Quick Navigation

Introduction

The Global Rolling Stock Market is experiencing steady growth as governments and transportation operators increasingly prioritize efficient, sustainable, and large-scale mobility solutions. Rolling stock, which includes locomotives, freight wagons, and passenger trains, forms the core of rail transportation networks used worldwide to support economic and social connectivity.

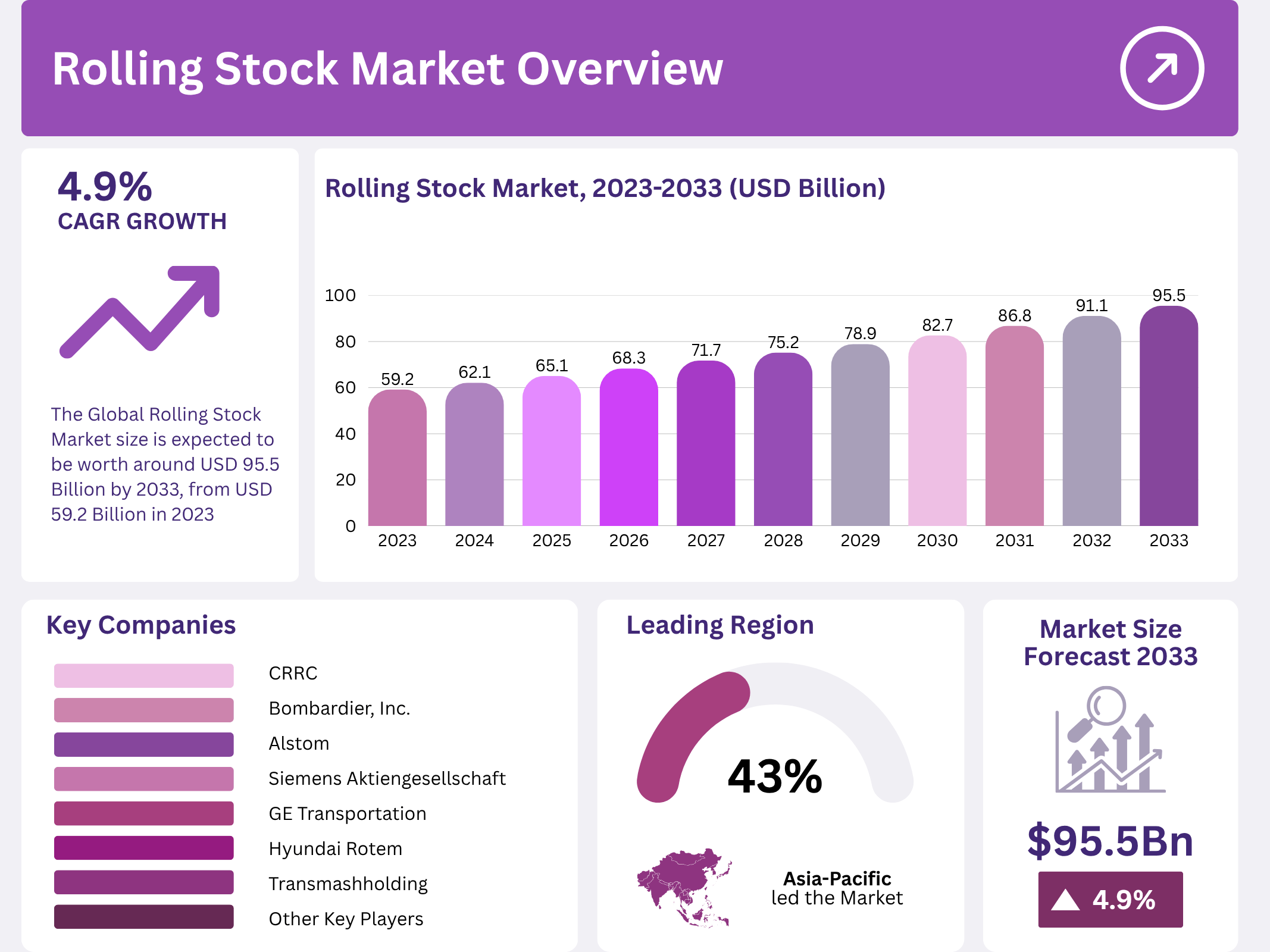

With expanding urban populations and the need for low-emission mass transit, rail systems are being reimagined to meet rising mobility demand. The market, valued at USD 59.2 Billion in 2023, is projected to reach USD 95.5 Billion by 2033. This transition is driven by investments in high-speed rail, electrification efforts, and smart transportation technologies.

Moreover, the integration of automation, real-time monitoring, and improved rail operations is further accelerating market expansion. As a result, rolling stock manufacturers and railway operators are continuously innovating to enhance passenger comfort, freight efficiency, and sustainability.

