Quick Navigation

Overview

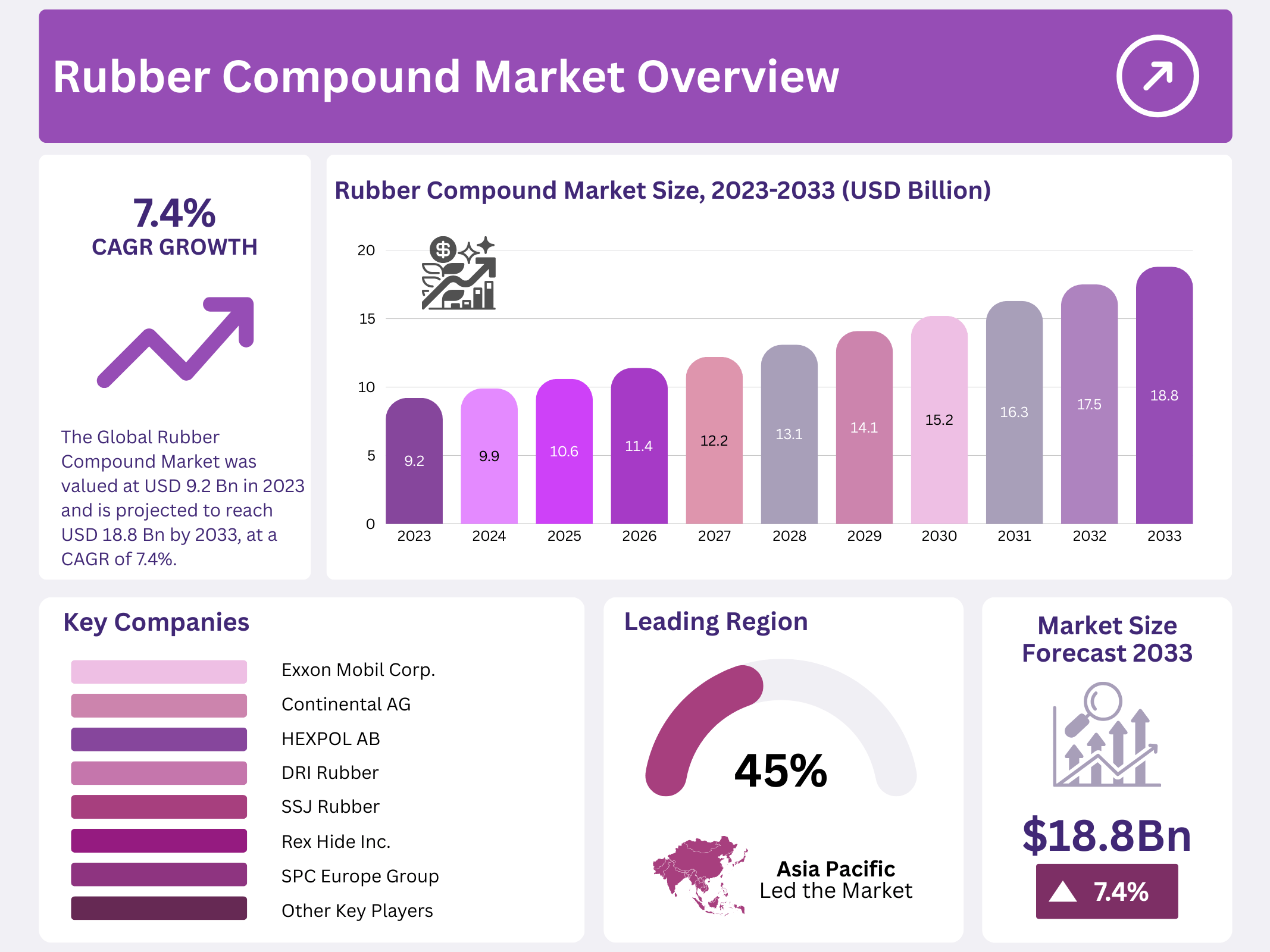

New York, NY – January 12, 2026 – The Global Rubber Compound Market is set for strong growth, with its size expected to reach around USD 18.8 billion by 2033, up from USD 9.2 billion in 2023, expanding at a CAGR of 7.4% during the forecast period from 2023 to 2033. This market covers the production and supply of rubber compounds, which are carefully formulated blends of natural or synthetic rubber combined with additives and fillers to achieve specific performance characteristics.

