Global 5G Enterprise Market Size, Share and Analysis Report By Communication Infrastructure Type (5G Radio Access Networks (RAN), 5G Core Networks, Transport/Backhaul Networks), By Deployment Model (Private 5G Networks, Public 5G Networks, Hybrid/Shared Networks), By Spectrum Licensing Type(Licensed Spectrum, Unlicensed/Shared (e.g., CBRS, LAA), Mixed Licensing), By Enterprise Vertical (IT and Telecommunications, BFSI, Manufacturing - Discrete, Manufacturing - Process, Retail and E-commerce, Healthcare, Energy and Utilities, Transportation and Logistics, Other Verticals), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174736

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Communication Infrastructure Type

- By Deployment Model Analysis

- By Spectrum Licensing Type Analysis

- Enterprise Vertical Analysis

- North America Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunities and Business Benefits

- Regulatory Environment

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

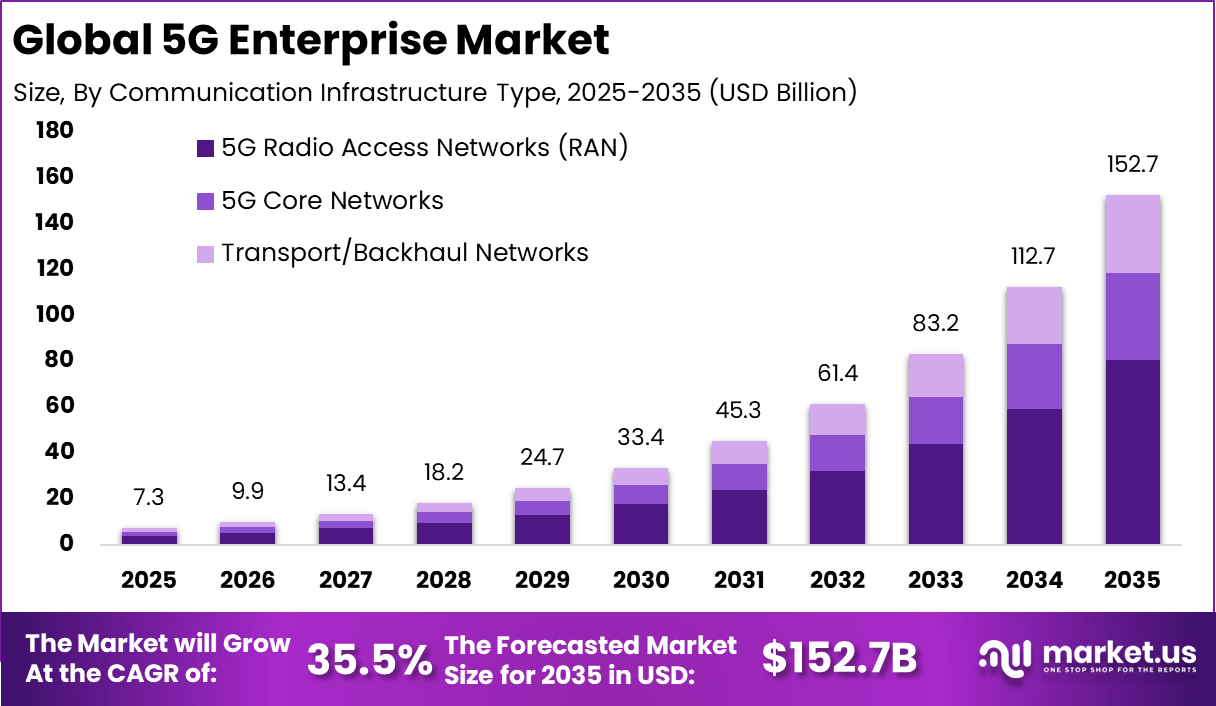

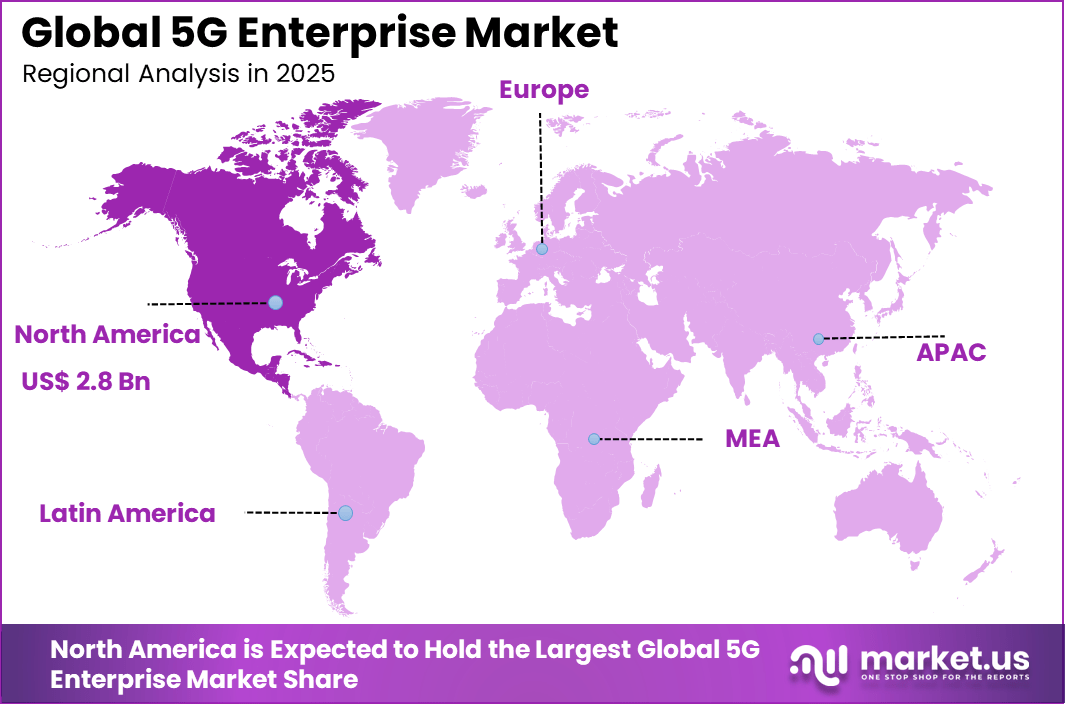

The Global 5G Enterprise Market size is expected to be worth around USD 152.7 Billion By 2035, from USD 7.3 billion in 2025, growing at a CAGR of 35.5% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 38.7% share, holding USD 2.8 Billion revenue.

