Quick Navigation

Overview

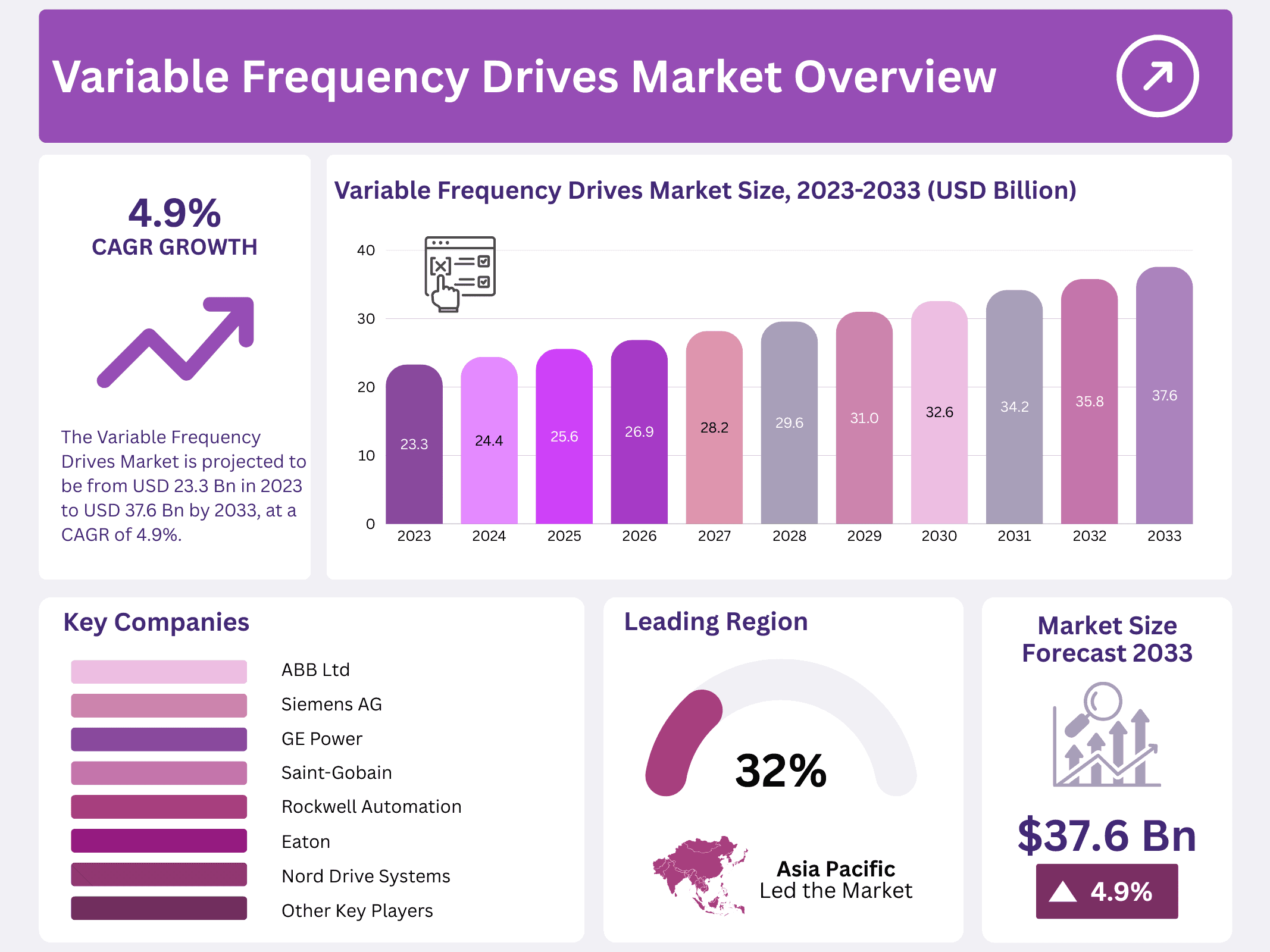

New York, NY – January 19, 2026 – The Global Variable Frequency Drives Market size is expected to be worth around USD 37.6 billion by 2033, from USD 23.3 billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033. Rapid industrialization, supportive government policies, rising construction activities, and growing energy consumption needs are key factors driving this long-term regional growth.

Countries such as India, China, and Japan are witnessing rapid commercialization across major sectors, including automotive, food and beverage, and manufacturing. As industries scale production, demand for VFDs continues to rise to enhance operational efficiency, reduce energy consumption, and support workforce expansion. This sustained industrial development is expected to reinforce the region’s economic strength and market leadership.

