Global 5G RAN Market Size, Share, Trends Analysis Report By Component (Solutions, Services), By Architecture Type (CRAN, ORAN, VRAN), By Deployment (Indoor, Outdoor), By End-use (Telecom Operators, Enterprises), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 132777

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

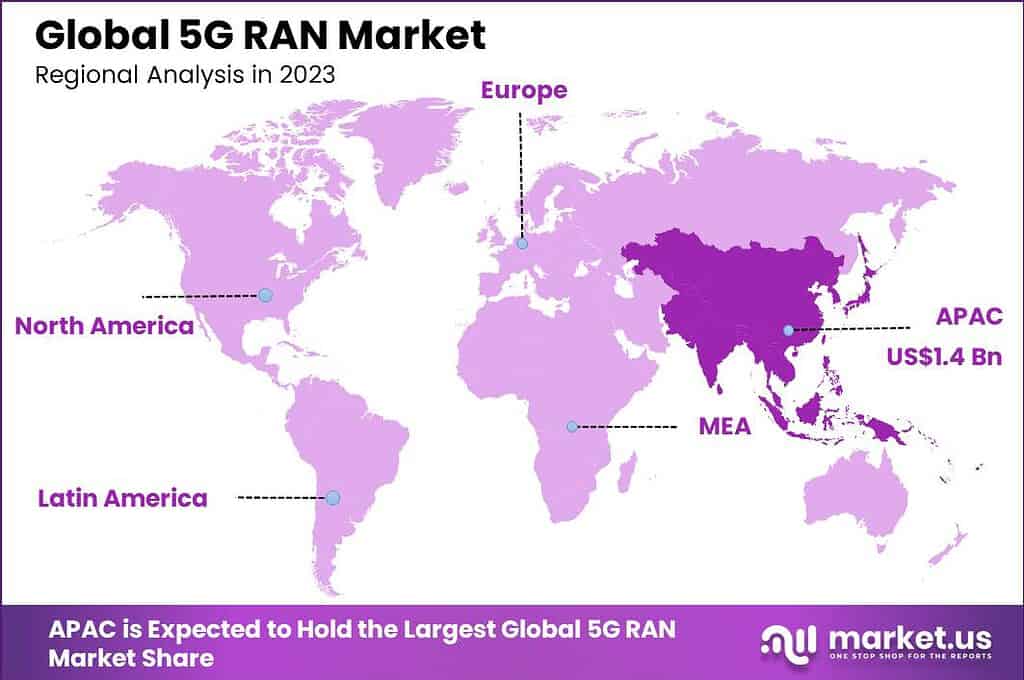

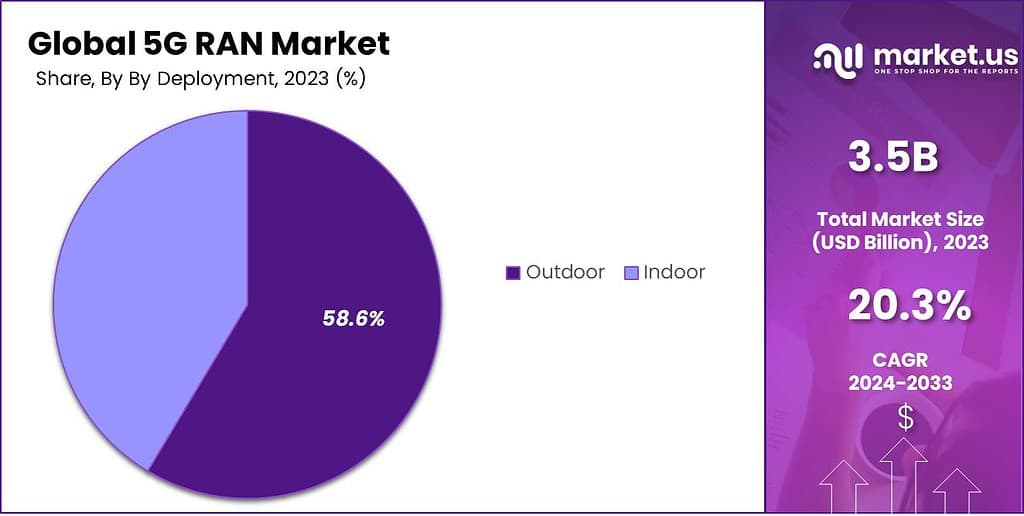

The Global 5G RAN Market size is expected to be worth around USD 22.2 Billion By 2033, from USD 3.5 billion in 2023, growing at a CAGR of 20.3% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 41.8% share, holding USD 1.4 billion revenue.