The 5G enterprise market refers to the adoption of fifth generation mobile network technology by businesses and organizations to support digital operations. Enterprises use 5G for high-speed connectivity, low latency communication, and reliable network performance. Applications include smart manufacturing, logistics, healthcare systems, remote operations, and enterprise IoT. 5G enables private networks and advanced wireless infrastructure within enterprise environments.

This market development has been influenced by limitations of existing wireless and wired networks. Traditional connectivity struggles to support data-intensive and latency-sensitive enterprise applications. 5G provides enhanced capacity and responsiveness for modern workloads. Enterprises increasingly rely on connected devices and real-time systems. This shift positions 5G as a foundational enterprise technology.

One major driving factor of the 5G enterprise market is the need for reliable low latency communication. Use cases such as automation, robotics, and remote monitoring require instant data transfer. 5G networks reduce delay and improve responsiveness. This capability enables new operational models. Performance requirements strongly drive adoption.

Another key driver is the expansion of connected devices and enterprise IoT. Businesses deploy sensors, machines, and mobile assets across operations. Managing these devices requires scalable and secure connectivity. 5G supports high device density and stable connections. IoT growth accelerates enterprise 5G adoption.

Top Market Takeaways

- 5G Radio Access Networks led communication infrastructure with a 52.7% share, as enterprises prioritized high-capacity and low-latency connectivity for critical operations.

