing at a CAGR of 78.2% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 39.2% share, holding USD 93.45 million in revenue.

6G Wireless Technology Market is shaping up to be a revolutionary step in wireless communications. It will offer speeds up to 1 terabit per second, ultra-low latency below one millisecond, and vastly expanded network capacity. This new generation will support immersive digital experiences such as real-time holography, augmented and virtual reality, and seamless machine-to-machine communications essential for smart cities and autonomous systems.

Growth is being supported by rising demand for extreme performance in terms of latency, reliability, and data throughput. Industries deploying autonomous machines, cloud robotics, real-time monitoring, and advanced simulation systems are beginning to exceed the limits of 5G. National competitiveness is also a major catalyst, with multiple countries treating 6G as part of their long-term digital sovereignty strategy.

Top Driving Factors for 6G adoption center around the increasing demand for faster, highly reliable networks with minimal delays. The rising need for enhanced security and privacy with AI-driven threat detection and quantum encryption is crucial as billions of connected devices grow globally. Sustainability also drives 6G development, as it aims to reduce energy consumption via AI-managed networks and supports environmental goals like smart grids.

According to Market.us Scoop, spectrum allocation for 6G will extend into the upper mid-band range of 7 to 24 GHz, commonly referred to as FR3. The 7 to 15 GHz segment is gaining strong interest due to its favorable propagation characteristics, which closely resemble frequencies below 7 GHz while offering far greater capacity. Bandwidth blocks of up to 20 GHz are currently being assessed for 6G use, although they present notable engineering challenges.

Data rates are expected to reach 1 terabit per second (Tbps), marking a dramatic leap from the 100 to 1000 Mbps speeds of 5G. With peak rates projected at 1000 Gbps, 6G is set to redefine mobile broadband performance altogether. Infrastructure spending is expected to follow, with transport network investment projected to hit USD 505 million by 2030.

For instance, in June 2025, Ericsson showcased its latest 6G prototypes, highlighting innovations such as Integrated Sensing and Communication (ISAC) and photonic radios. These technologies are central to Ericsson’s vision of 6G as a convergence of communication, sensing, and AI. The demonstrations emphasized ultra-low latency, real-time environmental awareness, and high-frequency spectrum utilization.

Top Market Takeaway

- In 2024, Hardware led with a 73.98% share, reflecting the importance of advanced devices and infrastructure in 6G development.

- The THz segment dominated with 78.1%, showcasing its role as the core spectrum technology for ultra-high-speed connectivity.

