Quick Navigation

Overview

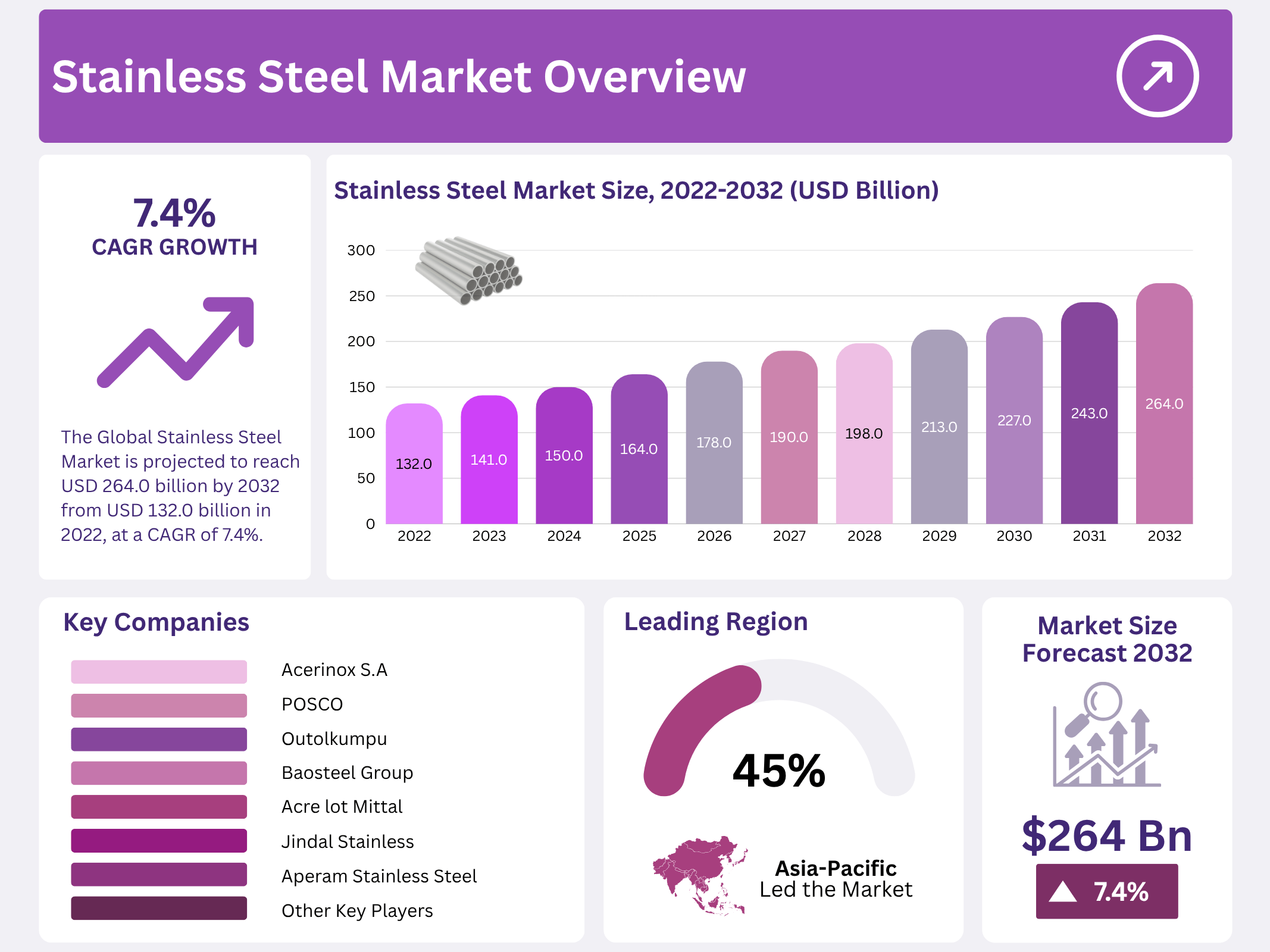

New York, NY – October 29, 2025 – The Global Stainless Steel Market is projected to reach USD 264.0 billion by 2032, rising from USD 132.0 billion in 2022 at a CAGR of 7.4% (2023–2032). Stainless steel, a family of alloy steels containing 10–30% chromium, is valued for its resistance to oxidation and corrosion. Alloying elements such as nickel, molybdenum, titanium, aluminum, niobium, copper, nitrogen, sulfur, and selenium further enhance its performance, offering unique mechanical and chemical properties suitable for diverse industrial uses.

In production, stainless steel is refined in electric arc or basic oxygen furnaces and undergoes argon-oxygen decarburization (AOD) to minimize carbon content and improve quality. This process—where oxygen and argon gases are injected into the molten steel—enhances purity and consistency, enabling the creation of high-grade stainless steels used in critical industries. The growing demand is strongly supported by rising residential housing and public and private infrastructure investments across emerging and developed economies.

