Global 5G NTN Market by Component (Hardware, Solution, Service) by Location (Urban, Rural, Remote, Isolated), By Application (Enhanced Mobile Broadband (EMBB), Ultra-Reliable and Low Latency Communications (URLCC), Massive Machine Type Communications (MMTC)) By End User (Maritime, Aerospace and Defense, Government, Mining, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 127600

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways:

- Component Segment Analysis

- Location Segment Analysis

- Application Segment Analysis

- End-User Segment Analysis

- Key Market Segments:

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

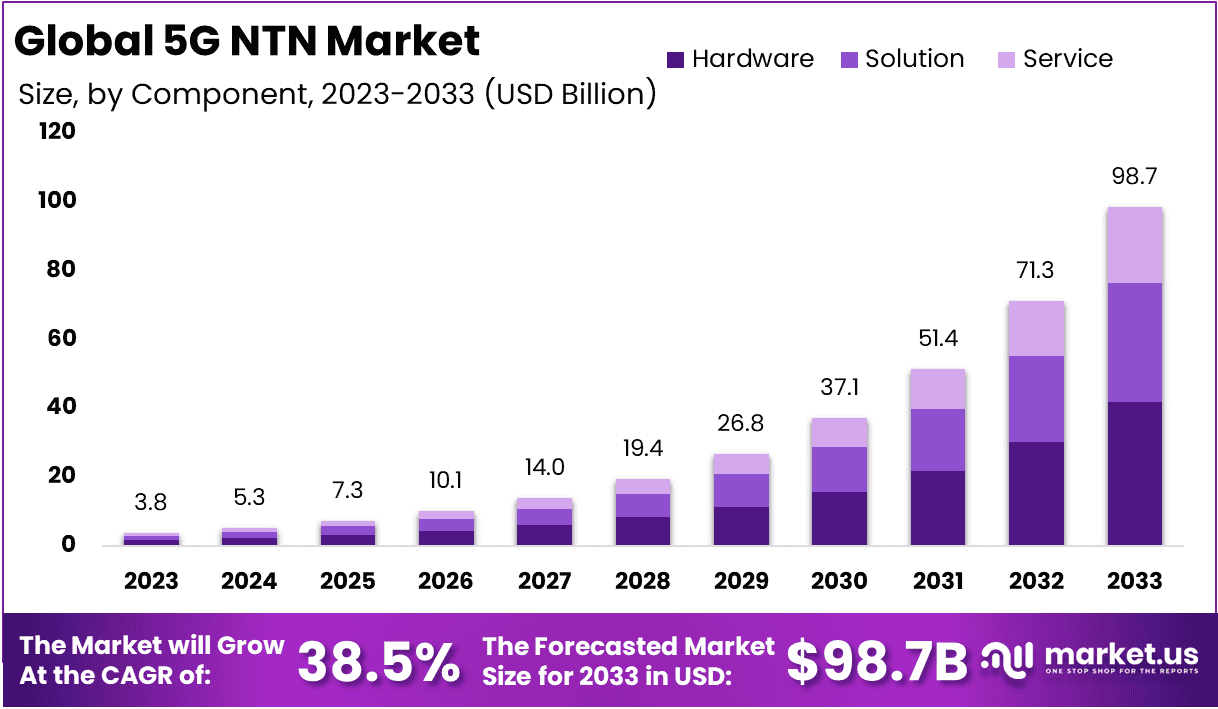

The Global 5G NTN Market size is expected to be worth around USD 98.7 billion by 2033, from USD 3.8 billion in 2023, growing at a CAGR of 38.5% during the forecast period from 2024 to 2033.

The global 5G Non-Terrestrial Network (NTN) market is a dynamic and rapidly evolving sector with significant potential for growth. The increasing demand for higher speed and reliable internet connectivity especially in remote areas, has crucially driven the market growth in recent days.

Additionally, the integration of Smart and IoT applications, requires a robust and wide-reaching network solution has also further increased the demand of the global 5G NTN Market. Government initiatives and funding to expand the digital infrastructure in rural areas have further bolstered the market growth.

