Quick Navigation

Introduction

The global robotaxi market is accelerating rapidly as autonomous mobility reshapes transportation ecosystems. Emerging technologies, major investments, and supportive regulations collectively fuel this transformation. Moreover, industry players continue unveiling innovations that enhance safety, scalability, and operational efficiency.

Across regions, governments increasingly endorse autonomous fleets to address congestion, emissions, and urban mobility challenges. Consequently, market participants experience growing opportunities to deploy next-generation ride-hailing solutions. Meanwhile, consumer acceptance rises steadily as robotaxis demonstrate proven reliability and convenience.

Furthermore, rapid advancements in artificial intelligence, LiDAR, and electric propulsion streamline robotaxi performance. As companies expand pilot programs and optimize algorithms, autonomous vehicles achieve greater precision. This momentum strengthens market confidence while accelerating adoption across global urban centers.

Additionally, sustained venture funding supports technological breakthroughs and commercial fleet development. Industry milestones—including regulatory approvals, IPO activity, and strategic partnerships—signal high-growth potential. Therefore, the robotaxi market approaches a decade of unprecedented expansion and global deployment.

Overall, as mobility ecosystems evolve, robotaxis emerge as pivotal solutions for efficient, sustainable, and cost-effective transportation. Their increasing integration into smart cities underscores a long-term shift toward autonomous, connected, and eco-friendly mobility frameworks.

Key Takeaways

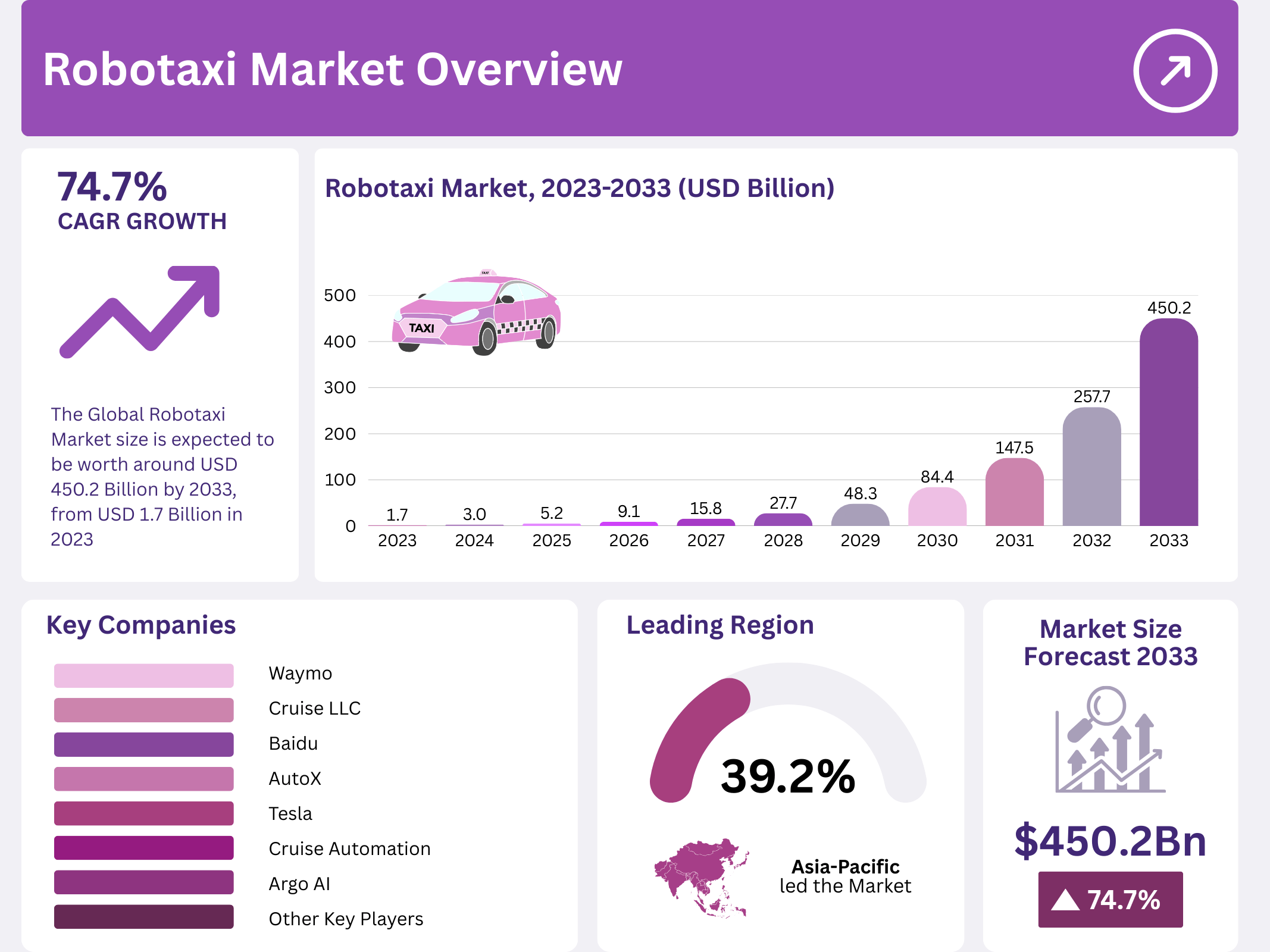

- The Robotaxi Market was valued at USD 1.7 billion in 2023 and is anticipated to reach USD 450.2 billion by 2033, exhibiting a CAGR of 74.7%.

