Global 4K Technology Market By Product (Set-Top Boxes, TV Monitors, Digital Signage, Smartphones, Tablets, and Laptops), By Vertical (Retail, Entertainment & Media, Business & Media, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 62666

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

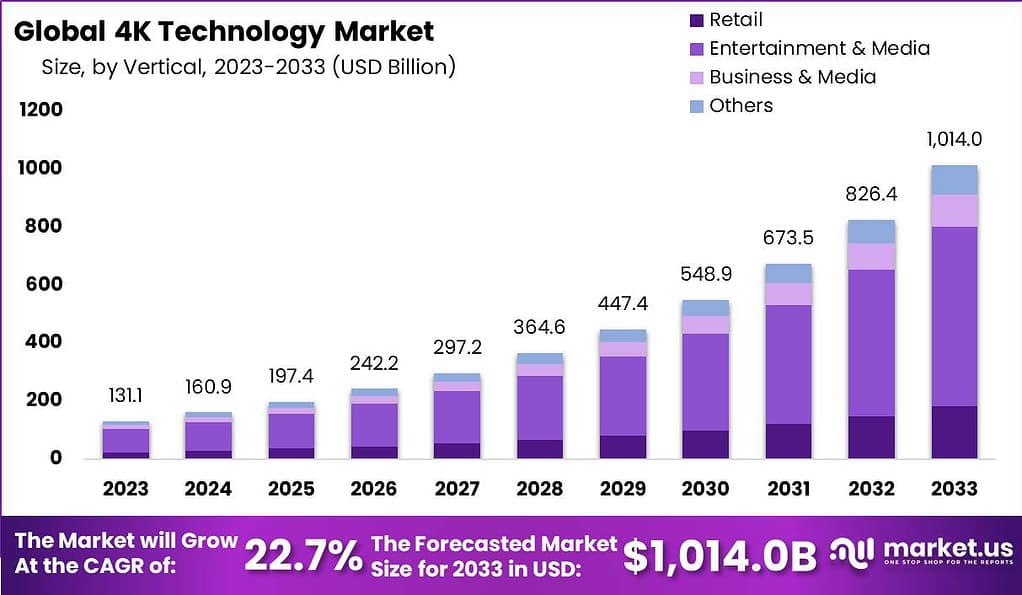

The Global 4K Technology Market is anticipated to be USD 1,014 billion by 2033. It is estimated to record a steady CAGR of 22.7% in the Forecast period 2024 to 2033. It is likely to total USD 160.9 billion in 2024.

4K technology is a revolutionary innovation that completely transforms our digital content experience. It delivers sharper, more detailed images, vibrant colors, and improved clarity, making it well-suited for large screens, projectors, and TVs. With its precision in presenting visuals, 4K technology has become the benchmark for superior image quality, ensuring an engaging and true-to-life viewing experience.

The 4K technology market is expected to continue growing rapidly, as both 4K production and consumption increases. Analysts predict strong sales growth for 4K TVs and prosumer and professional 4K cameras that will be used to create 4K content. The market has experienced a dramatic growth because of the growing demand for content with high resolution across a variety of sectors. In addition, advances with camera technologies have allowed the creation and recording of 4K-quality content and accelerated the growth of the market.

Note: The figures presented here are subject to change in the final report

Key Takeaways

- Market Size and Growth: The 4K Technology Market is expected to reach a valuation of USD 1,014.0 billion by 2033. It is projected to record a Compound Annual Growth Rate (CAGR) of 22.7% during the forecast period from 2024 to 2033.