One of the primary drivers of this growth is the increasing need for reliable connectivity in remote industries such as maritime, oil and gas, and aviation. By 2025, over 40% of 5G use cases in these industries are expected to rely on NTN to provide seamless, global coverage. This capability allows businesses to leverage high-speed, low-latency networks for critical operations, data transmission, and IoT applications in areas previously out of reach.

The rise of satellite constellations, such as those launched by SpaceX’s Starlink and OneWeb, is also a significant factor in the growth of 5G NTN. These low-earth orbit (LEO) satellites are enhancing the reach of 5G networks, particularly for high-bandwidth applications like autonomous vehicles and connected devices. By 2026, LEO satellites are projected to account for 60% of global 5G NTN deployments, making them a crucial component of future connectivity solutions.

While 5G NTN offers significant benefits, there are challenges, including high costs associated with launching and maintaining satellite networks. Despite this, government and private sector investments are accelerating. In 2024, global investments in 5G NTN infrastructure are expected to exceed $10 billion, as countries and companies alike prioritize bridging the digital divide and enhancing disaster recovery capabilities.

Overall, the 5G NTN market is poised for substantial growth as it addresses the global need for reliable, high-speed connectivity in remote and challenging environments. As industries expand their reliance on 5G, NTN is set to play a critical role in ensuring that connectivity is no longer confined by geography or traditional network limitations.

Key Takeaways:

- The Global 5G NTN Market size is expected to be worth around USD 98.7 Billion by 2033, from USD 3.8 Billion in 2023, growing at a CAGR of 5% during the forecast period from 2024 to 2033.

- In 2023, the hardware segment dominated the global 5G NTN market capturing a share of 42.4%.

- In 2023, by location, the remote segment dominated the global 5G NTN market capturing a share of 37.4%.