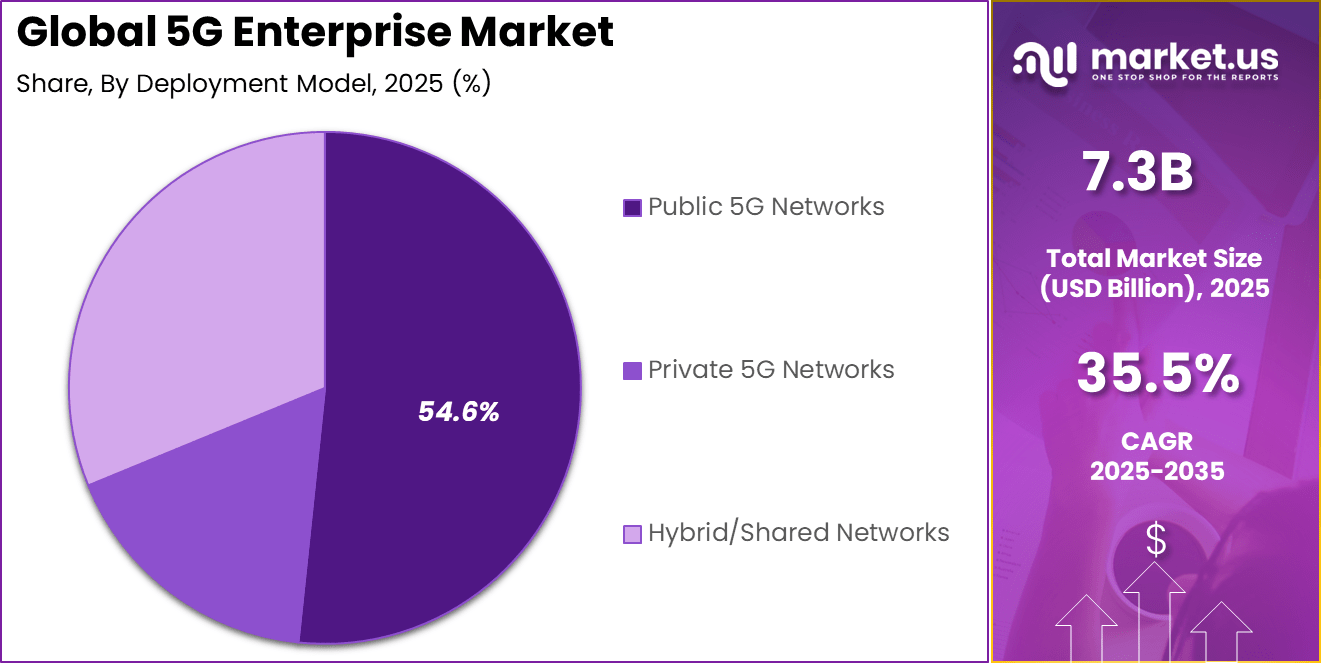

- Public 5G networks dominated deployment models at 54.6%, supported by faster rollout, lower upfront costs, and wide coverage availability.

- Licensed spectrum accounted for 48.9%, reflecting enterprise preference for secure, interference-free, and reliable network performance.

- IT and telecommunications emerged as the leading enterprise vertical with 37.6%, driven by early adoption of advanced network services and edge-enabled applications.

- North America captured 38.7% of the global market, supported by strong 5G infrastructure investment and enterprise digital transformation initiatives.

