Quick Navigation

Overview

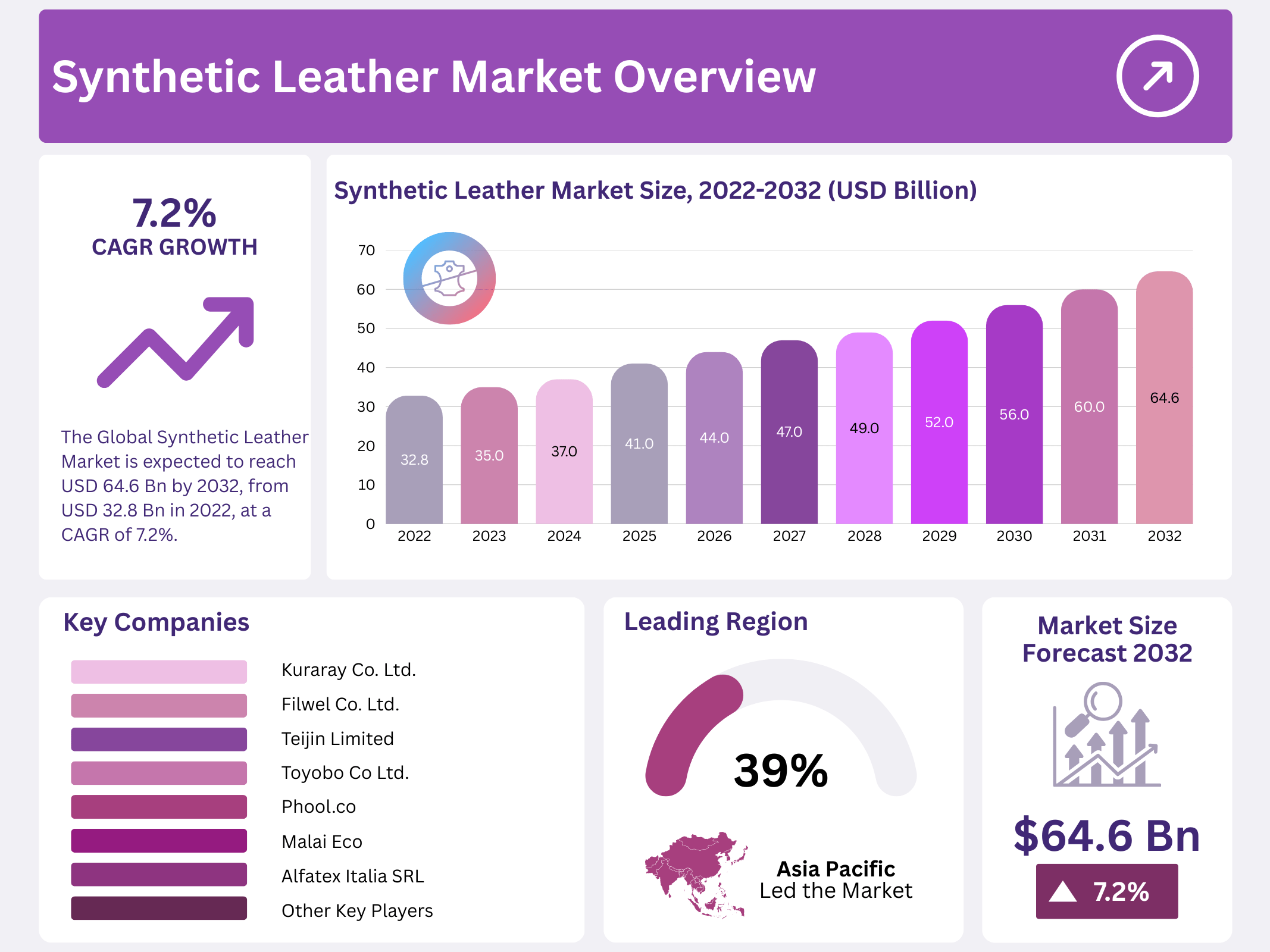

New York, NY – December 08, 2025 – The Global Synthetic Leather Market is projected to reach a value of around USD 64.6 billion by 2032, rising from USD 32.8 billion in 2022. This growth reflects a steady CAGR of 7.2% during the forecast period from 2023 to 2032. Expanding end-use industries and consistent demand across consumer and industrial applications continue to support this upward trend.

A major factor driving market expansion is the increasing use of synthetic leather in the footwear industry. Manufacturers are actively shifting toward alternative materials due to the rising cost and limited availability of natural leather. Synthetic leather offers a comparable appearance and performance at a lower cost, making it an attractive option for mass-market footwear production.