Rubber compounds are engineered to improve key properties such as strength, durability, flexibility, and resistance to heat, chemicals, abrasion, and electrical stress. Achieving these qualities requires precise formulation and blending expertise, as different applications demand different performance levels. These compounds play a vital role in the manufacture of products, including automotive tires and components, industrial and medical gloves, seals, gaskets, hoses, and a wide range of everyday consumer goods.

Market growth is being driven by advances in material science, rising demand from the automotive and transportation sectors, and the need for high-performance materials in industrial applications. The expanding healthcare industry, especially in medical devices and equipment, is also supporting demand. Manufacturers are investing heavily in research and development to enhance compound performance, create eco-friendly formulations, and ensure compliance with increasingly strict health, safety, and environmental regulations.

Key Takeaways

- The Global Rubber Compound Market was valued at USD 9.2 billion in 2023 and is projected to reach USD 18.8 billion by 2033, at a CAGR of 7.4% during the forecast period (2023–2033).

- Styrene Butadiene Rubber (SBR) held the largest share in 2023, accounting for over 31.5% of the total market.

- The Tires segment led the market in 2023, capturing more than 58.7% of the total share.

- Asia Pacific dominated the global market in 2023 with a 45.7% share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 9.2 Billion |

| Forecast Revenue (2033) | USD 18.8 Billion |

| CAGR (2024-2033) | 7.4% |

| Segments Covered | By Type(Styrene Butadiene Rubber, Nitrile Butadiene Rubber, Silicone Rubber, EPDM Rubber, Natural Rubber, Others), By Application(Tires, Automotive (Non-Tire), Belts and Hoses, Consumer Goods, Wire and Cable, Footwear, Others) |

| Competitive Landscape | Exxon Mobil Corp, Continental AG, Shin-Etsu Chemical Co. Ltd., Cooper-Standard Holdings Inc., HEXPOL AB, AirBoss of America Corp., POLYMERTECHNIK ELBE GMBH, Jiangsu Guanlian New Material Technology Co. Ltd., Rex Hide Inc., SPC Europe Group, DRI Rubber, SSJ Rubber |

Key Market Segments

By Type

In 2023, Styrene Butadiene Rubber (SBR) dominated the rubber compound market, accounting for more than 31.5% of the total share. Its strong position is mainly due to widespread use in tire manufacturing, where it offers a reliable balance of durability, abrasion resistance, and cost efficiency. Consistent demand from the automotive industry continues to support SBR consumption, while its growing use in industrial products further strengthens its market presence.

Nitrile Butadiene Rubber (NBR) captured a significant share of the market, driven by its superior resistance to oil and fuel. These properties make it highly suitable for automotive components such as seals, hoses, and gaskets. Rising automotive production and continued activity in the oil and gas sector are boosting demand for NBR, reinforcing its importance in applications that require chemical and fluid resistance.

Silicone Rubber plays a crucial role in applications that require high thermal stability, flexibility, and resistance to extreme temperatures. Its increasing use across healthcare, electronics, and automotive industries reflects its ability to meet strict performance and safety requirements. Meanwhile, EPDM Rubber (Ethylene Propylene Diene Monomer) is valued for its excellent resistance to weathering, ozone, and aging. Its extensive use in automotive weather seals, roofing systems, and outdoor construction materials is supported by growing demand for long-lasting and durable rubber solutions.

By Application

In 2023, the Tires segment led the rubber compound market, holding more than 58.7% of the total share. This dominance is closely linked to steady global demand for passenger and commercial vehicles, where tires remain a core component. Continuous innovation in tire performance and expansion into emerging automotive markets have further reinforced this segment’s leadership.

The Automotive (Non-Tire) segment also represented a major area of demand, covering products such as seals, gaskets, mounts, and vibration control components. Growth in vehicle production, along with a focus on durability, safety, and efficiency, has increased the use of advanced rubber compounds in this segment.

