Quick Navigation

Overview

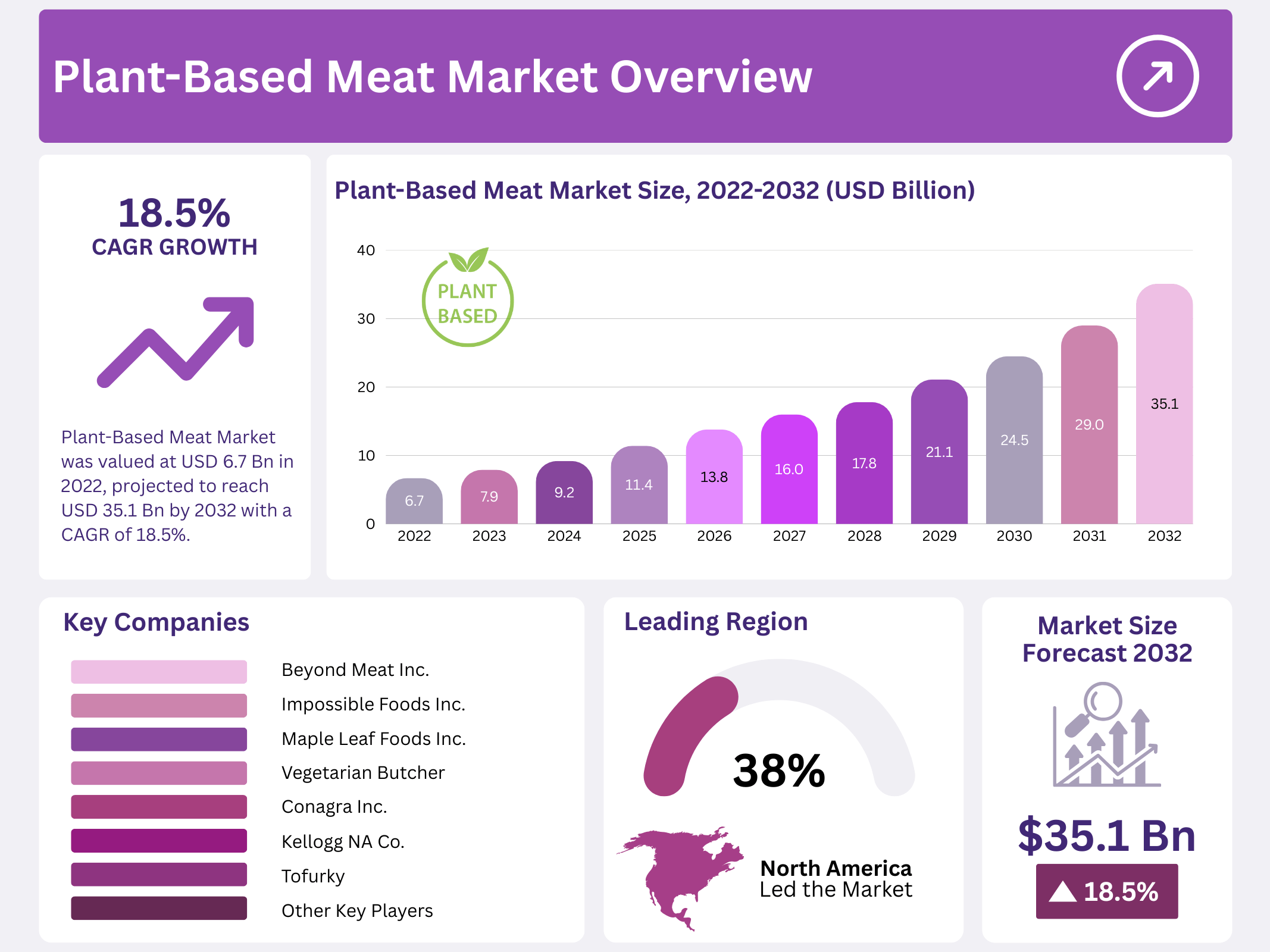

New York, NY – September 22, 2025 – The Global Plant-Based Meat Market is experiencing significant growth, driven by increasing consumer demand for healthier and more sustainable food options. Valued at approximately USD 6.7 billion in 2022, the market is projected to reach around USD 35.1 billion by 2032, reflecting a compound annual growth rate (CAGR) of 18.5% during the forecast period.

This expansion is fueled by rising health consciousness, environmental concerns, and shifting dietary preferences toward plant-based diets. Technological advancements in food processing and increased product availability in retail outlets have further contributed to the market’s growth. The popularity of plant-based meat is evident in the growing number of product offerings and the expansion of distribution channels, including supermarkets, online platforms, and foodservice establishments.