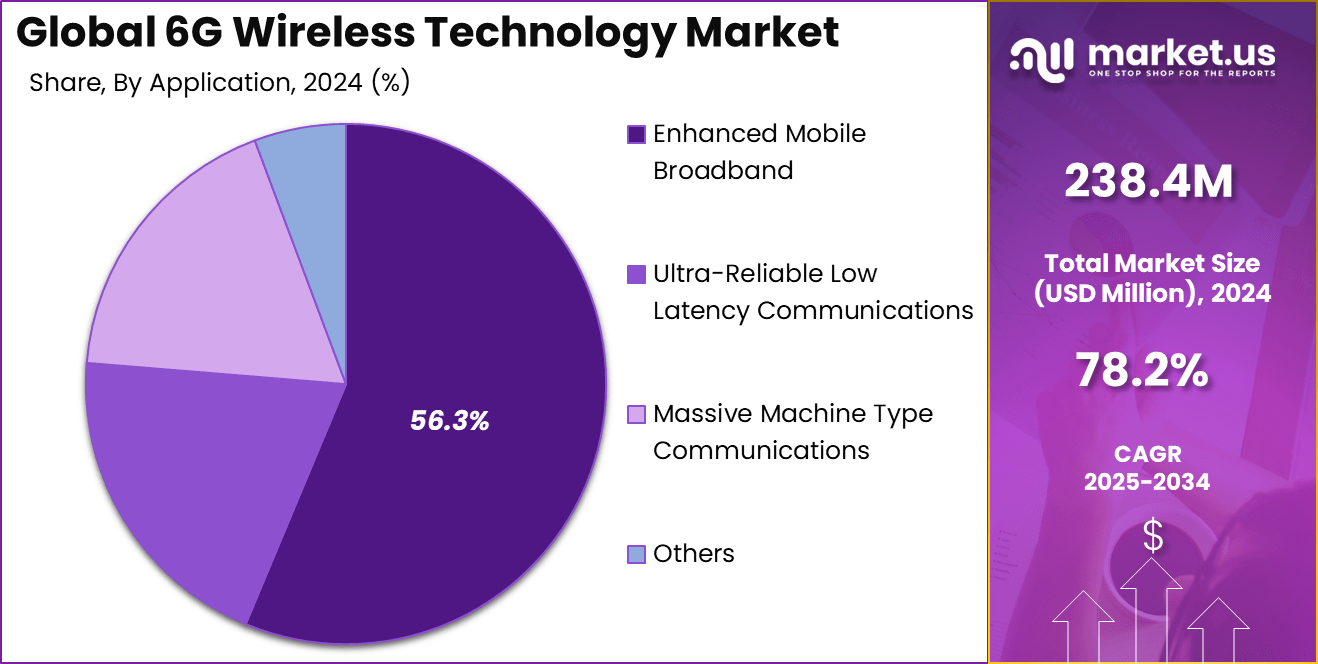

- Enhanced Mobile Broadband (eMBB) accounted for 56.3%, driven by demand for immersive experiences and high-capacity applications.

- The Telecommunications sector captured 62.1%, highlighting its leadership in early 6G deployment and investments.

