Quick Navigation

Overview

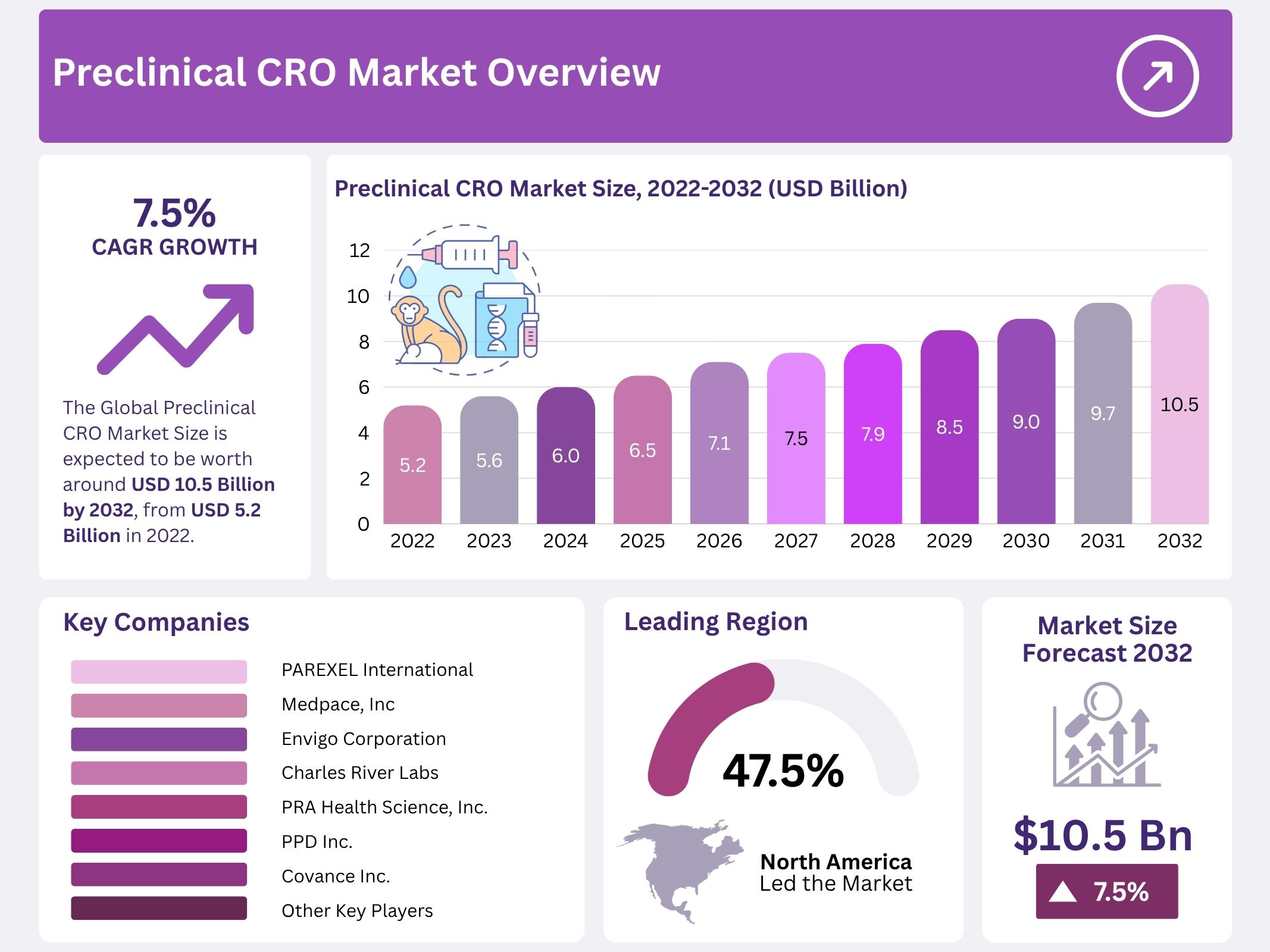

The global preclinical CRO market is projected to reach USD 10.5 billion by 2032, rising from USD 5.2 billion in 2022. Growth has been driven by steady expansion in pharmaceutical pipelines and the increasing volume of early-stage drug candidates. The sector has benefited from heightened reliance on outsourced research as smaller biotechnology firms continue to lack in-house laboratory capacity. As a result, the demand for external partners equipped to manage toxicology, pharmacology, and analytical studies has strengthened.