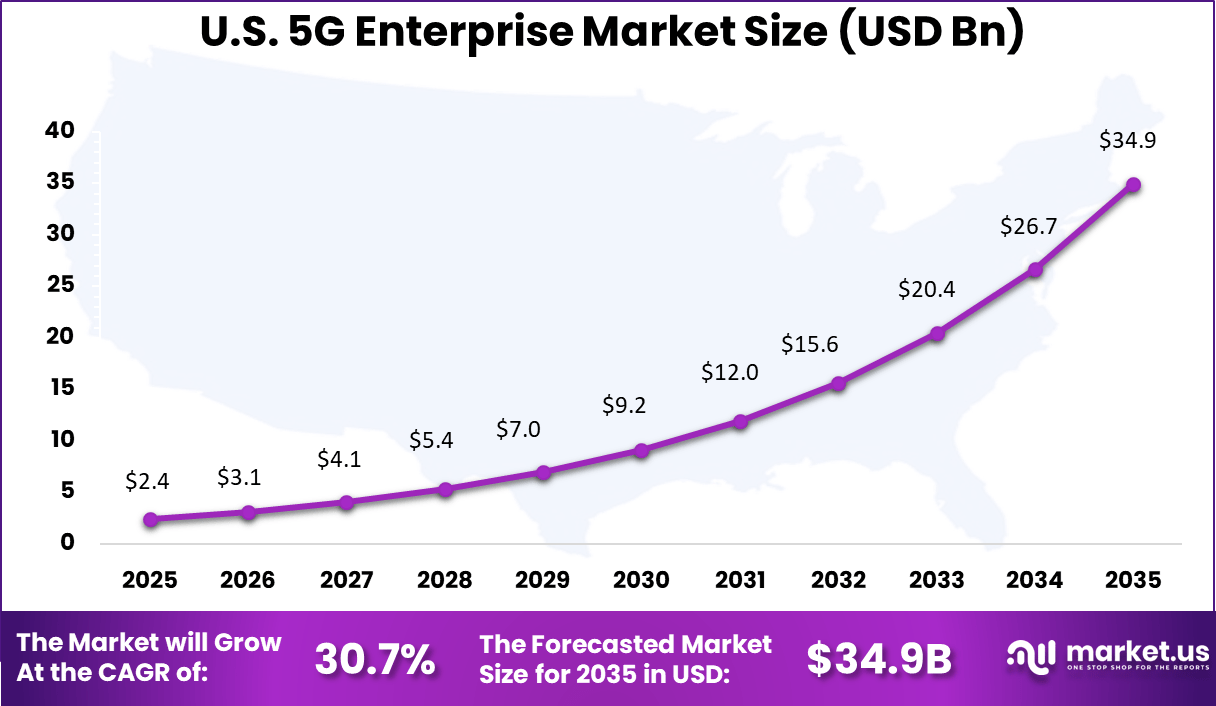

- The U.S. market reached USD 2.40 billion and is expanding at a 30.7% CAGR, driven by rising enterprise demand for private connectivity, automation, and real-time data applications.

Quick Market Facts

Adoption Rates and Scale

- Global 5G connections are projected to reach 3.2 billion by end of 2026.

- Asia Pacific accounts for over 60%, equal to about 2 billion connections.

- Enterprise 5G adoption continues to scale across industrial and service sectors.

Sector Leadership

- Manufacturing leads adoption, with 68% of firms deploying private 5G networks.

- Manufacturing users report up to 40% reduction in production downtime.

- Healthcare is the fastest-growing vertical, expanding at 36.4% CAGR.

- Healthcare investment in connected devices and remote surgery platforms rose by 65%.

Usage and Performance Statistics

- 76% of enterprises testing private 5G report operational efficiency gains of 45%.

- Network latency declines by up to 60% in private 5G environments.

- Global cellular data traffic is expected to reach 2,900 exabytes by 2026.

- This represents nearly 300% growth compared with 2021 levels.

IoT and Infrastructure Trends

- 5G IoT connections are forecast to reach 116 million globally by 2026.

- Cellular IoT devices are expected to outnumber smartphones for the first time.

- Hardware holds 73.3% of current revenue due to base station and radio investments.

- Software and services are expanding faster, growing at a 49% CAGR.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Enterprise digital transformation High bandwidth and low latency connectivity ~8.1% Global Short Term Expansion of private and public 5G use cases Mission critical enterprise applications ~7.0% North America, Europe Short Term Growth of IoT and edge computing Massive device connectivity requirements ~6.3% Global Mid Term Adoption of cloud native networks Software defined enterprise networking ~5.4% Global Mid Term Industry automation initiatives Smart factories and connected operations ~4.1% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High infrastructure cost Capital intensive 5G deployments ~6.0% Emerging Markets Short Term Spectrum availability constraints Licensing and allocation delays ~5.1% Global Short Term Cybersecurity vulnerabilities Expanded enterprise attack surface ~4.3% North America, Europe Mid Term Integration complexity Coexistence with legacy networks ~3.6% Global Mid Term Skills shortages Limited 5G network expertise ~2.8% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High deployment cost Network equipment and spectrum fees ~6.5% Emerging Markets Short to Mid Term Limited device ecosystem Slow availability of enterprise endpoints ~5.2% Global Mid Term Regulatory complexity Compliance with telecom regulations ~4.1% Europe Mid Term Uncertain ROI timelines Gradual enterprise monetization ~3.3% Global Long Term Vendor lock in concerns Dependence on single network providers ~2.7% Global Long Term By Communication Infrastructure Type

The 5G Radio Access Network segment represents the largest share of the enterprise market, accounting for 52.7%. This is because RAN forms the foundation of 5G connectivity by enabling direct wireless communication between enterprise devices and network cores. Enterprises depend on RAN to support high-capacity data transfer, ultra-low latency, and reliable wireless coverage across operational sites.

RAN infrastructure is widely deployed across factories, campuses, logistics centers, and smart facilities where wired connectivity is limited or inefficient. The increasing use of industrial automation, connected machines, and edge computing has increased the need for strong radio performance. As a result, enterprises continue to prioritize investment in RAN equipment and upgrades.

