Quick Navigation

Introduction

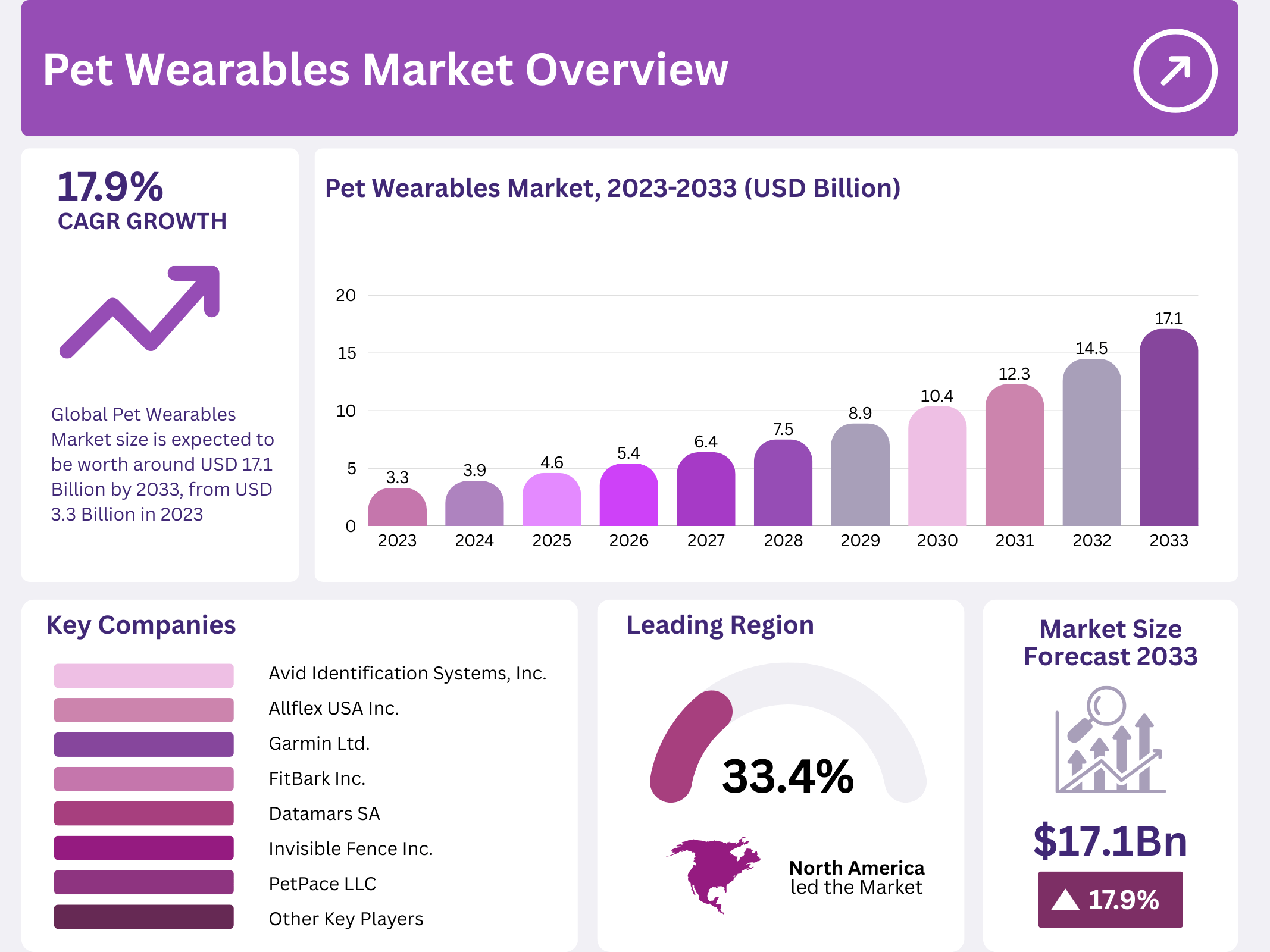

The global Pet Wearables Market is entering a strong expansion phase, supported by rapid digital adoption in pet care. As pet owners increasingly prioritize preventive healthcare, wearable technologies are emerging as essential tools. Consequently, demand is accelerating across tracking, health monitoring, and safety applications worldwide.

Moreover, rising pet humanization trends are reshaping consumer behavior. Pets are now considered family members, encouraging higher spending on health-focused products. As a result, smart collars, GPS trackers, and health-monitoring devices are becoming mainstream solutions rather than niche accessories.

