Quick Navigation

Introduction

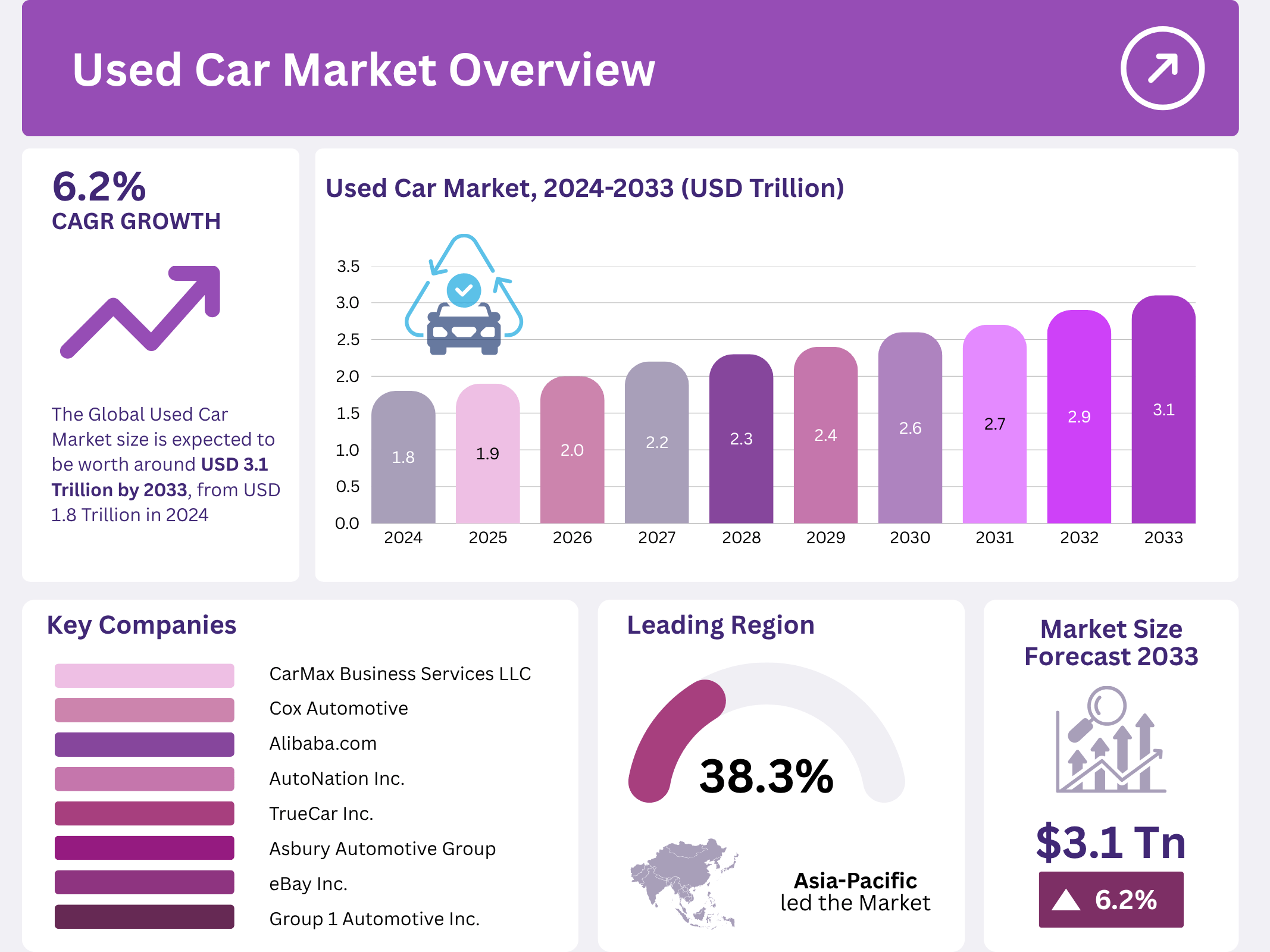

The global used car market is on track for significant growth, with its value expected to increase from US$ 1.7 trillion in 2023 to US$ 3.1 trillion by 2033, at a CAGR of 6.2%. This surge is driven by rising consumer demand for affordable vehicles, as high new car prices and economic pressures push buyers toward more cost-effective alternatives. The market’s expansion is also fueled by advancements in digital platforms, which have made the buying and selling process more transparent and accessible to a broader audience.

