Quick Navigation

Overview

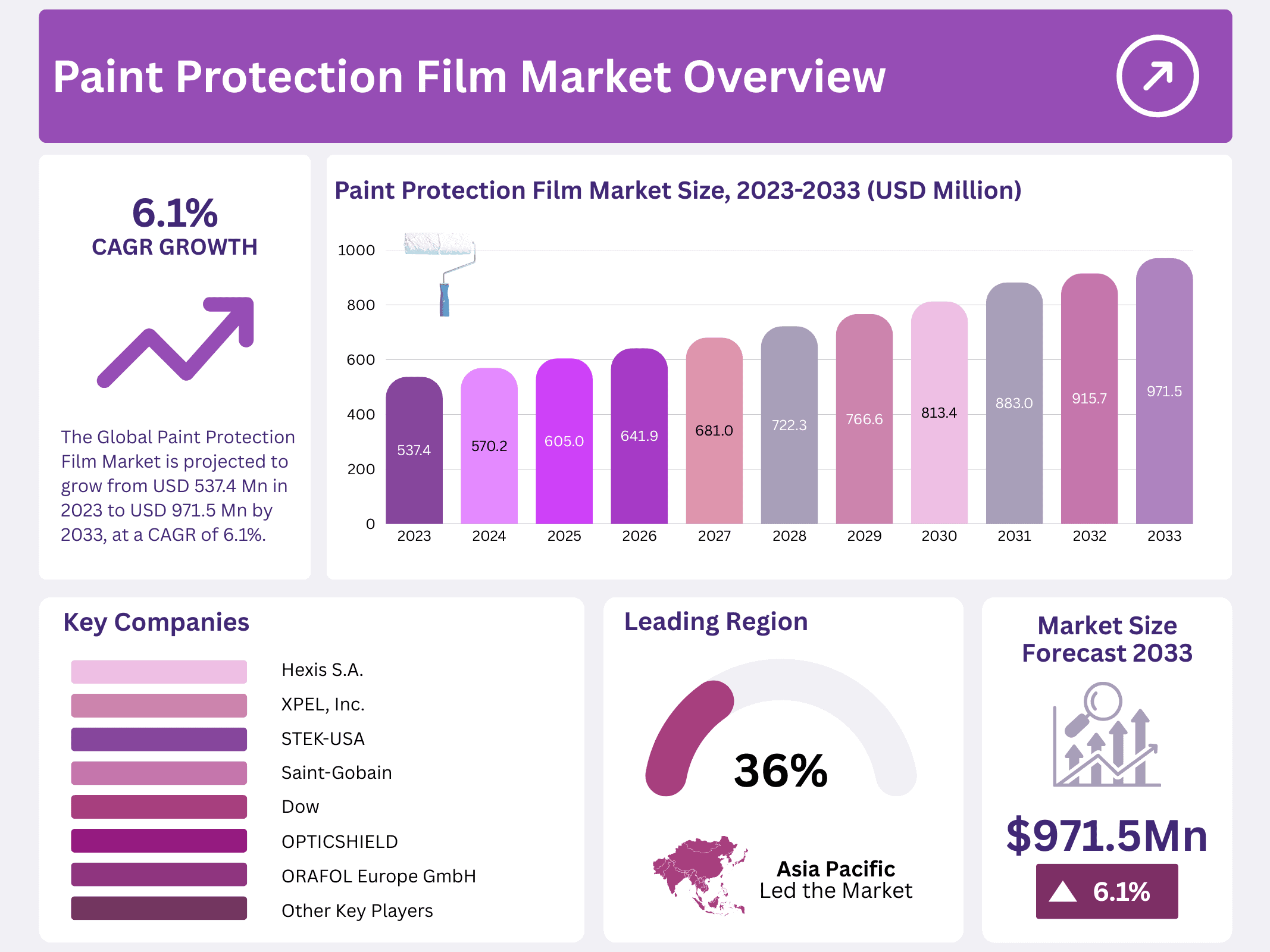

New York, NY – January 19, 2026 – The Global Paint Protection Film (PPF) Market is projected to reach USD 971.5 million by 2033, rising from USD 537.4 million in 2023, and expanding at a CAGR of 6.1% between 2023 and 2033. This steady growth reflects the increasing awareness among consumers about long-lasting vehicle care solutions and the willingness to invest in products that enhance surface durability.

