Quick Navigation

Introduction

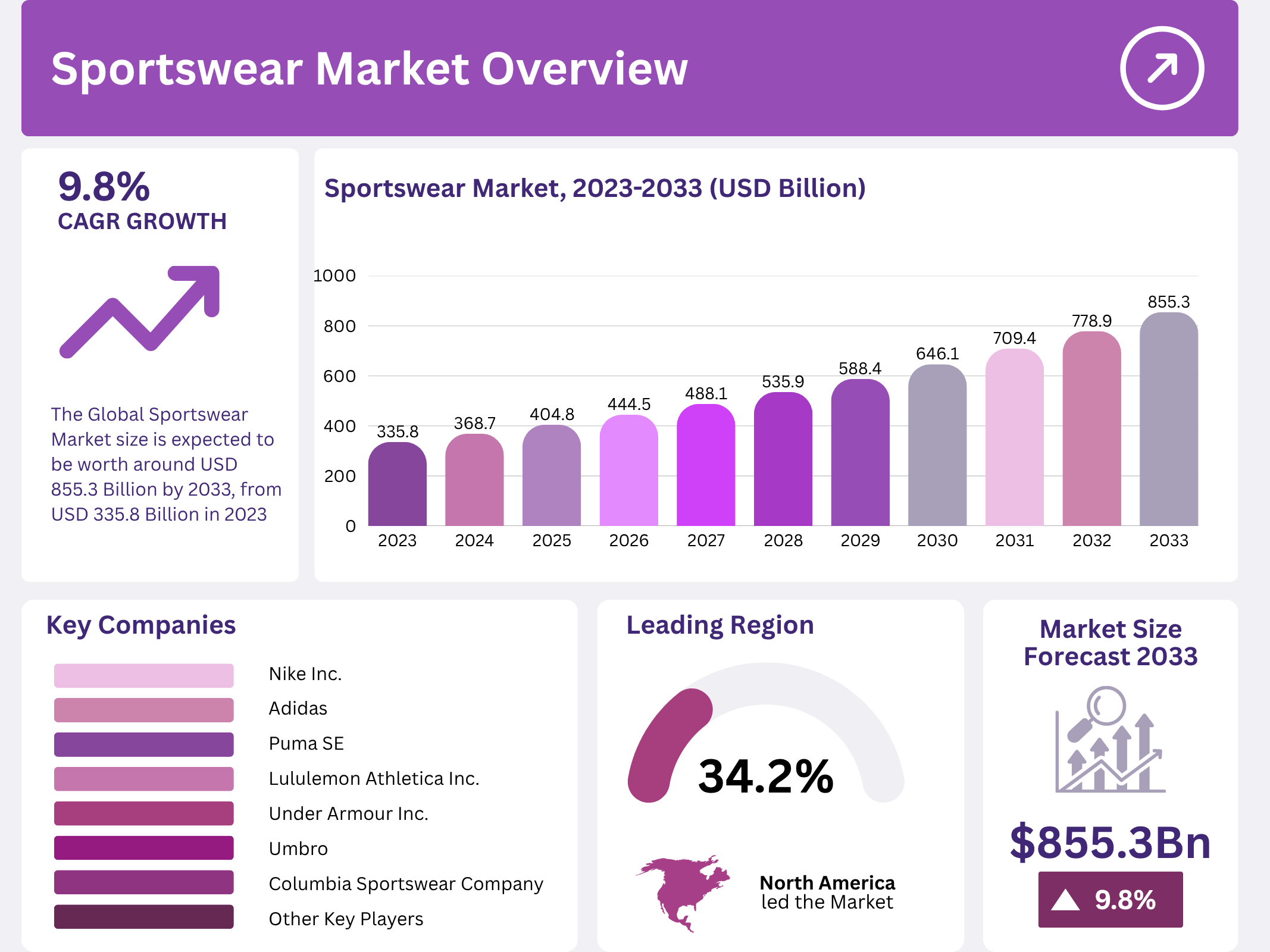

The global sportswear market is witnessing remarkable expansion, driven by the rising emphasis on fitness, active lifestyles, and fashion-forward athletic apparel. The market, valued at USD 335.8 billion in 2023, is projected to soar to USD 855.3 billion by 2033, reflecting a robust CAGR of 9.8% during the forecast period.

Furthermore, technological advancements in fabric innovation and a global shift toward wellness and virtual fitness have amplified consumer interest. North America led the market with a 34.2% share and revenue of USD 114.8 billion in 2023, showcasing the region’s strong sports culture and increasing preference for premium sportswear.

In addition, the integration of style with performance and the influence of digital retail platforms are redefining the industry’s growth dynamics. Consumers are increasingly adopting athleisure wear, blurring the lines between sportswear and everyday fashion, fueling sustained market momentum.