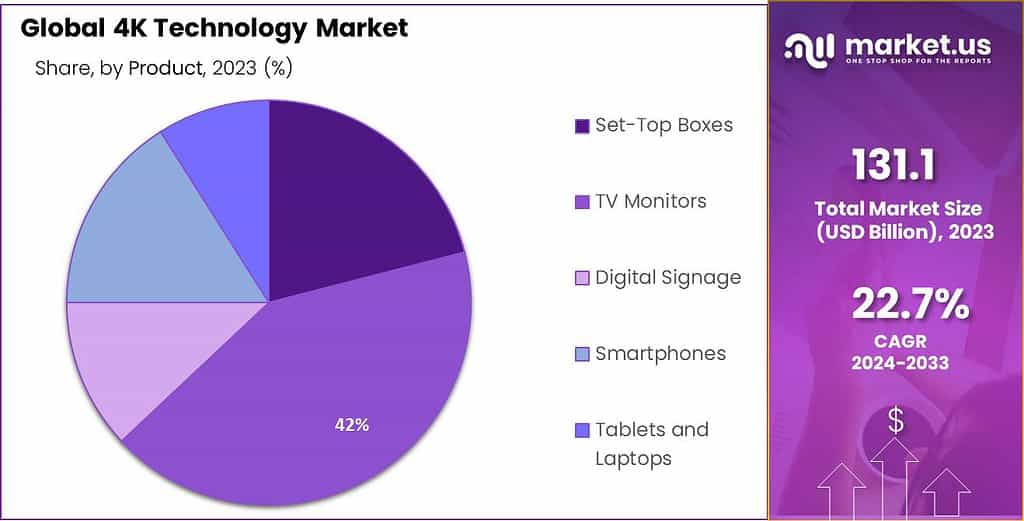

- Product Type Analysis: In 2023, TV Monitors emerged as the dominant segment in the 4K Technology market, capturing a significant 42% market share.

- Vertical Analysis: In 2023, the Entertainment & Media segment dominated the 4K Technology market with a substantial 61% market share. The industry’s demand for high-resolution content delivery was a key driver.

- Driving Factors: Rising consumer demand for high-resolution content is a primary driver, as people seek sharper and more immersive visual experiences.

- Restraining Factors: The high cost of 4K equipment, including TVs and cameras, remains a barrier to widespread adoption.

- Growth Opportunities: Emerging markets offer growth opportunities, driven by rising middle-class populations with increasing disposable income.

- Challenges: Protecting 4K content from piracy is a challenge due to its higher quality.