Market expansion has also been supported by the need to shorten development timelines. Competitive pressures and accelerated approval pathways have encouraged companies to reduce the time spent on preclinical testing. Outsourcing has provided access to trained staff, standardized workflows, and established infrastructure. These advantages have enabled drug developers to allocate internal resources more efficiently while delegating routine and complex studies to specialized CROs capable of meeting rapid turnaround requirements.

Regulatory expectations have become more rigorous, particularly concerning safety documentation and Good Laboratory Practice compliance. CROs with strong quality systems and validated processes have been preferred because they help reduce operational risk. The rising use of advanced therapeutics, including biologics, cell therapies, and gene-based products, has further increased the value of providers with expertise in complex study models. This shift has supported broad adoption of outsourced partnerships in sophisticated research settings.

The growing prevalence of chronic diseases has stimulated global research investment. Increased funding for drug discovery has generated consistent demand for early evaluation services. Technological advancements, including automation, digital platforms, and refined non-animal testing models, have also improved operational efficiency across CROs. These developments have strengthened the cost-effectiveness of outsourcing and have contributed to the continued expansion of the preclinical services landscape.

Geographic diversification has emerged as a strategic approach for many pharmaceutical companies. Multi-regional outsourcing has been used to control costs, improve study throughput, and access specialized expertise available across different markets. Emerging regions have provided competitive pricing advantages, while established scientific hubs have ensured high-quality research standards. This balanced global ecosystem has supported the long-term growth of the preclinical CRO sector and reinforced its role in modern drug development.

Key Takeaways

- The market was projected by an independent observer to expand from USD 5.2 billion in 2022 to nearly USD 10.5 billion by 2032 at a 7.5% CAGR.

- A third-party assessment noted that toxicology testing contributed the highest revenue in 2022, establishing it as the leading service category within the sector.

- Industry evaluation indicated that Patient-Determined Organoid (PDO) models dominated the model type segment, representing approximately 80% of total market share.

- External reviewers highlighted that pharmaceutical and biopharmaceutical organizations accounted for the largest end-user share, reflecting strong reliance on outsourced preclinical research activities.

- Independent market observation identified North America as the leading regional contributor in 2022, capturing nearly 47.50% of the global market.

- Analysts observing regional dynamics suggested that Asia Pacific is positioned for significant expansion, supported by a notably strong CAGR throughout the forecast period.

Regional Analysis

North America accounted for the largest share of 47.50% in 2022. This dominance was driven by the presence of established CROs with strong expertise in early-stage drug discovery. Major organizations such as Charles River Laboratories and LabCorp supported consistent outsourcing activity. The region benefited from a mature research ecosystem and advanced regulatory guidance. The market expansion was supported by high investments in drug development and the steady adoption of outsourcing models. These factors strengthened North America’s position in the global preclinical services landscape.

The U.S. represented the core of this regional strength. Many biopharmaceutical companies preferred outsourcing their preclinical studies to CROs located in the U.S. This preference was primarily associated with support in preparing Investigational New Drug applications required by the Food and Drug Administration. The availability of specialized services and advanced laboratory infrastructure increased the attractiveness of U.S.-based outsourcing partners. As a result, sustained demand for high-quality preclinical testing contributed to the country’s leading role in the global market.

Asia Pacific was expected to grow at the fastest rate of 10.9% during the forecast period. The rise in outsourcing by multinational companies and the increasing cost of research activities encouraged a shift toward cost-efficient CROs in India and China. The region offered competitive pricing and expanding scientific capabilities. Companies from Western Europe and the U.S. increasingly sought analytical services, site research support, and clinical development activities in Asia Pacific. This trend reduced research expenses and supported rapid expansion of the region’s preclinical outsourcing market.

Segmentation Analysis

Toxicology testing represents the largest portion of the global preclinical CRO market. Its growth is supported by the essential role it plays in screening new drug candidates before human trials. The process assesses safety, efficacy, and potential toxic effects. Demand has been rising as organizations expand their service portfolios in toxicology. This expansion has been driving the overall market. Bioanalysis and DMPK studies are also gaining traction. Their rising demand is linked to the need for pharmacokinetic support in IND-enabling studies.

