Global 3PL Market Size, Share, Growth Analysis By Service Type (Transportation Management, Domestic Transportation, International Transportation, Warehousing & Distribution, Value-Added Logistics (VAL), Others), By Mode of Transport (Roadways, Railways, Airways, Seaways), By End-Use Industry (Manufacturing, Retail & E-commerce, Automotive, Healthcare & Pharmaceuticals, Food & Beverages, Chemicals, Electronics, Energy & Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176234

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

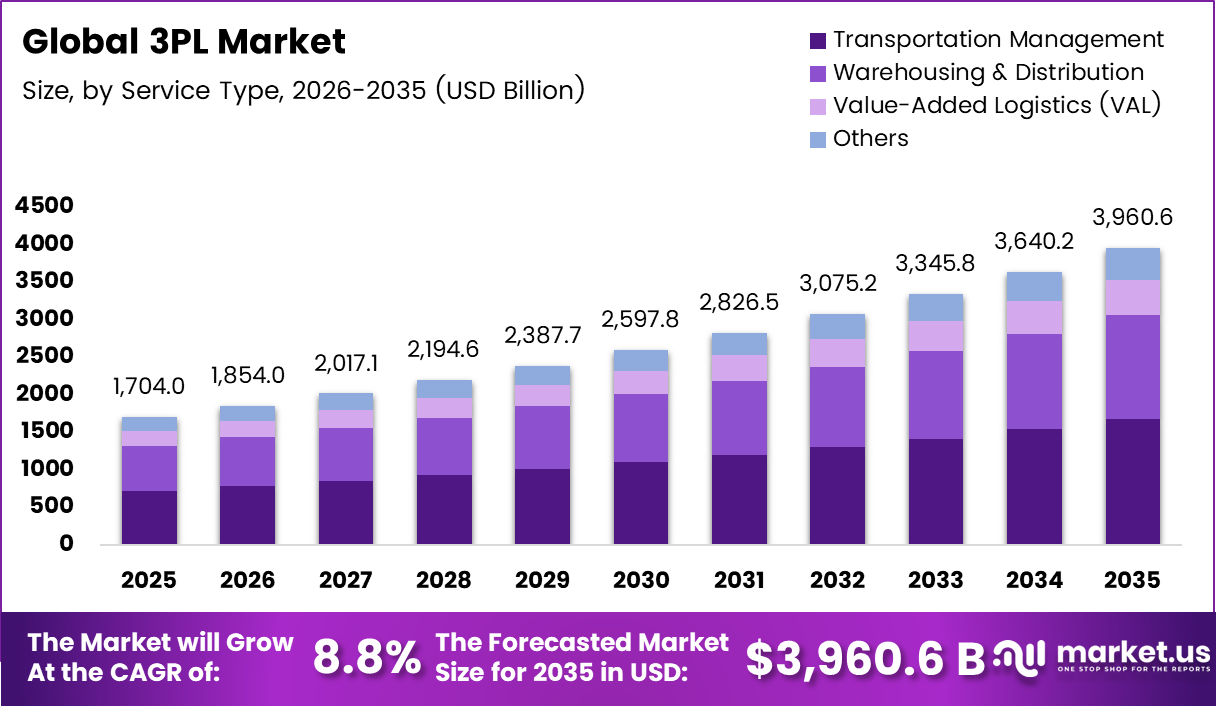

Global 3PL Market size is expected to be worth around USD 3,960.6 Billion by 2035 from USD 1,704.7 Billion in 2025, growing at a CAGR of 8.8% during the forecast period 2026 to 2035.

Third-party logistics refers to outsourcing supply chain functions including transportation, warehousing, and distribution to specialized service providers. Companies leverage 3PL providers to enhance operational efficiency while focusing on core business activities. This strategic partnership enables businesses to access advanced logistics infrastructure without substantial capital investment.