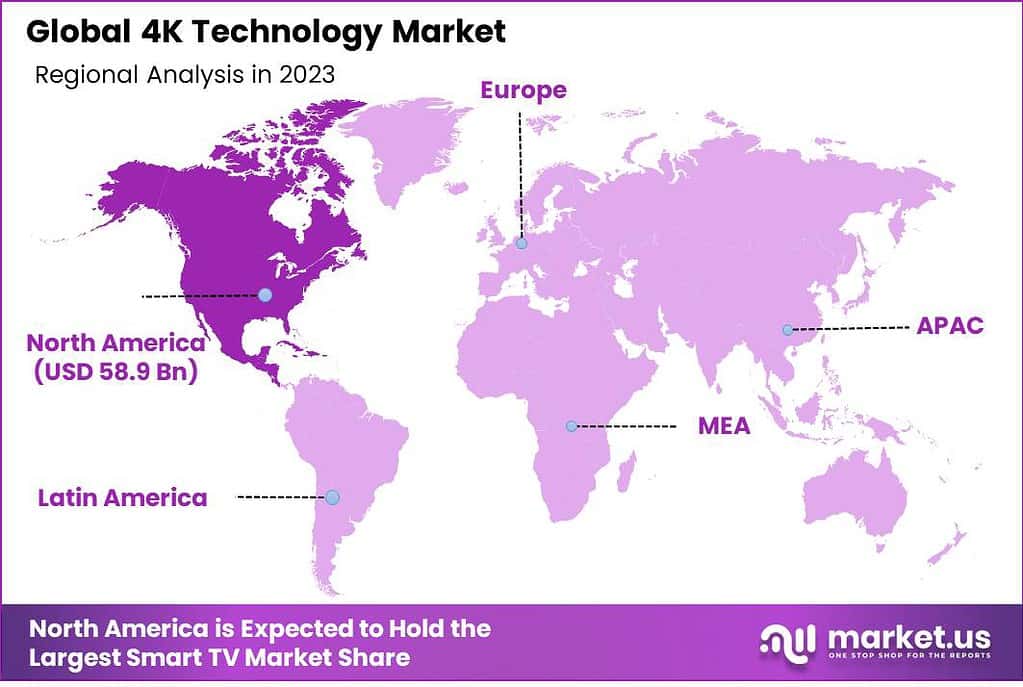

- Regional Analysis: North America holds a dominant market position (45% market share) due to its strong technological infrastructure.

- Key Players: Leading companies include Sony Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., and others.

Product Type Analysis

In 2023, the TV Monitors segment emerged as a dominant force in the 4K Technology market, solidifying its market leadership by capturing a 42% significant share. This segment’s robust performance was underpinned by the increasing demand for high-definition viewing experiences across households and businesses.

TV Monitors equipped with 4K technology offer unparalleled picture quality and clarity, driving consumer preferences towards these advanced displays. Furthermore, the rise in streaming services, gaming, and content consumption played a pivotal role in bolstering the market position of TV Monitors. With an impressive market share, this segment is poised for continued growth as consumers seek immersive entertainment and superior visual experiences.

Meanwhile, the Set-Top Boxes segment also exhibited strong growth, closely following TV Monitors in market influence. Set-Top Boxes equipped with 4K capabilities are in high demand, enabling viewers to access and enjoy ultra-high-definition content seamlessly. This segment’s growth can be attributed to the transition from standard to high-definition broadcasting, where 4K Set-Top Boxes serve as essential components for delivering premium content to households.

Additionally, Digital Signage emerged as a prominent segment in the 4K Technology market, leveraging the enhanced visual quality of 4K displays for advertising and information dissemination. Businesses across various industries are adopting 4K Digital Signage solutions to captivate their audiences with vivid and engaging content, driving the segment’s market share upward.

Moreover, the increasing integration of 4K technology into Smartphones, Tablets, and Laptops is reshaping the consumer electronics landscape. These segments are experiencing steady growth as users seek devices that provide stunning visuals and enhanced performance. As a result, 4K-enabled Smartphones, Tablets, and Laptops are gaining traction in the market, albeit with relatively smaller market shares compared to TV Monitors and Set-Top Boxes.

Note: The figures presented here are subject to change in the final report

Vertical Analysis

In 2023, the Entertainment & Media segment asserted its dominance in the 4K Technology market, securing a 61% substantial share of the market landscape. This commanding position was a direct result of the Entertainment & Media industry’s growing demand for high-resolution content delivery. With consumers increasingly seeking immersive and visually stunning experiences, 4K technology has become pivotal for content creators and broadcasters.

The segment’s leadership is reinforced by the adoption of 4K technology in streaming platforms, broadcasting, and the production of ultra-high-definition films and shows. As a result, the Entertainment & Media vertical is driving the market’s growth, offering viewers unparalleled visual quality and engaging content.

Additionally, the Retail sector exhibited notable growth in the 4K Technology market, reflecting the industry’s commitment to enhancing the in-store shopping experience. Retailers are leveraging 4K displays and signage to create captivating and interactive store environments, thereby increasing foot traffic and boosting sales. This segment’s market share is expected to continue its upward trajectory as more retailers recognize the value of 4K technology in attracting and engaging customers.

Furthermore, the Business & Media vertical is a significant player in the 4K Technology market, driven by the increasing adoption of high-resolution displays and video conferencing solutions in corporate settings. Businesses are embracing 4K technology to facilitate seamless communication and presentations, leading to improved collaboration and productivity. The segment’s growth is further supported by the demand for 4K monitors and displays in the professional media production and content creation industries.

