Quick Navigation

Overview

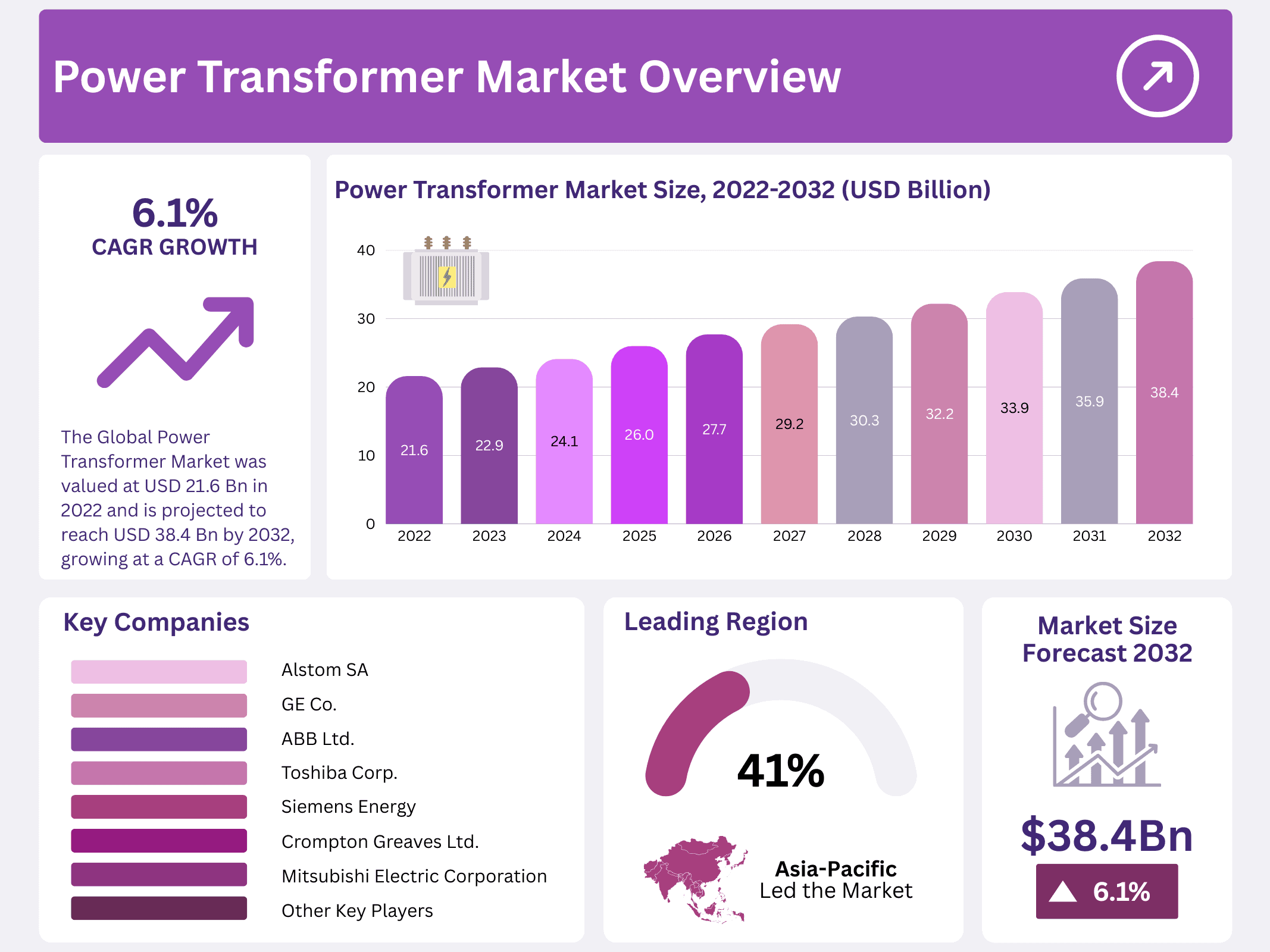

New York, NY – February 06, 2026 – The Global Power Transformer Market was valued at USD 21.6 billion in 2022 and is projected to reach USD 38.4 billion by 2032, reflecting a strong CAGR of 6.1% from 2023 to 2032. This steady expansion highlights the rising need for reliable power systems as industries, commercial facilities, and households continue to increase their energy consumption worldwide.

Power transformers form a crucial segment of the broader electrical equipment industry, supporting the transmission and distribution of electricity across vast networks. These devices transfer electrical energy between circuits—primarily stepping voltage levels up or down—to ensure safe, stable, and efficient power delivery. Their relevance is growing as utilities modernize aging grids and adopt advanced transformer designs that offer higher efficiency, reduced energy losses, and improved operational reliability.