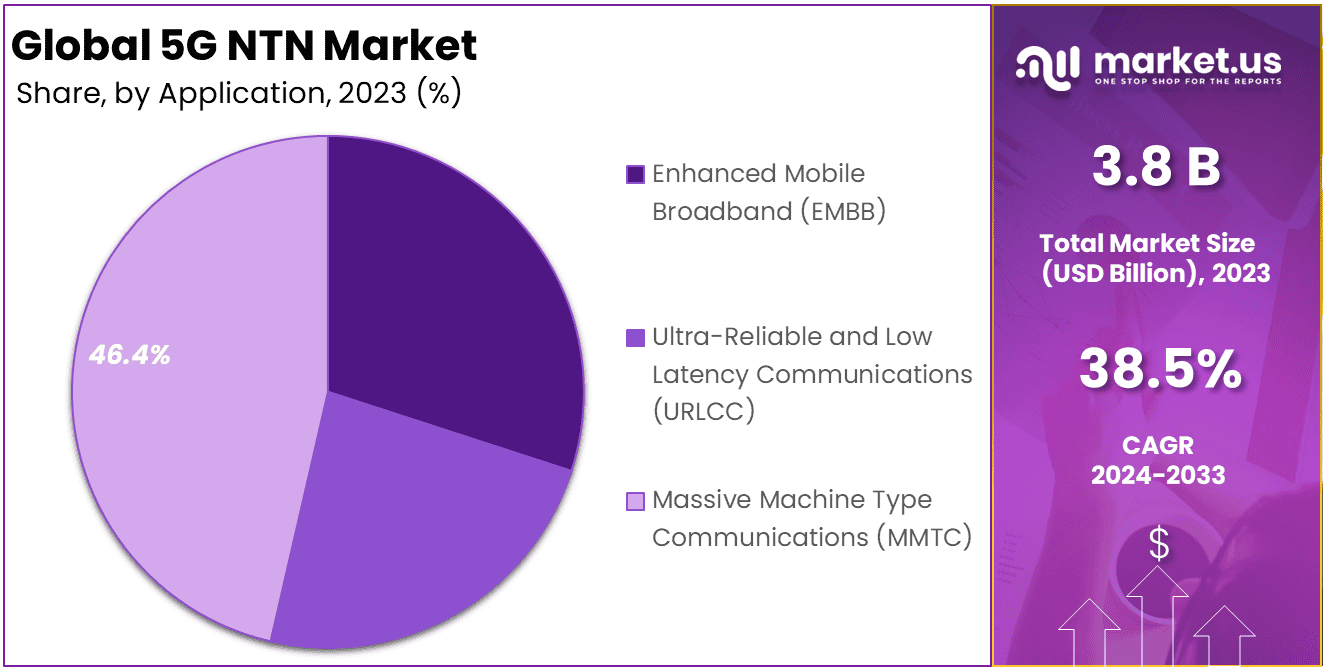

- In 2023, the Massive Machine-Type Communications (MMTC) segment dominated the global 5G NTN market capturing a share of 46.4%.

- In 2023, the Aerospace and Defense segment has dominated the global 5G NTN market capturing a share of 34.7%.

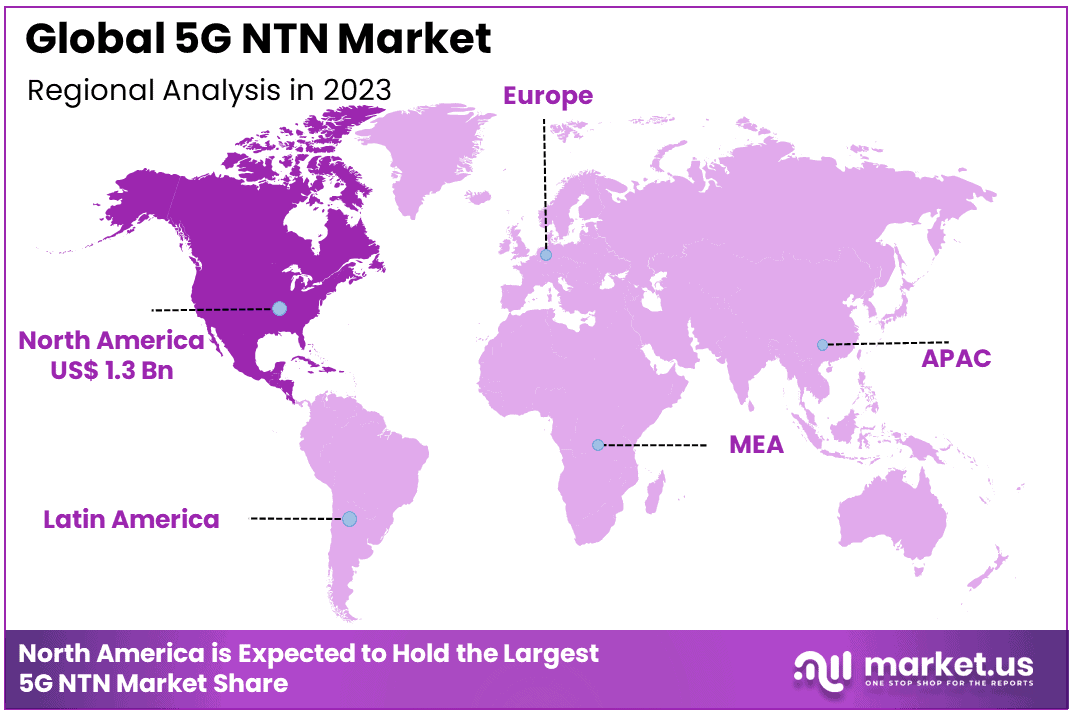

- In 2023, the North American region held a dominant market position in the 5G NTN market, capturing more than a 36.5% share.

Component Segment Analysis

In 2023, the hardware segment dominated the global 5G NTN market capturing a share of 42.4%. This can be attributed to several factors such as the increasing development as well as deployment of 5G NTN infrastructure by businesses with the help of advancements in hardware that include satellites, ground stations, and specialized equipment for communication. These are crucial for establishing and maintaining robust connectivity in remote areas.