The expansion of advanced RAN architectures such as virtualized and cloud-based RAN further supports adoption. These architectures improve scalability and reduce operational complexity for enterprises. Over time, RAN remains central to enterprise 5G strategies as connectivity requirements continue to increase.

By Deployment Model Analysis

Public 5G networks account for 54.6% of enterprise deployments, reflecting strong reliance on operator-managed infrastructure. Enterprises prefer public networks due to their wide coverage, lower upfront investment, and faster implementation timelines. This model allows businesses to access advanced 5G capabilities without managing network ownership.

Public 5G is especially suitable for enterprises with distributed operations across cities, regions, or countries. Sectors such as transportation, retail, utilities, and field services benefit from seamless connectivity across multiple locations. Network operators also offer enterprise-grade service quality options that support business-critical applications.

As operators continue to expand 5G coverage and enhance network performance, public deployments remain attractive. Improvements in latency, reliability, and security further strengthen confidence among enterprise users. Public 5G is expected to remain a key deployment approach alongside private and hybrid models.

By Spectrum Licensing Type Analysis

Licensed spectrum holds a 48.9% share of the enterprise 5G market, reflecting strong demand for reliable and interference-free connectivity. Licensed frequencies provide controlled access, ensuring consistent performance for critical enterprise operations. This reliability is essential for use cases where downtime or data loss cannot be tolerated.

Enterprises in manufacturing, healthcare, utilities, and logistics prefer licensed spectrum due to predictable network behavior. Dedicated spectrum access enables stable throughput and low latency, supporting automation systems and real-time monitoring. Regulatory frameworks in several regions also support enterprise access to licensed bands.

While shared and unlicensed spectrum options are gaining attention, licensed spectrum remains dominant for high-performance deployments. Enterprises continue to favor spectrum models that provide operational control and service assurance. This trend reinforces the role of licensed spectrum in long-term enterprise 5G adoption.

Enterprise Vertical Analysis

The IT and telecommunications vertical leads enterprise 5G adoption with a 37.6% share. Organizations in this sector act as both technology adopters and service enablers, using 5G to enhance digital infrastructure and service delivery. Their strong dependence on data-intensive operations drives early and large-scale adoption.

5G supports critical applications such as cloud connectivity, edge computing, and network virtualization within this vertical. These capabilities improve operational efficiency and enable new digital services. The sector also benefits from seamless integration between 5G and existing IT ecosystems.

As digital services continue to expand, IT and telecommunications firms remain key drivers of enterprise 5G demand. Their investments influence adoption across other industries by setting performance benchmarks. This vertical is expected to maintain leadership as enterprise connectivity requirements grow.

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity IT and telecommunications High performance enterprise connectivity 37.6% Advanced Manufacturing Smart factories and robotics 21.8% Developing Healthcare Remote monitoring and telemedicine 15.4% Developing Transportation and logistics Fleet and asset connectivity 13.2% Developing Energy and utilities Grid and field automation 12.0% Developing North America Regional Analysis

Market Share 38.7% | United States USD 2.40 Bn | CAGR 30.7%

North America accounts for 38.7% of the global enterprise 5G market, supported by advanced digital infrastructure and early technology adoption. Enterprises across the region actively deploy 5G to support automation, data analytics, and connected operations. Regulatory support and spectrum availability further strengthen market development.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Early enterprise 5G adoption 38.7% USD 2.83 Bn Advanced Europe Industrial automation and smart manufacturing 27.9% USD 2.04 Bn Advanced Asia Pacific Large scale enterprise digitization 24.8% USD 1.82 Bn Developing to Advanced Latin America Enterprise connectivity modernization 5.2% USD 0.38 Bn Developing Middle East and Africa Smart city and infrastructure projects 3.4% USD 0.25 Bn Early

The United States represents a significant portion of regional demand, with enterprise 5G market value reaching USD 2.40 billion. Strong participation from telecom operators and technology providers accelerates enterprise rollouts. Businesses across manufacturing, logistics, and services increasingly rely on 5G for operational efficiency.