5G RAN, or 5G Radio Access Network, is a key component of the 5G network architecture. It includes the radio transmitters and receivers that enable mobile devices to connect to the internet and communicate with each other and the network core. The RAN provides the necessary radio and signal processing capabilities required for managing connections, bandwidth, and mobility of user devices.

The 5G RAN market is integral to the rollout of next-generation networks, providing the infrastructure needed for ultra-fast and reliable internet services. This market includes a broad range of equipment and services necessary for constructing and maintaining 5G networks. Service providers are increasingly adopting 5G RAN to meet the growing demand for high-speed data and to support new technologies such as cloud gaming, AR/VR, and autonomous driving.

The primary driving factors for the 5G RAN market include the escalating demand for mobile broadband services, the proliferation of IoT devices, and the need for new applications that require higher bandwidths and lower latencies. Additionally, the push towards digital transformation across various industries necessitates robust mobile connectivity solutions, further propelling the growth of the 5G RAN market.

Technological innovations in 5G RAN, such as Massive MIMO, beamforming, and millimeter-wave technology, are crucial for enhancing network capacity and efficiency. These technologies enable more precise and efficient signal transmission, significantly improving the performance of 5G networks in dense urban areas where high data throughput is critical.

Moreover, the integration of advanced virtualization and cloud-native technologies in 5G RAN architectures allows for more scalable and flexible network deployments, which are vital for adapting to fluctuating network demands and supporting a wide array of 5G use cases.

For instance, In October 2024, Qualcomm Technologies, Inc. announced a strategic collaboration with Vodafone Group to accelerate the development of next-generation 5G technology. The partnership focuses on creating and integrating advanced 5G distributed units (DUs) and radio units (RUs) equipped with Massive MIMO capabilities. This initiative aims to support the commercial rollout of Open RAN infrastructure across Europe, enhancing network flexibility and performance.

There is a significant demand for 5G RAN technologies to support an ever-growing range of applications, from personal mobile internet access to enterprise-level solutions and smart city infrastructure. The ability of 5G RAN to support network slicing, where operators can partition their networks to cater to different types of traffic and services, presents substantial opportunities for tailored connectivity solutions.

According to Telecomlead, Indian telecom operators are expected to allocate approximately $5 billion in wireless Capex, accounting for about 3% of the global wireless Capex. Leading the 4G RAN (Radio Access Network) space in India are Samsung, Nokia, Ericsson, Huawei, and ZTE. Reliance Jio, which operates an all-India network, serves a massive base of around 420 million 4G subscribers, underscoring the scale of its operations.

Global 5G adoption is accelerating, with Ericsson reporting that population coverage outside mainland China stood at 40% by the end of 2023 and is projected to reach 80% by 2029. India and North America have made significant strides in mid-band 5G deployment, achieving 90% and 85% coverage, respectively. However, regions like Latin America and parts of Africa lag far behind, with less than 10% mid-band 5G coverage, highlighting the stark regional disparities in connectivity

Key Takeaways

- The Global 5G RAN Market is projected to grow significantly over the next decade. By 2033, the market size is expected to reach USD 22.2 billion, rising from USD 3.5 billion in 2023. This indicates a robust compound annual growth rate (CAGR) of 20.3% during the forecast period of 2024 to 2033.

- In 2023, the APAC region dominated the market, accounting for over 41.8% of the total share, contributing USD 1.4 billion in revenue.

- The Solutions segment emerged as the leading category within the 5G RAN industry, holding more than 81% of the market share in 2023.

- Among deployment types, the CRAN (Centralized Radio Access Network) segment stood out, capturing over 35% of the market share in 2023.

- The Outdoor segment led the 5G RAN deployment landscape in 2023, commanding a share of over 58.6%.

- In terms of end users, Telecom Operators held the lion’s share of the market, contributing more than 80% to the total revenue in 2023.

APAC 5G RAN Market Size

In 2023, the Asia Pacific (APAC) region emerged as a powerhouse in the 5G Radio Access Network (RAN) market, securing a dominant market position with a share exceeding 41.8% and generating revenues around USD 1.4 billion. This significant market share is primarily due to the rapid rollout of 5G networks across major economies such as China, South Korea, and Japan.

These countries have been at the forefront of 5G technology, driven by strong government support and initiatives aimed at enhancing their telecommunications infrastructure. Furthermore, the high population density in urban areas of APAC has necessitated the development of more efficient and faster network solutions, which has propelled the demand for 5G RAN technologies.