The market experiences robust growth driven by expanding e-commerce platforms requiring sophisticated fulfillment networks. Moreover, increasing globalization demands seamless cross-border logistics solutions that 3PL providers efficiently deliver. Consequently, businesses across industries recognize the strategic value of outsourcing complex supply chain operations.

Government initiatives worldwide promote infrastructure development and digital trade corridors, supporting 3PL expansion. Additionally, regulatory frameworks encouraging sustainable logistics practices drive investment in green transportation and warehouse technologies. Therefore, the sector witnesses continuous modernization aligned with environmental compliance standards.

Technology integration transforms traditional logistics through automation, artificial intelligence, and cloud-based management systems. However, companies face challenges balancing cost optimization with service quality expectations. Subsequently, successful 3PL providers differentiate through value-added services and customer-centric solutions.

According to EY, 88% of supply chain executives feel their C-suite views supply chains as cost centers rather than strategic assets. Furthermore, 85% of global warehouse operations have implemented warehouse management systems, indicating rapid technology adoption. Additionally, inventory management accounts for $759 billion of the $2.3 trillion spent on business logistics.

According to DV Unified, 28% of 3PLs manage inventory reactively, leading to operational inefficiencies. This highlights ongoing challenges despite technological advancements. Consequently, the industry prioritizes real-time visibility and predictive analytics to enhance inventory accuracy and customer satisfaction across complex supply networks.

Key Takeaways

- Global 3PL Market projected to reach USD 3,960.6 Billion by 2035 from USD 1,704.7 Billion in 2025, growing at 8.8% CAGR

- Transportation Management segment dominates Service Type with 42.3% market share in 2025