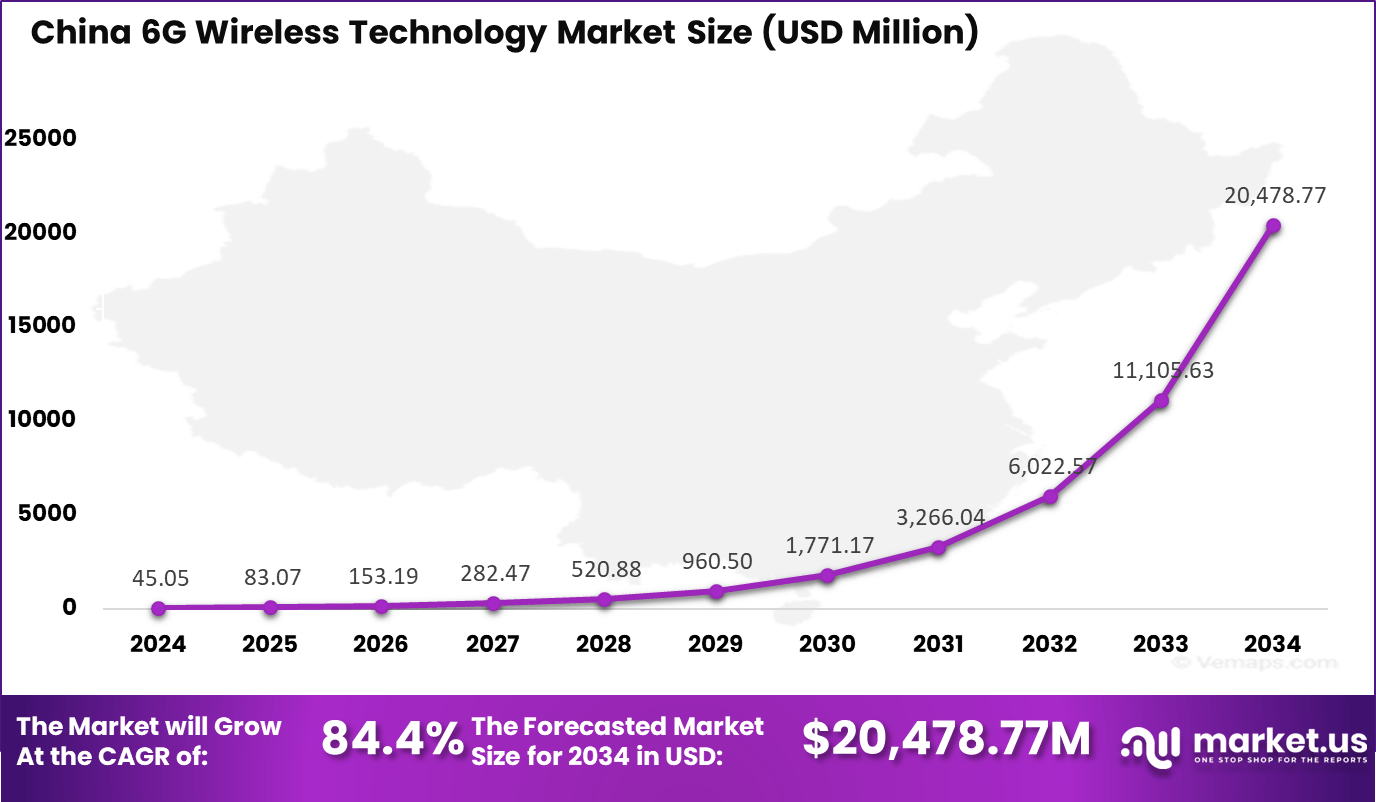

- The China 6G market was valued at USD 45.05 million in 2024 and is projected to grow at a remarkable CAGR of 84.4%, emphasizing its aggressive push in next-gen wireless innovation.

- Asia Pacific held the largest regional share at 39.2%, supported by strong R&D, government initiatives, and large-scale trials.

Analysts’ Viewpoint

Demand Analysis indicates a growing push from industries such as healthcare, transportation, and manufacturing toward ultra-reliable, low-latency connections that 6G will provide. Applications including remote surgery, real-time autonomous vehicle communication, and smart factory automation are expected to fuel this demand.

The need for seamless connectivity in dense urban environments and rural inclusivity will spur adoption, alongside growing consumer expectations for speedy and flawless digital services. The expected support for up to 10 million devices per square kilometer highlights a significant leap in device density catering to massive IoT deployments.

Increasing Adoption Technologies involve key advancements such as millimeter-wave and terahertz frequency bands, enabling massive bandwidth and data transfer rates. Technologies like massive MIMO antenna arrays, AI-native network architectures for real-time optimization, and integrated sensing and communication (ISAC) are central to 6G networks. These allow better network coverage, lower interference, and adaptive response to traffic demands.

Performance & Technical Specifications

Specification Details Data Rate Anticipated to reach 1 Tbps, which is 100 times faster than 5G Latency Expected to be as low as 1 ms, enabling near-instantaneous communication Reliability Forecasted to be up to 100 times more reliable than 5G, with a reliability rate of 99% Spectrum Will use higher frequencies, including terahertz (THz) bands, offering much wider bandwidth than 5G Energy Efficiency Aims for 1,000 times greater energy efficiency compared to 5G Connectivity Capable of supporting millions of connected devices per square kilometer Investment and Business Benefits

Investment Opportunities in 6G revolve around upgrading digital infrastructure, including deploying new cell sites, antennas, and fiber backhaul to handle higher frequency bands and data traffic. Investments also focus on AI-driven network management systems, quantum encryption technologies, and sustainable energy solutions.

Businesses stand to gain by developing AI and edge computing capabilities that optimize network performance and open avenues for new services, such as data-driven applications leveraging sensing capabilities. Early investments in talent development for specialized 6G competencies and strategic partnerships across industries can secure market advantages.

Business Benefits of 6G are wide-ranging. The technology will enable smarter, more efficient operations by supporting vast device connectivity and instant real-time data processing. Businesses can improve customer experiences through enhanced service quality, such as uninterrupted video communication, virtual collaborations, and immersive training via AR/VR. It also supports robust security frameworks protecting sensitive information.

Notable research and development

Region Details India In 2025, the government approved 104 projects related to 6G technology with a total investment of over ₹275 crores. United States The U.S. government allocated $500 million in 2023 to accelerate 6G R&D. European Union The EU invested $900 million in 6G research in 2024 through its Horizon Euro China Market Size

The market for 6G Wireless Technology within China is growing tremendously and is currently valued at USD 45.05 million, the market has a projected CAGR of 84.4%. The market is growing rapidly due to strong government support, strategic investments in R&D, and the country’s ambition to lead global telecom standards.

China’s tech giants and academic institutions are actively collaborating on 6G trials, satellite integration, and AI-driven networks. Additionally, the government’s policies prioritize digital infrastructure and innovation, fueling competitive advancements. This proactive ecosystem, combined with a large domestic market and manufacturing strength, positions China.

For instance, in September 2024, China’s International Telecommunication Union (ITU)-approved 6G standards marked a pivotal step in solidifying the country’s dominance in next-generation telecommunications. The approval sets the foundation for developing advanced 6G solutions, including ultra-high-speed data transfer, low-latency communication, and intelligent network management.