Lastly, the “Others” category encompasses various verticals that are gradually embracing 4K technology to enhance their operations and offerings. While this segment may have a smaller market share compared to Entertainment & Media, Retail, and Business & Media, it represents a diverse range of industries that are recognizing the benefits of 4K technology, including healthcare, education, and government sectors.

Driving Factors

- Increased Consumer Demand for High-Resolution Content: The primary driving factor in the 4K Technology market is rising demand of consumers for content with high resolution. With the rise of displays that can be equipped with 4K in the home, people are seeking more sharper and immersive visual experiences, which is prompting broadcasters and content creators to invest in 4K technology.

- Rising Adoption in Multiple Industries: 4K technology is finding applications beyond entertainment, with various industries such as healthcare, education, and gaming embracing it. The versatility of 4K displays, cameras, and monitors is driving growth as businesses and institutions recognize the advantages of enhanced visual quality for their operations.

- Advancements in Display Technology: Continuous advancements in display technology, including OLED and QLED panels, are contributing to the growth of the 4K Technology market. These innovations result in brighter, more vibrant, and energy-efficient 4K displays, attracting both consumer and business segments.

- Supportive Infrastructure and Connectivity: The availability of high-speed internet and compatible hardware, such as 4K streaming devices and gaming consoles, is a crucial driving factor. These infrastructure improvements ensure seamless delivery and consumption of 4K content, enhancing the overall user experience.

Restraining Factors

- High Cost of 4K Equipment: The cost associated with purchasing 4K-capable gadgets including TVs, monitors, and cameras, remains a significant barrier to widespread adoption. This may deter budget-conscious consumers as well as businesses from converting to 4K technology.

- Limited Availability of Native 4K Content: Despite the demand for 4K content, the availability of native 4K content, especially in certain niche genres, is limited. This shortage can hinder the market’s growth potential as viewers may not find enough compelling content to justify the investment in 4K equipment.

- Bandwidth and Storage Requirements: Streaming and storing 4K content require significantly higher bandwidth and storage capacities compared to standard HD content. This can strain network infrastructure and lead to additional costs, discouraging some users from embracing 4K technology.

- Compatibility Challenges: Ensuring compatibility between various 4K devices and content formats can be complex. This challenge, especially in multi-device environments, can hinder seamless integration and limit the user experience.

Growth Opportunities

- Emerging Markets Adoption: Growth opportunities abound in emerging markets where there is a rising middle-class population with increasing disposable income. As these markets mature, there will be a greater appetite for high-quality 4K displays and content.

- Integration with Augmented and Virtual Reality: The integration of 4K technology with augmented reality (AR) and virtual reality (VR) applications presents a promising growth avenue. Enhanced visual quality is crucial in these immersive environments, driving demand for 4K displays and cameras.

- Content Creation Tools: The demand for 4K content creation tools and equipment is on the rise. Opportunities exist for companies that provide advanced cameras, editing software, and production equipment tailored to 4K workflows.

- Innovation in Display Technologies: Ongoing innovations in display technologies, such as mini-LED and microLED displays, offer growth potential by delivering even higher-quality visuals while potentially reducing production costs.

Challenges

- Content Piracy and Copyright Concerns: The higher quality of 4K content makes it more vulnerable to piracy, posing challenges for content creators and distributors in protecting their intellectual property.

- Standardization and Interoperability: Ensuring consistent standards and compatibility across 4K devices and formats is an ongoing challenge. Lack of standardization can lead to fragmentation and interoperability issues.

- Environmental Concerns: The production of 4K displays and related equipment can have environmental impacts. Addressing sustainability concerns and reducing the carbon footprint of 4K technology is a challenge for the industry.

- Competition and Pricing Pressure: The competitive landscape in the 4K Technology market is intense, leading to pricing pressures. Companies must balance innovation with cost-effective solutions to maintain competitiveness.