Furthermore, the rapid evolution of satellite technology and the growing demand for higher speed and reliable internet services also drive the need for hardware 5G NTN solutions.

Additionally, hardware manufacturers are frequently innovating to improve performance, reduce latency, and enhance network capacity thus making the hardware segment a critical aspect of the market. The significant government, as well as private sector investments in communication and space technologies, have also enhanced the hardware segment’s growth.

Location Segment Analysis

In 2023, the remote segment dominated the global 5G NTN market capturing a share of 37.4%. 5G NTN technology is crucial for providing high-speed connectivity to remote areas where terrestrial networks are either impractical or higher in cost to deploy. These regions are characterized by challenging terrains and are benefited significantly from the satellite-based 5G networks.

In addition, the growing demand for reliable communication services in remote localities which is driven by different sectors such as agriculture, oil and gas, mining, as well as maritime operations further contributes toward the need for 5G NTN technology in remote areas.

Governments of different countries and private firms are investing extensively in the 5G NTN technology to ensure that every remote areas and communities have access to modern communication networks.

Application Segment Analysis

In 2023, the Massive Machine-Type Communications (MMTC) segment dominated the global 5G NTN market capturing a share of 46.4%. This is driven by the increasing growth in the number of connected devices and the demand for seamless Internet of Things (IoT) integration.

MMTC focuses on supporting a wide range of devices with varied applications from smart agriculture to environmental monitoring to industrial automation and smart cities. The segment’s prominence has arisen from its ability to handle the high density, low power, and wide area connectivity that needs these applications.

Additionally, the advancement in satellite technology tends to enhance the MMTC’s capabilities, thus ensuring robust as well as reliable communication even in remote areas. As various industries are increasingly adopting IoT solutions for operational efficiency and innovation, the requirement for scalable and resilient communication networks has become more critical, thus enhancing the demand for the 5G NTN market.

End-User Segment Analysis

In 2023, the Aerospace and Defense segment has dominated the global 5G NTN market capturing a share of 34.7%. This dominance is being driven by the need for advanced, secure, and reliable communication systems in the aerospace and defense segment.

5G NTN tends to offer a significant enhancement in connectivity, speed, and latency, which are crucial for modern aerospace and defense operations. This may include different applications such as real-time surveillance, unmanned aerial vehicle (UAV) operations, secure communication channels, and battlefield network integration.

Furthermore, the defense sector’s prioritization of resilient and reductant communication infrastructures aligns with the capabilities of NTN, which can provide robust connectivity even in contested or remote environments.

The strategic importance of maintaining a superior technological advantage in defense tends to drive substantial investment in 5G NTN technologies. Additionally, the government contracts and funding for the national security initiatives significantly contribute to the prominence of the aerospace and defense segment thus ensuring its significant contribution and leading position in the global 5G NTN market.

Key Market Segments:

By Component

- Hardware

- Solution

- Service

By Location

- Urban

- Rural

- Remote

- Isolated

By Application

- Enhanced Mobile Broadband (EMBB)

- Ultra-Reliable and Low Latency Communications (URLCC)

- Massive Machine Type Communications (MMTC)

By End User

- Maritime

- Aerospace and Defense

- Government

- Mining

- Others

Driving Factors

Increasing adoption of IoT devices

The increasing adoption of IoT devices is a significant driver for the 5G NTN market. IoT devices are proliferating across various industries including agriculture, healthcare, manufacturing, and transportation, which requires consistent and reliable connectivity. NTN technologies such as satellites can provide the required global coverage, especially in remote areas.

Different IoT devices used in autonomous vehicles, remote surgery, and real-time environment monitoring, demand high-speed data transmission and low latency. 5G NTN technology is being developed to meet these needs by offering enhanced data transfer rates and low latency as compared to previous network generations.