In 2024, Asia Pacific held a dominant market position in the Global 6G Wireless Technology Market, capturing more than a 39.2% share, holding USD 93.45 million in revenue. This dominance is due to its aggressive R&D investments, strong government backing, and leadership in early trials and patent filings.

Countries like China, South Korea, and Japan have prioritized 6G as a strategic national objective, fostering innovation through collaboration between industry, academia, and government. The region’s robust telecommunications infrastructure, manufacturing capabilities, and rapidly growing digital economy further reinforced its leadership.

For instance, in January 2021, the Japanese government allocated $482 million for 6G research and development, reinforcing Asia Pacific’s early leadership in 6G wireless technology. The funding aims to accelerate innovation in advanced communication systems, including terahertz transmission, ultra-low latency networking, and AI-driven connectivity. The goal was to build core technologies by 2025 and establish a leading position in telecommunications.

Component Analysis

In 2024, Hardware accounts for a significant 73.98% of the 6G wireless technology market. This dominance stems from the critical need for advanced physical equipment such as integrated circuits, antennas, base stations, and network infrastructure capable of supporting ultra-high-speed data transmission and ultra-low latency.

The rapid innovation in hardware technology focuses on miniaturization, energy efficiency, and enhanced signal processing to meet the rigorous demands of 6G technology. As 6G requires the deployment of complex systems that handle terahertz frequencies and massive data traffic, the investment in hardware development is essential.

With high-speed data rates reaching terabits per second and microsecond-level latency, the hardware segment will continue to drive technological advancements that enable new use cases such as autonomous vehicles, immersive AR/VR experiences, and smart cities. This emphasis on hardware infrastructure is crucial for the large-scale adoption of 6G wireless networks globally.

For Instance, in September 2025, scientists unveiled the world’s first all-frequency 6G chip, marking a major milestone in hardware innovation for 6G wireless technology. The chip operates across frequencies from 0.5 GHz to 115 GHz, delivering data speeds exceeding 100 Gbps. Measuring just 11 mm by 1.7 mm, it integrates multiple radio systems into a single compact design.

Spectrum Band Analysis

In 2024, the terahertz (THz) spectrum band captures the largest share at 78.1% in the 6G market. THz frequencies offer enormous bandwidth capabilities that significantly alleviate current spectrum scarcity challenges faced by wireless communication. Operating above 300 GHz, this spectrum band enables ultra-high-capacity connections, necessary for data-intensive applications like holographic communication, ultra-high-definition streaming, and real-time cloud gaming.

The challenge with THz lies in its propagation limitations and the need for highly specialized hardware. However, its advantages in supporting terabit-per-second wireless links and enabling seamless joint sensing and communication make it vital for 6G’s future. The THz band will complement lower frequency bands, creating a layered spectrum approach that balances coverage and capacity to deliver next-generation wireless network experiences.

For instance, in August 2024, the Telecom Regulatory Authority of India (TRAI) recommended the allocation of terahertz (THz) spectrum bands for 6G research and trials, marking a major policy step toward next-generation wireless development. The recommendations aim to facilitate experimentation with ultra-high-frequency bands essential for ultra-fast, low-latency communication.

Application Analysis

In 2024, Enhanced mobile broadband (eMBB) leads the application segment with 56.3% share, driven by the demand for ultra-fast, high-capacity wireless connections. eMBB supports data-intensive activities such as 8K video streaming, mixed reality, holographic communications, and cloud gaming, all of which require minimal latency and high reliability. This application form is central to enabling the digital lifestyle of the future, where instant access to massive amounts of data is common.

The growth of eMBB is closely tied to sectors like entertainment, telemedicine, autonomous vehicles, and smart cities. As user demand for immersive experiences increases, 6G networks will become essential to deliver consistent, fast, and reliable mobile broadband connectivity. eMBB’s dominance in the market reflects how vital seamless multimedia applications are in shaping 6G adoption globally.

For Instance, in August 2025, Ericsson published a blog post emphasizing how 6G wireless technology will significantly advance Enhanced Mobile Broadband (eMBB) capabilities. The company highlighted that 6G will deliver unprecedented data speeds, seamless connectivity, and ultra-low latency, enabling immersive experiences such as real-time holographic communication, 8K streaming, and extended reality (XR).

End-Use Analysis

In 2024, Telecommunications represents the largest end-user segment with 62.1% of the 6G market. Telecom operators are key adopters, investing heavily to upgrade infrastructure capable of supporting 6G’s promises of ultra-low latency, massive connectivity, and enhanced network reliability. This segment drives demand for 6G-enabled hardware, network infrastructure, and service provisions that meet the increasing needs of consumers and enterprises.