Among the available materials, PVC-based synthetic leather is gaining strong traction. It is widely used in products such as shopping bags, cosmetic cases, wallets, purses, and travel luggage. Advances in manufacturing techniques now allow shell coatings to be applied over synthetic blends, enabling consistent leather-like finishes for applications including clothing, upholstery, and accessories.

Key Takeaways

- The Global Synthetic Leather Market is expected to grow from USD 32.8 Bn in 2022 to USD 64.6 Bn by 2032 at a CAGR of 7.2%.

- PU synthetic leather held the largest share, contributing over 53% of global revenue in 2022.

- Footwear was the leading application segment, accounting for more than 28.4% of global revenue in 2022.

- Asia Pacific dominated the market with over 39.2% revenue share in 2022, led by China, India, and South Korea.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 32.8 Billion |

| Forecast Revenue (2032) | USD 64.6 Billion |

| CAGR (2023-2032) | 7.2% |

| Segments Covered | By Product- PU Synthetic Leather, PVC Synthetic Leather, and Bio-Based synthetic leather; and By Application- Footwear Sector, Clothing, Furnishing, Automotive Sectors/Vehicles, and Wallets, Bags, & Purses |

| Competitive Landscape | Kuraray Co. Ltd., H.R. Polycoats Pvt. Ltd., Alfatex Italia SRL, Filwel Co. Ltd., Yantai Wanhua Synthetic, Leather Group Co. Ltd., San Fang Chemical Industry Co. Ltd, Mayur Uniquoters Limited, Teijin Limited, Nan Ya Plastics Corporation, Asahi Kasei Corporation, Zhejiang Hexin Holdings Co., Ltd, Zhejiang Hexin Industry Group Co., Ltd., Fujian Polytech Technology Corp., Toyobo Co. Ltd., Mayur Uniquoters Ltd., H.R.Polycoats Pvt. Ltd., Daewon Chemical Co. Ltd., Phool.Co, Malai Eco, and Other Key Players |

Key Market Segments

Product Analysis

PU synthetic leather accounted for more than half of the global market share in 2022. Based on product type, the market is segmented into PU synthetic leather, PVC synthetic leather, and bio-based leather. PU synthetic leather emerged as the leading segment, contributing over 53% of global revenue in 2022. Improvements in product quality, wider design options, and higher manufacturing efficiency support its dominance.

Compared to genuine leather, polyurethane-based leather is lighter, waterproof, easier to clean, and more tear-resistant. It is also less affected by sunlight exposure, making it suitable for long-term use. PU synthetic leather is considered a more environmentally friendly alternative to vinyl leather, as it does not release dioxins during production or disposal. These performance and sustainability advantages are expected to continue driving demand over the forecast period.

The PVC synthetic leather segment is projected to experience slower growth. PVC-based leather was first developed in the 1920s using chemical-intensive processes. Although it gained early popularity in household and furnishing applications due to durability, PVC struggles to retain body heat and has a sticky texture. Its use in bags and clothing has gradually declined, allowing PU alternatives to take the lead.

Application Analysis

Rising demand for synthetic leather footwear, especially in developing economies, is shaping application trends. By application, the market includes footwear, clothing, furnishing, automotive, wallets, bags, and purses. The footwear segment dominated the market, accounting for more than 28.4% of global revenue in 2022.

Synthetic leather has become increasingly similar to genuine leather, enabling its use across footwear, bags, automotive interiors, and apparel. Higher disposable incomes and economic growth in emerging regions continue to support rising footwear consumption.

Climatic variations across regions influence footwear styles and functional requirements, further supporting synthetic leather usage. The material is commonly used in shoe uppers, linings, and soles for formal shoes, casual wear, sports shoes, sandals, and flip-flops. Its cost-effectiveness, durability, and water resistance make it a preferred option over natural leather, which is more prone to staining and moisture damage.

Regional Analysis

Asia Pacific emerged as the dominant regional market, accounting for over 39.2% of global synthetic leather revenue in 2022. Strong demand from countries such as China, India, and South Korea continues to support regional leadership. Rising disposable incomes, rapid urbanisation, and large population bases are creating sustained demand across footwear, automotive, and furnishing applications, offering significant growth opportunities.

China remains a key production and sales hub for leather and synthetic leather products. However, the COVID-19 outbreak temporarily disrupted manufacturing activities, as several producers were forced to reduce or halt operations. Supply chain interruptions, transportation restrictions, and delays in infrastructure development negatively impacted short-term demand across key end-use sectors.