Key Takeaways

- The Global Sportswear Market is expected to reach USD 855.3 Billion by 2033, from USD 335.8 Billion in 2023, growing at a CAGR of 9.8% between 2024 and 2033.

- In 2023, Footwear dominated the product segment with a 65.2% market share.

- In 2023, Men accounted for a 56.3% share in the end-user segment.

- Offline channels held a 33.1% share in the distribution channel segment in 2023.

- North America led with a 34.2% market share and USD 114.8 Billion in revenue in 2023.

Market Segmentation Overview

The Footwear segment dominated the sportswear market in 2023, securing 65.2% of the share. This surge was fueled by consumers’ increasing focus on athletic and leisure activities and innovations in shoe design that enhance comfort and performance while integrating fashion elements to attract a wider audience.

The Apparel segment also demonstrated strong growth potential, supported by advancements in sustainable fabric technologies and the growing demand for versatile clothing. With the global shift toward eco-conscious fashion, this segment is set to maintain a steady upward trajectory in the coming years.

By End-user, the Men’s segment held a commanding 56.3% share in 2023, driven by higher participation in sports and fitness activities. Meanwhile, the Women’s and Children’s categories continue to expand rapidly due to growing health awareness and rising involvement in organized sports.

Within Distribution Channels, Offline stores dominated with a 33.1% market share. Sporting goods retailers and exclusive brand outlets continue to attract consumers seeking personalized experiences and immediate product access. Despite e-commerce growth, the tangible benefits of in-store shopping remain influential.

Drivers

One major driver propelling market growth is the rising global focus on health and fitness. Increasing awareness of physical well-being encourages participation in sports and fitness programs, subsequently driving demand for high-performance sportswear and footwear that enhance athletic efficiency.

Another key driver is technological innovation in materials and design. The introduction of moisture-wicking fabrics, smart textiles, and sustainable materials has transformed consumer expectations, offering greater comfort, durability, and environmental responsibility. These innovations continue to expand market appeal across diverse demographics.

Use Cases

Sportswear is increasingly being used in athleisure fashion, a lifestyle trend blending fitness wear with casual attire. Consumers now wear sportswear for both exercise and daily activities, highlighting its versatility and positioning it as a core component of modern fashion culture.

Additionally, professional and amateur athletes rely on specialized sportswear to enhance performance, prevent injuries, and support recovery. Brands are developing sport-specific apparel and footwear designed with advanced technologies, allowing users to achieve optimal results in training and competition.

Major Challenges

A key challenge for the sportswear industry lies in the high cost of premium products. Advanced materials and production processes elevate prices, making it difficult for price-sensitive consumers to access top-tier sportswear, particularly in emerging or developing markets.

Another challenge is intense market competition and saturation. With numerous global and regional players vying for consumer attention, brands must invest heavily in marketing and innovation to maintain differentiation. This competitive pressure can constrain smaller players and reduce overall profitability.

Business Opportunities

An important opportunity emerges from the growing demand for sustainable and eco-friendly products. Environmentally conscious consumers are prioritizing sportswear made from recycled or biodegradable materials, encouraging brands to adopt green manufacturing practices and transparent sourcing.

Additionally, the rapid expansion of e-commerce presents vast potential for growth. Digital platforms enable sportswear brands to reach new global markets, enhance personalization through data analytics, and offer seamless shopping experiences that drive higher consumer engagement and loyalty.

Regional Analysis

North America maintained market dominance with a 34.2% share and USD 114.8 billion in revenue in 2023, driven by a strong sports culture, fitness enthusiasm, and the presence of leading global brands. The region continues to innovate through product development and sustainability initiatives.

Meanwhile, the Asia Pacific region is poised for the fastest growth, supported by rising disposable incomes, urbanization, and an expanding middle class. Countries such as China and India are witnessing increased health awareness and sports participation, fueling robust demand for affordable and stylish sportswear.

Recent Developments

- In August 2023, Umbro partnered with a major European football league to supply official team kits, strengthening its footprint in global football sportswear.

- In July 2023, Under Armour expanded into digital fitness by acquiring a fitness app startup, integrating workout tracking with its product ecosystem.

- In May 2023, Lululemon introduced a high-performance yoga wear line, leveraging advanced fabric innovations to expand its premium product portfolio.

Conclusion

The global sportswear market is entering a dynamic growth phase, fueled by health consciousness, digital transformation, and fashion-driven innovation. With an expected valuation of USD 855.3 billion by 2033, the industry promises vast opportunities for brands that emphasize sustainability, inclusivity, and technology integration.

As consumer lifestyles evolve toward wellness and active living, the boundaries between sportswear and everyday apparel will continue to blur. Companies investing in eco-friendly materials, smart fabrics, and omnichannel retail strategies will be best positioned to capture future market leadership in this rapidly expanding global industry.