Quick Navigation

Introduction

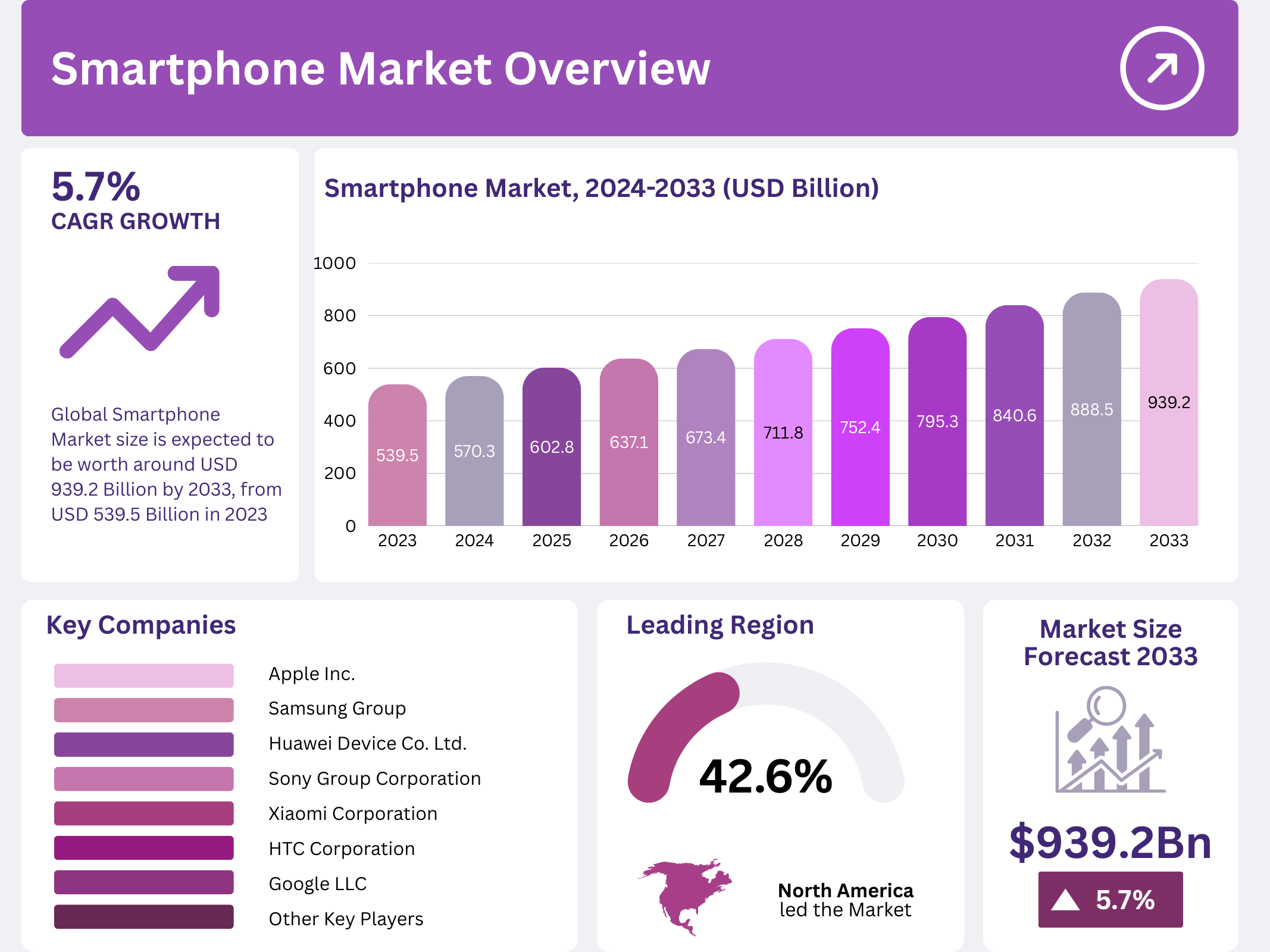

The global smartphone market is experiencing steady growth, projected to reach USD 939.2 billion by 2033, up from USD 539.5 billion in 2023, reflecting a robust CAGR of 5.7% over the forecast period from 2024 to 2033. This growth is driven by increasing consumer demand for advanced mobile technology, including 5G connectivity, AI integration, and foldable display devices.

Smartphones continue to evolve as essential tools for communication, entertainment, productivity, and business operations. With a growing global user base, smartphones are no longer just devices for making calls but are now indispensable for various daily activities. As the market expands, technological innovation and evolving consumer preferences will remain key drivers in shaping the industry’s future.

