Global 3d Sensing and Imaging Market By Component (Hardware, Software, Services), By Technology (Ultrasound, Structured Light, Time-of-Flight, Stereoscopic Vision, Other Technologies), By Sensor Type (Position Sensors, Image Sensors, Temperature Sensors, Accelerometer Sensors, Proximity Sensors, Other Sensor Types), By Connectivity (Wired Network Connectivity, Wireless Network Connectivity), By End-user Industry (Consumer Electronics, Automotive, Healthcare, Aerospace and Defense, Security and Surveillance, Media and Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166548

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

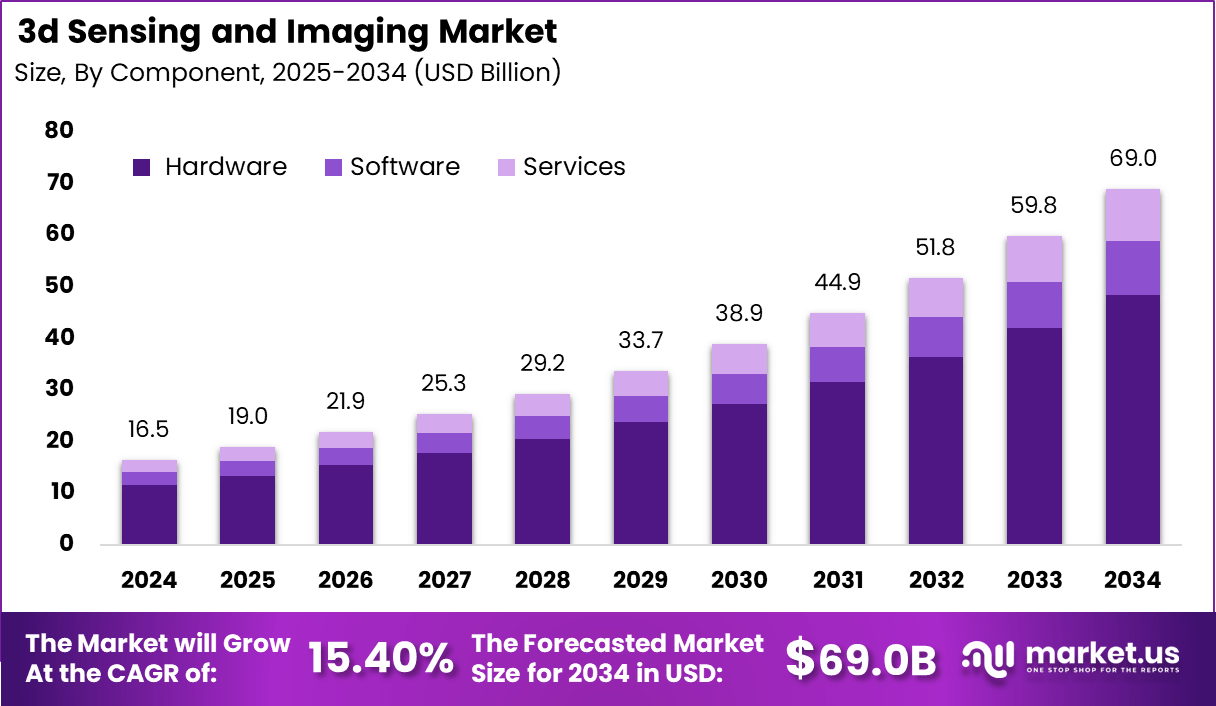

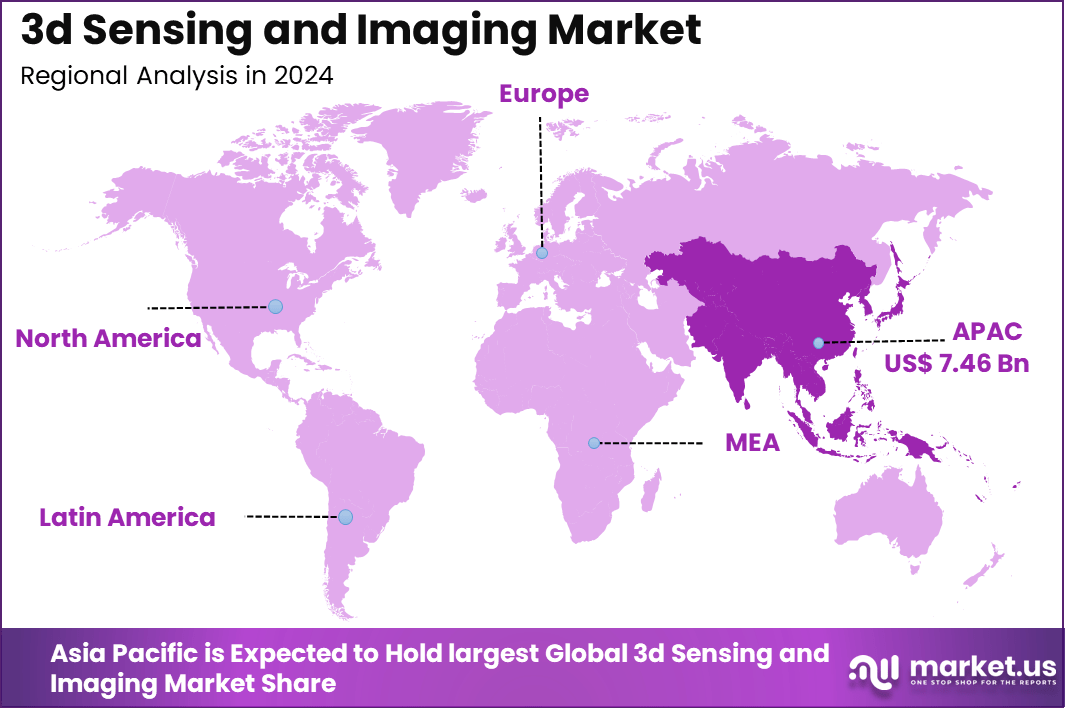

The Global 3d Sensing and Imaging Market generated USD 16.5 billion in 2024 and is predicted to register growth from USD 19 billion in 2025 to about USD 69 billion by 2034, recording a CAGR of 15.40% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 45.3% share, holding USD 7.46 Billion revenue.

The 3D sensing and imaging market has expanded as industries adopt depth sensing, structured light, stereo vision and time of flight technologies to capture accurate spatial information. Growth reflects rising use of 3D data for automation, security, medical imaging and consumer electronics. The market has moved from specialised industrial applications to mainstream adoption in smartphones, robotics and advanced automotive systems.

