Quick Navigation

Overview

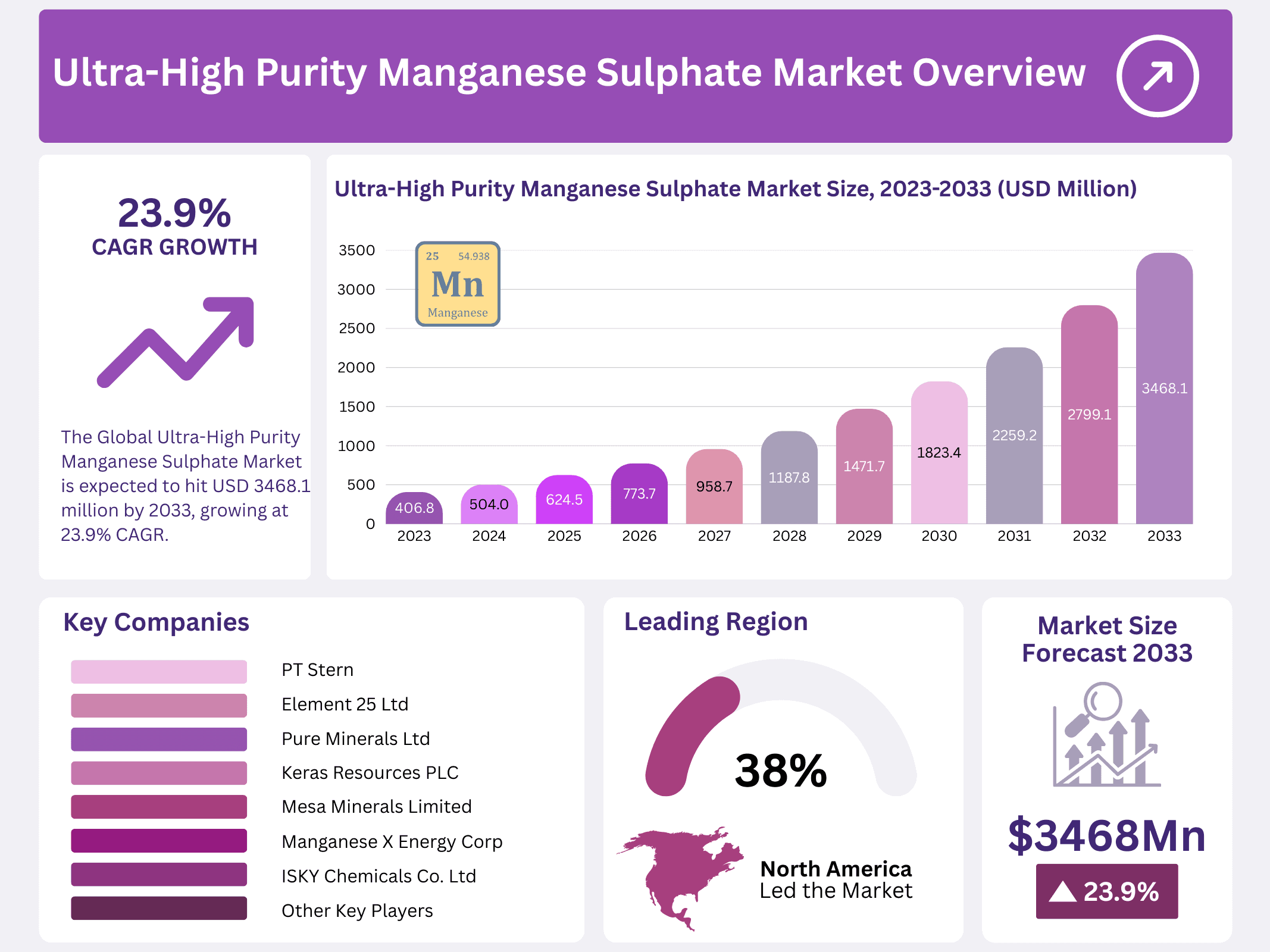

New York, NY – January 23, 2026 – The global Ultra-High Purity Manganese Sulphate Market is projected to reach USD 3,468.1 million by 2033, rising sharply from USD 406.8 million in 2023. This growth reflects a strong CAGR of 23.9% between 2023 and 2033, driven primarily by expanding demand across advanced industrial and energy applications. As industries pursue higher quality materials, ultra-high purity manganese sulfate has become essential for next-generation technologies.