With the expanding digital economy and emergence of new data-intensive applications, telecom companies focus on delivering next-gen service quality. Key areas include smart city deployments, connected vehicles, and industrial IoT. Telecommunications’ pivotal role ensures continuous evolution of wireless standards, making it indispensable for realizing the full benefits of 6G networks.

For Instance, in December 2024, Airtel highlighted how 6G wireless technology is set to revolutionize the telecommunications sector by delivering ultra-fast speeds, near-zero latency, and seamless connectivity. The company emphasized that 6G will enable advanced applications such as immersive communication, smart cities, and autonomous networks.

Emerging Trends

Emerging trends in 6G highlight a shift towards ultra-high frequency bands, such as terahertz (THz) communication, allowing wireless speeds up to 1 terabit per second. About 30% of current 6G research targets THz communications. Another trend is intelligent network management driven by AI, which supports applications requiring ultra-low latency and massive device connectivity.

Integration of edge computing and AI further improves responsiveness. Data indicates that as many as 75 billion wireless devices are expected to be in use globally by 2025, emphasizing the need for these advanced trends to address rising connectivity demands.

Growth Factors

Several growth factors are driving 6G adoption today. Advances in AI, quantum computing, and terahertz technology are critical enablers. There is increasing demand for ultra-reliable, low latency communication for applications in autonomous vehicles, smart cities, and industrial automation.

Private and government investments are accelerating research and advancing infrastructure development. Regional growth is especially strong in Asia Pacific, supported by rapid urbanization and a tech-savvy population. Official reports confirm that ultra-reliable and enhanced mobile broadband represent some of the largest usage scenarios for 6G.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Spectrum Band

- Sub-THz

- THz

By Application

- Enhanced Mobile Broadband

- Ultra-Reliable Low Latency Communications

- Massive Machine Type Communications

- Others

By End-Use

- Telecommunications

- Automotive

- Healthcare

- Manufacturing

- Media and Entertainment

- Others

Drivers

Demand for Ultra-Fast Connectivity

The primary driver for 6G wireless technology is the escalating demand for ultra-fast, reliable connectivity across various industries and consumers. As digital ecosystems evolve, applications such as real-time holographic communication, autonomous vehicles, and immersive virtual reality require data speeds far beyond those 5G can provide.

6G aims to deliver peak speeds around 1 terabit per second with latency reduced to less than 0.1 milliseconds, enabling seamless user experiences and new applications. This increased demand for bandwidth and low latency is fueling investments and innovations in 6G architectures, propelling the technology toward widespread commercialization by 2030.

For instance, in September 2025, Keysight Technologies announced plans to demonstrate AI-enabled 6G and advanced wireless technologies at the India Mobile Congress 2025. The showcase highlights Keysight’s innovations in combining artificial intelligence with next-generation communication systems to accelerate 6G research, testing, and deployment.

Restraint

Spectrum Scarcity and Propagation Limits

A significant restraint on 6G development is the scarcity of usable wireless spectrum and challenges inherent to higher-frequency communications. 6G is expected to utilize terahertz (THz) frequency bands, which offer very high data rates but suffer from severe signal loss and limited propagation distance.

High free-space path loss, atmospheric absorption, and material penetration limitations restrict the coverage area, complicating network design and requiring dense deployment of base stations or repeaters. These physical constraints raise technical and economic barriers to the widespread rollout of 6G.

For instance, in March 2025, MathWorks partnered with Altera to advance AI-driven wireless design, addressing the growing complexity and cost challenges of developing 6G infrastructure. The collaboration focuses on leveraging MathWorks’ simulation tools with Altera’s FPGA platforms to optimize design workflows, reduce prototyping expenses, and accelerate 6G hardware development.

Opportunities

Integration of AI and Enhanced Network Intelligence

6G technology presents a strong opportunity through its integration with artificial intelligence (AI) to create self-optimizing, intelligent networks. AI can enhance network management by dynamically allocating resources, predicting demand patterns, and minimizing latency and outages.

This improvement enables highly efficient, adaptive wireless systems that outperform previous generations in reliability and energy efficiency. The fusion of AI with 6G can revolutionize connectivity for smart cities, industrial automation, and personalized services, unleashing new business models and digital experiences.