Furthermore, the deployment of IoT devices often involves large-scale sensor networks that need scalable and flexible connectivity solutions. 5G NTN networks, with their capability to connect millions of devices over vast areas, are well suited for supporting the expansive and dynamic nature of IoT ecosystems.

Restraining Factors

Propagation delays and latency Issues

Propagation delays and latency issues are significant issues for the 5G NTN market. The large distances between the satellites and the terrestrial infrastructure result in considerable propagation delays. For instance, signals must travel thousands of kilometers to reach a low earth orbit (LEO) satellite and back, causing inherent latency that could affect real-time communication and application.

This latency can hinder the performance of time-sensitive applications such as interactive gaming, autonomous vehicles, telemedicine, and remote control systems, where near instantaneous response times are critical.

Users and industries expect ultra-low latency and high-speed connectivity from 5G networks. The delays introduced by the large distances in the NTNs may not meet these expectations, leading to potential dissatisfaction and slower adoption rates.

Growth Opportunities

Increasing adoption of 5G NTN networks across different sectors

The increasing adoption of 5G NTN technology across different industries tends to present significant opportunities for the market. The 5G NTN is capable of providing a higher speed internet to remote and rural areas where terrestrial networks are not feasible, thus aiding in bridging the digital gap and offering connectivity for essential services such as telemedicine, education, and e-commerce.

Further, the integration of 5G NTN supports the proliferation of IoT devices in smart city projects, thus enhancing urban infrastructure with smart utilities, traffic management, and public safety systems. Additionally, precision agriculture could benefit from the 5G NTN, which enables real-time monitoring and management of crops through connected sensors and drones, leading to increased efficiency and productivity in farming.

Additionally, the 5G NTN technology also supports advanced manufacturing processes, including automation and robotics, by providing robust, low-latency connectivity for real-time control and monitoring. It also has an improved tracking and management of supply chains through connected devices leading to more efficient logistics and reduced operational costs.

Challenging Factors

Signal Distortion and increased bit error rate due to Doppler shift

Signal distortion and the increased bit error rate due to the Doppler shift tend to present a significant challenge for the 5G NTN market. As satellites and other non-terrestrial platforms move relative to the Earth, the frequency of the transmitted signal experiences a shift known as the Doppler effect. This shift can lead to variation in the received signal frequency, causing a signal distortion.

This can lead to frequency mismatches and a phase error. This distortion complicates the demodulation process, making it difficult for the receiver to accurately interpret the transmitted data.

The distortion causes could also result in higher error rates as the receiver struggles to correctly decode the incoming signals. High bit error rates could degrade the overall communication quality, leading to data loss and reduced reliability of the network.

Growth Factors

- Increasing demand for global connectivity: there is an increasing need to provide high-speed internet access in remote regions where the traditional terrestrial networks are not feasible.

- Integration of IoT devices: there is an increasing adoption of IoT devices across different sectors including agriculture, healthcare, and manufacturing that requires a robust and widespread connectivity solution.

- Advancements in Technology: there is an ongoing improvement in satellite technologies, including smaller and more efficient satellites and advanced signal processing techniques.

- Support for emerging application: increasing need for reliable, low latency communication for autonomous vehicles, drones, and industrial automation.

Latest Trends

- Integration with AI and Machine Learning: AI and Machine Learning are being used to optimize network performance, manage resources efficiently, and predict as well as mitigate issues before they impact service quality.

- Expansion of Satellite Constellations: growth in the low earth orbit (LEO) satellite constellations by different companies including SpaceX, Amazon, and OneWeb, providing global broadband coverage could be the latest trend in the market.

- Increased support from the Government and Regulatory bodies: Governments across the globe are introducing different policies and funding initiatives to support the deployment of 5G NTN infrastructure, particularly in remote areas.

Regional Analysis

North America region is leading the market

In 2023, North America held a dominant market position in the 5G NTN market, capturing more than a 36.5% share. This region is home to major technological-based companies like SpaceX who pioneer the advancements in satellite technology and 5G NTN infrastructure.