Key Takeaways

- The global smartphone market is valued at USD 539.5 billion in 2023 and is projected to reach USD 939.2 billion by 2033, growing at a CAGR of 5.7%.

- Android dominates the operating system segment with 63.4% share in 2023.

- OEMs Store leads the distribution channel segment with 47.6% market share in 2023.

- North America holds the largest market share at 42.6%, valued at USD 229.83 billion in 2023.

Market Segmentation Overview

By Operating System

The smartphone market is segmented into operating systems, with Android dominating the space with 63.4% share in 2023. This widespread adoption is driven by Android’s open-source nature, offering flexibility to manufacturers and developers. iOS, with its premium appeal and integrated ecosystem, holds a significant share of the market. The Others category remains a small yet growing niche, mainly in regional markets.

By Distribution Channel

In 2023, OEMs Store dominated the distribution channel with a 47.6% share. This segment benefits from direct consumer relationships, ensuring authenticity and better customer service. Retailers and e-commerce platforms, although growing rapidly, contribute less to the overall market but are gaining traction due to convenience and competitive pricing.

Drivers

AI and AR Integration

The integration of Artificial Intelligence (AI) and Augmented Reality (AR) into smartphones significantly enhances user experience, making devices more intuitive and functional. These technologies enable personalized services, advanced camera capabilities, and immersive entertainment features, fostering market demand.

Increased Demand for Multi-functional Devices

Consumers increasingly seek smartphones with multiple features such as dual-SIM capabilities, health and fitness apps, and high-resolution displays. The trend toward multi-functional devices is growing, especially with more consumers managing both personal and professional communications on a single device.

Use Cases

Mobile Health Applications

Smartphones are driving the adoption of mobile health apps, offering consumers personalized health monitoring, fitness tracking, and telemedicine services. As health and wellness continue to be a priority for consumers, smartphones equipped with health-centric apps are gaining popularity.

Mobile Commerce and Payments

With the rise of mobile payments and e-commerce, smartphones are playing an integral role in digital transactions. Consumers are increasingly using their devices for shopping, financial services, and banking, making smartphones an essential tool for digital commerce.

Major Challenges

Data Privacy and Security Concerns

As smartphones become integral to personal and professional lives, concerns over data privacy and security are growing. The risk of data breaches and cyber-attacks is a significant challenge, hindering the adoption of advanced smartphone features that require access to sensitive data.

Supply Chain Disruptions

Geopolitical tensions and trade wars have disrupted smartphone supply chains. Tariffs, political instability, and manufacturing delays have led to cost increases and availability issues, making smartphones less affordable for consumers in some regions.

Business Opportunities

Sustainable Smartphone Development

There is growing demand for environmentally friendly smartphones, leading to opportunities for manufacturers to invest in sustainable materials and production processes. Consumers are becoming more eco-conscious, and manufacturers that prioritize sustainability can capture a market segment focused on reducing environmental impact.

Expansion of 5G Networks

The rapid expansion of 5G infrastructure presents significant opportunities for smartphone manufacturers. As 5G becomes more widespread, the demand for 5G-enabled smartphones will continue to rise, offering companies an opportunity to cater to an emerging, high-growth market.

Regional Analysis

North America

North America holds the dominant market share in the global smartphone market, accounting for 42.6% of the market in 2023. The region’s high consumer spending on premium smartphones, widespread adoption of 5G technology, and strong brand loyalty contribute to its dominance.

Asia Pacific

Asia Pacific is witnessing rapid growth in smartphone adoption, driven by urbanization and increasing demand for both affordable and premium smartphones. The growing smartphone penetration in countries like China, India, and South Korea is expected to keep the region as a major player in the global market.

Recent Developments

- Lynk Global and Slam Corp: In February 2024, Lynk Global merged with Slam Corp., valued at $800 million. The deal supports Lynk’s satellite constellation project for global smartphone connectivity, targeting completion by the second half of 2024.

- Yettel and Piceasoft: In October 2024, Yettel implemented Piceasoft’s PiceaOnline SDK, offering a smartphone diagnostics service to enhance customer self-service for device issues like battery health and connectivity.

- ABB and Sevensense: In January 2024, ABB acquired Sevensense to integrate AI-based 3D vision technology into its mobile robots, enhancing capabilities for logistics and manufacturing applications.

Conclusion

The smartphone market is poised for significant growth in the coming years, driven by technological advancements, increased demand for multi-functional devices, and the adoption of 5G technology. However, challenges such as data privacy concerns and supply chain disruptions will need to be addressed. The opportunities for sustainable innovations and expansion into new markets offer substantial potential for manufacturers. As the global smartphone user base continues to grow, businesses must remain agile and innovative to stay ahead in this highly competitive market.