For instance, in September 2025, LitePoint announced a collaboration with Advantech to develop next-generation industrial wireless connectivity technologies, paving the way for advancements aligned with 6G development. The partnership focuses on integrating LitePoint’s advanced wireless testing solutions with Advantech’s industrial computing platforms to accelerate innovation in smart factories and industrial automation.

Challenges

Network Densification and Energy Efficiency

One of the major challenges facing 6G deployment is managing ultra-dense network environments with an exponential increase in connected devices. This density creates issues around interference, seamless handovers, and resource allocation, needing sophisticated new technologies.

Planning and optimizing networks to support billions of IoT devices and maintain high service quality requires breakthroughs in antenna design, beamforming, and spectrum coordination. Furthermore, ensuring the scalability of these complex systems while keeping operational costs under control is a continuous concern.

For instance, in December 2023, a report by IT Munch discussed the growing intersection of AI and 6G wireless technology, emphasizing both its transformative potential and emerging security and privacy risks. As AI becomes deeply integrated into 6G networks, enabling intelligent automation and real-time optimization, new vulnerabilities are surfacing, particularly around data integrity, user privacy, and algorithmic bias.

Key Players Analysis

The 6G Wireless Technology Market is led by major telecom equipment manufacturers such as Huawei Technologies, Nokia Corporation, Ericsson AB, and ZTE Corporation. These companies are investing heavily in 6G research and early trials, focusing on ultra-low latency networking, terahertz spectrum utilization, and AI-native communication systems.

Technology and device manufacturers including LG Electronics, Sony Corporation, Cisco Systems Inc., and NEC Corporation contribute through hardware development, edge computing integration, and network virtualization. Their efforts focus on software-defined networking, satellite-to-terrestrial convergence, and energy-efficient base station design.

Global telecommunications operators such as AT&T Inc., Verizon Communications Inc., SK Telecom Co., Ltd., NTT DoCoMo, Inc., China Mobile Limited, and Deutsche Telekom AG are collaborating with infrastructure providers to shape future spectrum policies and deployment frameworks. Their early investments in 6G testbeds and pilot networks are critical for commercial readiness.

Top Key Players in the Market

- Huawei Technologies

- Nokia Corporation

- Ericsson AB

- Cisco Systems Inc.

- ZTE Corporation

- LG Electronics

- Sony Corporation

- NEC Corporation

- AT&T Inc.

- Verizon Communications Inc.

- SK Telecom Co., Ltd.

- NTT DoCoMo, Inc.

- China Mobile Limited

- Deutsche Telekom AG

- Others

Recent Developments

- In October 2025, Nokia entered a global licensing agreement with Hewlett Packard Enterprise (HPE) to strengthen its position in next-generation network technologies, including 6G. This partnership focuses on enhancing Nokia’s capabilities in AI-driven automation, cloud infrastructure, and data management.

- In July 2025, Huawei announced plans to launch two satellites dedicated to 6G technology research, marking a significant step in its pursuit of leadership in next-generation communications. These satellites aim to test advanced 6G network functions, including ultra-high-speed transmission and space-based connectivity.

Report Scope

Report Features Description Market Value (2024) USD 238.4 Mn Forecast Revenue (2034) USD 76,980.9 Mn CAGR(2025-2034) 78.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Spectrum Band (Sub-THz, THz), By Application (Enhanced Mobile Broadband, Ultra-Reliable Low Latency Communications, Massive Machine Type Communications, Others), By End-Use (Telecommunications, Automotive, Healthcare, Manufacturing, Media and Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Huawei Technologies, Nokia Corporation, Ericsson AB, Cisco Systems Inc., ZTE Corporation, LG Electronics, Sony Corporation, NEC Corporation, AT&T Inc., Verizon Communications Inc., SK Telecom Co., Ltd., NTT DoCoMo, Inc., China Mobile Limited, Deutsche Telekom AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  6G Wireless Technology MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

6G Wireless Technology MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Huawei Technologies

- Nokia Corporation

- Ericsson AB

- Cisco Systems Inc.

- ZTE Corporation

- LG Electronics

- Sony Corporation

- NEC Corporation

- AT&T Inc.

- Verizon Communications Inc.

- SK Telecom Co., Ltd.

- NTT DoCoMo, Inc.

- China Mobile Limited

- Deutsche Telekom AG

- Others