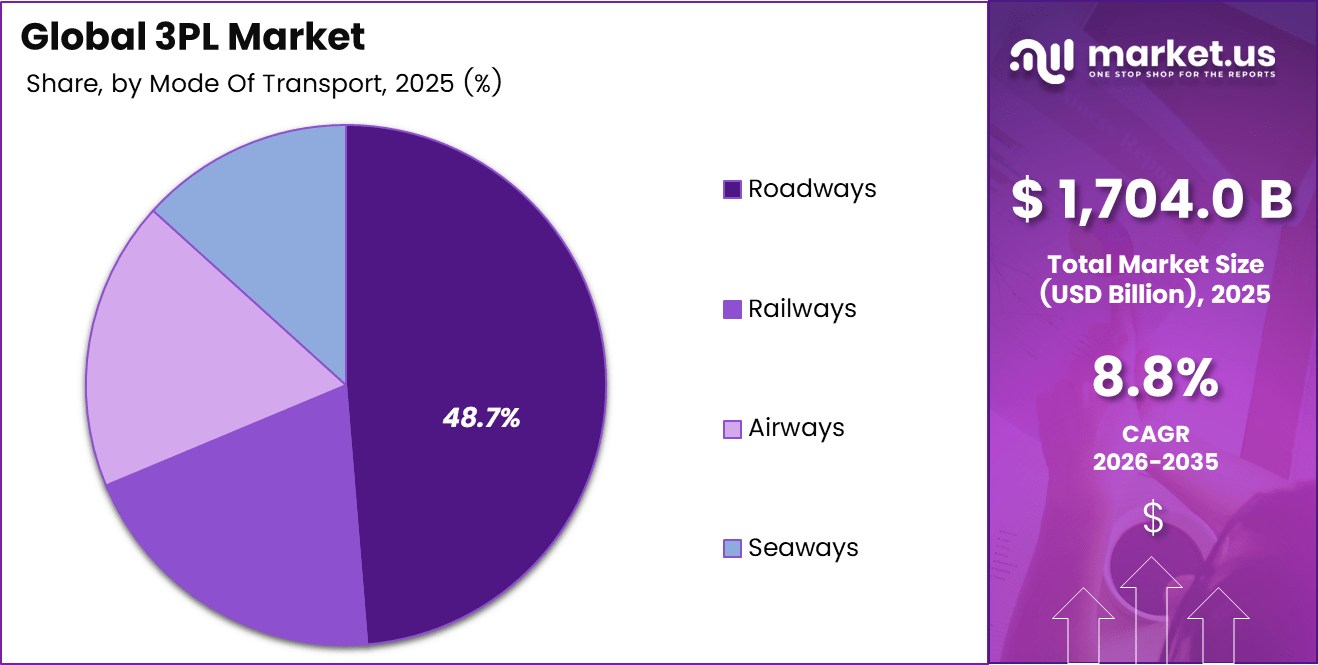

- Roadways segment leads Mode of Transport category with 48.7% share

- Manufacturing sector holds 28.7% share in End-Use Industry segment

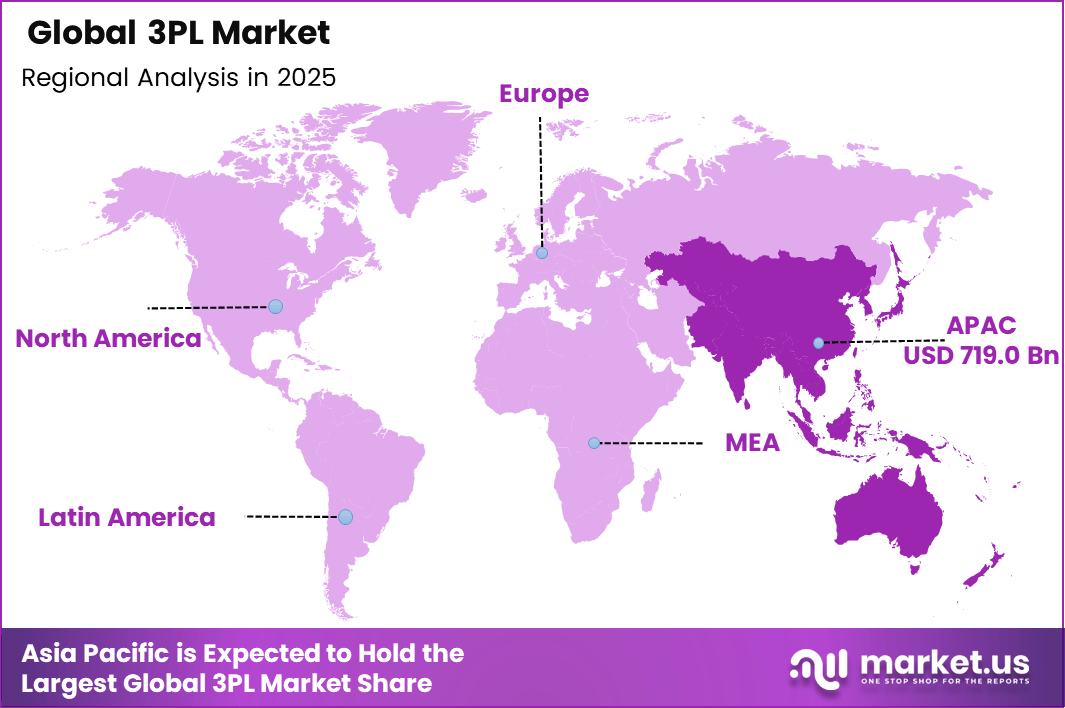

- Asia Pacific region dominates with 42.2% market share, valued at USD 719.0 Billion

- E-commerce expansion and logistics outsourcing drive significant market growth opportunities

Service Type Analysis

Transportation Management dominates with 42.3% due to critical role in supply chain connectivity.

In 2025, Transportation Management held a dominant market position in the By Service Type segment of 3PL Market, with a 42.3% share. This segment encompasses domestic and international transportation solutions that form the backbone of logistics operations. Companies increasingly outsource transportation to optimize route planning, reduce costs, and improve delivery speed across diverse geographies.