Demand for paint protection films is expected to rise as their applications expand across automotive, electronics, aerospace, and industrial sectors. The introduction of high-performance films—designed to offer superior clarity, self-healing properties, and extended durability will further strengthen market adoption as manufacturers continue innovating to meet evolving customer needs.

Technological advancements will also play a vital role, especially as companies focus on producing environmentally friendly films with reduced chemical impact. At the same time, the market will be influenced by differences in product quality and the ability of films to resist scratches, stains, and harsh weather conditions. These performance variations are likely to shape consumer preferences and guide future investment in PPF solutions.

Key Takeaways

- The Global Paint Protection Film (PPF) Market is projected to grow from USD 537.4 million in 2023 to USD 971.5 million by 2033, at a CAGR of 6.1% during 2023–2033.

- Thermoplastic Polyurethane (TPU) dominates the material segment with over 71.7% market share in 2023.

- The Automotive and Transport sector accounted for more than 68.4% of PPF revenue in 2023 and is expected to remain the leading application.

- Asia Pacific held the largest regional share at 36.6% of revenue in 2023 and is poised for continued strong growth.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 537.4 Million |

| Forecast Revenue (2033) | USD 971.5 Million |

| CAGR (2024-2033) | 6.1% |

| Segments Covered | By Material (Polyvinyl Chloride, Thermoplastic Polyurethane, and Others); By Application (Automotive & Transportation, Aerospace & Defense, and Others) |

| Competitive Landscape | 3M, Saint-Gobain, AVERY DENNISON CORPORATION, Eastman Chemical Company, XPEL, Inc., Hexis S.A., PremiumShield Limited, STEK-USA, Reflek Technologies Corporation, GRAFITYP Selfadhesive Products NV, ORAFOL Europe GmbH, OPTICSHIELD, SCHWEITZER-MAUDUIT INTERNATIONAL, INC., Dow. |

Key Market Segments

Material Analysis

Thermoplastic Polyurethane (TPU) stood out as the leading material, capturing over 71.7% of the total market share. Its dominance is rooted in its exceptional flexibility, durability, and overall performance. TPU is widely used across industries—ranging from footwear and automotive components to electronics and medical devices—making it one of the most versatile materials available today.

Meanwhile, Polyvinyl Chloride (PVC) accounted for 25.4% of the paint protection film (PPF) market. PVC-based protective films remain a preferred choice in the electronics industry due to their hardness, strong mechanical strength, and effective insulation properties. These material advantages directly contribute to the steady growth and adoption of PVC within the sector.

Application Analysis

The Automotive and Transport segment led the paint protection film market in 2023, representing more than 68.4% of overall revenue. This dominance is expected to continue as rapid industrialization, rising transportation needs, and increasing consumer awareness about vehicle maintenance all contribute to sustained demand.

Growing air travel, rising aircraft production, and intensified defense activities across several nations are major growth drivers. As aircraft and defense vessels require reliable protection from oxidation, corrosion, and environmental damage, the demand for high-performance paint protection films in this segment is expected to accelerate significantly.

Regional Analysis

The Asia Pacific region held a 36.6% revenue share in 2023, and it is expected to maintain strong expansion. This sustained growth is driven by the region’s high automobile production levels and rapid adoption of new vehicles. Asia Pacific continues to benefit from rising transportation activities, supported by low labor costs, easy access to raw materials, and robust consumer demand.

In North America, the automotive sector is projected to experience a 5.4% rise in product demand, driven by increased vehicle sales and an aging vehicle fleet requiring replacements and upgrades. Supportive government regulations and a well-developed manufacturing ecosystem are expected to reinforce the region’s growth trajectory over the forecast period.