The growth of the market can be attributed to increasing demand for high precision depth data, rising integration of 3D sensors in mobile devices and broader use of imaging systems to support automation. Expanding use of facial recognition, gesture control and object scanning further drives adoption. Advancements in AI processing and improved sensor performance also strengthen market momentum across sectors.

Demand analysis highlights consumer electronics as a leading segment, contributing around 40% to revenues through applications in smartphones, AR/VR devices, and gaming peripherals. The healthcare sector, accounting for over 30% growth, benefits from 3D sensing in surgical planning, diagnostics, and prosthetics, where precision and real-time imaging enhance patient outcomes.

Investment opportunities are multifold as 3D sensing and imaging find new applications across rising sectors. Emerging markets in Asia-Pacific and Latin America show growing investments, driven by industrial automation and smart infrastructure development. There is also significant interest in healthcare imaging advancements, autonomous vehicles, and consumer electronics.

Top Market Takeaways

- By component, hardware dominates with 70.3% share, driven by demand for sensors, cameras, processors, and related devices essential for 3D sensing and imaging applications.

- By technology, Time-of-Flight (ToF) sensors hold 34.7% of the market. ToF features fast, accurate depth sensing, crucial for applications like facial recognition, gesture control, and autonomous driving.

- By sensor type, image sensors lead with 58.3% share, widely used in smartphones, VR/AR devices, and industrial automation for precise 3D data capture.