Additionally, the growing interest in sustainability has contributed to the increasing appeal of used cars. As consumers seek environmentally friendly options, used electric vehicles (EVs) are gaining traction in the secondary market. Furthermore, the widespread adoption of certified pre-owned programs and improved vehicle durability is enhancing consumer confidence in pre-owned vehicles, making them a popular choice for those looking for affordable and reliable transportation.

Key Takeaways

- The global used car market size is expected to grow from US$ 1.7 trillion in 2023 to US$ 3.1 trillion by 2033, with a CAGR of 6.2%.

- SUVs dominate the vehicle type segment with 48.4% of the market share.

- Gasoline vehicles continue to lead the fuel type segment with 63.4% market share.

- Franchised dealers control 45.2% of the market sales, with the highest volume of transactions.

- Personal use remains the largest segment, representing 61.6% of total sales.

- The Asia-Pacific (APAC) region holds the largest share at 38.3% of the market, valued at US$ 0.65 trillion.

Market Segmentation Overview

Vehicle Type

- SUVs: Dominating the market with 48.4% of the share due to their versatility, comfort, and growing popularity for family-friendly features.

- Hatchbacks and Sedans: Hatchbacks make up a significant portion, being budget-friendly and ideal for urban settings. Sedans continue to cater to professionals and families due to their affordability and comfort.

Fuel Type

- Gasoline-powered vehicles lead with 63.4% of the market share. Diesel and hybrid/electric vehicles are gradually gaining ground due to increasing environmental awareness and fuel-efficiency demand.

Sales Channel

- Franchised dealers dominate with 45.2% of sales, leveraging trusted brands, warranties, and reliable after-sales services.

- Peer-to-peer and independent dealers are also significant, but they remain smaller players in comparison.

End-Use

- Personal use takes the largest share of 61.6%, driven by the increasing demand for personal mobility and independent transportation.

- Commercial use follows, serving industries like logistics and transportation, though it holds a smaller share.

Drivers

- Rising Affordability: Economic factors, including inflation and the increasing cost of new cars, have driven consumers toward affordable used vehicles. As new car prices rise, the appeal of used cars as a cost-effective alternative has intensified.

- Certified Pre-Owned Programs: The increasing adoption of certified pre-owned (CPO) programs is enhancing consumer trust and confidence in used cars. These programs offer warranties and thorough inspections, providing consumers with the assurance of quality.

Use Cases

- Personal Use: Consumers seeking affordable transportation solutions increasingly turn to the used car market, especially in regions with limited public transportation.

- Fleet Management: Businesses, especially in logistics, are opting for used vehicles to manage costs effectively.

- Electric Vehicles (EVs): The used EV market has seen a rise as more people look to invest in sustainable transportation options without the high upfront costs of new EVs.

Major Challenges

- High Maintenance Costs: Older vehicles often require frequent repairs and part replacements, which can deter potential buyers.

- Lack of Transparency: While digital platforms have improved transparency, some consumers still remain cautious about hidden defects or incomplete vehicle histories.

Business Opportunities

- Expansion of Online Platforms: With digital transformation continuing, used car dealers can further tap into the growing online marketplace to reach a broader consumer base. Platforms can introduce features like detailed vehicle histories, virtual tours, and more to enhance the customer experience.

- EV Expansion: As the demand for electric vehicles grows, the used EV market presents significant opportunities. Companies can expand their inventories of used EVs, providing consumers with affordable alternatives.

- Certified Pre-Owned Programs: Offering CPO vehicles with warranties and guarantees can serve as a major selling point, attracting customers who value peace of mind when buying used cars.

Regional Analysis

- Asia-Pacific (APAC): Dominates the global market with 38.3% share and US$ 0.65 trillion in value. Rapid urbanization and the rising middle class in countries like China and India are key growth drivers.

- North America: Continues to lead in consumer demand, especially with the adoption of digital platforms and CPO programs. The rise of EVs further fuels the market in this region.

Recent Developments

- Asbury Automotive’s Acquisition of Jim Koons Automotive: This acquisition in 2022 helped expand Asbury’s dealership network, reinforcing its digital transformation strategy.

- Carvana’s Increased Financing Options: In 2023, Carvana further expanded its financing options, with 80% of buyers opting for its financing services, making it easier for consumers to purchase used vehicles.

Contact Us

For any inquiries, please feel free to reach out to us through the following contact details:

Phone (International): +1 718 874 1545

Email: [email protected]

We look forward to assisting you!