Opportunities for market expansion exist in emerging regions, where awareness of plant-based diets is increasing, and in product innovation to cater to diverse consumer tastes and preferences. Despite challenges such as higher price points and taste perceptions, the plant-based meat market continues to evolve, presenting substantial opportunities for growth and innovation in the coming years.

Key Takeaways

- The Global Plant-Based Meat Market was valued at USD 6.7 billion in 2022, projected to reach USD 35.1 billion by 2032 with a CAGR of 18.5%.

- Soy-based meat held the largest revenue share of 46% in 2022, driven by its rich amino acid content.

- Plant-based chicken dominated with a 35% market share in 2022, popular in patties, cutlets, and nuggets.

- Burger patties led the product type segment with a 30% market share in 2022.

- Frozen plant-based meat products held a 55% market share in 2022, fueled by demand for innovative vegetarian options.

- HoReCa (hotels, restaurants, cafés) was the dominant end-user segment with a 58% market share in 2022.

- North America led with a 38.5% revenue share in 2022, driven by rising veganism and awareness of contaminated meat risks.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 6.7 Billion |

| Forecast Revenue (2032) | USD 35.1 Billion |

| CAGR (2023-2032) | 18.5% |

| Segments Covered | By Source- Soy, Pea, Wheat, Blends, And Other Sources; By Meat Type – Chicken, Pork, Beef, Fish, and Other Meat Types; By Product Type- Burgers, Patties, Sausages, Strips & Nuggets, Meatballs, Other Product Types; By Storage- Refrigerated, Frozen, and Shelf-Stable; By End-User- HoReCa, Food Industry, and Households. |

| Competitive Landscape | Beyond Meat Inc., Impossible Foods Inc., Maple Leaf Foods Inc., Vegetarian Butcher, Conagra Inc., Kellogg NA Co., Marlow Foods Ltd., Amy’s Kitchen Inc., Tofurky, Gold&Green Foods Ltd., Dr. Praeger’s Sensible Foods, VBites Foods Ltd., LikeMeat GmbH, Lightlife Foods Inc., Trader Joe’s, The Hain-Celestial Canada ULC, Marlow Foods Ltd., Ojah B.V., Eat Just Inc., No Evil Foods, and Other Key Players. |

Key Market Segments

Source Analysis

Soy-Based Meat Leads with Largest Market Share

The plant-based meat market is segmented by source into soy, pea, wheat, blends, and others, with soy-based meat commanding the largest global revenue share of 46% in 2022. Soy’s high amino acid content (BCAAs), low calories, and nutrients like vitamin B1, vitamin B, folic acid, iron, potassium, and pantothenic acid drive its demand.

With low fat, high dietary fiber, and zero cholesterol, soy meat supports exercise performance, muscle recovery, and muscle building while offering a lower carbon footprint and reduced formulation costs compared to animal-based meat. The pea-based meat segment is projected to grow at the fastest CAGR during the forecast period, attributed to its high protein, energy, folate, iron, and fiber content with lower saturated fats than ground beef.

Meat Type Analysis

Plant-Based Chicken Dominates Market Share

The market is divided by meat type into chicken, pork, beef, fish, and others, with plant-based chicken holding the largest revenue share of 35% in 2022. Its popularity stems from being a key ingredient in products like patties, cutlets, and nuggets, offering similar protein and nutrient levels to traditional chicken but without high animal fats and cholesterol. The plant-based pork segment is expected to see the fastest CAGR, driven by its rising popularity and composition from pea protein and soy, which provide high protein, fiber, and zero cholesterol with low fat.

Product Type Analysis

Burger Patties Lead with Largest Market Share

By product type, the market includes burgers, patties, sausages, strips & nuggets, meatballs, and others, with burger patties leading at a 30% market share in 2022. Plant-based burgers, made from soy and pea protein, offer rich nutrition, a meat-like “bleeding” texture, aroma, and diverse flavors, with 35% less fat and lower cholesterol than beef burgers. The plant-based sausage segment is anticipated to grow at the fastest CAGR, fueled by innovative juicy alternatives from companies like Beyond Meat and Lightlife Foods.

Storage Analysis

Frozen Plant-Based Meat Holds Largest Market Share

The market is segmented by storage into refrigerated, frozen, and shelf-stable, with frozen plant-based meat leading at a 55% revenue share in 2022. The demand for innovative vegetarian products drives this segment, as frozen options maintain nutritional value, taste, odor, and texture for six to eight months while protecting against microorganisms. The refrigerated segment is expected to grow at the fastest CAGR due to rising demand in the food and beverage industry.