The region’s burgeoning tech industry, coupled with a growing number of smartphone users demanding higher-speed data services, has also played a crucial role in this acceleration. Major telecommunications companies in these countries are investing heavily in 5G to gain a competitive edge, thereby boosting the market growth.

Additionally, the manufacturing sector in APAC, which is highly automated and reliant on the Internet of Things (IoT), has been another critical driver for 5G RAN deployment. The need for reliable and fast connectivity to manage and operate smart factories has led to increased adoption of 5G networks. The region’s commitment to adopting advanced technologies for industrial automation continues to create significant opportunities for the 5G RAN market.

Component Analysis

In 2023, the Solutions segment held a dominant market position in the 5G RAN industry, capturing more than an 81% share. This substantial market share is primarily due to the critical role that 5G RAN solutions play in enabling high-speed, low-latency communication across various applications. These solutions, which include both hardware and software components like antennas, base stations, and network management tools, are integral to the deployment and optimization of 5G networks.

As the backbone of 5G infrastructure, these solutions ensure that networks can handle the increased data traffic and the diverse needs of modern applications from internet-of-things (IoT) devices to autonomous vehicles and smart cities. The dominance of the Solutions segment can also be attributed to ongoing technological advancements and the increasing need for enhanced network capabilities.

Innovations such as Massive MIMO (Multiple Input Multiple Output) technology and advanced beamforming techniques have significantly increased the efficiency and capacity of 5G networks. These technologies improve signal quality and data throughput, even in densely populated areas, thus driving the demand for robust 5G RAN solutions that incorporate such cutting-edge technologies.

Furthermore, the growing trend towards virtualization and network slicing has propelled the Solutions segment to the forefront of the 5G RAN market. These technologies allow network operators to create multiple virtual networks that can coexist on a single physical infrastructure but have different characteristics and uses.

This flexibility is particularly beneficial for service providers looking to offer customized solutions to diverse sectors, enhancing their ability to meet specific customer demands and opening up new revenue streams. Overall, the Solutions segment’s commanding presence in the market underscores its pivotal role in the widespread deployment and success of 5G networks.

As the demand for faster, more reliable internet services continues to grow, and as more industries rely on 5G technology to drive innovation and efficiency, the importance of this segment is only expected to increase. Moving forward, companies within this segment are likely to continue experiencing significant growth as they evolve their offerings to meet the future demands of a digitally connected world.

Architecture Type Analysis

In 2023, the CRAN (Centralized Radio Access Network) segment held a dominant market position in the 5G RAN landscape, capturing more than a 35% share. This leadership is largely due to CRAN’s ability to centralize and consolidate network functions, which reduces operational costs and enhances the efficiency of network management.

By centralizing the baseband functions in fewer locations, CRAN facilitates more straightforward and cost-effective network upgrades and maintenance, a critical factor as networks evolve to support increasing 5G demands. CRAN’s architecture is particularly beneficial for urban areas where high data traffic volumes require robust network support without the physical space for extensive equipment setups at each site.

This setup minimizes the hardware footprint at cell sites, which is essential in densely populated areas. Additionally, CRAN supports high-capacity, low-latency applications such as video streaming and large-scale IoT deployments, which are becoming increasingly prevalent as cities become smarter and more connected.

Moreover, CRAN is compatible with advanced network functionalities like network slicing and virtualization, which are pivotal for tailoring 5G services to diverse customer needs. These capabilities allow telecom operators to deploy and manage multiple virtual networks efficiently, providing customized services that can meet the varied requirements of different industries, from manufacturing to entertainment.

As the demand for enhanced mobile broadband (eMBB) and ultra-reliable low-latency communications (URLLC) continues to grow, the CRAN segment is well-positioned to expand its market share. Looking ahead, ongoing innovations and improvements in centralized network technologies will likely drive further growth, solidifying CRAN’s essential role in the global 5G RAN market.

Deployment Analysis

In 2023, the Outdoor segment held a dominant market position in the 5G RAN deployment landscape, capturing more than a 58.6% share. This substantial market share is largely attributable to the extensive rollout of 5G networks in diverse environments that require robust outdoor connectivity solutions.

Outdoor 5G RAN deployment includes the installation of equipment such as antennas and base stations in a variety of outdoor settings, from urban streets to rural areas, enabling wide-area network coverage essential for mobile broadband and IoT connectivity. The dominance of the Outdoor segment is further driven by the increasing demand for improved mobile network coverage and capacity outside indoor environments.

As 5G technology supports higher data rates and more reliable network connections, industries such as transportation, logistics, and agriculture are increasingly dependent on uninterrupted outdoor network coverage to facilitate operations like real-time fleet tracking, precision farming, and automated equipment.