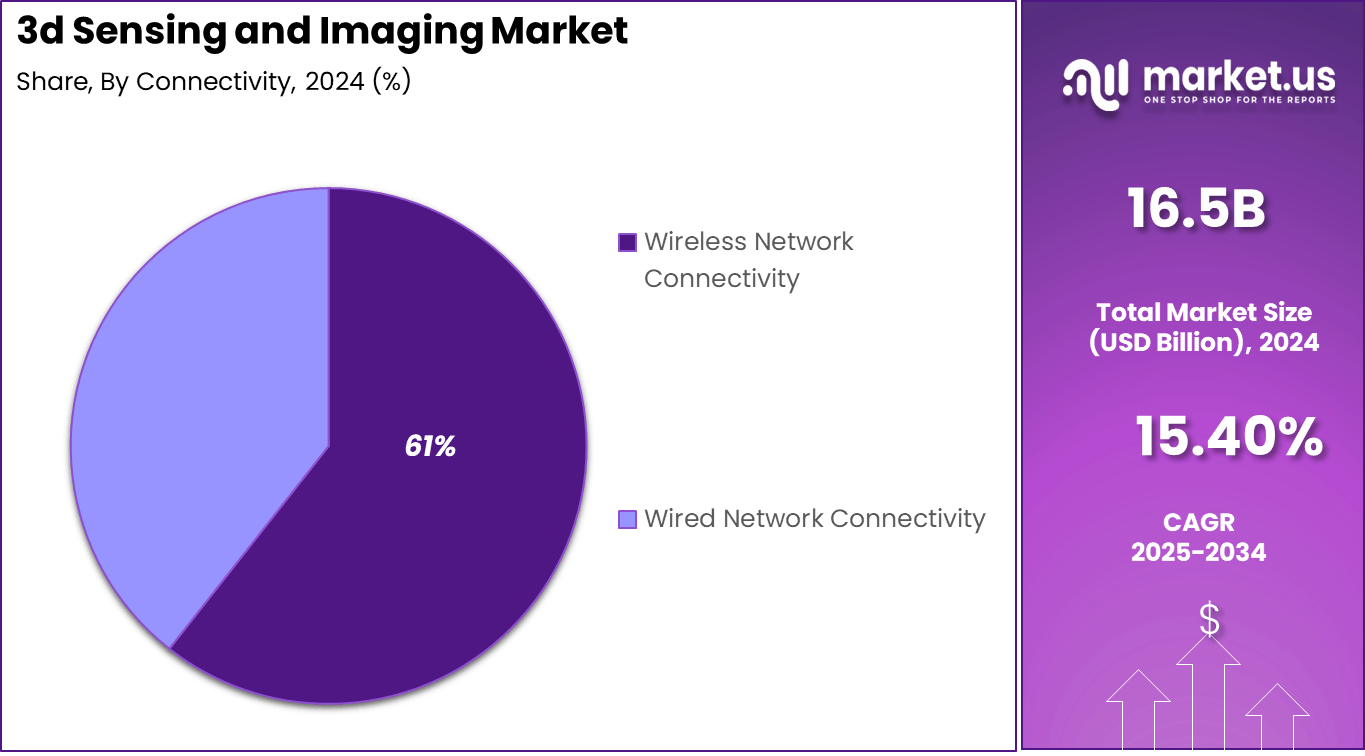

- By connectivity, wireless network connectivity holds 60.6%, preferred due to mobility and ease of deployment in consumer electronics, automotive, and industrial applications.

- By end-user industry, consumer electronics dominate with 45.1% share, propelled by growing adoption of 3D sensing in smartphones, gaming peripherals, smart home devices, and AR/VR applications.

- Regionally, Asia Pacific holds about 45.3% of the market, with China as a major contributor.