In parallel, technological innovation continues to redefine product capabilities. Advanced sensors, RFID systems, and GPS connectivity are enabling real-time data collection and actionable insights. Therefore, pet wearables are evolving from simple tracking devices into integrated health management platforms.

Additionally, market growth is reinforced by expanding veterinary digitalization. Telehealth services increasingly rely on wearable-generated data for remote diagnosis and monitoring. This integration strengthens the value proposition of pet wearables for both consumers and veterinary professionals.

Furthermore, regional dynamics play a significant role in shaping adoption rates. Developed markets benefit from higher disposable incomes and strong awareness, while emerging regions present untapped growth potential. Consequently, manufacturers are actively expanding global distribution and pricing strategies.

Overall, the Pet Wearables Market is positioned for sustained growth, driven by innovation, lifestyle shifts, and rising healthcare awareness. As technology matures, the market is expected to transition toward comprehensive, data-driven pet wellness ecosystems.

Key Takeaways

- The market was valued at USD 3.3 Billion in 2023 and is projected to reach USD 17.1 Billion by 2033, growing at a CAGR of 17.9%.

- RFID technology led the market with a share of 43.6% in 2023.

- Smart Collars dominated the product segment, accounting for 60.4% of total demand.

- Identification & Tracking remained the leading application with 60.2% share.

- North America held the largest regional share at 33.4%, valued at USD 1.10 Billion.

Market Segmentation Overview

By technology, RFID systems dominate due to their reliability and cost efficiency. They enable seamless identification and proximity-based tracking, which is particularly valuable in urban settings. As adoption increases, RFID integration with sensors and GPS is further enhancing overall device functionality.

By product type, Smart Collars lead the market because of their multifunctional design. These devices combine tracking, health monitoring, and identification into a single wearable. Consequently, they appeal to a broad consumer base seeking convenience and comprehensive pet management solutions.

By application, Identification & Tracking represents the core use case. It addresses critical concerns related to pet safety and loss prevention. Moreover, this segment acts as a foundation for advanced applications such as medical diagnostics and behavioral monitoring.

Drivers

Rising pet ownership is a primary growth driver. As more households adopt pets, spending on health and safety solutions increases. Consequently, wearable technologies are gaining traction as proactive tools for monitoring daily activity and overall wellness.

Technological advancements further accelerate market growth. Improvements in sensors, GPS accuracy, and data analytics have enhanced device reliability. Therefore, pet owners are increasingly confident in adopting wearables for real-time insights and preventive care.

Use Cases

Pet wearables are widely used for real-time location tracking. GPS-enabled collars help owners quickly locate lost pets, reducing recovery time. This use case remains highly relevant, particularly for outdoor pets and urban environments.

Health monitoring is another critical application. Wearables track vital signs, activity levels, and sleep patterns. As a result, early detection of health anomalies becomes possible, supporting timely veterinary intervention.

Major Challenges

High device costs remain a key challenge, especially in price-sensitive regions. Premium features often increase retail prices, limiting adoption among budget-conscious consumers. Consequently, affordability continues to influence purchasing decisions.

Battery life limitations also restrict usability. Frequent charging requirements may discourage continuous use. Therefore, manufacturers face ongoing pressure to improve power efficiency without compromising performance.

Business Opportunities

Emerging markets present substantial growth opportunities. Increasing urbanization and rising disposable incomes are expanding the pet owner base. As awareness improves, demand for affordable wearable solutions is expected to rise.

Integration with smart home and IoT ecosystems offers another opportunity. Connected platforms enhance user experience by centralizing pet data. This creates potential for subscription-based services and recurring revenue models.

Regional Analysis

North America leads the market due to high pet ownership and strong technology adoption. Consumers in the region actively invest in advanced pet healthcare solutions, supporting sustained demand for premium wearables.

Asia Pacific is witnessing rapid growth driven by urban pet adoption and rising income levels. Countries such as China and Japan are increasingly embracing smart pet technologies, strengthening regional market expansion.

Recent Developments

- In March 2024, PetPace launched an AI-driven health monitoring collar offering continuous vital sign tracking.

- In February 2024, Tractive introduced a bundled pet insurance product with a complimentary GPS tracker.

- In January 2020, Whistle Labs launched a fitness-focused wearable with personalized nutrition insights.

- In June 2022, Mars Petcare established a large-scale pet biobank to advance predictive health analytics.

Conclusion

The Pet Wearables Market is undergoing a transformative phase marked by technological innovation and changing consumer priorities. As pet health awareness grows, wearables are becoming integral to preventive care strategies.

Looking ahead, continued advancements in AI, connectivity, and data analytics are expected to enhance device capabilities. With expanding global adoption, the market is well-positioned for long-term, sustainable growth.