Quick Navigation

Introduction

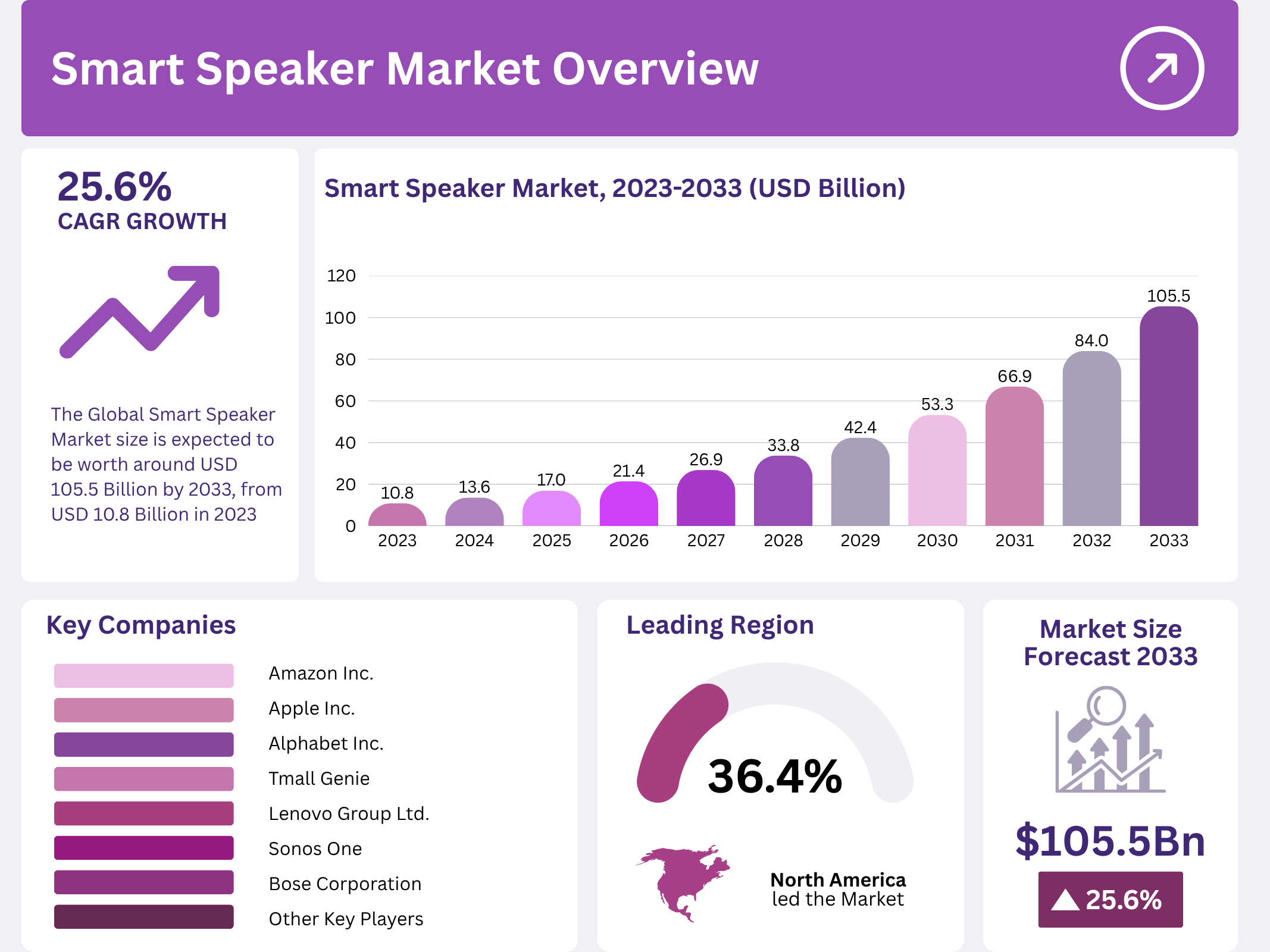

The Global Smart Speaker Market size is expected to be worth around USD 105.5 Billion by 2033, from USD 10.8 Billion in 2023, growing at a CAGR of 25.6% during the forecast period from 2024 to 2033.

The global smart speaker market is witnessing remarkable expansion as voice-enabled technologies become increasingly embedded in everyday living. Consumers are embracing smart speakers to streamline entertainment, communication, and home automation tasks with improved convenience and responsiveness.