Moreover, outdoor 5G networks are crucial for supporting the burgeoning number of smart city applications, which rely on continuous connectivity for functions ranging from traffic management to public safety monitoring systems. These applications necessitate a dense deployment of outdoor 5G infrastructure to handle high volumes of data traffic and provide the low-latency communication required by critical services.

Looking ahead, the Outdoor segment is expected to maintain its lead in the 5G RAN market as urbanization continues to grow and as new use cases requiring expansive outdoor connectivity emerge. The push for more connected devices and the expansion of 5G into new rural and suburban areas will further bolster the demand for outdoor 5G RAN solutions, ensuring its pivotal role in the global expansion of 5G networks.

End-use Analysis

In 2023, the Telecom Operators segment held a dominant market position in the 5G RAN market, capturing more than an 80% share. This substantial market share is primarily attributed to the accelerated deployment of 5G networks by telecommunications operators globally.

These operators are the backbone of mobile communications, upgrading their infrastructure to support the high-speed, low-latency capabilities of 5G technology. Their investments are driven by the growing demand for enhanced mobile broadband services, which require extensive coverage and more reliable network performance.

Telecom operators are not just expanding their consumer base but are also exploring new revenue streams through 5G applications such as ultra-reliable low-latency communications (URLLC) and massive machine type communications (mMTC). These applications are crucial for developing future-proof industrial solutions, including smart factories, automated logistics, and AI-driven decision-making processes, which further solidify their market dominance.

The need for robust back-end support to handle the vast data generated by these technologies makes telecom operators essential players in the 5G RAN market. Moreover, the ongoing global digital transformation, accelerated by the COVID-19 pandemic, has emphasized the importance of stable and fast internet connections.

Telecom operators are at the forefront of this transformation, providing the necessary infrastructure to facilitate remote working, cloud computing, and online services. Their efforts to expand and upgrade networks have been critical in accommodating the surge in internet traffic and in enabling seamless connectivity.

The telecom operators’ segment continues to dominate the 5G RAN market due to their pivotal role in network expansion and upgrades, coupled with the surge in demand for data-intensive services. Their ongoing investments in 5G deployment are crucial for supporting new technologies and innovations, ensuring their continued market leadership in the foreseeable future.

Key Market Segments

By Component

- Solutions

- Services

By Architecture Type

- CRAN

- ORAN

- VRAN

By Deployment

- Indoor

- Outdoor

By End-use

- Telecom Operators

- Enterprises

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

Latin America

- Brazil

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Driver

Expanding Network Infrastructure

The expansion of network infrastructure is a significant driver for the 5G RAN market. This growth is fueled by the escalating demand for high-speed internet and the ongoing global push for digital transformation. Governments and network operators worldwide are making substantial investments to develop 5G networks, which require extensive Radio Access Network (RAN) deployments to manage the increased data traffic efficiently.

These efforts are not just enhancing mobile network capabilities but also facilitating new services like ultra-reliable low-latency communications (URLLC) and massive machine type communications (mMTC), which are pivotal for industrial automation and smart city projects.

Restraint

High Costs and Complexity in Implementation

A major restraint in the 5G RAN market is the high cost and complexity involved in deploying 5G infrastructure. The initial setup for 5G RAN involves substantial capital, which can be a barrier for many operators, particularly in less developed regions.

Additionally, the integration of 5G technology with existing networks and services presents technical challenges that require significant expertise and resources to manage, potentially slowing down deployment rates.

Opportunity

Technological Innovations and Vendor Initiatives

The 5G RAN market is ripe with opportunities, especially from technological innovations and vendor-driven initiatives. Companies are continuously advancing RAN technology to support the deployment of 5G networks. Innovations such as Massive MIMO (Multiple Input Multiple Output) technology and improvements in network equipment are key enablers for enhancing network capacity and efficiency.

Furthermore, collaborations among tech giants are fostering the development of more robust and scalable 5G solutions, which can open new business avenues in various sectors including media, entertainment, and IoT.

Challenge

Spectrum and Regulatory Issues

One of the challenges in the 5G RAN market involves spectrum availability and regulatory issues. The allocation of radio frequencies is tightly controlled by governments, and the suitable spectrum for 5G services is limited, which can hinder the deployment of 5G networks.

Moreover, the need to comply with various national and international regulations regarding spectrum use adds another layer of complexity for 5G RAN deployment. These regulatory challenges require careful navigation and can vary significantly from one country to another, affecting the pace at which 5G services are rolled out globally.

