Quick Navigation

Overview

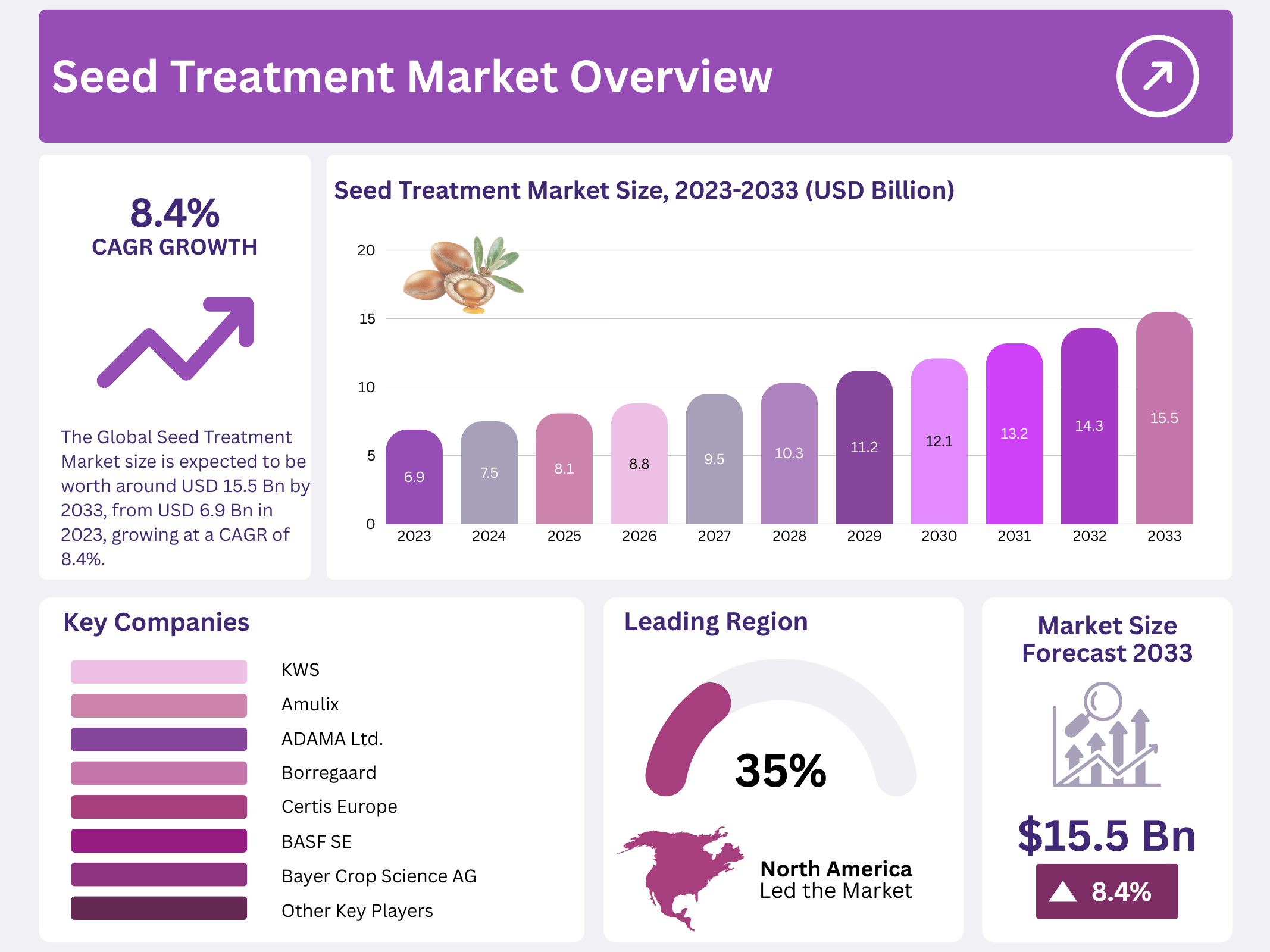

New York, NY – November 26, 2025 – The Global Seed Treatment Market is projected to reach around USD 15.5 billion by 2033, up from USD 6.9 billion in 2023, growing at a CAGR of 8.4% between 2024 and 2033. Seed treatment plays a vital role in modern agriculture by applying chemical or biological agents to seeds before planting. This process protects seeds from pests and diseases while improving seed vigor, helping farmers achieve better germination, stronger crop establishment, and higher overall yields.

The market includes a wide range of products such as fungicides, insecticides, and an increasing number of bio-based solutions designed to meet specific crop and soil requirements. These treatments help farmers address rising global food demand amid shrinking arable land by improving crop efficiency rather than expanding farmland. By enhancing early plant health, seed treatments contribute to more reliable harvests and improved farm productivity across major agricultural regions.