A CAGR of 30.7% highlights strong growth momentum in North America. Continued digital transformation initiatives and rising enterprise connectivity needs support sustained expansion. The region remains a key contributor to global enterprise 5G adoption and innovation.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior IT and telecom enterprises Very High ~37.6% Network modernization Platform wide deployment Large enterprises High ~31% Mission critical connectivity Phased rollout Cloud service providers High ~18% Edge and cloud integration Capital intensive Industrial enterprises Moderate ~9% Automation and control Selective adoption SMEs Low ~5% Cost sensitive connectivity Limited usage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status 5G RAN High speed wireless access ~8.4% Growing Network slicing Customized enterprise networks ~7.1% Growing Software defined networking Centralized network control ~6.0% Mature Edge computing Ultra low latency processing ~4.6% Developing Network security platforms Enterprise grade protection ~3.4% Developing Emerging Trends

Emerging trends in the 5G enterprise landscape include the convergence of 5G with edge computing to enable real time data processing closer to the source, reducing latency and supporting autonomous systems. Another trend is network slicing that allows enterprises to partition a single physical network into multiple virtual networks tailored for specific performance, security, and reliability needs.

There is also increasing adoption of private 5G networks by large organisations seeking greater control over connectivity, performance optimisation, and customised service level agreements. Integration with artificial intelligence and analytics tools is being explored to optimise network performance, predict faults, and automate traffic management.

Growth Factors

Growth in the 5G enterprise market is supported by rising demand for digital transformation, real-time applications, and connected solutions that require reliable high-speed connectivity. The expansion of digital services, rise of mobile computing, and deployment of smart factory and logistics initiatives reinforce enterprise motivation to transition from legacy wireless technologies to 5G based networks.

Continued advancements in hardware, radio technologies, and network functions make 5G more accessible and scalable for enterprise contexts, while supportive regulatory frameworks and spectrum policies in several regions encourage investment in infrastructure and services that enable next generation connectivity.

Opportunities and Business Benefits

Investment opportunities in the 5G enterprise market exist in private network solutions. Enterprises seek customized network deployments. Private 5G platforms attract strong interest. Service providers and technology vendors benefit. This segment shows strong potential.

Another opportunity lies in industry-specific 5G applications. Manufacturing, healthcare, and logistics require tailored solutions. Vertical-focused deployments improve adoption. Specialized offerings create differentiation. Industry alignment supports expansion.

5G enterprise solutions improve business agility by enabling faster decision making. Real-time data access supports responsive operations. Improved connectivity reduces bottlenecks. Agility improves competitiveness. Organizations adapt more quickly.

These solutions also support cost optimization over time. Wireless infrastructure reduces reliance on complex wiring. Scalable networks reduce long-term maintenance costs. Operational savings improve financial performance. Cost efficiency strengthens business outcomes.

Regulatory Environment

The regulatory environment for the 5G enterprise market includes spectrum allocation and telecommunications rules. Enterprises must comply with national communication regulations. Licensing and usage policies affect deployment. Regulatory compliance ensures lawful operation. Alignment is essential.

Data security and privacy regulations also influence adoption. Enterprise networks handle sensitive operational data. Secure network design is required. Compliance with data protection laws builds trust. Regulatory adherence supports responsible deployment.

Opportunity Analysis

Emerging opportunities in the 5G enterprise market are linked to innovative use cases that leverage enhanced mobile broadband, massive machine type communications, and ultra-reliable low latency communication. Industries such as manufacturing, healthcare, logistics, and smart cities can benefit from mission-critical applications that require real time responsiveness and high reliability.

For example, 5G enables connected robotics, remote surgical assistance, digital twins for industrial optimisation, and autonomous guided vehicles in warehouses. Service providers that can deliver tailored 5G solutions for specific industry needs, combined with edge computing and analytics, are well positioned to capture expanding enterprise demand.

Challenge Analysis

A central challenge facing the 5G enterprise market relates to security, spectrum management, and interoperability. As enterprises adopt 5G connectivity across different environments, securing distributed network edges, devices, and data flows becomes increasingly complex.

Ensuring network resilience, protecting against cyber threats, and managing secure access control require advanced security frameworks and specialised expertise. Spectrum allocation and regulatory uncertainty in some regions further complicate enterprise 5G rollouts, while ensuring interoperability with existing communications systems demands strategic planning and often custom engineering.