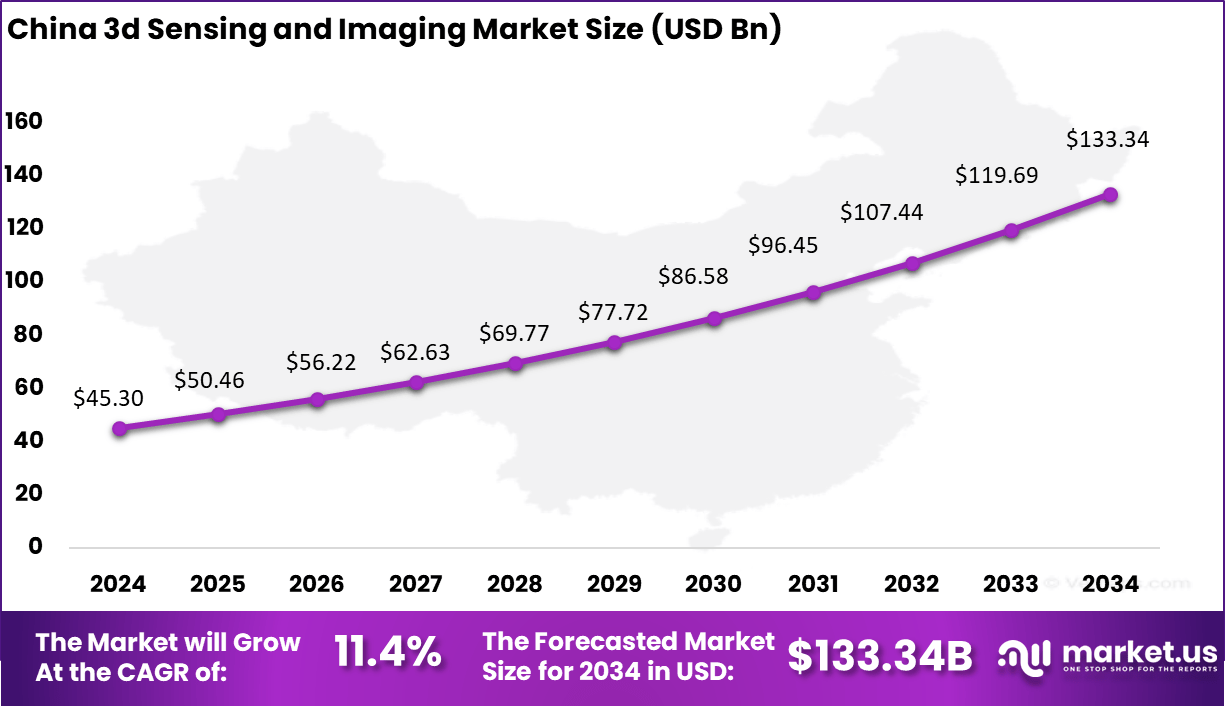

- The China market is valued at approximately USD 2.28 billion in 2025, backed by the smartphone manufacturing boom, automotive electronics growth, and investments in industrial automation.

- CAGR is estimated at 11.4%, driven by advancements in sensor technology, rising demand for mobile and automotive 3D sensing, and expansion into new applications like healthcare and industrial robotics.

By Component

In 2024, Hardware forms the backbone of the 3D sensing and imaging market, accounting for a majority share of about 70.3%. This dominance highlights the ongoing reliance on physical devices like 3D cameras, sensors, and scanners that capture spatial information.

Buyers continue to prioritize hardware for its critical role in delivering accurate and real-time data needed in various applications. Despite growing interest in software and services, hardware remains the mainstay, ensuring the foundational capabilities for 3D sensing systems.

The importance of hardware can also be seen in how it supports integration with advanced technologies, enabling enhanced functionalities like depth mapping and gesture recognition. These capabilities are essential for sectors relying on precise spatial data, including consumer electronics and industrial applications.

By Technology

In 2024, Time-of-Flight (ToF) technology accounts for approximately 34.7% of the 3D sensing and imaging market, making it a significant segment in the overall technology mix. ToF sensors measure the time taken for light to bounce off objects, which enables accurate distance and depth perception. This technology is key in applications where real-time 3D mapping and object detection are critical, such as smartphones, robotics, and automotive safety systems.

ToF technology continues to grow due to its fast response, reliability, and power efficiency compared to other 3D sensing methods. Its application in consumer electronics, especially for features like facial recognition and augmented reality, drives substantial adoption. The trend toward incorporating ToF sensors in smaller, high-performance devices underscores its pivotal role in the market.

By Sensor Type

In 2024, Image sensors represent a dominant 58.3% share of the 3D sensing market. These sensors are responsible for capturing visual data that is processed into 3D images, crucial for systems requiring detailed spatial analysis. The widespread use of image sensors in ToF and triangulation technologies underlines their value in achieving high resolution and depth accuracy.

Demand for image sensors is mostly fueled by consumer electronics, media, and entertainment sectors where high-fidelity 3D imaging improves user experience. These sensors’ versatility in diverse applications from smartphones to industrial inspection highlights their importance across the industry spectrum.

By Connectivity

In 2024, Wireless network connectivity accounts for about 60.6% of the market’s connectivity segment. The shift towards wireless stems from the need for flexibility, ease of installation, and the rise of IoT-enabled smart devices. Wireless connections enable mobility and scalability, supporting remote operation and data transfer in various applications including consumer electronics, healthcare, and industrial automation.

Additionally, advances in wireless technologies like 5G and Wi-Fi 6 greatly enhance the capacity and speed of data transmission for 3D sensing devices. This allows for seamless integration of 3D sensors in mobile and wearable devices where wired connections are impractical. The wireless segment’s growth reflects broader trends toward connected, smart environments.

By End-User Industry

In 2024, Consumer electronics lead the 3D sensing market with a significant 45.1% share. This industry benefits from 3D sensing technologies through enhanced device capabilities such as facial recognition, gesture control, and augmented reality experiences. These functions improve user interaction and increase device attractiveness and functionality in the highly competitive consumer market.