Key Takeaways

- The Rolling Stock Market was valued at USD 59.2 Billion in 2023 and is expected to reach USD 95.5 Billion by 2033, with a CAGR of 4.9%.

- In 2023, Rapid Transit Vehicle leads the product segment with 32%, driven by urban transit needs.

- In 2023, Electric is the dominant type at 62%, reflecting the shift toward cleaner energy.

- In 2023, Rail Passenger is the leading train type, driven by increasing public transportation demand.

- In 2023, the Asia Pacific region dominates with 43.0% market share, supported by significant rail infrastructure investment.

Market Segmentation Overview

The product segment is led by Rapid Transit Vehicles, which hold 32% of the market share. This growth is shaped by expanding urbanization and increased public transportation needs. Cities are investing in metro systems, monorails, and modern commuter lines to reduce traffic congestion and environmental impacts, boosting rapid transit demand.

By type, Electric rolling stock dominates with 62% share, driven by energy-efficient operations and regulatory focus on carbon reduction. Countries are prioritizing electrified networks to reduce emissions while lowering operational costs, enabling widespread adoption of electric locomotives and multiple-unit electric trains.

Rail Passenger trains lead the train type segment, benefiting from rising demand for comfortable, reliable, and cost-effective mobility. Investments in intercity and high-speed passenger networks reflect the global emphasis on sustainable transportation and supporting tourism and business travel.

Conventional locomotive technology remains dominant, supported by robust infrastructure, durability, and reliability. However, turbocharged and maglev technologies are gaining interest as rail operators explore faster, quieter, and more energy-efficient solutions for next-generation rail systems.

Drivers

Growing Demand for Urban Rail Transit: Expanding urban populations and increased traffic congestion have prompted governments to invest heavily in rail-based public transportation. Metro systems and commuter rail services offer high-capacity, eco-friendly mobility options, supporting sustained market demand.

Government Support for Sustainable Transportation: Global regulations promoting low-emission transportation are accelerating the adoption of electric and hybrid rolling stock. Government-funded modernization programs and climate policies encourage investments in high-performance, energy-efficient rail fleets.

Use Cases

Mass Transit and Commuting: Rolling stock plays a critical role in supporting daily commuting in metropolitan areas. Metro trains, trams, and suburban rail services help reduce road traffic, lower emissions, and provide reliable mobility for millions of passengers every day.

Freight and Logistics: Rail freight remains vital for transporting bulk goods over long distances. Heavy-duty locomotives and freight wagons enhance supply chain efficiency, reduce logistics costs, and support industrial sectors including mining, agriculture, and manufacturing.

Major Challenges

High Manufacturing and Development Costs: Rolling stock production requires advanced engineering, precision materials, and safety compliance, leading to high initial investment. These costs can limit expansion, especially for smaller rail operators and developing regions.

Long Delivery and Infrastructure Timelines: Installing and deploying new trains, tracks, and signaling systems requires extensive planning and construction time. Delays in procurement, testing, and certification can affect market growth and rollout schedules.

Business Opportunities

Expansion of High-Speed Rail Networks: Countries worldwide are investing in high-speed train corridors to enhance regional connectivity. This expansion opens opportunities for rail manufacturers to supply next-generation high-speed trains with advanced aerodynamics and digital control systems.

Integration of Digital and IoT Technologies: Smart trains equipped with IoT sensors enable real-time monitoring, predictive maintenance, and improved safety. The growing adoption of digital railway platforms offers new service and aftermarket revenue streams for suppliers.

Regional Analysis

Asia Pacific: Asia Pacific leads the global market with 43.0% share due to extensive investments in high-speed rail, metro expansion, and freight modernization. China, India, and Japan are key contributors, emphasizing sustainable and high-capacity transit networks.

Europe and North America: Europe maintains strong growth due to environmental regulations and high-speed rail innovation. North America is modernizing freight locomotives and gradually expanding passenger rail networks, supporting ongoing demand for rolling stock upgrades.

Recent Developments

- Eurostar Group announced a fleet expansion of up to 50 new trains and additional European routes planned by 2025.

- Go-Ahead Group resumed dividend payments of over £80 million to global shareholders.

- Paris enhanced its transport infrastructure in preparation for the 2024 Olympic Games, prioritizing public transit and cycling.

- Paris-Milan high-speed rail project confirmed to reduce travel time to 4.5 hours by 2032 through the new Alpine tunnel route.

Conclusion

The Global Rolling Stock Market is set to expand significantly, supported by rising urban mobility needs, sustainability initiatives, and modernization of rail networks. As electric and high-speed trains gain further adoption, manufacturers and railway operators are focused on enhancing efficiency, reducing emissions, and improving passenger and freight experiences. With ongoing government support and technological innovation, the market is poised for strong, sustained growth in the years ahead.