Environmental benefits further support market growth, as seed treatment reduces the need for large-scale field spraying, lowers chemical usage, and minimizes environmental emissions. These advantages align well with global sustainability goals and government regulations, including Maximum Residue Limits (MRLs) for pesticide use. Leading companies such as Bayer AG, Syngenta AG, and BASF SE are investing heavily in biologically derived seed treatments, reflecting the industry’s shift toward safer and more sustainable agricultural solutions. Together, regulatory support and continuous innovation are expected to drive steady market expansion in the coming years.

Key Takeaways

- The Global Seed Treatment Market size is expected to be worth around USD 15.5 billion by 2033, from USD 6.9 billion in 2023, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

- The Chemical segment dominated the Seed Treatment Market with a 68.6% share.

- Cereals & Grains dominated the Seed Treatment Market with a 41.3% share.

- Seed Protection dominated the Seed Treatment Market with a 38.7% share.

- Coating dominated the seed treatment market with over 39% share, enhancing crop yield and sustainability.

- North America dominates the seed treatment market with a 34.6% share, valued at USD 2.4 billion.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 6.9 Billion |

| Forecast Revenue (2033) | USD 15.5 Billion |

| CAGR (2024-2033) | 8.4% |

| Segments Covered | By Type (Chemical, Biological), By Crop Type [Oilseeds (Soybean, Cotton, Canola, Sunflower, Others), Cereals & Grains (Corn, Wheat, Rice, Sorghum, Barley, Others), Fruits & Vegetables ( Solanaceae, Cucurbits, Brassicas, Leafy vegetables, Root & bulb vegetables, Others), Other Crop Types], By Function [Seed Protection(Insecticides, Fungicides, Others), Seed Enhancement ( Bioinsectisides, Biofungicides, Others)], By Application (Coating, Dressing, Pelleting) |

| Competitive Landscape | Syngenta International AG, Bayer CropScience AG, BASF SE, Corteva Agriscience, Croda International PLC, KWS, Evologic Technologies, Borregaard, Amulix, ADAMA Ltd., Bioworks Inc., Certis Europe |

Key Market Segments

By Type Analysis

In 2023, the chemical segment dominated the Seed Treatment Market, accounting for 68.6% of the total share. Chemical seed treatments continue to be widely adopted due to their proven effectiveness in protecting seeds against pests and diseases. Farmers and agronomists rely on these solutions for their fast action, longer-lasting protection, and consistent performance across different crops and farming conditions. Their established usage and predictable results have reinforced trust among agricultural professionals, supporting strong market penetration.

Meanwhile, the biological segment, though smaller in comparison, is gaining steady momentum. Growth in this segment is driven by rising environmental awareness and the shift toward sustainable and organic farming practices. Biological treatments, based on natural microorganisms and substances, are increasingly preferred by farmers targeting eco-friendly cultivation and non-GMO or organic produce, positioning this segment for long-term expansion.

By Crop Type Analysis

In 2023, cereals and grains led the Seed Treatment Market by crop type, capturing 41.3% of the market share. The dominance of this segment is largely linked to strong global demand for staple food crops such as wheat, rice, and maize. Population growth, food security concerns, and the need for higher crop yields have encouraged the widespread use of treated seeds to improve germination and productivity.

Oilseeds followed as a key segment, supported by rising demand for edible oils and biodiesel. Effective seed treatment helps oilseed farmers manage early-stage crop risks and improve yields, especially in large-scale commercial farming. The fruits and vegetables segment also showed growing adoption, fueled by increasing consumer demand for healthier, pesticide-free produce and the use of advanced biological and organic seed treatment technologies.

By Function Analysis

Seed protection emerged as the leading function in 2023, holding a 38.7% market share. This segment focuses on protecting seeds from diseases, insects, and soil-borne pathogens during germination and early plant development. The strong emphasis on protecting crops at an early stage highlights the importance of preventive solutions in improving yield stability and reducing crop losses.

Seed enhancement applications are also playing a growing role, concentrating on improving seed vigor, stress tolerance, and germination performance. Advanced formulations help seeds adapt to challenging environmental conditions, supporting consistent crop development and stronger agricultural outputs.

By Application Analysis

In 2023, coating dominated the seed treatment market by application, capturing over 39% of the overall share. Seed coating involves applying a protective layer that shields seeds from pests and diseases while enhancing planting accuracy and germination. This approach helps farmers reduce chemical use in fields, supporting both productivity and sustainability goals.

Dressing remained another important application segment, typically involving the application of liquid or powder treatments just before sowing. It provides effective protection against soil-borne pathogens and early pest pressure, ensuring healthier crop establishment. Together, coating, dressing, and pelleting techniques continue to support efficient seed utilization and improved farm performance.