The rising demand for smart devices including smartphones, tablets, wearables, and gaming consoles propels the use of 3D sensors. Consumer electronics companies continually integrate advanced sensing technologies to meet customer expectations for security, convenience, and immersive user experiences, making this end-use segment a major driver of the market.

Emerging Trends

Key Trends Description AI and Machine Learning Integration Enhances real-time analysis, object recognition, and semantic understanding of 3D environments. Miniaturization and Cost Reduction Smaller and more affordable sensors increase adoption across consumer electronics and industrial uses. Expansion of AR and VR Rising demand for immersive experiences is driving the need for advanced 3D sensing technologies. Advanced LiDAR and Event-based Cameras Provides higher resolution, longer range, and improved performance in complex and dynamic environments. Edge AI and 5G Connectivity Supports rapid on-device processing and real-time, high-bandwidth data streaming for spatial computing. Growth Factors

Key Factors Description Rising demand for autonomous vehicles ADAS and autonomous navigation systems depend on accurate 3D perception to ensure safety and reliability. Growing adoption in healthcare and robotics Improved 3D imaging supports diagnostics, surgical robotics, and personalized medical treatment. Increasing use in industrial automation Accurate 3D sensing enhances object manipulation and navigation in manufacturing and logistics. Expanding smart city developments Requires high-precision environmental mapping and monitoring, boosting adoption of 3D sensing systems. Continuous sensor technology innovation Smaller, more efficient, and cost-effective sensors expand application possibilities across industries. Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Ultrasound

- Structured Light

- Time-of-Flight

- Stereoscopic Vision

- Other Technologies

By Sensor Type

- Position Sensors

- Image Sensors

- Temperature Sensors

- Accelerometer Sensors

- Proximity Sensors

- Other Sensor Types

By Connectivity

- Wired Network Connectivity

- Wireless Network Connectivity

By End-user Industry

- Consumer Electronics

- Automotive

- Healthcare

- Aerospace and Defense

- Security and Surveillance

- Media and Entertainment

- Others

Regional Analysis

In 2024, Asia Pacific dominated the 3D sensing and imaging market with a commanding 45.3% share, driven by rapid industrialization, technological advancements, and a strong electronics manufacturing ecosystem across countries like China, Japan, South Korea, and India.

The region experiences robust demand from sectors such as consumer electronics, automotive, industrial automation, and healthcare, all of which increasingly rely on sophisticated 3D sensing technologies for enhanced performance and productivity.

China stands as the largest contributor within Asia Pacific, with an estimated market size of USD 2.28 billion in 2024. Its leadership is propelled by strong government support for semiconductor and electronics manufacturing, alongside aggressive expansion in consumer electronics and automotive sectors. The country’s focus on AI-enabled products and smart device penetration enhances the adoption of 3D sensing and imaging technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Advanced Consumer Electronics and Automotive Safety

The 3D sensing and imaging market is strongly driven by the growing demand for advanced consumer electronics, including smartphones, tablets, and gaming consoles with facial recognition, gesture control, and augmented reality capabilities. These applications require high-precision depth sensing and spatial awareness technologies, fueling widespread adoption of 3D sensors.

In addition, the automotive industry’s push toward advanced driver-assistance systems (ADAS) and autonomous vehicles supports market growth significantly. Accurate environmental mapping and object detection provided by 3D imaging enhance safety and navigation, meeting stringent regulatory safety standards and consumer expectations.

Restraint

High Costs and Complex Data Processing

Despite rapid advancement, high costs remain a restraint for the 3D sensing and imaging market. Advanced sensors like LiDAR and time-of-flight cameras require expensive components and sophisticated manufacturing processes, limiting adoption in cost-conscious segments.

The complex processing and storage of large 3D datasets pose challenges. Real-time data analysis demands powerful hardware and software frameworks, increasing overall system costs. These factors reduce accessibility for smaller enterprises and slow market penetration in emerging regions.

Opportunity

Expansion in Healthcare and Industrial Automation

Growing applications in healthcare, such as medical imaging, diagnostics, and surgical assistance, create new opportunities for 3D sensing and imaging technology. The ability to capture high-resolution spatial data improves precision and outcomes, driving adoption in hospitals and clinics.

Industrial automation also benefits from 3D vision systems for robotic navigation, quality control, and predictive maintenance. Increasing investments in smart factories and Industry 4.0 facilitate integration of 3D sensors into automated workflows, broadening market reach and encouraging innovation.