- In 2023, Level 5 Autonomy dominated the market, reflecting advancements in fully autonomous vehicle technology.

- In 2023, Cars were the leading vehicle type, indicating their early adoption for passenger transport services.

- In 2023, Electric Propulsion was the dominant propulsion type, driven by the focus on electric vehicle development and environmental policies.

- In 2023, LiDAR led the component type segment, offering superior accuracy in autonomous navigation systems.

- In 2023, the Asia-Pacific region held a 39.2% market share, amounting to USD 0.72 billion, supported by strong government initiatives and investments.

Market Segmentation Overview

Level of Autonomy

Level 5 autonomy leads the segment as full automation capabilities redefine mobility. Moreover, its sophisticated AI decision-making replicates human reasoning, enabling safe navigation in all conditions and boosting adoption across urban networks.

Level 4 autonomy remains essential but secondary, offering high automation with limited human oversight. Additionally, it advances pilot deployments, yet Level 5 continues to dominate due to its transformative, driverless operational benefits.

Vehicle Type

Cars dominate robotaxi deployment because of their adaptability, maneuverability, and strong consumer acceptance. Furthermore, they integrate efficiently with autonomous platforms, supporting widespread commercialization across dense and suburban regions.

Shuttles and vans contribute to niche applications, including airport circuits and campus mobility. Moreover, their higher capacity aids group transport, though their utilization remains narrower than the versatility offered by cars.

Propulsion Type

Electric propulsion prevails as sustainability and energy efficiency drive vehicle development. Additionally, global emission mandates encourage electric robotaxi adoption, complementing smart-city environmental agendas.

Fuel cell propulsion emerges gradually, offering quick refueling and extended range. However, infrastructure limitations still constrain its scalability, keeping electric propulsion firmly in the lead.

Component Type

LiDAR dominates component demand due to its unmatched precision in mapping, detection, and 360-degree situational awareness. Consequently, it becomes indispensable for reliable and safe autonomous navigation.

Cameras, radar, and ultrasonic sensors support auxiliary perception functions. Moreover, these systems enhance depth analysis, object detection, and short-range safety, strengthening overall sensor fusion.

Application Type

Passenger transport holds the largest share as urban users increasingly prefer automated, convenient, and cost-efficient mobility. Additionally, robotaxis improve accessibility and reduce commuting burdens across growing metropolitan areas.

Goods transport expands gradually, benefiting from automation advancements. Furthermore, it remains an emerging domain where logistics integration continues to build momentum.

Drivers

Growing need to reduce traffic congestion: Rapid urbanization intensifies mobility challenges, prompting cities to adopt robotaxis for optimized routing and reduced vehicle density. These autonomous fleets minimize travel time and improve overall flow, supporting smarter transportation planning.

Shift toward eco-friendly and cost-effective mobility: Robotaxis powered by electric propulsion significantly cut emissions while delivering affordable public transport alternatives. As consumers prioritize greener solutions, adoption accelerates alongside government-backed sustainability initiatives.

Use Cases

Urban ride-hailing automation: Robotaxis provide efficient, on-demand transportation without human drivers. They reduce operational costs, enhance safety, and deliver consistent travel experiences, making them ideal for densely populated cities.

Mobility in controlled environments: University campuses, business parks, and airports deploy autonomous shuttles to streamline internal transport. These controlled settings enable fast implementation, demonstrating the reliability of autonomous systems.

Major Challenges

High development and operational costs: Technologies such as LiDAR, AI compute units, and long-range batteries require major investments. These expenses slow scalability and increase entry barriers for emerging market participants.

Regulatory and safety complexities: Global governments enforce strict standards for autonomous vehicle approval. Navigating safety frameworks, compliance protocols, and public trust issues remains a major industry obstacle.

Business Opportunities

Expansion enabled by 5G connectivity: High-speed networks support advanced V2X communication, real-time analytics, and enhanced autonomous decision-making. Companies can leverage this infrastructure to improve fleet performance and extend deployment zones.

Growth in emerging economies: Densely populated countries offer vast market potential for cost-efficient robotaxi fleets. With rising urban mobility demands, investments in infrastructure and awareness campaigns unlock new adoption pathways.

Regional Analysis

Asia Pacific leads global adoption: With a market share of 39.2%, the region benefits from fast urbanization, supportive policies, and strong manufacturing ecosystems. China, Japan, and South Korea accelerate innovation and large-scale testing programs.

North America and Europe strengthen regulatory and technological momentum: Major tech hubs and automakers drive continuous R&D, while progressive safety regulations enable pilot expansions. These regions remain pivotal in shaping global robotaxi standards.

Recent Developments

- In November 2024, WeRide unveiled its next-generation GXR Robotaxi platform, integrating 1,800+ days of operational experience with advanced Level 4 autonomous systems.

- In November 2024, Baidu received approval to test Apollo Go autonomous vehicles in Hong Kong’s North Lantau region, with trials running until December 2029.

- Uber announced major autonomous ride-hailing expansions, integrating Waymo vehicles into its platform in Austin and Atlanta starting early 2025, alongside new collaborations with Cruise.

Conclusion

The global robotaxi market enters a transformative decade driven by automation, sustainability, and technological innovation. As industry collaborations intensify and regulatory frameworks mature, robotaxis will redefine future mobility ecosystems. With accelerating adoption and strong regional investments, the sector stands poised for sustained growth and widespread commercial deployment.