Ultra-high purity manganese sulfate is produced through stringent purification processes that eliminate unwanted contaminants, resulting in a product with exceptional chemical consistency and performance. This high-grade material is widely used in specialized sectors due to its reliability, stability, and compatibility with precision manufacturing requirements. Its superior purity makes it suitable for applications where even minor impurities could compromise efficiency or safety.

The market covers production, distribution, consumption, pricing trends, and regulatory frameworks influencing global supply chains. Key industries that utilize ultra-high purity manganese sulfate include agriculture, where it supports soil micronutrient balance; pharmaceuticals, where it is used in formulation processes; ceramics, for improved durability; and most notably, battery manufacturing, where it plays a critical role in producing high-performance energy storage systems such as lithium-ion and next-generation battery chemistries.

Key Takeaways

- The Global Ultra-High Purity Manganese Sulphate Market is expected to hit USD 3468.1 million by 2033, growing at 23.9% CAGR.

- Application Dominance: The batteries segment holds a 70.4% market share, driven by EV and consumer electronics demand.

- Distribution Channels: Indirect sales channels capture 69.3% market share, offering accessibility across industries.

- North America leads with a 38.4% market share, propelled by US demand for high-efficiency battery components.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 406.8 Million |

| Forecast Revenue (2033) | USD 3468.1 Million |

| CAGR (2024-2033) | 23.9% |

| Segments Covered | By Grade(Battery Grade, Industrial Grade, Others), By Application(Batteries, Food, Chemical, Pharmaceutical, Others), By Distribution Channel(Direct Sales, Indirect Sales) |

| Competitive Landscape | P Inc (ERACHEM Comilog), Euro Manganese Inc, Manganese X Energy Corp, PT Stern, Keras Resources PLC, Element 25 Ltd, Mesa Minerals Limited, Pure Minerals Ltd, Guangxi Yuanchen Manganese Industry, Changsha Haolin Chemicals Co., Ltd, Fujian Liancheng Manganese Co., Ltd, Hunan Yueyang Sanxiang Chemical, ISKY Chemicals Co., Ltd, Yantai Cash Industrial Co., Ltd, Ningxia Tianyuan Manganese Industry Group Co., Ltd, GEM Co., Ltd |

Key Market Segments

By Grade

In 2023, Battery Grade ultra-high purity manganese sulfate dominated the market with a share of over 71.5%, driven largely by the expanding production of lithium-ion batteries used in electric vehicles (EVs) and consumer electronics. As a critical precursor for cathode materials, battery-grade manganese sulfate ensures high efficiency, stability, and overall performance of lithium-ion cells.

The global transition toward clean mobility and renewable energy storage continues to accelerate EV adoption, which in turn strengthens the demand for high-quality battery chemicals. This rising focus on sustainability has firmly positioned battery-grade manganese sulfate as an indispensable component in the battery manufacturing ecosystem. Meanwhile, Industrial Grade ultra-high purity manganese sulfate maintains a significant role despite a smaller market share.

Its diverse applications in agriculture, animal nutrition, water treatment, and industrial chemical processes reinforce its continued relevance. In agriculture and feed industries, the compound functions as a vital micronutrient, supporting crop quality, improving yields, and enhancing animal growth. Additionally, its use in water purification and specialty chemical production underscores the versatility and broad utility of industrial-grade manganese sulfate across multiple essential sectors.

By Application

In 2023, the Batteries segment led the ultra-high purity manganese sulfate market with a commanding 70.4% share. This strong position stems from the escalating global demand for lithium-ion batteries, particularly in the EV industry and portable electronic devices. As a key raw material in cathode formulation, ultra-high purity manganese sulfate enhances energy density, cycle life, and reliability, making it crucial for next-generation battery technologies.

The Food segment also contributes significantly, though with a smaller share. Manganese sulfate is widely utilized as an essential micronutrient in fertilizers and animal feed, improving nutritional value and supporting healthy development. Its use in dietary supplements highlights its importance in human nutrition and health-focused applications.

In the Chemical segment, ultra-high purity manganese sulfate serves as an essential input for various synthesis processes and water treatment formulations. Although smaller in size compared to Batteries, this segment plays a vital role in industrial processing and environmental management.

The Pharmaceutical segment further strengthens market diversity, utilizing manganese sulfate in supplements and therapeutic formulations requiring trace minerals. Continued research into mineral-based therapeutics ensures sustained interest and demand from the pharmaceutical sector.

By Distribution Channel

In 2023, Indirect Sales remained the leading distribution channel for ultra-high purity manganese sulfate, accounting for over 69.3% of the market. Distributors, resellers, and online platforms play a strategic role in expanding product reach and ensuring streamlined supply across multiple end-use industries. Their extensive networks, logistical capabilities, and established relationships with manufacturers and customers make indirect channels particularly effective.