Stainless steel plays a vital role in industrial sectors such as automotive, transportation, construction, railways, and process industries. Its strength, corrosion resistance, aesthetic appeal, long life cycle, and low maintenance costs make it a preferred material over carbon steel. These versatile properties, coupled with the increasing penetration of stainless steel in modern applications, are expected to significantly boost global market expansion in the coming years.

Key Takeaways

- The Global Stainless Steel Market is projected to reach USD 264.0 billion by 2032 from USD 132.0 billion in 2022, at a CAGR of 7.4%.

- Stainless steel contains 10–30% chromium and is prized for oxidation and corrosion resistance.

- The stainless steel market is segmented by grade into 200, 300, 400, and Duplex series, with the 200 series widely used in automotive and consumer goods.

- Asia Pacific holds the largest share at USD 63.5 billion, representing 45% of the global market, led by China.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 132.0 Billion |

| Forecast Revenue (2032) | USD 264.0 Billion |

| CAGR (2023-2032) | 7.4% |

| Segments Covered | By Type- Austenitic Stainless Steels, Martensitic Stainless Steels, Ferritic Stainless Steels, and Precipitation Hardened Stainless Steel; By Application- Automotive and Transportation, Building and Construction, Heavy Industries; By Grades- 200 Series, 300 Series, 400 Series, and Duplex Series |

| Competitive Landscape | Acerinox S.A., Aperam Stainless Steel, Acre lot Mittal, Baosteel Group, Jindal Stainless, Nippon Steel Corporation, Outokumpu, POSCO, Yieh United Steel Corporation, ThyssenKrupp Stainless GmbH, AK Steel Corporation, Other Key Players |

Key Market Segments

Type Analysis

Austenitic stainless steel dominates the market among the main types, which include austenitic, martensitic, ferritic, and precipitation-hardenable stainless steels. Renowned for its superior strength, durability, and corrosion resistance, austenitic stainless steel is also aesthetically pleasing, easy to manufacture, clean, and maintain, and environmentally friendly. These qualities make it the preferred choice for components in architecture, automobiles, and numerous other products.

Martensitic stainless steel offers excellent strength and corrosion resistance, making it suitable for a wide range of applications. Ferritic stainless steel, a non-hardening chromium-based alloy with 10.5%–30% chromium and less than 0.20% carbon, remains largely unhardened during heat treatment and only slightly hardens through cold rolling. Precipitation-hardenable stainless steel provides strong corrosion resistance and typically incorporates aluminum, nickel, titanium, and select steel alloys. Duplex stainless steel, a two-phase alloy with balanced ferritic and austenitic structures, combines the corrosion resistance and strength of austenitic stainless steel.

Application Analysis

The automotive and transportation segment leads in stainless steel applications, followed by building and construction, and heavy industries. Modern car manufacturers prioritize lightweight vehicles, and while light metals were once the primary alternative to traditional materials, their high cost and welding challenges have made stainless steel a compelling option due to its outstanding mechanical properties, weldability, and formability. These attributes enable designers to produce exceptionally lightweight stainless steel parts.

Stainless steel has been a staple in construction for over a century, valued for its attractive appearance, corrosion resistance, low maintenance requirements, and excellent strength, durability, and fatigue properties. Beyond everyday uses—such as cutlery, medical equipment, metal products, and vehicles—heavy industry has also been transformed by this versatile material. Heavy industry encompasses large-scale operations involving substantial equipment and facilities, including construction, steel production, mining, shipbuilding, aircraft manufacturing, and energy sectors like oil and gas, hydropower, nuclear power, and long-distance energy transmission.

By Grade

The stainless steel market is segmented by grade into the 200 series, 300 series, 400 series, and Duplex series. The 200 series, with minimal nickel content, is widely used in automotive components, food and beverage equipment, cutlery, and washing machines. The 300 series, non-magnetic, highly pliable, and extremely tough, is ideal for movable parts requiring polishing and grinding in environments where corrosion is prohibited; it finds extensive use in aerospace, automotive, and construction.

The 400 series is prized in medical applications for producing surgical instruments, thanks to its superior wear resistance, high strength, and machinability. The Duplex series dominates due to its high strength, lightweight nature, and exceptional corrosion resistance—particularly against stress corrosion cracking—driving demand across pharmaceuticals, oil and gas, water desalination, and chemical and petrochemical industries. Rising global demand for surgical tools, fueled by expanding healthcare facilities, is expected to further boost segment growth from 2022 to 2032.