Key Market Segments

By Communication Infrastructure Type

- 5G Radio Access Networks (RAN)

- 5G Core Networks

- Transport/Backhaul Networks

By Deployment Model

- Public 5G Networks

- Private 5G Networks

- Hybrid/Shared Networks

By Spectrum Licensing Type

- Licensed Spectrum

- Unlicensed/Shared (e.g., CBRS, LAA)

- Mixed Licensing

By Enterprise Vertical

- IT and Telecommunications

- BFSI

- Manufacturing – Discrete

- Manufacturing – Process

- Retail and E-commerce

- Healthcare

- Energy and Utilities

- Transportation and Logistics

- Other Verticals

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Key players such as Cisco Systems, Ericsson, Huawei Technologies, and Nokia lead the enterprise 5G infrastructure segment. These companies provide radio access networks, core networks, and private 5G solutions. Their focus remains on high reliability, low latency, and secure connectivity. Strong R&D capabilities support continuous technology upgrades. Adoption is driven by manufacturing, logistics, and critical enterprise applications.

Technology and chipset focused players such as Qualcomm and Intel Corporation support device and edge ecosystem development. Samsung Electronics, NEC Corporation, and ZTE Corporation strengthen end to end 5G offerings. Their solutions enable private networks and industrial automation. Integration with cloud and edge platforms improves enterprise deployment flexibility and performance.

Enterprise IT and service providers such as Hewlett Packard Enterprise, Dell Technologies, and Juniper Networks focus on campus and edge networking. Telecom operators including AT&T, Verizon Communications, and Deutsche Telekom AG drive managed private 5G services. Siemens AG and Fujitsu expand industrial use cases. Other players enhance regional reach and competition.

Top Key Players in the Market

- Cisco Systems

- Ericsson

- Huawei Technologies

- Nokia

- NEC Corporation

- Samsung Electronics

- ZTE Corporation

- Qualcomm

- Intel Corporation

- Hewlett Packard Enterprise (Aruba)

- Dell Technologies

- Juniper Networks

- Mavenir

- Rakuten Symphony

- CommScope

- AT&T

- Verizon Communications

- Deutsche Telekom AG

- Siemens AG

- Fujitsu

- Others

Recent Developments

- In January 2026, Quectel Wireless Solutions launched the RG600QA and RG660QB 5G modules to support a wide range of next generation 5G networks for homes and businesses. These modules are designed to enable reliable connectivity across diverse use cases. The launch supports growing demand for high speed and low latency wireless solutions.

- In August 2025, T Mobile US launched 5G network slicing for major enterprises such as Delta Air Lines and Axis Energy Services. Earlier, in April 2025, Cisco Systems partnered with Vodafone Idea in India to upgrade 4G and 5G backhaul using MPLS transport solutions. This upgrade reduced network latency by 30% and supported Vi’s 5G rollout in Delhi and Mumbai for high quality streaming and enterprise cloud applications.

- In February 2025, Ericsson partnered with Jaguar Land Rover to deploy a Private 5G network at the Solihull plant. The network replaced wired systems with wireless connectivity to support AI driven quality control, IoT sensors, and automated guided vehicles. This deployment reduced production line reconfiguration time from weeks to seconds, improving manufacturing flexibility and efficiency.

Report Scope

Report Features Description Market Value (2025) USD 7.3 Bn Forecast Revenue (2035) USD 152.7 Bn CAGR(2026-2035) 35.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Communication Infrastructure Type (5G Radio Access Networks (RAN), 5G Core Networks, Transport/Backhaul Networks), By Deployment Model (Private 5G Networks, Public 5G Networks, Hybrid/Shared Networks), By Spectrum Licensing Type(Licensed Spectrum, Unlicensed/Shared (e.g., CBRS, LAA), Mixed Licensing), By Enterprise Vertical (IT and Telecommunications, BFSI, Manufacturing – Discrete, Manufacturing – Process, Retail and E-commerce, Healthcare, Energy and Utilities, Transportation and Logistics, Other Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Ericsson, Huawei Technologies, Nokia, NEC Corporation, Samsung Electronics, ZTE Corporation, Qualcomm, Intel Corporation, Hewlett Packard Enterprise (Aruba), Dell Technologies, Juniper Networks, Mavenir, Rakuten Symphony, CommScope, AT&T, Verizon Communications, Deutsche Telekom AG, Siemens AG, Fujitsu, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cisco Systems

- Ericsson

- Huawei Technologies

- Nokia

- NEC Corporation

- Samsung Electronics

- ZTE Corporation

- Qualcomm

- Intel Corporation

- Hewlett Packard Enterprise (Aruba)

- Dell Technologies

- Juniper Networks

- Mavenir

- Rakuten Symphony

- CommScope

- AT&T

- Verizon Communications

- Deutsche Telekom AG

- Siemens AG

- Fujitsu

- Others