This distribution approach allows producers to concentrate on manufacturing excellence and innovation, while partners handle market penetration, customer service, and regional accessibility. As a result, indirect sales continue to be the preferred route for delivering ultra-high purity manganese sulfate to battery manufacturers, chemical processors, food industries, and pharmaceutical companies worldwide.

Regional Analysis

North America stands as a leading force in the ultra-high purity manganese sulfate market, capturing 38.4% of the global share. The United States is central to this dominance, driven by the accelerating demand for advanced battery materials needed to support the rapidly growing electric vehicle (EV) industry and high-performance electronics sector. This momentum reflects the region’s urgent push toward reliable, next-generation energy storage solutions.

Growing awareness within North America’s agricultural, industrial, and technology ecosystems is further amplifying the adoption of ultra-high purity manganese sulfate. Its ability to significantly enhance battery efficiency, cycle life, and performance has prompted increased investment across the region. As manufacturers prioritize sustainability, operational efficiency, and reduced environmental impact, ultra-high purity manganese sulfate is emerging as a preferred material, reinforcing North America’s position as an innovation-driven market ready for high-quality, future-ready battery components.

Top Use Cases

- Electric Vehicle Batteries: Ultra-high purity manganese sulphate acts as a key ingredient in making cathodes for lithium-ion batteries used in electric cars. It helps improve battery life, safety, and energy output, meeting the growing demand for cleaner transport options that reduce reliance on fossil fuels and support eco-friendly mobility solutions.

- Energy Storage Systems: In large-scale energy storage for grids and renewables, this compound enhances battery performance in systems that store solar or wind power. It ensures a stable energy supply during peak times, aiding the shift to sustainable energy sources and helping balance electricity demands in modern power networks.

- Consumer Electronics: For devices like smartphones and laptops, ultra-high purity manganese sulphate is used in battery components to boost efficiency and longevity. It allows for compact, reliable power sources that meet consumer needs for portable tech, driving innovation in gadgets that rely on high-performance energy storage.

- Agricultural Fertilizers: This high-purity form corrects soil deficiencies in farming, promoting healthier crop growth in fields like wheat or soybeans. It supports better yields and plant health without harmful impurities, contributing to sustainable agriculture practices that enhance food production and soil quality over time.

- Nutritional Supplements: In the health and pharma sectors, ultra-high purity manganese sulphate serves as a safe additive in supplements for human and animal nutrition. It aids in enzyme functions for digestion and nerve health, providing essential micronutrients that support overall wellness and prevent deficiencies in diets.

Recent Developments

1. P Inc (Eramet-Comilog)

- Eramet, through its subsidiary Comilog, is advancing its high-purity manganese sulfate project in Gabon. Recent developments focus on completing pilot campaigns and qualification processes with major battery cell manufacturers. The project targets an initial production of high-purity manganese for the electric vehicle market, with a final investment decision expected in the coming period.

2. Euro Manganese Inc.

- Euro Manganese is developing the Chvaletice Manganese Project in the Czech Republic, a unique waste-recycling initiative. Recent key developments include completing a detailed Feasibility Study, securing a production pilot plant, and achieving sample qualification with multiple potential customers. The company aims to be a leading, sustainable producer of high-purity manganese for the European battery supply chain.

3. Manganese X Energy Corp.

- Manganese X is advancing its Battery Hill project in New Brunswick, Canada. Recent work has focused on metallurgical testing and pilot plant studies to produce battery-grade manganese sulfate. The company released a Preliminary Economic Assessment and is progressing with environmental and engineering studies to move the project toward feasibility.

4. PT Stern (Stemergy)

- PT Stern, operating under the brand Stemergy in the manganese segment, is developing a high-purity manganese sulfate project in Indonesia. Recent activities center on progressing its feasibility study and engaging with strategic partners in the battery supply chain. The company aims to leverage Indonesia’s position as a hub for electric battery materials.

5. Keras Resources PLC

- Keras Resources has shifted its strategic focus. It completed the sale of its Nayega Manganese Project in Togo in 2021 and is no longer actively developing manganese assets. The company’s recent developments are now centered on its gold projects in Australia and its iron ore royalty in Indonesia.

Conclusion

Ultra-High Purity Manganese Sulphate as a vital material bridging clean energy and essential industries. Its role in advancing battery tech for vehicles and storage, alongside uses in farming and health, positions it for strong market growth amid global pushes for sustainability and resource efficiency, making it a smart focus for future investments.