Regional Analysis

The Asia Pacific region holds the largest share of the stainless steel market, valued at USD 63.5 billion and projected to see significant revenue growth during the forecast period. Accounting for 45% of the global market, the Asia Pacific benefits from rising demand across chemical and petrochemical products, medical supplies, energy, consumer goods, and heavy and vehicle transportation sectors.

China leads the region with the highest stainless steel market presence. In Europe, demand for stainless steel is surging due to rapid expansion in the automotive industry and ongoing technological advancements. North America is experiencing steady market growth driven by enhanced R&D facilities and high rates of technology adoption.

The region is particularly seeing increased use of duplex series stainless steel in electronic and engineering applications. In South America, Brazil and Mexico are the leading markets. Meanwhile, the Middle East and Africa are poised for significant growth, fueled by a boom in construction activities across the region.

Top Use Cases

- Architecture & Construction: Stainless steel is a top choice for modern buildings due to its strength and sleek appearance. It is used for exterior cladding, structural supports, and roofing. Its key advantage is long-term durability with minimal upkeep, resisting rust from rain and pollution. This makes it a cost-effective material over a building’s entire lifespan, justifying its initial investment for architects and developers.

- Food & Beverage Industry: From commercial kitchens to food processing plants, stainless steel is the mandatory material. Its non-porous surface prevents bacterial growth and is easy to sanitize, meeting strict health standards. It is used for countertops, sinks, storage tanks, and processing equipment. The material does not rust or impart taste, ensuring product purity and safety throughout the production and preparation chain.

- Medical & Healthcare Sector: In hospitals and labs, stainless steel is critical for sterility and reliability. It is used to manufacture surgical instruments, implantable devices, and hospital furniture. The material can withstand repeated, aggressive sterilization using high heat and chemicals without degrading. This inert and hygienic nature is essential for preventing infections and ensuring patient safety during critical medical procedures.

- Automotive & Transportation: The automotive industry increasingly uses stainless steel for both functional and aesthetic parts. It is found in exhaust systems for its heat resistance and in decorative trims for its shine. Beyond cars, it is vital for building railway cars, shipping containers, and chemical tankers because of its ability to withstand harsh weather and corrosive substances during long-term use.

- Consumer Goods & Electronics: Stainless steel is a marker of quality and modern design in consumer products. It is used to make durable kitchen appliances, cutlery, and sinks for the home. In electronics, it provides a sleek, scratch-resistant casing for high-end smartphones and smartwatches. This application leverages the material’s attractive finish and its ability to protect delicate internal components from daily wear and tear.

Recent Developments

1. Acerinox S.A.

Acerinox is advancing its sustainability agenda with its Stainless Steel Future program, focusing on decarbonization and a circular economy. The company is investing in its Spanish plants to increase the use of renewable energy and enhance recycling capabilities. A key recent development is the launch of the Acerinox Next digital platform, designed to streamline the customer purchasing experience with real-time data and e-commerce functionalities, improving supply chain transparency.

2. Aperam Stainless Steel

Aperam is strategically expanding its high-value product portfolio, particularly in aerospace and automotive alloys. A major recent development is the commissioning of a new Bright Annealing line at its Genk facility, significantly boosting its capacity for premium surface-finish stainless steel. Concurrently, the company is progressing on its Leadership in Climate Action plan, increasing the use of solar power at its Brazilian operations to reduce the carbon footprint of its production.

3. Arcelor Mittal

Arcelor Mittal is heavily investing in large-scale decarbonization projects. This facility will use hydrogen and natural gas to produce low-carbon iron, a crucial feedstock for its stainless and specialty steel production. This represents a significant step towards the company’s goal of reducing CO2 emissions in Europe.

4. Baosteel Group

Baosteel Group, a core subsidiary of China Baowu Steel Group, is focusing on technological innovation and green manufacturing. Recent developments include the successful development of new, high-performance stainless steel grades for ultra-supercritical thermal power units, enhancing efficiency. The company is also actively promoting its carbon neutrality roadmap, with recent investments in carbon capture and electrification processes at its flagship plants to meet national environmental goals.

5. Jindal Stainless

Jindal Stainless is aggressively expanding its production capacity and global footprint. A landmark recent development is the commissioning of its 1.1 MTPA expansion at its Jajpur, Odisha facility, making it one of the world’s largest single-location stainless steel plants. The company has also secured a multi-million dollar contract to supply stainless steel for India’s rapid metro rail expansion, highlighting its focus on large-scale infrastructure projects.

Conclusion

The demand for stainless steel is firmly anchored in its fundamental properties of corrosion resistance, hygiene, and durability. The market sees sustained growth as it remains an irreplaceable material in established sectors like construction and healthcare, while simultaneously finding new applications in consumer electronics and green technologies. Its long service life and recyclability further enhance its appeal, positioning it as a critical material for both modern industry and sustainable development.