The Asia-Pacific region is expected to dominate market growth over the next decade, driven mainly by rapid economic development in China and India. These countries are witnessing major investments in power infrastructure, expanding industrial output, and rising residential electricity consumption. As a result, the APAC region is positioned to remain the leading hub for power transformer demand in the foreseeable future.

Key Takeaways

- The Global Power Transformer Market was valued at USD 21.6 billion in 2022 and is projected to reach USD 38.4 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

- The Shell Core segment holds the leading 42.7% market share, favored for its cost efficiency, cooling performance, short-circuit resistance, and magnetic flux control.

- Oil-insulated transformers dominated in 2022 with a 58.4% share, thanks to excellent high-temperature performance and superior dielectric properties.

- Three-phase transformers command a 63.7% market share, driven by their efficiency, compact design, cost-effectiveness, and suitability for industrial load distribution.

- The 101–500 MVA capacity range leads with 62.8% share, fueled by strong demand in industrial, distribution, and high-energy sectors amid rising global consumption.

- The Industrial sector is the largest end-user with a 43.8% share, supported by the need for reliable power, smart transformer adoption, and heavy infrastructure investments.

- Asia-Pacific holds the top regional position with 41.2% revenue share in 2022, led by rapid industrialization, urbanization, and major grid investments (especially in China).

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 21.6 Billion |

| Forecast Revenue (2032) | USD 38.4 Billion |

| CAGR (2023-2032) | 6.1% |

| Segments Covered | By Core (Shell, Closed, and Berry), By Insulation (Gas, Oil, Solid, and Air), By Phase (Three, and Single), By Rating (Below 100 MVA, 101 To 500 MVA, 501 To 800 MVA, and Above 800 MVA), By Application (Industrial, Residential & Commercial, and Utilities) |

| Competitive Landscape | Mitsubishi Electric Corporation, Alstom SA, Hyosung Power & Industrial Systems Performance Group, Crompton Greaves Ltd., GE Co., Hyundai Heavy Industries Co. Ltd., Siemens Energy, ABB Ltd., Toshiba Corp., Bharat Heavy Electricals Limited, Other Key Players |

Key Market Segments

By Core

The Shell Core Segment Holds a Significant Share in the Power Transformer Market

The Shell Core segment leads with a 42.7% market share, driven by its suitability for both electronic circuits and low-voltage systems. Shell core transformers are widely preferred because their square or rectangular cross-section design helps reduce circuit costs while enhancing adaptability. They offer notable advantages such as improved cooling efficiency, strong short-circuit resistance, and superior magnetic flux control, making them a durable and reliable option for modern electrical networks.

These cores are now the most commonly used magnetic type in power transformers due to their low noise, high efficiency, and capability to handle high voltages and currents. Their relatively simple manufacturing process and solid magnetic properties make closed cores an attractive choice for transformer manufacturers looking to optimize performance and reduce production complexity.

By Insulation

Oil Segment Accounted for the Largest Revenue Share in 2022

The Oil-insulated segment dominated the market in 2022 with a 58.4% share. Oil insulation remains widely used due to its ability to perform reliably under high temperatures while offering strong dielectric properties that minimize voltage-related damage. The use of oil-based insulation is common in high-voltage transformers, fluorescent lamp ballasts, and high-voltage switchgear, making it the preferred choice for manufacturers across multiple applications.

Solid Insulation Segment to Register Fastest Growth

The solid insulation segment is driven by increasing demand for safer, environmentally friendly alternatives. Solid-insulated transformers provide advantages such as reduced fire risk, lower maintenance needs, and improved performance in harsh environmental conditions. Their coolant-free design eliminates the risk of oil spills while offering longer operational lifespans, making them ideal for applications prioritizing safety and sustainability.

By Phase Analysis

Three-Phase Segment Holds a Significant Share in the Market

The Three-Phase segment leads with a 63.7% market share, thanks to its efficiency, compact size, and lower cost relative to single-phase alternatives. Three-phase transformers are preferred for industrial applications due to their effective load distribution, superior isolation, and strong interference suppression. Their customizable design and ability to support low-voltage distribution with high fluctuation conditions further expand their adoption across diverse industries.

By Rating Analysis

101 MVA to 500 MVA Segment Accounted for the Largest Revenue Share

The 101–500 MVA category dominates with a 62.8% share, owing to high demand across industrial sectors, power distribution networks, and motor-driven equipment. Growing global energy consumption—driven by rapid urbanization and industrial expansion—continues to increase the need for transformers in this range. Advancements in design and technology have further strengthened their efficiency and applicability.