Key Market Trends

- 4K Streaming Services: The proliferation of 4K streaming platforms and services is a key trend, as major players like Netflix and Amazon Prime Video offer a growing library of 4K content.

- 4K Gaming: The gaming industry is embracing 4K technology, with gaming consoles and graphics cards supporting 4K resolutions for immersive gaming experiences.

- AI-Enhanced Upscaling: AI-powered upscaling techniques are becoming prevalent, allowing for the enhancement of non-4K content to near-4K quality, addressing the content availability challenge.

- 4K in Education and Healthcare: 4K displays are finding applications in education and healthcare for detailed imaging, remote consultations, and enhanced learning experiences, driving adoption in these sectors.

Key Market Segments

By Product

- Set-Top Boxes

- TV Monitors

- Digital Signage

- Smartphones

- Tablets and Laptops

By Vertical

- Retail

- Entertainment & Media

- Business & Media

- Others

Regional Analysis

In 2023, North America held a dominant market position in the 4K Technology Market, capturing a 45% significant share. The prominence of this region is attributable to North America’s strong technological infrastructure as well as its early use of 4K technology throughout different sectors.

In the United States, in particular was a key player in pushing the market forward as well as a high demand from consumers for 4K TVs, cameras and displays. The presence of major tech companies has also aided in its position of leadership. In 2023 North America continued to see significant growth in the market for 4K technology which further established its position.

Moving to Europe, it played a big part in the world of 4K technology. Countries like Germany, the UK, and France were leaders in using 4K, as people there wanted better-quality content. Europe’s focus on new technology and good internet helped 4K grow steadily, making it an important player in the market.

In the Asia-Pacific (APAC) region, the 4K Technology Market grew a lot and was worth a good amount by 2023. More people in APAC’s middle class had more money, and they really wanted good-quality content. Places like China, Japan, and South Korea led the way in using 4K technology. Because 4K TVs and smartphones became cheaper, APAC became a great market for 4K tech.

In Latin America, the 4K Technology Market had a lot of potential to grow and was worth a good amount. Countries like Brazil and Mexico saw more interest in 4K screens, especially in things like TVs. The entertainment industry in the region also added to the demand for 4K stuff. By 2023, Latin America had a strong presence in the 4K technology market.

Finally, the Middle East and Africa (MEA) region also joined the global 4K technology wave, with a notable market value by 2023. As MEA countries continued to invest in technological infrastructure, the adoption of 4K technology gained momentum. The region saw increased usage of 4K displays in sectors such as broadcasting, hospitality, and healthcare. MEA’s role in the 4K technology market continued to evolve, reflecting its growing significance in the industry.

Note: The figures presented here are subject to change in the final report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Leading companies in the 4K Technology market are heavily investing in innovation and research to expand their offerings. This commitment is expected to drive further growth in the market. These organizations are also actively pursuing various strategic initiatives to strengthen their global reach.

Notable activities include the introduction of new products, forming contractual partnerships, merging with or acquiring other companies, ramping up investments, and collaborating with other firms. To flourish and stay ahead in this increasingly competitive and evolving market, companies in the 4K Technology sector need to focus on delivering high-quality yet affordable products.

Top Key Players

- Sony Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Sharp Corporation

- Canon Inc.

- JVC Kenwood Corporation

- Red Digital Cinema

- Blackmagic Design Pty. Ltd.

- Nikon Corporation

- GoPro, Inc.

- Fujifilm Holdings Corporation

- Other Key Players

Recent Developments

- In 2023, Samsung introduced “Mini-LED” Quantum Dot technology, enhancing the brightness and precision of High Dynamic Range (HDR) for 4K TVs. They also launched the world’s first 8K QLED TV with an impressive 1,000 nits peak brightness. In a strategic move, Samsung partnered with leading streaming services such as Netflix and Prime Video to expand the availability of 4K HDR content.