Warehousing and Distribution services provide essential storage and fulfillment capabilities for businesses managing complex inventory requirements. These services integrate advanced automation technologies enabling efficient order processing and distribution. Additionally, providers offer strategic warehouse locations that minimize transportation time and enhance supply chain responsiveness.

Value-Added Logistics services deliver customization, packaging, labeling, and returns management beyond basic transportation and storage. These specialized offerings help businesses differentiate their customer experience while maintaining operational flexibility. Furthermore, demand for VAL services grows as companies seek comprehensive solutions that streamline end-to-end supply chain operations.

Mode of Transport Analysis

Roadways dominates with 48.7% due to flexibility and extensive infrastructure networks.

In 2025, Roadways held a dominant market position in the By Mode of Transport segment of 3PL Market, with a 48.7% share. Road transportation offers unmatched flexibility for last-mile delivery and door-to-door service capabilities. Consequently, this mode remains preferred for domestic freight movement across varied distances and product categories.

Railways provide cost-effective bulk transportation for heavy cargo over long distances with reduced environmental impact. This mode suits industrial shipments requiring reliable scheduled services and lower per-unit transportation costs. Moreover, railway infrastructure development in emerging markets expands capacity for intermodal logistics solutions.

Airways deliver time-critical shipments requiring rapid transit across international borders with minimal handling. Although expensive, air freight serves high-value products and perishable goods demanding speed. Additionally, seaways handle massive cargo volumes for global trade routes, offering economical solutions for non-urgent international shipments.

End-Use Industry Analysis

Manufacturing dominates with 28.7% due to complex supply chain requirements.

In 2025, Manufacturing held a dominant market position in the By End-Use Industry segment of 3PL Market, with a 28.7% share. Manufacturing operations require sophisticated logistics for raw material procurement, work-in-progress movement, and finished goods distribution. Therefore, manufacturers extensively outsource logistics to maintain production efficiency and market responsiveness.

Retail and E-commerce sectors drive significant 3PL demand through omnichannel fulfillment and rapid delivery expectations. These industries require scalable warehousing, efficient order processing, and last-mile delivery capabilities. Subsequently, 3PL providers develop specialized e-commerce solutions including returns management and real-time inventory visibility.

Automotive industry utilizes just-in-time delivery systems requiring precise coordination between suppliers and assembly plants. Meanwhile, Healthcare and Pharmaceuticals demand specialized cold chain logistics ensuring product integrity and regulatory compliance. Additionally, Food and Beverages, Chemicals, Electronics, Energy, and other sectors leverage 3PL expertise for industry-specific logistics challenges.

Key Market Segments

By Service Type

- Transportation Management

- Domestic Transportation

- International Transportation

- Warehousing & Distribution

- Value-Added Logistics (VAL)

- Others

By Mode of Transport

- Roadways

- Railways

- Airways

- Seaways

By End-Use Industry

- Manufacturing

- Retail & E-commerce

- Automotive

- Healthcare & Pharmaceuticals

- Food & Beverages

- Chemicals

- Electronics

- Energy & Utilities

- Others

Drivers

Rapid E-Commerce Growth and Strategic Outsourcing Drive Market Expansion

E-commerce platforms continue expanding globally, creating unprecedented demand for sophisticated fulfillment networks and last-mile delivery solutions. Retailers require scalable logistics infrastructure supporting omnichannel strategies and customer expectations for rapid delivery. Consequently, businesses increasingly partner with 3PL providers possessing specialized capabilities and geographic reach.

Companies outsource logistics functions to optimize costs while accessing advanced technologies and industry expertise without capital investment. This strategic approach enables businesses to focus resources on core competencies and product innovation. Moreover, outsourcing provides operational flexibility to scale capacity during demand fluctuations.

Global trade complexity increases with cross-border regulations, customs requirements, and multi-modal transportation coordination. Additionally, businesses demand scalable warehousing and transportation solutions adapting to market dynamics. Therefore, 3PL providers deliver integrated services managing end-to-end supply chain operations efficiently across international markets.