Bioanalysis and DMPK services are expected to record a CAGR of 8.5% during the forecast period. Their importance spans all stages of drug development. These studies help researchers evaluate drug absorption, metabolism, and elimination. They are not confined to the preclinical phase. This broad applicability has supported strong segment growth. Rising requirements for pharmacokinetic data in toxicology studies further strengthen demand. Continued integration of these services into drug development workflows has contributed to a favorable outlook and steady market expansion across therapeutic pipelines.

The Patient-Derived Organoid (PDO) model segment held 80.47% of the market in 2022. Its dominance is attributed to the use of patient-derived tissues that support personalized healthcare. These samples can be cryopreserved and used for faster diagnosis. Patient-Derived Xenograft (PDX) models are also expanding. Growth is driven by CROs maintaining in-house stocks of immune-deficient mice. PDX models preserve the genetic profile of tumors. Their clinical relevance improves the prediction of patient responses. This relevance supports safer drug evaluation and facilitates regulatory progression.

Key Market Segments

By Service

- Toxicology Testing

- Safety Pharmacology

- Drug Metabolism

- Pharmacokinetics

- IND Programs

- Other Services

By Model Type

- Patient Derived Organoid (PDO) Model

- Patient Derived Xenograft Model

By End-User

- Pharmaceutical and Biopharmaceutical companies

- Medical Device manufacturing companies

- Academic Research Organizations

- Other End Users

Key Players Analysis

The competitive landscape in the preclinical CRO market has been shaped by rapid strategic expansion and a strong focus on service differentiation. Market growth has been driven by the rising need for reliable research support across pharmaceuticals and medical devices. Companies have adopted structured approaches to strengthen their market share. These approaches include acquisitions, technology upgrades, and targeted collaborations. This environment has created a fragmented but highly active market where global and regional players compete to secure long-term partnerships and broaden their operational capabilities.

Acquisition activities have played a key role in strengthening the position of major service providers in this industry. The growth of several companies has been supported through structured investments in specialized research organizations. One such example includes the acquisition of Toxikon Corporation by Labcorp in December 2021. This step expanded its preclinical service offerings and reinforced its position across pharmaceuticals and medical devices. Similar actions by other companies indicate that acquisitions remain essential for expanding technical expertise and improving global reach.

Collaborative ventures have further contributed to market expansion by enabling access to advanced technologies and wider research capabilities. Strategic alliances are used to enhance service innovation and strengthen competitive positioning. An example is the partnership formed between Eurofins Scientific and Combination Antibodies in August 2021. This collaboration aims to support improved antibody development for multiple diseases through advanced platforms. Such partnerships demonstrate how leading companies rely on shared expertise to deliver efficient outcomes and maintain relevance in a market driven by scientific advancement.

The market includes several established companies that maintain strong global operations and extensive research infrastructures. These participants have secured significant presence through consistent service expansion and broad client networks. Key companies active in this industry include PAREXEL International Corporation, Laboratory Corporation of America Holdings, Medpace Inc., Envigo Corporation, Charles River Laboratories, PRA Health Science Inc., PPD Inc., and Covance Inc. Their combined efforts have contributed to the overall development of the preclinical CRO market and continue to influence competitive dynamics across regions.

Leading Market Players

- PAREXEL International Corporation

- Laboratory Corporation of America Holdings

- Medpace, Inc.

- Envigo Corporation

- Charles River Labs

- PRA Health Science, Inc.

- PPD Inc.

- Covance Inc.

- Other Key Players.

Conclusion

The preclinical CRO market is expected to remain on a steady growth path as demand for outsourced research continues to rise. Expansion has been supported by the strong need for safety testing, advanced study models, and specialized scientific expertise. Pharmaceutical and biotechnology companies are relying more on external partners to reduce development time and improve research quality. The shift toward complex therapies has further increased the value of skilled CROs with broad capabilities. Advancements in technology and wider global access to research services are strengthening the overall ecosystem. As a result, preclinical service providers are positioned to play a central role in future drug development activities.