- In 2023, LG rolled out OLED TVs with improved refresh rates and AI-powered image processing, providing smoother experiences for 4K gaming and sports viewing. Additionally, LG collaborated with Dolby Laboratories to integrate Dolby Vision IQ with Precision Detail, further elevating the 4K HDR viewing experience.

- In 2023, Sony expanded its BRAVIA XR 4K TV lineup by incorporating the Cognitive Processor XR. This processor optimizes picture and sound based on ambient conditions and the content being viewed. Sony also focused on promoting its BRAVIA CORE streaming platform, offering exclusive 4K Blu-ray-quality content to users.

Analyst Suggestions

- Focus on Content Creation: To meet the increasing demand, industry participants are advised to heavily invest in producing and licensing more native 4K content. Collaborations with content creators and studios can play a pivotal role in expanding content libraries. This strategic move ensures a diverse and engaging range of offerings for consumers.

- Enhance User Experience: Prioritizing improvements in compatibility, interoperability, and ease of use for 4K devices is crucial. Companies should aim for seamless integration with other smart devices and develop intuitive user interfaces. By doing so, they can significantly enhance the overall user experience, making 4K technology more accessible and user-friendly.

- Capitalize on Emerging Markets: The rapid adoption of 4K technology in emerging markets presents lucrative opportunities. Companies are encouraged to tailor their products and pricing strategies to suit the specific needs and affordability levels of these markets. This targeted approach ensures a competitive edge and positions companies to effectively capture the untapped potential in these growing markets.

Report Scope

Report Features Description Market Value (2023) US$ 131.1 Bn Forecast Revenue (2033) US$ 1,014.0 Bn CAGR (2024-2033) 22.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Set-Top Boxes, TV Monitors, Digital Signage, Smartphones, Tablets, and Laptops), By Vertical (Retail, Entertainment & Media, Business & Media, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sony Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Panasonic Corporation, Sharp Corporation, Canon Inc., JVC Kenwood Corporation, Red Digital Cinema, Blackmagic Design Pty. Ltd., Nikon Corporation, GoPro, Inc., Fujifilm Holdings Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 4K technology, and how does it differ from other display technologies?4K technology refers to display devices with a resolution of approximately 4,000 pixels horizontally. It offers significantly higher image clarity compared to traditional display technologies, such as Full HD.

Why is 4K technology gaining popularity in the market?4K technology is gaining popularity due to its ability to deliver sharper and more detailed images, vibrant colors, and enhanced clarity, providing an immersive viewing experience. It has become a standard for superior image quality.

How big is 4K Technology Market?The Global 4K Technology Market is anticipated to be USD 1,014 billion by 2033. It is estimated to record a steady CAGR of 22.7% in the Forecast period 2024 to 2033. It is likely to total USD 160.9 billion in 2024.

Which are the main companies that are currently operating within the market?Key players in the 4K technology market include Sony Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Panasonic Corporation, Sharp Corporation, Canon Inc., JVC Kenwood Corporation, Red Digital Cinema, Blackmagic Design Pty. Ltd., Nikon Corporation, GoPro, Inc., Fujifilm Holdings Corporation, Other Key Players

What are the factors that are predicted to propel the growth of the market?Potential limitations to market growth include challenges related to the large amount of data required for 4K content, bandwidth constraints, and the relatively higher cost of 4K devices. These factors may hinder widespread adoption.

What are the main opportunities available in the market?Opportunities lie in investing in content creation, improving compatibility and ease of use for 4K devices, and targeting emerging markets with tailored products and pricing strategies. Collaborations with content creators and advancements in technology present avenues for growth.

-

-

- Sony Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Sharp Corporation

- Canon Inc.

- JVC Kenwood Corporation

- Red Digital Cinema

- Blackmagic Design Pty. Ltd.

- Nikon Corporation

- GoPro, Inc.

- Fujifilm Holdings Corporation

- Other Key Players