Growth Factors

The 5G RAN market is experiencing robust growth, propelled by the increasing global demand for high-speed internet and advanced wireless services. This surge is driven by the widespread adoption of mobile devices and the ongoing digital transformation across industries.

As 5G technology facilitates significantly faster data speeds and more reliable network connections compared to its predecessors, industries such as autonomous driving, IoT, smart cities, and telemedicine are increasingly relying on 5G networks to streamline operations and improve service delivery. Additionally, the expansion and modernization of existing telecommunications infrastructure to support 5G deployments are further catalyzing market growth.

Emerging Trends

One of the notable trends in the 5G RAN market is the shift towards Open RAN (ORAN), which promises enhanced network flexibility and interoperability between different vendor’s equipment. This trend is particularly significant as it allows for a more diverse and competitive supplier ecosystem, reducing dependency on specific hardware vendors and fostering innovation through software-defined network solutions.

Another emerging trend is the integration of AI and machine learning technologies, which are being leveraged to optimize network operations and enhance traffic management. These technologies enable predictive maintenance, real-time analytics, and automated network adjustments, which are crucial for maintaining the efficiency and reliability of 5G networks.

Business Benefits of 5G RAN

The deployment of 5G RAN brings numerous business benefits, including significantly improved network efficiency and capacity. This is critical for businesses operating in data-driven environments where high data throughput and low latency are paramount.

Moreover, 5G RAN supports a multitude of new applications and services, opening up new revenue streams for operators and businesses alike. For enterprises, 5G enables a new era of industrial automation with technologies such as IoT and AI becoming more integrated within factory settings to improve productivity and operational efficiencies.

Additionally, 5G RAN facilitates enhanced mobile broadband (eMBB), which delivers better user experiences through faster data speeds and more reliable connections, essential for high-definition video streaming, augmented reality, and more.

Key Player Analysis

The 5G RAN market is highly consolidated, with a few prominent players driving significant competition through heavy investments in research and development. Companies like Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., Nokia, and Samsung are at the forefront, leveraging cutting-edge innovations to enhance 5G services and RAN capabilities.

Huawei Technologies Co., Ltd., Intel Corporation, and Cisco Systems, Inc. are also intensifying the competitive landscape by integrating advanced technologies to capture market share. Additionally, Rakuten Symphony, Verizon, VMware, Inc., and other key players are focusing on partnerships, product enhancements, and strategic expansions to strengthen their positions. This dynamic competition is fostering rapid advancements in the market, making it a critical battleground for global tech leaders.

Top Key Players in the Market

- Telefonaktiebolaget LM Ericsson

- Qualcomm Technologies Inc.

- Nokia

- Rakuten Symphony Singapore Pte. Ltd

- Intel Corporation

- Samsung

- Verizon

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- VMware Inc.

- Other Key Players

Recent Developments

- In October 2024, Ericsson signed a deal with Spain’s largest telecom operator, MasOrange, to upgrade its network with Open RAN technologies. This partnership marks Ericsson’s first Open RAN contract in Europe, covering approximately 10,000 sites to meet the demand for 5G services in diverse areas, including urban, rural, and large venues.

- In October 2024, Du advanced its partnership with Nokia to expand its 5G network capabilities, focusing on integrating advanced technologies like enhanced mobile broadband, network slicing, and edge computing. This move is set to elevate Du’s ability to deliver robust, high-speed network services tailored to both individual and enterprise-level customers.

- In October 2024, Software Radio Systems (SRS) launched srsRAN Enterprise 5G, a versatile, full-stack software solution for private 5G networks. Built on an Open RAN architecture, it offers flexible deployment options and is designed for rapid implementation using standard hardware, catering to a variety of computing environments and user needs

Report Scope

Report Features Description Market Value (2023) USD 3.5 Bn Forecast Revenue (2033) USD 22.2 Bn CAGR (2024-2033) 20.3% Largest Market APAC Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Architecture Type (CRAN, ORAN, VRAN), By Deployment (Indoor, Outdoor), By End-use (Telecom Operators, Enterprises) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Telefonaktiebolaget LM Ericsson, Qualcomm Technologies Inc., Nokia, Rakuten Symphony Singapore Pte. Ltd, Intel Corporation, Samsung, Verizon, Cisco Systems Inc., Huawei Technologies Co. Ltd., VMware Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Telefonaktiebolaget LM Ericsson

- Qualcomm Technologies Inc.

- Nokia

- Rakuten Symphony Singapore Pte. Ltd

- Intel Corporation

- Samsung

- Verizon

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- VMware Inc.

- Other Key Players