Belts and Hoses remain essential across industrial and automotive applications, where they support fluid transfer and power transmission in engines and machinery. In addition, Consumer Goods account for a steady share of demand, as rubber compounds are widely used in household items, footwear, sports equipment, and other everyday products. The material’s flexibility, strength, and safety characteristics continue to make it a preferred choice across diverse consumer applications.

Regional Analysis

The Asia Pacific region leads the global rubber compound market, accounting for 45.7% of the total share. This strong position is driven by rising demand for rubber compounds across major industries such as automotive, consumer goods, industrial manufacturing, and construction. Rapid urbanization, expanding infrastructure projects, and growing vehicle production have significantly increased the need for high-performance rubber materials throughout the region.

In North America, the rubber compound market has shown steady growth, supported by economic stability and strong demand from the automotive, manufacturing, and consumer goods industries. The region places a high emphasis on product quality, innovation, and sustainable material solutions.

Europe is expected to experience consistent growth, driven by demand from the automotive and construction sectors. The region’s strong focus on sustainability, regulatory compliance, and the adoption of green building practices is encouraging the use of advanced and eco-friendly rubber compound technologies.

Top Use Cases

- Automotive Industry: Rubber compounds play a key role in the automotive world by forming tires, seals, and hoses that handle heat, oil, and rough conditions. They boost vehicle safety, cut down on noise and vibrations, and help engines run efficiently, making them a go-to choice for car makers focused on durability and performance.

- Healthcare Applications: In healthcare, rubber compounds are used for gloves, tubing, and devices that need to be flexible yet strong against chemicals and germs. They ensure safe patient care, support surgical tools, and fit well in medical gear, helping providers deliver reliable services in hospitals and clinics.

- Construction Sector: Rubber compounds are vital in construction for creating seals, gaskets, and bridge parts that resist weather and absorb shocks. They help buildings and structures stay stable over time, prevent leaks, and handle movements from wind or earthquakes, supporting safer and longer-lasting infrastructure projects.

- Industrial Machinery: For industrial uses, rubber compounds make conveyor belts, hoses, and pads that withstand abrasion and harsh environments. They improve machine efficiency, reduce downtime from wear, and enhance worker safety in factories, mining, and processing plants by providing grip and flexibility.

- Consumer Goods: Rubber compounds appear in everyday items like shoe soles, kitchen tools, and sports gear, offering comfort, grip, and toughness. They make products more user-friendly and long-lasting, appealing to consumers who value quality in footwear, household essentials, and recreational equipment.

Recent Developments

Exxon Mobil Corp. has expanded its line of Santoprene thermoplastic vulcanizates (TPVs), introducing grades with enhanced softness and adhesion properties for automotive sealing. These developments focus on lightweighting and sustainability, with some grades incorporating recycled content. The company continues to innovate in elastomer technology for demanding applications.

Continental AG is advancing rubber compounding for sustainability, developing Taraxagum natural rubber from dandelions and increasing the use of recycled materials and renewable oils in its tire compounds. Their R&D focuses on reducing the carbon footprint and material consumption without compromising performance, particularly for their premium tire lines.

Shin-Etsu Chemical Co., Ltd. has developed new silicone rubber compounds for the automotive and electronics sectors, offering superior heat resistance, durability, and precision moldability. Recent innovations include low-hardness compounds for soft-touch components and thermally conductive grades for EV battery pads, meeting stringent industry demands.

Cooper-Standard Holdings Inc. recently launched Fortrex, a new high-performance sealing material. It offers significant weight reduction and improved compression set compared to traditional EPDM, enhancing fuel efficiency and durability in automotive sealing systems. This compound is designed to meet stringent emission and efficiency standards.

HEXPOL AB has expanded its DryFlex TPE and thermoset rubber compound portfolios with several sustainable solutions. Recent developments include compounds with high bio-based or recycled content, and advanced materials for electric vehicle charging cables and cooling systems, aligning with circular economy goals.

Conclusion

Rubber Compounds stand out as adaptable materials that fuel growth in diverse sectors by blending strength with customization. As a market research analyst, I observe their role in solving real-world challenges through innovation, ensuring they remain a cornerstone for future developments in manufacturing and daily life.