End-User Analysis

HoReCa Sector Dominates Market Share

By end-user, the market is categorized into HoReCa (hotels, restaurants, cafés), food industry, and household, with HoReCa leading at a 58% revenue share in 2022. The growing popularity of vegan and healthy foods drives demand, as restaurants, hotels, and fast-food chains increasingly offer meat-free options. Rising consumer spending on celebrations at restaurants and luxury hotels further boosts this segment. The food industry is projected to grow at the fastest CAGR due to increasing demand for packaged, ready meals.

Regional Analysis

North America Leads the Global Plant-Based Meat Market

In 2022, North America dominated the global plant-based meat market, capturing the largest revenue share of 38.5%. The region’s market growth is largely driven by rising consumer awareness about the health risks associated with contaminated meat products. Increasingly, consumers are adopting plant-based and flexitarian diets as part of their daily routine. Additionally, the growing popularity of veganism in North America is expected to further accelerate market demand and support sustained growth in the coming years.

Top Use Cases

- Health-Conscious Diets: Many people switch to plant-based meat to cut down on fats and cholesterol from regular meat, helping with heart health and weight control. It fits well in everyday meals like salads or wraps, giving a tasty protein boost without the guilt. As more folks aim for balanced eating, this option appeals to busy families seeking simple, nutritious swaps that keep meals exciting and varied.

- Environmental Sustainability: Plant-based meat helps lower the carbon footprint by using fewer resources like water and land than farming animals. It’s a smart choice for eco-aware shoppers who want to support greener food choices without changing their favorite recipes. This use case shines in home cooking, where it reduces waste and promotes a healthier planet for future generations.

- Flexitarian Lifestyles: For those eating mostly plant foods but enjoying meat occasionally, plant-based versions offer a flexible bridge. They mimic the flavor and texture of beef or chicken, making it easy to mix into stir-fries or tacos. This appeals to casual diners exploring less meat, helping them feel satisfied while gradually building more veggie-forward habits.

- Restaurant and Foodservice Innovation: Chefs in cafes and fast-food spots use plant-based meat to create menu items like burgers or nuggets that draw in diverse crowds. It broadens appeal to vegans and curious eaters alike, boosting customer visits. This use case drives fresh ideas, like spicy wings or patties, turning eateries into hubs for modern, inclusive dining experiences.

- Vegan and Vegetarian Staples: Dedicated plant-eaters rely on these products for hearty mains like sausages or meatballs in pasta dishes. Made from peas or soy, they deliver protein and chew without animal ingredients. This core use case supports full vegan routines, making holidays or weeknights feel complete with familiar comforts reimagined in a cruelty-free way.

Recent Developments

1. Beyond Meat Inc.

Beyond Meat is focusing on health and cost, launching its revamped, nutrient-dense Beyond IV platform. This includes the new Beyond Burger and Beyond Beef, featuring avocado oil for improved fat profiles and less sodium. The reformulation aims to address consumer demands for cleaner ingredients and better nutrition while competing on taste with traditional meat.

2. Impossible Foods Inc.

Impossible Foods recently launched its much-anticipated Impossible Chicken Nuggets and Patties in retail, expanding beyond foodservice. The company is also pushing international growth, entering Australia and New Zealand. Their focus remains on innovating products that directly compete with animal meat on taste and texture, believing this is key to converting mainstream consumers and achieving their mission.

3. Maple Leaf Foods Inc.

Through its Greenleaf Foods division, Maple Leaf expanded its leading Lightlife brand with new products like Plant-Based Chick’n Fillets and Breakfast Patties. The company is navigating a challenging market but remains committed to long-term growth, emphasizing its integrated manufacturing advantage and focus on core, popular products to maintain its strong position in the North American retail market.

4. Vegetarian Butcher

The Vegetarian Butcher (owned by Unilever) is a key player in foodservice, recently partnering with Hard Rock Cafe to roll out its plant-based burgers across European locations. The brand continues its global expansion, particularly in Asia and Latin America, and is innovating with products like plant-based seafood alternatives, leveraging Unilever’s extensive distribution network to reach a wide array of restaurants and retailers.

5. Conagra Inc. (Gardein Brand)

Conagra Brands is innovating within its Gardein line, launching new offerings like the Ultimate Plant-Based Lasagna Bowl and Soup Bites to tap into convenient meal and snack occasions. The company leverages its strength in frozen food to provide accessible, easy-to-prepare options, focusing on variety and flavor to attract flexitarian consumers looking for quick, familiar plant-based meals.

Conclusion

Plant-Based Meat is carving out a strong spot in today’s food world, fueled by smarter eaters who value wellness, kindness to animals, and a lighter touch on the earth. It’s not just a fad; it’s reshaping kitchens and menus with tasty stand-ins that feel familiar yet fresh. Expect wider shelves in stores and eateries, pulling in more everyday folks eager for easy, guilt-free meals. This shift promises a brighter, more balanced future for how we nourish ourselves and our planet, one bite at a time.