Restraints

Operational Control Concerns and Competitive Pricing Pressure Limit Growth

High dependency on external logistics providers reduces direct operational control over critical supply chain functions. Companies face challenges maintaining service quality standards and responsiveness when outsourcing core logistics activities. Subsequently, businesses must carefully evaluate provider capabilities and establish robust performance monitoring frameworks.

Loss of internal logistics expertise over time may limit strategic flexibility and increase switching costs. Organizations become vulnerable to provider service disruptions or contract renegotiations affecting business continuity. Therefore, companies must balance outsourcing benefits against potential risks of reduced operational autonomy.

Intense market competition creates significant margin pressure as providers compete aggressively on pricing to secure contracts. Price sensitivity among customers limits revenue growth opportunities despite increasing operational costs. Consequently, 3PL providers struggle maintaining profitability while investing in technology upgrades and infrastructure expansion.

Growth Factors

Advanced Technologies and Emerging Market Expansion Accelerate Growth

Advanced analytics and artificial intelligence enable predictive demand forecasting, route optimization, and automated decision-making across logistics networks. These technologies enhance operational efficiency while reducing costs and improving customer service levels. Moreover, AI-powered systems provide real-time visibility enabling proactive issue resolution.

Emerging markets and tier-two cities present substantial expansion opportunities as economic development drives logistics infrastructure investment. Growing manufacturing activity and rising consumer spending in these regions increase demand for reliable logistics services. Additionally, urbanization patterns create new distribution networks requiring sophisticated fulfillment capabilities.

Specialized cold chain logistics demand grows significantly for healthcare products, vaccines, and perishable food requiring temperature-controlled transportation. Furthermore, integration of value-added services including packaging, labeling, and returns management creates differentiation opportunities. Therefore, providers offering comprehensive solutions capture higher margins.

Emerging Trends

Digital Transformation and Sustainability Reshape Logistics Operations

Automation and robotics revolutionize warehousing operations through autonomous vehicles, picking systems, and sorting technologies. These innovations significantly improve productivity, accuracy, and throughput while addressing labor shortages. Consequently, warehouse automation investments accelerate as providers seek competitive advantages through operational excellence.

Sustainability initiatives drive adoption of electric vehicles, renewable energy, and carbon-neutral operations across logistics networks. Companies prioritize green practices responding to regulatory requirements and customer environmental expectations. Moreover, sustainable logistics enhances brand reputation while potentially reducing long-term operational costs.

Digital freight platforms and cloud-based transportation management systems enable real-time collaboration and visibility across supply chains. On-demand and same-day delivery models emerge responding to consumer expectations for immediate gratification. Therefore, technology-enabled services transform traditional logistics into dynamic, customer-centric operations.

Regional Analysis

Asia Pacific Dominates the 3PL Market with a Market Share of 42.2%, Valued at USD 719.0 Billion

Asia Pacific leads the global market driven by robust manufacturing activity, expanding e-commerce penetration, and infrastructure development across emerging economies. The region benefits from strategic trade routes connecting major markets and extensive port networks facilitating international commerce. Moreover, China and India represent substantial growth opportunities with rapidly modernizing logistics ecosystems and increasing consumer demand.

North America 3PL Market Trends

North America maintains strong market presence supported by advanced logistics infrastructure and sophisticated technology adoption across supply chains. The region benefits from mature e-commerce markets demanding efficient fulfillment capabilities and last-mile delivery solutions. Additionally, nearshoring trends and manufacturing reshoring initiatives drive increased domestic logistics activity.

Europe 3PL Market Trends

Europe demonstrates steady growth with emphasis on sustainable logistics practices and regulatory compliance across integrated markets. The region benefits from well-developed transportation networks connecting diverse economies with varying logistics requirements. Furthermore, Brexit implications continue reshaping cross-border logistics strategies and warehouse location decisions.