The 501–800 MVA segment is set to record the fastest growth, supported by rising demand for large-scale transformers in power generation, transmission systems, and renewable energy projects. These high-capacity transformers reduce transmission losses, improve system efficiency, and are engineered to operate at elevated voltages, making them essential for large power plants and long-distance energy transport.

By Application Analysis

Industrial Segment Holds a Significant Share in the Application Market

The Industrial Segment leads with a 43.8% market share, driven by the rising need for safe, reliable, and uninterrupted electricity use in heavy industries. The adoption of smart transformers has further accelerated industrial usage by enhancing efficiency, safety, and control. Strong global investments in energy infrastructure, industrial expansion, and urban development continue to boost demand for advanced power transformers across manufacturing, processing, and utility sectors.

Regional Analysis

The Asia-Pacific region held the leading position in the global power transformer market in 2022, accounting for 41.2% of total revenue. This dominance is driven by rapid economic expansion, population growth, and the rising need for a reliable, uninterrupted power supply. China, in particular, continues to invest heavily in expanding and modernizing its transmission and distribution networks to support its fast-paced industrialization and urbanization.

The region’s economic momentum, coupled with increasing electricity consumption across residential, commercial, and industrial sectors, is accelerating the demand for high-performance power transformers. Strong government-led investments—especially in China’s grid modernization initiatives—are further strengthening the region’s position as a key growth hub in the global power transformer industry.

Top Use Cases

- In electricity transmission networks, power transformers step up voltage from power plants to enable efficient long-distance delivery with minimal energy loss. They then step down the voltage at substations for safe distribution to homes and businesses, ensuring a reliable power supply across vast grids and supporting urban expansion.

- For renewable energy sources like solar farms and wind turbines, power transformers convert generated low-voltage power to higher levels suitable for grid integration. This helps in reducing transmission losses and stabilizing inconsistent output from renewables, making clean energy more viable for widespread adoption.

- In manufacturing industries such as steel and cement plants, power transformers adjust voltage for heavy machinery like furnaces and grinders. They ensure stable power flow, protect equipment from surges, and improve operational efficiency, allowing factories to run continuously without costly interruptions.

- Commercial buildings, including offices and shopping malls,s use power transformers to lower high grid voltage for everyday systems like lighting and air conditioning. This provides consistent electricity, enhances safety for occupants, and supports modern amenities that drive business productivity and customer comfort.

- In the oil and gas sector, power transformers supply adapted voltage to remote sites like drilling rigs and refineries. They enable reliable operation of pumps and compressors in harsh environments, boosting energy extraction efficiency and minimizing downtime in critical resource production.

Recent Developments

1. Hyundai Heavy Industries Co. Ltd.

- Hyundai Electric (spun off from HHI) is advancing eco-friendly transformers, focusing on biodegradable ester oil and low-noise designs. They are expanding production to meet global grid modernization demands, particularly for HVDC and renewable integration projects, enhancing grid stability and efficiency.

2. Siemens Energy

- Siemens Energy is integrating digitalization with its transformer portfolio through platforms like SenseFormer. This uses embedded sensors for real-time condition monitoring and predictive maintenance. The company is also advancing high-voltage direct current (HVDC) transformer technology for long-distance renewable energy transmission.

3. ABB Ltd.

- ABB is a leader in sustainable transformer solutions, promoting ester-based and dry-type transformers to eliminate mineral oil. Their ABB Ability transformer monitoring provides advanced analytics. Recently, they secured orders for ultra-high-voltage transformers to support grid interconnections and large-scale solar projects across Asia and Europe.

4. Toshiba Corp.

- Toshiba Energy Systems & Solutions Corporation is developing next-generation transformers with enhanced fire safety using less-flammable insulating materials. They are also working on compact, high-capacity models for urban substations and have supplied large transformers for major thermal and nuclear power plants in Japan and Southeast Asia.

5. Bharat Heavy Electricals Limited (BHEL)

- BHEL is indigenously developing and manufacturing ultra-high-voltage AC transformers, a key milestone for India’s transmission network. They are also focusing on green transformers with lower losses and have recently commissioned several units for substation projects under India’s grid strengthening initiatives.

Conclusion

Power transformers are essential pillars in modern energy systems, driving efficiency across transmission, renewables, and industries. With growing demands for sustainable power and infrastructure upgrades, these devices offer strong opportunities for innovation, helping meet global energy needs while supporting economic growth in diverse sectors.