Privatization initiatives, ongoing urbanization, and rising demand from key end-use industries—such as pulp and paper, cement, chemicals, and natural gas—are driving this regional expansion. Brazil and Mexico, in particular, are contributing significantly to the increased adoption of VFD technologies across industrial applications. These elements collectively position Asia Pacific as the fastest-expanding market globally.

Key Takeaways

- The Global Variable Frequency Drives Market is projected to grow from USD 23.3 billion in 2023 to USD 37.6 billion by 2033, at a CAGR of 4.9%.

- AC drives dominated the market in 2023, holding approximately 68.6% of total revenue due to their efficiency in motor speed control and energy savings.

- Low-power drives captured the largest share in 2023, accounting for over 42.3% of revenue, driven by widespread use in pumps, fans, and similar applications.

- The pump application segment led in 2023 with more than 30.2% of total revenue, thanks to energy optimization and the elimination of mechanical gearboxes.

- The oil & gas sector was the top end-use industry in 2023, representing over 20.3% of the market, fueled by efficiency gains in drilling, extraction, and refining operations.

- The Asia Pacific region led the VFD market in 2023 with a value of USD 8.27 billion and is expected to maintain dominance due to rapid industrialization and supportive energy-efficiency policies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 23.3 Billion |

| Forecast Revenue (2033) | USD 37.6 Billion |

| CAGR (2024-2033) | 4.9% |

| Segments Covered | By Product Type (AC Drives, DC Drives, and Servo Drives), By Power Ranges (Micro (0-5 kW), Low (6-40 kW), and Others), By Application(Pumps, Electric Fans, Conveyors, HVAC, Extruders, Others), By End-Use(Oil & Gas, Power Generation, Industrial, Infrastructure, Automotive, Food & Beverages, Others) |

| Competitive Landscape | ABB Ltd, Siemens AG, Danfoss A/S, Rockwell Automation, GE Power, Toshiba International Corporation, Schneider Electric, Mitsubishi Electric Corporation, Honeywell International Inc., Emerson Industrial Automation, Fuji Electric Co. Ltd, Johnson Controls Inc., Eaton PLC, Hitachi Ltd., Nord Drive Systems, Eaton |

Key Market Segments

Product Type Analysis

In 2023, AC drives dominated the market, accounting for approximately 68.6% of total revenue. Their widespread adoption is driven by their ability to efficiently control motor speed, improve operational stability, and reduce energy consumption across industrial processes. AC drives are extensively used in industries such as food and beverage processing, power generation, and automotive manufacturing, where precision and reliability are essential.

Ongoing industrial automation and rising energy-efficiency mandates are expected to sustain strong demand for AC drives over the forecast period. Its adoption remains limited due to higher maintenance requirements, lower energy efficiency, and restricted performance under harsh operating conditions. These limitations reduce the suitability of DC drives for modern infrastructure and heavy-duty industrial applications, slowing their broader market penetration.

Power Ranges Analysis

In 2023, Low-power drives held the largest market share, capturing more than 42.3% of total revenue. These drives are widely used in common industrial applications such as pumps, fans, and centrifuges, where moderate power and precise speed control are required. Manufacturers are investing heavily in compact low-voltage drives, high-performance medium-voltage solutions, and systems designed for low-temperature environments.

The growing adoption of low-voltage frequency drives across multiple industries, supported by increased R&D investment, is expected to strengthen this segment’s dominance. Medium-power drives generated a substantial portion. These drives offer enhanced operational flexibility and advanced control capabilities, making them a preferred choice in sectors such as mining, wastewater treatment, petrochemicals, and oil & gas. Rising demand from the petrochemical industry continues to support this segment’s growth trajectory.

Application Analysis

In 2023, the Pump application segment led the market, accounting for over 30.2% of total revenue. Pumps are essential across industries for fluid movement and process control, and variable frequency drives (VFDs) help optimize their performance by reducing energy consumption and eliminating the need for mechanical gearboxes. VFD adoption is particularly strong in oil and gas operations and treatment plants, where efficiency gains directly impact operating costs.

Although the VFD market remains highly competitive, the presence of cost-effective regional manufacturers is expected to create significant growth opportunities over the forecast period. Between 2023 and 2032, heating is supported by expanding residential and commercial construction. Integrating VFDs into HVAC systems improves energy efficiency and allows precise control of pumps, blowers, and compressors.

End-Use Analysis

In 2023, the Oil & Gas sector emerged as the leading end-use industry, capturing more than 20.3% of the market. The industry relies heavily on motors and pumps for drilling, extraction, transportation, and refining operations. By integrating VFDs with these systems, operators can enhance output efficiency while significantly reducing power consumption. Growing emphasis on cost optimization and operational efficiency is expected to drive continued demand from this sector.