Europe has long been a key revenue generator, largely due to its strong passenger car and aircraft manufacturing base. Additionally, increasing defense budgets in Germany, the U.K., and France are anticipated to further strengthen regional market performance. Rising product requirements from the electronics industry will also contribute to Europe’s continued expansion in the years ahead.

Top Use Cases

- Automotive Protection: Paint protection film is widely applied to cars to shield the exterior from everyday road hazards like rock chips, scratches, and bug splatters. As a market research analyst, I see it as a smart choice for vehicle owners who drive frequently, helping maintain the car’s resale value by keeping the paint pristine without frequent touch-ups or repairs.

- Motorcycle Shielding: For motorcycles, this film covers vulnerable painted areas to guard against debris kicked up during rides and minor impacts from branches or gravel. In my analysis, it’s ideal for enthusiasts who ride off-road or in urban settings, extending the bike’s aesthetic appeal and reducing maintenance needs over time.

- Aviation Applications: Airplanes benefit from paint protection film on leading edges and fuselages to resist erosion from high-speed particles, weather, and UV rays. From a market perspective, it supports the aviation sector by minimizing downtime for repaints, ensuring aircraft remain operational and visually sharp in demanding flight conditions.

- Recreational Vehicles and Boats: RVs and kayaks use the film to protect against environmental wear like water spots, tree sap, and trail scratches. As an analyst, I note its value for outdoor adventurers, preserving the vehicle’s or vessel’s finish during adventures, which enhances longevity and user satisfaction without constant upkeep.

- Electronics and Screens: On cell phones, laptops, and screens, the film prevents scratches from daily handling and drops. Market insights show it’s growing in consumer electronics, offering a clear layer that doesn’t alter functionality while protecting delicate surfaces, appealing to tech users seeking durable device protection.

Recent Developments

1. 3M Company

- 3M continues to innovate in paint protection film (PPF) with its 3M Paint Protection Film Pro Series. Recent developments focus on enhanced self-healing technology and improved gloss retention for long-term appearance. The company emphasizes precision digital cutting patterns and training for certified installers. 3M also integrates sustainability efforts into its film production processes.

2. Saint-Gobain

- Through its Solar Gard brand, Saint-Gobain has launched OptiShield paint protection film. A key recent development is its Pro-Dry adhesive technology, designed for easier, bubble-free installation with repositioning capability. The films feature advanced topcoat chemistry for high resistance to stains, etching, and yellowing, catering to both automotive OEMs and the aftermarket.

3. AVERY DENNISON CORPORATION

- Avery Dennison’s Supreme Defense PPF series features NeverYellow and Self-Healing technologies. Recent developments include the expansion of its DynoShield line, offering films with a 10-year warranty and hydrophobic properties. The company heavily invests in precision-cut software (DAP) and global installer training programs to ensure application quality and an extensive pattern library.

4. Eastman Chemical Company

- As a major material supplier, Eastman advances PPF through its specialty interlayer and adhesive resins. Recent developments highlight Saflex SG series polymers, enhancing clarity, durability, and adhesion for film manufacturers. Eastman’s Tritan copolyester is also being leveraged to create more chemical-resistant and stain-resistant top coats for next-generation PPF products.

5. XPEL, Inc.

- XPEL remains a leader with its ULTIMATE PLUS paint protection film, featuring top-coated technology for enhanced stain resistance. A major recent development is the expansion of its industry-leading pre-cut pattern database (DAP) using AI and 3D scanning for perfect vehicle coverage. XPEL also emphasizes its FUSION PLUS matte film and robust warranty programs for consumer assurance.

Conclusion

Paint Protection Film stands out as a versatile and reliable solution for safeguarding surfaces across various industries, evolving from its military origins to everyday applications. It offers robust defense against physical and environmental damage, making it an attractive option for consumers focused on long-term preservation and minimal maintenance, with ongoing innovations promising even broader adoption in the future.