In North America, market growth is expected to progress at a slower pace. High market maturity and saturation of established domestic fashion and lifestyle brands have limited expansion opportunities. Despite steady consumption, the region faces challenges in achieving rapid volume growth compared to emerging markets.

Europe has witnessed notable growth in synthetic leather demand, driven largely by rising awareness around animal welfare and sustainability. Advocacy efforts by organisations such as PETA and WWF have contributed to reduced demand for natural leather, accelerating the shift toward synthetic alternatives. Additionally, expansion in the automotive and consumer appliance industries continues to support synthetic leather adoption across the region.

Top Use Cases

- Automotive Interiors: Synthetic leather shines in car seats and dashboards, offering a soft, stylish look that mimics real leather without the high upkeep. It’s tough against spills and sun damage, making it perfect for daily drives. Drivers love how it stays fresh longer, helping car makers cut costs while keeping rides comfy and chic for families on the go.

- Furniture Upholstery: In homes and offices, synthetic leather covers sofas and chairs, giving a luxurious feel at a friendly price. It wipes clean easily from pet hair or food messes, ideal for busy households. Designers pick it for its range of colours and textures, blending style with everyday toughness that lasts through seasons.

- Fashion Accessories: Handbags, belts, and wallets crafted from synthetic leather turn heads with their sleek vibe and endless patterns. Shoppers grab them for the wallet-saving appeal and cruelty-free edge, perfect for trendsetters mixing outfits. It holds up to daily wear without fading, making it a go-to for casual or bold statements.

- Footwear Applications: Shoes and boots made with synthetic leather step up comfort and style for all-day wear. They resist water and scuffs, great for rainy commutes or weekend hikes. Brands use it to offer trendy designs affordably, drawing in eco-aware folks who want durable kicks that pair with any look effortlessly.

- Sports and Outdoor Gear: From gym bags to bike seats, synthetic leather equips athletes with gear that’s lightweight and weather-proof. It shrugs off sweat and dirt, keeping equipment sharp after tough sessions. Outdoor lovers choose it for its quick-dry perks, boosting performance in active lifestyles without the weight or worry of real leather.

Recent Developments

1. Kuraray Co. Ltd.

Kuraray is advancing its “Clarino” synthetic leather with a strong focus on sustainability, developing new plant-based and recycled material options. The company is targeting high-performance applications in sports shoes and automotive interiors, emphasising durability and eco-friendly production processes. Recent developments include enhancing the material’s breathability and softness to better compete with natural leather while reducing environmental impact.

2. H.R. Polycoats Pvt. Ltd.

This Indian manufacturer is expanding its “HRPL” product range to include more sustainable polyurethane (PU) leather alternatives. Recent efforts focus on improving quality for export markets and developing products with recycled content. The company is also investing in more efficient production technologies to serve the growing demand for synthetic leather in footwear, bags, and upholstery across price-sensitive markets.

3. Alfatex Italia SRL

Alfatex continues to innovate in high-fashion synthetic leather, developing exclusive finishes and textures that mimic exotic and luxury hides. Recent work emphasises custom colour matching and unique tactile surfaces for European fashion brands. The company is also integrating a higher proportion of pre-consumer recycled materials into its products to meet brand sustainability mandates without compromising on aesthetic quality.

4. Filwel Co. Ltd.

A key supplier to the Korean market, Filwel’s recent developments are in ultra-functional synthetic leathers for automotive and electronics. The company is creating materials with enhanced stain resistance, UV stability, and anti-microbial properties. Investments are being made in cleaner production methods and bio-based PU to align with global environmental, social, and governance (ESG) trends and stringent OEM specifications.

5. Yantai Wanhua Synthetic Leather Group Co., Ltd.

As part of the Wanhua Chemical conglomerate, this company leverages expertise in raw materials to develop innovative synthetic leather. Recent progress is in bio-based and waterborne PU leather, significantly reducing volatile organic compound (VOC) emissions. They are a major force in the Chinese market, scaling production of eco-friendlier alternatives for the apparel, footwear, and furniture industries.

Conclusion

Synthetic Leather is a smart shift in how we think about materials for everyday needs. It steps up as a kind, wallet-friendly pick that skips animal harm while delivering that classic leather charm in cars, clothes, and couches. With folks leaning toward green choices and easy-care options, this stuff is weaving into more homes and wardrobes, promising a brighter, more flexible future for style and comfort alike.