The infrastructure segment is anticipated to be driven by global industrial expansion and large-scale construction projects. As industries increasingly replace mechanical drives with electric motor systems, demand for variable frequency drives is expected to rise steadily, supporting long-term market growth.

Regional Analysis

The Asia Pacific Variable Frequency Drives (VFD) Market was valued at USD 8.27 billion in 2023 and is expected to remain the leading regional market over the coming decades. This dominance is mainly driven by rapid industrialization across emerging economies, supported by favorable government initiatives, rising construction activities, and policy frameworks that encourage energy-efficient technologies. Growing electricity demand across manufacturing and infrastructure projects is further accelerating the adoption of VFDs, positioning the Asia Pacific as the fastest-growing region globally.

Strong growth in VFD demand is also linked to the rapid expansion of large-scale automotive, food, and beverage manufacturing in countries such as India, China, and Japan. As these industries scale up production, the need for efficient motor control systems is increasing to improve operational efficiency, reduce energy losses, and enhance process reliability. This trend is contributing to stable economic growth, improved industrial productivity, and increased employment across the region.

This growth is largely supported by ongoing privatization and urbanization initiatives in key economies such as Brazil and Mexico. Rising investments in industrial sectors—including pulp and paper, cement, gas, and chemicals—are creating sustained demand for VFDs, as industries seek cost-effective solutions to optimize energy use and improve equipment performance.

Top Use Cases

- HVAC Systems: Variable Frequency Drives play a key role in heating, ventilation, and air conditioning setups by adjusting fan and pump speeds to match building needs. This leads to better temperature control, reduced energy waste, and enhanced comfort in places like offices, hotels, and homes, making them a smart choice for efficient climate management.

- Water Pumps: In water supply and treatment facilities, Variable Frequency Drives control pump motors to maintain steady pressure and flow without constant full-speed operation. This approach minimizes equipment strain, extends system lifespan, and supports reliable water distribution in urban areas, boosting overall operational smoothness.

- Conveyor Belts: Manufacturing lines use Variable Frequency Drives to fine-tune conveyor speeds for different production stages. This ensures gentle material handling, cuts down on jams or damage, and improves workflow efficiency, helping factories adapt quickly to varying output demands while keeping processes steady.

- Cranes and Hoists: Material handling equipment like cranes benefits from Variable Frequency Drives through smooth acceleration and precise load positioning. By varying motor speeds, they reduce swings and shocks, enhancing safety and control in warehouses or construction sites, leading to fewer accidents and better productivity.

- Air Compressors: Variable Frequency Drives optimize air compressors by matching output to real-time demand, avoiding unnecessary high-speed running. This results in quieter operation, lower maintenance needs, and consistent pressure delivery in industrial settings, making them ideal for tasks requiring variable air supply.

Recent Developments

1. ABB Ltd

- ABB has enhanced its ACS880 VFD series with improved predictive maintenance features via the cloud-connected Ability platform. They’ve also introduced single-axis modular drives for lower power applications, offering greater flexibility. Recent updates focus on cybersecurity and energy efficiency compliance with new international standards.

2. Siemens AG

- Siemens expanded its Sinamics G120X VFD line, designed specifically for water and wastewater applications, featuring enhanced durability. They also integrated VFDs into their Digital Enterprise suite for seamless IoT connectivity and data analytics, improving lifecycle management and operational transparency.

3. Danfoss A/S

- Danfoss launched the next-generation VACON 20 range, a compact and modular drive for easy installation and service. They have focused on enabling circular economy principles with drives designed for repair and refurbishment. Recent developments include enhanced software for HVAC-specific applications to optimize energy use.

4. Rockwell Automation

- Rockwell’s PowerFlex 6000T drive now includes advanced threat detection for industrial networks. They’ve also introduced the PlantPAx-ready drive portfolio, simplifying integration into modern DCS for process industries. Emphasis is on scalable safety features and leveraging data within their FactoryTalk Analytics platform.

5. GE Power (now part of GE Vernova)

- Under GE Vernova, the company has advanced its LV-7000e VFD with silicon carbide technology for higher efficiency in medium voltage applications. Developments focus on renewable energy integration, such as optimizing pump storage, and providing digital fleet management tools through Grid Solutions software.

Conclusion

Variable Frequency Drives are gaining traction across industries due to their ability to enhance motor control and promote sustainable practices. With growing emphasis on automation and resource optimization, these devices are set to become even more integral, driving innovation in energy management and operational efficiency for the foreseeable future.