Driven by advancements in artificial intelligence and seamless integrations across smart ecosystems, demand continues to rise across households and commercial environments. Companies are investing in enhanced voice recognition, privacy protection, and multilingual capabilities to broaden global market reach.

As adoption accelerates, the industry sees heightened competition, innovative product development, and strategic partnerships, positioning smart speakers as a core element of connected living experiences.

Key Takeaways

- The Smart Speaker Market was valued at USD 10.8 Billion in 2023 and is expected to reach USD 105.5 Billion by 2033, with a CAGR of 25.6%.

- In 2023, Amazon Alexa leads the virtual personal assistant segment with 37.1%, owing to its high user engagement.

- In 2023, Software is the dominant component, emphasizing the role of digital solutions in the smart home ecosystem.

- In 2023, Smart Home is the leading application, driven by the increasing demand for home automation.

- In 2023, North America leads with 36.4% market share, underscoring its technological advancement and adoption rate.

Market Segmentation Overview

Virtual Personal Assistant: Amazon Alexa holds the leading position with a 37.1% market share, supported by extensive ecosystem integration and continuous upgrades in voice interaction. Google Assistant and Siri follow with strong platform-specific engagement, while region-focused solutions like DuerOS and Ali Genie gain traction in Asian markets.

Component: Software dominates as advancements in natural language processing and cloud-powered AI capabilities enhance device intelligence. Continuous updates and feature enhancements drive value growth, while hardware improvements focus on sound quality, connectivity, and form factor sophistication.

Application: The Smart Home segment leads the market as households increasingly adopt automated lighting, climate control, and surveillance systems. Smart speakers serve as centralized control hubs, while Smart Office and consumer-focused entertainment uses continue to expand.

Drivers

Rising Adoption of Connected Home Ecosystems: Increasing demand for smart home convenience propels smart speaker usage. Consumers value hands-free control for managing lighting, appliances, security systems, and entertainment. Growing compatibility among devices further accelerates adoption.

Advancements in AI and Voice Recognition: Continued development in speech algorithms, personalization features, and cloud-based analytics enables more natural interactions. Improved responsiveness elevates user experience, fueling market growth and customer retention.

Use Cases

Home Automation Management: Smart speakers act as centralized hubs for controlling smart thermostats, lighting systems, and home security devices. This streamlines daily routines and enhances home safety, delivering efficiency and comfort.

Voice-Activated Entertainment: Users access music, podcasts, audiobooks, and streaming services through voice commands. Enhanced sound quality and integration with home theater systems elevate media consumption experiences.

Major Challenges

Privacy and Data Security Concerns: Smart speakers continuously process voice inputs, raising concerns over data handling, surveillance risks, and unauthorized access. Consumer trust remains a sensitive factor impacting adoption.

Limited Language and Regional Support: Lack of comprehensive multi-language capability reduces product appeal in diverse regions. Localization and dialect compatibility remain key development challenges for global expansion.

Business Opportunities

Growth in Emerging Markets: Rising urbanization and disposable incomes in Asia-Pacific, Latin America, and Middle East regions create avenues for market expansion. Affordable models and localized features can attract new user bases.

Integration with IoT and Industry Applications: Opportunities exist for deploying smart speakers in hospitality, healthcare, office environments, and public service sectors. Voice-driven automation can enhance customer interaction and operational efficiency.

Regional Analysis

North America: Leading with a 36.4% share, the region demonstrates strong consumer adoption supported by advanced infrastructure, high internet penetration, and dominant technology companies. Frequent product innovation strengthens market maturity.

Asia Pacific: The region shows rapid growth driven by large populations, rising tech-savvy consumers, and increasing smart home adoption in China, South Korea, and Japan. Local AI platforms offer strong competitive advantages.

Recent Developments

- Sonos introduced the Era 100 and Era 300 smart speakers in September 2024 with multi-room audio and Dolby Atmos support.

- Google upgraded Nest Audio in October 2024 with enhanced AI-based voice recognition and improved sound quality.

- Apple HomePod Mini expanded market share in November 2024, gaining popularity for affordability and seamless Apple ecosystem integration.

Conclusion

The global smart speaker market is poised for substantial growth as AI technology advances and consumer demand for connected environments rises. Companies continue to innovate in design, user personalization, and multi-device compatibility. With expanding opportunities in emerging markets and commercial sectors, smart speakers will remain central to evolving digital lifestyles and automation-driven ecosystems.