Latin America 3PL Market Trends

Latin America experiences expanding logistics demand driven by economic development and increasing trade integration across regional markets. However, infrastructure limitations and regulatory complexity present challenges requiring specialized local expertise. Consequently, investment in modern logistics facilities and digital platforms accelerates.

Middle East & Africa 3PL Market Trends

Middle East and Africa region witnesses growth through strategic positioning as global trade hub and ongoing infrastructure mega-projects. The region benefits from government initiatives promoting economic diversification and logistics sector development. Additionally, expanding consumer markets and e-commerce adoption create new opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Amazon continues transforming global logistics through massive fulfillment network expansion and advanced automation technologies. The company leverages proprietary robotics, artificial intelligence, and data analytics to optimize warehouse operations and delivery speed. Furthermore, Amazon invests heavily in last-mile delivery infrastructure including air cargo capabilities and electric vehicle fleets.

DHL Supply Chain & Global Forwarding maintains market leadership through comprehensive service offerings spanning contract logistics, international freight, and supply chain consulting. The company emphasizes digital transformation initiatives and sustainable logistics solutions addressing evolving customer requirements. Moreover, DHL’s global network provides seamless connectivity across major trade routes and emerging markets.

Kuehne + Nagel delivers integrated logistics solutions combining sea freight, air freight, and contract logistics expertise across diverse industries. The company focuses on technology innovation including digital platforms enhancing supply chain visibility and operational efficiency. Additionally, Kuehne + Nagel expands specialized services for healthcare, automotive, and perishable goods sectors.

DSV strengthens market position through strategic acquisitions and organic growth initiatives expanding service capabilities and geographic coverage. The company prioritizes operational excellence and customer-centric solutions delivering reliable, cost-effective logistics services. Furthermore, DSV invests in automation and sustainability initiatives aligning with industry trends and customer expectations.

Key players

- Amazon

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel

- DSV

- DB Schenker

- CEVA Logistics

- Nippon Express

- C.H. Robinson

- Maersk Logistics

- J.B. Hunt

- UPS Supply Chain Solutions

- Expeditors

- GEODIS

- Rhenus Logistics

- DP World Logistics

Recent Developments

- January 2026 – Echo Global announced acquisition of ITS Logistics from GHK, with deal expected to close by end of H1 2026. This strategic acquisition expands Echo Global’s service capabilities and market presence in specialized logistics segments.

- May 2025 – Leading 3PL provider announced acquisition of Drexel Industries’ 3PL business, transitioning four physical locations and 100 associates. This expansion strengthens Canadian presence in key logistics hub, enhancing cross-border service capabilities.

Report Scope

Report Features Description Market Value (2025) USD 1,704.7 Billion Forecast Revenue (2035) USD 3,960.6 Billion CAGR (2026-2035) 8.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Transportation Management, Domestic Transportation, International Transportation, Warehousing & Distribution, Value-Added Logistics (VAL), Others), By Mode of Transport (Roadways, Railways, Airways, Seaways), By End-Use Industry (Manufacturing, Retail & E-commerce, Automotive, Healthcare & Pharmaceuticals, Food & Beverages, Chemicals, Electronics, Energy & Utilities, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amazon, DHL Supply Chain & Global Forwarding, Kuehne + Nagel, DSV, DB Schenker, CEVA Logistics, Nippon Express, C.H. Robinson, Maersk Logistics, J.B. Hunt, UPS Supply Chain Solutions, Expeditors, GEODIS, Rhenus Logistics, DP World Logistics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amazon

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel

- DSV

- DB Schenker

- CEVA Logistics

- Nippon Express

- C.H. Robinson

- Maersk Logistics

- J.B. Hunt

- UPS Supply Chain Solutions

- Expeditors

- GEODIS

- Rhenus Logistics

- DP World Logistics