Additionally, significant investments in research and development backed by both the public and the private sectors, have accelerated the deployment of 5G NTN solutions.

Furthermore, a favorable regulatory environment with policies and spectrum allocation aimed at promoting the growth of 5G NTN networks has provided a solid foundation for deployment and development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 5G NTN market is characterized by a mixture of established companies, technology giants, and different innovative start-ups. These key players are driving the advancements in satellite technology, global connectivity, and integrated network solutions, each facing unique strengths and challenges.

Key players in the 5G NTN market include SpaceX’s Starlink and OneWeb, both of which are leading the development of low-earth orbit (LEO) satellite constellations to provide global 5G connectivity.

Huawei and Nokia are significant contributors, focusing on integrating 5G NTN technology into existing infrastructure, while Thales Alenia Space is pioneering satellite solutions specifically designed for 5G NTN applications.

These companies are shaping the future of 5G by extending its reach through satellite and non-terrestrial networks, driving global connectivity advancements.

Top Key Players in the Market

- Qualcomm Technologies

- MediaTek Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Keysight Technologies

- Intelsat

- Spirent Communications

- Thales

- Rohde & Schwarz

- Nokia

- Other Key players

Recent Developments

- In March 2024, OQ Technology Group launched two new, LEO satellites named Tiger-7 and Tiger-8, built by Nanoavionics. These are 6U-sized small seats carrying cell tower NB-IoT payloads.

- In February 2023, Samsung announced the launch of a new secured and standardized 5G NTN modem technology that will enable direct communication between the smartphone and the satellites.

Report Scope

Report Features Description Market Value (2023) USD 3.8 billion Forecast Revenue (2033) USD 98.6 billion CAGR (2024-2033) 38.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Solution, Service) by Location (Urban, Rural, Remote, Isolated), By Application (Enhanced Mobile Broadband (EMBB), Ultra-Reliable and Low Latency Communications (URLCC), Massive Machine Type Communications (MMTC)) By End User (Maritime, Aerospace and Defense, Government, Mining, Others) Region Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qualcomm Technologies, Inc. , MediaTek Inc., Telefonaktiebolaget LM Ericsson, ZTE Corporation., Keysight Technologies, Intelsat, Spirent Communications, Thales, Rohde & Schwarz, Nokia, Other Key players. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 5G NTN?5G Non-Terrestrial Network (NTN) refers to the extension of 5G connectivity using satellites and airborne platforms, providing network coverage to remote or underserved areas beyond traditional terrestrial networks.

What are the key factors driving the growth of the 5G NTN Market?Key drivers include the growing demand for global, reliable connectivity in industries like maritime, aviation, and remote IoT, as well as the expansion of satellite networks to support 5G coverage in hard-to-reach regions.

What are the current trends and advancements in the 5G NTN Market?Current trends include the rise of low-earth orbit (LEO) satellite constellations, such as SpaceX's Starlink, and the increasing use of 5G NTN for high-bandwidth applications like autonomous vehicles and IoT devices.

What are the major challenges and opportunities in the 5G NTN Market?Challenges include the high cost of deploying and maintaining satellite networks, while opportunities lie in expanding 5G coverage to remote areas, enhancing disaster recovery capabilities, and addressing the global digital divide.

How big is 5G NTN Market?The Global 5G NTN Market size is expected to be worth around USD 98.7 billion by 2033, from USD 3.8 billion in 2023, growing at a CAGR of 38.5% during the forecast period from 2024 to 2033.

Who are the leading players in the 5G NTN Market?The leading players in the 5G NTN Market are as follows:

- Qualcomm Technologies

- MediaTek Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Keysight Technologies

- Intelsat

- Spirent Communications

- Thales

- Rohde & Schwarz

- Nokia

- Other Key players

-

-

- Qualcomm Technologies

- MediaTek Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Keysight Technologies

- Intelsat

- Spirent Communications

- Thales

- Rohde & Schwarz

- Nokia

- Other Key players