Challenge

Standardization and Privacy Concerns

A major challenge is the lack of standardized protocols and interoperability across different 3D sensing and imaging technologies, hindering seamless integration and widespread market adoption. Diverse device architectures and proprietary software complicate ecosystem compatibility.

Privacy concerns also arise due to extensive spatial data collection, especially in consumer devices with facial recognition and location tracking features. Regulatory oversight and user trust demand stringent data security practices, adding compliance complexity and potentially slowing technology deployment.

Competitive Analysis

STMicroelectronics, Infineon Technologies, Microchip Technology, and Viavi Solutions lead the 3D sensing and imaging market with advanced depth-sensing chips, time-of-flight modules, and infrared components. Their technologies support smartphones, industrial automation, robotics, and automotive applications. These companies focus on improving depth accuracy, power efficiency, and real-time sensing performance.

Rockwell Automation, KEYENCE, Suteng Innovation, Autodesk, Cognex, OMNIVISION, SICK AG, Panasonic, Sony, and Lumentum strengthen the landscape with high-precision 3D cameras, LiDAR modules, structured-light systems, and industrial vision tools. Their solutions enhance inspection, mapping, quality control, and autonomous navigation.

FARO Technologies, Occipital, LMI Technologies, Trimble, Balluff, and other participants expand the market with specialized 3D scanning, metrology, and spatial-mapping solutions. Their platforms support construction, surveying, logistics, and AR/VR applications. These companies emphasize accuracy, portability, and seamless software integration.

Top Key Players in the Market

- STMicroelectronics N.V.

- Infineon Technologies AG

- Microchip Technology Inc.

- Viavi Solutions Inc.

- Rockwell Automation Inc.

- KEYENCE Corporation

- Suteng Innovation Technology Co. Ltd.

- Autodesk Inc.

- Cognex Corporation

- OMNIVISION Technologies Inc.

- SICK AG

- Panasonic Holdings Corporation

- Sony Group Corporation

- Lumentum Holdings Inc.

- FARO Technologies Inc.

- Occipital Inc.

- LMI Technologies Inc.

- Trimble Inc.

- Balluff GmbH

- Others

Recent Developments

- June, 2025, STMicroelectronics launched the VD55H1, a direct Time-of-Flight (dToF) LiDAR module with market-leading 2.3k resolution for smartphones, AR/VR, robotics, and smart buildings. Mass production is in full swing, with early design wins for mobile-robot deep-vision systems.

- May, 2025, Infineon and pmdtechnologies announced collaboration on automotive 3D Time-of-Flight (ToF) sensors for driver monitoring, occupant detection, and gesture control, enhancing vehicle safety and user experience.

Report Scope

Report Features Description Market Value (2024) USD 16.5 Bn Forecast Revenue (2034) USD 69 Bn CAGR(2025-2034) 15.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (Ultrasound, Structured Light, Time-of-Flight, Stereoscopic Vision, Other Technologies), By Sensor Type (Position Sensors, Image Sensors, Temperature Sensors, Accelerometer Sensors, Proximity Sensors, Other Sensor Types), By Connectivity (Wired Network Connectivity, Wireless Network Connectivity), By End-user Industry (Consumer Electronics, Automotive, Healthcare, Aerospace and Defense, Security and Surveillance, Media and Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape STMicroelectronics N.V., Infineon Technologies AG, Microchip Technology Inc., Viavi Solutions Inc., Rockwell Automation Inc., KEYENCE Corporation, Suteng Innovation Technology Co. Ltd., Autodesk Inc., Cognex Corporation, OMNIVISION Technologies Inc., SICK AG, Panasonic Holdings Corporation, Sony Group Corporation, Lumentum Holdings Inc., FARO Technologies Inc., Occipital Inc., LMI Technologies Inc., Trimble Inc., Balluff GmbH, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Sensing and Imaging MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

3D Sensing and Imaging MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- STMicroelectronics N.V.

- Infineon Technologies AG

- Microchip Technology Inc.

- Viavi Solutions Inc.

- Rockwell Automation Inc.

- KEYENCE Corporation

- Suteng Innovation Technology Co. Ltd.

- Autodesk Inc.

- Cognex Corporation

- OMNIVISION Technologies Inc.

- SICK AG

- Panasonic Holdings Corporation

- Sony Group Corporation

- Lumentum Holdings Inc.

- FARO Technologies Inc.

- Occipital Inc.

- LMI Technologies Inc.

- Trimble Inc.

- Balluff GmbH

- Others