Regional Analysis

North America continues to dominate the global market, holding a 34.6% share valued at USD 2.4 billion. This strong position is supported by the widespread use of advanced agricultural technologies and the high adoption of genetically modified crops, which require specialized seed treatment solutions to improve productivity and protect against pests and diseases.

Europe represents a mature and steadily evolving market, driven by strict environmental regulations and a strong focus on sustainable agriculture. The region is increasingly shifting toward biological seed treatments that support reduced chemical use and align with the European Union’s green and climate-driven agricultural policies. This focus on eco-friendly farming methods is steadily reshaping seed treatment preferences across European countries.

The Asia Pacific region is emerging as the fastest-growing market for seed treatment solutions. Rapid agricultural expansion in countries such as India and China, along with rising awareness of yield improvement techniques, is supporting market growth. Additionally, government programs promoting modern farming methods and increased investment in biotechnology research are expected to accelerate adoption, making the Asia Pacific a key growth engine in the coming years.

Top Use Cases

- Pest Protection: Seed treatment applies protective coatings to seeds, shielding them from soil insects like wireworms and cutworms that attack during early growth. This simple step helps young plants thrive without extra sprays, saving farmers time and effort while ensuring stronger starts in tough field conditions. Farmers notice healthier seedlings that grow evenly, leading to reliable harvests even in pest-prone areas.

- Disease Control: By treating seeds with safe agents, this method fights off fungi and bacteria that cause root rot or damping-off in crops like corn and soybeans. It keeps seedlings healthy from the moment they sprout, reducing the need for later treatments. This approach is gentle on the soil, promoting steady plant development and supporting farms that focus on clean, disease-free fields for better long-term yields.

- Better Germination: Seed treatments enhance water uptake and nutrient absorption, helping seeds sprout quickly and uniformly, even in cool or dry soils. This boosts early plant vigor, making it easier for farmers to achieve full crop stands without replanting. It’s a smart way to overcome weather challenges, ensuring crops get off to a robust start and grow more consistently across the field.

- Storage Safety: Treating seeds before storage prevents mold and rot from developing during off-seasons, keeping planting material fresh and viable for months. This protects farmers’ investments in high-quality seeds, allowing them to plant at the right time without losses. It’s an easy practice that maintains seed health, supporting steady farming operations year after year.

- Sustainability Boost: Using biological treatments like helpful microbes on seeds cuts down on broad chemical use, fostering soil life and fitting into eco-friendly farming. It helps crops resist stresses naturally, aligning with green practices that preserve land health. Farmers gain stronger plants with less environmental impact, paving the way for balanced agriculture that supports future generations.

Recent Developments

1. Syngenta International AG

Syngenta is advancing biological seed treatments with products like VICTRATO. This novel nematicide and insecticide seed treatment combats nematodes and sucking pests in various crops. It leverages a unique fermentation process to create a potent biological option, reducing reliance on synthetic chemicals. This aligns with the growing demand for sustainable Integrated Pest Management (IPM) solutions that protect yield and soil health.

2. Bayer Crop Science AG

Bayer is integrating digital tools with seed treatment. Their latest innovations include premium treatments bundled with the Climate FieldView platform, providing data-driven planting recommendations. They also focus on novel fungicidal and insecticidal combinations, such as those in the COPeO portfolio, to enhance early-season vigor and protect against a broader spectrum of soil-borne diseases and pests, ensuring a stronger crop start.

3. BASF SE

BASF is expanding its seed treatment portfolio with a strong emphasis on sustainability. Recent launches include the bio-fungicide Vercoras and the nematicide Nemasphere. They are also pioneering water-dispersible granule (WG) formulations to minimize dust and improve handler safety. These developments focus on providing effective, environmentally conscious solutions that fit within modern resistance management and stewardship programs for long-term efficacy.

4. Corteva Agriscience

Cortevais is focusing on novel modes of action and integrated solutions. Their LumiGEN seed treatment brand includes advanced fungicides and insecticides that enhance seed health and early plant development. A key development is their investment in biologicals, creating hybrid solutions that combine conventional and biological products. This approach aims to maximize genetic potential from planting and address increasing regulatory and resistance challenges.

5. Croda International PLC

Croda, through its subsidiary Innospec, is a leader in seed treatment formulation, adjuvants, and polymers. Their recent developments focus on innovative film coats and sticker agents that enhance the safety and performance of active ingredients. Products like the SENTRY series help reduce dust-off, improve flowability, and ensure uniform coverage, which is critical for the efficacy of both chemical and biological seed treatments applied by manufacturers.

Conclusion

Seed Treatment is a cornerstone of modern farming, offering a straightforward way to safeguard seeds and nurture healthier crops from day one. This practice not only shields against common threats like pests and diseases but also sparks even growth and resilience in varying conditions, making it easier for farmers to meet rising food needs.